In early 2020, two friends running a small fintech startup found themselves at a crossroads. One favored Tether (USDT) for its high liquidity, the other vouched for USD Coin (USDC) for its transparency. Their debate reflects a broader tension in the stablecoin ecosystem, a balancing act between speed, trust, and compliance. Fast forward to 2025, and this dynamic is even more pronounced as both coins evolve under the weight of global regulations, institutional scrutiny, and rising DeFi demand. This article lays out how USDC and USDT compare across critical metrics, helping investors, developers, and policymakers better navigate the stablecoin landscape.

Key Takeaways

- 1USD Coin currently has a market capitalization of $34.2 billion, while Tether maintains a dominant lead at $97.6 billion.

- 2USDT leads the 24-hour trading volume with over $52 billion, compared to USDC’s more modest $5.8 billion.

- 3In 2025, USDT is available on 13 blockchain networks, while USDC supports 11.

- 4USDC’s reserve transparency remains unmatched, with 100% of reserves held in cash and short-term U.S. Treasuries, according to monthly attestations.

Tether’s Reserve Backing Breakdown

- U.S. Treasury Bonds make up the largest portion of Tether’s reserves, accounting for 79.7% of the total backing.

- Cash and Equivalents represent 5.6%, offering liquidity and immediate redemption capability.

- Other Investments, including miscellaneous financial assets, comprise 8.0% of the reserve pool.

- Gold holdings account for 2.3%, providing a hedge against inflation and market volatility.

- Bitcoin contributes 4.4% to Tether’s reserves, indicating a modest exposure to cryptocurrency volatility.

Circulating Supply Trends

- As of July 2025, USDT’s total supply is 96.7 billion tokens.

- USDC currently has 33.6 billion tokens in circulation.

- USDT’s supply increased by 9.2% in the first half of 2025, driven largely by demand in Asia and Africa.

- USDC’s circulating supply decreased by 5.4% in 2025, reflecting reduced usage on centralized exchanges.

- Over 72% of USDT’s supply is held on Ethereum and Tron combined.

- USDC’s Ethereum-based tokens account for 86% of its total supply, with the rest on Solana, Base, and Arbitrum.

- USDT’s TRC-20 tokens grew to represent 44% of its total issuance.

- USDC’s burn rate increased by 11.3% quarter-over-quarter, reflecting on-chain redemptions and consolidations.

- Average USDT wallet balances have increased to $1,250, while USDC wallets average $1,040.

- New USDT addresses grew by 14.5% YTD, compared to USDC’s more modest 5.8% increase.

Blockchain Networks and Ecosystem Integration

- In 2025, USDT operates on 13 blockchains, including Ethereum, Tron, Solana, Avalanche, and Polygon.

- USDC is now live on 11 networks, recently adding zkSync and Scroll to its integration list.

- USDT’s usage on Tron represents 49% of its on-chain activity, while USDC’s dominant chain is Ethereum at 71%.

- USDC has seen increased adoption in Layer 2 ecosystems, especially on Base and Arbitrum, where it powers $3.2 billion in TVL.

- USDT is still the preferred stablecoin on DEXs across Asia, making up 61% of fiat conversions.

- USDC’s integration into Visa’s Cross-Border Payment system has expanded to over 20 countries in 2025.

- USDT has partnered with Bitfinex Pay to enable low-cost settlement in over 15 digital marketplaces.

- USDC is now supported by over 55 DeFi protocols, including integrations with Balancer, Curve, and Uniswap v4.

- USDT still leads in gaming applications, particularly in Web3 ecosystems like Immutable X and BNB Chain.

- In Q2 2025, USDC bridged volume across chains exceeded $5.1 billion, a 22% increase from Q1.

USDC Usage by dApp Type

- Dexes lead USDC usage with 19.6%, showing strong integration in decentralized exchange platforms.

- Lending platforms account for 18.6%, reflecting USDC’s reliability in loan and borrowing protocols.

- Derivatives dApps utilize 17.5% of USDC, indicating their growing role in synthetic asset markets.

- RWA (Real-World Assets) contribute 15.9%, showcasing the tokenization of real-world financial instruments.

- CDP (Collateralized Debt Positions) takes up 9.4%, reinforcing USDC’s role in stable collateral systems.

- Bridge protocols use 8.5%, enabling cross-chain asset movement.

- Yield-focused dApps consume 2.6%, tied to interest-earning strategies.

- Yield Aggregators make up 2.4%, streamlining earnings from multiple DeFi sources.

- Leveraged Farming represents 1.5%, while Liquidity Managers hold the smallest share at 0.9%.

Transparency and Audit Practices

- USDC continues to publish monthly attestation reports, with each showing 100% backing in cash and short-term U.S. Treasuries.

- As of June 2025, Circle’s attestation partner remains Deloitte, reinforcing trust with institutional users.

- USDT, on the other hand, releases quarterly assurance reports conducted by BDO Italia, with its latest showing 84.3% reserves in liquid assets.

- USDC reports indicate that over $26.7 billion in reserves are held in 3-month U.S. Treasury bills, reflecting ultra-low risk.

- Circle’s transparency dashboard saw over 5 million unique visits in the first half of 2025, a 17% increase from the prior year.

- Tether faced minor public criticism in March 2025 over a lack of daily data, though its quarterly reports maintain internal consistency.

- USDC includes a breakdown of jurisdictional reserve holdings, with 98% held in the U.S., enhancing legal clarity.

- USDT publishes token issuance and burn records, but doesn’t provide audited breakdowns by jurisdiction.

- Despite improvements, USDT’s transparency score in third-party crypto trust indexes remains at B+, while USDC’s holds steady at A.

Regulatory Standing and Compliance

- USDC is issued by Circle, a U.S.-based entity registered as a money transmitter in 48 states.

- In 2025, Circle continues its pursuit of a federal payment stablecoin license, with approval expected by Q4.

- Tether, by contrast, is registered in the British Virgin Islands and operates under less stringent international regulatory standards.

- USDC is compliant with FinCEN regulations, and Circle is a registered participant in U.S. AML programs.

- USDT faced scrutiny from UK regulators in February 2025 for insufficient source-of-funds disclosures on high-volume wallets.

- USDC has passed five consecutive quarterly compliance reviews, including ones related to the Bank Secrecy Act (BSA).

- USDT has improved its KYC procedures for corporate redemptions, requiring multi-level verification in jurisdictions like Singapore and Brazil.

- In 2025, USDC has been accepted as a compliant stablecoin in the EU’s MiCA framework, giving it access to regulated European crypto markets.

- Circle now holds four virtual asset service provider (VASP) licenses, covering the EU, Hong Kong, Singapore, and UAE.

- Tether’s global operations face increased compliance obligations due to cross-border AML directives, especially in LATAM and South Asia.

USDC’s Reserve Backing Breakdown

- The Circle Reserve Fund makes up the majority of USDC’s reserves, accounting for 80.2%, ensuring stability and compliance.

- Cash at Reserve Banks represents 19.8%, offering liquidity and immediate redemption assurance for users and institutions.

Adoption in DeFi and Web3 Platforms

- USDC is integrated into over 55 DeFi protocols, leading all stablecoins in compliant DeFi usage.

- As of July 2025, USDC secures $7.3 billion in DeFi total value locked (TVL), topping USDT’s $4.9 billion.

- USDT remains the default stablecoin on many high-volume DEXs, especially across the Asia-Pacific regions.

- USDC dominates on Ethereum Layer 2s like Arbitrum and Base, powering over 45% of all lending markets.

- USDT leads on Tron-based DApps, with over $3.2 billion transacted in Q2 2025 alone.

- USDC is now native to zkSync, Scroll, and Polygon zkEVM, expanding its reach in scalable rollup chains.

- USDT is preferred in Web3 gaming, used in titles across BNB Smart Chain and Immutable X, contributing to over $860 million in asset purchases.

- USDC is now used as the default stablecoin in Chainlink CCIP, securing cross-chain stable swaps worth $1.9 billion.

- USDT retains an edge in NFT marketplaces, with nearly 60% of non-ETH NFT platforms using USDT as the base currency.

- In DAO treasuries, USDC holds a 58% share among the top 100 treasuries, while USDT holds 24%.

Trading Volume and Exchange Listings

- In July 2025, USDT consistently ranks #1 in daily trading volume, averaging $52 billion per 24h.

- USDC’s daily volume is significantly lower at $5.8 billion, reflecting an institutional rather than retail focus.

- USDT is listed on over 470 exchanges, including Binance, OKX, Kraken, Bybit, and Bitfinex.

- USDC is supported on over 300 exchanges, with deep integration into Coinbase, Kraken, Robinhood, and Fidelity Digital.

- USDT supports the highest number of trading pairs globally, more than 9,600 markets.

- USDC’s share in stablecoin-settled derivatives trading is growing, reaching 12.5%.

- USDT dominates perpetual swap pairs, covering 76% of all stablecoin-collateralized derivatives.

- USDC is now the base asset in Circle Trade, processing $2.4 billion/month in institutional volume.

- USDT pairs are used in nearly 88% of altcoin markets in high-liquidity exchanges.

- USDC has seen increased usage in options markets, now powering 18% of DeFi options volumes via protocols like Lyra and Premia.

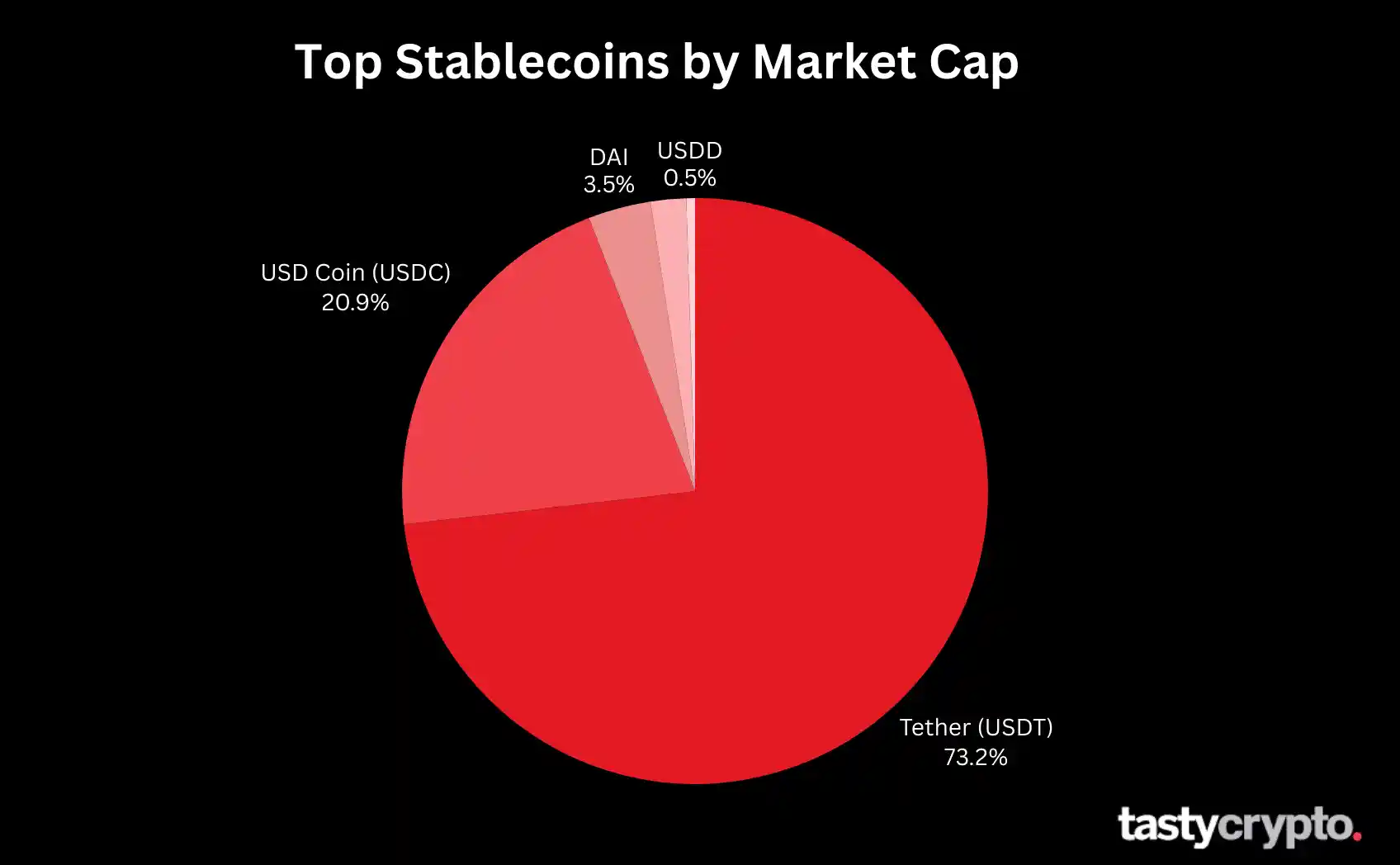

Top Stablecoins by Market Cap

- Tether (USDT) holds the largest market cap among stablecoins, accounting for 73.2% of the total.

- USD Coin (USDC) follows as the second largest, with 20.9%, showing significant usage in the stablecoin market.

- DAI holds 3.5% of the market cap, reflecting its role as a decentralized stablecoin.

- USDD contributes 0.5%, indicating a smaller, yet notable presence in the stablecoin space.

Redemption Mechanisms and Liquidity

- USDC offers near-instant redemption to fiat for verified users, with average settlement times of under 7 minutes via Circle Account.

- Tether processes redemptions manually, with fiat withdrawal windows ranging between 24 and 72 hours.

- As of June 2025, USDC’s daily redemption capacity is $4.8 billion, backed by bank-grade liquidity facilities.

- USDT now supports partial automated redemptions through select partners, processing up to $2.1 billion/day.

- USDC charges no redemption fees for business accounts under $1 million/month, while Tether charges 0.1% to 0.3%, depending on volume.

- Circle holds $9.2 billion in liquidity buffers, allowing for uninterrupted redemptions during market shocks.

- USDT’s buffer is estimated at $6.7 billion, including cash equivalents held across multiple custodians.

- USDC’s integration with US banking rails like ACH and FedNow enables instant off-ramps, especially in the U.S.

- Tether’s redemption partners are primarily offshore OTC desks, and their access is jurisdiction-dependent.

- In Q1 2025, USDC outflows during market dips were 52% faster than USDT, per comparative withdrawal reports.

Geographic Distribution of Users

- USDT leads globally, with over 58% of users based outside North America, especially in Asia and South America.

- USDC is dominant in the United States, with 46% of wallet holders located in U.S. jurisdictions.

- USDT’s largest market is China (including OTC usage), followed by Turkey, India, and Nigeria.

- USDC has seen rapid growth in Canada, Singapore, and the UK, contributing to a 19% increase in EMEA wallet registrations.

- As of mid-2025, USDT processes over $7.2 billion/day in Latin America for informal FX and remittance use.

- USDC is used by state-compliant fintech apps in over 26 U.S. states, including integrations with neobanks.

- USDT mobile wallet usage grew 18.6% YoY in African nations, especially in Kenya, Ghana, and South Africa.

- USDC usage in Hong Kong has grown by 22% post-MiCA adoption and stablecoin regulation clarity.

- In 2025, USDT leads in P2P markets across Eastern Europe, particularly Ukraine and Russia.

- USDC’s educational campaigns in emerging markets helped drive a 15% increase in non-custodial wallet adoption in India and Brazil.

Stablecoin Market Dominance Breakdown

- Tether (USDT) dominates the stablecoin market with a 62.21% share, maintaining its lead as the most used stablecoin globally.

- USD Coin (USDC) holds the second position with 24.16%, indicating strong institutional trust and adoption.

- USDe captures 2.34%, showing growing relevance in the emerging stablecoin sector.

- DAI, the decentralized option, accounts for 1.75%, reflecting steady demand for non-custodial alternatives.

- USDS and BUIDL represent 1.61% and 1.15% respectively, as newer players are gaining traction.

- Smaller stablecoins such as USD1 (0.87%), USDTB (0.58%), FDUSD (0.51%), and PYUSD (0.40%) round out the list with niche usage.

- Other stablecoins collectively hold 4.42%, capturing diverse yet fragmented market segments.

Historical Price Stability Performance

- In 2025, USDC’s average daily deviation from $1 is ±0.002, indicating near-perfect peg stability.

- USDT maintains an average deviation of ±0.006, though it experienced short-term dips to $0.987 during black swan liquidity events.

- Over 99.98% of USDC transactions in Q1 2025 cleared within 0.25% of its $1 peg.

- Tether’s price volatility index remains 12% higher than USDC’s, based on on-chain spread metrics.

- USDC’s real-time redeemability has made it the preferred stablecoin for arbitrageurs and cross-chain swaps.

- USDT’s peg deviation is more frequent during high-volume sell-offs, particularly on Tron-based exchanges.

- On average, USDC re-pegs to $1 within 3.2 minutes post-deviation, versus 7.9 minutes for USDT.

- Since 2020, USDC has recorded fewer than 10 sustained peg breaks, none exceeding 1.2%.

- USDT experienced 3 minor depeg events in 2025, the longest lasting 26 minutes, before full recovery.

- In volatile periods like the March 2025 bond sell-off, USDC maintained peg integrity across all major DEXs, while USDT temporarily dropped to $0.982 on two platforms.

Institutional Usage and Partnerships

- As of 2025, USDC is accepted by 10 of the top 15 U.S. crypto custodians, including Anchorage Digital, BitGo, and Fireblocks.

- Tether is the stablecoin of choice for non-U.S. hedge funds, accounting for $12.7 billion in active balances.

- USDC powers cross-border B2B payments for platforms like Stripe, Visa, and Checkout.com, handling over $3.4 billion/month.

- USDT’s partnership with Bitfinex Pay enables e-commerce integrations across more than 1,800 stores globally.

- Circle’s commercial APIs are used by over 400 fintechs, including those offering stablecoin payroll, treasury solutions, and consumer banking apps.

- USDT is integrated into global OTC desks, processing over $5.9 billion in monthly settlements for institutional clients.

- USDC’s tokenized treasury offerings saw $940 million in inflows from asset managers in the first half of 2025.

- Tether’s presence in derivative exchanges like BitMEX and Bybit drives its appeal among institutional traders.

- USDC received a “green-light rating” from U.S. regulators for use in federal financial experiments and sandboxes.

- USDT is now accepted by over 30 international FX brokers, further embedding it in cross-border finance.

Stablecoin Usage by Purpose

- DeFi and Trading dominate stablecoin usage, accounting for a massive 67%, highlighting their core role in decentralized finance ecosystems.

- Remittances make up 15%, showing strong adoption for fast and low-cost international money transfers.

- Inflation Hedge usage stands at 10%, reflecting growing demand in countries with unstable fiat currencies.

- Merchant Payments represent 5%, indicating emerging use for everyday commerce and online transactions.

- Other purposes comprise 3%, including niche use cases like gaming, payroll, and microtransactions.

Recent Developments

- In May 2025, Circle launched programmable USDC, enabling smart contract-based auto-payments on Base and Ethereum.

- Tether introduced USDT Gold+, a hybrid asset pegged to both USD and gold, aiming at commodity-stable value seekers.

- USDC completed a pilot integration with FedNow, making it the first stablecoin eligible for near-instant U.S. interbank settlement.

- Tether launched a wallet freeze feature, complying with new EU anti-terrorism financing mandates.

- USDC launched on Scroll, bringing high-speed, low-cost transactions to zkEVM ecosystems.

- In Q2 2025, Tether onboarded Fireblocks custody integration, improving its appeal to regulated funds.

- Circle announced its public IPO filing in June 2025, signaling potential SEC scrutiny and retail exposure.

- USDT surpassed $100 billion in total on-chain transfer volume per week, for the first time in its history.

- USDC debuted tokenized asset modules, allowing developers to program treasury flows, interest, and maturity terms via smart contracts.

- Tether partnered with African fintech firms, introducing stablecoin-based savings accounts with 6.5% APY.

Conclusion

USD Coin and Tether have both matured dramatically by 2025, but their paths reflect distinct priorities. USDC stands as the transparent, regulatory-first choice for institutions and U.S. entities, while USDT holds its grip as the globally liquid and exchange-dominant asset. As stablecoins embed deeper into the architecture of global finance, these two titans will continue to define the rules of programmable money, one block, one dollar, and one transaction at a time.