The cryptocurrency exchange Upbit has emerged as a major force in South Asia’s digital asset ecosystem, with significant implications for both retail traders and institutional players. In real-world terms, thousands of Korean investors use Upbit to access KRW-crypto pairs, while blockchain project teams see Upbit listings drive short-term token liquidity and price spikes. This article walks you through the most current statistics for Upbit, from user counts and trading volumes to market positioning and platform features, so you can grasp its role and explore how it fits into broader crypto trends.

Editor’s Choice

- Upbit reportedly serves between 5 and 8 million verified users globally.

- Daily spot trading volume for Upbit often falls in the $2– $4 billion range.

- The number of coins listed on Upbit stands at 293, with 638 trading pairs.

- Upbit received a global trust ranking of 7th in the “World’s Most Trustworthy Crypto Exchanges” by Forbes in 2025.

- Trading volume has declined substantially in 2025, with reports of a ~70% dip in some metrics.

Recent Developments

- In September 2025, Upbit temporarily suspended KRW deposits and withdrawals, citing a technical or maintenance issue with its banking partner and regulatory pressures.

- That suspension coincided with a liquidity drop estimated at 70%, highlighting how concentrated local-market risk can be.

- Mapping the global exchange market, Upbit’s share of the top-10 volume dropped about 44% quarter-on-quarter in Q2 2025.

- Korean retail investor interest in crypto has faded, as the Google search index for “bitcoin” in Korea fell 66% from the peak of late 2024.

- As of October 6, 2025, Upbit captured 72% of South Korea’s crypto market volume among registered exchanges.

- The increase in regulatory scrutiny in South Korea has put pressure on account onboarding and KYC processes for Upbit.

- Upbit’s 30-day volume at one point was $70.9 billion, annualized to about $862 billion, but that still marked an 11% drop compared to the prior 30-day period.

- Upbit listings continue to trigger sharp token price moves, though commentary suggests many of these are short-lived.

Korean Crypto Exchange Market Share Highlights

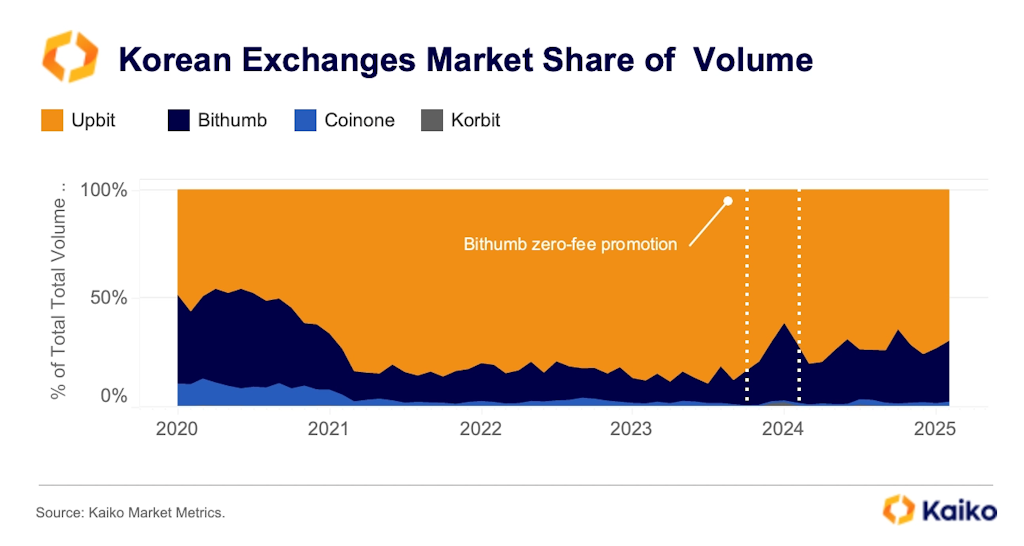

- Upbit maintained market dominance throughout 2020–2025, holding over 70–85% of total trading volume in most years.

- Bithumb was the main competitor, with its share dropping from around 45% in 2020 to below 15% by 2023.

- During 2024, Bithumb’s zero-fee promotion briefly boosted its market share to about 35%, cutting into Upbit’s lead.

- Coinone and Korbit remained minor players, together accounting for under 10% of total market volume across the entire period.

- By 2025, Upbit had regained dominance with roughly 80% market share as Bithumb’s volume normalized post-promotion.

- The data shows a highly consolidated Korean crypto market, where Upbit consistently controls the majority of trading activity.

Company Overview

- Dunamu, Upbit’s parent company, was founded in 2017 and operates with real-name banking via partner banks in South Korea.

- Upbit’s executive team includes CEO Sirgoo Lee and Chairman Song Chi-hyung.

- Upbit has maintained strong security certifications, including ISO 27001, 27017, 27018, ISMS-P, and AI-powered anomaly detection.

- The company enforces a 98% cold storage policy for digital assets with mandatory two-factor authentication for withdrawals.

- The exchange’s trading fees are as low as 0.05% for KRW trading pairs and 0.25% for BTC and USDT pairs.

Market Rankings

- Upbit is ranked among the global “top five” exchanges for spot volume according to CoinRanking, with daily trades in the $2–4 billion band.

- South Korea’s crypto market is highly concentrated, as Upbit and its main local rival together account for roughly 98% of national trading volume.

- Global comparison shows that while Upbit’s volume is smaller than that of Binance or OKX, its local dominance gives it outsized influence in its region.

- Upbit’s position in global rankings has slipped in volume terms, reflecting broader volume declines in 2025 across major exchanges.

Top Traded Coins on Upbit

- On July 20, 2025, the daily trading volume of XRP alone on Upbit reached $3.2 billion, representing about 15.15% of Upbit’s total volume that day.

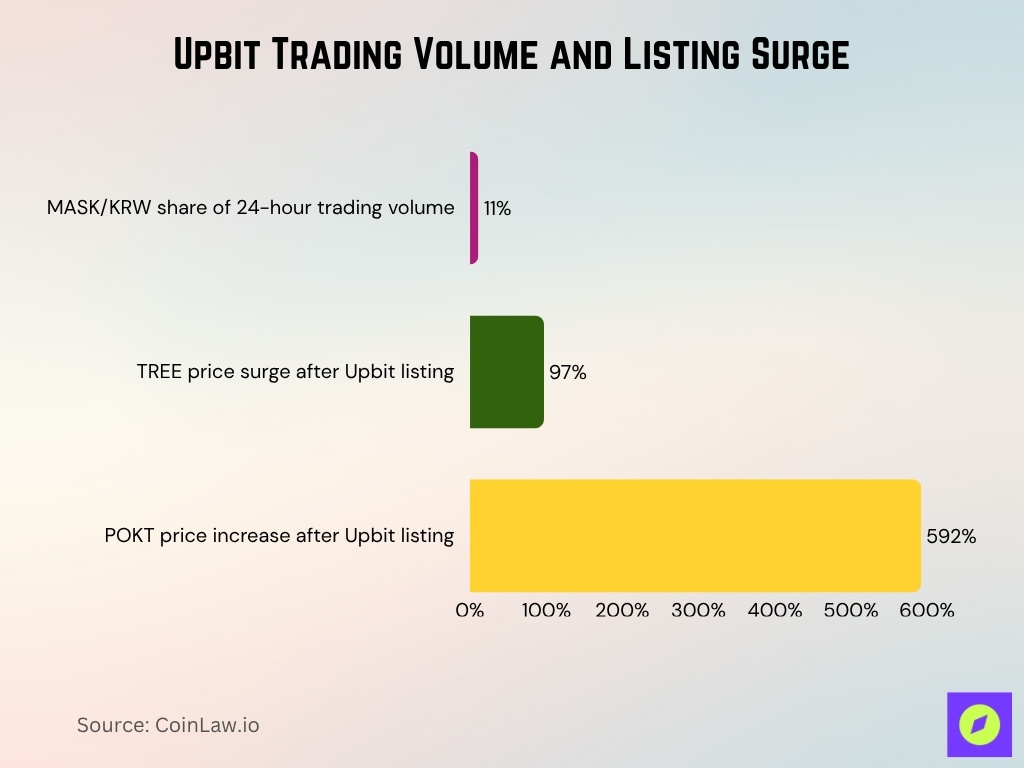

- The trading pair MASK/KRW accounted for 10.95% of Upbit’s 24-hour volume in one snapshot, underscoring altcoin demand in Korea.

- When Upbit listed Treehouse (TREE) on August 28, 2025, its price surged by ~96.78% shortly after the announcement.

- Coins like FLOCK, FORT, and LPT saw rapid price moves immediately after being listed on Upbit. For example, POKT rose by over 592% minutes after listing.

- Upbit’s most active trading pair was XRP/KRW with a 24-hour volume of roughly $175 million in one sample.

- Global rank data suggests Upbit processes $2–$4 billion daily in spot trades, placing these top coins in a high-volume context.

User Levels and KYC Verification

- Upbit has a 4-level KYC system with each level unlocking higher transaction limits.

- Level 1 allows only basic sign-up with no deposit or withdrawal access.

- Level 2 users can withdraw up to approximately SGD 5,000 per day.

- Levels 3 and 4 users have withdrawal limits up to SGD 100,000 per day.

- Regulators reportedly identified over 500,000 to 700,000 KYC compliance issues at Upbit during inspections in early 2025, raising concerns over enforcement procedures.

- Upbit requires KYC verification for access to most core services and fiat on/off ramps.

- The layered KYC complies with South Korea’s AML and VASP regulatory framework.

- Unverified users have withdrawals capped at about $850 per transaction until verification.

Deposit and Withdrawal Methods

- Upbit supports Korean Won (KRW) bank transfers via real-name accounts for deposits.

- Deposit fees on Upbit are typically zero across all methods.

- BTC withdrawal fee is fixed at 0.0005 BTC per transaction.

- Withdrawal limits depend on KYC level, e.g., Level 2 allows up to SGD 5,000 per day.

- On September 25, 2025, Upbit suspended KRW deposits and withdrawals due to a banking partner inspection.

- Withdrawal fees vary by cryptocurrency, e.g., the ETH fee is approximately 0.01 ETH, and XRP is 0.01 XRP.

Staking Statistics on Upbit

- Annual reward rates range from 2.6% (ADA) to 16.6% (SOL) according to Upbit data.

- Upbit offers staking rewards of up to 17% annually for select assets.

- Total staked assets on Upbit exceeded ₩3 trillion ($2.1 billion) by mid-2024.

- Staking is available for ETH, SOL, ADA, ATOM, and MATIC with varying yields.

- Upbit deducts a 10% fee from staking rewards for validator costs.

Upbit Security Measures

- On CertiK’s Skynet rating, Upbit holds an A-grade score of 83.52, with operational resilience of 92.40.

- The security stack includes two-step verification (2FA), an additional fund-withdrawal password, and cold-wallet storage for most assets.

- The platform holds ISO certifications for information security (ISO 27001) and cloud or privacy security frameworks (ISO 27017 and 27018).

- Upbit experienced a significant hack in November 2019 when 342,000 ETH (~$50 million) was moved to an anonymous wallet.

- Upbit maintains a bug-bounty program and claims to monitor transactions 24/7 for suspicious activity.

- Withdrawal limits and user-verification tiers ensure that large fiat transfers undergo additional scrutiny.

Cybersecurity and Trust Scores

- Upbit has a trust score of 8 out of 10 on CoinGecko as of mid-2025.

- Forbes ranked Upbit as the 7th most trustworthy crypto exchange worldwide in early 2025.

- Upbit’s average bid-ask spread on key markets is approximately 4.209%.

- In October 2025, Upbit experienced a temporary outage lasting approximately 20 hours, as reported by user forums and industry monitoring tools.

- User reviews on Trustpilot average 1.8 out of 5 stars, indicating negative user experiences.

- Upbit holds multiple security certifications, including ISO 27001 and ISMS-P.

- Proof-of-reserves transparency scores around 0.5 out of 1, indicating limited public disclosure.

- South Korea’s strict AML and KYC regulations bolster Upbit’s local trust and compliance.

- Upbit’s cybersecurity rating is 83.6% in operational resilience assessments.

Crypto ETF Flow Trends

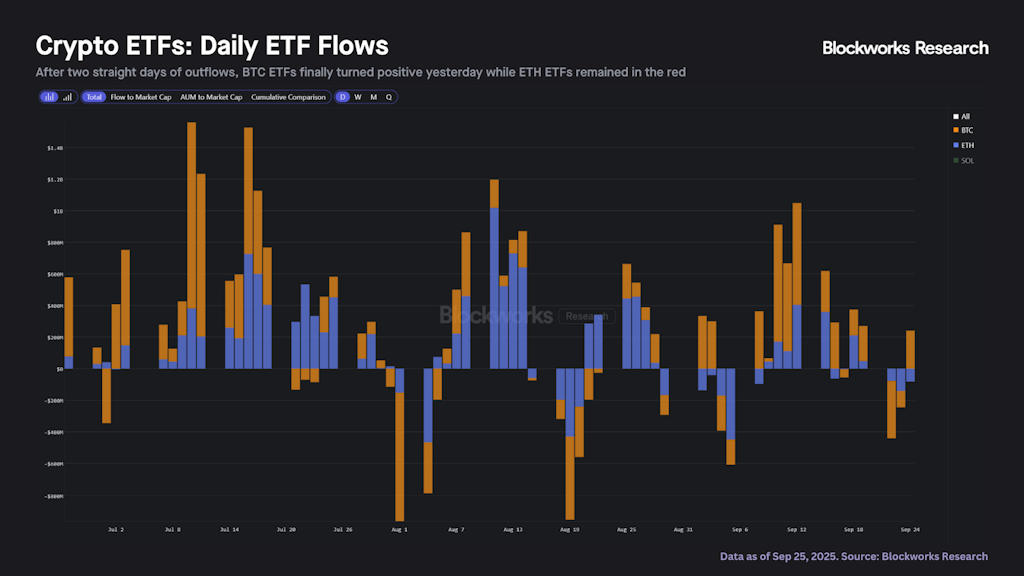

- BTC ETFs rebounded strongly after two straight days of outflows, turning positive with renewed investor confidence.

- The largest BTC ETF inflow peaked at around $1.3 billion, marking one of the strongest recovery points of the quarter.

- ETH ETFs continued to record net outflows, staying in the red throughout the observed period.

- Peak ETH ETF inflows earlier in the cycle reached about $800 million, but momentum weakened by late September.

- The market saw significant ETF outflows in early and late August 2025, exceeding $600–800 million per day across BTC and ETH combined.

- Mid-September witnessed a noticeable return of inflows, led primarily by Bitcoin-linked ETFs.

- SOL ETFs showed minimal trading activity, contributing only a small fraction to total ETF flows.

- Overall, daily ETF movement fluctuated widely between +$1.3B inflows and –$800M outflows, signaling strong volatility and investor rotation.

Upbit Platform and Applications

- Upbit’s mobile app has a 2.6-star rating from over 4,000 Android reviews.

- Spot market trading fees start at 0.05%, with BTC/USDT markets charged up to 0.25%.

- Upbit operates in South Korea and Southeast Asia markets: Singapore, Indonesia, and Thailand.

- Upbit is largely mobile-first, with staking and investment products integrated into the app.

- Compared with global platforms, Upbit lacks derivatives and P2P markets but has strong spot liquidity.

- Regular app updates focus on bug fixes and performance improvements.

- Upbit mobile app has over 1 million downloads worldwide as of 2025.

Comparison With Other Exchanges

- Upbit has between 5 and 8 million active users, compared to Swapzone’s 50,000 users.

- Upbit scored 6.0/10 in one review, while OKX scored 7.5/10 overall.

- Upbit holds around 72% of South Korea’s crypto exchange trading volume.

- Global trust rankings rate Upbit at 8 out of 10, compared to leaders at 10 out of 10.

- Upbit’s maximum trading fee of 0.25% is higher than competitors’ fees of 0.10% or less.

- Upbit focuses on spot and fiat markets, lacking derivatives and P2P features common on Binance and Kraken.

- Outside Korea, Upbit’s market share is smaller than Binance, OKX, and Kraken.

Frequently Asked Questions (FAQs)

Upbit captured about 71.6% of South Korea’s crypto trading volume.

It recorded an average daily volume of ₩4.6 trillion (≈ $3.36 billion).

MASK accounted for 10.95% of Upbit’s total trading volume in that period.

Conclusion

Upbit stands as a formidable force in the Korean crypto market, with a dominant local market share, robust security architecture, and a trusted platform for KRW-crypto trading. Globally, however, it faces competition from exchanges offering broader feature sets, deeper accessibility, and higher user satisfaction scores. Whether you’re evaluating Upbit for regional access or comparing it to global platforms, the key statistics here provide a clear view of its strengths and limitations. Explore the full article to understand how Upbit’s numbers translate into real-world impact for traders and investors.