Thailand is launching a new pilot program called TouristDigiPay that lets tourists convert cryptocurrency into Thai baht for local spending.

Key Takeaways

- 1Thailand’s TouristDigiPay program will run for 18 months starting in Q4 2025

- 2Tourists can convert crypto into baht, but cannot pay directly in crypto

- 3Strict KYC and AML rules will apply, with monthly spending capped at 500,000 baht

- 4The initiative aims to attract more tourists amid a significant decline in arrivals, especially from China

What Happened?

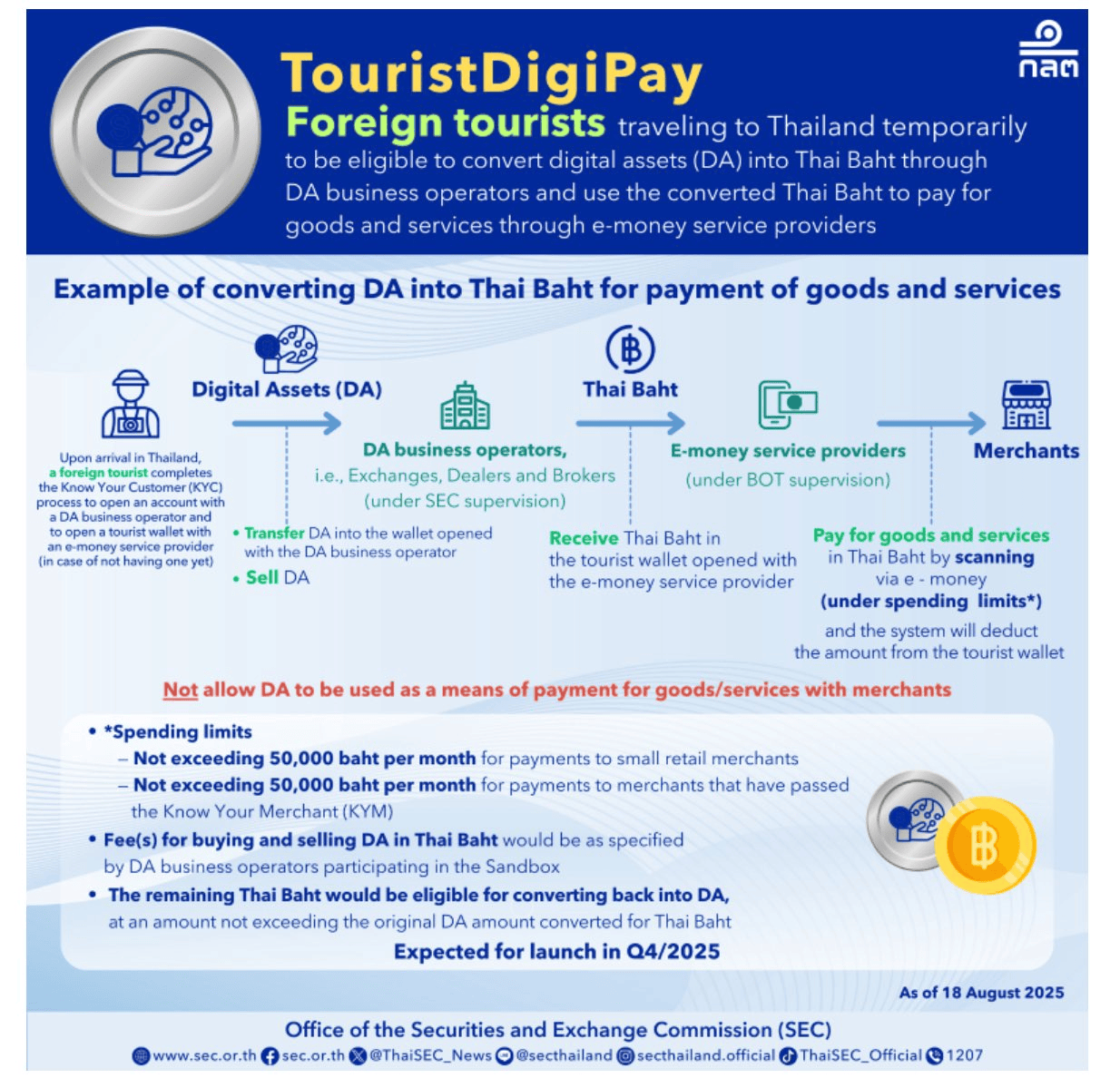

Thailand has introduced a new pilot initiative called TouristDigiPay, which allows foreign tourists to convert digital assets into Thai baht for spending during their stay. The program will run under a regulatory sandbox for 18 months, starting in the fourth quarter of 2025, as announced by the country’s Ministry of Finance and the Securities and Exchange Commission (SEC).

Thailand’s Bold Crypto Move to Boost Tourism

TouristDigiPay is designed to stimulate Thailand’s tourism-dependent economy, which has seen a noticeable slump in recent months. The program enables travelers to convert their crypto into baht via licensed platforms. These funds can then be used across local merchants, though merchants will only receive baht, not digital currencies.

Officials emphasized that the goal is not to promote cryptocurrency as a direct method of payment but to provide a more convenient and modern alternative to cash and credit cards. As Finance Minister Pichai Chunhavajira explained, this digital innovation is meant to “replace overseas visitors’ cash and credit card use here.”

The program is jointly overseen by several government bodies, including:

- The Ministry of Finance

- The Securities and Exchange Commission

- The Anti-Money Laundering Office (AMLO)

- The Ministry of Tourism and Sports

Key Compliance and Security Features

Thailand’s SEC has made it clear that crypto cannot be used directly to buy goods or services. Instead, tourists will undergo Know Your Customer (KYC) and Customer Due Diligence checks. Digital asset operators and e-money providers involved must comply with anti-money laundering laws.

There will also be risk management mechanisms, including:

- A monthly spending limit of 500,000 baht per person

- A block on direct cash withdrawals

- Use of only regulated platforms for conversions

These features are intended to safeguard tourists and merchants and ensure financial transparency.

Thailand’s Tourism Struggles Drive Innovation

The move comes as Thailand confronts a significant drop in tourist numbers, especially from China, traditionally one of its largest markets. According to recent reports:

- Tourist arrivals from East Asia dropped by 24% in the first half of 2025

- Chinese visitors fell by 34%

- Total tourist arrivals dropped 6.9% year-on-year, reaching 20.2 million as of August 10

Due to these setbacks, the Thai government revised its 2025 full-year forecast from 37 million to 33 million tourists. With tourism contributing about 12% of GDP, revitalizing the sector is critical.

Global Trends: Crypto and Travel

Thailand is not alone in exploring crypto-enabled tourism. Other countries and companies making similar moves include:

- Bhutan, which partnered with Binance Pay for crypto-based tourist payments

- Blue Origin, now accepting crypto for space travel bookings

- United Arab Emirates, which partnered with Crypto.com for in-flight crypto payments

Thailand had also previously trialed crypto payments in Phuket, though that initiative is still ongoing.

CoinLaw’s Takeaway

I think this is a smart and timely move by Thailand. In my experience covering global tourism and crypto, bridging convenience with innovation is a winning strategy. Tourists today expect flexible and tech-savvy options. By introducing this program, Thailand is not only modernizing its payment infrastructure, but also making itself more appealing in a competitive tourism market.

I found it particularly smart that they’ve included strict safeguards, so they’re not rushing into crypto without oversight. If this works out, it could become a blueprint for other tourist-heavy nations struggling to bounce back from downturns.