Amid the chaos, one name steadily rises, not because of wild price swings but because it doesn’t move at all. That name is Tether (USDT). Built to hold a 1:1 peg with the US dollar, Tether has evolved from a niche concept to a cornerstone of the global crypto economy. Fast-forward today, and it now powers billions of transactions daily, bridging the volatile world of crypto with the relative stability of fiat.

But how big is Tether, really? Where does it stand among other stablecoins? And what do the numbers reveal about its growth, usage, and trustworthiness? Let’s dive into the data.

Editor’s Choice

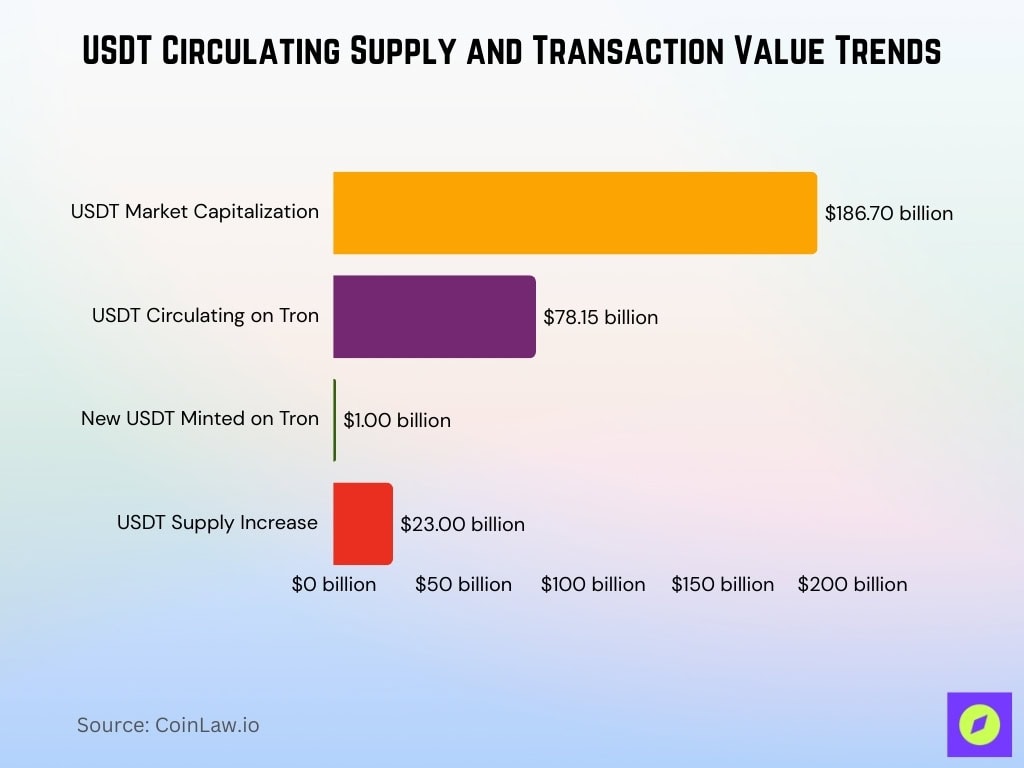

- Tether’s market capitalization is around $186.7 billion, keeping USDT the largest stablecoin by market cap.

- USDT’s circulating supply is roughly 186.9 billion tokens, ranking it third in the overall crypto market by size.

- In 2025, Tether facilitated about $13.3 trillion in transaction volume, a major share of the record $33 trillion stablecoin flows.

- Global stablecoin transactions totaled $33 trillion in 2025, with Tether remaining the largest stablecoin by market value despite USDC leading by volume.

- Stablecoin payment volumes are projected to reach $56 trillion by 2030, underscoring Tether’s role in long-term on-chain payments growth.

- TRON hosts over $80 billion in circulating USDT, highlighting its importance as a primary settlement layer for Tether transfers.

- TRON’s average daily USDT transfer volume recently reached about $23.9 billion, with roughly 1.15 million accounts transacting each day.

Recent Developments

- USDT processed about $156 billion in payments of $1,000 or less in 2025, underscoring its growing use for everyday transactions.

- Wallet in Telegram now counts over 150 million registered users globally, offering integrated support for USDT alongside BTC and TON.

- Telegram’s TON blockchain ecosystem holds roughly $193 million in TVL and around $1.28 billion in stablecoins, with USDt as the primary unit.

- Tether invested in SQRIL to scale QR-based payments across emerging markets, initially targeting corridors in Asia, Africa, and Latin America.

- The SQRIL API already supports QR payments in the Philippines, Vietnam, and Indonesia, plus bank transfers in Malaysia and Thailand.

- Tether and HoneyCoin expanded stablecoin access across Africa, building rails for low-cost USDT payments and remittances.

- Tether introduced Scudo, a unit of account for Tether Gold (XAU₮), aimed at making roughly 116 tons of gold reserves usable in everyday payments.

- Tether launched USA₮, a compliant dollar stablecoin for the U.S. market aligned with the GENIUS Act framework.

Circulating Supply Trends

- Tether’s circulating supply is about 186.7 billion tokens, aligned with its market cap of $186.7 billion.

- Over 60% of the total USDT supply now resides on Tron, making it the primary settlement network.

- Tron sustains roughly $78.15 billion of USDT, accounting for about 42% of all circulating supply.

- Tether minted an additional $1 billion USDT on Tron in January, signaling renewed on-chain liquidity.

- Total USDT users are approaching 500 million, with about 17 million average daily traders.

- Roughly 35% of the USDT supply is held by long-term holders, according to recent disclosures.

- In early 2025, USDT supply expanded by about $23 billion in just two months via new issuance.

Blockchain Networks Supporting Tether

- TRON sustains about $78.15 billion in USDT supply, accounting for roughly 42% of all circulating Tether.

- TRON facilitated approximately $7.9 trillion in USDT transfer volume over the past 12 months.

- Recent data show TRON now exceeds $80 billion in circulating USDT, with daily transfers often between $20–30 billion.

- Between July and September 2025, TRON captured about 65% of global retail-sized USDT transfers under 1,000 tokens.

- As of December 2025, TRON has processed over 12 billion total transactions and onboarded more than 356 million user accounts.

- TRON’s USDT market share climbed past 60% of active usage as low fees and high throughput drove migration from Ethereum.

- Total issued USDT on TRON was reported near $165.5 billion, compared with $102.7 billion on Ethereum at one point in 2025.

- Typical TRC20 USDT fees range roughly between $0.81–$8.45, depending on energy usage and wallet status.

Tether’s Share in the Stablecoin Market

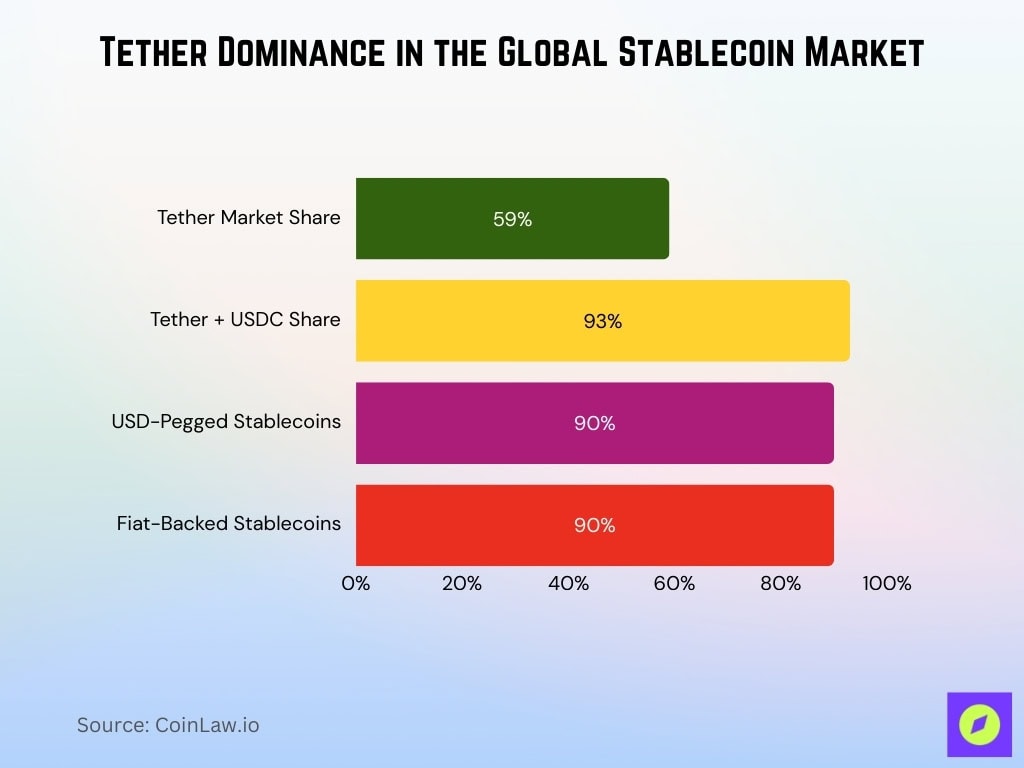

- Tether controls about 59% of the global stablecoin market cap, with USDC and other majors making up most of the remainder.

- Tether and USDC together account for around 93% of total stablecoin market capitalization, underscoring fiat‑backed concentration.

- More than 90% of fiat‑backed stablecoins are USD‑pegged, dominated by Tether and USDC.

- Fiat‑backed stablecoins represent over 90% of the entire stablecoin sector, far exceeding algorithmic and crypto‑collateralized designs.

- As of early 2026, the total stablecoin market cap is roughly $317.9 billion, with USDT at about $186.7 billion in circulation.

- In 2025, stablecoin trading volume hit $33 trillion, with USDT handling about $13.3 trillion and USDC $18.3 trillion.

- By market cap, USDT’s $186.7 billion dwarfs USDC’s roughly $75 billion, cementing Tether’s lead despite USDC’s higher volume.

- Stablecoin transaction volume in Q4 2025 alone reached about $11 trillion, highlighting rapid growth in settlement usage.

Geographic Distribution of Tether Usage

- Between mid‑2024 and mid‑2025, South Asia’s crypto volume rose 80% YoY to about $300 billion, driven heavily by stablecoin activity.

- Stablecoins comprise roughly 30% of all on‑chain crypto transaction volume worldwide, with annual flows above $4 trillion as of August 2025.

- Global stablecoin volumes have surged from $7.4 trillion in 2022 to around $46 trillion in 2025 across regions.

- TRON‑based USDT usage is expanding fastest in Latin America and Africa, with Nigeria ranking 6th globally for USDT activity.

- Asia, MENA, Africa, and Latin America collectively see over $600 billion in monthly stablecoin transfers, mostly in tickets under $1,000.

- Sub‑Saharan Africa received more than $205 billion in on‑chain crypto value between July 2024 and June 2025, up 52% year over year.

- In March 2025, Sub‑Saharan Africa’s monthly on‑chain volume neared $25 billion, driven largely by Nigerian centralized exchange flows.

Top Exchanges by Tether Volume

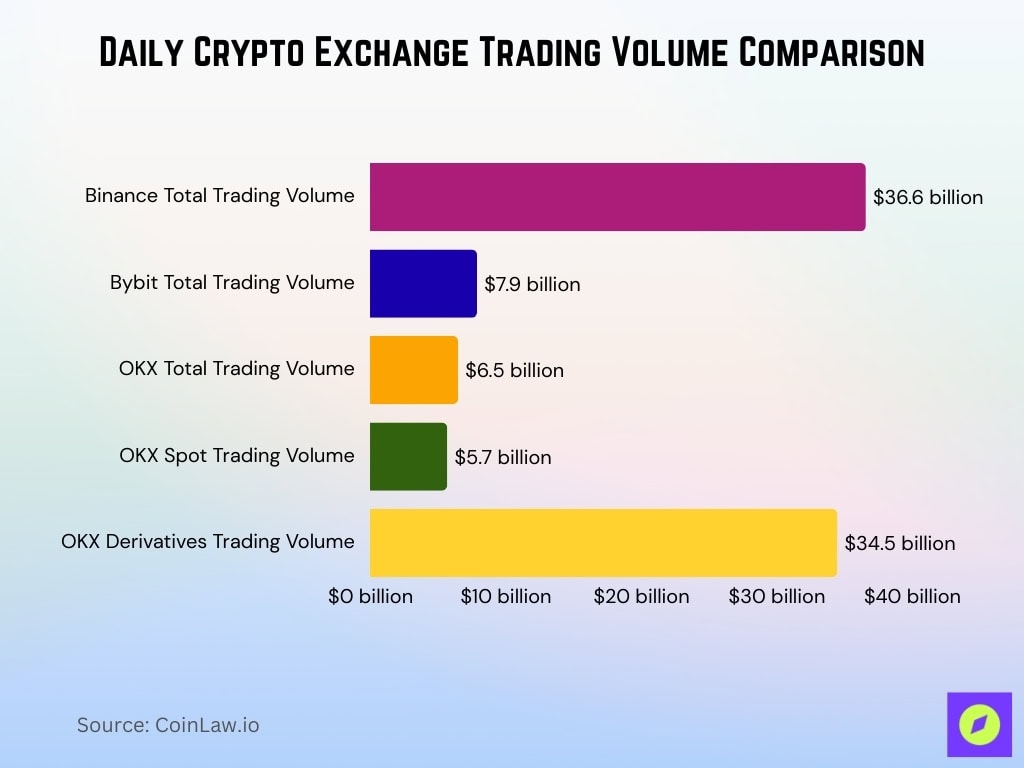

- Binance’s average daily trading volume near $36.6 billion in 2025 far exceeds Bybit’s $7.9 billion and OKX’s $6.5 billion.

- OKX processes over $5.7 billion in 24‑hour spot volume and more than $34.5 billion in daily derivatives trading, led by ETH/USDT.

- USDT remains the base asset in a large share of Binance markets, with more than 1,500 total trading pairs listed.

- The global spot crypto market reached about $18.6 trillion in 2025, with USDT pairs accounting for the majority of turnover on leading CEXs.

- Across top centralized exchanges, Binance maintains around 38–41% market share by volume, underpinning USDT’s liquidity dominance.

- OKX supports over 300 coins and 770 trading pairs, many quoted against USDT as the primary settlement asset.

Wallet Distribution and On-Chain Activity

- The top 100 USDT addresses collectively hold about 37% of the total supply in circulation.

- Current circulating USDT stands near 186.9 billion tokens, with a total issued supply of around 190.8 billion.

- Over $3.29 billion in USDT has been frozen across 7,268 blocklisted addresses on Ethereum and Tron from 2023–2025.

- Of this, roughly $1.75 billion in frozen USDT sits on Tron wallets alone, reflecting its role in enforcement actions.

- USDT blocklisted wallets surpassed 4,000 on Tron by October 2025, rising almost exponentially from mid‑2023.

- Tether coordinated with more than 275 law enforcement agencies across 59 jurisdictions to manage freeze events.

- Recent analyses estimate the frozen USDT value is about 30× higher than frozen USDC, both in address count and asset scale.

- USDC freezes totaled roughly $109 million across 372 addresses during the same 2023–2025 period.

Tether (USDT) Reserve Asset Breakdown

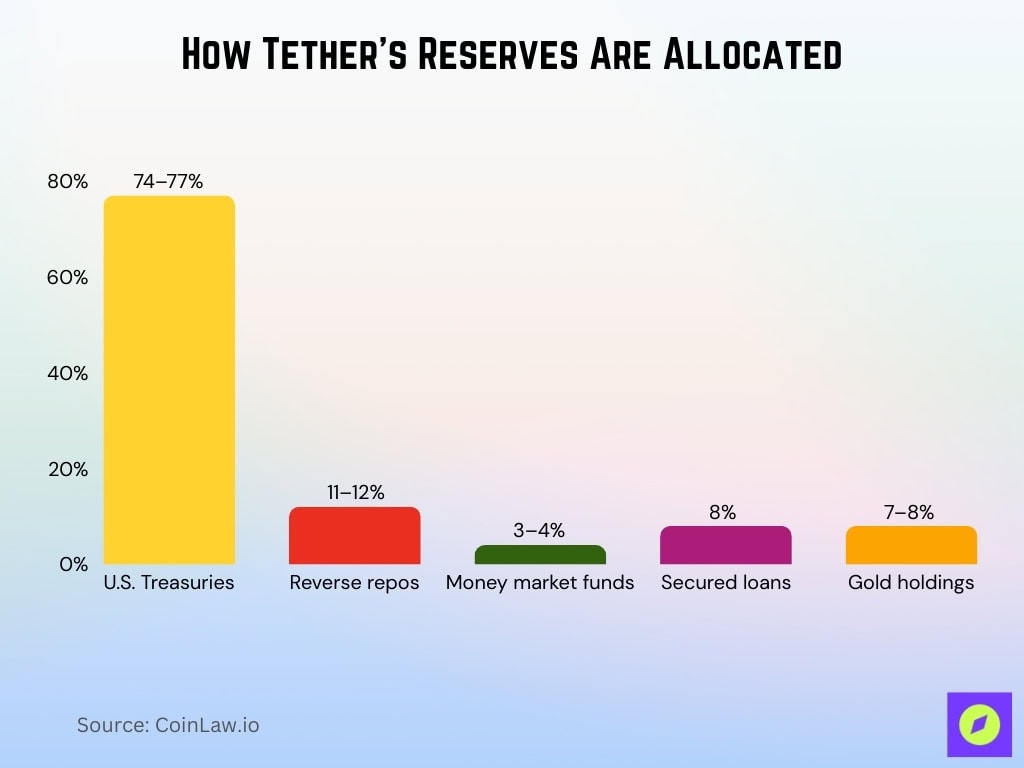

- U.S. Treasuries total about $135 billion, representing roughly 74–77% of Tether’s reserve assets.

- Reverse repurchase agreements account for approximately $21.0 billion, or around 11–12% of reserves.

- Money market funds contribute about $6.4 billion, roughly 3–4% of the total reserve pool.

- Secured loans stand near $14.6 billion, equal to about 8% of Tether’s reserves.

- Gold holdings are valued at around $12.9–14.0 billion, estimated at 7–8% of total reserves and linked to roughly 116 tons of bullion.

- Bitcoin reserves exceed 96,000 BTC, worth roughly $8.4–9.9 billion and comprising about 5–6% of assets.

- Total reserves reported for Q3 2025 were about $181.2 billion against $174.4 billion in liabilities, leaving a surplus of $6.8 billion.

- Earlier 2025 attestations showed assets of $162.6 billion versus liabilities of $157.1 billion, implying equity of roughly $5.5 billion.

Environmental Impact and Energy Consumption

- A post‑Merge Ethereum transaction uses about 0.02–0.03 kWh, versus roughly 84 kWh under PoW, a >99.9% energy reduction.

- Studies estimate Ethereum’s carbon footprint fell by around 99.992%, with per‑transaction emissions dropping from over 100 kg CO₂ to near 0.01 kg CO₂.

- A single Bitcoin transaction in 2025 emitted about 712 kg CO₂, equal to 1,578,956 VISA transactions, highlighting stablecoins’ relative efficiency.

- Proof‑of‑stake networks can be over 2,000× more efficient than proof‑of‑work, consuming under 0.001% of Bitcoin’s energy per transaction.

- Bitcoin’s per‑transaction footprint (around 830 kWh) dwarfs PoS chains, where typical transactions consume well below 1 kWh.

- Ethereum’s annual energy use dropped to roughly 0.0026 TWh, comparable to a small enterprise rather than a large country.

- Under PoS, Ethereum maintains block times near 12 seconds while supporting significantly lower emissions per unit of activity.

Frequently Asked Questions (FAQs)

Tether’s market cap is about $186.7 billion as of January 2026.

The circulating supply of USDT is approximately 186.8 billion tokens.

USDT’s 24h trading volume is roughly $120 billion.

One USDT is trading around $0.999–$1.0 today.

Conclusion

Tether’s dominance in the stablecoin world is no accident; it’s the result of continuous adaptation, growing trust, and strategic expansion. From becoming the first stablecoin to leading cross-border settlements and DeFi liquidity, USDT continues to redefine what digital dollars can do. While scrutiny and competition persist, Tether’s commitment to transparency, compliance, and innovation makes it a central pillar in the future of digital finance.