TeraWulf Inc. (Nasdaq: WULF) is scaling its vertically integrated bitcoin mining and high-performance computing (HPC) operations with a focus on zero-carbon energy. In the U.S. mining space, it is shifting from purely bitcoin extraction into large-scale data-center hosting, while also navigating rising power costs and regulatory dynamics.

For example, its infrastructure is now being positioned to serve both blockchain-mining and AI/HPC workloads. In manufacturing or data-centre operations, a real-world scenario would involve its Lake Mariner facility deploying megawatts of capacity for both mining and enterprise compute. In the energy sector, it shows how a mining firm uses hydro/nuclear zero-carbon power to lower its carbon profile.

Editor’s Choice

- Revenue of $47.6 million in Q2 2025, up from $35.6 million a year earlier.

- Mining capacity of 12.8 EH/s (exahashes per second) in Q2 2025, up ~45.5 % year-over-year.

- Held $219.6 million in combined cash and bitcoin holdings as of March 31, 2025.

- Cost of revenue (excluding depreciation) in Q2 2025 $22.1 million, up from $13.9 million in Q2 2024.

- Net loss in Q1 2025 of approximately $61.4 million.

- Convertible senior notes issuance of $850 million (1.00 % convertible senior notes due 2031) was announced in August 2025.

- Target of 200-250 MW operational HPC hosting capacity by the end of 2026.

Recent Developments

- In August 2025, TeraWulf upsized its offering of $850 million of 1.00 % convertible senior notes due 2031 to fund data-centre expansion.

- The company announced contracts to deliver 72.5 MW of gross HPC hosting infrastructure in 2025 at its Lake Mariner site.

- It reported in Q2 2025 that BTC mining capacity grew to 12.8 EH/s, signifying a ~45.5 % year-over-year increase.

- The cost per bitcoin self-mined rose to $45,555 in Q2 2025, compared to $22,954 in Q2 2024.

- Self-mined bitcoins in Q2 2025, 485 BTC, down from 699 BTC in Q2 2024.

- Interconnection approval at Lake Mariner to draw up to 500 MW, pending further approvals to reach 750 MW.

- The company repurchased $33 million of its common stock in Q1 2025.

- Revenue for Q1 2025 decreased 19 % year-over-year to $34.4 million.

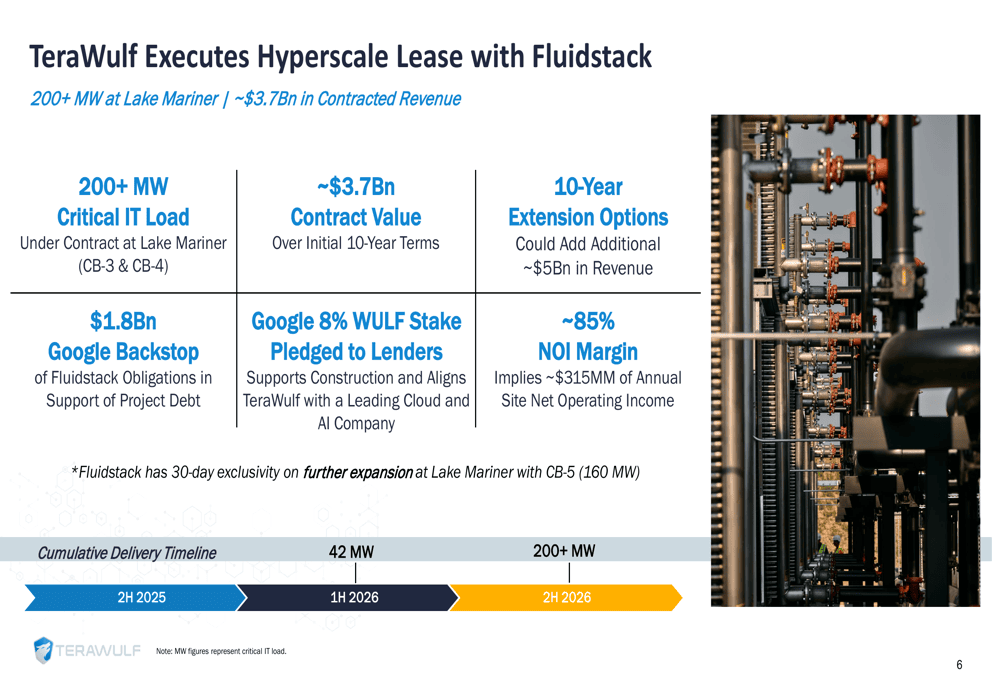

TeraWulf Executes Hyperscale Lease with Fluidstack

- 200+ MW of critical IT load is under contract at Lake Mariner across CB-3 and CB-4, supporting large-scale HPC and AI operations.

- The partnership represents a $3.7 billion contract value over an initial 10-year term, positioning it among the largest hyperscale leases in the U.S. data infrastructure sector.

- 10-year extension options could add an additional ~$5 billion in future revenue potential.

- A $1.8 billion Google backstop secures Fluidstack’s obligations, strengthening the project’s financial backing.

- Google holds an 8% stake in TeraWulf (WULF), pledged to lenders to support construction and align incentives with a major AI and cloud partner.

- The site is expected to generate an ~85% NOI margin, translating to roughly $315 million in annual net operating income.

- Fluidstack retains a 30-day exclusivity for further expansion at Lake Mariner (CB-5), potentially adding 160 MW of additional capacity.

- The cumulative delivery timeline includes 42 MW by 2H 2025 and scaling to 200+ MW by 2H 2026, marking rapid infrastructure growth.

Key Financial Statistics

- Q1 2025 revenue, $34.4 million, down 19 % year-over-year.

- Q2 2025 revenue, $47.6 million, up ~34 % year-over-year (from $35.6 million).

- Trailing twelve-month revenue (TTM) approx $144.09 million, up ~19.8 % from prior year.

- Cost of revenue (excl. depreciation), Q2 2025 $22.1 million, vs. $13.9 million in Q2 2024.

- Cost of revenue as a % of revenue in Q2 2025, 46.4 %, up from 39.1 % in Q2 2024.

- Cash and bitcoin holdings, $219.6 million (as of March 31, 2025).

Revenue Growth Trends

- Revenue grew from ~$35.6 million in Q2 2024 to $47.6 million in Q2 2025.

- Annual revenue for 2024 was approximately $140.05 million, up ~102.3 % from 2023.

- Trailing-12-month revenue of ~$144.09 million implies modest growth (~19.8 %) from the prior period.

- Q1 2025 revenue drop (-19 %) shows halving and cost headwinds weighing on growth.

- Capacity expansion for mining (12.8 EH/s) supports future revenue growth potential.

- The shift into HPC hosting (72.5 MW in 2025) opens an alternative revenue stream beyond bitcoin mining.

- The company’s revenue per share and employee metrics show high leverage (~$12 million per employee as of 2025).

TeraWulf vs. Bitcoin Mining Peers: Total Return Performance

- TeraWulf Inc. (WULF) posted a -41.7% total return as of May 2025, marking the steepest decline among major crypto-mining peers amid heavy infrastructure spending and market volatility.

- MARA Holdings Inc. (MARA) recorded a smaller drop of -14.8%, reflecting relatively stronger balance sheet management and diversified revenue sources.

- The CoinShares Valkyrie Bitcoin Miners ETF (WGMI), which tracks a basket of mining firms, showed a -30.0% total return, indicating sector-wide headwinds in the first half of 2025.

- The downward trend from January to April 2025 aligns with Bitcoin price corrections and increased energy and debt costs across miners.

- By early May 2025, share prices across the mining sector began to stabilize, hinting at possible recovery momentum tied to AI/HPC diversification efforts.

Profitability Metrics

- Q1 2025 net loss, approximately $61.4 million.

- Q1 2025 cost of revenue (excl. depreciation), $24.6 million, up ~70 % year-over-year.

- Q2 2025 adjusted EBITDA $14.5 million, down from $19.5 million in Q2 2024.

- Power cost per bitcoin self-mined in Q2 2025, $45,555, is about double the $22,954 in Q2 2024.

- Self-mined bitcoin count in Q2 2025, 485 BTC vs. 699 BTC in Q2 2024.

- Cost of revenue as % of revenue in Q1 2025, ~71.4 % (vs ~34 % in Q1 2024), showing margin pressure.

- Although revenue rose in Q2, the heavy cost base and infrastructure investments mean full profitability remains a challenge.

Market Capitalization & Valuation

- Revenue per Employee, $12.0 million, implying high efficiency in staff deployment.

- TeraWulf’s P/S ratio is approximately 29.4×, based on trailing twelve-month revenue of $144.09 million.

- Conversion price for the August 2025 convertible notes, $12.43 per share, representing a ~32.5 % premium to the closing price then.

- Some analyst reports noted elevated forward multiples despite loss-making operations.

- High short interest (~40 % of float) has been noted in the market, though not strictly valuation data.

- The shift into HPC hosting and AI infrastructure is viewed as de-risking the bitcoin-only narrative and may impact valuation positively.

Infrastructure & Energy Sources

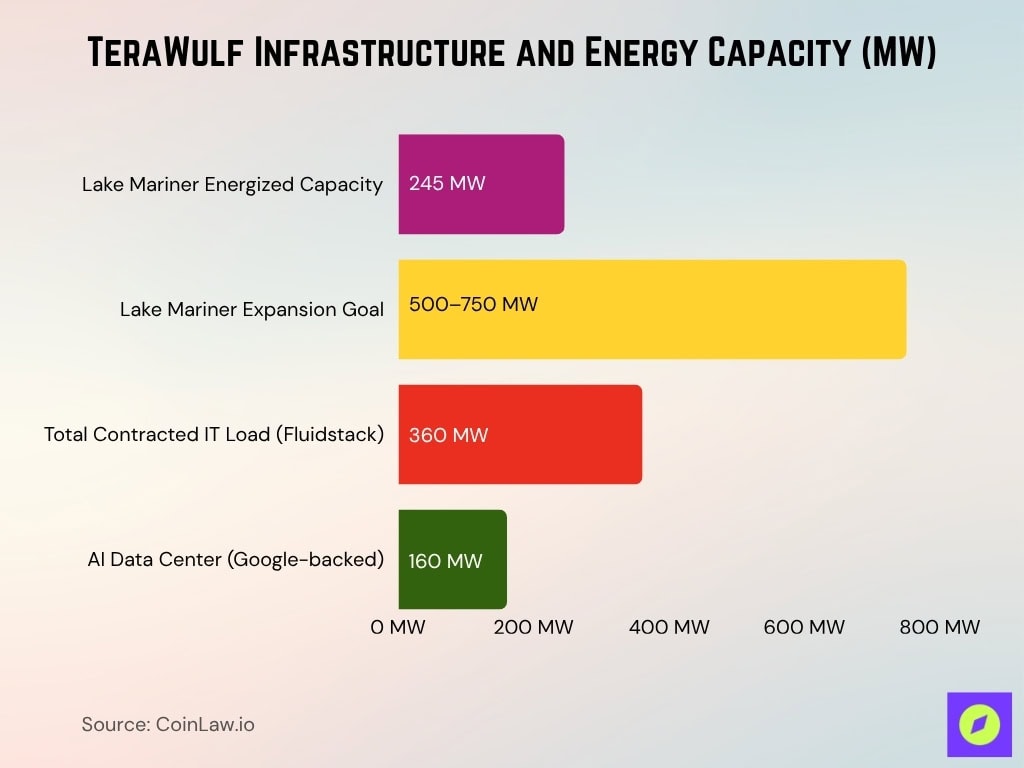

- The Lake Mariner facility currently has 245 MW of energized capacity and is expanding toward 500–750 MW full interconnection.

- TeraWulf’s total contracted IT load with Fluidstack reached 360 MW in 2025, making it one of the largest HPC campuses in the U.S..

- Google-backed financing totaling $3.2 billion supports a 160 MW AI data center buildout at the same campus.

- Dual 345 kV transmission lines provide redundant, high-capacity grid connectivity for steady power delivery.

- The Beowulf acquisition, valued at $52.4 million, integrated 94 employees and solidified vertical control over energy generation assets.

- TeraWulf’s development portfolio exceeds 600 MW of digital infrastructure capacity to date across mining and HPC segments.

- The company’s zero-carbon power utilization remains above 90%, mainly from hydroelectric and nuclear sources.

- Lake Mariner’s expansion includes 72.5 MW of new HPC infrastructure targeted for Core42 clients in 2025.

- TeraWulf’s HPC and mining strategy has improved hashrate capacity 45–50% year-over-year, enhancing power utilization efficiency.

Share Price Performance

- The stock ticker TeraWulf Inc. (NASDAQ: WULF) traded around $9.45 at one recent snapshot, with a market capitalization near $3.7 billion.

- Over the past 52 weeks, the stock has ranged from a low of about $2.06 to a high near $16.19.

- On a day when a major AI-hosting deal was announced, WULF surged by roughly 43%.

- The option put-call ratio dropped to 0.22, signalling increased call interest, when shares rose 5.6%.

- Short interest in the company is estimated at ~40% of float, a significant level for volatility.

- Institutional ownership has risen; Quantbot Technologies LP added 1.356 million shares (~0.35% of the company).

- Insider moves: A director sold $584 000 in shares recently.

- WULF’s price/earnings and profitability metrics remain weak (e.g., normalized ROA ~ -10.23%).

Shareholder Structure

- Institutional investor ownership is estimated at ~62.49% of total shares.

- The director’s sale of $584k in shares signals active insider liquidity events.

- Retail and short-seller dynamics, short interest at ~40% of float, suggest a large speculative component.

- Harbour Capital Advisors LLC acquired 107,415 shares (~$470k) in Q2.

- The company repurchased $33 million of its common stock during Q1 2025.

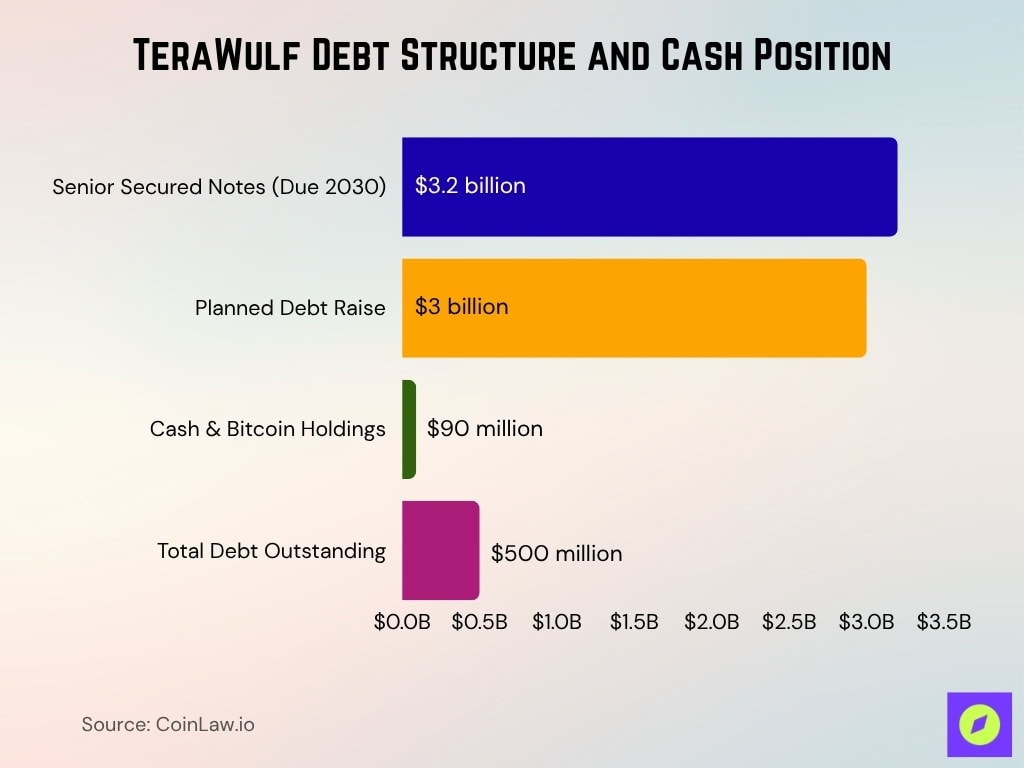

Debt Financing & Fundraising Initiatives

- The company priced $3.2 billion of 7.750% Senior Secured Notes due 2030 to fund its Lake Mariner campus expansion.

- The planned debt raise (~$3 billion) is backed by the Google/Fluidstack lease commitments, aiming to support institutional-grade funding.

- Liquidity position includes $90 million in cash/bitcoin and $500 million in total debt outstanding.

- Earlier in 2025, the company executed convertible note offerings and debt-capital structures to fund HPC expansion.

- The debt is secured by first-priority liens on assets of the subsidiary WULF Compute and its guarantors.

- The capital structure reflects the shift from near-term cash-flow mining to long-cycle infrastructure investment.

- Large-scale debt increases leverage and risk, but is mitigated by long-term contracts and back-stop arrangements.

- Capital-raising via debt, rather than major equity dilution, signals intent to preserve shareholder value while scaling.

Bitcoin Mining Capacity & Output

- As of Q2 2025, TeraWulf’s bitcoin mining capacity was 12.8 EH/s, up 45.5% year-over-year.

- In Q1 2025, self-mining capacity rose to 12.2 EH/s, up 52.5% over Q1 2024.

- In December 2024, the installed hash rate was 9.7 EH/s, with an operational average of 8.4 EH/s.

- Prior to that (Sept 2024), capacity was 10.0 EH/s with miners operating at 8.2 EH/s.

- In November 2024, self-mined bitcoins in that month were 115 BTC, with an average daily production of 3.8 BTC.

- In August 2024, the company mined 184 BTC (~5.9 BTC/day) with 10.0 EH/s installed capacity.

- Mining output for Q2 2025, 485 BTC, down from 699 BTC in Q2 2024 (reflecting the bitcoin halving effect).

Hash Rate Expansion

- Installed capacity increased from 9.7 EH/s in December 2024 to 12.8 EH/s by June 2025.

- Q1 2025 year-over-year hash rate growth of 52.5%.

- November 2024 operational capacity reported at 8.4 EH/s, up 68% year-over-year.

- Operating capacity projections include miner building expansions, MB-5 (50 MW), scheduled for completion mid-Q1 2025.

- Optimization efforts improved average hash rate performance under varying demand response events.

- Mining facility capacity, 195 MW at Lake Mariner as of December 2024.

- The company expects its hash-rate growth to support new revenue streams via HPC hosting as well as bitcoin mining.

Cost of Revenue & Operational Expenses

- Q2 2025 cost of revenue (excluding depreciation) was $22.1 million, vs. $13.9 million in Q2 2024.

- In Q1 2025 cost of revenue (excl. depreciation) was $24.6 million, up from $14.4 million in Q1 2024.

- Power cost per bitcoin self-mined in Q1 2025 was $66,084, compared with $15,501 in Q1 2024.

- In November 2024, the average power cost per bitcoin was $41,190.

- The cost of revenue as a percentage of revenue in Q2 2025 was 46.4%.

- Infrastructure build-out (miner buildings, data hall expansions) is increasing fixed and operational costs.

- FPGA/miner upgrades improved efficiency (e.g., November 2024 upgrades improved efficiency to 19.2 J/TH).

Earnings & EBITDA Highlights

- The company reported a GAAP net loss in Q1 2025 of approximately -$61.4 million.

- Adjusted EBITDA for Q2 2025 was approximately $14.5 million, down from $19.5 million in Q2 2024.

- Losses for 2024 were around -$72.42 million, compared to -$69.23 million in 2023.

- EPS for Q1 2025 missed estimates by $0.01 per share.

- The company emphasised its liquidity buffer of $219.6 million in bitcoin and cash as of March 31, 2025.

- Operating cost pressures (higher cost per bitcoin) are compressing margins even as capacity expands.

- The ramping of HPC hosting revenue is expected to improve profitability trends over 2026 and beyond.

Digital Asset Holdings (Bitcoin/Cash)

- As of March 31, 2025, the company held $219.6 million in combined cash and bitcoin, reinforcing its solid liquidity position.

- This liquidity buffer stands out as a key competitive strength compared with other mining peers.

- By mid-2025, TeraWulf had $500 million in convertible senior notes outstanding, followed by an additional $3.2 billion in senior secured notes raised in October 2025.

- The company’s digital-asset portfolio also acts as a natural hedge against bitcoin price swings, helping to stabilize mining-related revenues.

- During Q2 2025, the value of self-mined bitcoin reached $47.6 million, reflecting strong operational output.

- Rather than prioritizing near-term payouts, the company continues to deploy its holdings and liquidity toward infrastructure growth and expansion initiatives.

High-Performance Computing (HPC) Expansion

- Fluidstack has exercised an option for an incremental 160 MW of critical IT load at the Lake Mariner campus, bringing total contracted IT load to ~360 MW.

- The CB-5 build is expected to enter operations in H2 2026, targeting AI and liquid-cooled workloads.

- The Lake Mariner facility has secured interconnection approval to draw up to 500 MW, with pending approvals to reach 750 MW total.

- Acquisition of Beowulf Electricity & Data LLC in May 2025 strengthens vertical integration of power and compute infrastructure.

- The pivot to HPC hosting is framed as a dual-use strategy (bitcoin mining + AI/HPC) to diversify revenue and improve asset utilization.

- The expansion places the company in one of the largest AI-/HPC-capable digital infrastructure platforms in the U.S. at scale.

- The infrastructure build-out timeline and capital commitments suggest a multi-year rollout, with initial phases in 2025 and full capacity targeted beyond.

Major Contracts & Partnerships

- In August 2025, TeraWulf raised $850 million in convertible notes, followed by $3.2 billion in senior secured notes in October 2025, reflecting separate but aligned financing moves.

- The CB-5 lease follows similar terms to earlier facilities, maintaining consistency in its contractual framework.

- The company is also in advanced talks to expand HPC hosting capacity at Lake Mariner while exploring additional potential sites.

- Its dual-use model, combining bitcoin mining and HPC hosting, is supported by strategic partnerships that strengthen access to capital and balance operational risks.

- These alliances add recognizable credibility and broaden the customer base beyond traditional crypto clients.

- The rollout of key contracts indicates a steady evolution from a mining-focused player to a trusted infrastructure provider for AI and enterprise compute.

- With longer-term agreements and scalable deployments, the company is positioning for stronger revenue visibility and efficient utilization of its high-density compute assets.

Sustainability & Environmental Impact

- Approximately 89% of the grid energy powering TeraWulf’s Lake Mariner campus is zero-carbon sourced from hydroelectric and nuclear generation.

- The Lake Mariner facility is projected to reach 750 MW of total capacity upon full buildout, repurposing the former 700 MW coal site.

- TeraWulf’s operations currently utilize more than 91% zero-carbon energy, largely from nuclear and hydro sources.

- Its HPC expansion targets 200–250 MW operational capacity by late 2026, integrated with renewable infrastructure.

- The company’s energy cost averages $0.035–$0.045/kWh, reflecting efficient renewable sourcing and grid alignment.

- The Lake Mariner data center design with liquid-cooling and optimized density cuts overall energy use by up to 30% versus air-cooled setups.

Frequently Asked Questions (FAQs)

Initial contracted revenue: $3.7 billion; with extensions could reach $8.7 billion.

Gross margin: 43.83%; profit margin: -91.42%.

Shares outstanding: 407.94 million; shares have increased by +40.92% YoY.

Self-mined: 485 BTC; power cost per bitcoin: $45,555.

Conclusion

TeraWulf Inc. has pivoted substantially, from primarily a bitcoin mining enterprise toward a large-scale, mission-critical digital infrastructure operator servicing both mining and high-performance computing workloads. The highlighted expansions, major contracts, vertical integration of infrastructure and energy, ambitious debt financing plans, and valuation/analyst dynamics all reflect a company at an inflection point.

That said, execution risk remains tangible; timely construction, power sourcing, contract delivery, and debt servicing will all be critical. The sustainability story and long-term contracts offer promise, but investors and industry watchers will be monitoring whether the ambition translates into consistent revenue and profit growth. For those seeking to understand how TeraWulf is positioned in the intersecting domains of cryptocurrency, AI-driven compute, and energy infrastructure, the numbers above offer a comprehensive snapshot.