Introduction

Black Friday is the day after Thanksgiving and has traditionally been considered the start of the holiday shopping season in the United States. The term “Black Friday” dates back to the 1960s and was used to describe the heavy traffic and chaos that occurred in Philadelphia before the Army-Navy football game on that Friday after Thanksgiving.

Retailers today offer major sales and special deals on Black Friday to encourage people to start their holiday shopping. It has become one of the busiest shopping days of the year, with customers lining up outside stores early in the morning or even the night before to take advantage of promotions.

For many retailers, Black Friday is the start of their peak sales before Christmas. The sales and profits accumulated on Black Friday can often determine if retailers have a successful holiday season overall. It’s one of the key days that put many retailers “in the black” for profitability for the year.

Editor’s Choice

- U.S. retail sales on Black Friday increased 12% year over year.

- Black Friday sales increased 12% year over year in stores and 14 % for online purchases in the US.

- Cyber Week sales globally experienced a 2% year-on-year growth to reach $281 billion globally.

- Consumers worldwide spent an estimated global total of $1.14 trillion online during the Holiday Season.

- Americans spent over $270 billion online during the Holiday Season.

- Cyber Week online sales surged 9% year-on-year to reach $68 billion, an impressive result.

(source: Adobe)

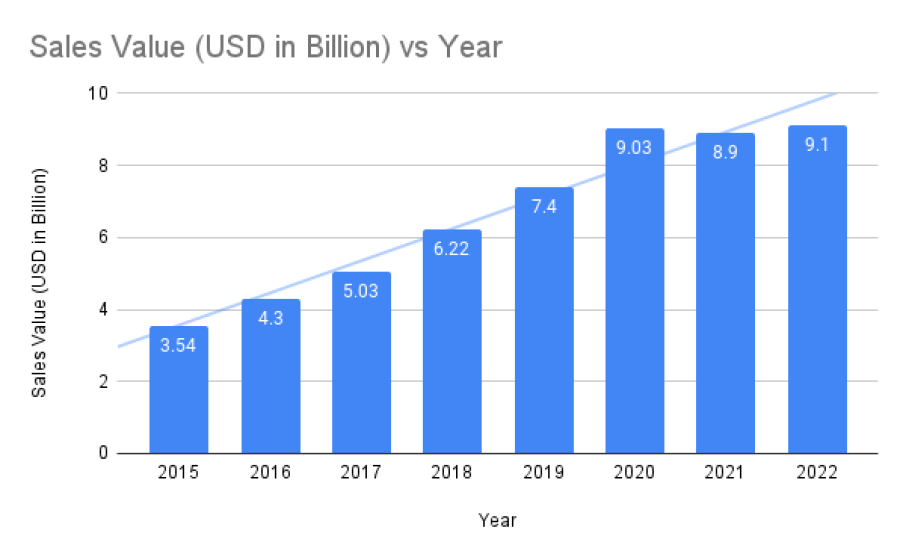

Black Friday By Annual Revenue

- Black Friday sales are projected to top $9.8 billion by 2023.

- In 2022, Black Friday sales totaled $9.12 billion – surpassing every record set over previous decades!

- On average, Black Friday discounts average 25%.

- Black Friday sales saw nearly 196.7 million consumers purchasing products both online and offline during 2022’s Black Friday sales period.

- At Black Friday 2022, conversion rates on our e-commerce platform increased by 50%.

- 2022 saw an 88% surge in usage of “Buy Now, Pay Later”, and its usage is predicted to further expand with sales in 2023.

- Black Friday sales accumulated $9.12 billion in 2022.

(source: Adobe)

Black Friday Shopping Trends

- Total sales increased 5.8% over last year to $9.4 billion.

- Top categories purchased:

- Electronics 27% of sales

- Toys 22%

- Clothing/Apparel 18%

- Appliances 12%

- Other 21%

- In-store sales accounted for 66% of total Black Friday revenue. Online sales made up 34% of revenue.

- Cyber Monday sales followed at $8.1 billion, growing 4% over last year.

- Stores opened as early as 6 PM on Thanksgiving evening with doorbuster deals. 60% of retailers opened at midnight compared to 50% last year.

- Retailers used promotions like offering the first 100 customers a free gift card and matching competitor prices to incentivize early shopping.

- Average discount rates were 23% for appliances, 20% for televisions, and 15% for toys and clothing.

Total sales and growth rates year-over-year

- In 2022, total Black Friday sales reached $9.12 billion, representing a 6.2% increase from 2021’s sales total of $8.92 billion.

- Black Friday sales in 2021 grew by 4.9% compared to 2020 sales, rising from $8.61 billion to $8.92 billion.

- 2020 saw a decline of 1.3% in total sales volume on Black Friday, dropping from $8.74 billion in 2019 to $8.61 billion. This marked the first time Black Friday revenue decreased year-over-year since 2015.

- Looking further back, Black Friday sales grew by 6.1% from 2018 ($8.23 billion) to 2019 ($8.74 billion).

- Between 2017 and 2018, total sales increased by 7.2% from $7.67 billion to $8.23 billion.

- The highest growth rate in the past five years came between 2016 and 2017 when Black Friday revenue grew 13% from $6.79 billion to $7.67 billion.

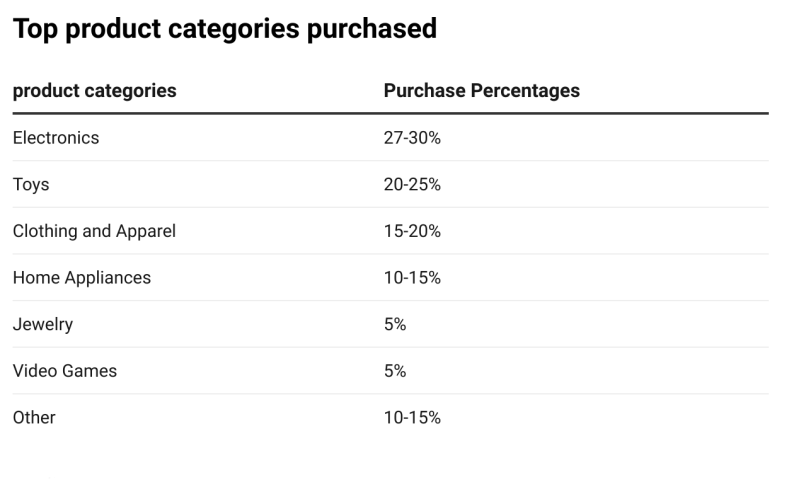

Top product categories purchased

- Electronics Usually accounts for 27-30% of total Black Friday sales. Items like smartphones, tablets, laptops, and TVs are top sellers.

- Toys Make up around 20-25% of Black Friday revenue. Major retailers deeply discount toy items to bring in customers. Popular toys that are “hot” for the holidays see huge demand.

- Clothing and Apparel Traditionally 15-20% of sales. Retailers promote “doorbuster” deals on coats, shoes, and other apparel.

- Home Appliances Around 10-15% of sales. Major home appliances like refrigerators, ovens, and washing machines see significant discounts.

- Jewelry About 5% of sales, as jewelry stores try to boost sales before the December holidays.

- Video Games Makeup is around 5% of purchases, led by discounted gaming systems and accessories.

- Other The remaining 10-15% is made up of misc. categories like furniture, beauty, books, and sports equipment.

Breakdown of in-store vs online sales

- In 2022, in-store sales accounted for 58% of total Black Friday revenue.

- Online sales made up 42% of total Black Friday sales in 2022.

- In 2021, the split was 62% in-store and 38% online for Black Friday sales.

- In 2020, due to the COVID-19 pandemic, more sales shifted online. In-store sales made up 55% of revenue, while online sales grew to 45% of the total.

- In 2019, the in-store vs online breakdown was 67% in-store and 33% online.

- Over the past 5 years, the share of online sales on Black Friday has steadily grown, taking a share away from in-store sales.

Cyber Monday comparison

- In 2022, Cyber Monday online sales reached $11.3 billion, up 5.8% from 2021.

- Black Friday 2022 saw $9.1 billion in total sales, up 6.2% versus the prior year.

- Cyber Monday tends to see higher growth rates in online revenue compared to Black Friday in recent years.

- In 2021, Cyber Monday sales grew 8.6% year-over-year to $10.7 billion. Black Friday increased 4.9% to $8.9 billion.

- About 20-30% of consumers wait until Cyber Monday specifically to take advantage of online deals.

- Top-selling products are similar, dominated by electronics, clothing, toys, and major appliances.

- Cyber Monday features more sitewide sales rather than specific doorbuster deals.

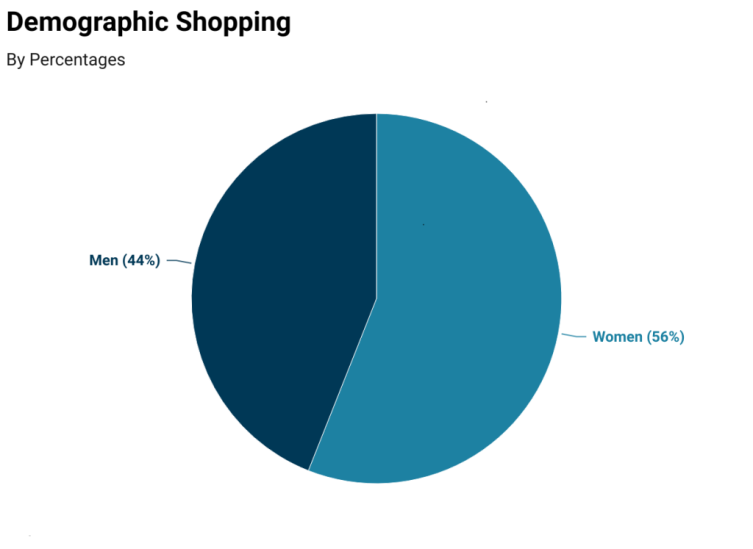

Demographic Shopping Patterns

The gender split of shoppers

- In 2022, 56% of Black Friday shoppers were women and 44% were men.

- This gender split has remained relatively stable over the past several years.

- Women tend to spend more overall on Black Friday sales events.

Age groups of shoppers

- Over one-third (38%) of Black Friday shoppers in 2022 were under 35 years old.

- About 46% were 35-54 years old.

- 16% were over 55 years old.

- Young adults and parents dominate Black Friday crowds.

Income levels of shoppers

- Households earning less than $50,000 annually accounted for 36% of shoppers in 2022.

- Middle-income shoppers with $50,000 to $100,000 made up 34%.

- Higher-income households earning over $100k were 30% of shoppers.

Geographic differences

- The South (29%) and Midwest (24%) saw the highest Black Friday participation in 2022.

- The West accounted for 23% of shoppers and the Northeast for 24%.

- Rural areas tend to see less Black Friday activity compared to suburban and urban locations.

Retail Strategies

Trends in Advertising & Promotions:

- Retailers start advertising and teasing deals up to a month in advance through email, social media, TV, and circulars.

- More Black Friday ads are focused on online deals rather than only in-store doorbusters.

- Stores promote sneak peeks of deals and even release some prices early to entice planning and shopping.

Opening Times & Doorbuster Deals:

- Major retailers open as early as 5 or 6 p.m. on Thanksgiving day for doorbuster deals.

- Limited quantity and deeply discounted doorbuster deals are used to draw in early crowds.

- Doorbuster deals are usually for the most popular items like electronics, apparel, and toys.

Preparing Inventory & Staffing:

- Retailers stock the most in-demand doorbuster deal items well in advance. Extra inventory is held in the backroom.

- Additional staffing is scheduled for Black Friday in customer service and to handle large crowds.

- More self-checkout lanes and POS systems are opened to allow quicker purchases.

- Security is increased with crowd control and monitoring for thefts and safety issues.

Online Shopping Trends

Growth of Online Sales:

- Online sales on Black Friday grew by over 20% from 2021 to 2022.

- Online revenue now makes up over 40% of total Black Friday spending.

- The pandemic accelerated the shift from in-store to online buying on Black Friday.

Mobile vs Desktop Sales:

- In 2022, mobile purchasing accounted for 55% of all e-commerce sales on Black Friday.

- Desktop purchases made up the remaining 45% of online revenue.

- Mobile shopping on smartphones continues to take share on Black Friday year-over-year.

Top Online Retailers:

- Amazon dominates online Black Friday sales, accounting for over 50% of revenue.

- Other top retailers for online Black Friday include Walmart, Target, Best Buy, Macy’s and Etsy.

- Clothing and tech items saw the highest online demand on Black Friday 2022.

- Small business online spending also increased by double digits versus last year.

Consumer Sentiment & Spending

Economic Concerns & Enthusiasm:

- High inflation has made consumers more cautious and deal-focused for 2022 holiday shopping.

- Despite concerns, spending enthusiasm remains high with over 70% of shoppers planning Black Friday purchases.

Consumer Confidence:

- The Conference Board’s consumer confidence index fell to 100.2 in November, down from 102.2 in October.

- Confidence remains relatively weak compared to pre-pandemic levels over 125.

Planned Spending & Budgets:

- Shoppers plan to spend an average of $225 on Black Friday sales in 2022, up 7% year-over-year.

- For holiday shopping overall, the average spend is expected to rise 7% to $932 per consumer.

- Over one-third of consumers save and budget specifically for Black Friday deals.

- Gift cards, toys, and clothing are top-planned purchases.

Future Outlook

Expert Projections:

- Holiday retail sales are projected to grow between 6-8% over 2021 totals.

- Black Friday in-store traffic is expected to remain below pre-pandemic levels as online shopping accelerates.

- Supply chain issues and higher prices could dampen growth compared to previous holiday seasons.

Expected Consumer Trends:

- Online shopping, buy online pickup in-store (BOPIS), and omnichannel retail will continue to grow.

- Consumers will compare shops more than in past years due to high inflation.

- More shopping may happen earlier in Nov-Dec to spread out spending.

Retailer Strategies & Innovations:

- Retailers will offer expanded pickup and delivery options for online orders.

- Payment and shopping tools like “buy now, pay later” will be more prominent to ease costs.

- More stores will be closed on Thanksgiving itself and open later on Black Friday.

- Technology like location-based offers and AI recommendations will play a bigger role.

FAQ

1. When is Black Friday 2023?

A. Black Friday 2023 will be on Friday, November 24th. It always falls on the Friday after Thanksgiving.

2. What time do Black Friday sales start?

A. Many retailers open their doors as early as 5 or 6 p.m. on Thanksgiving evening. However, Black Friday deals are available online even earlier most retailers launch some online-only deals at midnight or very early morning hours.

3. What are the most popular Black Friday purchases?

A. The most popular Black Friday purchases are electronics like smartphones, TVs, and laptops. Clothing, toys, and major appliances also see heavy discounts and are top-selling categories.

4. Is it better to shop online or in stores on Black Friday?

A. It depends on what you want. Doorbuster deals are usually available only in physical stores, so you have to shop in person. However, there are usually lots of online-only deals too. Shopping online avoids crowds and you can potentially get deals all weekend long.

ABOUT AUTHOR

Kundan Goyal possesses a wealth of experience in Digital Marketing, offering valuable insights to businesses of all sizes. He actively contributes to industry-specific PR, news outlets, and forums, shaping discussions and driving forward-thinking strategies. Outside of work, HE enjoys carrom and has a deep passion for news editing and research. His strength lies in helping companies make informed, strategic decisions and predicting future trends. With his dedication and innovative approach, he is a versatile professional who brings a unique blend of skills and expertise to the ever-evolving digital landscape, enabling businesses to thrive in this dynamic environment.