In the fast-paced world of digital payments, PayPal has been a pivotal player, shaping how consumers and businesses interact online. What started as a small service back in 1998 has grown into a global powerhouse, connecting millions of users across the world. Today, PayPal continues to innovate, offering a wide range of financial services that make it easier than ever to manage money digitally. But just how big is PayPal, and what are its key milestones? Let’s dive into the data to explore PayPal’s growth and its impact on the digital payments landscape.

Editor’s Choice

- In Q3 2025, PayPal generated $8.42 billion in revenue, marking 7% year-over-year growth.

- PayPal processed around 6 billion transactions in Q1, with total payment volume reaching $417.2 billion.

- PayPal has approximately 436 million active accounts, reflecting about 2% annual growth.

- Venmo helped drive PayPal’s Q3 surge, as revenues grew 7% year-over-year to $8.42 billion on the back of Venmo and BNPL growth.

- PayPal’s Q1 net income reached $1.29 billion, up 45% from $888 million a year earlier.

- Transaction margin dollars increased 7% to $3.7 billion in Q1, highlighting improved profitability.

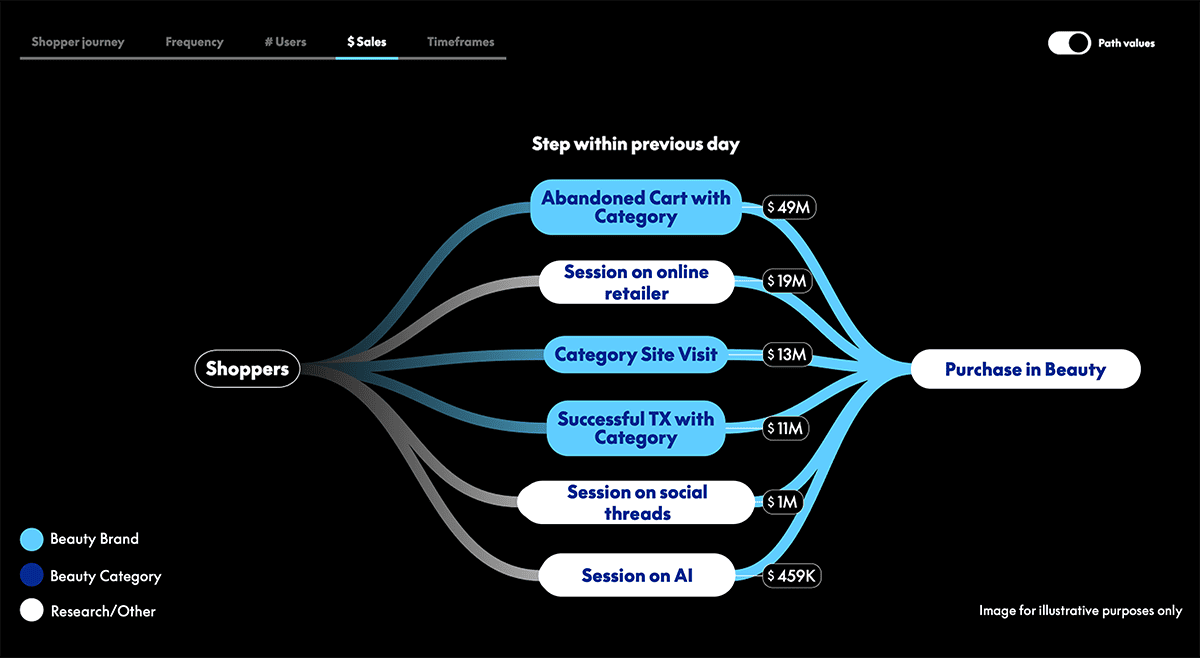

PayPal Shopper Journey Insights

- Abandoned carts are the largest revenue driver, contributing $49 million in beauty purchases within a single day, highlighting PayPal’s strength in re-engaging high-intent shoppers.

- Online retailer sessions generated $19 million in beauty sales, showing PayPal’s strong checkout conversion influence across merchant platforms.

- Category site visits accounted for $13 million in purchases, reinforcing PayPal’s role in early-stage product discovery and research.

- Successful prior transactions drove $11 million in follow-on beauty purchases, indicating strong repeat usage and customer loyalty within PayPal’s ecosystem.

- Social thread activity resulted in $1 million in beauty sales, demonstrating PayPal’s ability to capture intent from social commerce channels.

- AI-driven sessions produced $459,000 in purchases, showing an emerging but measurable AI-assisted shopping impact on PayPal-enabled transactions.

PayPal Revenue and Profit

- $32.86 billion in total revenue for twelve months ending September 30, 2025, up from prior periods.

- $8.42 billion in revenue for Q3 2025, marking 7% year-over-year growth.

- $1.5 billion in GAAP operating income for Q2 2025, reflecting a 14% year-over-year increase.

- $8.3 billion net revenues in Q2 2025, with 5% currency-neutral growth.

- $2.55 billion net income for the six months ended June 30, 2025, up from the prior year.

- $1.26 billion net income in Q2 2025, a 12% year-over-year rise.

- $443.5 billion total payment volume in Q2 2025, increasing 6% year-over-year.

- 6.2 billion payment transactions in Q2 2025, down 5% year-over-year overall.

- Transaction revenues reached $7.52 billion in Q3 2025 from core operations.

- 53% of total revenue was generated from the U.S. market in recent periods.

Growth in User Base and Merchant Accounts

- 436 million active user accounts as of Q1 2025, marking a 2% year-over-year increase.

- 36 million merchants worldwide utilize PayPal for transactions, reflecting 10.76% compound annual growth over five years.

- 72.9 million users are projected to use Venmo in 2025, a 6.7% increase from 2024.

- Small and medium-sized businesses constitute approximately 75% of PayPal’s merchant base.

- The average number of transactions per active account is 59.4 in 2025, a 1% decrease from the previous year.

- 15.4 million business accounts are active globally in 2025.

- The U.S. accounts for 38.87% of PayPal’s total user base, followed by Germany at 19.25%.

- PayPal provided loans to over 420,000 business accounts globally.

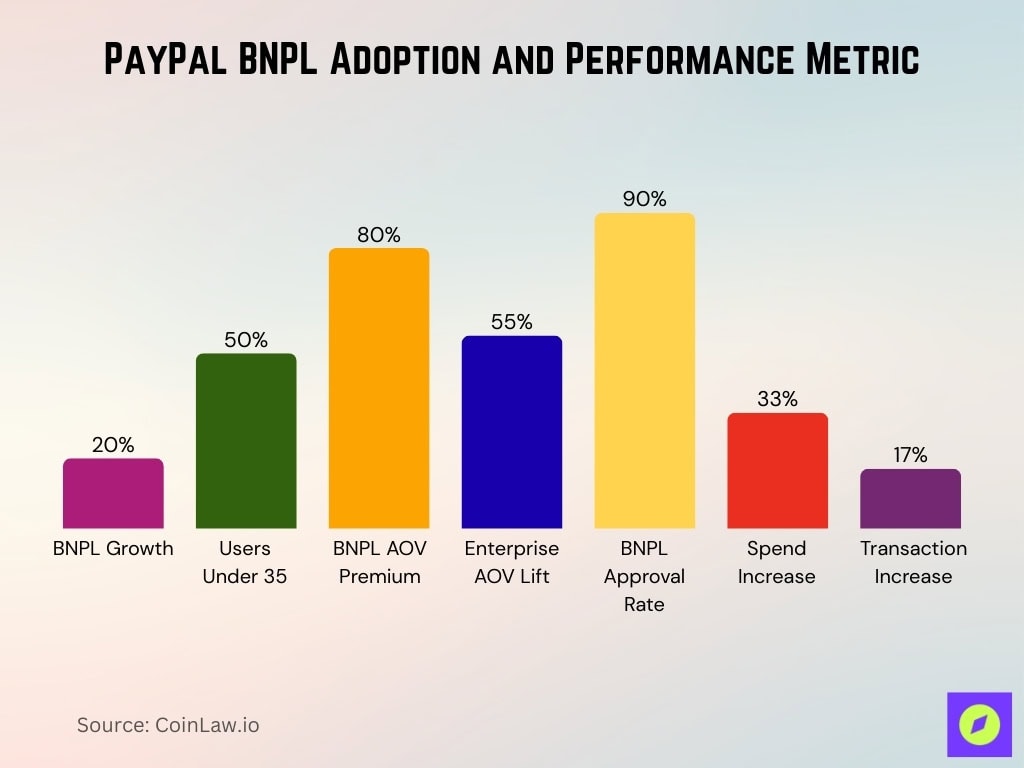

Buy Now, Pay Later (BNPL) Adoption

- Over 40 million PayPal users utilized BNPL, with TPV and monthly active accounts growing over 20% in Q3 2025.

- 50% of BNPL users are under 35 years old, appealing strongly to younger consumers.

- Average order value (AOV) for BNPL purchases is 80% higher than standard transactions.

- Retail and e-commerce drive significant BNPL adoption, with 55% higher AOV for enterprises.

- 90% approval rate for PayPal BNPL customers, boosting merchant sales.

- PayPal BNPL is available in over 15 countries, with expansion plans.

- BNPL users spend 33% more on average, with 17% more transactions.

Transaction Volume and Payment

- 6.2 billion transactions processed in Q2 2025, reflecting a 5% year-over-year decrease.

- $443.5 billion in total payment volume (TPV) in Q2 2025, marking 6% growth.

- $437 billion in TPV for Q4 2024, slightly below estimates.

- $71.53 was the average transaction size in Q2 2025 (TPV/transactions).

- 26% of TPV from P2P payments, including Venmo, in recent quarters.

- 90.8% of PayPal’s revenue from transactions in Q2 2025 ($7.44 billion of $8.3 billion).

- 1.72% take rate approximated from recent transaction metrics.

- Transaction margin dollars up 7% to $3.8 billion in Q2 2025.

Mobile Payment and Digital Wallet Insights

- 45% of PayPal transactions are made via mobile devices.

- Venmo processed $276 billion in transactions, reflecting a 13.1% year-over-year increase.

- Mobile payments on PayPal reached $720 billion in total volume, over 43% of overall transactions.

- 80 million PayPal users actively use the One Touch service for seamless payments.

- PayPal’s QR code payments grew by 20%, with businesses adopting contactless options.

- PayPal’s mobile app downloads reached 65 million globally.

- Venmo’s user base grew to 97.1 million, with users sending an average $1,650 per person annually.

- $760 billion estimated in PayPal mobile transactions.

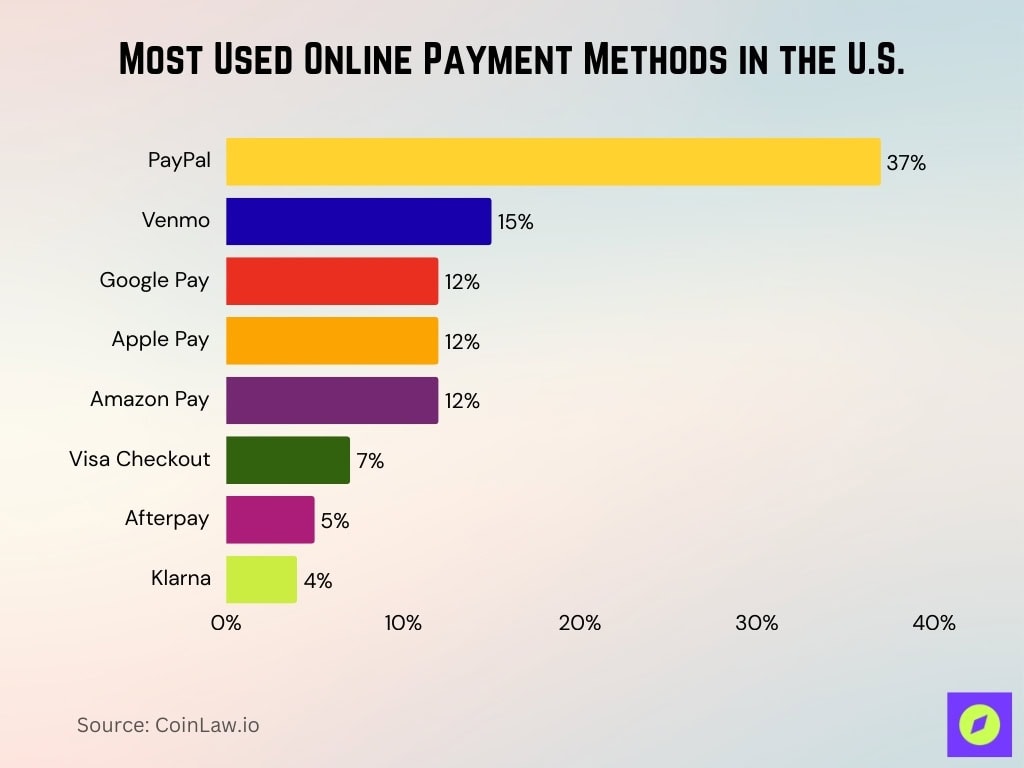

Most Popular Online Payment Methods in the U.S.

- PayPal dominates with 37% of users choosing it for online payments.

- Venmo is used by 15% of respondents.

- Google Pay, Apple Pay, and Amazon Pay each hold a 12% share.

- Visa Checkout is used by 7%.

- Afterpay is adopted by 5%.

- Klarna rounds out the list with 4% usage.

Venmo and Subsidiary Performance

- Venmo processed $325 billion in payments, with a 10% year-over-year increase in Q4 2024.

- Venmo’s user base reached 97.1 million.

- 83% of Venmo users are between 18–34 years old.

- Venmo’s transaction volume accounted for 16% of PayPal’s total payment volume.

- Venmo revenue grew 20% year-over-year in Q1 2025, doubling TPV growth.

- Braintree processed $250 billion in payments globally.

- 26% of Venmo users are aged 25–34, the largest demographic group.

- iZettle saw strong merchant growth in SMEs via PayPal Zettle integration.

Global Reach and User Demographics

- PayPal operates in over 200 countries and supports 25 currencies.

- 53% of PayPal’s total revenue from the US, 29% from Europe, 18% from Asia-Pacific.

- 55% of the active user base is aged 25-44 years.

- 57 million PayPal business accounts globally.

- Europe’s penetration rate at 45%, led by Germany and the UK.

- Latin America’s user base grew 15% from the e-commerce surge.

- Africa adoption grew 12% via mobile payments.

- US holds 38.87% of total users, the largest market.

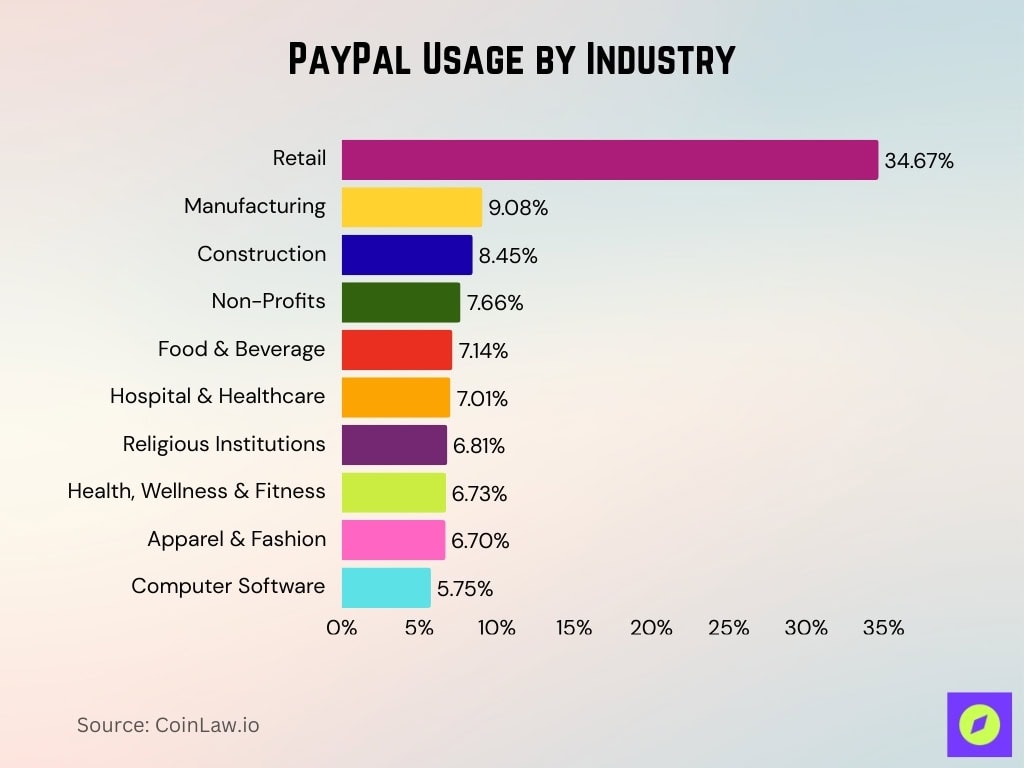

PayPal Usage by Industry

- Retail leads with 34.67% (154,050 businesses).

- Manufacturing follows at 9.08% (40,368 companies).

- Construction accounts for 8.45% (37,540 companies).

- Non-profits represent 7.66% (34,050 organizations).

- Food & Beverage at 7.14% (31,706 businesses).

- Hospital & Healthcare contributes 7.01% (31,142 companies).

- Religious Institutions use PayPal at 6.81% (30,245 institutions).

- Health, Wellness, & Fitness makes up 6.73% (29,904 businesses).

- Apparel & Fashion contributes 6.70% (29,779 companies).

- Computer Software rounds out at 5.75% (25,562 companies).

Recent Developments

- PayPal launched 3.7% annual rewards for PYUSD holders in the summer of 2025.

- PayPal Savings accounts offer 4.00% APY as of early 2025.

- Checkout with Crypto is available at over 26 million merchants worldwide.

- Expanded partnerships with Apple and Google Pay for seamless integration.

- AI-powered dispute tool resolved over 1.5 million disputes in 2025.

- On track for 100% renewable energy in data centers by 2030.

- Super App gained 20 million new users in 2025.

- Launched Transaction Graph Insights for cross-merchant analytics in January 2026.

Frequently Asked Questions (FAQs)

PayPal controls roughly a 45% share of the global online payments market.

PayPal is used in over 200 markets worldwide.

More than 10.3 million websites worldwide offered PayPal payments.

Conclusion

PayPal’s journey from a simple online payment solution to a global fintech leader is nothing short of remarkable. With its robust revenue growth, expanding user base, and continued investment in security and innovation, PayPal is well-positioned to maintain its dominance in the digital payments space. As the world shifts further toward mobile and contactless transactions, PayPal’s adaptable approach ensures that it remains a trusted and reliable platform for individuals and businesses alike. The future looks promising for PayPal, as it continues to innovate, expand, and shape the future of digital finance.