Square, a leading player in the digital payments landscape, continues to shape the future of commerce with its innovative solutions. From its humble beginnings in 2009 as a mobile card reader to becoming a pivotal force in the cashless payment revolution, Square has demonstrated unparalleled growth and adaptability. This article delves into the latest statistics and trends surrounding Square Pay in 2025, offering insights into how this tech giant is influencing the global financial ecosystem.

Editor’s Choice: Key Milestones

- Square’s Gross Payment Volume (GPV) reached $210 billion in 2025.

- The company’s market capitalization hit $88 billion in early 2025, reaffirming its strength among global fintech leaders.

- Cash App surpassed 58 million monthly active users in 2025, showing continued user base expansion.

- In 2025, Square extended Tap-to-Pay support to over 90% of Android models, further enhancing platform accessibility.

- The firm maintained a 93% customer satisfaction rate for business services, reinforcing its strong client focus.

- Square accelerated its renewable energy roadmap, reporting 35% of operations now powered by clean energy.

- Square Online Stores saw a 45% increase in e-commerce sales, driven by digital adoption among SMBs in 2025.

Square Payments Users by Business Size

- The majority of Square Payments users are small businesses, with 34% having only 1 employee.

- Another 34% consists of businesses with 2–10 employees, confirming Square’s strong appeal to micro-businesses.

- 13% of users have 11–50 employees, while 8% fall into the 51–200 employees category.

- Larger businesses are far less represented: only 3% each for 201–500 employees and 501–1,000 employees.

- Enterprises with over 1,000 employees make up just 1% or less of the user base, including 10,000+ employee firms.

Gross Payment Volume (GPV) Trends

- Square’s GPV grew to $180 billion, marking its 10th consecutive year of double-digit growth.

- Small-to-medium-sized businesses accounted for 70% of Square’s GPV, highlighting its core market focus.

- Healthcare and wellness sectors using Square saw an increase of 24% in GPV, driven by service demand and streamlined payment processes.

- The food and beverage industry contributed 30% to GPV, with Square POS systems becoming ubiquitous in restaurants.

- Square’s international markets accounted for 20% of GPV, with expansions in Canada, Australia, and Japan driving growth.

- Peer-to-peer payments via Cash App surged by 25%, reaching $60 billion in GPV.

- Contactless payment options, such as NFC-enabled cards and mobile wallets, now constitute 58% of Square’s GPV.

Revenue and Profit Statistics

- Square’s revenue in 2025 hit $24.5 billion, showing a 22% year-over-year growth from 2024.

- Subscription and services revenue made up 33% of total revenue, fueled by strong demand for Square Capital and Payroll.

- Transaction-based revenue reached $14.1 billion, marking a 17% increase compared to the previous year.

- Gross profit margin remained strong at 46%, reflecting Square’s continued operational efficiency.

- Square Pay hardware revenue rose 14%, driven by upgraded POS systems and mobile card readers.

- Net income for 2025 stood at $3.8 billion, continuing a stable rebound from earlier post-pandemic phases.

- Analysts project a 16% revenue growth for 2026, citing Square’s expanding product ecosystem and enterprise adoption.

- Square’s momentum in digital payments and business solutions positions it as a key innovator in the global fintech space.

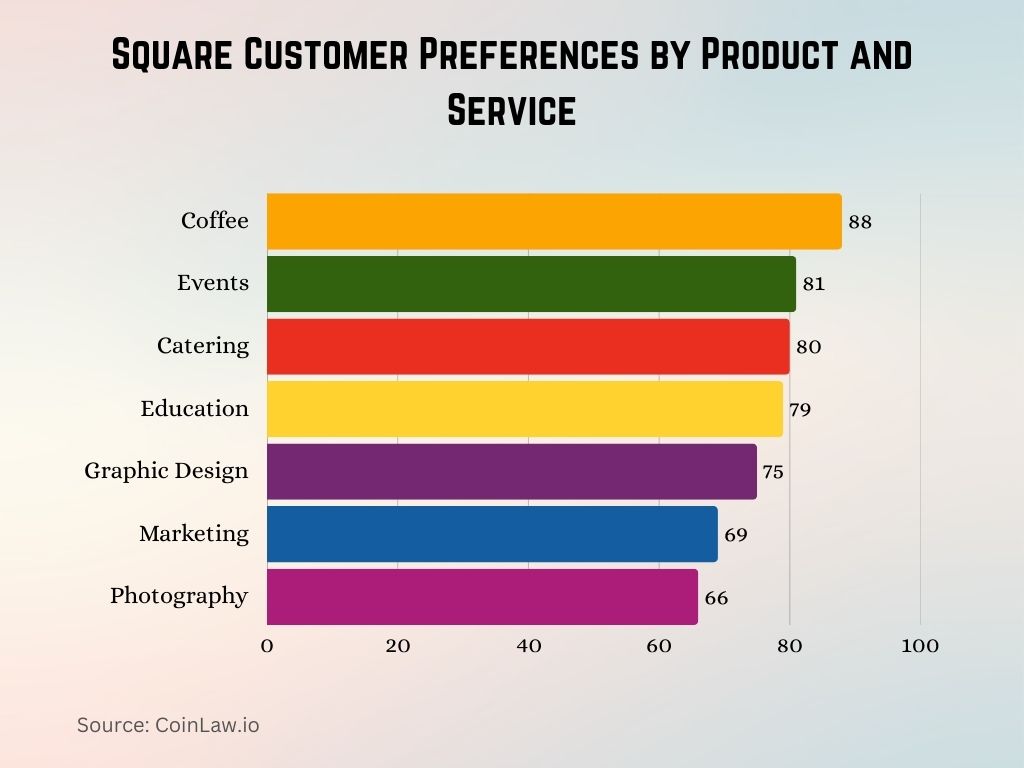

Square Customer Preferences by Product and Service

- Coffee leads the list with 88 customers, making it the most popular product or service among Square users.

- Events services attract 81 customers, showing strong demand in the event planning and hosting sector.

- Catering follows closely with 80 customers, reflecting the importance of food services in Square’s customer base.

- Educational services also perform well, with 79 customers relying on Square for their operations.

- Graphic Design businesses account for 75 customers, highlighting steady demand for creative and visual services.

- Marketing services are used by 69 customers, indicating growing adoption of Square among promotional and branding professionals.

- Photography services round out the list with 66 customers, showing consistent interest from visual content creators.

Merchant Adoption and Market Share

- Square’s merchant base grew to over 4.1 million active sellers worldwide by the end of 2025.

- 54% of small businesses in the US now use Square for payments, reinforcing its market leadership.

- Retail businesses make up 42% of Square’s merchant portfolio, fueled by its user-friendly POS systems.

- Square holds a 22% market share in digital payments, widening the gap against many traditional providers.

- 38% of new merchants in 2025 were first-time adopters of digital payments, showing Square’s pull with tech newcomers.

- Loyalty program features boosted merchant retention by 18%, highlighting Square’s focus on long-term value.

- Merchant adoption in Southeast Asia surged by 34%, powered by localized onboarding and support tools.

Share of Cashless Businesses Globally

- 35% of global businesses are expected to operate entirely cashless, with Square playing a pivotal role in this transition.

- In the United States, 60% of Square merchants report being fully cashless, driven by consumer preference for contactless transactions.

- Square facilitated over $100 billion in cashless transactions, a 20% increase year-over-year.

- Europe’s cashless adoption rate among Square users climbed to 45%, led by industries like hospitality and retail.

- Small businesses using Square report a 70% higher likelihood of going cashless than those using traditional payment methods.

- Digital wallets and QR code payments now account for 25% of Square transactions, underscoring the shift to alternative payment methods.

- The number of cash-free restaurants using Square rose by 18%, particularly in urban centers with younger demographics.

A Global Look at Cashless Businesses

- The global cashless payments market reached $93 billion in 2025, growing at a CAGR of 14% toward 2030.

- Square’s services expanded to 13 countries, increasing global access to cashless payment tools.

- Asia-Pacific led in cashless transactions, with Square processing $6.4 billion in payments across the region in 2025.

- North America accounted for 48% of Square’s global payment volume, driven by strong digital infrastructure.

- Square’s e-commerce partnerships in Europe boosted cross-border payments by 33%, enhancing international trade.

- Cashless market growth in Sub-Saharan Africa hit 24%, with Square supporting urban micro-merchants.

- Businesses using Square reduced operational costs by 27%, showcasing the value of digital-first payment systems.

Growth of Online and Contactless Payments Continues

- Square reported a 40% increase in online payments processed through its platform.

- Contactless payment methods, including tap-to-pay cards and mobile wallets, represented 58% of Square transactions last year.

- Online sales through Square Online grew by 30%, driven by small businesses launching digital storefronts.

- Square’s e-gift card sales rose by 25%, reflecting growing consumer interest in digital gifting options.

- Mobile wallet adoption surged, with Apple Pay and Google Pay representing 30% of Square’s processed payments in the US.

- Square expanded its Buy Now, Pay Later (BNPL) offerings, leading to a 20% increase in transaction value for participating merchants.

- Square introduced AI-powered fraud detection tools, reducing fraudulent transactions by 15%.

- Square’s leadership in driving cashless and online payment adoption underscores its transformative impact on global commerce.

Card Usage Accelerates Among Low Tickets

- Transactions under $20 using credit and debit cards increased by 30%, driven by Square’s affordable processing fees.

- Digital wallets accounted for 20% of low-ticket transactions, with younger consumers leading adoption.

- Square merchants in the quick-service restaurant (QSR) sector reported a 25% rise in card-based payments for small purchases.

- Microtransactions via Square saw an 18% boost, attributed to seamless mobile and contactless payment options.

- Consumers paying with cards under $10 grew by 15%, highlighting shifting behaviors even for minor expenditures.

- Convenience store merchants using Square noted a 20% increase in sub-$20 card transactions, emphasizing the trend in daily purchases.

- In urban areas, low-ticket transactions via Square’s platform rose by 28%, outpacing traditional payment methods.

Wage Growth, Earnings, and Inflation Trends

- Average Hourly Earnings Growth peaked near 9% before gradually declining to 3.63%.

- Wage Growth (YoY) followed a similar path, rising sharply to over 8%, then steadily dropping to 2.73%.

- Inflation (CPI-U) spiked dramatically from below 2% to over 9%, then declined to 2.57%.

- All three metrics, earnings growth, wage growth, and inflation, converged near the 2.5% to 3.6% range, signaling a stabilization phase after extreme fluctuations.

Top Categories for Square Online Stores

- Food and beverage businesses led with 37% of Square Online sales, maintaining their position as the top-performing category.

- Retail stores contributed 26% of total online sales, with strong growth in clothing and accessories.

- Health and wellness products saw a 23% year-over-year increase, fueled by rising demand for supplements and self-care.

- Home and lifestyle brands posted an 18% sales boost, expanding their digital storefront reach in 2025.

- Digital service providers grew online transactions by 28%, especially in virtual coaching and education.

- Specialty food markets generated $610 million in online sales, driven by bakeries, cafes, and artisanal products.

- Pet care and supplies experienced a 12% growth in online transactions, supported by recurring purchase options.

- Subscription-based businesses increased recurring revenue by 45%, thanks to enhanced auto-billing and renewal tools.

- Seasonal businesses saw a 35% growth during peak periods, aided by Square’s promotional and scheduling features.

- Nonprofits using Square Online saw a 19% rise in donation transactions, boosted by optimized mobile donation pages.

Recent Developments

- In 2025, Square enhanced its AI-driven analytics, offering merchants real-time insights into inventory flow and customer behavior.

- Tap-to-Pay on Android expanded to 95+ countries, unlocking new reach for millions of SMBs globally.

- Square’s partnerships with top e-commerce platforms led to 25% faster transaction processing in 2025.

- New reporting tools in Square Dashboard boosted user adoption by 18%, improving financial visibility for businesses.

- Localized payment options launched in 12 new regions, adapting to unique consumer payment habits.

- Contactless tipping rose by 38%, thanks to improved digital prompt customization at checkout.

- Payroll platform integration covered over 700,000 employees, streamlining wage distribution and compliance.

- Subscription tools supported 650,000+ merchants, reflecting Square’s growth in recurring billing solutions.

- Square accelerated blockchain adoption, piloting cross-border stablecoin settlements in select regions.

- Sustainability efforts cut Square’s carbon footprint by 14% in 2025, progressing toward its 2030 net-zero goal.

Conclusion

Square’s impressive evolution in 2025 reflects its commitment to innovation, merchant empowerment, and sustainability. From driving low-ticket card usage to supporting diverse online stores and advancing global cashless adoption, Square has solidified its role as a transformative force in the digital payment space. By focusing on strategic partnerships, cutting-edge technology, and customer-centric tools, Square is not just adapting to the future, it is actively shaping it.