Small businesses are the backbone of the economy, providing jobs, fostering innovation, and contributing to community development. Yet, one of the greatest challenges they face is securing the necessary funding to grow and thrive. Whether it’s for expansion, managing cash flow, or purchasing new equipment, small business lending is crucial.

As we navigate post-pandemic recovery and economic uncertainty, understanding the trends and statistics behind small business lending has never been more important. Let’s explore some key statistics and trends shaping small business lending this year.

Editor’s Choice

- Across approved borrowers in 2026, small businesses received, on average, 75% of the funding amount they requested.

- Business loan interest rates in 2026 range roughly from 3% to about 60.9%, depending on lender, product, and credit profile.

- About 52% of small businesses that applied for financing in recent Fed studies reported receiving full funding, shaping 2026 lender risk models.

- Around 65% of approved small business borrowers in 2026 use loan funds primarily for working capital needs.

- Nearly 22% of approved small business borrowers earn less than $500,000 in annual revenue, yet still secure financing.

Recent Developments

- Globally, digital lending is now a $507 billion market, with small businesses a major driver of adoption.

- Studies show digital lending automation has cut small business loan turnaround times by up to 70%, enabling near-instant approvals for simple cases.

- BAI’s outlook reports that small financial institutions now approve at least partial funding for about 82% of small business loan applicants.

- Non-bank and online providers are chosen by roughly 74% of small businesses seeking fast working capital, reflecting a shift away from traditional banks.

- Agentic AI platforms in SME lending report decision times dropping from weeks to near-instant for straightforward applications.

- The U.S. Small Dollar Loan Program alone has facilitated over $40.2 million in lending through participating CDFIs, supporting very small borrowers.

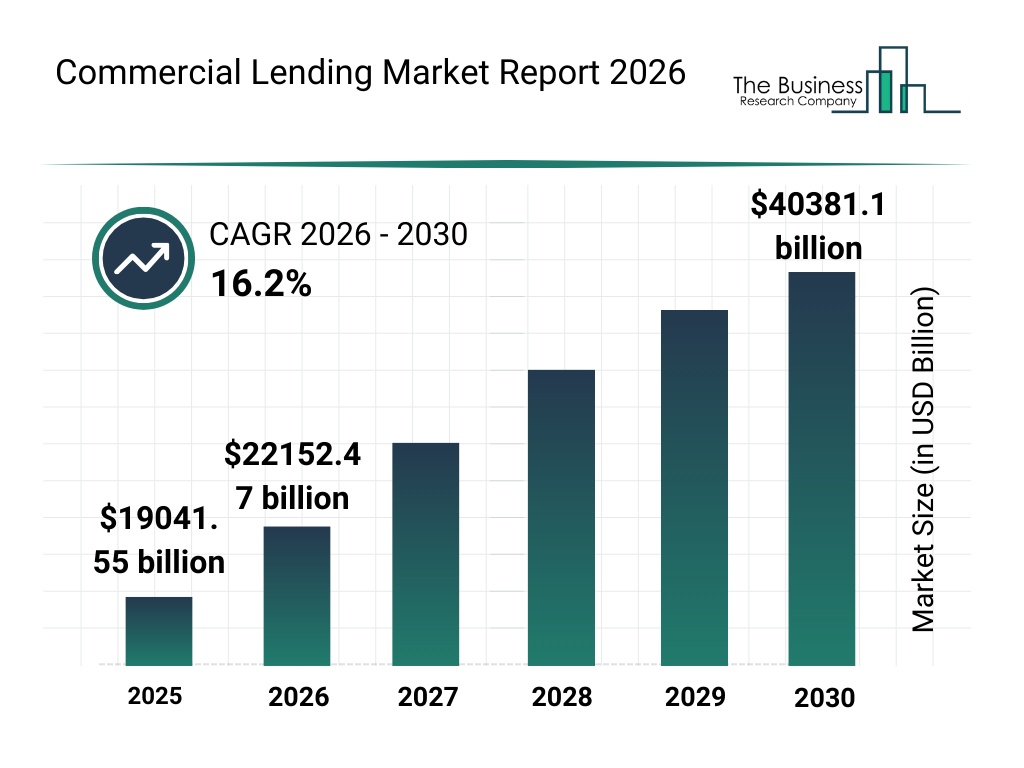

Commercial Lending Market Size Growth Highlights

- The global commercial lending market was valued at $19,041.55 billion in 2025, reflecting strong post-pandemic credit demand.

- In 2026, the market expanded to $22,152.47 billion, driven by rising business borrowing and improved lending conditions.

- Market size is projected to reach approximately $25,700 billion in 2027, indicating steady year-over-year expansion.

- By 2028, commercial lending is expected to grow to around $30,200 billion, supported by increased SME and corporate financing.

- The market is forecast to hit nearly $35,600 billion in 2029, fueled by digital lending platforms and diversified credit products.

- By 2030, the commercial lending market is projected to reach $40,381.1 billion, marking a significant long-term expansion.

- From 2026 to 2030, the market is expected to grow at a compound annual growth rate (CAGR) of 16.2%, highlighting strong, sustained momentum.

Small Business Outstanding Debt

- About 29% of small businesses report having no outstanding debt, leaving 71% carrying some level of debt.

- Around 61% of small businesses carry $100,000 or less in debt, indicating most firms keep balances relatively modest.

- About 8% of small businesses have debt balances exceeding $1 million, making very large debts relatively uncommon.

- In recent surveys, 34% of firms report challenges with making debt payments, signaling rising repayment stress.

- Elevated existing debt is cited as a denial reason by 41% of small business credit applicants, up from 22% in 2021.

- Overall, roughly 70% of small employer firms report having outstanding debt of some kind on their books.

Small Business Ownership by State (Geographic Distribution)

- California leads with 4.3 million small businesses, the highest nationwide.

- Texas follows with 3.5 million small businesses across the state.

- Florida ranks third with approximately 3.3 million small businesses.

- New York has about 2.2 million small businesses, securing fourth place.

- Georgia comes in fifth with roughly 1.3 million small businesses.

- The U.S. totals 36.2 million small businesses overall, comprising 99.9% of all firms.

- Small businesses employ 62.3 million workers, representing 45.9% of the private workforce.

- California small businesses account for 47.4% of the state’s employees, totaling 7.6 million.

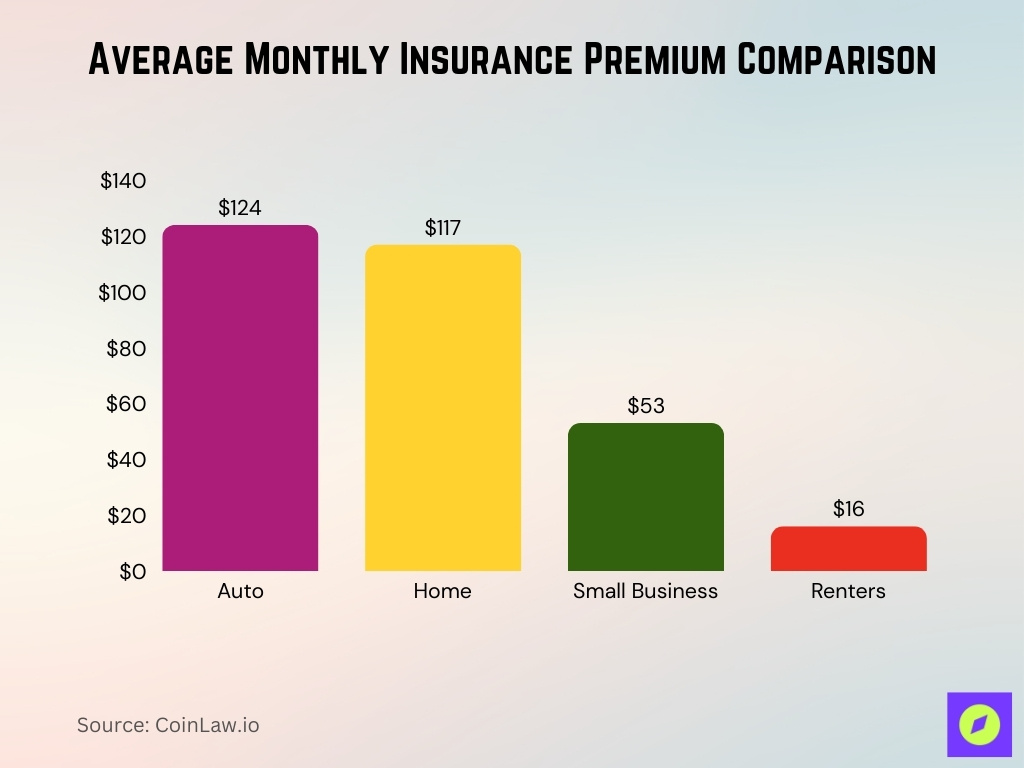

Average Monthly Insurance Premium Comparison

- Auto insurance carries the highest average monthly premium at $124, reflecting higher risk exposure and coverage requirements.

- Home insurance follows closely, with an average monthly cost of $117, driven by property value and replacement coverage needs.

- Small business insurance averages $53 per month, making it significantly more affordable than auto and home policies.

- Renters insurance is the least expensive option, with an average monthly premium of just $16, offering low-cost protection for tenants.

- On average, auto insurance costs nearly 8 times more than renters insurance, highlighting wide premium disparities across policy types.

- Small business insurance premiums are less than half the cost of home insurance, underscoring their relative affordability for business owners.

Small Business Loan Application

- 37% of small employer firms applied for loans, lines of credit, or merchant cash advances in the prior 12 months.

- 51% of applicants received the full amount of funding requested, with rates steady year-over-year.

- Small banks fully approved 54% of applicants, the highest among lender types.

- Credit unions and finance companies each fully approved 51% of small business loan applicants.

- Online lenders fully approved only 44% of applicants, with 30% denied.

- Large banks fully approved 44% of applicants, down from prior years, with 34% denied.

- Operating expenses drove 56% of loan applications, while expansion motivated 46%.

- 76% of loan applications were approved at least partially by surveyed banks.

Average Interest Rates

- Bank small-business loans range from 6.3% to 11.5%.

- SBA 7(a) fixed rates span 11.75% to 14.75% based on loan size.

- SBA 7(a) variable rates range from 9.75% to 13.25%.

- Median fixed-term business loan rate is 7.23%.

- Median variable-term business loan rate is 7.79%.

- Online term loans carry rates from 14% to 99% APR.

- SBA microloans typically range from 8% to 13%.

- Business lines of credit average 6.47% to 7.92% APR.

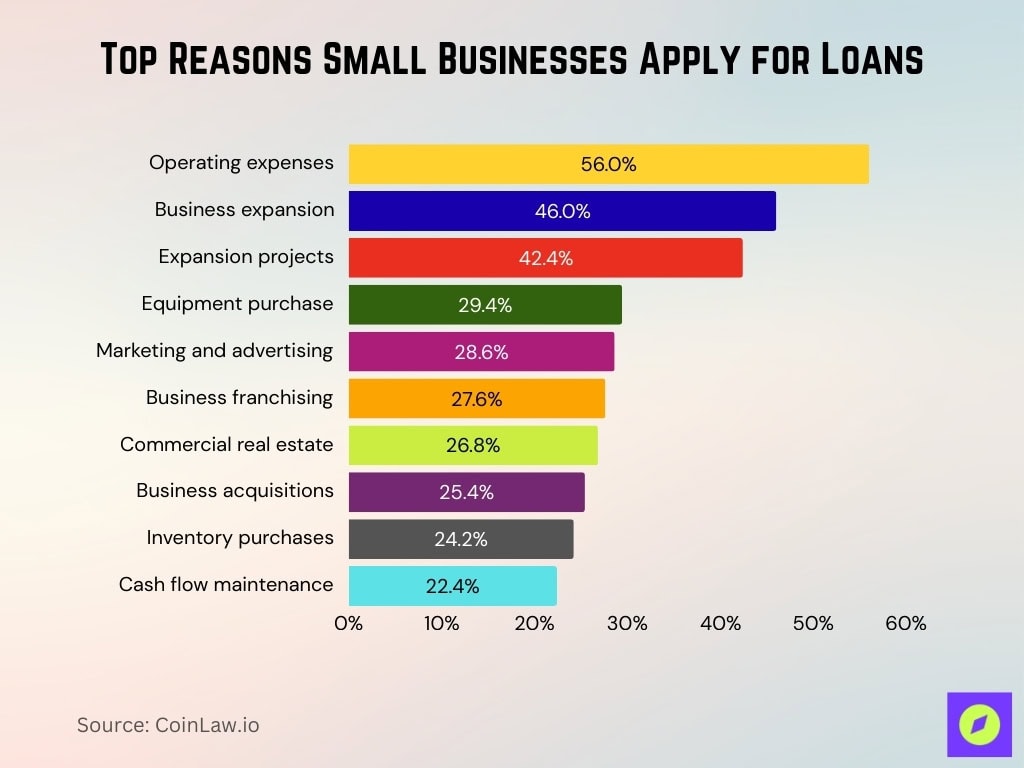

Top Reasons Small Businesses Apply for Loans

- 56% of small businesses seek loans to meet operating expenses.

- 46% pursue financing for business expansion or new opportunities.

- 42.4% use loan funds primarily for business expansion.

- 29.4% apply for loans to purchase equipment.

- 28.6% seek funding for marketing and advertising efforts.

- 27.6% pursue loans to support business franchising.

- 26.8% direct loans toward commercial real estate purchases or remodeling.

- 25.4% apply for business acquisitions.

- 24.2% take loans for inventory purchases.

- 22.4% seek loans to maintain cash flow for everyday operations.

Percentage of Businesses That Had Their Loans Denied

- 21% of small businesses had their loan, line of credit, or merchant cash advance applications fully denied.

- Businesses with annual revenues of $50,001-$100,000 faced the highest denial rate of 35%.

- Firms with revenues over $10 million saw the lowest denial rate at just 4%.

- 50% of SBA loan/line of credit applicants were denied, the highest among loan types.

- 29% of businesses aged 3-5 years experienced loan denials, the peak by firm age.

- Retail sector businesses faced a 25% denial rate, the highest among industries.

- Black-owned businesses had a 39% denial rate, compared to 18% for white-owned.

- Too much existing debt was cited as the reason for 41% of denials.

Average Credit Score for Loan Applications

- Banks and credit unions typically require an average credit score of 680 or higher for small business loans.

- SBA 7(a) lenders generally seek personal credit scores of 620 to 680, varying by program.

- Online lenders often approve with scores as low as 650, focusing less on credit alone.

- 55% of approved applicants in recent studies reported personal credit scores of 700 or higher.

- One in five approved borrowers secured funding despite credit scores below 660.

- FICO SBSS business scores for SBA small loans require at least 165 out of 300 for prescreening.

- Scores above 720 correlate with 75% approval rates among loan applicants.

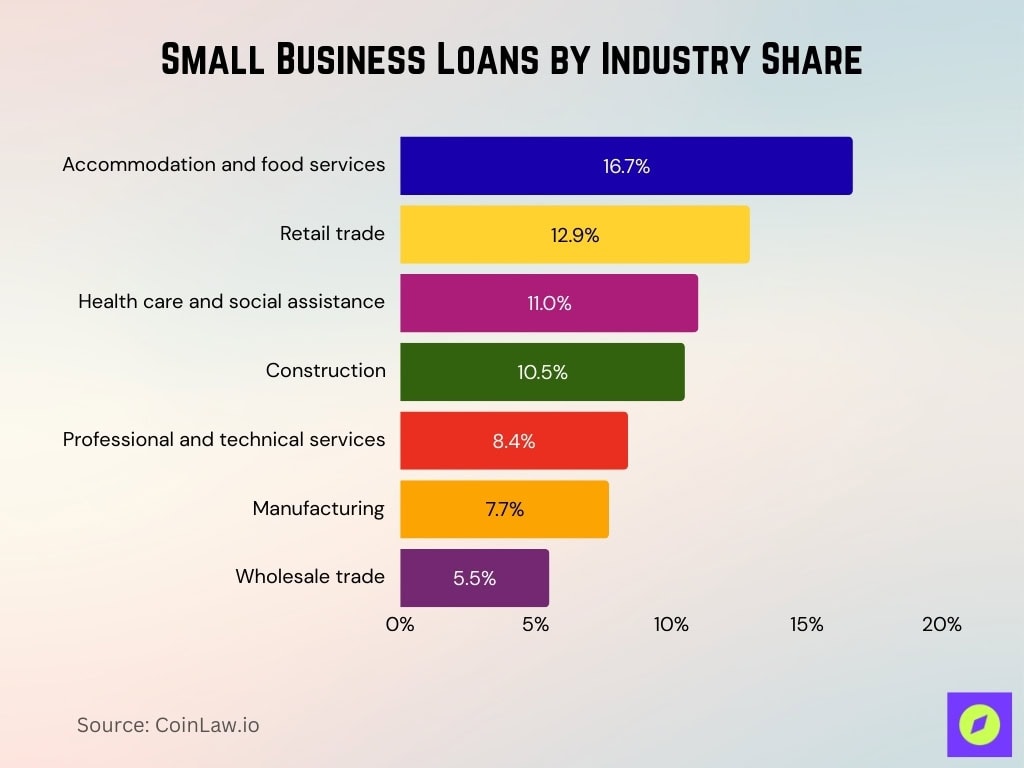

Small Business Loans by Industry

- Accommodation and food services received 16.7% of SBA 7(a) loan amounts.

- Retail trade accounted for 12.9% of 7(a) loan funding approvals.

- Health care and social assistance captured 11.0% of 7(a) loan dollars.

- Construction businesses obtained 10.5% of the total 7(a) loan amounts.

- Manufacturing firms secured 7.7% of SBA 7(a) financing.

- Professional, scientific, and technical services took 8.4% of 7(a) loans.

- Wholesale trade received 5.5% of SBA 7(a) loan funding.

Impact of Small Business Loans on the Economy

- Small businesses contribute 43.5% of U.S. GDP.

- Small firms account for 64% of new jobs created annually.

- SBA loans create 3 to 3.5 jobs per million dollars disbursed.

- Small businesses employ 61.7 million Americans, or 46.4% of the private workforce.

- In Q2 2022, small businesses generated 98.5% of net job gains.

Frequently Asked Questions (FAQs)

The average small business bank loan amount is $633,000.

Only 26.9% of small business loan applications are approved by major financial institutions.

About 65% of small business loan recipients say they’re seeking working capital.

SBA loan rates are around 11%, while revenue‑based financing can cost 30% or more.

Conclusion

Small business lending today presents both opportunities and challenges. As businesses navigate economic recovery, access to capital remains critical for growth, innovation, and survival. With advancements in technology, greater inclusivity, and more flexible lending options, small businesses have more avenues than ever to secure the funding they need. However, navigating this landscape requires careful planning, strong credit profiles, and an understanding of the various lending options available.