SafePal has become a key player in the crypto wallet space by combining hardware and software solutions under one unified ecosystem. Demand for noncustodial wallets is rising as users seek safety, control, and flexibility. In real-world contexts, institutional crypto funds use hardware wallets for cold storage, while DeFi users rely on software wallets to access staking, swaps, and dApps without compromising security. Let’s dig into the numbers, trends, and developments shaping SafePal Wallet Statistics. Read on to uncover usage, growth, and metrics.

Editor’s Choice

- SafePal’s user base jumped from 10 million+ to 20 million+ users in 2024.

- The wallet supports over 30,000 cryptocurrencies and tokens across many blockchains.

- SafePal expanded service coverage to 127 countries and 200+ regions in 2024.

- To date, no SafePal wallet has been hacked, giving it a strong security record.

- SafePal blocklisted over 2,400 scam DApps as part of ongoing security enforcement.

- SafePal’s SFP token has a maximum supply of 500 million.

- In 2025, the hardware wallet / cold storage sector is estimated to grow at a CAGR of 23–30%.

Recent Developments

- In 2025, SafePal launched a CeDeFi Banking Gateway enabling fiat-to-crypto & in-app payments across merchant networks.

- On July 22, 2025, SafePal and 1inch distributed 300 limited-edition hardware wallets to active DeFi users.

- SafePal integrated KiloEx perpetual trading into its app (50× leverage over 100+ markets) in July 2025.

- SFP was listed on BitDelta (Aug 29, 2025), expanding exchange access.

- SafePal added support for Venom, Chromia, and Filecoin blockchains in 2025.

- Localization and regional expansion included 16 languages and events in Singapore, Thailand, Japan, etc.

- SafePal continued to blocklist scam DApps, maintaining industry vigilance.

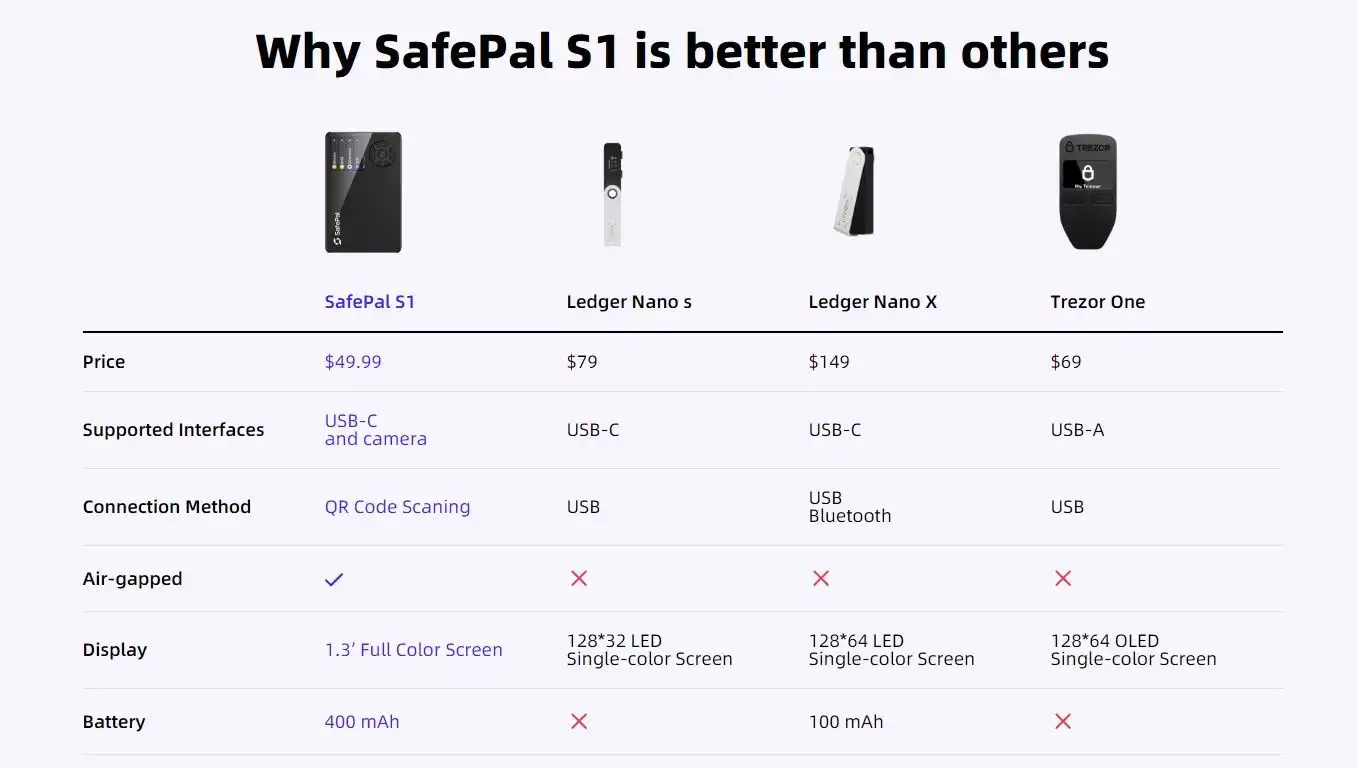

SafePal S1 vs Other Wallets

- SafePal S1 costs $49.99, making it the most affordable compared to Ledger Nano S ($79), Ledger Nano X ($149), and Trezor One ($69).

- It supports USB-C and a camera, while competitors only offer USB-C or USB-A connections.

- SafePal S1 uses QR code scanning for transactions, unlike Ledger and Trezor devices, which rely on USB or Bluetooth.

- It is air-gapped (✔), providing stronger isolation from online threats, while Ledger and Trezor devices are not air-gapped (✘).

- Features a 1.3” full-color screen, whereas others have single-color LED or OLED screens with limited resolution.

- Offers a 400 mAh battery, significantly higher than Ledger Nano X (100 mAh), while Ledger Nano S and Trezor One lack batteries.

Wallet Overview

- Launched in 2018, SafePal offers hardware wallets, mobile apps, and browser extension options.

- The wallet supports 100+ blockchains.

- Over 30,000 crypto assets and tokens can be stored, swapped, or tracked via SafePal.

- The hardware wallets (S1, S1 Pro, X1) emphasize air-gapped, offline security.

- SafePal includes built-in features, NFT storage, staking/yield earning, dApp browser, and fiat-bridge.

- The native token SFP is used for incentives, governance, and discounts within the platform.

- SafePal offers support in multiple languages and region-specific UI localization.

User Statistics

- In 2024, SafePal’s user base doubled, from 10M+ to 20M+ users.

- As of earlier reports, SafePal had over 3 million users in 196 countries.

- The platform now covers 127 countries and 200+ regions.

- Downloads and revenue stats by country for the SafePal app are tracked in 2025.

- SafePal has never suffered a known wallet hack, boosting user confidence.

- It has blocklisted over 2,400 scam DApps, protecting users.

- It maintains a 7-year clean security record.

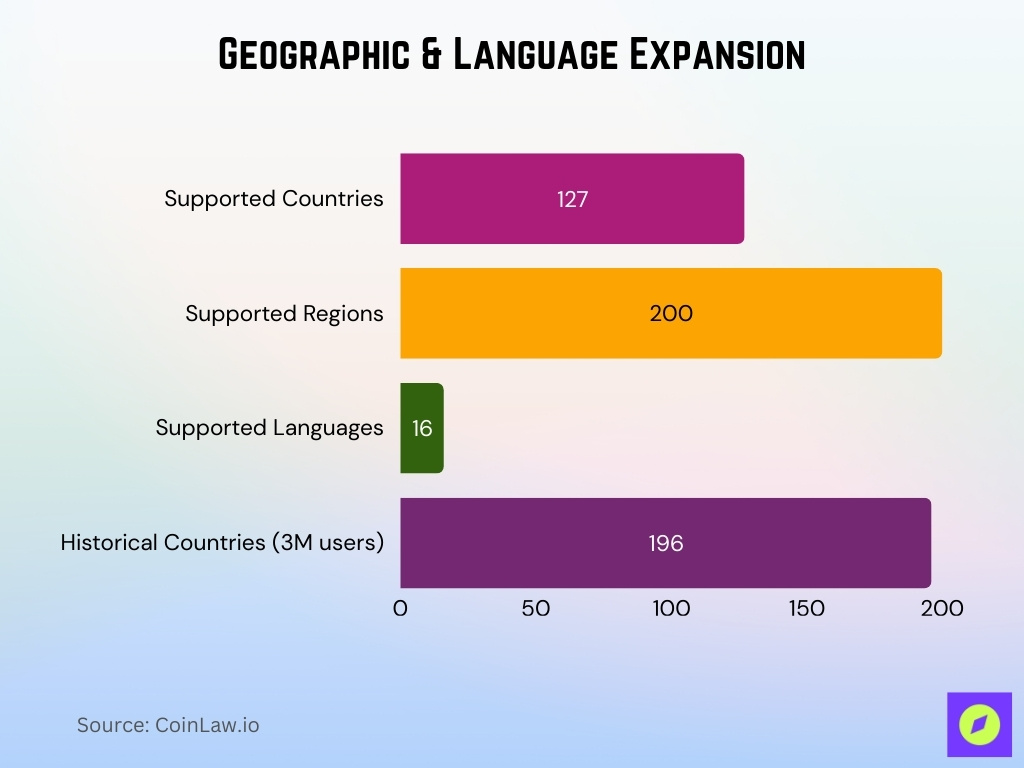

Geographic Distribution of SafePal Users

- SafePal expanded coverage to 127 countries / 200+ regions.

- SafePal localizes into 16 supported languages to accommodate diverse user bases.

- Its global usage includes Asia, Southeast Asia, North America, Europe, and the Middle East.

- Earlier data, SafePal had users across 196 countries when it cited a 3M user figure.

- Regional campaigns and support events were held in Singapore, South Korea, Japan, Thailand, Vietnam, Dubai, Hong Kong, and Taiwan.

- The expansion strategy targeted both developed and emerging markets.

- Some markets lean toward software-only wallet use, others prefer hardware / cold storage depending on maturity.

Supported Cryptocurrencies and Blockchains

- SafePal supports over 30,000 cryptocurrencies and tokens.

- It supports 100+ blockchains across its hardware and software solutions.

- Among the blockchains supported are Bitcoin, Ethereum, BNB Chain, Tron, and many others.

- SafePal’s blockchain additions in 2025 include Venom, Chromia, and Filecoin.

- The wallet supports both native coins and token standards (ERC-20, BEP-20, etc.).

- Users can manage multi-chain portfolios seamlessly within the SafePal ecosystem.

- The large token support allows inclusion of niche, emergent crypto projects alongside major assets.

SafePal Wallet Growth Trends

- SafePal’s user base grew from 10M+ to 20M+ in 2024.

- SafePal expanded its service to 127 countries and 200+ regions in 2024.

- Localization improved with 16 supported languages as of late 2024.

- SafePal blocklisted over 2,400 scam DApps.

- In 2025, SafePal integrated Chromia (CHR) support for its >20 M user base.

- The wallet launched a Telegram Mini-app wallet to reach Telegram’s 950M users.

- SafePal integrated KiloEx perpetual trading in July 2025.

- SFP token listings expanded via exchanges like BitDelta (Aug 2025).

- SFP saw +32% 90-day gains, reflecting rising interest.

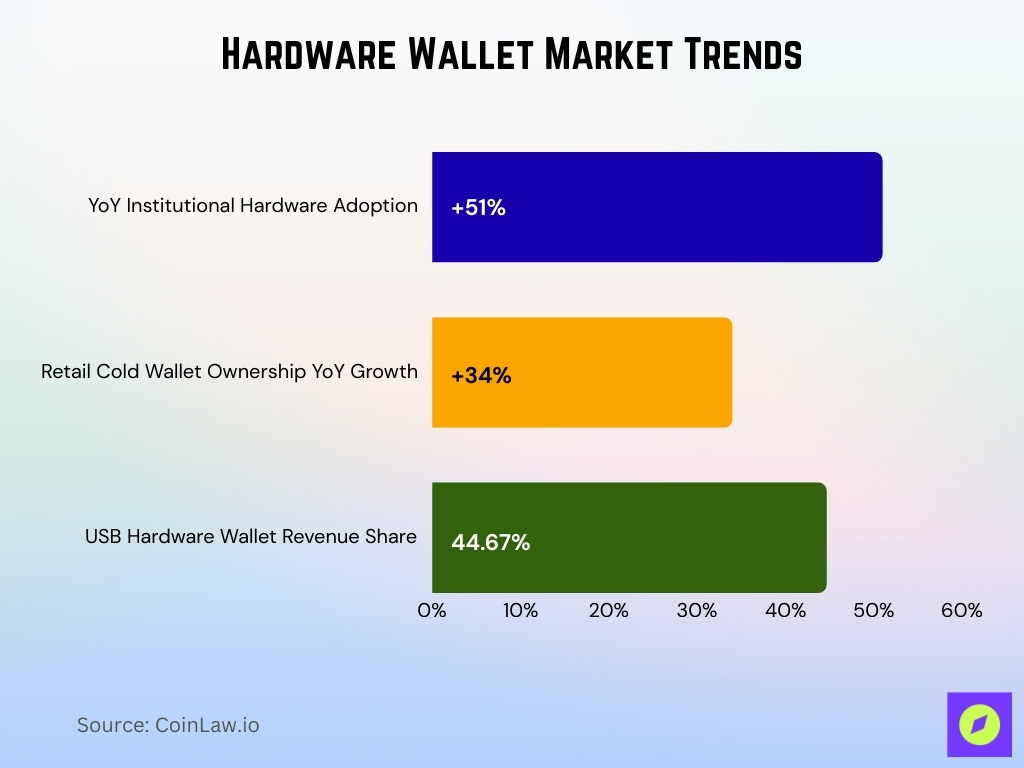

SafePal Hardware vs. Software Wallet Usage

- Institutional adoption of hardware / cold wallets rose 51% year over year in 2025.

- Cold wallet ownership among retail users rose 34% YoY in 2025.

- In 2025, USB-based hardware wallets dominate ~44.67% of hardware wallet revenues.

- Globally, ~78% of crypto users rely on hot/software wallets in 2025, ~22% use cold/hardware first.

- Among hardware wallet providers, SafePal is cited as one of the dominant vendors in 2025.

- The hardware wallet market value is projected to reach ~$0.56 billion in 2025.

- Within SafePal’s product line, the S1 and S1 Pro models employ 100% air-gapped architecture, while X1 uses Bluetooth/USB.

- The cost barrier for hardware may limit adoption in some markets, and entry models (~$49.99) compete with free software wallets.

Market Share Among Crypto Wallets

- In the hardware wallet niche, SafePal is named as one of the top vendors for 2025.

- While the exact share among all wallets is not published, SafePal’s growth suggests a rising presence.

- Among software wallet providers, transparency is lower, but SafePal’s hybrid design gives it an edge.

- SafePal’s expansion into DeFi, staking, and CeFi tools helps it compete as a crypto platform.

- Wallet providers with banking integration may capture more share.

- SafePal’s coverage of 200+ blockchains and 30,000+ tokens enhances appeal.

- Its security record strengthens competitiveness in user trust metrics.

SafePal SFP Token Statistics

- The maximum supply of SFP is 500 million tokens.

- SFP is used for incentives, governance, and fee discounts.

- SFP registered +32% over 90 days in recent price momentum.

- Circulation and trading liquidity are boosted by new listings like BitDelta.

- Expansion into DeFi tools increases utility-based demand for SFP.

- Sentiment is strongly linked to SafePal ecosystem growth.

- Forecasts tie SFP’s upside to wallet adoption and token velocity.

- Derivatives open interest sometimes showed declines during volatility.

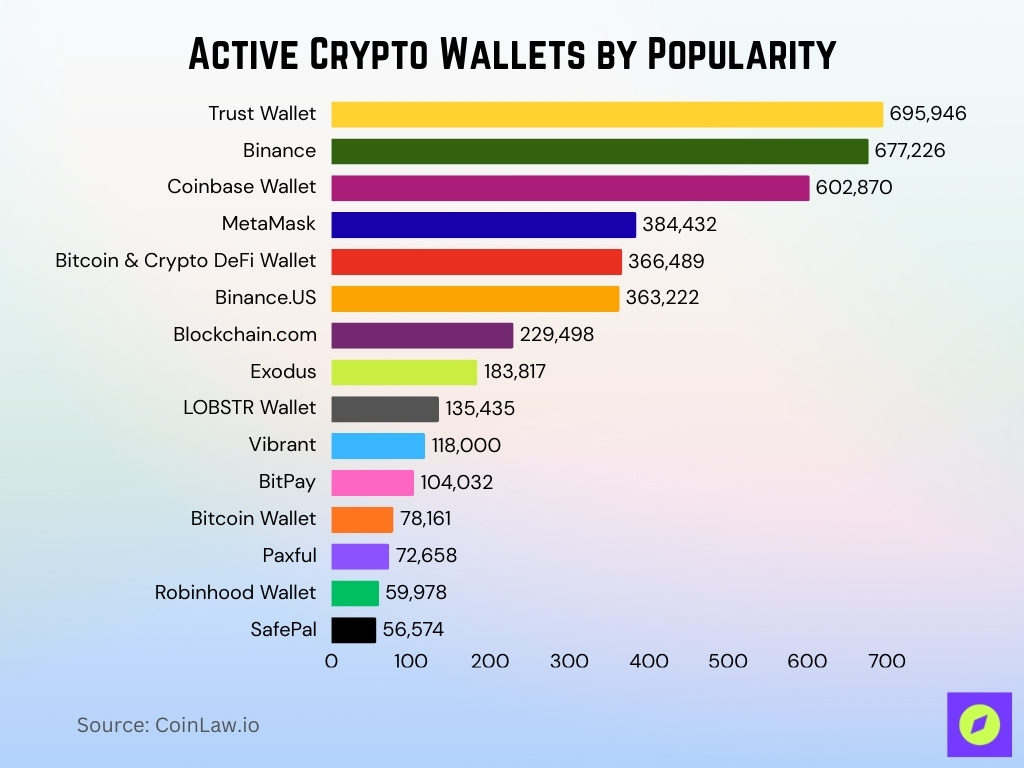

Active Crypto Wallets by Popularity

- Trust Wallet leads with 695,946 active wallets, representing 16.86% of the total.

- Binance follows closely with 677,226 wallets, holding a 16.40% market share.

- Coinbase Wallet has 602,870 users, accounting for 14.60% of the total.

- MetaMask records 384,432 active wallets, equal to 9.31% share.

- Bitcoin & Crypto DeFi Wallet holds 366,489 wallets, or 8.88% of the total.

- Binance.US has 363,222 wallets, representing 8.80% market share.

- Blockchain.com counts 229,498 wallets, making up 5.56%.

- Exodus reports 183,817 wallets, with a 4.45% share.

- LOBSTR Wallet has 135,435 wallets, capturing 3.28%.

- Vibrant totals 118,000 wallets, about 2.86%.

- BitPay shows 104,032 active wallets, or 2.52% share.

- Bitcoin Wallet holds 78,161 wallets, which is 1.89%.

- Paxful records 72,658 wallets, accounting for 1.76%.

- Robinhood Wallet has 59,978 wallets, equal to 1.45% of the total.

- SafePal reports 56,574 active wallets, representing 1.37% market share.

Transaction Volume and Activity Statistics

- SafePal integrated KiloEx perpetual trading in July 2025.

- The wallet supports thousands of swap operations and cross-chain bridging.

- Integration of Chromia (CHR) in 2025 expands transaction types.

- SafePal blocklisted 2,400+ scam DApps in 2024.

- With 20M+ users, daily activity likely reaches high transaction counts.

- Supporting 200+ networks, transaction volume scales widely.

- The rise in hardware adoption means more offline signing events.

- DeFi and staking usage also contribute to activity metrics.

SafePal Staking and Earn Usage Data

- SafePal’s SFPlus x Oasis Airdrop program uses a scoring model.

- Maximum staking score per wallet is capped at 5,000 points.

- SFP staking APY benchmarked at ~1.14% on Binance (flexible).

- In-app “Earn / Staking” integrates yield-earning from DeFi protocols.

- Time-based score bonus incentivizes extended locks.

- Staking is diversified across chains supported by SafePal.

- Earn module also allows liquidity pool participation.

- The total staked SFP or staking participation rate is not disclosed.

NFT Storage and Usage on SafePal

- SafePal supports NFTs on Ethereum, BSC, Polygon, Solana, TON, and Near.

- Users can receive, view, send, and hide NFTs.

- Supports ERC-721, ERC-1155, and BSC standards.

- Hardware models integrate NFT support across multiple chains.

- Users have view toggles and can hide unwanted NFTs.

- App guides support TON NFT integration.

- Early documentation shows a transfer from Rarible to SafePal.

- Metrics like total NFTs held or traded are not disclosed.

SafePal Integration with DApps and DeFi

- SafePal includes a built-in dApp browser.

- Users can engage in swaps, yield farming, lending, and liquidity provisioning.

- SafePal-Chromia integration in 2025 gives over 20 million users access.

- Multi-chain support enables bridging into many DeFi ecosystems.

- Wallet-to-dApp connectivity often uses WalletConnect or internal RPC.

- SafePal’s swap and mini-program modules bring liquidity from exchanges.

- App upgrade logs show improvements in dApp interaction.

- Metrics like TVL or user dApp counts are not published.

SafePal Banking and CeDeFi Adoption

- SafePal introduced its CeDeFi Banking Gateway.

- The gateway provides connectivity to over 40 million merchants worldwide.

- The solution integrates with the virtual VISA and Mastercard networks.

- At the same time, Arbitrum’s governance proposal monitored metrics such as Daily Transaction Count.

- In terms of targets, SafePal set a KPI of 42,000 transactions over 12 weeks.

- On the compliance side, users are required to complete KYC verification to enable banking features.

- Taken together, the CeDeFi initiative reflects SafePal’s ambition to expand from a wallet provider into a broader financial platform.

- Fiat flow data and banking user statistics remain undisclosed, limiting transparency for analysts.

Supported Platforms and Devices Statistics

- SafePal offers a mobile app, a browser extension, and hardware wallets.

- A browser extension was launched to complete the full wallet suite.

- Supports 100 blockchains and 30,000+ assets.

- Hardware models use air-gapped offline signing.

- X1 model supports Bluetooth / USB.

- App listing supports “10,000+ cryptocurrencies.”

- The app is ranked in the finance/utilities categories.

- Updates in 2025 added features like quick transfers to Binance.

Customer Support and Satisfaction Statistics

- SafePal lists 16 supported languages.

- Claims a “clean 7-year track record with no major security incidents.”

- blocklists scam DApps (2,400+).

- Provides a Zendesk knowledge base.

- App ratings on App Store, 4.8/5 from ~13,100 ratings.

- Guides showcase structured user support.

- Updates include user experience improvements.

- No published support ticket metrics or independent surveys.

Frequently Asked Questions (FAQs)

The SFP token has a market cap of roughly $244 million and a circulating supply of 500 million SFP.

In 2024, SafePal grew to 20 million+ users, with service coverage in 127 countries and 200+ regions.

Over 90 days, SFP gained ~32%, and SafePal has blocklisted 2,400+ scam DApps.

In 2025, ~78% of crypto users rely on hot/software wallets, while ~22% use cold/hardware wallets.

Conclusion

SafePal’s trajectory begins with its transformation from a simple wallet provider and progresses into a multifunctional crypto ecosystem. Through its hybrid hardware-software design, broad asset support, staking and banking ambitions, and dApp connectivity, the platform is positioned for significant growth. However, despite these visible advances in adoption and functionality, many crucial performance metrics, such as AUM, transaction volumes, staking balances, and banking usage, remain undisclosed. As a result, for analysts and users, the gap between product ambition and transparency emerges as both a risk and an opportunity.