Picture this: A digital revolution, powered by a single app, is reshaping the way people handle their money globally. This is Revolut, the financial technology giant that has become synonymous with seamless banking, competitive exchange rates, and an unparalleled digital experience. Launched in 2015, Revolut was designed to provide an alternative to the traditional banking system. Fast-forward, and it stands as one of the most transformative fintech companies in the world, empowering millions to take control of their finances with simplicity and precision.

This article dives into Revolut’s staggering growth, from its valuation milestones to its expanding user base. Let’s explore how this fintech disruptor has carved its niche in the digital banking ecosystem.

Editor’s Choice: Key Milestones

- Surpassed 40 million users globally in 2025, reflecting a 25% year-over-year growth.

- Revenue exceeded $2.1 billion in 2025, showing a 40% increase from the previous year.

- Revolut’s valuation climbed to $36 billion, cementing its status as a top-tier global fintech leader.

- Introduced 12+ new products in 2025, including AI-driven budgeting and cross-border investment tools.

- Processed transactions worth over $210 billion in 2025.

- Entered three new markets in 2025, expanding deeper into Asia, Africa, and the Middle East.

- Achieved a customer satisfaction score of 92%, showcasing its commitment to delivering exceptional service.

Revolut Revenue and Profit

- Annual revenue reached $2.1 billion in 2025, driven by growth in subscriptions and high-frequency transactions.

- Monthly active users grew by 28% in 2025, fueling gains from card usage and currency exchange.

- Plus, Premium, and Metal plans made up 63% of revenue, reinforcing the strength of paid tiers.

- Reported a record profit of $180 million in 2025, continuing strong momentum from earlier profitability.

- Cross-border payments contributed 42% of transactional revenue, boosted by B2B and remittance demand.

- Profit margins improved by 18% year-over-year, thanks to tighter cost control and platform scalability.

- Business account revenue rose by 75% in 2025, largely fueled by SME adoption across Europe and Asia.

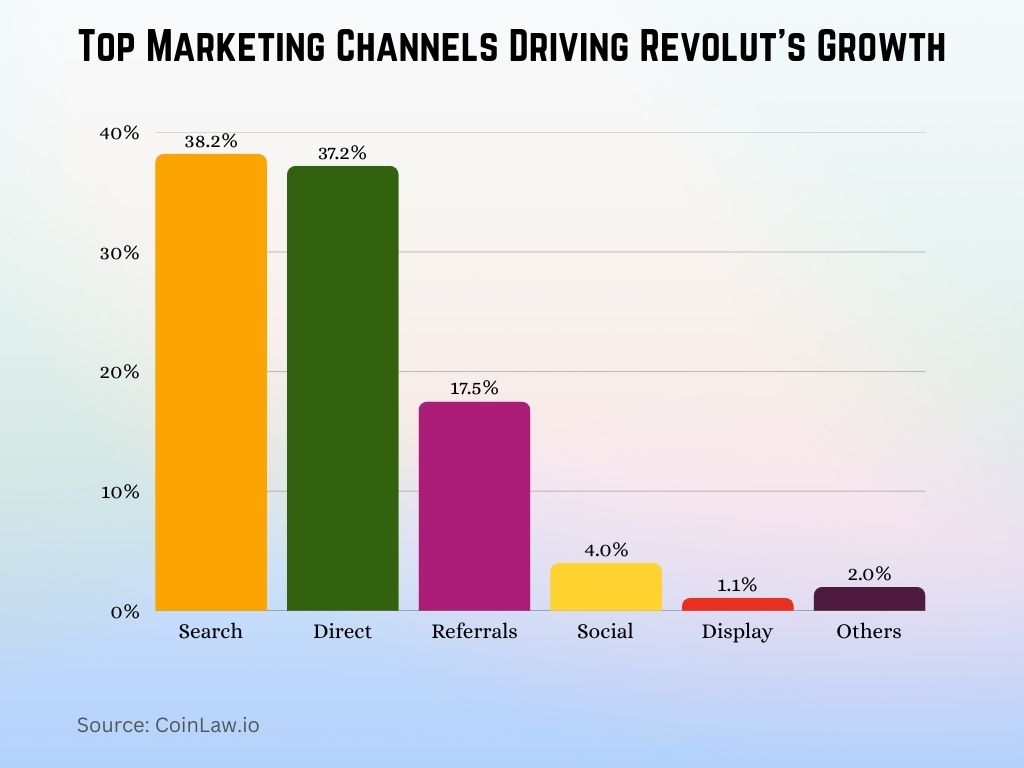

Top Marketing Channels Driving Revolut’s Growth

- Search is the leading channel, accounting for 38.2% of Revolut’s marketing traffic. This suggests a strong investment in SEO and/or paid search strategies.

- Direct traffic follows closely at 37.2%, indicating a high level of brand awareness and customer loyalty.

- Referrals contribute 17.5%, highlighting the effectiveness of partner networks and possibly referral programs in user acquisition.

- Social media plays a smaller role, with just 4%, showing it may be a supportive rather than primary channel in Revolut’s strategy.

- Display advertising has the lowest share at 1.1%, suggesting limited focus or ROI from banner and visual ads.

Revolut Users and Demographics

- Revolut surpassed 30 million users globally, with a 20% increase compared to the previous year.

- Over 70% of users are between the ages of 18 and 34, making it a favorite among millennials and Gen Z.

- 55% of users identify as male, while 45% are female, indicating a near-equal gender distribution.

- 68% of users are based in urban areas, reflecting its stronghold in metropolitan markets.

- Revolut Business accounts grew by 40%, with an increasing number of freelancers and SMEs joining the platform.

- The average user performs 30 transactions per month, demonstrating high engagement levels.

- Revolut Premium and Metal subscribers increased by 35%, highlighting the growing adoption of its paid plans.

Revolut Valuation and Market Position

- Valuation hit $33 billion, cementing its position as one of the top fintech unicorns globally.

- Ranked among the top 10 most valuable fintech companies alongside giants like Stripe and PayPal.

- Private equity and venture capital funding crossed $2 billion, with significant contributions from firms like SoftBank and Tiger Global.

- Market share in digital banking reached 12% in the UK, making it a dominant player.

- Revolut accounts for 20% of cross-border transactions in Europe, showcasing its leadership in the payments sector.

- Achieved a Net Promoter Score (NPS) of 75, reflecting high customer loyalty.

- Competition with legacy banks intensified, as Revolut now challenges major players like HSBC and Barclays on their turf.

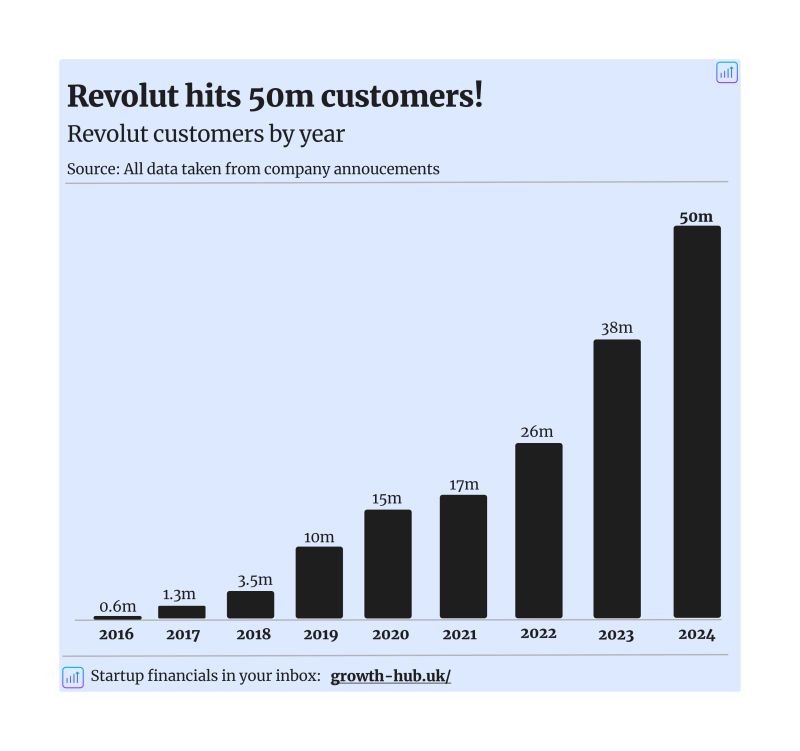

Revolut’s Explosive Customer Growth

- Revolut started with just 0.6 million customers in 2016.

- By 2019, it had reached 10 million users, marking a significant early milestone.

- Growth continued steadily, with 15 million in 2020 and 17 million in 2021.

- A sharp jump followed in 2022, with 26 million customers.

- In 2023, Revolut surged to 38 million users.

- In 2024, Revolut had 50 million customers globally.

Revolut Transaction Volume

- Transaction volume surpassed $210 billion in 2025, marking a 40% year-over-year increase.

- Daily transactions averaged 18 million, showing steady growth in user engagement and platform usage.

- International payments contributed 43% of the total volume, underscoring Revolut’s role in global remittances.

- Card payments made up 53%, while mobile wallet usage grew 35% year-over-year across all regions.

- Cryptocurrency transactions rose by 50%, driven by ongoing demand for Bitcoin, Ethereum, and stablecoins.

- Revolut Business contributed 28% of all transaction volume in 2025, backed by strong SME activity.

- Weekend transaction volume jumped 23%, linked to travel, leisure, and entertainment spending.

Revolut Deposits and Financial Activity

- Total deposits exceeded $27 billion in 2025, setting a new record for the platform.

- Savings accounts grew by 32%, fueled by high-yield interest rates and flexible saving options.

- Crypto wallets now hold over $4.2 billion, highlighting Revolut’s traction among digital asset users.

- Consumer lending rose 38%, led by rising demand for credit cards and personal loans.

- Business account deposits surged 55%, reflecting increasing reliance by SMEs and startups.

- Revolut Junior accounts expanded by 28%, driven by enhanced parental controls and education tools.

- Investment product adoption jumped 48%, with strong user interest in stocks, ETFs, and commodities.

Revolut Funding and Investment

- Total funding surpassed $2.4 billion in 2025, backed by major firms like SoftBank and Sequoia Capital.

- In 2025, Revolut secured $650 million, continuing its streak of high-profile fintech funding rounds.

- Venture capital contributed 58% of all funding, while private equity made up the remaining 42%.

- $250 million was allocated toward tech innovation and market expansion across Asia and Latin America.

- IPO readiness accelerated in 2025, with plans for a potential listing now targeted for early 2026.

- Early investors have realized a 24x return, reflecting strong valuation growth since 2015.

- Revolut’s valuation rose by 22% in 2025, signaling sustained investor confidence and momentum.

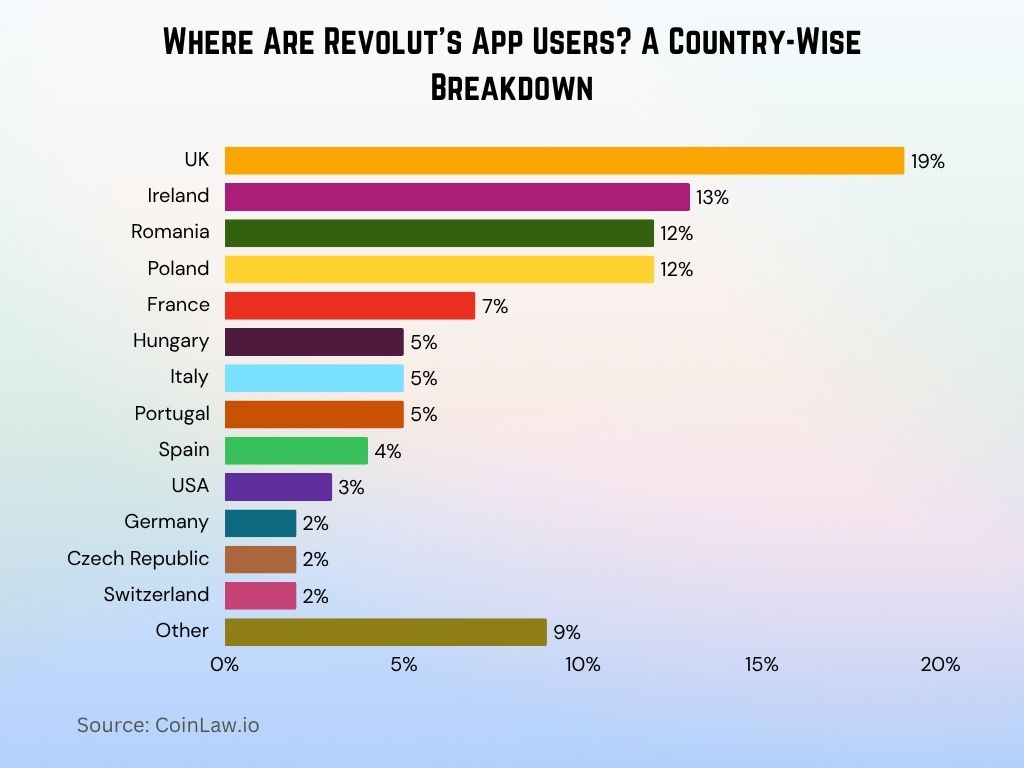

Where Are Revolut’s App Users? A Country-Wise Breakdown

- The United Kingdom leads with 19% of Revolut’s total app downloads.

- Ireland holds second place at 13%, reflecting strong market penetration.

- Both Romania and Poland account for 12% each, showing high adoption in Eastern Europe.

- France makes up 7%, while Hungary, Italy, and Portugal each contribute 5%.

- Spain follows with 4%, and the USA represents 3% of downloads.

- Smaller shares include Germany, the Czech Republic, and Switzerland at 2% each.

- The “Other” category makes up 9%, encompassing the remaining global markets.

Conclusion

Revolut’s journey demonstrates its unwavering ability to disrupt the financial landscape and redefine how people interact with money. With a valuation of $33 billion, 30 million active users, and $150 billion in transaction volume, the fintech giant has solidified itself as a leader in the digital banking revolution.

Through a strategic focus on user growth, global expansion, and technological innovation, Revolut continues to bridge the gap between traditional banking and modern financial needs. Its expansion into emerging markets, the introduction of cutting-edge products, and its emphasis on user-centric services ensure that it remains at the forefront of the fintech ecosystem.

Looking ahead, Revolut’s ongoing investments in crypto adoption, sustainable banking solutions, and business account services position it as a trailblazer in shaping the future of global finance. With its sights set on an IPO and continued innovation, Revolut is not just a company; it’s a movement that empowers individuals and businesses to take control of their financial destinies.