Phantom Wallet has rapidly evolved from a Solana-centric crypto wallet into a multichain platform with growing influence in DeFi, NFTs, and self-custodial finance. Today, it supports multiple major blockchains, handles tens of billions in assets, and serves millions of active users monthly. This shift matters in real-world contexts, for example, Solana-based developers seeking wallets with embedded trading/perpetuals find Phantom’s Hyperliquid integration pivotal, and NFT creators leverage its growing user base and multichain support to reach wider audiences. Read on to explore detailed data on user growth, transactions, revenues, and Phantom’s place in the crypto wallet landscape.

Editor’s Choice

- Phantom Wallet reached ~ 15 million monthly active users (MAUs) as of early 2025.

- It processed 850 million on-chain transactions in 2024.

- The annual swap volume exceeded $20 billion.

- Total assets under self-custody reached around $25 billion.

- Phantom’s valuation as of its Series C funding was $3 billion.

- In 2024, the wallet had ~10 million MAUs; by mid-2025, it grew to ~17 million MAUs.

- Phantom supports at least six major blockchains in mainnet use (Solana, Ethereum, Bitcoin, Polygon, Base, Sui), with some like Monad still in testnet.

Recent Developments

- Phantom raised $150 million in Series C in January 2025, co-led by Sequoia Capital and Paradigm.

- As of early 2025, the company’s valuation stood at $3 billion.

- It made two acquisitions in 2024, Bitski (to improve onboarding) and Blowfish (for enhanced security).

- Expanded blockchain support, added Bitcoin and Base in 2024, planning or already expanded to Sui and Monad for 2025.

- Launched integration with Hyperliquid for perpetual futures (perps) trading inside the wallet.

- At peak, MAUs reached ~ 17 million in 2025, up from ~10 million in 2024.

- Phantom increased its in-wallet functionality, swaps, staking, NFT management, and cross-chain features became more seamless.

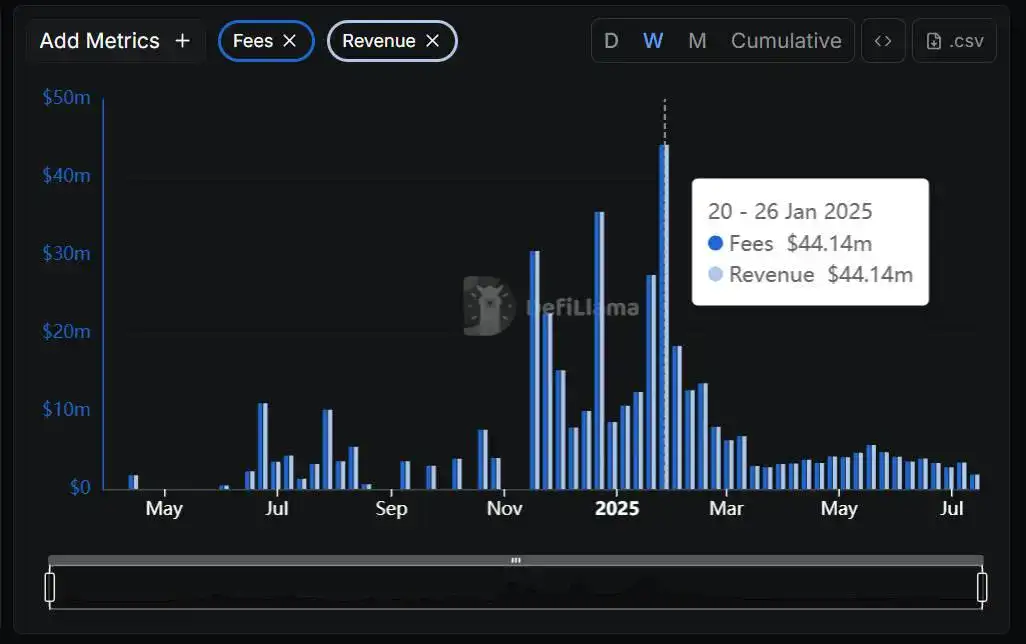

Phantom Wallet Revenue and Fees Highlights

- Phantom Wallet generated $44.14 million in both fees and revenue during its peak week of January 20–26, 2025, marking its highest single-week performance.

- Revenue and fees were identical across all weeks, indicating that fees are the core source of Phantom’s revenue.

- Between October 2024 and January 2025, Phantom consistently recorded weekly revenues between $20 million and $40 million, showing strong user and transaction growth.

- Phantom’s weekly revenue began surging in late Q4 2024, following a relatively quiet summer period.

- During May to August 2024, revenue and fees were below $5 million per week, reflecting minimal on-chain activity.

- After the January 2025 peak, Phantom’s revenue stabilized at ~$10 million–$15 million weekly by May to July 2025, suggesting a sustained user base even after peak volatility.

Phantom Wallet Overview

- Launched in 2021, Phantom began as a Solana-only wallet focused on UX and ease of use.

- It is a self-custodial (non-custodial) wallet; users hold their own private keys, and Phantom does not control them.

- Available both as a mobile (iOS & Android) app and a browser extension, desktop.

- Supports a multichain asset portfolio; major blockchains in use include Solana, Ethereum, Bitcoin, Polygon, Base, and Sui. Monad is in testnet.

- Key features: token swaps, staking of SOL, NFT support (viewing/managing), cross-chain bridging/swapping.

- Security features, biometric login, ledger hardware wallet integration, independent audits, bug bounty programs.

- Usability improvements, onboarding via acquisitions (Bitski), improvements in metadata and spam token detection (SimpleHash), and social features (usernames/profiles/follows) were launched.

User Base & Adoption

- 2024, ~ 10 million monthly active users (MAUs).

- In early to mid-2025, MAUs rose to approximately 15 million.

- Later in 2025, peak MAUs approached ~ 17 million.

- The average number of app opens per day per user is around 12 times.

- Growth from 2024 to 2025 in MAUs is roughly ~50‑70%, depending on when measured.

- Phantom is used across Solana and Ethereum ecosystems, with new adoption from Base, Sui, and Bitcoin expanding reach.

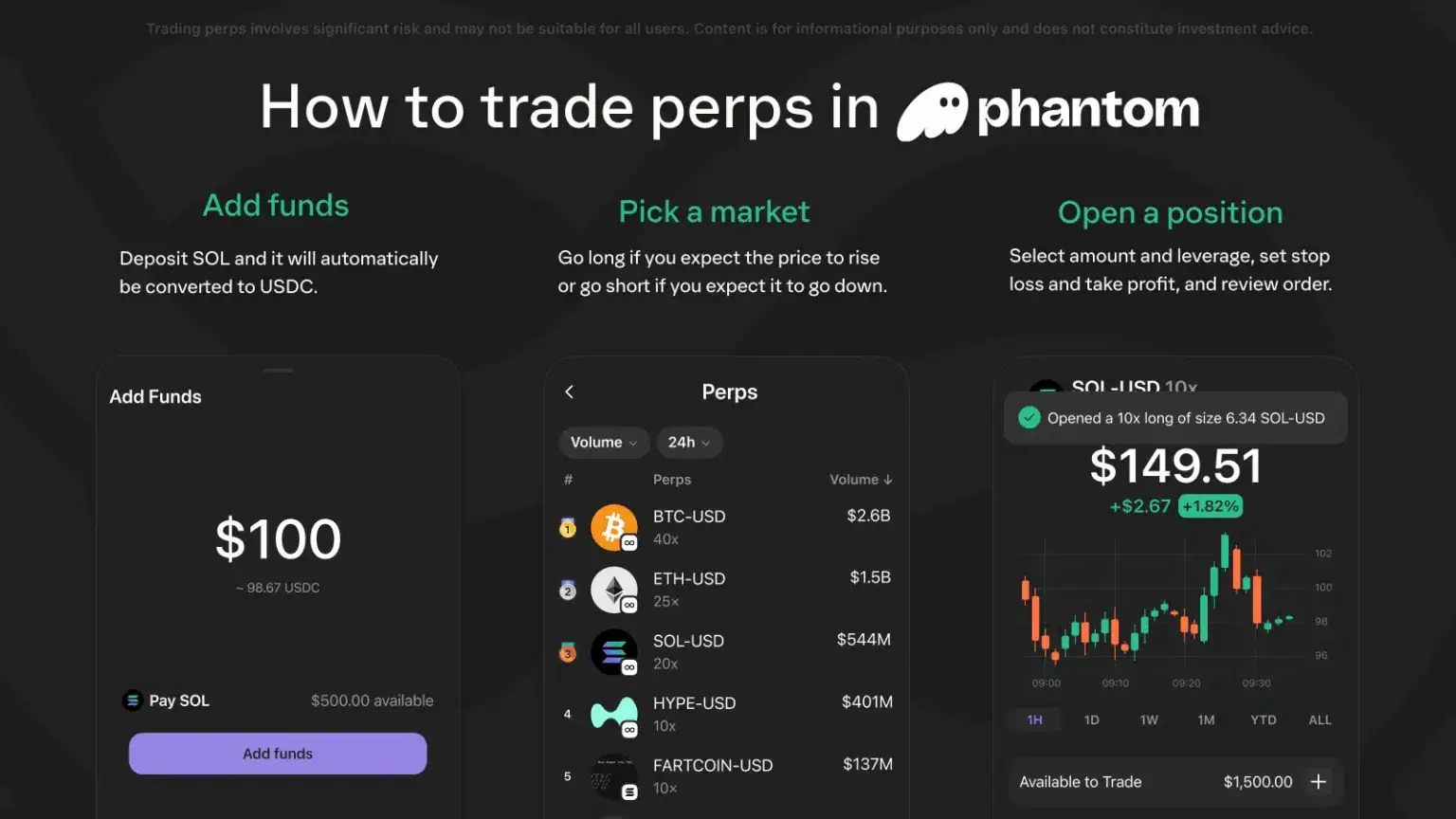

Phantom Wallet Perpetuals Trading Overview

- Users can deposit SOL, which is automatically converted to USDC for trading perps within the Phantom Wallet.

- The interface shows a sample deposit of $100, equivalent to ~98.67 USDC, with $500 available in SOL.

- Phantom supports up to 40x leverage for selected perpetual markets.

- The top perpetual trading pairs by 24h volume include:

- BTC-USD at $2.6 billion, 40x leverage.

- ETH-USD at $1.5 billion, 25x leverage.

- SOL-USD at $544 million, 20x leverage.

- HYPE-USD at $401 million, 10x leverage.

- FARTCOIN-USD at $137 million, 10x leverage.

- A sample trade shows a 10x long position on SOL-USD with a size of 6.34 SOL at $149.51, reflecting a +1.82% gain (+$2.67).

- Users can customize positions with leverage, stop loss, and take profit options, making the system suitable for both beginners and advanced traders.

- The trading dashboard includes multiple chart intervals (1H, 1D, 1W, 1M, YTD, ALL) and shows $1,500 available to trade.

- These features make Phantom a fully embedded DeFi trading solution, eliminating the need to leave the wallet for perpetual markets.

Phantom Wallet User Growth

- Growth rate: Phantom saw 5× growth over the previous year in active users.

- From post-FTX lows in 2023 to value shown in 2025, growth is roughly 28×.

- Download growth by the end of 2024, mobile app downloads will have hit ~ 24 million.

- Chain expansion contributed to growth, adding support for Base, Bitcoin, Sui, and testnet networks (Monad) increased addressable user segments.

- New feature launches (e.g. perpetuals via Hyperliquid), split user behavior, and trading users increased.

- Social/community features such as usernames and follows helped retention, engagement.

- An increasing number of active traders vs passive holders, embedded swap volume surged at certain peak times.

Monthly Active Users

- 10 million MAUs in 2024.

- ~ 15 million MAUs by early 2025.

- Peak around 17 million MAUs mid-2025.

- In comparison to 2023 (post-FTX lows), the growth multiplier is ~28× by 2025.

- Average daily app opens ~12 times per user.

- A significant portion of these users are active in trading, swapping, or interacting with DeFi/NFTs, not just holding assets.

- Retention appears tied to features like social profiles, safety improvements, and cross-chain support.

Total Wallet Downloads

- Mobile app downloads hit ~ 24 million by the end of 2024.

- Downloads include both iOS and Android.

- Growth in downloads correlates with peaks in memecoin interest and Solana ecosystem activity, especially in 2024.

- Geographic expansion and multichain support likely helped new downloads.

- Users downloading now are more likely to engage in swaps, NFTs, and perps features compared to early adopters.

- Download growth from late 2023 through 2024 was strong, especially after mobile-focused promotions and UI improvements.

Solana Wallet Market Share Breakdown

- Phantom Wallet leads the market with a dominant 39.4% share, making it the most widely used wallet in the Solana ecosystem.

- Embedded wallets, those built directly into dApps, claim 32.7% of the total wallet share, highlighting the rise of seamless in-app onboarding.

- Magic Eden Wallet holds 12.1%, reflecting its popularity among NFT traders and marketplace users.

- OKX Wallet accounts for 8.3%, driven by its cross-chain capabilities and growing Solana integration.

- Other wallets collectively represent around 4.1%, showing a fragmented landscape beyond the top players.

- Solflare Wallet captures roughly 2.1% of the market, maintaining relevance among DeFi-focused users.

- Backpack Wallet has a small but active user base with 1.3% share, often linked to xNFT and token-gated experiences.

- Combined, Phantom, Embedded, and Magic Eden wallets control over 84% of the Solana wallet ecosystem.

Supported Blockchains

- Mainnet support includes Solana, Ethereum, Bitcoin, Polygon, Base, and Sui.

- Monad is supported in testnet as of mid-2025.

- Solana remains the dominant chain for Phantom in terms of embedded swap volume and transaction activity. Estimates suggest ~97% of swap activity/volume occurs on Solana.

- Other chains are supported largely for tokens, NFTs, storage, staking, etc., but may not yet rival Solana in usage intensity.

- Cross-chain bridging and swaps are part of Phantom’s features, enabling transfers among supported chains.

- As Phantom adds chains like Sui and Base, its multichain asset coverage expands, which helps users hold and move diverse assets in one wallet.

Transaction & Trading Volumes

- Phantom’s perpetual-futures feature (via Hyperliquid) has now surpassed $1 billion in cumulative trading volume.

- Hyperliquid, the perpetual engine Phantom uses, handled about $1.57 trillion in perpetual futures volume over the past 12 months.

- In June 2025 alone, Hyperliquid posted $208 billion in trading volume, generating roughly $56 million in revenue.

- Phantom reports more than 850 million total on-chain transactions in 2024.

- In 2024, users bridged over $613 million across chains via Phantom, $421.6 million of that was bridged to Solana.

- The wallet supported 120 million swaps in 2024.

- Phantom averaged ~27 transactions per second during peak 2024 throughput.

- On some days, Phantom’s daily trading volume exceeded $1.25 billion, with over 10 million transactions processed.

Phantom Wallet Revenue and Valuation

- Phantom raised $150 million in Series C funding in January 2025, giving it a valuation of ~$3 billion.

- Phantom’s estimated annual revenue is $79.1 million.

- Peak revenue months are estimated to reach ~$110 million in monthly transaction volume or revenue for certain periods.

- Phantom has made acquisitions (SimpleHash, Blowfish, Bitski) that likely increase both cost base and valuation.

Phantom Wallet Transaction Statistics

- In 2024, Phantom processed 850 million on-chain transactions.

- Average users opened the mobile app 16 times per day in 2024.

- There were 120 million token swaps done in 2024.

- Bridging volume across chains in 2024 was ~$613 million total.

- Of the bridging volume, $421.6 million went into Solana.

- Token universe, users traded more than 788,000 different tokens in swaps in 2024.

- Peak throughput, ~27 transactions per second, during spikes in activity.

- During high-volume days, trades topped $1.25 billion daily volume, with 10 million+ transactions on those days.

Total Volume and Assets Managed

- While exact assets under management (AUM) numbers are less publicly shared, Phantom’s integration with Hyperliquid ties it to platforms handling trillions in derivative volumes (perps, ~$1.57 trillion).

- The swap and bridge volumes (~$613 million bridged in 2024) indicate a sizeable asset flow through Phantom’s platform.

- Phantom’s revenue estimates suggest that assets and volume activity are sufficiently large to sustain meaningful income streams from swap fees and trading.

Geographic Distribution of Users

- Phantom’s user base is heavily represented in Nigeria (≈ 17%), India (≈ 11%), and Indonesia (≈ 10%).

- 96% of the wallet’s balance (capital held) is concentrated in India.

- The United States holds a large share of transaction volume (on-chain activity), dominating Phantom’s transaction statistics.

- Website traffic to phantom.app is also led by the U.S., which contributes roughly 26.7% of desktop traffic.

- Gender breakdown of visitors: about 70% male, 30% female.

- The age group most represented, 25‑34 year olds, make up the largest share of phantom.app’s web audience.

Phantom Wallet Demographics

- Over 15 million monthly active users as of mid‑2025.

- The majority of users are in the age range of 25‑34.

- Gender breakdown from web traffic shows approximately 70% male / 30% female among site visitors.

- A large share of users comes from emerging markets (e.g., Nigeria, India, Indonesia), especially in terms of wallet users.

- However, capital balances are skewed toward developed markets; for example, in India, Phantom holds ≈ 17% of balances.

- For many users, interaction is not passive; usage includes swaps, NFT minting, staking, and social features.

- Demographic data on income, education, etc., is less public, but indicators suggest users are more crypto-savvy, likely tech-literate.

Comparative Position / Market Share

- Phantom holds ≈ 17% of balances in India.

- MetaMask still leads in many regions, both in users and capital.

- Phantom’s valuation ($3 billion) and self-custodied assets exceeding $25 billion place it among the top non-custodial wallets by financial scale.

- Its feature expansion is helping it compete with MetaMask, Trust Wallet, and OKX.

- Wallets that hold capital (balance share) in Phantom are strong in certain emerging markets.

- Phantom is recognized as one of the “most widely used multichain wallets.”

On-Chain Activity and Daily Transactions

- Phantom wallet transactions accounted for ≈ 35% of Solana’s total volume on a high-activity day in early June 2025.

- Solana’s daily active addresses rose to ≈ 1.2 million.

- Phantom user activity has shown a recent ~12% spike week-over-week in transaction counts.

- On days of high interest, daily transactions and wallet connections jump noticeably.

- On-chain swap/bridge activity is consistently increasing as Phantom adds more blockchains and cross-chain functionality.

Phantom Wallet NFT and DeFi Usage

- Phantom’s NFT gallery supports multiple chains.

- Integration with SimpleHash enhances metadata and spam filtering.

- DeFi usage includes staking, token swaps, and recently, perpetual futures (Hyperliquid).

- Phantom Perps surpassed $1 billion in cumulative volume.

- Cross-chain swapping is increasingly used.

- Phantom’s DeFi tools, like PSOL, provide liquid staking options.

- NFT drops and marketplace integrations are driving activity.

Security & Trust Metrics

- Phantom is a self-custodial wallet.

- It offers optional hardware wallet integration (Ledger).

- Phantom has had independent audits and runs a bug bounty program.

- It uses third-party data for verified metadata and scam protection.

- No major security breach tied directly to Phantom in 2025.

- Phantom is rated highly for security, but as a hot wallet carries inherent risk.

Social and Community Growth

- Phantom reports having over 15 million users.

- Phantom introduced a social feed feature in 2025.

- Speculation on Phantom airdrop rumors stirred engagement.

- Community sentiment is generally strong.

- Phantom’s presence in app store rankings is improving.

- Acquisitions have expanded its community reach and tools.

Frequently Asked Questions (FAQs)

Phantom raised $150 million in its Series C round in January 2025 at a $3 billion post‑money valuation.

As of mid‑2025, Phantom has more than 15 million MAUs and over $25 billion in assets under self‑custody.

The annualized revenue/fees are approximately $220.69 million, with 30‑day fees around $18.09 million.

Phantom has raised $268 million in total funding and supports six major blockchains on mainnet (Solana, Ethereum, Bitcoin, Polygon, Base, Sui) as of mid‑2025.

Conclusion

Phantom Wallet has clearly matured beyond its first role as a Solana-only wallet into a multichain platform that handles substantial DeFi, NFT, and trading activity. With 15 million+ active users, $25 billion+ in assets under custody, and new tools like perpetual futures, staking, and social identity layers, it is carving out a strong niche, especially among users who want one wallet for many blockchains. At the same time, challenges remain, balancing growth and security for a hot wallet, increasing presence and trust in developed markets, and differentiating vs giants like MetaMask and Trust Wallet.