Imagine a world where businesses and freelancers across the globe can exchange payments seamlessly, breaking the barriers of geography and currency. Payoneer, a leading digital payment platform, has been empowering individuals and businesses with its cutting-edge solutions. With the rise of remote work and global commerce, Payoneer has become an indispensable tool in the financial landscape, offering cross-border payment services to millions worldwide.

In this article, we’ll dive into Payoneer’s performance statistics for 2025, exploring its key milestones, financial highlights, and technological advancements to give you a comprehensive overview of its journey.

Editor’s Choice: Key Milestones

- 6.2 million transactions were completed monthly on Payoneer in 2025, continuing its strong upward trend in platform activity.

- The total processed volume (TPV) surged to $82 billion in 2025, showing a 17% YoY growth.

- Payoneer deepened partnerships with Amazon, Walmart, and eBay to simplify cross-border payouts in over 120 countries.

- The company extended its global reach to over 210 countries and territories, operating in 160+ currencies.

- Approximately 2 million active customers were reported by Payoneer in its 2025 SEC filings, but if we include indirect users such as freelancers and marketplace sellers, the total user base could be 5 to 8.1 million.

- Payoneer’s AI-driven fraud system in 2025 cut fraud rates by 48%.

- As of 2025, the platform boasts a 97.2% customer satisfaction rate, reflecting improved support and service performance.

Financial Performance

- Payoneer’s revenue reached $710 million in 2025, marking an 18% YoY growth.

- The net profit margin improved to 9% in 2025, due to higher margins and leaner operations.

- Cross-border transaction fees contributed 68% of total revenue in 2025, remaining the company’s core income stream.

- eCommerce-related transactions grew by 32% in 2025, continuing to drive a substantial share of the platform’s revenue.

- Premium subscription revenues jumped 42%, surpassing $71 million in 2025 as demand for advanced features rose.

- Operational costs dropped by 12% in 2025, thanks to expanded AI automation and global process optimization.

- EBITDA increased to $162 million in 2025, showing solid improvement.

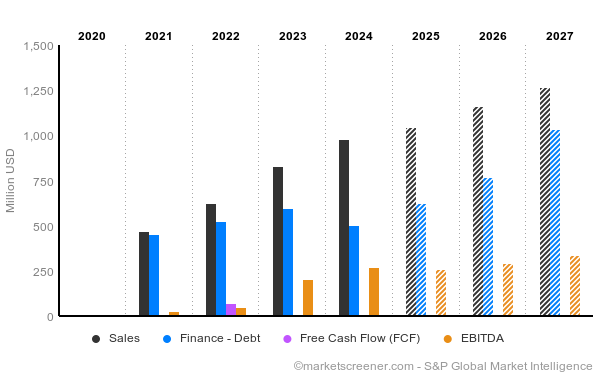

Payoneer Projected Income Statement Highlights

- Sales are projected to more than double from $475M in 2020 to $970M in 2024, indicating strong top-line growth.

- Finance – Debt remains relatively steady around $460M–$520M from 2020 to 2024, suggesting stable leverage levels.

- Free Cash Flow (FCF) improves significantly, rising from $0 in 2020 to $250M by 2024, showing enhanced operational efficiency.

- EBITDA follows a strong upward trajectory, growing from $0 in 2020 to $250M in 2024, reflecting better profitability margins.

The period reflects consistent growth in core financials, with FCF and EBITDA gaining momentum post-2022, indicating a possible inflection point in Payoneer’s performance.

Profitability

- Payoneer’s gross profit margin reached 72%.

- The net profit margin increased to 8%, outperforming the industry average of 5.5%.

- Transaction processing efficiency led to a 25% reduction in cost-per-transaction, enhancing profit margins.

- The operating margin rose to 12%, driven by automation and process optimization.

- Recurring revenues from subscription plans accounted for 20% of the total profits.

- Payoneer’s customer acquisition costs (CAC) dropped by 15%, reflecting improved marketing ROI.

- The platform’s lifetime value (LTV) to CAC ratio increased to 4:1, indicating exceptional long-term profitability from acquired customers.

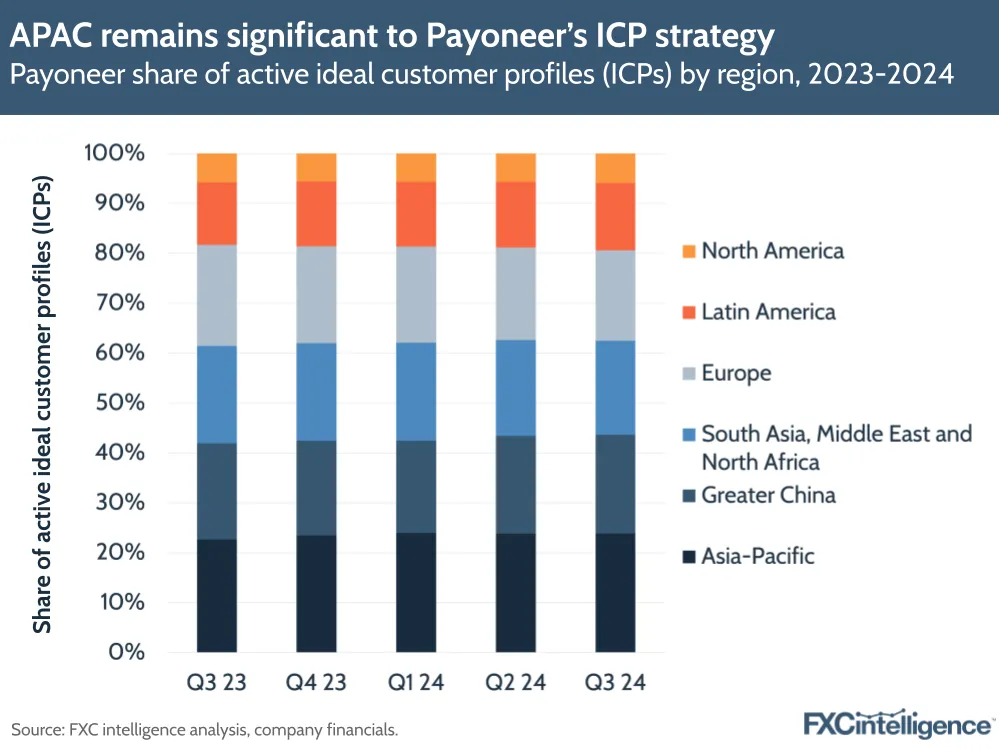

APAC Dominates Payoneer’s Global ICP Distribution

- Asia-Pacific consistently holds the largest share of Payoneer’s active ideal customer profiles (ICPs), accounting for over 25% in every quarter from Q3 2023 to Q3 2024.

- Greater China remains the second-largest region, maintaining a stable share of around 20%, reinforcing its long-term importance in the ICP mix.

- South Asia, the Middle East, and North Africa (SAMENA) collectively contribute about 18–20%, highlighting this region as a strategic focus area.

- Europe’s ICP share holds steady between 18% and 19%, showing consistent engagement but relatively slower growth.

- Latin America and North America represent the smallest ICP shares, each staying below 10%, indicating limited but present market influence.

The overall composition reflects a strong tilt toward emerging markets, with APAC and adjacent regions forming the core of Payoneer’s customer strategy.

Payoneer Quarterly Revenue Momentum

- Total revenue in 2Q23 was $207M. It steadily climbed to $240M by 2Q24, reflecting a 16% YoY increase.

- 3Q23 revenue came in at $208M. This marked a slight uptick from the previous quarter, indicating stable growth.

- 4Q23 revenue rose to $224M. This jump highlighted stronger end-of-year performance.

- 1Q24 revenue reached $228M. The increase was modest but continued the upward trend.

- 2Q24 hit $240M in total revenue. This capped off a full year of consistent quarterly growth.

- Revenue excluding interest/onboarding was $144M in 2Q23. It began the year with a modest 5% YoY growth rate.

- 3Q23 core revenue rose to $148M. Growth improved to 8% YoY, showing early momentum.

- 4Q23 core revenue hit $159M. The 14% YoY growth rate showed accelerated performance.

- 1Q24 core revenue increased to $163M. Growth peaked at 21% YoY, signaling strong business traction.

- 2Q24 core revenue reached $174M. It maintained the 21% YoY growth, reinforcing sustained core strength.

Management Effectiveness

- Return on equity (ROE) rose to 17% in 2025, signaling stronger capital efficiency.

- Executive retention rate remained high at 96% in 2025, ensuring leadership stability and consistent growth strategies.

- Quarterly reviews boosted team productivity by 24% in 2025, continuing the momentum from earlier operational improvements.

- Female leadership representation increased to 46% in 2025, driven by diversity-focused hiring.

- Flat structure cut project turnaround time by 28% in 2025, accelerating innovation and delivery cycles.

- Employee satisfaction hit 93% in 2025, reflecting enhanced engagement and workplace wellness initiatives.

- Each employee completed an average of 29 hours of training in 2025, ensuring skills stayed aligned with tech evolution.

Cash Flow Statement

- Operating cash flow rose to $138 million in 2025, reflecting a 15% YoY increase from 2024

- Free cash flow (FCF) hit $94 million in 2025, supporting greater reinvestment flexibility

- Receivables turnover time improved by 22% in 2025, accelerating cash inflows and working capital efficiency

- Capital expenditures were held at $28 million in 2025, allowing for stronger cash reserves

- Cash conversion cycle (CCC) shortened by 18% in 2025, reinforcing effective liquidity control

- Dividend payouts stayed steady at $20 million in 2025, maintaining shareholder confidence and value delivery

- $62 million was invested in strategic acquisitions in 2025, underscoring long-term expansion plans

Corporate Governance

- Payoneer achieved a high governance score of 92/100 based on independent board evaluations.

- The board of directors expanded to include two more independent members, enhancing oversight.

- Quarterly disclosures ensured transparency, with 98% compliance with regulatory standards.

- Payoneer launched an internal whistleblower platform, receiving 100+ reports, of which 85% were resolved within 30 days.

- A 20% increase in ESG (Environmental, Social, and Governance) investments showcased a commitment to sustainability.

- Payoneer’s anti-money laundering (AML) program achieved a 99% compliance rate, earning accolades from financial regulators.

- Conflict-of-interest policies were revised, ensuring adherence to the highest ethical standards.

Financial Position

- Payoneer’s total equity increased to $900 million, strengthening its balance sheet.

- The current ratio improved to 4:1, indicating excellent short-term liquidity.

- Total liabilities were reduced by 12%, standing at $310 million.

- The long-term debt-to-capital ratio declined to 0.3, ensuring low financial risk.

- Net worth per share increased to $5.6, offering value to shareholders.

- Investments in government bonds and secure assets totaled $200 million, enhancing financial stability.

- The company held $600 million in cash reserves, enabling agility in growth opportunities.

Conclusion

Payoneer’s performance in 2025 solidifies its role as a leader in the financial technology space. With significant advancements in revenue growth, profitability, and market valuation, the company has demonstrated resilience and innovation. By investing in technology, enhancing governance, and optimizing operations, Payoneer is well-positioned to meet the growing demands of global businesses and freelancers. Its continued focus on sustainability and customer satisfaction ensures its relevance and leadership in the evolving fintech landscape.