In today’s rapidly evolving digital world, payment processing solutions have become the backbone of global commerce. Picture a bustling marketplace, but online, where transactions are instant, secure, and borderless. With the explosive growth of e-commerce and mobile payments, businesses and consumers alike are adopting innovative payment methods at an unprecedented pace. This shift towards digital transactions isn’t just a trend; it’s shaping the future of finance. In this article, we’ll dive deep into today’s payment processing landscape, uncovering key statistics, emerging trends, and the technologies driving this essential industry forward.

Editor’s Choice

- The global payment processing solutions market is projected to reach $173.38 billion in 2025.

- In the U.S., 43% of consumers used a digital wallet in 2024, up from 23% in 2019.

- Global cross-border digital payments are expected to hit $222.1 billion by 2025.

- The global payments market is estimated at $783.02 billion in 2025, growing from $716.31 billion in 2024.

- In the U.S., online transactions via mobile and digital wallets already account for 36.7%, with peer-to-peer mobile payments at 70%.

- The global digital wallet user base is forecast to reach 5 billion by 2025, up from 3.9 billion in 2023.

- Apple Pay is projected to account for 10% of all global card transactions by 2025, driven by widespread mobile adoption and NFC-enabled point-of-sale expansion.

Main Issues Caused by Invoice Processing Challenges

- 30% of challenges are linked to stress on AP teams, making it the top issue.

- 29% fall into other causes, reflecting various inefficiencies and hidden costs.

- 21% of problems arise from damaged relationships with vendors and suppliers.

- 20% lead to delays in the delivery of goods and services, impacting operations.

Payment Processing Solutions Market Trends

- BNPL usage among U.S. consumers reached about 33% in 2025, up from 30% in 2022.

- Over 20,000 companies now accept Bitcoin payments in 2025, reflecting wider crypto adoption.

- India’s Unified Payments Interface (UPI) powered nearly 50% of all real-time payment transactions in India by 2025, contributing significantly to the global surge in instant payments.

- The embedded finance market is forecast to be worth around $148 billion in 2025, growing rapidly toward 2030.

- The virtual cards market is expected to total about $567 billion in 2025, up from $474 billion in 2024.

- The voice-based payment market is projected to $12.7 billion in 2025, up from $11.5 billion in 2024.

- Subscription-based services remain strong in 2025, with most major digital providers offering recurring monthly payment options.

Key Players and Market Share in Payment Processing Solutions

- Visa and Mastercard control roughly 52% and 25% of U.S. credit card transactions, respectively, in 2025, together accounting for about 77% of the market.

- PayPal dominates the global payment processing market with about 45.5% market share in 2025.

- Stripe holds around 17% of the global market in 2025 and saw its valuation soar to $91.5 billion.

- Block (formerly Square) serves approximately 57 million users and 4 million sellers, processing about $241 billion in payments annually.

- Apple Pay leads U.S. mobile wallet usage with about 57% market share in 2025, and is accepted at 94% of U.S. retail point-of-sale terminals.

- Amazon Pay accounts for around 6% of global digital payments in 2025 and about 7% share of North American e-commerce transactions.

- Adyen processed roughly $1.08 trillion in volume in 2025 and saw net revenue reach €1.82 billion.

Adoption and Usage by Payment Method

- Digital wallets now make up 53% of e-commerce transactions globally in 2024.

- Credit cards account for around 22% of digital transactions worldwide, holding steady despite a gradual decline.

- Bank transfers, including real-time payments, represent about 15% of global digital transactions, growing steadily.

- Cryptocurrency payments now make up approximately 8% of global e-commerce transactions, a notable rise from 5% the previous year, as reported by Chainalysis and industry trend analyses.

- BNPL transactions have surged by 20% year-over-year, particularly popular among Millennials and Gen Z.

- In Sweden, cashless payments are the norm, with 98% of all transactions now digital.

- Contactless card payments account for 42% of global in-store purchases, fueled by convenience and hygiene concerns.

Most Popular Online Payment Methods

- 42% of online shoppers prefer credit cards, making them the top payment choice.

- 39% use electronic payment services like PayPal when available.

- 28% rely on debit cards for their online purchases.

- 23% still opt for cash on delivery, showing demand for flexible options.

- 20% of buyers use bank transfers, particularly for larger transactions.

- 15% prefer gift cards or vouchers as a secure payment method.

- 14% adopt mobile payments, reflecting the growth of digital wallets.

- Only 3% of online shoppers use cryptocurrencies like Bitcoin.

- Another 3% fall into the other payment methods category.

Technological Innovations in Payment Processing

- Over 81% of financial institutions have explored or implemented blockchain solutions, reflecting growing confidence in its security and transparency benefits

- Around 90% of financial institutions now use AI to detect fraud in real time.

- AI-based fraud detection systems can achieve up to 95% accuracy in identifying suspicious transactions and have helped reduce fraud-related losses by 30%, according to industry leaders like Visa and Mastercard.

- Biometric authentication is on the rise, with over 20% of digital transactions now using methods like fingerprint or facial recognition.

- Tokenization protects consumer data and is used in approximately 75% of e-commerce transactions.

- Voice commerce growth continues; about 10% of U.S. consumers now use voice-activated devices for purchases.

- NFC drives contactless adoption with roughly 72% of terminals in developed markets supporting NFC.

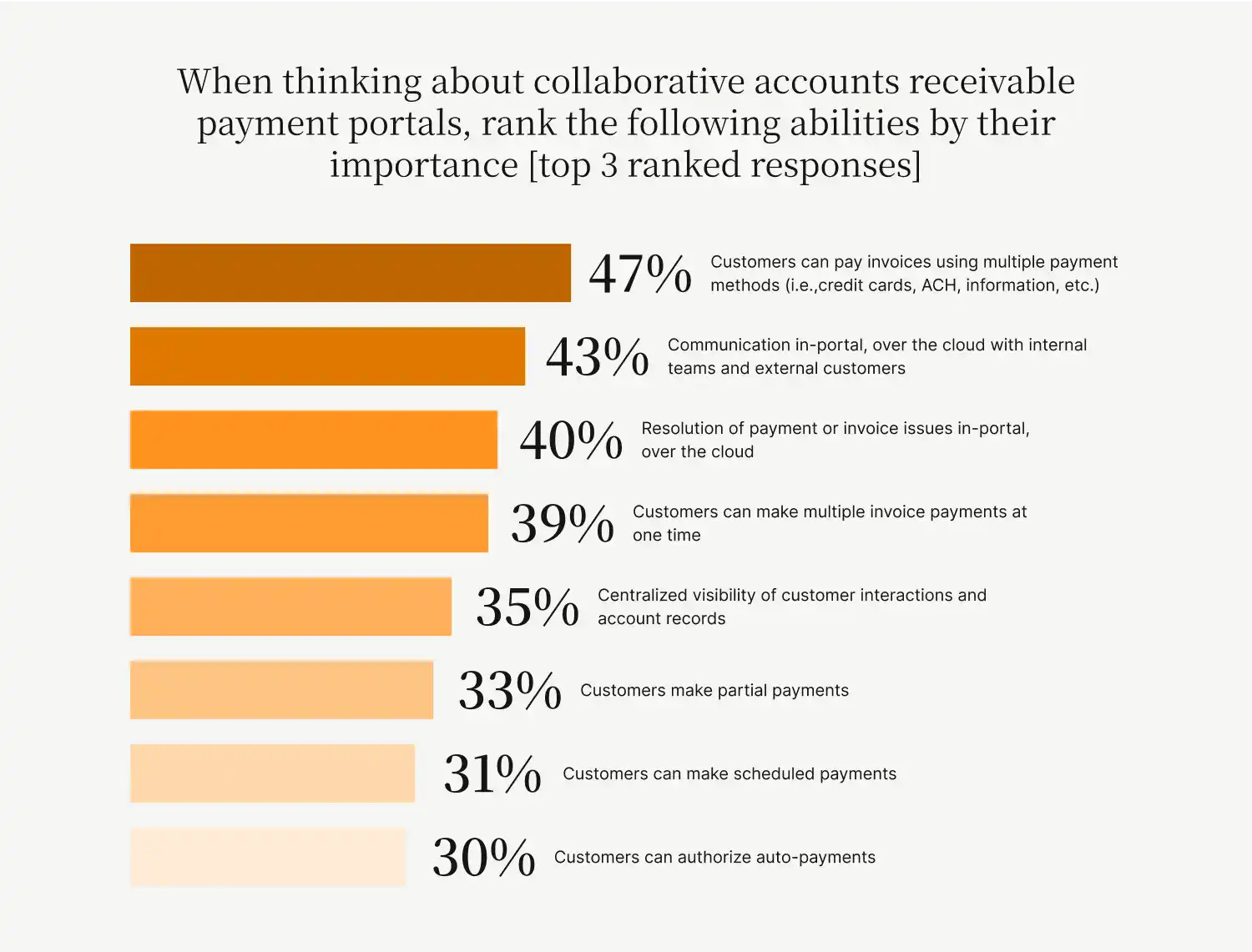

Key Abilities Valued in Accounts Receivable Payment Portals

- 47% of customers want the ability to pay invoices using multiple payment methods, such as credit cards and ACH.

- 43% value communication within the portal, over the cloud, with both internal teams and external customers.

- 40% consider the resolution of payment or invoice issues in-portal a top priority.

- 39% prefer being able to make multiple invoice payments at one time.

- 35% see importance in centralized visibility of customer interactions and account records.

- 33% want the option to make partial payments.

- 31% value the ability to schedule payments in advance.

- 30% look for the convenience of authorizing auto-payments.

Security and Fraud Prevention in Digital Payments

- Global digital payment fraud losses are estimated to exceed $40 billion, pushing organizations to intensify security measures.

- Machine learning now helps 79% of organizations detect payment fraud attempts, a marked leap from traditional manual methods.

- Businesses are projected to lose $15 billion in fraudulent chargebacks in 2025, highlighting the growing cost of first-party fraud.

- Global cybersecurity spending to protect payment systems is expected to reach $213 billion in 2025.

- Deepfakes and AI-powered account takeover scams are surging, showing the growing threat of sophisticated fraud techniques.

- About 79% of organizations experienced payment fraud attempts in 2024, underscoring the widespread nature of the threat.

Mobile Bill Payments by Age Group

- 46% of smartphone owners under 30 use their devices to pay mobile bills.

- 57% of those aged 30–39 make mobile bill payments, the highest among all groups.

- 51% of smartphone users aged 40–49 pay bills through their phones.

- Only 30% of those 50 or older use smartphones for mobile bill payments.

Regional Insights and Differences in Payment Processing Costs

- Merchants in North America now typically pay processing fees averaging 2.0–3.2% per transaction.

- In Europe, regulated standards have pushed transaction fees down to around 0.3% for credit cards, aligned with EU caps.

- In China, Alipay and WeChat Pay together control over 90% of mobile payments, dominating the digital payments landscape.

- India’s UPI system handled roughly ₹170 lakh crore (≈ $2 trillion) in 2024, reflecting continued rapid adoption since 2020.

- Africa’s mobile money ecosystem, led by services like M-Pesa, now contributes around 10% of global digital payments, critical for financial inclusion.

- Latin America, especially Brazil and Mexico, sees digital payment volumes growing about 30% annually, thanks to government incentives.

- In Japan, approximately 70% of urban transactions are cashless, while rural areas still rely heavily on cash.

Recent Developments in Payment Processing Solutions

- Apple Pay Later, launched in 2023, processed about $870 million in BNPL transactions in 2025, showing strong adoption.

- Stripe Connect is now used by 75% of leading marketplaces, enabling multi-party payouts and vendor management.

- Stripe’s total payment volume reached $1.4 trillion in 2024, continuing rapid growth into 2025.

- Amazon One’s palm recognition payment expanded in 2025 beyond retail into sectors like healthcare.

- Stripe now supports over 125 global payment methods, including real-time networks like UPI and Pix.

- Stripe processed more than $1.05 trillion in payments in 2025 with a valuation close to $90 billion.

Conclusion

As digital transactions continue to soar, payment processing solutions are evolving to keep pace with consumer demands and technological advancements. The trends and developments today highlight a clear move towards seamless, secure, and flexible payment options. From biometric authentication and AI-driven fraud prevention to the rise of CBDCs and mobile payment adoption, the future of payments is both dynamic and promising. Businesses that adapt to these innovations will be well-positioned to thrive in an increasingly cashless society. As global economies become more interconnected, payment processors are not just facilitators; they’re shaping the digital economy of tomorrow.