The crypto options market has matured rapidly in recent years, becoming an increasingly important tool for hedging, speculation, and income strategies. The notional size, open interest, and diversity of products have reached new highs, reshaping how traders and institutions interact with digital assets. Its influence shows up in real-world applications, for instance, a hedge fund may overlay bitcoin options to protect against drawdowns, while a DeFi protocol might use options to offer yield products. Below is a snapshot of key metrics, and then we’ll dive into detailed sector-by-sector statistics.

Editor’s Choice

- $8.94 trillion: approximate monthly volume of crypto derivatives (including options) in 2025, surpassing spot volumes in many months.

- ~76 %: share of derivatives trading among total crypto trading in 2025.

- Notional open interest in Bitcoin options reached approximately $4 billion on CME Group alone in Q2 2025, highlighting growing institutional participation in regulated venues.

- 65 % increase: year-on-year rise in average daily volume for Ether options (Q2 2025 vs Q2 2024).

- 68 %: share of derivatives trades accounted for by Bitcoin and Ethereum combined.

- 33–36 %: portion of Deribit’s monthly volume attributed to Paradigm’s institutional network.

- ~98 % coverage: CoinDesk Data captures ~98% of global options volume in derivatives markets.

Recent Developments

- In Q2 2025, Bitcoin options hit record open interest, with notional OI nearing $4 billion.

- Ether options saw 65% year-over-year growth in average daily volume in the same interval.

- The crypto derivatives market has expanded to $8.94 trillion monthly volume in 2025, reflecting the growing use of leverage and structured products.

- Bitcoin and Ethereum dominate, making up ~68% of total derivatives activity.

- Institutions increased engagement, Paradigm’s network accounted for 33–36% of Deribit’s monthly volume.

- CoinDesk Data claims coverage of ~98% of global crypto options volume.

- Rising interest in everlasting options (a perpetual-style options construct) is emerging in DeFi protocols.

- New pricing frameworks (e.g., regime-based implied volatility models) are being applied to crypto options to better adapt to volatility regimes.

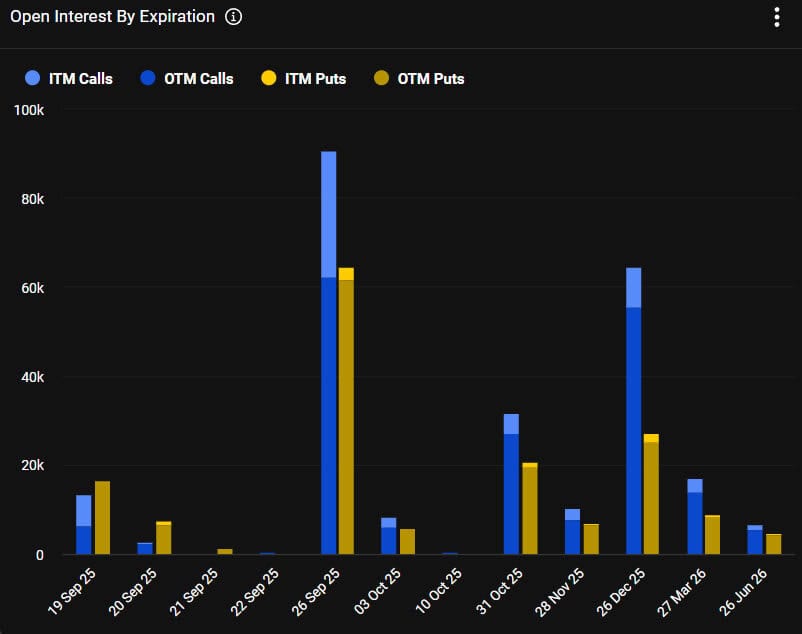

Crypto Options Expiry Impact on Spot Markets

- The largest expiry falls on 26 Sep 2025, with open interest nearing 90,000 ITM Calls and over 62,000 OTM Calls, alongside 65,000 ITM Puts and 67,000 OTM Puts.

- The 20 Dec 2025 expiry also stands out, showing nearly 65,000 ITM Calls and 28,000 OTM Puts, signaling strong hedging demand into year-end.

- The 31 Oct 2025 expiry has open interest above 28,000 ITM Calls and 22,000 OTM Puts, reflecting a balanced mix of speculative and protective positioning.

- Short-term expiries like 19–21 Sep 2025 are smaller but still relevant, with up to 17,000 OTM Puts, showing short-dated protection demand.

- Longer-dated contracts into Mar 2026 and Jun 2026 carry 18,000 ITM Calls and 13,000 OTM Puts, highlighting institutional hedging and strategic exposure beyond 2025.

Crypto Options Market Overview

- Crypto derivatives (futures + options) now frequently outpace spot in volume; options are an integral subset of that trend.

- Options allow limited downside exposure with leveraged upside, a key tool for many traders in volatile crypto markets.

- Open interest (OI) in Bitcoin options now exceeds $4 billion in certain quarters, showing increasing capital committed to hedging and speculative bets.

- Ethereum options are catching up in liquidity and volume, with double- or triple-digit growth rates year-over-year.

- A handful of exchanges (especially Deribit and others) dominate the options landscape, becoming liquidity hubs for institutional flows.

- Options pricing models are evolving, and regime switching, implied stochastic volatility, and dynamic hedging are more commonly used.

- The overlap with DeFi is growing; some protocols experiment with perpetual or “everlasting” option constructs.

- Market data infrastructure is maturing, and aggregated options data platforms now report comprehensive metrics (volume, implied vol, skew).

Growth Trends in Crypto Options Trading

- From 2024 to 2025, average daily volume in Ether options grew by 65%.

- The crypto derivatives market expanded to $8.94 trillion monthly in 2025, reflecting steady growth in demand for trading and hedging tools.

- Bitcoin and Ethereum together contribute ~68% share of derivatives volume, indicating concentration on top assets.

- Paradigm’s institutional network supports 33–36% of Deribit’s volume, demonstrating concentrated institutional flows.

- The number of active options markets has increased, with more altcoins being offered with strikes and expiries.

- Liquidity provisioning and tighter bid-ask spreads are observed in major markets as competition intensifies.

- Data infrastructure growth (more exchanges reporting options metrics, data aggregators) supports more transparency and participation.

- In some regional markets, regulatory initiatives or changes have spurred growth or constrained trading.

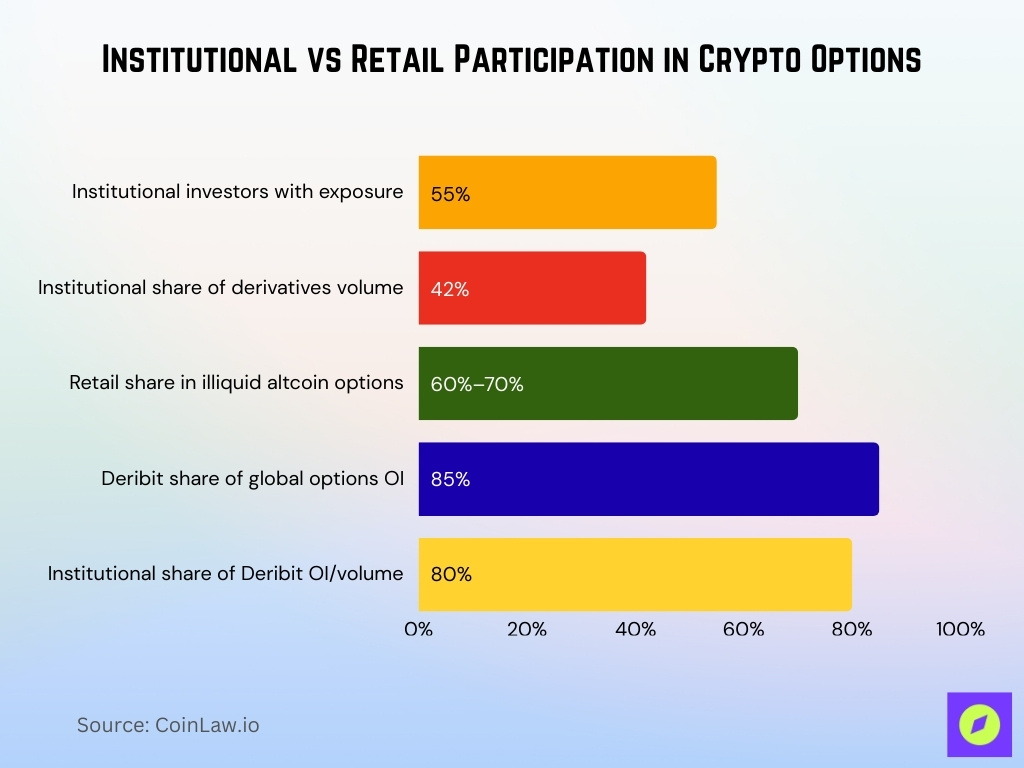

Institutional vs Retail Participation in Options

- In 2025, 55% of institutional investors report engaging in crypto options exposure.

- Institutions now contribute ~42% of total derivatives trading volume, including options.

- Retail traders remain dominant in high-volatility altcoin options; retail accounts for an estimated 60–70% of volume in less liquid pairs.

- Deribit reportedly holds 85% of the crypto options open interest, and 80% of its volume/OI is from institutional participants.

- Institutional flows tend to favor longer-dated contracts (3- to 6-month expiries), while retail flows concentrate on weekly and monthly expiries.

- Retail participation surges during volatility events, for example, during sharp price swings in 2025, short-dated options volumes rose 30–50% above baseline.

- Institutional traders use options largely for hedging large spot positions or overlay strategies, while retail traders often use directional and volatility plays.

- Studies show that retail-driven illiquidity impacts option pricing more sharply in low-volume strikes.

Leading Crypto Options Exchanges

- Deribit remains one of the dominant venues for crypto options in 2025, especially for Bitcoin and Ethereum derivatives.

- Paradigm’s institutional network contributes 33–36% of Deribit’s monthly volume, highlighting its importance among top exchanges.

- Other exchanges (with options capability) increasingly compete in niche pairs or unfamiliar types, though often with less liquidity.

- Some centralized exchanges (CEXs) now offer integrated options modules, bundling spot, futures, and options products.

- Data aggregators publish options analytics per exchange, showing trade volumes, open interest, and implied volatility per exchange.

- Exchanges that maintain high transparency and low slippage tend to capture more market share in options spread and skew-based trades.

- Some exchanges specialize in altcoin options or unfamiliar contracts, differentiating from the Bitcoin/Ether-centric competition.

- The competitive pressure has pushed exchanges to reduce fees, improve settlement mechanics, and expand expiries or strike granularity.

Top Cryptocurrencies in Options Markets

- Bitcoin and Ethereum comprise ~68% of all crypto derivatives volume (futures + options) as of 2025.

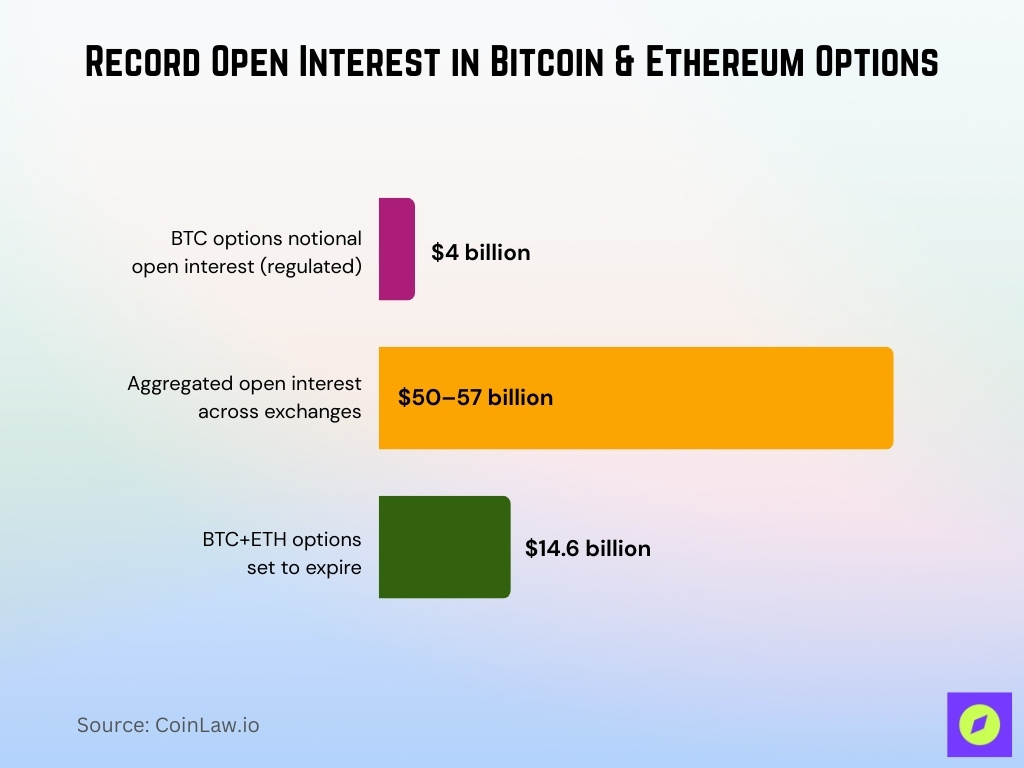

- Aggregated open interest in Bitcoin options across major exchanges reached nearly $50–57 billion in mid-2025.

- Ethereum options volume increased ~65% year-over-year (Q2 2025 vs Q2 2024) in average daily terms.

- Among altcoins, Solana and Cardano options saw year-on-year growth in 2025, +27% and +31% respectively.

- In major expiries around August 2025, $14.6 billion in BTC + ETH options were set to expire.

- BTC put options have shown stronger demand during drawdowns, for example, large expirations in 2025 skewed toward puts.

- Implied volatility surfaces show steeper skew for Bitcoin relative to Ethereum, reflecting higher downside hedging pressure.

- Emerging altcoins (e.g., SOL, MATIC) have begun to attract options interest, but remain <10% of total options volume combined.

Bitcoin Options Market Statistics

- Record notional open interest in BTC options in Q2 2025 nearly reached $4 billion on regulated platforms.

- Aggregated open interest across exchanges surged to $50–57 billion by mid-2025.

- In a large expiry in August 2025, BTC+ETH options totaling $14.6 billion were set to expire.

- Daily volume of Bitcoin options (across Deribit, OKX, etc.) consistently ranks among the top in crypto derivatives charts.

- Prior expiries have seen $4–5 billion in BTC + ETH options in a single day.

- The implied volatility for BTC options fluctuates broadly, and annualized IV ranges from 60% to 120%+, depending on maturity and skew.

- Max pain levels in BTC options often cluster in the $110,000–$120,000 zone, attracting attention at expiry.

- Put skew is steeper than call skew in BTC options, especially during drawdowns when downside demand grows.

Options Trading Volume by Expiry Date

- In mid-2025, short-dated expiries (weekly to one-month) accounted for ~60% of total options volume.

- Longer-dated options (3–6 months) held ~25–30% share, with the remainder in very short (daily) or far-dated (beyond 6 months) contracts.

- Expiry events tend to concentrate volume, for example, $4.3 billion in BTC + ETH options expired on a single day in September 2025.

- On the August 2025 expiry, $14.6 billion in BTC + ETH options were structured to expire.

- The put-to-call ratio in major expiries often leans >1, indicating a tilt toward downside protection demand.

- Very short expiries (1–7 days) show sharp intraday volume surges ahead of event risk (e.g., macro announcements).

- Volume decay curves (higher near expiry) are steeper in crypto options relative to equities, owing to volatility and leverage.

- Some DeFi protocols are experimenting with perpetual-type options (no fixed expiry), though adoption remains nascent.

Geographic Distribution of Crypto Options Volume

- The Asia-Pacific region contributes >48% of global crypto derivatives volume as of 2025.

- North America ranks second in crypto volume, aided by favorable regulatory shifts and institutional flows.

- Europe, while smaller relative to APAC, still captures a meaningful share among regulated venues.

- Many “offshore domicile” exchanges cater globally and blur geographic attribution; local trading origin vs exchange headquarters often diverge.

- U.S.-based regulated markets (CME) capture a comparatively tiny share; daily volumes on CME crypto options are modest relative to global venues.

- Regions like Southeast Asia, India, and the Middle East show increasing regional flows into derivatives, especially via accessible exchanges.

- Regulatory arbitrage encourages users from restrictive jurisdictions to route volume through neutral-domicile platforms.

- Data providers note that ~95% of derivative volume historically has come from non-U.S. venues.

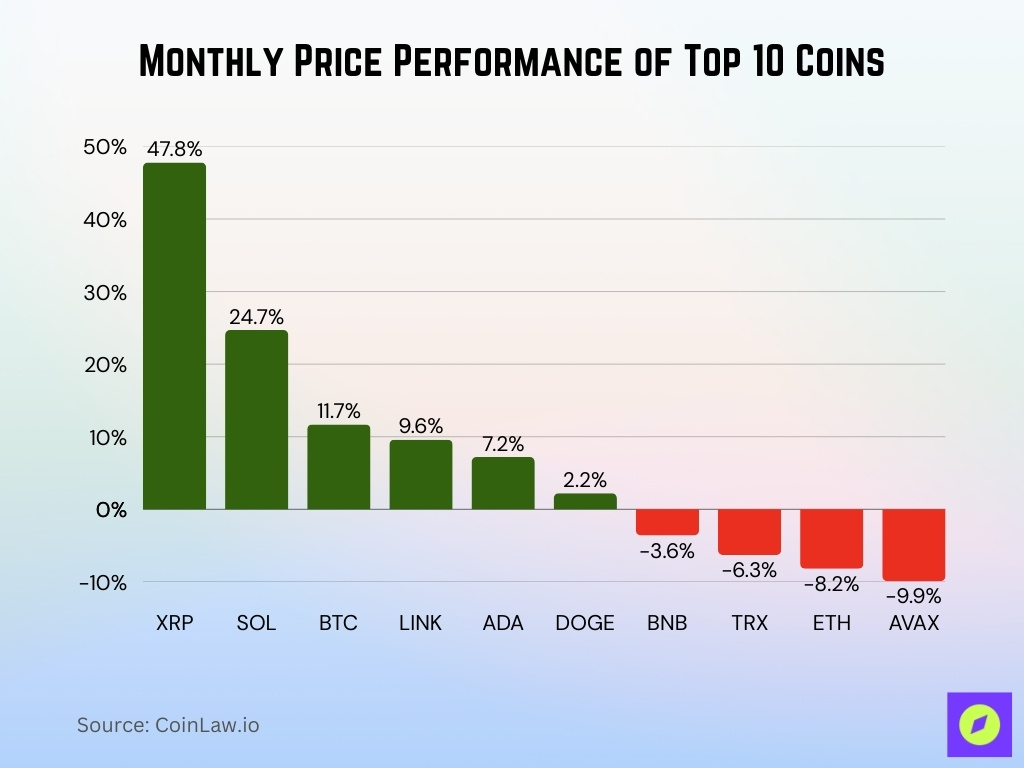

Monthly Price Performance of Top 10 Coins

- XRP surged 47.8%, leading the market with the strongest monthly gain.

- Solana (SOL) rose 24.7%, cementing its position as a top-performing altcoin.

- Bitcoin (BTC) gained 11.7%, showing steady growth alongside renewed institutional demand.

- Chainlink (LINK) increased 9.6%, while Cardano (ADA) climbed 7.2%, highlighting solid altcoin performance.

- Dogecoin (DOGE) edged up 2.2%, marking modest growth compared to peers.

- Binance Coin (BNB) slipped 3.6%, beginning the month in negative territory.

- TRON (TRX) dropped 6.3%, extending its recent underperformance.

- Ethereum (ETH) declined 8.2%, reflecting profit-taking and market rotation.

- Avalanche (AVAX) fell 9.9%, the weakest performer among the top 10 coins.

Ethereum Options Market Statistics

- Ethereum options trading volume (in dollar terms) has shown strong momentum in 2025.

- Aggregated open interest in Ethereum options reached between $50–57 billion across major exchanges, including Deribit and CME, in mid-2025.

- On August 29, 2025, ETH options open interest data showed heavy call positioning in December expiries, indicating forecasts of upward movement.

- CME’s Ether options market now supports weekly expiries in addition to monthly and quarterly ones, enhancing flexibility for traders.

- Put-call ratios in large ETH expiries often hover near ~0.99, showing a relatively balanced bias compared to Bitcoin skew.

- In a $14.6 billion BTC+ETH expiry event in August 2025, ETH options were more balanced while BTC skewed toward puts.

- Implied volatility for ETH options tends to show more sensitivity to macro news compared to BTC.

- New product types (e.g., weekly, micro-ETH options) are being listed to attract retail and institutional interest.

Altcoin Options Market Growth

- While BTC and ETH dominate, altcoin options (e.g., SOL, MATIC, ADA) are gradually gaining traction, though still constituting a small slice (<10%) of total options volume.

- Year-over-year growth for major altcoin options is in the 20–40% range in 2025.

- Some exchanges are now listing options for Solana (SOL), Polkadot (DOT), and Polygon (MATIC), enabling more diversification.

- Liquidity in altcoin options is still thin, bid-ask spreads are often wide, and volumes are episodic.

- Retail traders dominate altcoin options because institutions often avoid lower liquidity markets.

- Implied volatilities for altcoin options tend to be more volatile (spiky) relative to BTC/ETH, especially around news events or network upgrades.

- Unfamiliar or structured options (barrier, range) are more likely to appear first in altcoin markets, as exchanges experiment.

- Some DeFi native projects are experimenting with token-specific options, linking project metrics to option payoffs.

Options Market Volatility Trends

- Cryptocurrency volatility remains high overall, studies show asymmetric volatility behavior, BTC is better captured by TGARCH, and ETH by EGARCH.

- The volatility-of-volatility (VOV) as a component is increasingly used in pricing models to better capture the erratic swings in crypto.

- Realized volatility and implied volatility tend to diverge more in crypto than in equities, especially during structural regime shifts.

- Before major option expiries, implied volatility often jumps (volatility premium increases) compared to the baseline.

- During macro shocks (e.g., interest rate surprises, inflation prints), crypto options’ volatility can spike 20–40% in hours.

- The skew (difference between implied vol for calls vs puts) often steepens on the downside for Bitcoin, reflecting hedging demand.

- Some research suggests volatility clustering is more persistent in crypto, meaning high volatility days tend to follow each other.

- In 2025, volatility compression periods (low IV) are becoming shorter, with more frequent regime switches.

Risk Management and Liquidations in Options

- Options offer limited downside risk for buyers (only the premium paid), making them useful in hedging large spot positions.

- Writers (sellers) can face large losses if direction is misjudged; proper collateral and margining are crucial.

- In 2025, major expiry days (e.g. $14.6 billion in BTC+ETH options) have triggered cascade liquidations in futures and options markets.

- Put-call ratio extremes often coincide with liquidation levered flows in futures, compounding volatility.

- Many exchanges now simulate stress scenarios, computing “liquidation thresholds” for options portfolios.

- Some protocols integrate auto-deleveraging (ADL) or insurance funds to absorb blowups when option writers default.

- Options writers must closely monitor Greeks (delta, gamma, vega) and hedging costs.

- In crypto, tail events (e.g., black swan moves) are more frequent, so risk buffers need to be higher than in traditional options.

Frequently Asked Questions (FAQs)

$8.94 trillion.

~$4 billion.

65%.

~68 %.

$50 to $57 billion.

Conclusion

The crypto options landscape today is more robust, liquid, and sophisticated than ever before. Bitcoin and Ethereum remain the pillars, but altcoins and unfamiliar structures are gradually gaining ground. Volatility trends are more acute, and derivative yield strategies are maturing.

Meanwhile, risk management frameworks, liquidations, and regulations continue to shape how the market evolves. The tug-of-war between CeFi and DeFi options markets points toward a hybrid future. As this market deepens, staying attuned to metrics like open interest, skew, expiration dynamics, and regulatory shifts will be vital for investors and traders alike.