Online and mobile banking now power the daily financial lives of millions. Over 216.8 million Americans will use digital banking services. These tools enable rapid transfers, budget tracking, and seamless bill payments, whether at a desk or on the go, and fuel industries from retail to investment advice. With clear and practical insights, this article explores how online and mobile banking stack up, and invites you to explore the full breakdown ahead.

Editor’s Choice

- 216.8 million Americans use digital banking services.

- 3.6 billion global users now access online banking.

- 34% of U.S. consumers use mobile banking daily.

- 77% of banking interactions happen via digital channels.

- Mobile banking has surpassed online banking in preference by a factor of 2.5, with recent data showing 64% of U.S. adults prefer mobile apps, compared to 25% favoring web-based online banking.

- 91% of consumers prioritize access to mobile and online banking when choosing a bank.

- 96% of consumers describe their digital banking experience, whether via mobile or web, as good or excellent.

Recent Developments

- Traditional banks still lead, with 83% of Americans holding accounts there, but 42% also use fintech platforms like Chime or PayPal.

- Nearly 1 in 5 consumers (17%) may switch institutions in 2025, and over half of Millennials (58%) and Gen Z (57%) are open to switching if better options exist.

- 83% of consumers say digital innovations have made banking more accessible.

- Branch visits are down: 55% use mobile apps, 22% use online banking, and only 8% still go to branches.

- The digital banking trends show AI-powered budgeting and other tools gaining traction.

Adoption Rates: Online Banking vs Mobile Banking

- U.S. digital banking users are expected to top 216.8 million by 2025.

- 48% of Americans were using mobile banking as of 2023; that share has more than tripled in under a decade.

- Digital banking is the preferred method for 77% of consumers, with mobile being 2.5× more popular than online banking.

- A 2024 survey found 41% prefer mobile banking, while 33.5% favor online banking via web browser.

Demographic Breakdown of Users

- In the U.S., mobile banking adoption is 48% overall, highest in the West at 51%.

- Age 15–24 leads usage at 77%, while households earning $75,000+ show 56% adoption.

- College-educated users have a 54% adoption rate.

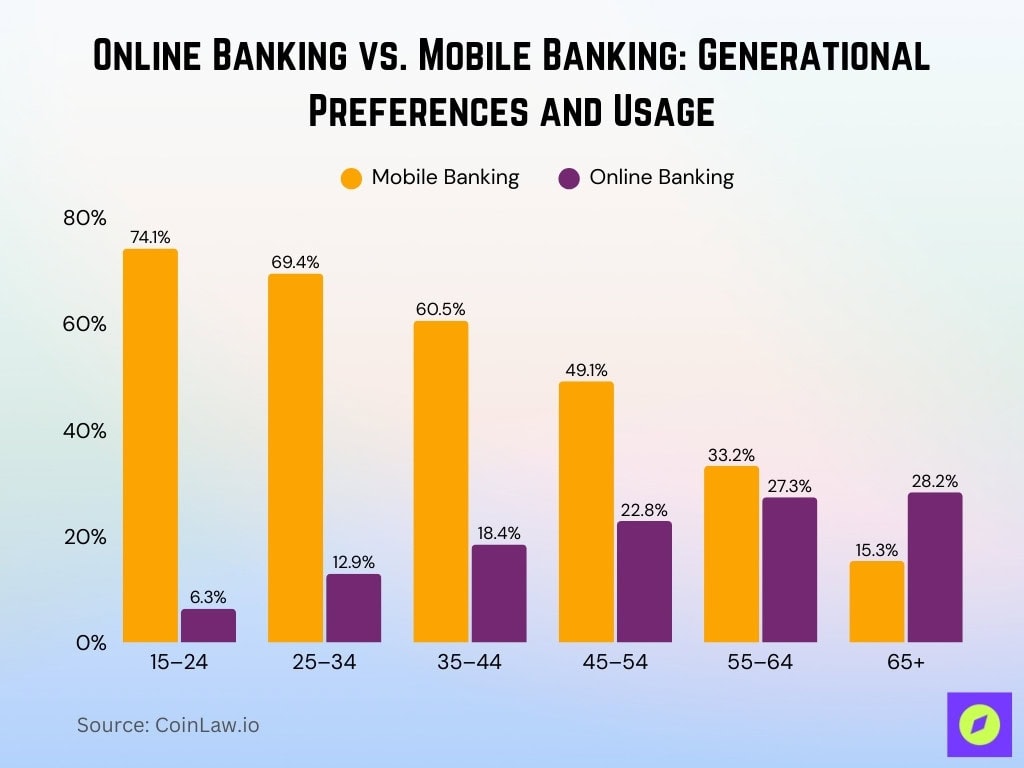

Generational Preferences and Usage Statistics

- 60% of Millennials, 57% of Gen Z, and 52% of Gen X primarily use mobile banking apps.

- In the age group 15–24, 74.1% primarily use mobile banking, compared with only 6.3% who prefer online.

- Ages 25–34: 69.4% mobile vs. 12.9% online.

- Ages 35–44: 60.5% mobile vs. 18.4% online.

- Ages 45–54: 49.1% mobile vs. 22.8% online.

- Ages 55–64: 33.2% mobile vs. 27.3% online.

- Ages 65+: 28.2% online vs. 15.3% mobile.

Gender Differences in Usage

- Among those identifying as two or more races, 52.3% use mobile, 20.6% use online.

- Hispanic users: 49.6% mobile, 11.6% online.

- Asian users: 48.6% mobile, 25.7% online.

- Black users: 45.4% mobile, 12.1% online.

- White users: 41.1% mobile, 25.8% online.

- Native American or Alaska Native: 50.6% mobile, 13.3% online.

Device Preferences for Banking Access

- Overall, 42% of consumers prefer mobile apps, while 36% favor online banking via website.

- 34% use a mobile banking app daily, versus 36% logging into online banking at least weekly.

Urban vs. Rural Banking Trends

- In 2025, digital banking usage climbed to 89% of U.S. adults, underlining its mainstream adoption.

- Yet, rural areas faced a loss of 1 in 4 bank branches, highlighting growing banking deserts in low-population ZIP codes.

- Nationwide, branch closures have dropped 5.6% since 2020, driven by the digital shift and pandemic-era closures.

- The Banking Deserts Dashboard shows shrinking physical access in rural communities, informing where digital inclusion is most needed.

- Rural neobank adoption grew 27% in 2023, spurred by smartphone access and improving digital literacy.

- Government and financial institutions are investing in mobile and digital payment solutions to narrow rural access gaps.

- Despite access issues, 38% consider branches indispensable, and 72% will use branches at a consistent rate, showing they remain relevant.

Top 10 Largest Online Banking Companies by Market Cap

- JPMorgan Chase leads globally with a market cap of $686.13 billion, dominating the online banking sector.

- ICBC ranks second with $320.05 billion, showing strong growth from China’s banking market.

- Bank of America holds $302.55 billion, remaining one of the top U.S. players in digital banking.

- Agricultural Bank of China is valued at $256.8 billion, reflecting robust domestic adoption.

- Wells Fargo records $233.68 billion, supported by its expansive U.S. customer base.

- China Construction Bank follows with $216.53 billion, further boosting China’s dominance in the top 10.

- Bank of China stands at $207.13 billion, solidifying its role as a major global player.

- HSBC holds $197.07 billion, leveraging its international reach in online banking.

- Morgan Stanley has $187.63 billion, showcasing strong performance in investment-led banking services.

- HDFC Bank rounds out the list with $184.44 billion, representing India’s growing digital banking sector.

Online Banking Activity Statistics

- Among U.S. adults, 73% actively use online banking services as of 2025.

- Digital banking user numbers rose from 196.8 million (2021) to an estimated 216.8 million by 2025.

- Online banking use is now 2.8 times more common than branch visits, with 22% using online services, compared to 8% visiting branches over the past year.

- 63% of Americans conduct banking primarily on smartphones or tablets, and only 43% use personal computers.

- Younger consumers (ages 18–24) are nearly 3.8 times more likely to rely on online-only accounts than those 55+.

- Direct (online-only) banks achieved average satisfaction scores of 692 (checking) and 705 (savings), well above traditional institution averages.

- Satisfaction with online banking apps and websites rose, but offerings are increasingly homogeneous, making differentiation difficult.

Mobile Banking Activity Statistics

- By 2025, 72% of U.S. adults report using mobile banking apps, up from 65% in 2022 and 52% in 2019.

- Among Millennials, 68% primarily use mobile banking apps in 2025.

- Generation Z (ages 18–24) is closing in fast, with 72% actively using mobile banking apps.

- Nationwide, 64% of U.S. adults now prefer mobile banking, up from 58% in 2023 and 37% in 2019.

- Globally, 2.17 billion people used mobile banking services by the end of 2025, a 35% increase since 2020.

- Around 89% of banks worldwide had launched mobile banking apps by 2025, reflecting widespread institutional adoption.

- In North America, mobile banking penetration reached 61% in 2025, up from 58% in 2023.

Future Banking Service Preferences

- 79% of customers prefer more all-digital processes, showing a strong shift toward online banking solutions.

- 47% want drive-thru and touchless banking, highlighting demand for safer, contact-free transactions.

- 26% favor in-person banking with new safety measures, indicating a smaller segment still values physical branch interactions.

Frequency of Use: Online vs Mobile Banking

- 34% of consumers use a mobile banking app daily in 2025.

- Conversely, 36% log into online banking via website at least weekly.

- Only 2% visit a branch daily, while 3% call a representative that often, highlighting the dominance of digital channels.

- Mobile app usage rose from 52% in 2019 to 72% by 2025, a marked increase in daily engagement.

- Online banking usage similarly climbed, supporting the 216.8 million users forecast by 2025.

- Millennials (80%) lead in digital preference and usage compared to other generations.

- Increased daily use underscores that mobile banking is not only preferred, it’s habitual and integrated into daily routines.

Satisfaction Rates and User Experience

- Satisfaction with U.S. national banking apps scored 669 out of 1,000 in 2025, up 18 points from 2024.

- Branching satisfaction is high for direct banks: 692 for checking (up 4 points) and 705 for savings (down 5 points).

- Among national banks, Bank of America’s mobile app (678) and Capital One’s online portal (684) led satisfaction rankings.

- Virtual assistants remain underwhelming; users cite limited capabilities, though AI enhancements are expected.

- Adoption of multifactor authentication increased satisfaction; users scored 16 points higher when using MFA.

- The digital experience across providers is now “positive, if somewhat homogenous,” meaning there’s consumer confidence, but fewer standout innovations.

- Regions Bank achieved a 5% satisfaction gain, scoring 83, thanks to improvements in account and service experience.

Use of Online, Mobile, and Traditional Banking for Different Activities

- 37% use online banking to inquire about a product, while 48% still prefer traditional banking for this task.

- 53% rely on online banking for international money transfers, compared to 24% using mobile apps and 23% choosing traditional methods.

- 47% update account details via online banking, 26% through mobile apps, and 27% at a branch.

- 44% pay bills using online banking, while 41% use mobile apps, and only 15% prefer in-person.

- 48% transfer money to another person via mobile banking apps, outpacing 38% using online banking and 14% through branches.

- 48% also use mobile banking apps to transfer between accounts, with 38% preferring online banking and 14% choosing traditional options.

- 56% conduct balance inquiries through mobile apps, followed by 29% via online banking and 15% in person.

Traditional Banks vs. Neobanks: Adoption Trends

- 83% of Americans still maintain accounts with traditional banks, but 42% now also use fintech platforms like PayPal, Chime, or SoFi.

- 17% of consumers are likely to switch financial institutions in 2025, rising to 37% if alternatives better match their needs.

- 54% of Gen Z now rely primarily on non-traditional providers, drawn to real-time payouts and social values alignment.

- 68% of neobank users say these platforms offer better budgeting and financial tracking tools than traditional banks.

- 80% of neobank users actively use their accounts for daily transactions, suggesting high engagement.

- Rural neobank adoption grew 27% in 2023, showing that digital-first channels are closing rural access gaps.

- The neobanking market transaction value rose to $7.36 billion in 2025, with the U.S. alone at about $1,785 billion in 2024.

Security and Cybersecurity Statistics

- Globally, cybercrime is projected to cost $10.5 trillion annually by 2025, emphasizing the magnitude of the threat.

- In 2025, there are about 2,200 cyberattacks daily, averaging one attack every 39 seconds.

- Credential theft has surged 160% in 2025, accounting for 20% of data breaches, with around 14,000 monthly cases reported.

- Over 115 million U.S. payment cards were compromised via SMS phishing (“smishing”) in a single year.

- A massive leak of 16 billion login credentials from major platforms underscores the scale of digital vulnerabilities.

- In 2025, 80% of bank cybersecurity leaders say they cannot keep pace with AI‑powered threats.

- AI is now used in banking security operations, 30% of cybersecurity teams have fully integrated AI, with another 42% evaluating it.

- Emerging threats, like ransomware, social engineering, cloud breaches, and IoT vulnerabilities, continue to challenge banks in 2025.

Churn Rate and Customer Retention

- The global average churn rate for banks in 2025 is 17.6%, while retail banks in North America experience a slightly higher churn of 19.2%.

- Digital‑only banks report a significantly lower churn rate of 10.8%.

- Across industries, the average customer retention rate is approximately 75.5%.

- Financial services show a slightly higher retention average of 78%, with traditional banking at around 75%.

- 80% of banking customers say they would switch banks if a rival offered a better experience.

- 56% of customers who leave cite a lack of retention effort from their bank.

- Half of those who depart do so within the first 90 days.

- A churn rate of 19% is the median for financial services, with retention at 81%.

- For banks, an annual churn rate below 5–10% is considered acceptable by industry standards.

Regulatory and Compliance Statistical Insights

- The OCC, FDIC, and Federal Reserve issued a rule requiring banks to report computer-security incidents to regulators within 36 hours.

- Supervisory guidance emphasizes operational resilience and cloud security.

- Phishing and malware remain dominant threats; MFA, biometrics, AI fraud detection, and blockchain are key defenses.

- Cybersecurity spending is growing, with a global security market of $377 billion by 2028.

- Nearly half of global business leaders plan to invest in data protection or trust in 2025.

- Banks are urged to strengthen cloud defenses, AI-based security, and adopt proactive risk management approaches.

Growth in Emerging Markets

- Emerging regions are seeing accelerated adoption of both online and mobile banking.

- Mobile-first strategies help access underserved populations.

- Neobanks and fintech platforms play a role in bridging banking gaps.

- Regulatory frameworks are adapting, though gaps remain.

- Cross-border remittances via mobile channels continue to grow.

- Partnerships between global fintech firms and local institutions support scalability.

Technology Partnerships and Innovation Trends

- Banks increasingly partner with AI and cybersecurity firms.

- AI-driven solutions are adopted to improve service personalization and fraud detection.

- Cloud-based tools enable faster integration of fintech services.

- Banks work with passwordless tech providers and support passkeys and biometrics.

- Blockchain and secure transaction protocols are piloted for fraud risk reduction.

Popular Services Used: Online Banking

- The most frequently used functions include balance checks, fund transfers, bill payments, and account statements.

- Other common features: loan applications, investment tracking, and customer service messaging.

- Account alerts and security notifications rank high.

- Tools like budgeting dashboards and alerts for unusual activity are increasingly used.

- Investment-linked features are gaining traction among users aged 25–45.

- Online chat and virtual assistant features are rising.

- QR codes and remote deposit services remain widely used.

Popular Services Used: Mobile Banking

- Mobile banking usage centers on quick balance checks, peer-to-peer transfers, and mobile check deposits.

- Features like Face ID login, alerts, and one-tap bill payments are attractive to users.

- Apps with budgeting tools and spending insights see higher engagement.

- Mobile platforms offer integrated card controls and fraud alerts.

- Contactless payments and wallet integration are popular among younger users.

- Push notifications drive real-time awareness.

- New offerings include loan pre-approvals and micro-savings tools.

Conclusion

Online and mobile platforms now serve as primary financial channels for over 200 million Americans, offering convenience and choice across demographics. Yet, rising cyber risks, from credential theft and AI-enhanced phishing to massive data breaches, demand vigilant security and innovative safeguards.

With churn rates averaging 17–19% for traditional banks and lower rates among neobanks, institutions must prioritize user experience, personalization, and stability. New regulations tighten incident reporting and cybersecurity expectations, while technology partnerships, from AI to blockchain, forge paths toward resilience. Emerging markets show fast digital uptake, highlighting both opportunity and the need for inclusive design.

As we move ahead, the balance of security, innovation, and customer-centricity remains central. Digital banking isn’t just the norm, it’s the frontier.