The OKX Wallet has rapidly grown into one of the most widely used multi-chain wallets in the crypto ecosystem. With increasing integrations, user base expansion, and regulatory developments, its role in the decentralized finance (DeFi), NFT, and asset custody landscape has grown significantly. From gasless transactions to cross-chain swaps and advanced Proof of Reserves, OKX Wallet is evolving on both the technology and compliance fronts.

Real-world usage spans industries. In DeFi, traders use OKX Wallet for liquidity provisioning and token swaps. In the gaming sector, NFT players leverage it to store and trade in-game assets seamlessly across supported blockchains. This article unpacks key statistics behind the platform’s rise today.

Editor’s Choice

- OKX Wallet supports over 500,000 tokens across more than 100 blockchains.

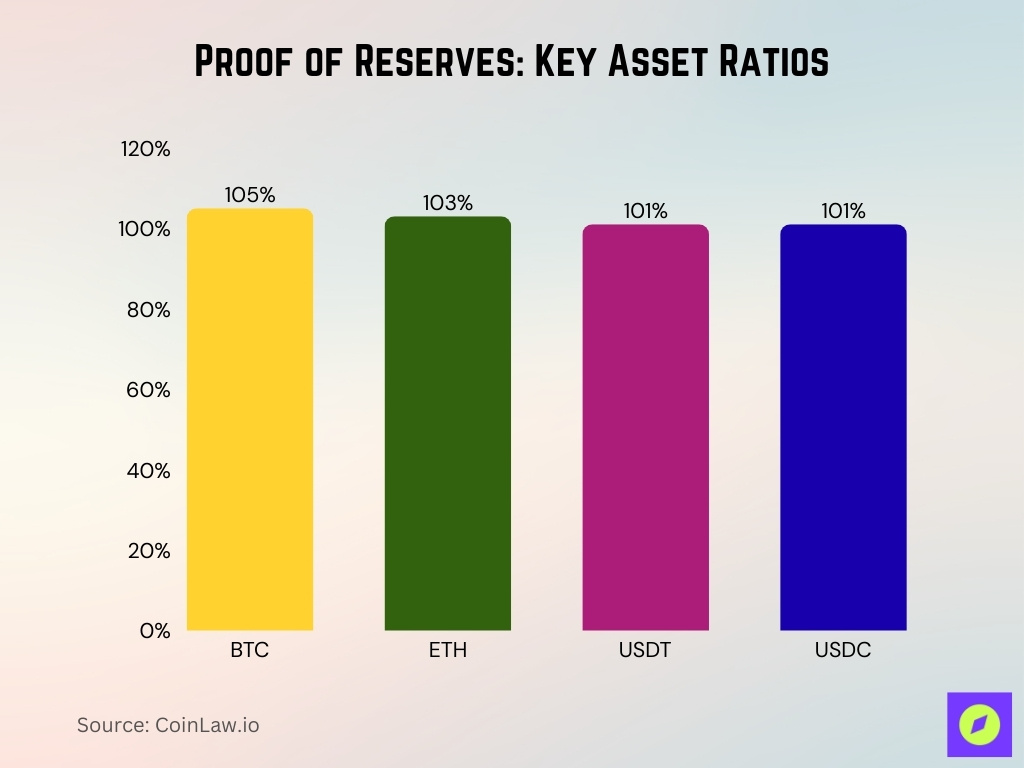

- The latest Proof of Reserves shows $33.7 billion in primary assets with reserve ratios above 100% for BTC, ETH, and USDT.

- OKX Wallet users are 67.47% male and mostly aged 25‑34.

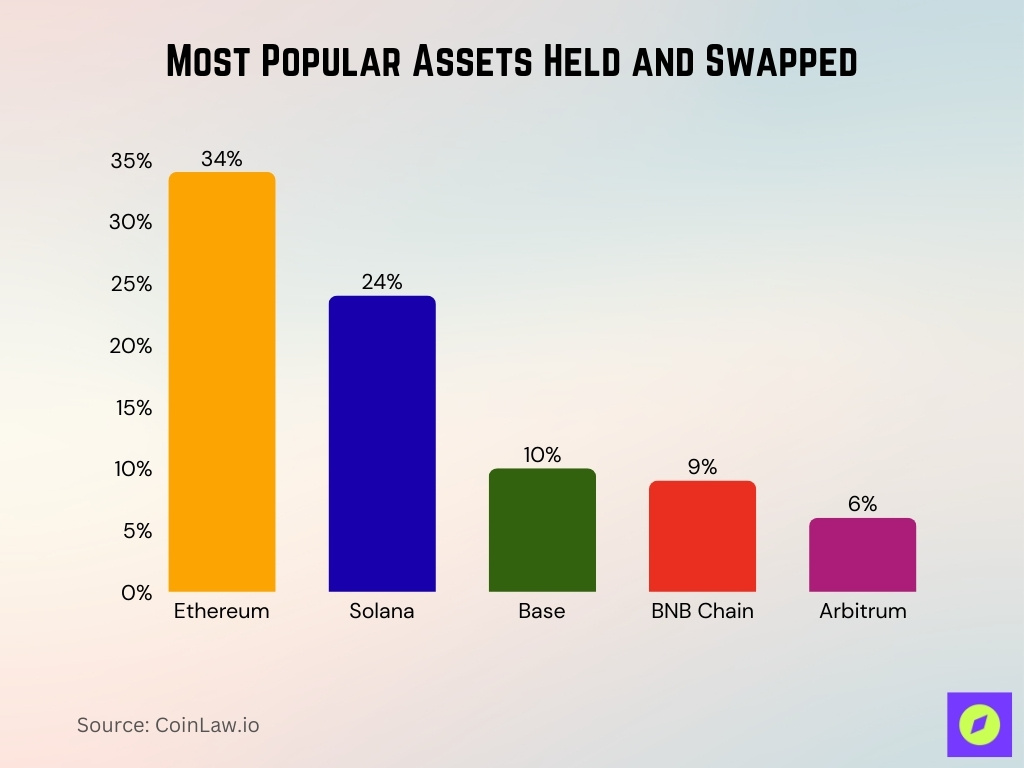

- Cross-chain swaps are dominated by Ethereum (34%) and Solana (24%).

- OKX’s U.S. entity launched in April 2025, following a $505 million regulatory settlement.

- OKX Wallet is non-custodial, giving users full control over their keys.

- Active wallet users span over 100 countries, with top regions including Asia, Europe, and the Americas.

Recent Developments

- In April 2025, OKX launched a regulated platform for U.S. users, including wallet services and token trading.

- OKX Wallet reached 100 supported blockchains by Q2 2025, marking a major milestone in multi-chain accessibility.

- OKX integrated the UnicornX cross-chain protocol to support seamless dApp access and token swaps across blockchains.

- The wallet introduced gasless transaction support to simplify the user experience across EVM-compatible chains.

- Support for Blinks lets users initiate transactions from social media links, including staking, swaps, and NFT mints.

- OKX reported no major security breaches across its wallet infrastructure in 2025.

- The platform released its 34th Proof of Reserves report in August 2025, verifying holdings of $33.7 billion.

- OKX added new UI upgrades, allowing users to monitor multi-chain activity within a single dashboard.

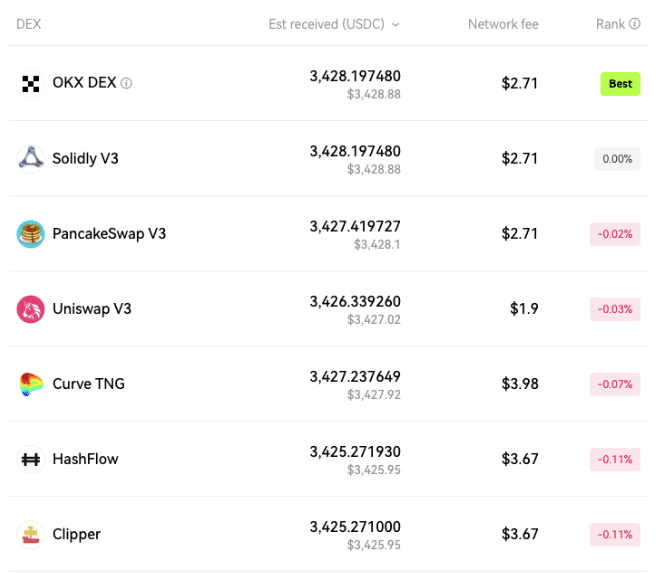

DEX Comparison: OKX Wallet vs Competitors

- OKX DEX offered the highest estimated return of 3,428.197 USDC ($3,428.88) with a network fee of $2.71, ranking it the best option.

- Solidly V3 matched OKX with 3,428.197 USDC ($3,428.88) received and the same $2.71 fee, but without the “Best” ranking.

- PancakeSwap V3 delivered 3,427.419 USDC ($3,428.10) at a $2.71 fee, slightly lower than OKX’s output (-0.02% difference).

- Uniswap V3 users received 3,426.339 USDC ($3,427.02) at a lower $1.90 fee, but total value still ranked below OKX (-0.03% difference).

- Curve TNG provided 3,427.237 USDC ($3,427.92), but with a higher $3.98 fee, cutting into overall returns (-0.07% difference).

- HashFlow resulted in 3,425.271 USDC ($3,425.95) with a $3.67 fee, a noticeable drop compared to OKX (-0.11% difference).

- Clipper had the lowest return at 3,425.271 USDC ($3,425.95) with a $3.67 fee, tying HashFlow at the -0.11% mark.

Number of OKX Wallet Users

- OKX Wallet has over 50 million downloads across mobile and browser extension formats.

- As of mid-2025, the active wallet user base is estimated to exceed 5 million globally.

- A 20% increase in monthly active wallet users was recorded in Q2 2025 compared to the same period in 2024.

- The U.S. launch of OKX US added a significant boost in verified wallet registrations, particularly in California, Texas, and New York.

- OKX Wallet’s user growth rate has outpaced many competitors, with more than 300% growth since 2023.

- OKX reports over 100,000 new wallet sign-ups per month globally.

- In emerging markets like India and Nigeria, adoption has grown by 28% YoY as of Q2 2025.

- According to internal projections, wallet user numbers are expected to reach 10 million by the end of 2025.

OKX Wallet Adoption Trends

- The average user interacts with at least 3 blockchains through OKX Wallet.

- Growth in DeFi usage is notable, with 35% of wallet users accessing yield protocols.

- NFT integration has surged, with 12% of users interacting with NFTs directly through the wallet.

- Usage of cross-chain bridging features increased by 57% between Q3 2024 and Q2 2025.

- Token swap activity in-wallet is up 41% YoY.

- Web3 gaming dApp interaction through the wallet saw a 22% increase in Q1 2025 alone.

- OKX Wallet saw a 15% uptick in Layer 2 usage, particularly Arbitrum and Base, driven by lower fees.

- The wallet supports “Blinks,” enabling transactions directly from social media, used by 7% of active users in 2025.

OKX Wallet Market Share

- OKX Wallet ranks in the top 5 crypto wallets globally by user base.

- Among multi-chain wallets, OKX Wallet’s growth has surpassed MetaMask in terms of chain support.

- OKX controls roughly 6.5% of the global crypto wallet market, up from 3.2% in 2023.

- In Asia, its market share reaches 10%, largely due to integrations with regional DeFi platforms.

- OKX Wallet has the third-highest swap volume among wallets in 2025.

- Among new wallet sign-ups in 2025, 14% chose OKX Wallet over other non-custodial solutions.

- OKX Wallet handles over 300,000 daily swap transactions, ranking above competitors like Trust Wallet and SafePal.

Active User Statistics

- More than 5 million active users in 2025, up from 2.1 million in 2024.

- Daily active users (DAU) average 850,000.

- The average user initiates 3.2 transactions per day.

- Power users (top 10%) initiate over 25 swaps weekly.

- On average, active users hold 5–8 different assets.

- Nearly 78% of active users use DeFi or NFTs within the wallet.

- The number of active DeFi users rose 32% YoY in 2025.

- The transaction success rate within the wallet is over 99.8%.

Regional Distribution of OKX Wallet Users

- Largest user base comes from Asia-Pacific (43%), followed by Europe (24%) and North America (21%).

- Within Asia, India, Japan, and Indonesia lead in new wallet sign-ups.

- U.S. user base has grown 52% since the official OKX US launch.

- In Latin America, Brazil and Argentina are emerging markets with a 17% YoY increase in wallet adoption.

- European users primarily come from Germany, the UK, and France.

- African usage is concentrated in Nigeria, South Africa, and Kenya, with over 300,000 active users combined.

- Australia accounts for 3% of OKX Wallet’s global user base.

- Middle East adoption is growing rapidly, with the UAE seeing a 12% increase in 2025.

Demographic Insights of OKX Wallet Users

- OKX’s site visitors are 67.47% male, 32.53% female.

- The largest age group visiting OKX is 25‑34 years old.

- 64% of global crypto wallet users are aged 18‑34 in 2025.

- 19% of wallet holders are aged 35‑44.

- 29% of global wallet users are female.

- 34% of users earn over $100,000 annually.

- 42% fall within the $50,000‑99,999 income bracket.

- 15% of new wallet users globally are students and gig economy workers.

OKX Wallet Supported Assets

- OKX supports over 500,000 different cryptocurrencies.

- The wallet is compatible with 100 blockchains, including BTC, ETH, Solana, and TON.

- Enables access to 10,000+ decentralized applications.

- Users can view balances across all chains in one place.

- 90%+ of wallet holders transact on multiple chains.

- Supports “anything-to-anything” swaps.

- Stablecoins such as USDT and USDC dominate reserves.

- Top asset categories include DeFi, stablecoins, and gaming tokens.

Most Popular Assets in OKX Wallets

- Ethereum makes up 34% of swap volume, Solana 24%, Base 10%, BNB Chain 9%, and Arbitrum 6%.

- USDT reserve ratio is 105% relative to liabilities.

- ETH reserve ratio is 104%.

- BTC reserve ratio is 106%.

- XRP reserve ratio is 107%.

- USDC reserve ratio fluctuates around 100%.

- DeFi tokens like AAVE and UNI see strong wallet activity.

- Popular NFT projects are also stored and traded via OKX Wallet.

OKX Wallet Trading Volume

- 24‑hour spot trading volume: $4.00 billion.

- Offers 294 coins and 673 trading pairs.

- ETH/USDT is the most traded pair.

- Total exchange reserves: ~$29.11 billion.

- Spot trading fees range from 0.02%–0.2%.

- The highest volume assets are ETH, BTC, and SOL.

- On-chain swap volume favors L1s like Ethereum and Solana.

Wallet Transaction Volume and Frequency

- 90%+ of users transact across multiple blockchains.

- Swap volumes are highest on Ethereum (34%) and Solana (24%).

- BTC holdings dropped 3.34% to ~116,000 BTC in July 2025.

- ETH holdings fell 0.11%.

- USDT holdings increased 4.62% to $9.02 billion.

- Average transaction size ranges between $140–240.

- Swap transaction frequency growing 19% YoY.

Proof of Reserves: Key Asset Ratios

- OKX Wallet reports 100%+ reserves for 22 of the most traded assets, confirming strong user fund backing.

- Bitcoin (BTC) reserves are at 105%, ensuring full coverage with additional surplus.

- Ethereum (ETH) shows a 103% reserve ratio, reflecting reliable overcollateralization.

- Tether (USDT) reserves stand at 101%, slightly above the full backing threshold.

- USD Coin (USDC) also maintains a 101% reserve ratio, supporting stablecoin trust.

Security Features and Breaches

- Proof of Reserves report confirms $33.7 billion in assets.

- BTC reserve ratio: 106%, ETH: 104%, USDT: 105%.

- Uses zk‑STARKs and Merkle trees for verification.

- Cold and hot wallet separation protects assets.

- Third-party audits by Hacken, CertiK, and SlowMist.

- No major breaches reported in 2025.

- Fined $505 million in 2025 for historic AML violations.

Proof of Reserves and Transparency

- 34th PoR shows $33.7 billion in assets.

- Reserve ratios above 100% for top tokens.

- 29th PoR (March 2025): $24.6 billion, up YoY.

- Verified by external auditors.

- Full transparency on wallet addresses and reserves.

- Users can verify data on-chain.

User Asset Holdings in OKX Wallet

- BTC holdings: ~116,000, down 3.34%.

- ETH holdings: slight drop of 0.11%.

- USDT: $9.02 billion, up 4.62%.

- Top assets: BTC, ETH, USDT, USDC.

- Asset breakdown shown in PoR reports.

- Wallet assets often exceed liabilities.

OKX Wallet and DeFi/NFT Integration

- Supports 10,000+ dApps across 100+ chains.

- High volume on DeFi chains: ETH, SOL, Base.

- Enables staking, yield farming, and NFTs.

- Swaps and bridges enhance liquidity access.

- USDT and USDC are used heavily in DeFi.

- Built-in NFT support allows in-wallet trading.

Supported Blockchains and Cross-Chain Capabilities

- Supports 100 blockchains, including BTC, ETH, SOL, and Base.

- Integrated 20 new blockchains in 2024-2025.

- Most users operate on multiple chains.

- Blinks allow social sharing of on-chain actions.

- Cross-chain swaps simplify asset mobility.

- Gasless transactions are enabled across EVM networks.

Regulatory and Compliance Status

- Paid $505 million in regulatory fines in February 2025.

- Includes $84.4 million fine and $420.3 million forfeiture.

- Must retain compliance consultant through 2027.

- U.S. operations launched in April 2025.

- Registered with NMLS (ID: 1767779).

- Offers jurisdiction-based product access.

- AML/ATF checks, OFAC screening are in place.

Customer Support and Community Engagement

- 24/7 support via chat and phone.

- Regularly updated risk and help center articles.

- Dedicated resources for compliance questions.

- Community engagement through new features (UnicornX, Blinks).

- Risk disclosures are published with each regulatory update.

- Commitment to user education via the “Learn” section.

- Public statements emphasize compliance reforms.

Frequently Asked Questions (FAQs)

OKX’s 34th Proof of Reserves report lists $33.7 billion in primary assets

BTC: 106%

ETH: 104%

USDT: 105%

XRP: 107%

OKX Wallet had about 3.8 million active users in Q3 2024, with an 81% YoY growth rate projected for Q3 2025.

The 29th PoR shows $24.6 billion in primary assets, comprising roughly $11.6 billion in BTC, $3.5 billion in ETH, $8.2 billion in USDT, and $1.3 billion in USDC.

In Hong Kong, OKX Wallet is preferred by 53.2% of on‑chain users, making it the leader there.

Conclusion

OKX Wallet today combines substantial growth, increasing transparency, and broader global compliance. Its Proof of Reserves reports and reserve ratios above 100% for major tokens build trust. Cross-chain innovations like UnicornX integration and gasless transaction support enhance usability. Regulatory milestones, especially in the U.S., both challenge and shape OKX’s operations. $505 million in fines mark a turning point, but so does its formal entry into U.S. markets under regulated status. Community tools, customer service, and visibility into security features are steadily improving.

For users and observers, the key takeaways are clear: OKX Wallet is maturing as a product, not just expanding. The platform is becoming more resilient to regulatory pressure and more competitive in offering cross-chain, interoperable features. That said, full transparency on some metrics still lags. As the crypto landscape evolves, so will OKX Wallet’s role.