Nvidia‘s CEO Jensen Huang has sold $36.4 million worth of company shares, adding to a year of extraordinary wealth accumulation amid Nvidia’s record-breaking market performance.

Key Takeaways

- 1Jensen Huang sold 225,000 Nvidia shares worth $36.4 million under a prearranged plan.

- 2Nvidia’s stock recently closed at $164.92, pushing its valuation close to $4 trillion.

- 3Huang’s net worth has surged to $143 billion, nearly matching Warren Buffett.

- 4Executive stock sales reflect a broader 2025 trend of profit-taking among CEOs.

What’s going on with Nvidia’s boss? Jensen Huang just sold a chunk of his stock, but he’s still holding plenty more. With Nvidia riding high on the AI boom, it’s not just the company’s chips that are making headlines, it’s the billions piling up for its top execs too.

Let’s dive into what Huang’s move means and why it’s part of something much bigger in corporate America.

Huang Sells Shares Amid Soaring Valuation

Nvidia CEO Jensen Huang sold 225,000 shares worth about $36.4 million according to an SEC filing. The transaction was executed under a prearranged trading plan set in motion in March 2025, allowing Huang to sell up to six million shares by the end of the year.

This isn’t his first cash-out. Huang previously sold $15 million in June and had offloaded roughly $700 million earlier in the year under different arrangements. Despite these sizable transactions, he still owns more than 858 million Nvidia shares.

Nvidia’s stock closed at $164.92, driven by continued AI-driven demand and investor enthusiasm. That recent close reflects Nvidia’s meteoric growth, which briefly pushed its market cap over the $4 trillion mark during intraday trading.

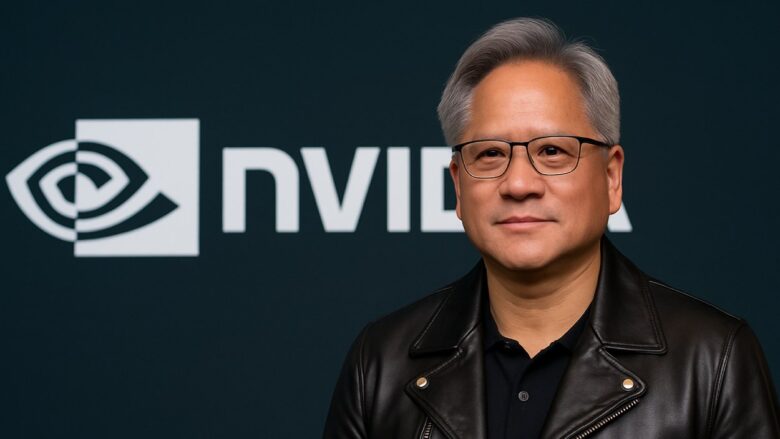

CEO Wealth Surge Reflects a 2025 Trend

Huang’s financial rise is nothing short of astonishing. His net worth now sits at $143 billion, nearly equaling that of Warren Buffett, according to Bloomberg’s Billionaires Index. Just this year, his fortune has grown by over $29 billion.

But Huang isn’t alone. Executive stock sales are up across the board. In February 2025 alone, CEOs from 197 companies sold over $1 million each, including massive transactions by Nikesh Arora ($275 million) and Jamie Dimon ($233 million).

This wave reflects a deeper structural change in how CEOs are compensated:

- Executive pay has surged 940% since 1978, compared to just 12% growth for average workers.

- Stock-based compensation has become the dominant form of executive income since the 1990s.

Transparency and Portfolio Diversification

Huang’s stock sale was not out of the blue. Prearranged sales like this one are designed to offer transparency and protect executives from accusations of insider trading. These plans also help with long-term financial planning and risk management.

Most Fortune 100 companies, including Nvidia, have strict ownership policies. These rules require executives to hold large amounts of stock over multi-year periods. Huang’s latest sale, which still leaves him heavily invested, aligns with these governance practices.

Industry data shows that 87.6% of Fortune 100 companies require executive stock ownership, with median CEO ownership targets at $9 million. Huang far exceeds that, underlining continued confidence in Nvidia’s trajectory.

Nvidia’s Market Power and Investor Enthusiasm

Nvidia’s growth story is stunning. Fueled by its AI-optimized chips, the company briefly hit a $4 trillion valuation, surpassing Microsoft and Apple during intraday sessions. Although it closed slightly below that milestone at $3.97 trillion, the achievement highlights its dominance.

The company’s GPUs are essential to powering everything from large language models to enterprise AI infrastructure. Key partnerships with firms like Microsoft only bolster its central role in the tech ecosystem.

The numbers speak volumes:

- Year-to-date gain: 23.98%

- 3-year return: Over 1,000%

- 5-year return: More than 1,490%

Insider selling isn’t limited to Huang. Nvidia board member Brooke Seawell sold $24 million in stock recently. Still, investor confidence remains high as the AI wave continues to fuel Nvidia’s momentum.

CoinLaw’s Takeaway

Honestly, Huang’s $36 million sale is just a blip in the bigger picture. The guy still owns hundreds of millions of shares, and his wealth continues to skyrocket. What this really shows is how much power and money are concentrated at the top. CEOs are riding the AI revolution like no one else. But hey, when your company is changing the tech world and adding trillions in value, maybe that kind of payday isn’t so surprising. Still, it’s a stark reminder of just how wide the gap has become between execs and everyone else.