Nvidia and Advanced Micro Devices have agreed to give the US government 15% of revenues from specific AI chip sales to China in exchange for export licenses.

Key Takeaways

- 1Nvidia’s H20 and AMD’s MI308 chips can now be sold in China under the deal.

- 2This marks the first time US firms have pledged foreign sales revenue for export approval.

- 3Trump administration calls it a “little deal” after initially seeking 20%.

- 4Analysts warn the move could set a precedent in US trade policy and export controls.

What Happened?

The Trump administration has approved export licenses for Nvidia’s H20 AI accelerator and AMD’s MI308 chip, allowing the products back into the Chinese market. In return, both companies will give the US government 15% of revenue from those China sales. The unusual arrangement was finalized after Nvidia CEO Jensen Huang met with President Donald Trump last week.

JUST IN:

,Evan (@StockMKTNewz) August 10, 2025

Nvidia $NVDA and $AMD have reportedly agreed to share 15% of the revenues from H20 chip sales in China 🇨🇳 with the United States 🇺🇸 Government – Financial Times pic.twitter.com/igGrPHPItG

An Unprecedented Agreement

The Financial Times first reported the revenue-sharing deal on Sunday, calling it a historic first for American companies seeking overseas export permission. Trump said he initially wanted a 20% cut on H20 sales to China but settled for 15%. The agreement comes amid broader trade talks with China and follows the administration’s push for tariffs and domestic manufacturing investment.

Nvidia has not shipped its H20 chips to China for months due to prior restrictions, but expects deliveries to resume soon. AMD confirmed it has received initial export license approvals. Both companies say they follow all US export control laws.

Commerce Secretary Howard Lutnick defended the deal, describing the H20 as Nvidia’s “fourth-best chip” and suggesting it was in America’s interest for China to rely on US technology, even if the most advanced chips remain off-limits.

Market and Industry Impact

China remains a major market for both firms. Nvidia generated $17 billion in revenue from China last fiscal year, while AMD earned $6.2 billion in 2024. Analysts estimate Nvidia could have sold 1.5 million H20 chips in China this year, generating about $23 billion before restrictions.

Morgan Stanley projects AMD could earn $3–$5 billion in 2025 if sales resume at scale. Chinese alternatives such as Huawei’s Ascend chips already account for up to 30% of domestic demand.

Some experts warn the move undermines the US national security rationale behind export controls, potentially weakening Washington’s position with allies. “This seeming quid pro quo is unprecedented from an export control perspective,” said Jacob Feldgoise from the Center for Security and Emerging Technology.

An “unprecedented” move that “will likely undermine the US’ position when negotiating with allies to implement complementary controls.”

,CSET (@CSETGeorgetown) August 11, 2025

CSET’s @jacob_feldgoise spoke to @business about the U.S. government’s deal with @nvidia & @AMD. https://t.co/90TUopcFcW

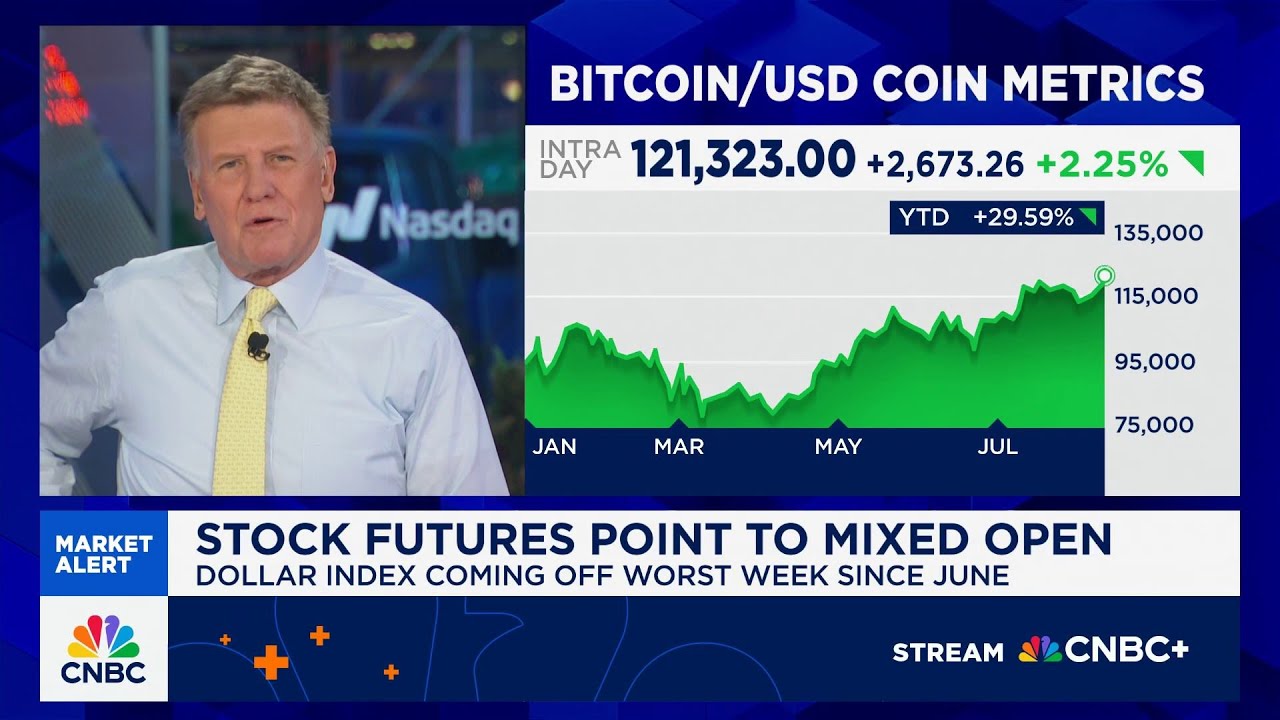

Stock Market Reaction

Nvidia shares closed at $180.46, down 0.2% on Monday, while AMD gained 2.6% to $177.33. Analysts remain bullish, with Morgan Stanley setting a $200 target, Citi at $190, and Loop Capital projecting $250. Technical analysis shows Nvidia stock remains in a strong uptrend, with solid support around $178–$181.

The broader chip sector has also been buoyed by easing US-China trade tensions and the launch of OpenAI’s GPT-5, which has increased demand expectations for AI chips. Nvidia continues to dominate the AI GPU market with over 90% market share, and in August it became the first company to surpass a $4 trillion market cap.

CoinLaw’s Takeaway

I think this is one of the boldest trade moves we’ve seen in tech. The US effectively just turned chip exports into a taxable asset, and Nvidia and AMD agreed because they need access to China’s market. While it might send a billion dollars a quarter to Washington if sales bounce back, the bigger story is the precedent. If the US starts attaching revenue-sharing conditions to more export licenses, other industries could be next. Personally, I’m curious to see how Beijing reacts long term, especially with Chinese chipmakers eager to grab more market share.