Choosing a payment gateway is more than a technical decision; it’s a long-term financial commitment. While many platforms boast convenience and features, some silently erode your margins with high fees, hidden charges, and unfavorable cross-border costs. This guide explores the most expensive e-commerce payment gateways, breaking down their true cost structure, what drives those prices, and how merchants can avoid costly mistakes in selection.

Key Takeaways

- 1High costs often stem from international fees, chargebacks, fraud tools, or gateway subscriptions.

- 2PayPal, 2Checkout, and Authorize.Net are consistently ranked among the more expensive platforms due to their stacked fees, as shown in fee analyses by Merchant Maverick and CardRates.

- 3“Expensive” doesn’t always mean bad; some platforms offer enterprise-grade features justifying their price.

- 4Merchants should focus on the total cost of ownership, not just per-transaction fees.

What Makes a Payment Platform “Expensive”?

E-commerce payment platforms charge in different ways, and “expensive” isn’t just about the advertised transaction fee. You must look deeper:

- Per-transaction fee: Often 2.9% to 3.9% + a fixed $0.30 or more

- Monthly gateway/subscription fees: Common in legacy providers like Authorize.Net

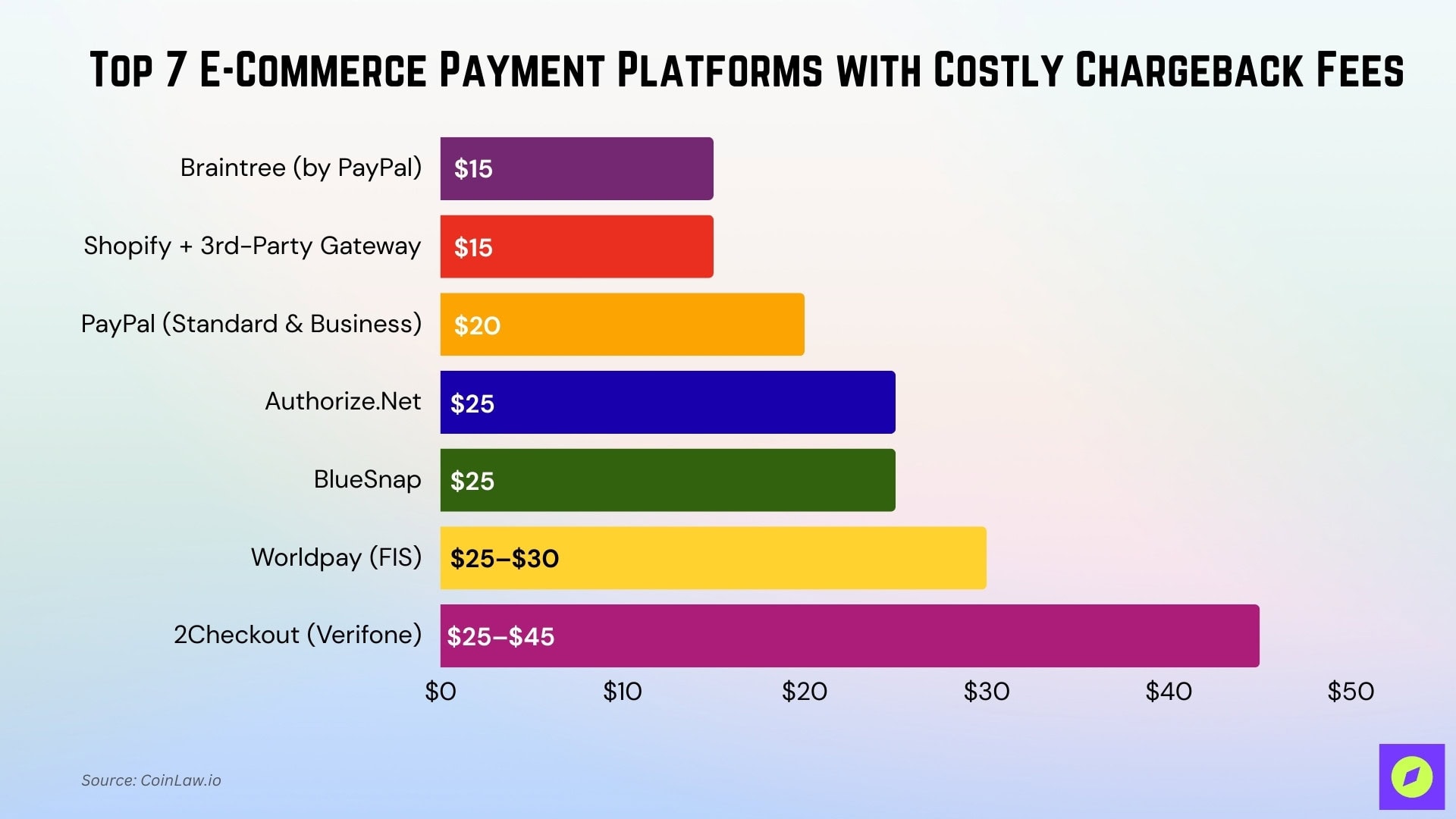

- Chargeback fees: $15 to $30 per incident, depending on the provider

- Currency conversion & cross-border markup: Adds 1.5% to 3.5% per international sale

- Hidden costs: PCI compliance fees, fraud detection tools, API overages, early termination charges

Depending on the provider and international exposure, combined processing-related costs, including fees, conversions, and add-ons, can total 4–6%, as estimated by high-volume merchant case studies.

Top 7 Most Expensive E-commerce Payment Platforms

Below is a breakdown of the most expensive payment platforms for e-commerce merchants in terms of transaction fees, cross-border costs, chargebacks, and other overheads. Each fee has been sourced from official pages or trusted industry reviews.

| Rank | Platform | Base Fee | Cross-Border Fee | Currency Conversion | Chargeback Fee | Monthly Fee | Key Cost Driver |

| 1 | Braintree (by PayPal) | 2.9% + $0.30 | 0.01 | 0.01 | $15 | None | Add-ons (fraud tools, recurring billing, FX fees) |

| 2 | Shopify + 3rd-Party Gateway | Up to 2% + gateway fee | Varies | Varies | $15 | $39–$399 | Double fees unless using Shopify Payments |

| 3 | PayPal (Standard & Business) | 3.49% + $0.49 | 0.015 | ~3–4% | $20 | None | Stacked fees on cross-border + conversion |

| 4 | Authorize.Net | 2.9% + $0.30 + $25/mo | Varies | Varies | $25 | $25 | Monthly gateway & legacy structure |

| 5 | BlueSnap | 3.90% + $0.30 | 0.02 | Included | $25 | Custom | High flat rates + FX & fraud tools |

| 6 | Worldpay (FIS) | ~3.5%+ | 1–3% | Varies | $25–$30 | Custom | Opaque pricing & high termination cost |

| 7 | 2Checkout (Verifone) | 3.5% + $0.35 | 0.02 | Included | $20–$45 | None | Commission model; expensive at scale |

1. Braintree (by PayPal)

Braintree is favored by developers and SaaS platforms for its deep customization and flexible integrations. However, its advanced feature stack often requires technical oversight, adding indirect operational costs over time

- Base Fee: 2.9% + $0.30

- Cross-Border Fee: +1%

- Currency Conversion: +1%

- Chargeback Fee: $15

- Why It’s Expensive: While technically competitive, costs stack up fast with international transactions and additional services like fraud tools or recurring billing.

2. Shopify Payments (Using Third-Party Gateways)

Shopify’s ecosystem is robust, but using outside gateways introduces layered costs and reduces native payment advantages. This structure subtly incentivizes merchants to remain locked into Shopify’s own payment processor.

- Additional Fee: Up to 2% per transaction if not using Shopify Payments

- Monthly Platform Fee: $39–$399+

- Chargeback Fee: $15

- Why It’s Expensive: Using third-party gateways like PayPal or Stripe incurs extra fees on top of Shopify’s SaaS pricing.

3. PayPal (Standard & Business)

Known for global trust and frictionless checkout, PayPal prioritizes convenience and consumer familiarity. Yet for merchants, the tradeoff often comes in the form of complex fee layering and limited pricing transparency.

- Base Fee: 3.49% + $0.49 per transaction

- Cross-Border Fee: +1.5%

- Currency Conversion: ~3–4% markup

- Chargeback Fee: $20

- Monthly Fee: None

- Why It’s Expensive: Despite its ease of use and brand trust, PayPal adds significant layers of cost for cross-border payments and currency conversion.

4. Authorize.Net

As a legacy processor, Authorize.Net offers strong reliability and compatibility with a wide range of third-party services. It tends to appeal more to traditional businesses that prioritize stability over pricing agility.

- Base Fee: 2.9% + $0.30 + $25/month gateway fee

- Chargeback Fee: $25

- Setup Fee: Sometimes applies via resellers

- Why It’s Expensive: Monthly fees and old-school infrastructure make this costly for SMBs, especially when used through third-party resellers.

5. BlueSnap

BlueSnap is built for merchants selling across borders, with support for over 100 currencies and global tax compliance. While powerful for scaling internationally, its pricing favors enterprise merchants with negotiating power.

- Base Fee: 3.90% + $0.30 per transaction

- Cross-Border Fee: +2%

- Chargeback Fee: $25

- Why It’s Expensive: BlueSnap provides global sales features but includes additional cross-border and compliance fees, as outlined in its official pricing and merchant comparison reports.

6. Worldpay (FIS)

Worldpay delivers enterprise-grade infrastructure with extensive payment method support across regions and sectors. But navigating its contracts and fee structures can be challenging without dedicated account management.

- Processing Fee: Often 3.5%+, based on contract

- Cross-Border Fee: 1%–3%

- Chargeback Fee: $25–$30

- Early Termination Fee: $295–$495

- Why It’s Expensive: Opaque and customized pricing makes it difficult to estimate real costs, with multiple add-on and cancellation fees.

7. 2Checkout (Verifone)

2Checkout provides a seamless onboarding experience for international merchants, especially digital sellers and SaaS providers. Still, its revenue-percentage pricing model can become disproportionately expensive as businesses scale.

- Base Fee: 3.5% + $0.35 per sale

- Cross-Border Fee: 2%

- Chargeback Fee: $20–$45

- Monthly Fee: None

- Why It’s Expensive: 2Checkout’s commission-based pricing becomes less cost-efficient as sales scale, particularly with global transactions, according to Verifone’s official tier breakdown and third-party reviews.

When Paying a Premium Might Be Worth It

Expensive doesn’t always mean inefficient. There are several scenarios where paying a higher rate actually adds value:

- Global Expansion – Platforms like BlueSnap or 2Checkout support complex international tax compliance, multi-currency checkout, and localization tools that can justify their rates.

- High-Risk Industries – Merchants in verticals like supplements, CBD, or digital services may find fewer gateway options and must rely on providers with higher tolerance and advanced fraud tools.

- Enterprise-Grade Features – Braintree’s vaulting, subscription logic, and developer toolkits offer customization that low-cost providers can’t match.

- Speed & Reliability – In markets where uptime is crucial (e.g., flash sales, event ticketing), paying for performance and support SLAs can be a smart investment.

Ultimately, it’s about value-to-cost ratio, not just line-item pricing.

Tips to Reduce Payment Processing Costs

Reducing payment costs isn’t just about switching providers; it’s about optimizing every stage of your payment stack. The right strategies can significantly improve your profit margins without compromising performance.

- Negotiate Custom Rates – High-volume merchants should never settle for default pricing; platforms like Stripe, PayPal, and Braintree often offer lower rates at scale.

- Use In-House Gateways – Shopify Payments, Wix Payments, and WooCommerce plugins typically eliminate the need for third-party transaction fees.

- Optimize Checkout Routing – For global stores, routing transactions through localized processors can reduce cross-border surcharges.

- Consolidate Add-ons – Use bundled features (e.g., fraud tools or reporting) to avoid paying separately for third-party integrations.

- Audit Your Statements – Regularly check for creeping fees, new surcharges, or unused services, and address them with your account manager.

Being proactive with platform selection, negotiation, and optimization can save thousands per year, especially as your business scales.

Conclusion

While platforms like Braintree, PayPal, and Authorize.Net offer robust capabilities, they can also introduce high and sometimes opaque costs that impact your bottom line. Understanding the total cost of ownership, not just the headline fee, empowers you to make smarter decisions aligned with your growth goals.

Before choosing or renewing a payment gateway, analyze your transaction volume, international exposure, product category, and technical needs. The most expensive platform isn’t always the wrong one, but it should never be a blind decision.