Improving your credit shouldn’t cost you a fortune, but for millions of Americans, simple credit repair mistakes end up creating long-term financial losses. From inflated loan payments to excessive insurance premiums, a weak credit profile quietly drains wealth.

This guide breaks down the most expensive credit repair mistakes, how much they cost in dollar terms, and what to do instead. Understanding these pitfalls is essential whether you’re applying for a mortgage, crypto-backed loan, or just aiming for financial resilience.

Key Takeaways

- Mortgage interest rate gaps due to poor credit can cost $19,000+ over a 30-year loan.

- A bad-credit auto loan could cost $12,000+ more in interest than one for a borrower with good credit.

- Credit card APR gaps based on score can result in $400+ more interest on a $5,000 balance.

- Homeowners with poor credit may pay up to $2,000 more per year in insurance.

- Personal loans for bad credit can generate $11,000+ in extra interest charges over five years.

Top 5 Most Expensive Credit Repair Mistakes

Some credit repair missteps quietly drain your finances, costing thousands in interest, insurance premiums, and missed opportunities. These mistakes are the most financially damaging, and avoiding them can protect your credit and your wallet for years to come.

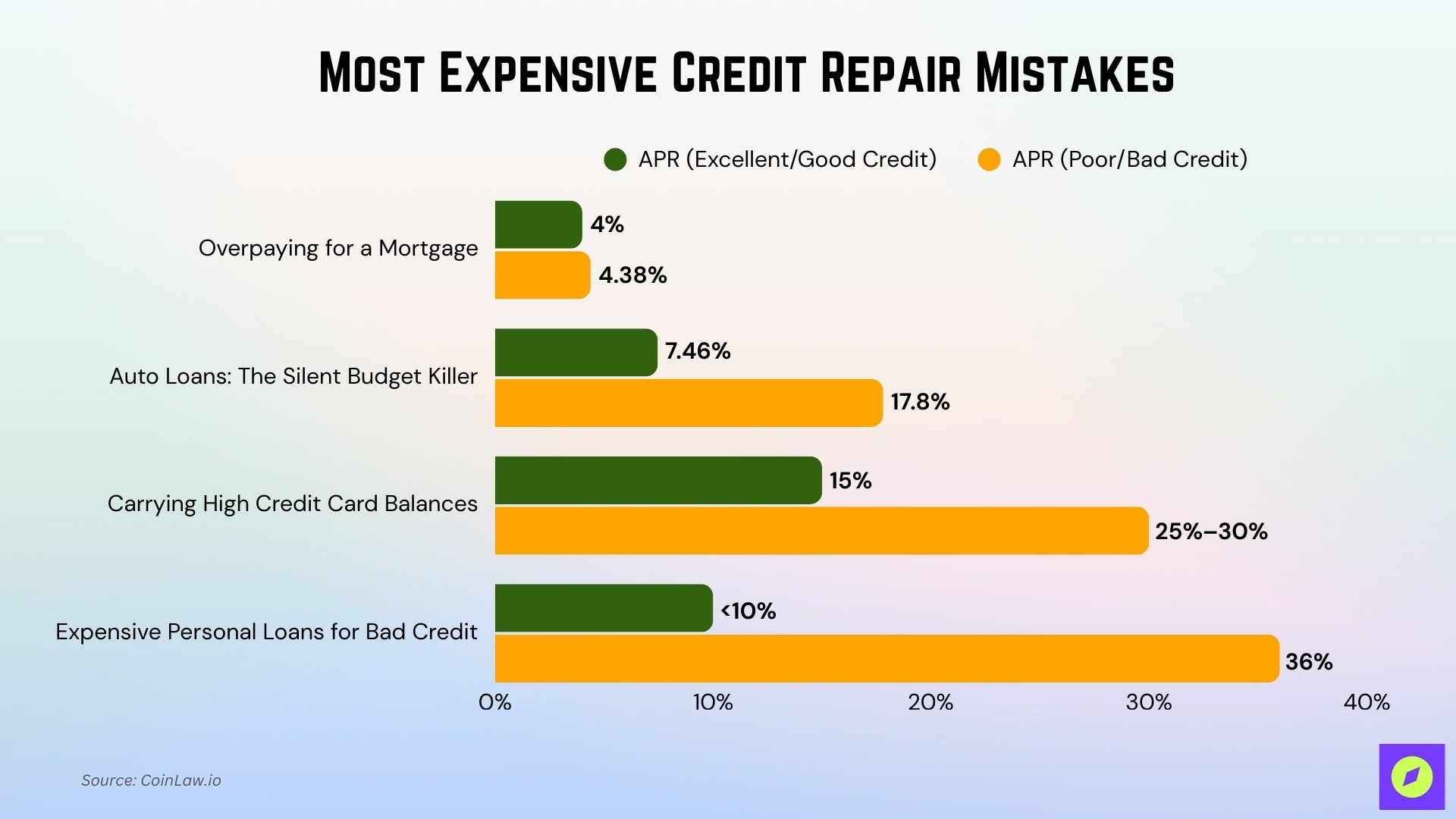

| Category | Loan/Amount | Excellent/Good Credit | Poor/Bad Credit | Extra Cost |

| Overpaying for a Mortgage | $250,000, 30 years | 4% APR → $1,194/month | 4.38% APR → $1,249/month | $55/month → $19,000+ over 30 years |

| Auto Loans: The Silent Budget Killer | $40,000, 60 months | 7.46% APR → $801/month, $8,047 interest | 17.8% APR → $1,011/month, $20,677 interest | $210/month → $12,630 extra interest |

| Carrying High Credit Card Balances | $5,000 balance | 15% APR | 25–30% APR | $400+ more interest (over time, min. payments) |

| Paying Too Much for Homeowners Insurance | Annual Policy | Excellent Credit → Baseline | Low Credit → +$2,000/year | $20,000 over 10 years |

| Expensive Personal Loans for Bad Credit | $10,000, 5 years | <10% APR → ~$3,500 interest | 36% APR → $11,680 interest | $8,000+ more interest (Total repayment > $21,000) |

1. Overpaying for a Mortgage

Your credit score directly affects the interest rate lenders offer, and nowhere is this more financially painful than with a mortgage. Consider this:

- A borrower with excellent credit could lock in a 4% APR.

- Someone with a score between 620–639 might only qualify for 4.38% APR.

- On a $250,000, 30-year mortgage, that difference = $55 more per month, or $19,000+ over 30 years.

That’s not just a rounding error. It’s a five-figure financial leak caused by ignoring or mismanaging your credit during the repair process. And in markets where mortgage rates are already elevated, this gap could be even more punishing.

2. Auto Loans: The Silent Budget Killer

Unlike a home loan, auto loans are shorter-term, so borrowers often underestimate the cost difference of bad credit. Here’s the reality:

- A $40,000 loan at 7.46% APR (good credit) → ~$801 monthly, $8,047 interest.

- At 17.8% APR (very poor credit) → ~$1,011 monthly, $20,677 interest.

- Total cost difference: $12,630 more in interest alone.

If you’re rebuilding credit, don’t blindly accept any auto loan offer. Even a six-point bump in your credit score could save you thousands over a 60-month term.

3. Carrying High Credit Card Balances

One of the most common and underestimated credit repair mistakes is failing to reduce card balances, especially when tied to high APRs caused by poor credit.

Let’s say you carry a $5,000 balance:

- A card with excellent credit might offer 15% APR.

- With bad credit, you could be looking at 25–30% APR.

- The interest difference alone could cost $400+ more over time, assuming you make minimum payments.

This mistake compounds quickly, especially if you’re trying to rebuild credit but never attack your utilization rate (which makes up 30% of your FICO score). Carrying debt while focusing only on removing derogatory marks is like bailing water from a sinking ship without plugging the hole.

4. Paying Too Much for Homeowners Insurance

Credit scores don’t just affect loans; they influence insurance premiums, too. Most consumers are unaware that their credit-based insurance score (separate from their FICO) plays a major role in home insurance pricing.

The numbers are staggering:

- Homeowners with excellent credit pay far less.

- Those with low credit scores pay an average of $2,000 more per year for the same policy.

- Over a 10-year period, that’s $20,000 in avoidable costs.

This makes poor credit a tax on homeownership, penalizing responsible borrowers simply due to lingering negative marks or high credit utilization.

5. Expensive Personal Loans for Bad Credit

When you’re in credit repair mode, personal loans can feel like a lifeline, but they often turn into financial traps if you accept high APRs just to consolidate or cover short-term needs.

Example:

- A $10,000 personal loan over 5 years at 36% APR (bad credit) = $11,680 in interest.

- A similar borrower with good credit might pay <10% APR, reducing interest by $8,000 or more.

That means the total repayment with bad credit could exceed $21,000, more than double the original loan. Often, this mistake is made out of desperation or misunderstanding of loan terms, particularly when borrowers skip reading amortization tables or rely on misleading ads.

How to Repair Credit the Smart Way

Smart credit repair isn’t about tricks or shortcuts; it’s about building a long-term foundation for lower interest rates, better approvals, and financial flexibility. By following proven steps, you can improve your score without falling into costly traps or illegal tactics.

- Check Your Credit Reports Regularly: Pull your reports from the bureaus and review for errors, duplicates, or outdated information.

- Dispute Only Inaccurate or Unverifiable Items: Never dispute accurate negatives; doing so can lead to rejections, fraud alerts, or worse. Stick to correcting factual errors with proper documentation.

- Lower Your Credit Utilization: Aim to use less than 30% of your credit limits (ideally under 10%). Pay down card balances and consider requesting credit line increases.

- Keep Long-Standing Accounts Open: Don’t close your oldest accounts; they help boost your average credit age, which makes up 15% of your FICO score.

- Use Safe Credit-Building Tools: Apply for secured credit cards, credit-builder loans, or use services like Experian Boost to add on-time payments.

- Avoid Credit Sweeps and Illegal Tactics: Steer clear of “file segregation” or “credit sweep” services; these are often scams and can expose you to legal action.

- Make On-Time Payments Non-Negotiable: Set up automatic payments to avoid late fees. Your payment history is the single most important factor in your credit score.

- Work With a Nonprofit Counselor If Needed: Consider a HUD-approved credit counseling agency if your debts feel overwhelming. They can help build a legitimate repayment plan.

Impact of These Mistakes on Your Finances

Credit repair mistakes don’t just affect your score; they cost real money over time in the form of higher interest, inflated premiums, and reduced access to affordable credit. These financial hits often go unnoticed until they compound into five-figure losses.

- Higher Loan Payments: Bad credit leads to higher APRs on mortgages, auto loans, and personal loans, costing you hundreds more per month and tens of thousands over time.

- Excessive Interest Charges: Carrying balances with high interest rates results in thousands in added interest, especially on credit cards and installment loans.

- Overpriced Insurance Premiums: Homeowners and auto insurance providers charge significantly more to those with low credit scores, up to $2,000 more per year in some cases.

- Lost Access to Premium Financial Products: Poor credit disqualifies you from 0% APR offers, cashback cards, and low-interest refinancing options that build long-term wealth.

- Delayed Financial Milestones: Whether it’s buying a home, getting approved for a business loan, or securing a crypto-backed loan, bad credit pushes major goals further out of reach.

- Lower Net Worth Over Time: The combination of higher costs, fewer opportunities, and limited liquidity leads to a long-term reduction in your total financial potential.

Frequently Asked Questions (FAQs)

A comparison of the highest vs the lowest credit‑score tiers shows the higher‑score borrower saves about $59,274 in total interest over the life of a 30‑year mortgage.

In most U.S. states, homeowners with poor credit pay about 71% more in annual homeowners’ insurance than those with good credit.

Homeowners with low credit are charged about $1,996 more per year on average compared to otherwise similar homeowners with high credit.

In Arizona, low‑credit homeowners pay an extra $2,125 annually, on average, for homeowners’ insurance compared to those with high scores.

Across the U.S., a homeowner with a medium credit score (≈740) may pay about $792 more per year than a homeowner with a high credit score.

Conclusion: Treat Credit Like an Asset Class

In the age of tokenized finance and on-chain identity, your credit score remains one of your most valuable financial assets. Just like crypto custody or smart contract audits, credit repair must be handled with care, transparency, and long-term thinking.

Avoiding the mistakes above isn’t just about saving money; it’s about unlocking lower interest rates, better insurance premiums, and a broader range of financial tools, both on-chain and off-chain.

Don’t let one score quietly drain tens of thousands from your future!