Not all credit cards are created equal, and some are designed not just for spending but for showcasing extreme wealth, status, and access. The world’s most expensive credit cards aren’t simply tools of convenience. They’re symbols of ultra-high-net-worth privilege, granting their holders entry into a realm of luxury few can imagine. In this guide, we break down what makes these cards so expensive and why they remain sought-after among elite circles.

Key Takeaways

- Annual fees reach as high as $10,000+, with initiation fees sometimes exceeding $7,500.

- Invite-only status applies to most premium cards; public application is not an option.

- Benefits include 24/7 elite concierge, private jet booking, first-class upgrades, and exclusive events.

- The top-tier cards are tailored for UHNWIs, often requiring $10M+ in assets or $250K+ annual spend.

- More accessible premium alternatives exist for high spenders, not in the ultra-rich bracket.

What Makes These Cards So Expensive?

The high costs of luxury credit cards go far beyond the annual fees. Several factors contribute to their exclusivity and pricing:

- Initiation Fees: Some cards charge a one-time fee just to be invited, often $7,500 or more, as seen with the American Express Centurion.

- Annual Fees: Ranging from $595 to well over $10,000, these fees ensure only the most serious clients apply.

- Wealth & Spending Requirements: Many cards require clients to spend at least $250,000 annually, or have $10M+ in assets under management with the issuing bank.

- Perks that Justify the Cost: Elite concierge teams, access to members-only clubs, priority boarding, lifestyle management services, and automatic elite status with top airlines and hotels.

- Exclusivity: Many cards are invitation-only, not listed publicly, and not available through normal application routes.

These costs are positioned less as barriers and more as filters, a way to segment access to the truly elite.

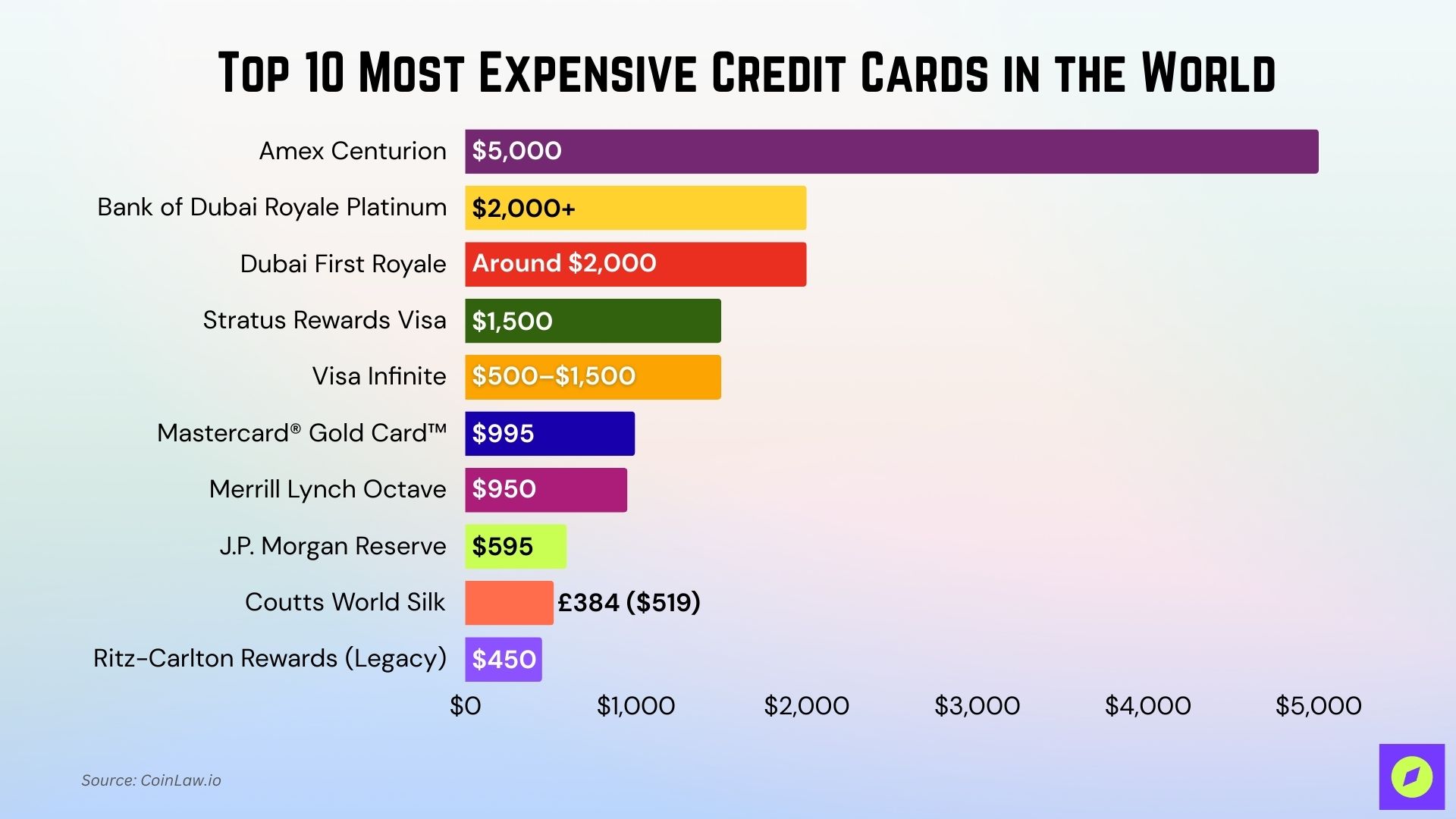

Top 10 Most Expensive Credit Cards in the World

These ultra-premium credit cards represent the highest tier of exclusivity, luxury, and cost. Annual fees can soar past $10,000, and in many cases, public application is not even possible. Here’s a ranked breakdown of the world’s most expensive and elite credit cards.

| Rank | Card | Annual Fee | Eligibility | Main Perks |

| 1 | Amex Centurion | $5,000 | $250K+ annual spend, invite only | Private jet, concierge, luxury access |

| 2 | Bank of Dubai Royale Platinum | $2,000+ | Ultra-wealthy clients only | Hospitality services, elite retail privileges |

| 3 | Dubai First Royale | Around $2,000 | UAE royalty/invite-only | Diamond card, no limit, royal perks |

| 4 | Stratus Rewards Visa | $1,500 | Invite-only | Private jet discounts, pooled perks |

| 5 | Visa Infinite | $500–$1,500 | Bank-issued to elite customers | Global travel perks, emergency coverage |

| 6 | Mastercard® Gold Card™ | $995 | Open application | 24k gold, lounge, concierge |

| 7 | Merrill Lynch Octave | $950 | $10M+ in assets | Travel credits, investment perks |

| 8 | J.P. Morgan Reserve | $595 | $10M+ AUM at J.P. Morgan | Airport perks, concierge, United Club |

| 9 | Coutts World Silk | Around £384 ($519) | Coutts clients only | Travel & concierge, UK elite access |

| 10 | Ritz-Carlton Rewards (Legacy) | $450 | Closed to new applicants | Hotel perks, annual credits |

1. American Express Centurion Card (Black Card)

Reserved for an elite few, this card represents the pinnacle of exclusivity and personalized financial services. Its mystique lies in the discreet, invite-only nature that defines the Centurion experience.

- Initiation Fee: $10,000

- Annual Fee: $5,000

- Eligibility: Invite-only; requires $250,000+ in annual Amex spend

- Why It’s Expensive: The most iconic status symbol in the credit card world, this card grants access to a dedicated Centurion concierge, first-class upgrades, top-tier hotel elite status, private jet arrangements, and ultra-exclusive events.

- Target Audience: Celebrities, CEOs, ultra-high-net-worth individuals (UHNWIs)

2. Bank of Dubai Platinum Royale Card

Crafted for the financial elite of the Gulf, this card combines cultural prestige with extravagant personal service. It’s designed for individuals whose influence crosses borders and industries.

- Initiation Fee: Confidential

- Annual Fee: Rumored to exceed $2,000

- Eligibility: Ultra-exclusive clients only

- Why It’s Expensive: Offers invitation-only perks, global airport privileges, exclusive retail offers, and luxury hospitality services.

- Target Audience: GCC elites, international investors

3. Dubai First Royale Mastercard

This card is less a financial tool and more a status artifact, tailored for royalty and global power players. With aesthetics as bold as its clientele, it embodies wealth beyond limits.

- Initiation Fee: Undisclosed

- Annual Fee: Around $2,000; Rumored to be unlimited or waived for royals

- Eligibility: Invite-only for UAE royalty and billionaires

- Why It’s Expensive: Features a 24k gold-trimmed body with an embedded diamond, paired with limitless credit, a personal relationship manager, and white-glove luxury services.

- Target Audience: Heads of state, billionaires, royalty

4. Stratus Rewards Visa (White Card)

Focused on lifestyle elevation, this card caters to those who travel in private jets and live in curated experiences. It thrives in tight-knit circles where exclusivity builds community value.

- Initiation Fee: $1,500

- Annual Fee: $1,500

- Eligibility: Invitation-only; tailored for high-flying private jet travelers

- Why It’s Expensive: Provides private jet discounts, luxury hotel upgrades, and concierge services, with benefits pooled for group members (ideal for celebrities or athletes).

- Target Audience: Jet-setters, entertainers, corporate elites

5. Visa Infinite Cards (varies by issuer)

With broad global availability through select issuers, this tier offers access to high-end perks while preserving brand versatility. It’s a premium gateway for those scaling into luxury.

- Initiation Fee: Varies

- Annual Fee: Up to $1,500

- Eligibility: Income-based or private client status required

- Why It’s Expensive: Offers high-end travel perks, emergency services, trip delay protection, luxury hotel privileges, and more. Issued through premium banks worldwide.

- Target Audience: Frequent global travelers

6. Luxury Card Mastercard® Gold Card™

A bold blend of form and function, this card appeals to design-conscious high spenders. Its solid gold finish makes a statement without saying a word.

- Initiation Fee: None

- Annual Fee: $995

- Eligibility: Open, but with strict credit and income criteria

- Why It’s Expensive: Made with 24K gold, this card includes airline credits, a global entry fee credit, airport lounge access, and a luxury concierge service.

- Target Audience: Affluent travelers who want luxury with availability

7. Merrill Lynch Octave Card

Deeply integrated into wealth management ecosystems, this card is a silent partner in high-net-worth lifestyles. It rewards those whose assets speak louder than applications.

- Initiation Fee: Undisclosed

- Annual Fee: $950

- Eligibility: Must have $10M+ in assets with Bank of America or Merrill

- Why It’s Expensive: Provides up to $350 in travel credits, concierge service, and access to elite Merrill investment tools.

- Target Audience: UHNW investors within the Merrill/BofA ecosystem

8. J.P. Morgan Reserve Card

Blending private banking prestige with everyday utility, this card is a quiet badge of generational wealth. It’s a symbol of financial trust and influence within America’s most exclusive circles.

- Initiation Fee: None

- Annual Fee: $595

- Eligibility: Must hold $10M+ with J.P. Morgan Private Bank

- Why It’s Expensive: Though the annual fee is low, the eligibility threshold is among the highest globally. Offers airport lounge access, travel insurance, concierge services, and a United Club membership.

- Target Audience: HNWIs banking with J.P. Morgan

9. Coutts World Silk Card (UK)

Discreet and distinguished, this UK-based card offers understated luxury aligned with legacy banking tradition. It’s crafted for individuals who value privacy as much as privilege.

- Initiation Fee: None

- Annual Fee: Around £384 ($519); clients only

- Eligibility: Must be a client of Coutts Bank (e.g., the British Royal Family’s bank)

- Why It’s Expensive: Offered only to highly select UK-based clients, the card provides tailored perks, elite travel insurance, and personalized financial services.

- Target Audience: Ultra-affluent UK clients, royal connections

10. Ritz-Carlton Rewards® Credit Card (Legacy holders only)

Though no longer open to new applicants, this card still delivers boutique-level hospitality to legacy holders. It’s a relic of refined loyalty programs from a bygone luxury era.

- Initiation Fee: None

- Annual Fee: $450

- Eligibility: No longer available to new applicants

- Why It’s Expensive: Cardholders enjoy unlimited Priority Pass access, $300 annual travel credit, and elite hotel status upgrades.

- Target Audience: Marriott and Ritz-Carlton loyalists

Strategic Value or Vanity Spend?

Not all expensive cards deliver equal value. For some, the high annual fee is offset by hundreds (or even thousands) of dollars in travel credits, airport lounge perks, and elite statuses. But in many cases, status outweighs utility; these cards are less about ROI and more about identity signaling.

Here’s how to weigh the real-world value of owning one of these ultra-premium cards:

1. Cost-to-Benefit Ratio

- A $5,000 annual fee may seem exorbitant, but if you receive $3,000+ in annual perks, including airline fee credits, concierge bookings, private lounge access, and free hotel nights, the math starts to balance.

- While cards like the Dubai First Royale or Stratus Rewards Visa offer elite benefits, their value is often perceived as more symbolic than practical, based on limited availability and exclusivity rather than quantifiable returns.

2. Lifestyle Fit

- If you’re not flying business class monthly or booking through elite travel portals, you won’t utilize half the benefits.

- These cards are built for ultra-frequent travelers, executives, or entertainers who demand seamless global experiences.

3. Hidden Fees and Restrictions

- Some cards come with additional authorized user fees (up to $2,500 each), international transaction charges, or tiered benefits that only activate after specific usage thresholds.

How to Get Invited to Elite Cards

If your goal is to level up to the likes of the Amex Centurion or J.P. Morgan Reserve, here’s how insiders play the long game:

- Build a high-spend history with the issuer. Example: spend $250,000+ per year on Amex Platinum to trigger Centurion tracking.

- Consolidate assets with the issuing bank. J.P. Morgan Reserve and Merrill Lynch Octave require $10 million+ in AUM.

- Use concierge and travel services frequently. This signals lifestyle alignment with ultra-premium products.

- Wait for a call. Many of these cards are invitation-only; you don’t apply, they approach you.

Final Thoughts

Owning one of the world’s most expensive credit cards is less about financial practicality and more about identity, access, and exclusivity. For most people, better-value cards deliver similar perks without the high barrier. But for a select global elite, these cards act as passports to a frictionless lifestyle, unlocking ultra-private lounges, curated events, private aviation, and elite recognition at every checkpoint.

Just be sure the prestige is worth the price.