Monero remains one of the most privacy-centered digital currencies, with growing interest from individuals who value anonymity and decentralization. Its use is strong among privacy advocates, while also surfacing in regulatory discussions due to concerns over illicit applications. This article offers a focused statistical view of Monero today and how its core metrics have evolved over the past year, inviting you to explore the full insights ahead.

Editor’s Choice

- $259.69, the approximate current price per XMR as of August 22, 2025.

- Around $4.75 billion in market capitalization, placing it among the top 30 crypto assets.

- Circulating supply hovers between 18.37 to 18.45 million XMR, nearly fully released.

- 24-hour trading volume falls between $90 M $115 M, showing steady liquidity.

- Monero’s year-over-year price gain stands at approximately +60%, reflecting renewed interest.

- RandomX remains its PoW algorithm, reinforcing ASIC resistance and decentralization.

- Network structure now centers around a core-periphery P2P topology, improving resilience.

Recent Developments

- Protocol upgrade v0.18.4.1 launched July 25, 2025, delivering minor enhancements.

- Research highlights a stronger core–periphery network structure in peer-to-peer topology.

- Another study mapped network connectivity, unveiling peer patterns and supernode roles with high inference accuracy.

- Academic concern over privacy vulnerabilities in Haveno DEX, showing some traceability in cross-chain links.

- Several centralized exchanges delisted Monero amid regulatory pressure, Binance ended listings in early 2024, and some EEA restrictions continued into 2025.

- EU’s announced plan (May 2025) to ban anonymous crypto accounts starting in 2027 signals a changing legal climate.

- Privacy upgrades such as Bulletproofs continue enhancing transaction confidentiality and reducing costs.

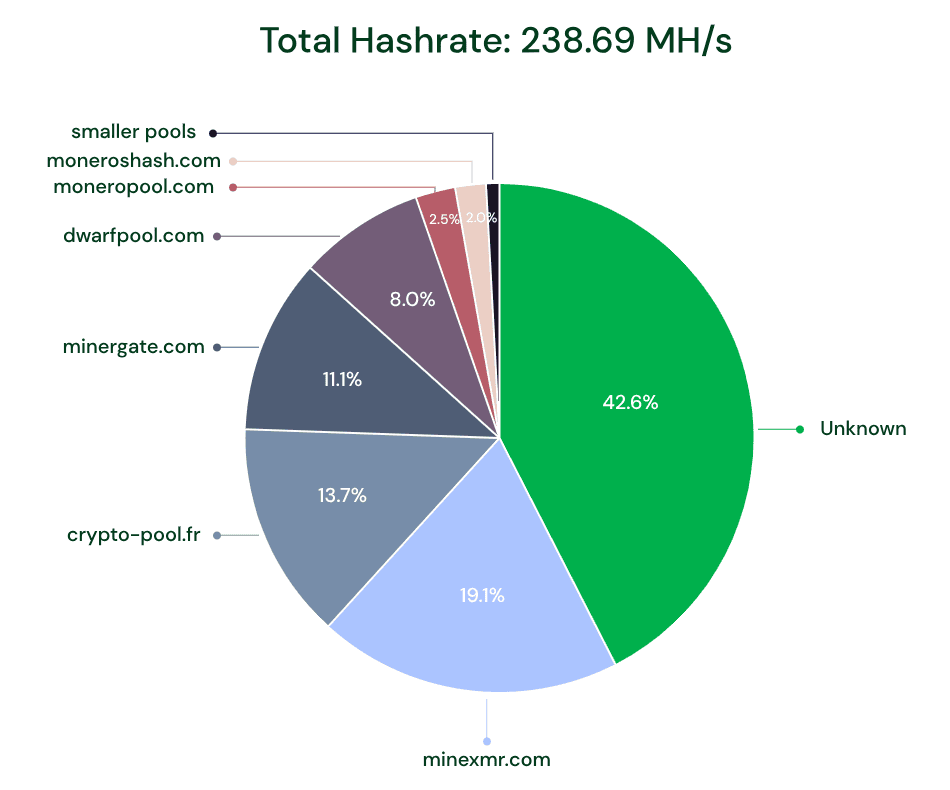

Monero Mining Pool Distribution

- Unknown pools dominate with 42.6% of the total Monero hashrate (238.69 MH/s).

- minexmr.com contributes 19.1%, making it the largest identifiable pool.

- crypto-pool.fr accounts for 13.7% of the hashrate.

- minergate.com follows with 11.1% share.

- dwarfpool.com controls 8.0% of the network.

- Smaller pools like moneropool.com (2.5%) and moneroshash.com (2.0%) contribute marginally.

- Collectively, smaller pools represent only 1.0% of Monero’s total mining power.

Monero Price Statistics

- Current estimates range between $257.5 and $259.7 per XMR as of August 22, 2025.

- 24-hour change varies from a –1.73% dip to modest daily increases up to +1%.

- One-year growth stands strong at +60% to +63%, up from around $162 a year ago.

- Weekly movement shows fluctuation; some sources report +7% to +9% gains.

- All-time high peaked at $542 (January 9, 2018), current value sits about –52% below ATH.

Market Capitalization Data

- Market cap is consistently reported between $4.75 B and $4.83 B.

- Fully diluted valuation matches market cap, reflecting absence of supply cap.

- Ranking varies; Monero sits around #28 to #35 by market cap across platforms.

- Supply deployment is now near complete, circulating supply is ~18.4 million XMR.

- No maximum supply limit, meaning inflation continues via tail emissions.

Trading Volume Overview

- 24-hour volume ranges from $90–$115 million.

- Over 7 days, volume totals $848 million, averaging $121 million per day.

- In the 30-day window, volume reaches around $3.45 billion, still averaging $115 million daily.

- Some drop-off is noted; daily volume may fall below weekly averages.

- Trading remains active, indicating investor engagement despite regulatory headwinds.

QUBIC Custom Mining Report

- QUBIC mining earnings ranged from $88,741 in Epoch 168 to a peak of $180,250 in Epoch 171.

- Buybacks fluctuated, starting at 93.64 billion in Epoch 167 and declining to 65.90 billion by Epoch 171.

- Monero mined rose significantly, from 270 XMR in Epoch 167 to 481 XMR in Epoch 171.

- Hashrate share more than doubled, climbing from 17.5% in Epoch 167 to a dominant 45.0% in Epoch 171.

Monero Supply and Circulation

- Circulating supply sits between 18.37M and 18.45M XMR.

- This represents over 99% of the total issuing supply.

- No fixed supply cap, ongoing tail emission ensures block rewards persist.

- Supply mechanics aim to support mining incentives and network security.

Exchange Listings and Market Share

- Monero remains delisted from several major US exchanges, and its access is limited in North America, increasing liquidity risk.

- Despite restrictions, XMR trades on dozens of global exchanges, primarily via crypto-to-crypto pairs like BTC/XMR and USDT/XMR.

- Typical 24-hour trading volume is in the tens to low hundreds of millions USD, much lower than assets like BTC and ETH.

- Monero ranks roughly 30–40th in global market cap, placing it among mid-tier crypto assets.

- Institutional investors face access challenges due to regulatory scrutiny, further limiting XMR’s market share in regulated regions.

- Many users opt to hold XMR in private wallets rather than exchange custody, reducing exchange-based liquidity but boosting security.

- XMR’s market niche, focused on privacy, means it captures a disproportionately large share of the privacy-coin sector.

Historical Price Performance

- Monero’s current price (late August 2025) ranges around $257–$259 per XMR.

- Monero remains –52% below its all-time high of $542 from January 2018.

- Earlier in 2025, Monero experienced sharp volatility, losing over 7% in a single day due to a 51% hashrate scare.

- That event triggered heightened concern when the Qubic mining pool claimed to control a majority of the network’s hashrate.

- On-chain sentiment metrics like Spot CVD and Taker CVD turned negative, signaling growing selling pressure.

- Social sentiment dropped by over 40% within 24 hours after the hashrate control claims surfaced.

- Disparities between BTC’s stability and XMR’s volatility, XMR tends to underperform during correlated sell-offs, falling 5–7% more than BTC.

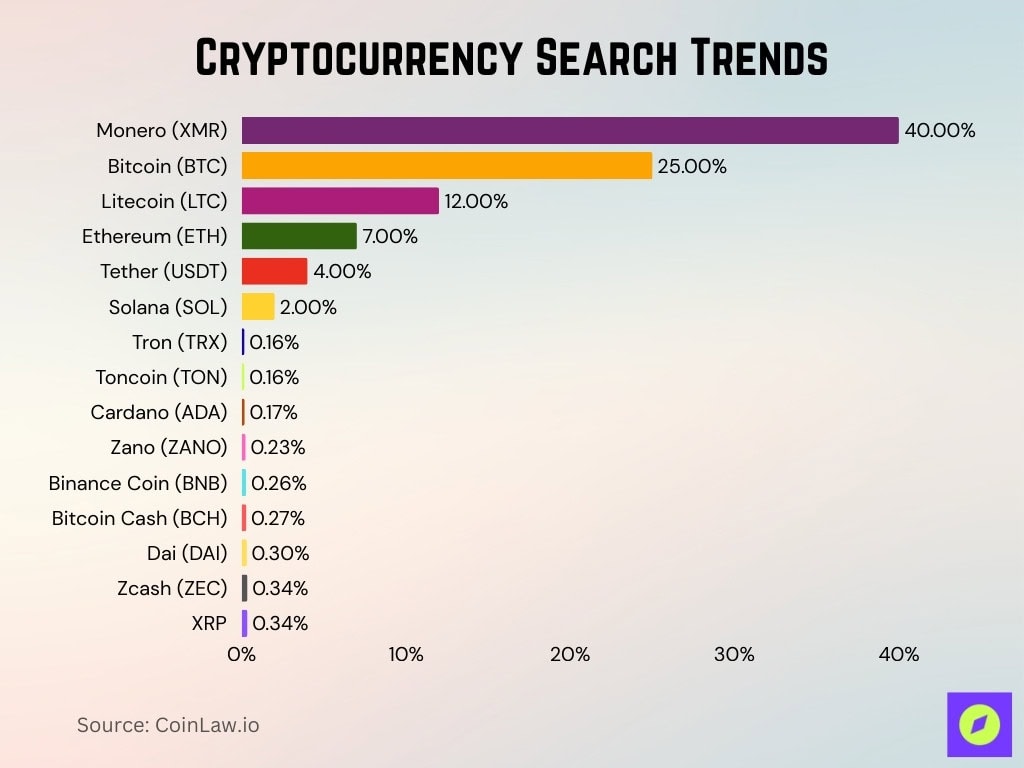

Cryptocurrency Search Trends

- Monero (XMR) leads with 40% of all searches, showing its dominance in privacy-focused interest.

- Bitcoin (BTC) ranks second at 25%, maintaining strong relevance.

- Litecoin (LTC) holds 12%, securing the third position.

- Ethereum (ETH) captures 7% of search share.

- Tether (USDT) accounts for 4%, the top stablecoin in searches.

- Solana (SOL) registers 2%, reflecting notable attention among altcoins.

- Niche coins and tokens show smaller shares: Tron (TRX 0.16%), Toncoin (TON 0.16%), Cardano (ADA 0.17%), and Zano (0.23%).

- Other minor mentions include Binance Coin (0.26%), Bitcoin Cash (0.27%), Dai (0.30%), Zcash (0.34%), and XRP (0.34%).

On-chain Activity Metrics

- In 2021–2022, Monero saw 9.09 million transactions, up from 5.87 million the previous year, an approximate 54% increase.

- Daily transactions reached up to 40,000 at peak, indicating growing adoption.

- As of mid-2022, cumulative transactions hit about 32 million XMR, compared to ~800 million on Bitcoin’s blockchain.

- About 23,425 transactions in the last 24 hours, averaging 976 transactions per hour.

- Average transaction fee remains low at around 0.00045 XMR (~$0.12).

- Stability in block intervals, Monero maintains an average block time of ~2 minutes 4 seconds, with 692 blocks mined in the past 24 hours.

- Dynamic block size and adaptive emissions help keep fees low and the network responsive during surges.

Mining Statistics

- Monero’s PoW algorithm, RandomX, remains ASIC-resistant and CPU-friendly, supporting decentralization.

- As of 2025, network hashrate sits around 4.2 GH/s.

- Bulletproofs and ring signature audits, led by Monero Research Lab, ensure continued mining and privacy integrity.

- The Qubic mining pool recently claimed 51% of the hashrate, raising security concerns due to chain reorganization vulnerabilities.

- Epoch‑172 recap shows 4285 blocks mined, with ~517 XMR generated in that period, half allocated to Qubic buybacks and half to miner incentives.

- The block reward averages 0.6 XMR per block, supplemented by fees, delivering roughly $158 per block.

- Mining profitability hovers at $0.0221 per day per 1 KHash/s.

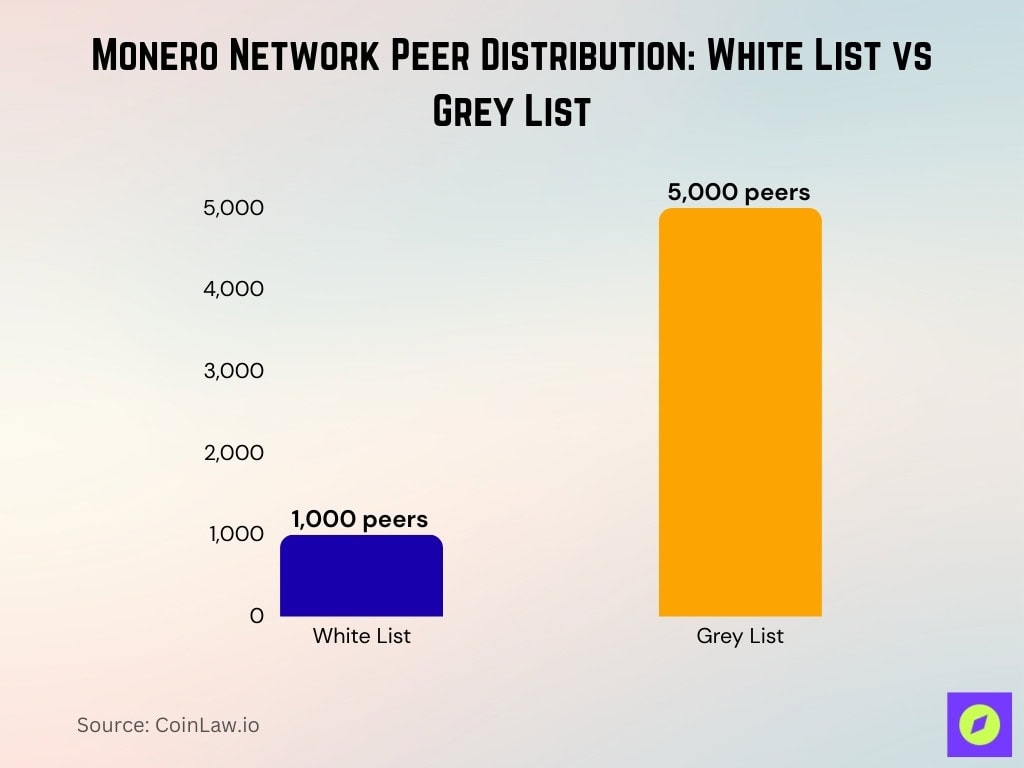

Network Topology and Nodes

- Peer lists include a white_list (1,000 peers) and a grey_list (5,000 peers) to balance connectivity and resilience.

- Recent P2P network analysis confirms Monero has a core-periphery structure, with tightly connected supernodes at its core.

- Studies revealed that Monero nodes maintain 8 outgoing connections by default, supporting network cohesion.

- Timestamps for peer activity were removed in recent protocol updates, making topology inference more challenging.

- Advanced inference methods achieved high accuracy in mapping peer connections without relying on timestamps.

- The architecture resists targeted attacks; removing central nodes doesn’t break the largest network component.

- Research also highlights the ongoing challenge of cryptojacking, unauthorized mining, which threatens network security.

Transaction Statistics

- Total transactions per day average around 23,400, with hourly transactions around 976.

- Average fees per transaction remain modest, 0.00045 XMR (~$0.12).

- Block production remains consistent, approximately 692 blocks in the last 24 hours, each averaging 85 KB in size.

- Fee proportion of block reward is low, averaging 1.24% of total block reward.

- Difficulty and hashrate both dropped slightly in the last 24 hours, –5.3% difficulty, –8.5% hashrate.

- The dynamic block size mechanism adapts to demand, helping control transaction backlog and maintain speeds.

- On-chain transaction surges often reflect privacy-focused vector movements or whale activity amid market uncertainty.

Privacy and Security Metrics

- The latest Monero protocol release, v0.18.4.1, launched on July 25, 2025, continues requiring privacy mechanisms by default.

- Privacy is rooted in features like ring signatures, stealth addresses, and confidential transactions, keeping sender, recipient, and amounts hidden.

- Dandelion++ adds protection by obfuscating transaction broadcast origins, hiding IP addresses during propagation.

- Monero enforces fungibility; coins are indistinguishable, preventing blocklisting based on history.

- Research warns of privacy risks on Haveno DEX; certain trades may be linked across Monero and Bitcoin.

- The Monero Research Lab recommends enabling IP ban lists to block known spy-node addresses.

- Core-periphery network structure and removal of timestamps enhance the difficulty of mapping peers.

Social Media and Community Activity

- In late 2023, Monero’s active addresses averaged around 75,000 per day, reflecting steady interest.

- GitHub activity, over 6,000 forks, and approximately 200 active contributors as of Q1 2024.

- Grassroots events, Monero meetups, and workshops occurred in more than 20 countries, helping users learn privacy tools.

- Social media exposure and Asian trading activity fueled a revival in Monero demand in 2025.

- Community forums show engaged discussions around mining decentralization, DEX feedback, and node setup tools.

- Educational content remains vibrant, guides for running full nodes, using CLI, and firewall configuration.

Comparison with Other Cryptocurrencies

- Monero remains the leading privacy coin, thanks to enforced anonymity vs. optional privacy features in coins like Zcash.

- Compared to Flow, Monero trading patterns reflect stronger community ties and privacy-focused utility.

- Unlike transparent blockchains, Monero conceals transaction history and addresses by default.

- Institutional investors tend to prefer mainstream assets, reducing XMR’s comparative liquidity.

- Despite regulatory restrictions, Monero’s niche retains a steady position in the top 30 cryptocurrencies.

Technical Upgrades and Developments

- The July 2025 upgrade to v0.18.4.1 marks the latest in active protocol updates.

- Privacy enhancements like Bulletproofs and RingCT continue to secure transactions.

- Dandelion++ broadcast mechanism further conceals user IPs during transaction relay.

- MRL guides developers and node operators to mitigate privacy threats via networking and code tools.

- Ongoing research evaluates P2P topology and spy-node vulnerabilities.

- GitHub momentum, including forks and contributions, signals active innovation within the community.

Adoption and Usage Statistics

- South Korea saw a 41% increase in Monero-based transactions following new privacy-friendly retail payment rules.

- Across Africa, privacy coin usage rose 37% year-over-year, driven by remittances and low fees.

- In Latin America, small business adoption reached 26%, particularly in Argentina and Venezuela.

- Rising merchant support aligns with Monero’s use for privacy-preserving payments.

- Persistent peer-to-peer trading fills gaps left by centralized exchange delistings.

Regulatory and Compliance Statistics

- Binance, Kraken, and other platforms implemented Monero delistings in the EU and beyond in 2024.

- The EU announced in May 2025 that, starting in 2027, anonymous crypto accounts would be banned.

- Regulatory action spurred P2P and decentralized platform growth, seen as safer routes for Monero access.

- Privacy coins nodemon remain resilient, 24-hour trading volumes and overall value remained relatively stable post-regulation.

- Privacy enhancements like full-chain membership proofs emerged partly as responses to increased scrutiny.

Conclusion

Monero continues to assert itself as a leading privacy cryptocurrency, anchored by strong on-chain metrics, active technical development, and global adoption, particularly in regions seeking confidential financial tools. While regulatory forces create market friction, they also catalyze decentralized alternatives and privacy innovation. Monero’s core architecture and vibrant community ensure it remains resilient and relevant. Explore earlier parts of this article to gain a deep dive into price trends, mining dynamics, and network structure that shape Monero’s position today.