Millennials and Gen Z are reshaping investing with distinct mindsets, priorities, and behavior. While Millennials entered the market during the rise of robo‑advisors, Gen Z is growing up with investing apps and AI tools built into their smartphones. Their differences influence everything from risk appetite to platform choice. In the U.S., fintech firms are tailoring offerings to each generation, while financial advisors are adjusting messaging to appeal to values-driven younger clients. In the sections below, you’ll see hard data on participation, product preferences, and the social forces driving investing today.

Editor’s Choice

- 99% of Gen Z investors say they are interested in sustainable investing.

- 97% of Millennials report interest in ESG or sustainable investing.

- 21% of Gen Z invested in the stock market in 2025, up from 15% in 2024.

- 55% of Gen Z lack an emergency fund covering three months of expenses.

- 45% of Generation Z and Millennials began investing in early adulthood.

- 31% of Millennial women say they feel very confident in their investment strategy.

- Assets in ESG mutual funds / ETFs rose to $605.23 billion in August 2025.

Recent Developments

- In Q1 2025, $8.6 billion of net outflows were recorded from sustainable funds after a strong Q4 2024.

- Despite the above, overall ESG-aligned fund assets climbed to $605.23 billion by August 2025.

- The Schwab Modern Wealth Survey indicates Gen Z sets lower thresholds for what counts as “wealthy”, $329,000 is viewed as “wealthy” for Gen Z vs. $847,000 for Millennials.

- Gen Z and Millennials account for ~33% of Bank of America’s consumer investment accounts.

- Gen Z makes up 12% of U.S. investors, Millennials 25%, yet their influence on fintech and trends is “outsized”.

- 45% of Gen Z and Millennials started investing in young adulthood, compared to just 15% of Gen X and Boomers.

- In 2025, 62% of Americans own stock, matching 2024 levels but still among the highest since 2007.

- The S&P 500 rose ~7% in Q3 2025, fueling renewed enthusiasm among new investors.

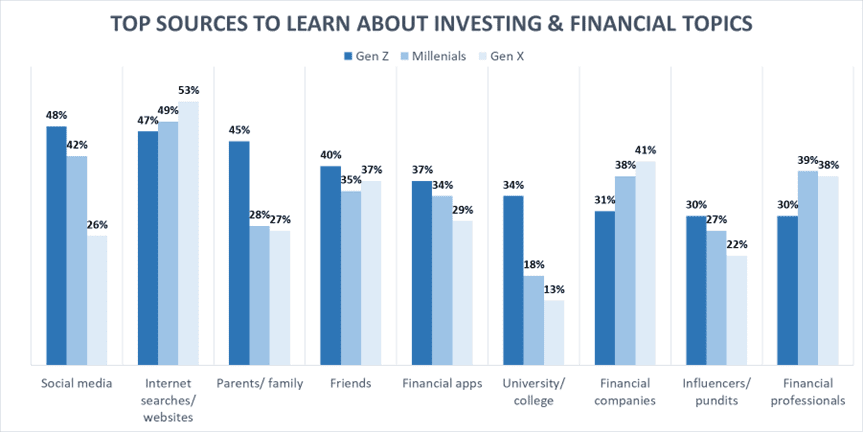

Top Sources to Learn About Investing and Financial Topics

- Social media is the leading learning source for 48% of Gen Z, compared to 42% of Millennials and only 26% of Gen X, showing a clear generational shift toward online communities.

- Internet searches and websites remain strong across all age groups, led by Gen X (53%), followed by Gen Z (49%) and Millennials (47%), highlighting broad digital reliance.

- Parents and family play a major educational role for 45% of Gen Z, but influence drops significantly among Millennials (28%) and Gen X (27%).

- Friends are a common learning channel for 40% of Gen Z, 35% of Millennials, and 37% of Gen X, showing consistent peer influence across generations.

- Financial apps attract 37% of Gen Z, 34% of Millennials, and 29% of Gen X, confirming younger investors’ preference for tech-based learning.

- University and college sources are most impactful for Gen Z (34%), declining sharply for Millennials (18%) and Gen X (13%), reflecting shifting access to formal financial education.

- Financial companies are trusted by 41% of Gen X, 38% of Millennials, and 31% of Gen Z, suggesting increasing trust with age.

- Influencers and pundits guide 30% of Gen Z, 27% of Millennials, and 22% of Gen X, showing that social credibility remains strongest among younger investors.

- Financial professionals remain steady across generations, 39% of Gen Z, 38% of Millennials, and 30% of Gen X, proving consistent reliance on expert advice.

Investment Participation Rates

- 21% of Gen Z invested in the stock market in 2025, up from 15% in the prior year.

- 55% of Gen Z lack emergency savings to cover three months of expenses, and 49% of Millennials are in the same position.

- Gen Z and Millennials began investing earlier, 45% did so in early adulthood, versus 15% for Gen X/Boomers.

- Among U.S. adults, 62% now own stocks (via markets, funds, or accounts).

- Households held 45.4% of assets in equities (a record).

- Millennials hold a dominant share in retail investing; they form 25% of U.S. investors, with Gen Z another 12%.

- 43% of Gen Z believe they are or will become wealthy, nearly tied with Millennials at 42%.

- Gen Z and Millennials show higher rates of documented financial planning than older generations.

Preferred Investment Platforms and Tools

- Younger investors prefer commission-free mobile apps and smartphone platforms.

- Both generations favor passive strategies and automated portfolios over active stock picking.

- 41% of Gen Z & Millennials say they’re comfortable with AI tools managing portfolios, versus 29% of Gen X, 14% of Boomers.

- Gen Z and Millennials demand digital-first tools and user-friendly UX in fintech products.

- They often launch investing via brokerage apps, robo-advisors, or ETF platforms rather than full-service brokers.

- Social investing or crowd insights embedded in platforms gain traction, tools that combine investing with social feedback.

- Many younger investors track performance using in-app charts, alerts, and AI‑driven insights.

- They prefer minimal friction, instant deposits, fractional shares, and one-click trades.

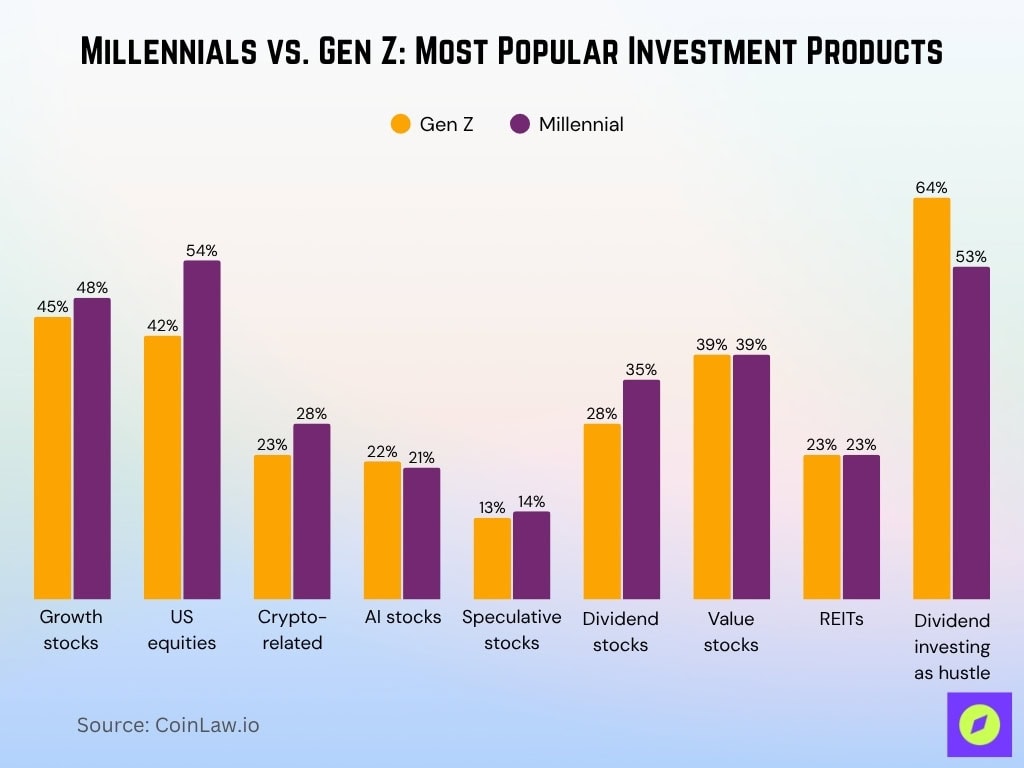

Most Popular Investment Products

- Growth stocks are held by 45% of Gen Z and 48% of Millennials.

- U.S. equities are held by 42% of Gen Z and 54% of Millennials.

- Cryptocurrency‑related stocks are part of 23% of Gen Z portfolios, 28% of Millennials’ portfolios.

- AI stocks appear in 22% of Gen Z and 21% of Millennial portfolios.

- Speculative stocks are held at 13% (Gen Z) and 14% (Millennials), roughly triple the rate among boomers.

- Dividend stocks appear in 28% of Gen Z and 35% of Millennial portfolios.

- Value stocks hold about a 39% share across both Gen Z and Millennials.

- REITs appear in 23% of Gen Z and Millennial holdings.

- 64% of Gen Z, 53% of Millennials call dividend investing a “side hustle”.

Investment Goals and Priorities

- 47% of Millennials say their primary investment goal is to retire on time.

- Gen Z investors rank financial independence and homeownership above retirement as goals.

- Roughly 80% of Gen Z and Millennials say growing savings is their top financial priority in 2025.

- 69% of Gen Z, and 62% of Millennials, say they have made lifestyle trade‑offs in the past three months in order to save more.

- 74% of Gen Z express interest in opening a certificate of deposit (CD) amid higher interest rates, but only about 8% currently own one.

- Gen Z’s top goal is growing investments, while Millennials still prioritize paying off debt.

- Nearly half of respondents say financial security is critical and drives many of their career and investing decisions.

- Over one‑third of Gen Z (37%) and Millennials (34%) say they definitely plan to save more in the coming year.

Risk Tolerance and Investment Approach

- Younger investors are more comfortable with volatility; many Gen Z and Millennials include tech/growth stocks and crypto allocations in their portfolios.

- 51% of Gen Z and 45% of Millennials now allocate 21–50% of their portfolios to sustainable (ESG) investments.

- Younger respondents are significantly more likely to over‑allocate to sustainable investments than older groups.

- Many use a hybrid approach, a core of index funds or ETFs plus higher-risk “satellite” bets in crypto, AI, or thematic equities.

- 41% of Gen Z / Millennials are willing to let an AI assistant manage their portfolio.

- Financial literacy strongly predicts risk-taking behavior; more literate investors adopt more aggressive or diversified strategies.

- Robo‑advisory adoption is rising among those with moderate to high tolerance for automation in decision-making.

- Despite openness to risk, many still include diversification, dollar-cost averaging, and stop‑loss rules to mitigate downside.

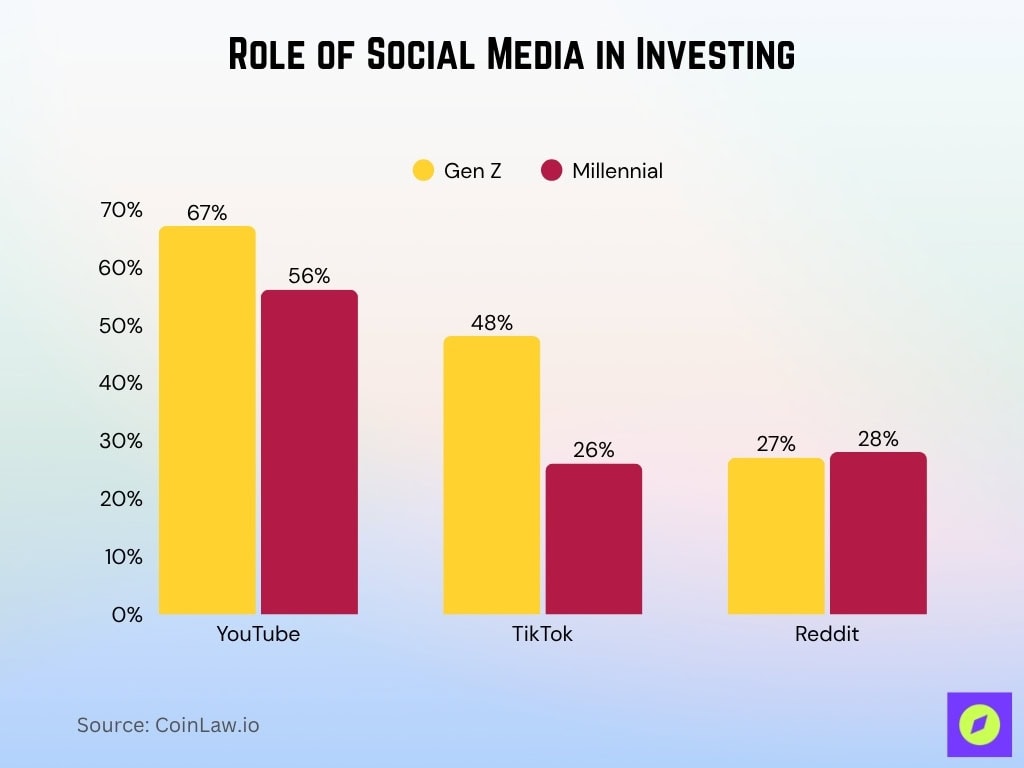

Role of Social Media in Investing

- YouTube is used by 67% of Gen Z, 56% of Millennials for financial learning.

- TikTok is used by 48% of Gen Z, 26% of Millennials for investment ideas.

- Reddit is used by 27% of Gen Z, 28% of Millennials for dividend/investing ideas.

- Gen Z and Millennials consume investment content on YouTube, TikTok, and Reddit more than traditional media.

- Social media influencers are a common but controversial source of investing advice.

- They tend to prioritize peer-shared content, user-generated tutorials, and community sentiment over formal research.

- Platforms with integrated social features (comment feeds, community analytics) appeal more to younger investors.

Use of Technology and Digital Solutions

- 41% of Gen Z and Millennials say they’d allow an AI assistant to manage investments.

- Investing apps offering fractional shares, real-time alerts, and fee transparency are among the most used by younger investors.

- Many platforms embed social features, such as in‑app forums, sentiment scores, and community strategies.

- Gen Z and Millennials show high adoption of mobile-first fintech tools vs. desktop or legacy broker interfaces.

- Tools using AI / ML for insights draw strong interest from younger investors.

- Robo‑advisors are increasingly used as a default for new retail investors lacking the time or knowledge to pick individual stocks.

- Some also use budgeting + fintech combos, where saving, investing, and cash management are merged in one app.

- Security and biometric authentication (fingerprint, face ID) are standard expectations among younger users before trusting digital investing apps.

ESG and Sustainable Investing Preferences

- 51% of Gen Z and 45% of Millennials hold 21–50% of portfolios in ESG investments.

- Younger respondents are more likely to say ethical/sustainable investing is a criterion in their decisions.

- ~70% of Gen Z and Millennials consider environmental sustainability an important factor when choosing employers or brands.

- Over the past decades, ESG fund inflows have surged, but in Q1 2025, there were notable net outflows from sustainable funds.

- Younger investors are more likely to accept lower returns if they align with environmental or social goals.

- Millennials are likelier than older cohorts to favor exclusionary screening, impact investing, or shareholder activism.

- Higher ESG preferences can create asymmetric market reactions in firms during monetary or policy shifts.

- ESG preferences also correlate with voting behavior, brand loyalty, and values-based investing, particularly among younger investors.

Ambitions of Generation Z and Millennials in the US

- Making money tops the list for 70% of Gen Z and 60% of Millennials, showing that financial success is the most dominant goal across both generations.

- Having a successful career closely follows, with 69% of Gen Z and 59% of Millennials striving for professional growth and stability.

- Work-life balance is a shared priority, as 61% of Gen Z and 59% of Millennials want more time to pursue hobbies alongside their careers.

- Family aspirations remain strong, with 60% of Millennials and 58% of Gen Z valuing the goal of having a family in their future plans.

- Close friendships hold equal importance for both groups, as 55% in each generation see strong social bonds as key to fulfillment.

- Car ownership remains appealing, cited by 56% of Millennials and 55% of Gen Z, reflecting continued interest in personal mobility and independence.

- Buying a home remains a milestone for 53% of Gen Z and 51% of Millennials, showing a lasting dream of homeownership despite housing affordability challenges.

- Romantic relationships are moderately prioritized, with 46% of Millennials and 43% of Gen Z viewing them as life goals.

- Marriage is less emphasized, with only 39% of both generations including it in their top ambitions, highlighting shifting views on long-term commitment.

- Travel appeals to 39% of Millennials and 37% of Gen Z, underscoring a consistent desire for exploration and cultural experience.

- Fame ranks lowest, with just 12% of Gen Z and 7% of Millennials aspiring to it, indicating a move toward practical ambitions over celebrity status.

Savings Behavior and Financial Discipline

- 55% of Gen Z do not have emergency savings to cover three months of expenses, and 49% of Millennials are in the same situation.

- Average “readily available cash” is $5,948 for Gen Z, $8,594 for Millennials.

- Over half of Gen Z and Millennials say they increased their savings during the first half of 2025: 58% of Gen Z, 54% of Millennials.

- 80% of younger Americans name growing savings as their top financial priority.

- 74% of Gen Z express interest in CDs amid higher rates, though few hold them yet.

- 37% of Gen Z and 34% of Millennials definitely plan to save more over the next year.

- Younger Americans outpace older generations in savings growth in early 2025.

- A notable share reports making conscious lifestyle sacrifices to prioritize savings.

Demographic and Income Insights

- Gen Zers are earlier in their careers, which partly explains lower absolute cash reserves compared to Millennials.

- 47% of Gen Z report receiving some financial support, though this declines from 54% in 2024.

- Income growth for Gen Z has been relatively strong in early 2025, particularly in tech and higher-education fields.

- Gen Z generally reports lower net worth and fewer assets than Millennials at comparable ages, but higher engagement in investing.

- Millennial women are more likely to say they feel very confident in their investment strategy than prior cohorts.

- Younger investors in metro areas tend to adopt digital investing earlier and allocate more to ESG or tech holdings.

- Education correlates strongly; younger investors with college or graduate degrees are much more likely to invest and adopt fintech tools.

- Many younger investors cite student debt burdens and high living costs as constraints to higher allocation to investments.

Sources of Investment Information

- 58% of Gen Z and 49% of Millennials report using social media as a key source of investment news.

- YouTube tops the list (61%) as a platform for financial news/advice, followed by Facebook (58%), Instagram (49%), TikTok (44%), Twitter/X (39%), and Reddit (26%).

- 32% of younger investors cite social media as a source of investment information (vs. 18% of all investors).

- About 19% of Gen Z / Millennial investors say social media influences their actual investment decisions.

- 60% of Gen Z investors use YouTube as a primary source, and 34% rely on TikTok for market ideas.

- Nearly half of all trades by Gen Z-advised accounts are ETFs, suggesting they learn via ETF‑focused educational content.

- Reliance on financial professionals, media, and social networks each has a separate influence on crypto investment behavior.

- Friends and family remain a top channel; about 43% of U.S. adults rely on them for financial information.

Market Entry Age and Early Investment Trends

- 54% of Gen Z respondents say they began investing by age 21.

- Among Millennials, 31% began investing by 21, for Gen X, ~27%.

- 70% of Gen Z say they have been active in the market for 1–5 years.

- Nearly 50% of Gen Z trades are in ETFs.

- Roughly 30% of Gen Z begin investing by early adulthood (vs. 15% of Millennials).

- Younger generations are pushing earlier entry than prior cohorts, enabled by mobile platforms and fractional investing.

- A growing share of Gen Z and Millennials hold at least one private-market investment.

- The idea of “waiting until your 30s” is less common among Gen Z / younger Millennials.

Comparison of Cryptocurrency Investments

- 68% of crypto investors believe Bitcoin will hit $200,000 in 2025.

- 87% anticipate further investment into ETPs and spot cryptocurrencies in 2025.

- 53% of financial advisors name volatility as a top concern when advising clients on digital assets.

- Crypto adoption among retail investors continues to exceed that of older generations, though exposure percentages vary.

- Reliance on social networks/media positively correlates with crypto investing behaviors.

- Behavioral biases can weaken the translation of knowledge into action.

- Many crypto investors adopt stop-loss rules, position limits, or treat crypto as a speculative allocation only.

- The rise of crypto-inclusive ETFs appeals to younger investors seeking regulated exposure.

Frequently Asked Questions (FAQs)

~65% of Gen Z respondents plan to invest in crypto in 2025.

84% of Gen Z investors view cryptocurrency as a risky investment.

51% of Gen Z have at least one private market investment, compared to 47% of Millennials.

30% of Gen Z began investing in early adulthood, compared to 15% of Millennials.

Conclusion

Millennials and Gen Z are not just the future of investing; they are actively reshaping today’s markets. From earlier entry ages and heavy use of ETFs to social media–driven information flows and bold crypto bets, the younger cohort approaches investing with both ambition and caution. Behavioral biases, digital tools, and shifting attitudes toward advisors further complicate the picture. What remains clear, successful players in finance must adapt to generational