Imagine you’ve just made a killing trading crypto, maybe you flipped a few NFTs or cashed in on a promising altcoin. But then tax season arrives, and suddenly, you’re drowning in paperwork, trying to figure out what you owe. If this sounds familiar, you’re not alone. Cryptocurrency taxation has long been a murky area, with unclear regulations and loopholes that some traders have used to their advantage.

Enter MiCA (Markets in Crypto-Assets Regulation), a game-changing regulatory framework introduced by the European Union. Designed to bring clarity to the crypto industry, MiCA is reshaping how digital assets are classified, taxed, and reported. With its impact reaching far beyond Europe, even US-based investors and businesses are feeling the ripple effects.

Editor’s Choice

- MiCA introduces uniform crypto taxation rules across the EU, impacting over 450 million residents and thousands of businesses.

- 65% of crypto investors in the EU are unaware of new MiCA tax compliance rules, increasing the risk of penalties.

- By 2025, crypto tax reporting violations are expected to drop by 45%, thanks to MiCA’s enforcement measures.

- Government tax revenue from digital assets is projected to increase by $2.5 billion annually under MiCA‑driven policies.

- Under MiCA, 90% of centralized exchanges in the EU must modify their tax reporting systems to comply with the new rules.

- Over 75% of crypto businesses anticipate higher compliance costs due to MiCA’s stricter regulatory demands.

- Only 35% of EU crypto traders currently track their capital gains accurately, a major issue as MiCA enforces stricter audit policies.

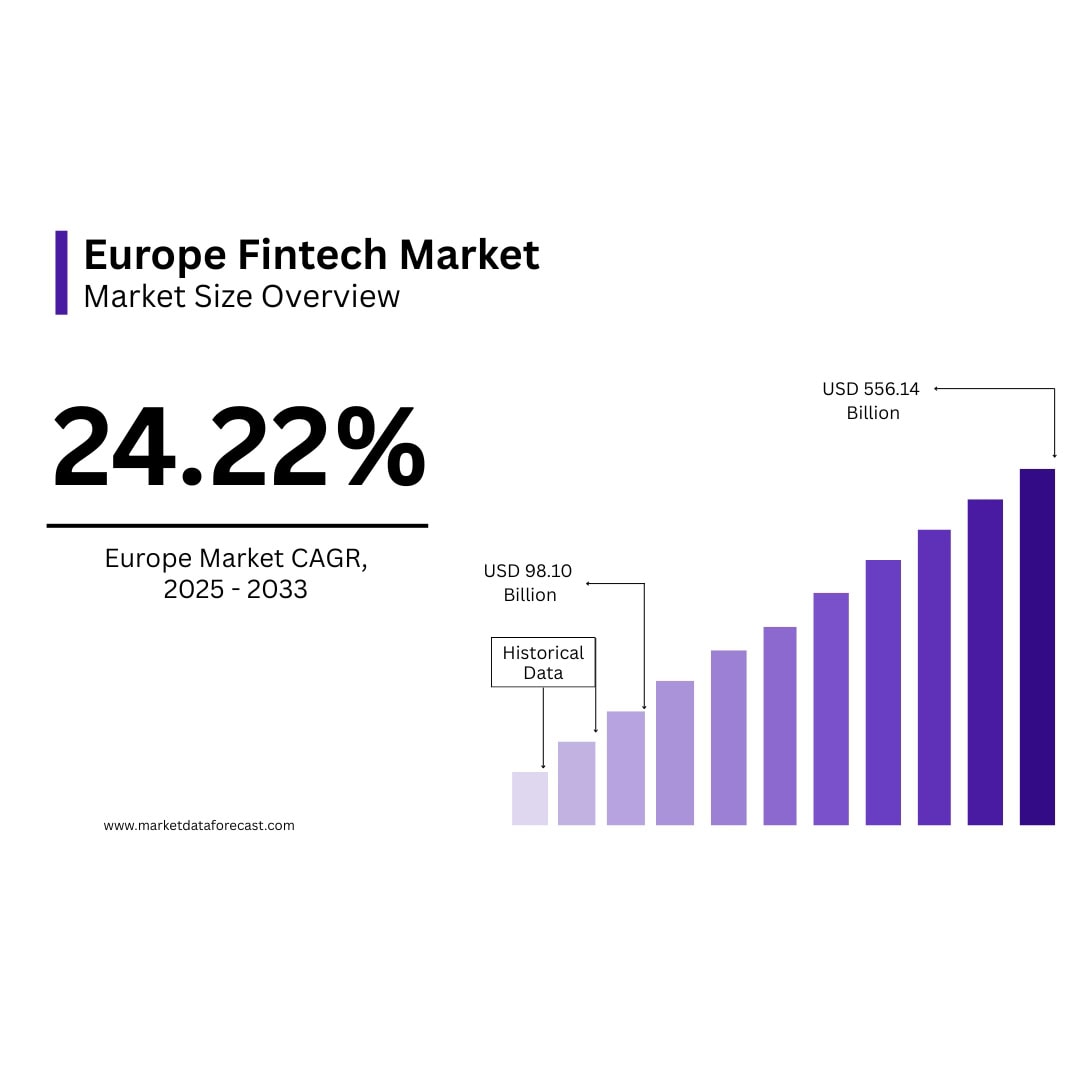

Europe Fintech Market Growth Insights

- The European fintech market is projected to expand at a CAGR of 24.22% between 2025 and 2033.

- The market size is expected to rise from $98.10 billion in 2025 to $556.14 billion by 2033.

- This represents a 5.6× increase in total market value over the 8-year forecast period.

- The rapid growth is driven by digital payment adoption, neobanking expansion, and AI-based financial services.

- Europe remains one of the fastest-growing fintech regions globally, with venture funding and regulatory alignment accelerating innovation.

Overview of MiCA (Markets in Crypto-Assets Regulation)

- MiCA now covers 27 EU member states, making it one of the most expansive crypto regulations globally.

- Over 12,000 crypto‑related businesses in the EU must comply with MiCA’s requirements.

- MiCA is expected to reduce fraudulent crypto activities by 40% by enforcing stricter transparency measures.

- 75% of EU regulators believe MiCA will significantly improve investor confidence in digital assets.

- MiCA’s tax provisions apply to over 60 million retail crypto investors across Europe.

- The legislation aims to generate at least €2 billion in additional annual tax revenue via stricter crypto income reporting.

Tax Impact Based on MiCA Classification

- Utility tokens will face an average capital gains tax of 20% depending on their use case and jurisdiction.

- 50% of European crypto investors currently hold at least one stablecoin, making MiCA’s taxation changes highly relevant.

- By 2025, transaction reporting requirements for EMTs will increase by 60% significantly impacting stablecoin issuers.

- Regulatory penalties for failing to report taxable crypto gains will increase by 30% under MiCA’s enforcement framework.

- Nearly 90% of EU-based crypto exchanges will need to modify their tax policies to comply with MiCA’s asset classification system.

- Transactions involving ARTs will require tax declarations for all gains above €10,000, affecting high-net-worth investors.

Taxonomy of Crypto‑Assets Under MiCA

- E‑Money Tokens (EMTs) are digital assets pegged 1:1 to fiat currencies, and in 2025, 80% of stablecoin flows will fall under EMT rules.

- Asset‑Referenced Tokens (ARTs) are backed by multiple fiat currencies, commodities, or other assets, and by 2025, 65% of ART issuance will require full reserve backing.

- Utility Tokens grant access to services within blockchain ecosystems, and in 2025, they face an average 20% capital gains tax under MiCA’s framework.

MiCA as Part of the Digital Finance Package

- MiCA accounts for 45% of all regulatory changes in the EU’s Digital Finance Package.

- By 2025, 60% of EU‑based fintech companies will need to update their compliance strategies due to MiCA and related regulations.

- The European Central Bank estimates crypto‑related tax evasion will drop by 50% with the implementation of the Digital Finance Package.

- Under MiCA, 95% of EU‑based stablecoin issuers will be required to maintain full tax documentation for all transactions.

- The Digital Finance Package is projected to generate an additional €4 billion in government tax revenue through enhanced oversight of digital assets.

- MiCA enforcement will involve over 200 new financial regulators across EU member states.

- More than 500 fintech firms have already started adjusting their operational frameworks to align with MiCA and the broader Digital Finance Package.

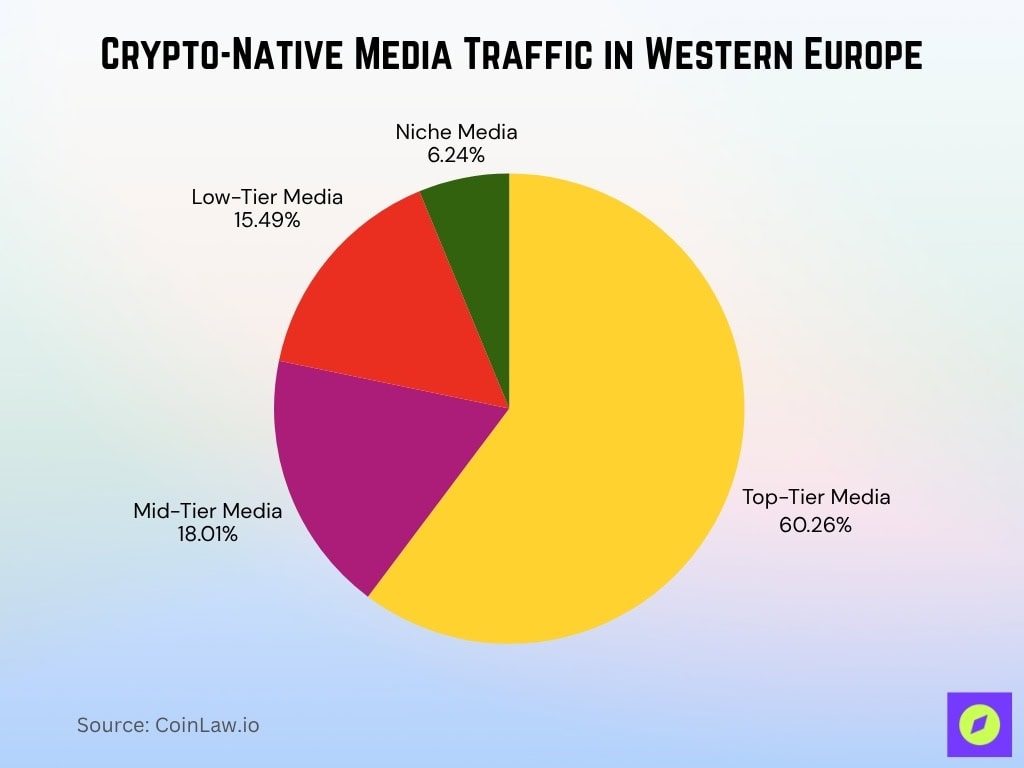

Crypto-Native Media Traffic in Western Europe

- Top-Tier Media (7 outlets with >1M visits) dominated traffic, capturing 60.26% of all crypto-native visits.

- Mid-Tier Media (6 outlets with >500K visits) accounted for 18.01% of the traffic.

- Low-Tier Media (16 outlets with >100K visits) made up 15.49% of total visits.

- Niche Media (58 outlets with <100K visits) contributed just 6.24% of the market share.

- The data excludes general, finance, and tech media with inconsistent crypto coverage, ensuring focus on crypto-native ecosystems.

Key Crypto Taxation Policies Affected by MiCA

- 95% of EU crypto transactions will be subject to capital gains tax once MiCA is fully implemented.

- By 2026, 70% of crypto‑related tax loopholes will be closed, reducing tax avoidance opportunities.

- The EU expects a 45% increase in crypto tax compliance rates thanks to MiCA’s strict reporting requirements.

- More than €3.8 billion in undeclared crypto earnings were reported across the EU in 2024, highlighting the need for regulation.

- Over 65% of European crypto traders will experience new tax obligations under MiCA’s classification system.

- The average tax rate on long‑term crypto holdings in the EU is set to increase from 15% to 22% due to MiCA’s stricter capital gains policies.

- By 2027, EU governments expect to collect an additional €2 billion annually from previously unreported crypto gains.

Changes in Crypto Tax Reporting Requirements

- All crypto transactions above €1,000 must be reported to tax authorities, affecting more than 45% of active traders.

- 60% of crypto investors in the EU admit they have never reported crypto taxes, a habit MiCA aims to eliminate.

- New tax filing tools for crypto traders will see a 55% increase in adoption as compliance becomes mandatory.

- Centralized exchanges must now provide real‑time reporting on user transactions affecting over 90% of EU‑based trading platforms.

- EU citizens who fail to report crypto gains could face penalties of up to €5,000, a 50% increase from previous fines.

- By 2026, tax audits on crypto investments will increase by 70% ensuring compliance with MiCA’s new guidelines.

- More than 75% of businesses dealing in crypto will need to update their accounting and reporting systems to align with MiCA.

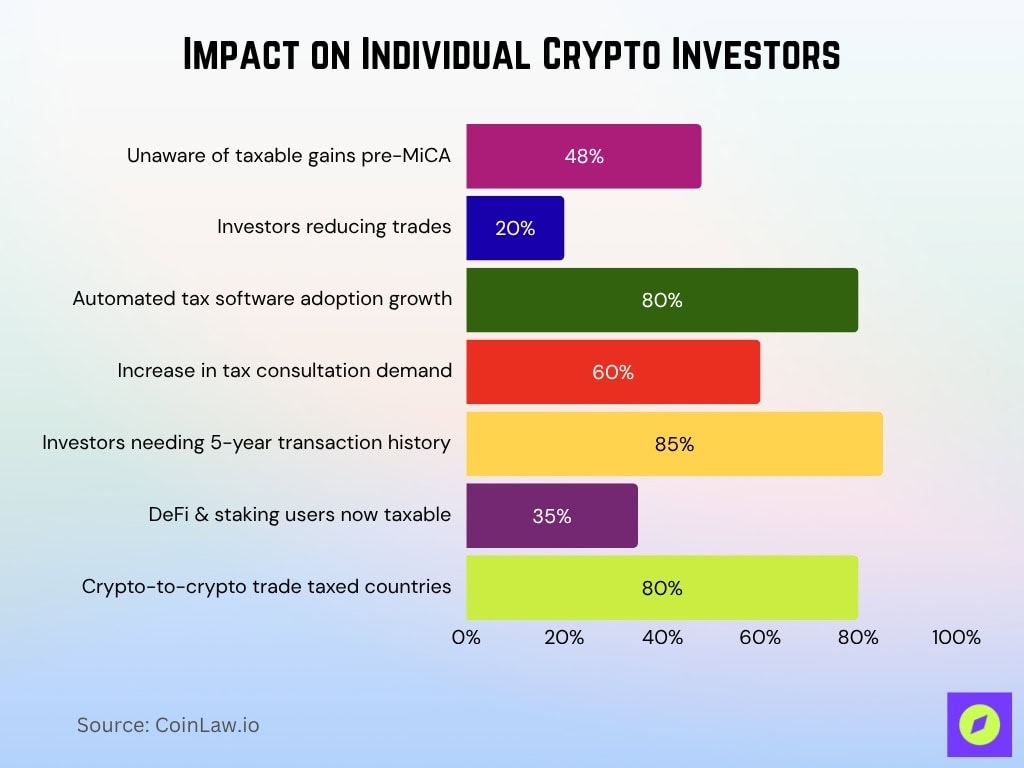

Impact on Individual Crypto Investors

- 48% of crypto investors in the EU were unaware of taxable crypto gains prior to MiCA, driving a surge in demand for tax advisory services.

- 20% of investors are expected to reduce their trading activity, fearing higher taxation under MiCA’s new policies.

- By 2025, automated crypto tax software usage will increase by 80% as investors seek to simplify tax filing.

- The number of EU‑based investors seeking tax consultation services has increased by 60% since MiCA’s announcement.

- 85% of crypto investors will need to provide transaction histories spanning up to five years to comply with MiCA regulations.

- Under MiCA, staking rewards and DeFi earnings are now taxable, affecting an estimated 35% of active crypto users.

- Crypto‑to‑crypto trades (e.g., swapping BTC for ETH) will be subject to taxation in 80% of EU countries, significantly impacting trading strategies.

Effect on Businesses and Crypto Exchanges

- 90% of crypto exchanges operating in the EU must modify their tax infrastructure to comply with MiCA.

- EU‑based exchanges have reported a 40% increase in compliance costs due to MiCA’s reporting requirements.

- By 2026, 60% of crypto exchanges will need to hire specialized tax compliance teams, further increasing operational expenses.

- More than 50% of DeFi platforms are expected to introduce KYC and tax compliance measures aligning with MiCA.

- EU regulators anticipate a 30% increase in business tax revenue from crypto exchanges thanks to improved tax tracking.

- MiCA mandates that all exchanges maintain transaction records for at least 10 years, affecting over 5,000 crypto service providers.

- 85% of businesses in the crypto sector believe MiCA’s regulations will lead to industry consolidation, favoring larger, compliant firms over smaller ones.

Comparison of Pre‑MiCA and Post‑MiCA Taxation Statistics

- Before MiCA, over 40% of EU crypto traders did not report their taxable crypto gains, and now compliance has increased by 55%.

- Tax evasion related to crypto was estimated at €10 billion annually before MiCA, and this figure is expected to drop by 60% by 2026.

- Only 35% of EU tax authorities had the infrastructure to track crypto transactions pre‑MiCA, and now over 80% have access to advanced tracking tools.

- In 2024, just 25% of European crypto businesses fully complied with tax laws, and by 2025, that number is projected to rise to 85%.

- Under MiCA, taxable events such as staking rewards, DeFi earnings, and airdrops are now clearly defined, impacting over 3 million investors.

- Before, MiCA tax audits on crypto investors were rare, and under the new rules, audits will increase by 70% by 2026.

- MiCA eliminates country‑specific tax loopholes, which previously led to €4.2 billion in uncollected taxes annually across the EU.

Government Revenue Changes Due to MiCA Regulations

- EU governments expect an additional €5 billion in annual tax revenue from previously untaxed crypto gains.

- By 2026, digital asset taxation will contribute 3.5% of total tax revenue in some EU countries.

- Tax penalties for non‑compliance have increased by 40% under MiCA, generating €600 million in additional government revenue annually.

- MiCA requires exchanges to automatically report tax data to authorities, leading to a 50% increase in reported crypto earnings.

- Governments are investing €2 billion in blockchain analytics tools to monitor tax compliance more efficiently.

- Countries like Germany and France are already reporting a 30% increase in crypto tax revenues thanks to MiCA‑driven enforcement.

- By 2027, more than 90% of taxable crypto transactions will be accurately reported, reducing tax fraud significantly.

Recent Developments in MiCA and Crypto Taxation

- The European Commission is preparing a second phase of MiCA, which may introduce taxation on NFTs and advanced DeFi protocols, expanding the taxable base.

- More than 25 EU‑based crypto firms have proposed amendments to MiCA, pushing for more flexible tax policies on staking and lending.

- EU regulators are collaborating with the OECD to align MiCA’s tax framework with global crypto taxation standards such as CARF and DAC8.

- An estimated 20% of EU crypto startups are lobbying for tax incentives to support blockchain innovation under MiCA compliance.

- MiCA’s framework is influencing crypto tax laws globally, with countries like Switzerland, Canada, and Japan exploring similar regulations.

- By 2025, regulators plan to introduce a public blockchain‑based tax ledger, enabling authorities to monitor tax compliance transparently.

Frequently Asked Questions (FAQs)

75 % of Europe’s 3,167 VASPs are expected to lose registration status by June 2025.

They have increased approximately 6× (from ~€10,000 to ~€60,000).

Violations are expected to drop by 40% by 2025.

An additional $2.2 billion annually is projected under MiCA’s policies.

Conclusion

MiCA is reshaping how crypto taxation works across Europe and beyond. By standardizing crypto asset classification, taxation policies, and reporting requirements, the regulation is closing tax loopholes and ensuring fairer taxation in the industry.

While compliance remains a challenge, the long-term benefits include higher government tax revenues, reduced fraud, and improved regulatory clarity for investors and businesses alike. As MiCA continues to evolve, its impact will extend far beyond Europe, influencing global crypto tax policies for years to come.