In the evolving world of crypto exchanges, MEXC has positioned itself as a major player with global relevance. Its strategy, focused on fast listings, zero-fee trading, and high liquidity, has significantly impacted market share and user acquisition. Real-world applications, such as its rapid response to trending tokens and high-frequency listing approach, have made it a go-to exchange for traders seeking agility. Industry collaborations and its expanding ecosystem initiatives show MEXC is no longer just a trading platform, but a full-service crypto infrastructure provider. Explore this data-rich breakdown to understand the full scale of MEXC’s growth, influence, and today’s performance.

Editor’s Choice

- MEXC’s global user base surpassed 36 million in 2025, growing significantly from the prior year.

- Spot trading volume reached $150.4 billion in July 2025, marking a 61.8% month-over-month increase.

- Based on MEXC’s disclosures and third-party data, MEXC reportedly held a 13.06% global market share in Q1 2025, placing it behind Binance.

- Over 3,000 assets are listed on MEXC, with 2,908 spot pairs and 1,136 futures pairs by April 2025.

- MEXC’s insurance fund reached $559 million in 2025, according to platform statements; however, independent audits confirming the figure are not publicly accessible.

- MEXC’s Proof of Reserves dashboard indicated a 129.85% BTC reserve ratio in August 2025, with publicly viewable wallet addresses for partial verification.

- MEXC launched a $300 million Ecosystem Fund and $30 million IgniteX CSR initiative in 2025.

Recent Developments

- MEXC introduced 0-fee trading for 100 futures pairs in Q2 2025.

- Trading campaigns with TON, Solana, and Story Network drew over $6.6 billion in volume.

- MEXC’s user base crossed 36 million, with 2,000+ employees globally.

- The TON Triumph campaign resulted in a record-setting 110,000+ participants.

- MEXC expanded its Proof of Reserves dashboard, showing detailed coin-by-coin ratios.

- Launched multi-language support for over 15 new global regions.

- Unveiled a revised UI/UX update on web and mobile platforms for faster trade execution.

- Hosted Solana Eco Month, featuring zero fees and a $1M prize pool.

- Added real-time insurance fund tracking to improve transparency.

- Released bi-monthly security reports detailing anti-fraud measures.

Spot/Derivative Volume Shares

- HTX led the market with the largest spot share increase of 4.98%, pushing its spot ratio close to 46%.

- MEXC recorded a modest 0.76% growth in spot share, maintaining a roughly 20% spot / 80% derivatives balance.

- Bitget grew its spot share by 0.39%, holding about 17% spot share overall.

- Bybit gained 0.30% spot growth, but still leaned heavily toward derivatives with an 86% share.

- Binance stayed stable with only a 0.03% increase in spot share, showing the lowest volatility in ratio changes.

- OKX posted a 0.35% rise in spot share, sitting at about 23% spot.

- BingX improved by 0.47%, but its market was still 88% derivatives-driven.

- KuCoin boosted its derivative dominance with a 1.75% increase, keeping spot at around 32%.

- Gate saw the largest shift toward derivatives, with a 17.79% surge, leaving spot at just 27%.

MEXC Overview

- Founded in 2018, MEXC has grown into a top 5 crypto exchange by trading volume.

- Operates in 170+ countries, with strong traction in Southeast Asia, Europe, and LATAM.

- Offers spot, futures, margin trading, staking, launchpads, and more.

- Known for the fastest listing speed in the industry, averaging 1–3 days from project application.

- Offers high liquidity depth, especially on emerging tokens.

- Supports API and trading bots, used by professional and institutional traders.

- Implements AI-powered risk controls for margin and futures trading.

- Prioritizes security, using cold storage, 2FA, and reserve audits.

- Operates under regulatory guidance in select regions to expand legitimacy.

Global User Statistics

- According to MEXC’s internal data, the platform surpassed 36 million users globally in 2025.

- The majority of growth came from Asia-Pacific (42%), Europe (27%), and LATAM (15%).

- MEXC supports over 15 languages, with a strong presence in Vietnam, Turkey, Russia, and Brazil.

- Over 4 million new users were onboarded in Q2 2025 alone.

- Active daily users reached 4.2 million, with peak times aligning to U.S. and SEA hours.

- Over 65% of users engage via mobile, driven by enhanced app functionality.

- More than 70% of users participate in both spot and futures markets.

- MEXC stated that KYC compliance among users rose to 83% in 2025.

- Referral programs account for 22% of new sign-ups.

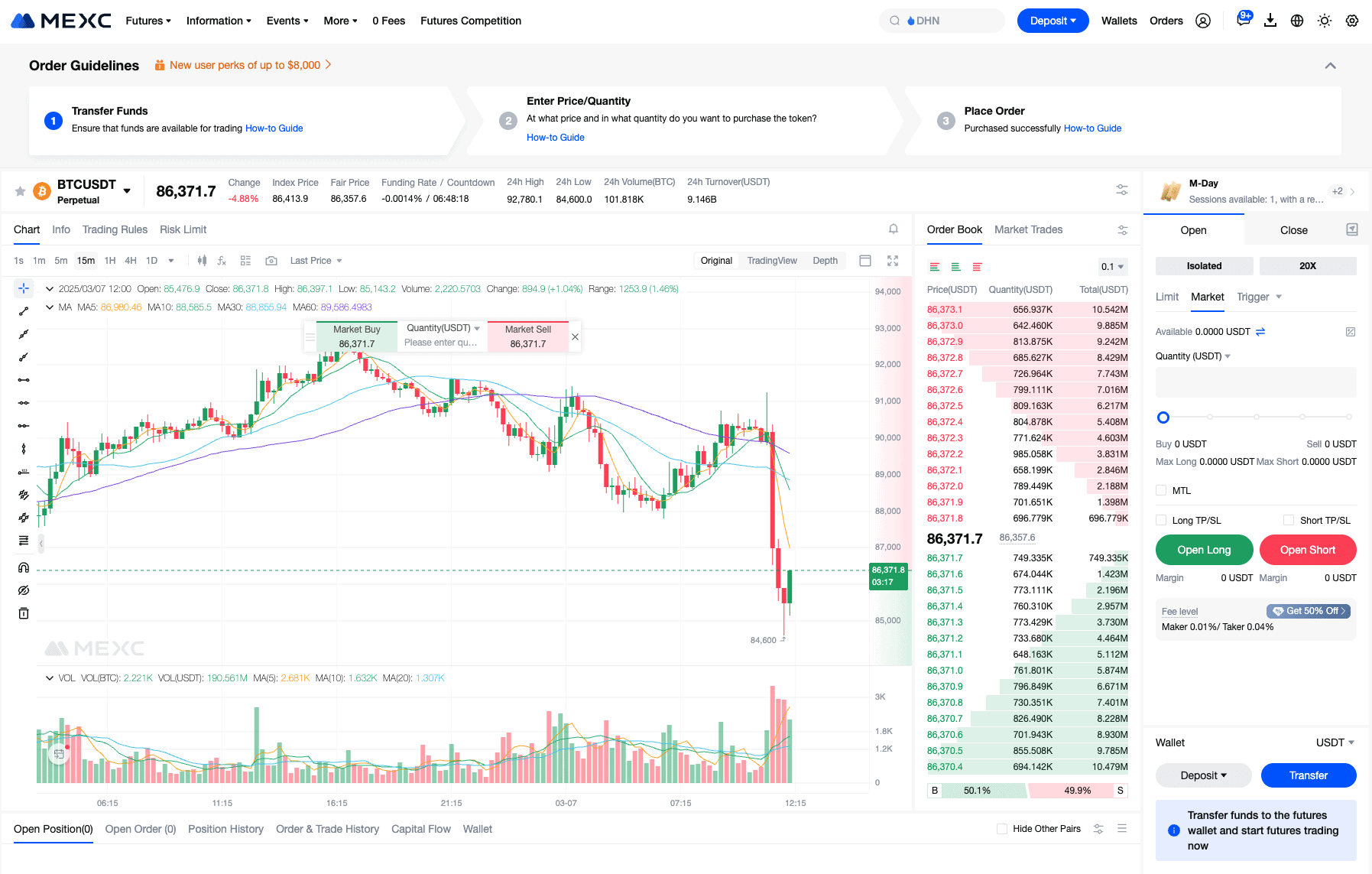

BTC/USDT Futures Snapshot on MEXC

- The last traded price of BTC/USDT futures was 86,371.7 USDT.

- The pair saw a 24h drop of -4.88%, reflecting strong bearish pressure.

- The 24h high reached 92,780.1 USDT, while the 24h low dipped to 84,600.0 USDT.

- The 24h trading volume was 84,600 BTC, with a turnover of 9.146B USDT.

- The funding rate stood at -0.0014%, signaling short-side dominance.

- The index price was 86,413.9 USDT, nearly aligned with the fair price of 86,371.6 USDT.

- The order book showed strong liquidity, with sell walls above 86,373 USDT and buy support clustering near 86,371 USDT.

Spot Trading Data

- Spot trading volume reached $150.4 billion in July 2025, a 61.8% MoM increase.

- Daily average spot volume stood at $5 billion+, up from $3.2 billion in 2024.

- As of July 2025, MEXC reportedly held the #2 spot market share position with 8.6%.

- Top spot pairs include BTC/USDT, ETH/USDT, TON/USDC, and SUI/USDC.

- Zero-fee spot campaigns boosted trading volume by 42% in promoted pairs.

- Spot slippage was less than 0.01% on the top 50 pairs, indicating strong liquidity.

- MEXC added 200+ new spot tokens in the first half of 2025.

- Peak single-day volume hit $9.4 billion during the TON campaign.

- Over 50% of trades come from professional accounts and APIs.

Futures Trading Data

- MEXC processes over $25.3 billion in daily futures volume.

- Futures open interest sits at $8.75 billion, indicating deep market participation.

- MEXC offers 1,200+ futures trading pairs, the most in the industry.

- Offers up to 200x leverage on select contracts.

- Zero-fee futures events were run for 140+ tokens in Q2 and Q3.

- Popular pairs include ETH/USDT, TON/USDC, SUI/USDC, and ARB/USDC.

- Over 65% of user activity now involves futures markets.

- Funding rate stabilization features were added in 2025.

- Institutional clients increased by 42% YoY in the futures segment.

- Mobile futures trading adoption rose by 38% in H1 2025.

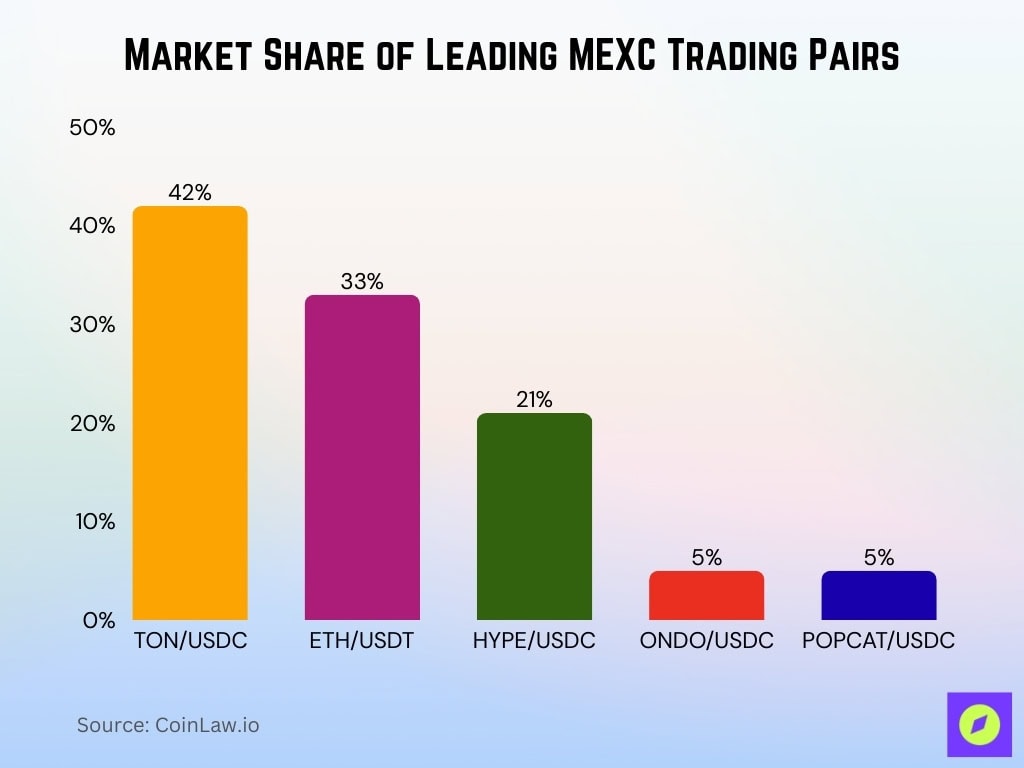

Most Popular Trading Pairs

- In Q2 2025, MEXC’s zero-fee promotions boosted several futures pairs dramatically. TON/USDC captured a 42% market share, ETH/USDT held 33%, HYPE/USDC reached 21%, ONDO/USDC and POPCAT/USDC each held 5%.

- Futures volume surged on SUI/USDC (up 147%), CRV/USDC (up 129%), HBAR/USDC (up 125%), ARB/USDC (up 59%), and ETH/USDT (up 58%) during Q2.

- ETH/USDT leads in both spot and futures liquidity, consistently among the top-traded pairs.

- Zero-fee campaigns encompassed 100 tokens, significantly drawing trader attention.

- Spot markets reflect mainstream volume concentration on BTC/USDT, ETH/USDT, and other major pairs.

- Amid these promotions, emerging pairs like SUI and TON outperformed expectations in quarter-on-quarter adoption.

- The strategy indicates MEXC’s ability to align listing strategy with demand narratives.

- Zero-fee incentives helped elevate both trading volume and pair diversity.

Listed Assets Count

- As of early 2025, MEXC had listed over 3,000 assets.

- By April 16, 2025, MEXC offered 2,908 spot trading pairs and 1,136 futures pairs.

- MEXC led the industry in the fastest listing speed, particularly between November 2024 and February 2025.

- MEXC strategically listed early innovators in bull-market narratives.

- Listing coverage spans memecoins, DeFi tokens, NFTs, and popular altcoins.

- The exchange continues bi-weekly high-frequency listing cycles to stay trend-responsive.

- Rapid listing capability underscores their adaptability and operational efficiency.

Supported Cryptocurrencies

- MEXC supports over 2,800 coins and tokens in total.

- These cover a broad spectrum: top caps like Bitcoin and Ethereum, plus a range of niche and emerging projects across DeFi, NFTs, and memecoins.

- The futures segment offers support across USDT-margined, coin-margined, DeFi, metaverse, layer-2, NFT, and meme sectors.

- Large listing volume gives traders access to wide diversification and early-stage assets.

- Listing pace ensures coverage of trending narratives and quick capitalisation on sector interest.

- Global accessibility emphasizes inclusion across geographies and token categories.

CEX Market Volume Share

- Binance dominated the market with a massive 41.68% share, reinforcing its position as the leading exchange.

- OKX secured the second spot with 16.19%, highlighting its strong global presence.

- Bybit followed closely with 12.50%, showing steady growth in derivatives-driven trading.

- Bitget captured 10.28%, reflecting its rising popularity among futures traders.

- MEXC Global held 4.10%, benefiting from its aggressive listing and zero-fee campaigns.

- Gate.io contributed 2.44%, maintaining its relevance in niche markets.

- Crypto.com accounted for 2.40%, driven by its retail-focused ecosystem.

- Other smaller exchanges collectively represented about 10.41%, indicating a fragmented but competitive market beyond the top players.

Trading Volume Statistics

- MEXC’s spot trading volume hit $150.4 billion in July 2025, up 61.8% MoM from $93 billion in June.

- In Q2 2025, spot volume reached $346.2 billion, a 3.7% increase over Q1’s $334 billion.

- YoY spot volume rose 143%, and futures surged 118%.

- Global market share climbed from 2.4% in 2023 to 13.06% in Q1 2025.

- Average futures daily volume exceeds $24 billion.

- Daily futures volume can reach $25.3 billion.

- Combined, spot and futures volumes reflect steadily rising transaction activity, underpinned by strategic zero-fee and listing campaigns.

Exchange Liquidity Metrics

- Futures liquidity is deep, across ±5 basis points. MEXC holds ~82 million USDT, outpacing a top-3 rival’s ~31 million USDT by ~2.6×.

- Trust score remains 10/10 on CoinGecko for spot liquidity reliability.

- Reserve ratios exceed 100% across major assets, underscoring strong backing.

- Open interest in futures markets (~$8.75 billion) complements the large volume figures, reflecting deep market engagement.

- Deep liquidity across spot and derivative markets ensures smooth trade execution and tight spreads.

- Continuous asset reserve additions (approximately $389 million between Feb–Apr 2025) reinforce financial stability.

Fee Structure Statistics

- Spot trading typically charges 0.05% taker, with 0% maker fees occasionally during promotions.

- For futures: 0.00% maker and 0.02% taker, among the lowest in the industry.

- Over 140 futures pairs had 0 maker and 0 taker fees during the “0‑Fee Fest” as of July 8, 2025.

- Zero-fee campaigns extended across both spot and futures assets, notably on trending stablecoin and DeFi pairs.

- These discounts reinforce MEXC’s value proposition versus competitors charging 2.25×–3× higher rates.

- Fee structure significantly enhances cost-efficiency for traders, especially high-volume or leveraged participants.

Proof of Reserves Data

- MEXC maintains a 1:1 reserve ratio, meaning the platform holds at least as many of each asset as users, ensuring full backing and transparency.

- As of April 2025, reserve ratios stood at USDT 115.23%, USDC 106.36%, BTC 117.53%, ETH 109.92%, demonstrating consistent over-collateralization.

- In June 2025, Bitcoin reserve coverage increased to 127.59%, with holdings of 4,083.89 BTC, 69,234 ETH, 2.32B USDT, and 72.36M USDC.

- By August 2025, reserves remained strong, BTC at 129.85%, ETH at 104.05%, USDT at 113.23%, and USDC at 105.74%.

- The audits are conducted bi-monthly, with data publicly disclosed for independent verification.

- MEXC’s Proof of Reserves page shows over $2.66 billion in stablecoins (USDT + USDC), with some on-chain wallet addresses supporting these figures.

- MEXC’s approach enables users to confirm holdings via blockchain address transparency independently.

Insurance Fund Statistics

- As of late 2025, the insurance fund had grown to a record $559 million USDT, the highest level reported to date.

- This fund acts as a buffer against extreme market volatility and ensures protection against negative balances.

- Up to June 30, 2025, over $559 million had been paid out from the Futures Insurance Fund to compensate traders, reinforcing market stability.

- MEXC’s fund outpaces many competitors, bolstering user confidence in its risk management infrastructure.

- The growing size of the fund indicates active reinvestment and strong financial resilience.

- Clear and consistent reporting of fund status contributes to the platform’s reputation for transparency.

Ecosystem Development Initiatives

- MEXC Ventures unveiled a $300 million Ecosystem Development Fund at Token2049 Dubai in May 2025, planned to span five years.

- The fund targets innovation across public chains, stablecoins, wallets, media platforms, and crypto infrastructure.

- In parallel, MEXC launched the IgniteX CSR program, a $30 million, five-year initiative focused on nurturing early-stage Web3 startups and talent.

- The MEXC Foundation, formally launched in April 2025, consolidates CSR efforts under three pillars: Education, Empowerment, and Community Giving.

- These initiatives reflect MEXC’s shift from being purely an exchange to a comprehensive ecosystem builder.

- IgniteX supports Web3, AI × blockchain projects, and infrastructure, and aligns with broader strategic growth.

- Ecosystem investment signals long-term commitment to blockchain adoption and innovation.

Community and CSR Initiatives

- The MEXC Foundation’s $30 million CSR program aims to bridge education gaps, support underrepresented communities, and foster inclusive Web3 adoption.

- Through Education, Empowerment, and Community Giving, MEXC funds learning opportunities, mentorships, and global outreach programs.

- IgniteX specifically targets early-stage infrastructure and Web3 project support, strengthening developer and startup ecosystems.

- These initiatives position MEXC as a leader in responsible and inclusive corporate action in crypto.

- By focusing on long-term ecosystem health rather than short-term gain, MEXC sets a CSR benchmark in the industry.

- The Foundation’s global scope underscores MEXC’s commitment to practical, measurable social impact.

Industry Partnerships & Collaborations

- MEXC partnered with Story Network (IP) to launch a $1 million prize pool campaign, offering zero fees on IP trading and up to 400% APR staking in August 2025.

- The successful TON Triumph campaign with The Open Network (TON) featured a $1 million reward pool, waived trading fees on TON pairs, and staking yields up to 100× standard yields.

- The $1 million TON campaign generated over $6.6 billion in combined trading volume and drew 110,000+ participants, a record-setting promotional performance.

- MEXC also partnered with Solana for the Solana Eco Month, a month-long campaign featuring a $1 million prize pool, zero-fee SOL trading, staking APRs up to 13%, and airdrops.

- At Solana Summit APAC 2025, MEXC served as a major sponsor, reinforcing its strategic ties with the Solana ecosystem.

- MEXC maintains a broad network of trusted partners, including crypto platforms, media, and ecosystem players.

- These relationships power MEXC’s promotional campaigns and deepen its market integration.

Year-on-Year Growth Figures

- In Q1 2025, spot trading volume grew 143% YoY, while futures trading jumped 118% YoY.

- Market share climbed from 2.4% in 2023 to 13.06% in Q1 2025, reflecting a steep rise in platform usage.

- The user base expanded to 36 million globally, up significantly from previous years.

- Employee count also doubled to 2,000+, signaling internal growth.

- The ecosystem development fund ($300 million) and IgniteX CSR program ($30 million) highlight strategic reinvestment in future growth.

- Reserve backing also grew markedly, from April’s 117–115% levels to August’s 130%+ region, strengthening financial resilience.

- The insurance fund ballooned to $559 million, reinforcing trust and protection.

Conclusion

MEXC’s performance demonstrates a firm blend of rapid growth and strategic resilience. From maintaining over-collateralized reserves and a record-sized insurance fund to committing more than $330 million to ecosystem and CSR initiatives, the platform showcases both financial strength and community responsibility. Its standout promotions and deep partnerships, from TON to Solana, reflect agility in engaging new audiences and reinforcing industry ties. Supported by double-digit YoY growth, a growing global user base, and expanded liquidity, MEXC is redefining what it means to be a crypto exchange, evolving into a builder of ecosystems, trusted institutions, and sustainable innovation.