Insurance fraud remains a hidden but mounting financial burden, costing consumers and businesses hundreds of billions annually. Its impact spans sectors, from costly auto claims to sprawling health scams, eroding trust and spiking premiums. The stakes are higher and more complex. Explore how evolving fraud schemes shape the industry, and what steps can protect both policyholders and insurers.

Editor’s Choice

- Total U.S. insurance fraud losses may reach up to $308.6 billion annually, though this figure includes both hard and soft fraud and is not based on audited totals.

- Global insurance fraud losses are estimated to exceed $1 trillion annually.

- While some sectors report fraud rates approaching 10%, industry-wide suspicious insurance payouts are generally estimated to be closer to 2–10%, depending on the line of business and jurisdiction.

- Health insurance fraud accounts for $68 billion of U.S. losses in 2023.

- Auto insurance fraud rose 19% worldwide in 2023, driven by staged accidents.

- Workers’ compensation fraud is estimated to cost U.S. insurers between $32 and $44 billion annually, though precise national figures are difficult to verify due to varying state-level reporting and definitions of fraud.

- The global fraud detection market is growing fast, expected to reach $9.05 billion in 2025.

Recent Developments

- 324 individuals, including medical professionals, were charged in the 2025 national health care fraud takedown, with an alleged fraud amount exceeding $14.6 billion.

- The Department of Justice exposed Operation Gold Rush, a Medicare scam involving $10.6 billion in fraudulent billing for unnecessary equipment.

- Property & Casualty fraud alone costs insurers around $50 billion annually.

- The Affordable Care Act marketplace may include 1 to 6.4 million potentially fraudulent enrollments, depending on assumptions and methods.

- Fraudulent Medicaid coverage in New York may cost the state as much as $20 billion yearly, according to one report.

- Insurers face creative schemes, like the “bear suit” staged crash ruse, costing claims investigators $141,839 in one case.

- Law enforcement used AI and data fusion centers to counter sophisticated fraud rings revealed in Operation Gold Rush.

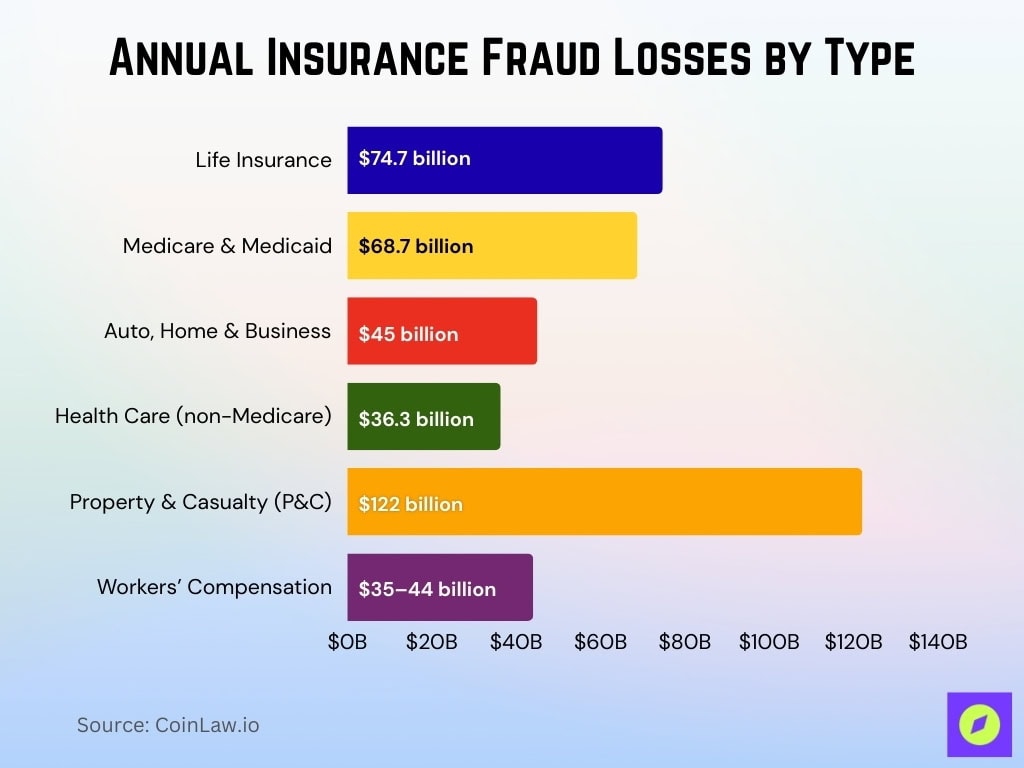

Insurance Fraud by Type

- Life insurance leads with $74.7 billion in annual fraud losses.

- Medicare and Medicaid fraud cost around $68.7 billion annually.

- Auto, home, and business insurance together bring $45 billion in annual fraud.

- Health care fraud (non‑Medicare) clocks in at $36.3 billion per year.

- Property & Casualty (P&C) fraud accounts for 10% of industry losses, or $122 billion annually.

- Workers’ compensation fraud totals between $35 billion and $44 billion annually.

Auto Insurance Fraud Statistics

- Auto fraud jumped 19% worldwide in 2023, driven by staged accidents.

- U.S. auto insurance rate increases slowed to 10% in 2024, down from 15% in 2023, but rates are still up 35% since January 2022.

- Direct written premiums in auto insurance rose 13.6% in 2024, slightly less than the 14% growth seen in 2023.

- Staged crashes, like the “bear suit” incident, have cost insurers substantial payouts and fraud investigations.

- The prevalence of fraud contributes to higher premiums and slower processing for all drivers.

- Florida leads staged-crash incidents due to its no-fault PIP structure.

- At least 15 states and DC have enacted specific laws targeting organized auto fraud networks.

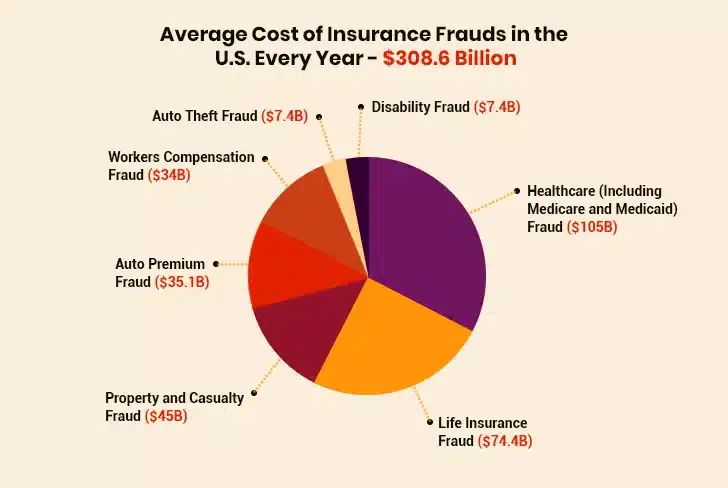

Average Cost of Insurance Frauds in the U.S.

- Healthcare fraud (including Medicare & Medicaid) is the largest category, costing about $105 billion annually.

- Life insurance fraud follows, with losses of around $74.4 billion each year.

- Property and casualty fraud contributes $45 billion in annual costs.

- Auto premium fraud accounts for approximately $35.1 billion per year.

- Workers’ compensation fraud adds another $34 billion annually.

- Auto theft fraud results in losses of $7.4 billion per year.

- Disability fraud also costs about $7.4 billion annually.

- Overall, insurance fraud drains an estimated $308.6 billion every year from the U.S. economy.

Health Insurance Fraud Statistics

- The 2025 National Health Care Fraud Takedown charged 324 defendants, including 96 licensed medical professionals, over schemes involving $14.6 billion in intended loss.

- CMS prevented over $4 billion in fraudulent Medicare and Medicaid payments, and authorities seized $245 million in assets such as cash, luxury vehicles, and cryptocurrency.

- “Operation Gold Rush” exposed a scheme targeting Medicare worth $10.6 billion, impacting over one million Americans and hiding through fake medical supply firms. Authorities intercepted over 99% of Medicare payments, but supplemental insurers still paid out around $1 billion.

- DOJ’s false claims settlements (Jan–May 2025) hit $1.257 billion, largely from healthcare fraud cases.

- Reports estimate healthcare fraud alone costs taxpayers up to $125 billion annually, considering that Medicare and Medicaid account for 24% of the federal budget.

- A conservative estimate of annual U.S. healthcare fraud ranges from 3% to 10% of total healthcare expenditures, a potential loss in the tens to hundreds of billions.

- Healthcare fraud recovery showed high returns; every $1 spent on fraud prevention can yield $3.35 in recoveries.

Property and Casualty Fraud

- U.S. insurers lose approximately $45 billion per year to property and casualty (P&C) fraud.

- About 10% of P&C insurance claims are fraudulent, making up around $122 billion in losses industry‑wide.

- Reports show a 16% rise in staged fires and theft claims in 2023 compared to the previous year.

- Inflated property damage claims account for 35% of detected P&C fraud cases.

- Fake repair invoices appeared in 22% of reviewed property insurance claims.

- Fraudulent renters’ insurance claims climbed by 11%, often tied to fabricated thefts.

- Staged vehicle accidents numbered over 15,000 globally, resulting in $2.6 billion in losses.

- Drone technology helped detect $1 billion worth of fraudulent property damage claims in 2023.

Techniques Used by Insurers to Detect Fraudulent Claims

- Business rules remain the foundation of fraud detection, applied by 100% of insurers.

- Automated red flag systems are equally widespread, with 100% adoption across insurers.

- Predictive modelling is gaining strong traction, used by 75% of insurers to identify suspicious patterns.

- Data visualization tools are employed by 25% of insurers to enhance fraud detection efforts.

- Social media analytics are also leveraged by 25% of insurers, showing an emerging but limited role in investigations.

Life Insurance Fraud

- Life insurance fraud costs are estimated at $74.7 billion annually.

- This figure places life insurance at the top of insurance fraud losses by category.

Workers’ Compensation Fraud

- U.S. insurers face between $34 billion and $44 billion in annual losses from workers’ compensation fraud.

- Fraud includes $9 billion in premium fraud and $25 billion in claims fraud.

- Such fraud contributes to escalated business insurance costs and stricter claim reviews.

Demographic Trends in Insurance Fraud

- Specific demographic data for 2025 is sparse. However, soft fraud, like inflating claims or misreporting health info, is more prevalent among retail customers, while hard fraud, such as staged accidents or fake death claims, often involves organized rings.

- Policyholders lying on applications to lower premiums contribute to $35.1 billion in fraud annually.

- Medicare fraud schemes often exploit vulnerable populations who are less likely to report misuse.

Geographic Trends in Insurance Fraud

- Florida sees especially high levels of staged-auto fraud, partly driven by its no-fault insurance structure.

- The widespread nature of medical supply and telehealth fraud means these schemes affect multiple states across regional lines.

- Internationally, “Operation Gold Rush” revealed fraud rings involving actors from Estonia, Kazakhstan, and Russia targeting U.S. Medicare.

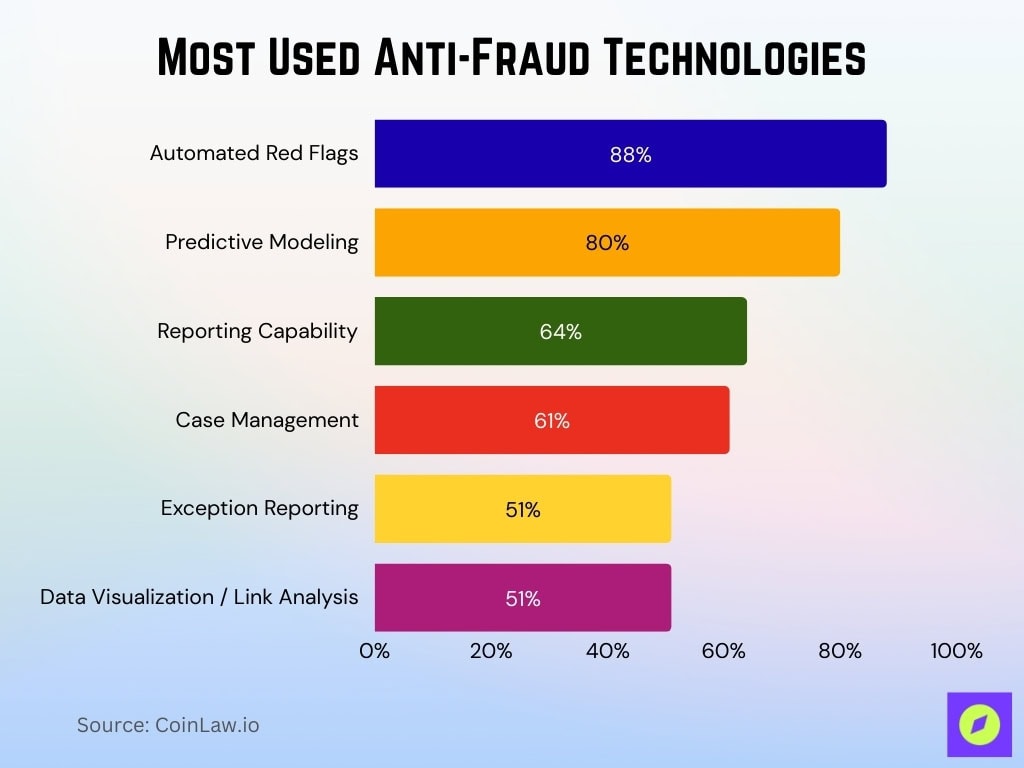

Most Used Anti-Fraud Technologies

- Automated red flags are the leading tool, adopted by 88% of insurers, to spot suspicious activity quickly.

- Predictive modeling is widely implemented, used by 80% of insurers to forecast and identify fraud risks.

- Reporting capabilities support fraud detection in 64% of organizations, ensuring transparency and tracking.

- Case management systems are applied by 61% of insurers to streamline investigations.

- Exception reporting is leveraged by 51% of insurers to flag irregular claims.

- Data visualization and link analysis are also used by 51% of insurers, providing deeper insights into fraud patterns.

Common Fraud Schemes and Methods

- “Padding” remains widespread; policyholders inflate legitimate claims by exaggerating damages.

- Some applicants misrepresent facts on applications, income, usage, or history, to get lower premiums.

- Staged accidents, especially in auto, are common; fraud rings prey on schemes like phantom rear-ends.

- Premium diversion occurs when agents or brokers pocket payments instead of forwarding them to insurers.

- Producers may sell insurance without a license or collect premiums while denying legitimate claims.

- Synthetic identity fraud now accounts for $30 billion in life insurance losses.

- Applicant misrepresentation, elder financial abuse, and data misuse have risen in life fraud cases.

Emerging Trends and New Fraud Tactics

- Deepfake and impersonation fraud now drives roughly 82% of fraud attempts, making detection harder.

- Synthetic voice schemes surged; 2024 saw a 475% increase in voice-based fraud, raising rates by 19%.

- Account takeover (ATO) threats are accelerating through mobile wallets, P2P apps, and crypto platforms.

- Though fading, “pig butchering” crypto scams persist but are declining as awareness grows.

- A global rise in cyber-scam losses continues, driven by coordinated threat actors.

- Emerging Aadhaar-based identity fraud in India shows how ID systems can be compromised.

Fraud Detection and Prevention Technologies

- The market for fraud detection tools is rising, from $7.5 billion in 2024 to $9.05 billion in 2025.

- Projections suggest the sector could reach $22.9 billion by 2029, at a 25.9% CAGR.

- One report expects growth from $63.9 billion in 2025 to $246 billion by 2032, a 21.2% CAGR.

- Insurers using AI to detect fraud can reduce fraud by 20–40%, depending on implementation and fraud type.

- Soft fraud detection rates currently stand at 20–40%, while hard fraud is detected at 40–80%.

- In 2023, fraud prevention tools saved insurers $4 billion globally.

- Drones helped uncover $1 billion in fraudulent property damage claims in 2023.

Law Enforcement and Legal Actions

- The 2025 National Health Care Fraud Takedown charged 324 defendants for over $14.6 billion in intended losses, the largest of its kind.

- Operation Gold Rush targeted a Medicare fraud ring billing for unnecessary medical supplies, affecting over one million Americans and generating $10.6 billion in false claims.

- Federal recovery through False Claims Act settlements reached $1.257 billion between January and May 2025.

- Whistleblower incentives were expanded in 2025, helping expose fraud targeting private insurers under the DOJ’s CWA initiative.

- NYC’s Operation Bright Eyes equips 500 taxis with cameras to stop a $1 billion fraud network staging accidents with lawyers and healthcare providers.

Consumer Awareness and Reporting

- About 32% of people believe they’ve been victims of insurance fraud, but 29% never report it.

- An estimated 68% of consumers are unaware of common auto fraud schemes like phony tow services and unnecessary repairs.

- A full 90% of Americans now accept that anyone can fall victim to fraud, breaking older assumptions.

- However, more than half remain overconfident in spotting AI-driven scams, a rising risk.

Economic Impact of Insurance Fraud

- Insurance fraud costs the U.S. economy around $1 trillion annually, slowing growth and eroding trust.

- Total U.S. insurance fraud costs hover at $308.6 billion per year, raising consumer premiums by roughly $900 annually.

- P&C fraud contributes nearly $90 billion to this total.

- Globally, life & P&C losses exceed $300 billion, growing at over 10% per year.

Insurance Fraud in the Digital Age

- The collision of digital tech and fraud has led to a marked increase in deepfakes, voice, and identity attacks.

- McKinsey links deepfake scams to the 10% annual rise in insurance fraud.

- The digital era now demands multilayered detection systems, blending AI, analytics, and contributor data for early detection.

- Pandemic-era shifts toward digital submissions continue to expose fraud risks and demand innovative monitoring.

- Identity theft and cybercrime movements indicate consumers are less trusting and demand more robust verification.

Conclusion

Insurance fraud today has grown both in scale and sophistication, from deepfake impersonation and synthetic voice attacks to complex cross-border schemes. Losses remain staggering, over $300 billion a year in the U.S., and rising rapidly. Yet, technology offers hope. Smart AI, drones, fusion centers, and reinforced detection systems are turning the tide. Meanwhile, raised awareness and legal pressure, like DOJ takedowns and Whistleblower expansion, are hitting fraudsters hard. In a digital-first world, staying informed and vigilant is not optional; it’s essential.