Hyperliquid posted a record-breaking $106 million in revenue this August, powered by a HYPE token rally and a staggering $400 billion in trading volume.

Key Takeaways

- Hyperliquid earned $106 million in August, marking a 23% increase from July and its highest monthly revenue ever.

- The protocol processed $400 billion in perpetual trading volume and now exceeds $2 trillion in cumulative volume.

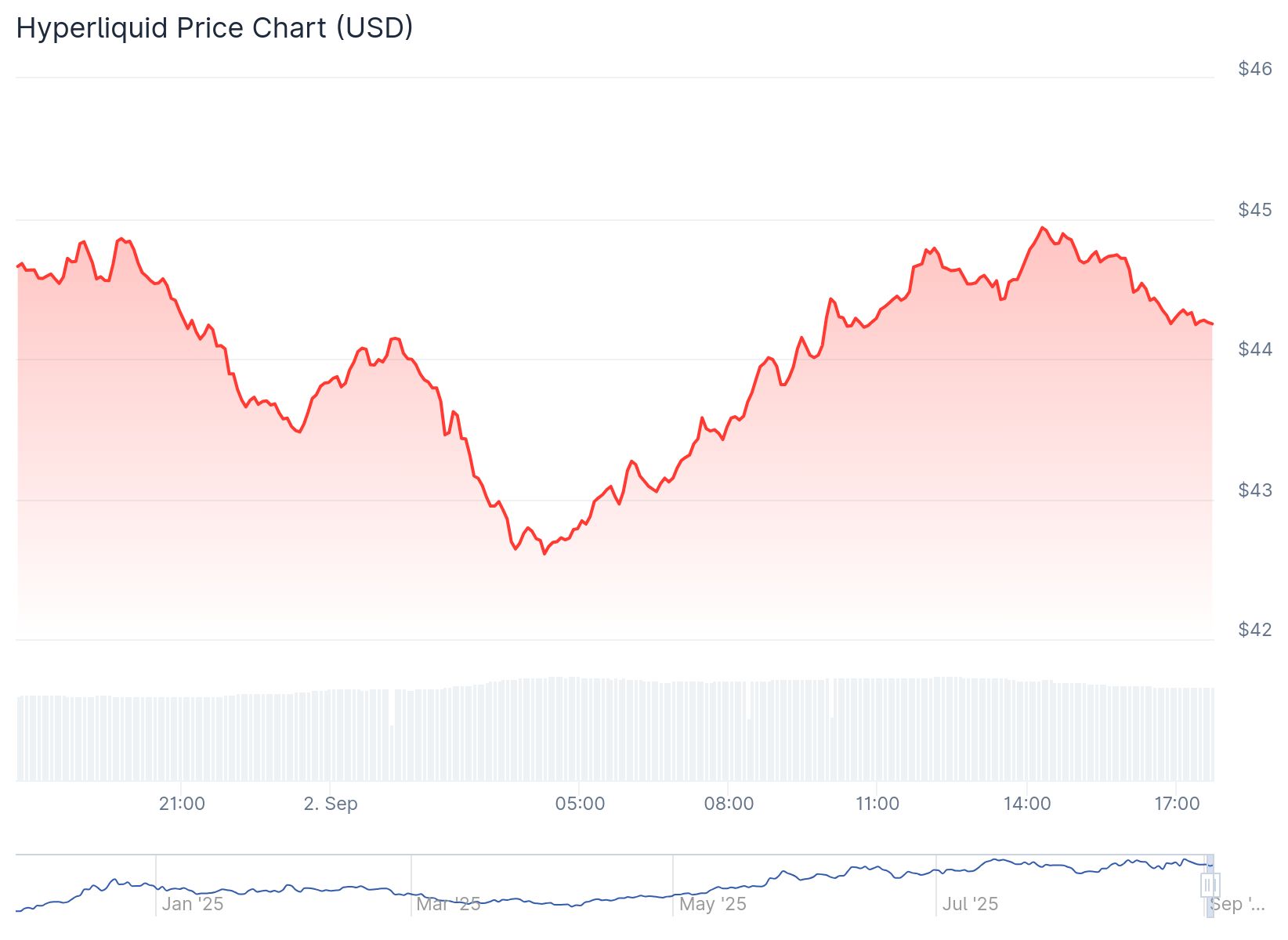

- HYPE token surged to $51.17 before cooling to $44.25, while 29.8 million HYPE tokens are now held in the platform’s Assistance Fund.

- Hyperliquid captured 70% of decentralized perpetuals trading volume and launched a regulated ETP through 21Shares.

What Happened?

Hyperliquid had its strongest month to date in August, pulling in $106 million in revenue, up from $86.6 million in July. This was driven by massive perpetual trading volume and a sharp rise in the HYPE token, which hit a new all-time high of $51.17. The token now trades at $44.25, down slightly by 0.9% over the last 24 hours.

Hyperliquid’s Record-Breaking Month

August marked a breakthrough for Hyperliquid as it surged to the top of the decentralized finance space. According to DefiLlama, the platform generated $106 million in monthly revenue, boosted by nearly $400 billion in perpetuals trading volume.

- This growth helped Hyperliquid exceed $2 trillion in cumulative trading volume since its 2023 launch.

- It now processes over $8 billion in daily trading activity on average.

A major catalyst behind this performance is Hyperliquid’s Layer-1 blockchain, HyperEVM, which provides high throughput and low fees, attracting both individual and institutional traders.

Hyperliquid made $106M in the last 30 days.

— Holosas (@Holosas_) September 1, 2025

⁰Solana + Ethereum together made $19.75M.

That’s 5x more revenue for Hyperliquid.

Market caps:⁰Hyperliquid – $12B⁰Solana – $108B⁰Ethereum – $530B

I’m not selling my $HYPE this cheap.⁰See you higher.

Conviction over noise. pic.twitter.com/xHXhTJg6m0

HYPE Token Buybacks and Whale Activity

Hyperliquid’s Assistance Fund continues to play a key role in the protocol’s tokenomics strategy. It automatically buys back HYPE tokens using a portion of platform revenue.

- Since January, the fund has grown its holdings from 3 million to 29.8 million HYPE tokens, now valued at over $1.5 billion.

This buyback mechanism supports the HYPE token’s price and long-term value. Notably, the recent rally in HYPE was partially driven by whale accumulation and elevated trading fees.

Dominance in the Decentralized Derivatives Market

Hyperliquid has emerged as a market leader, capturing 70% of the decentralized perpetuals market share, outpacing platforms like Jupiter and Orderly Network.

- It even achieved a $3.4 billion 24-hour volume in its Hyperliquidity Cluster, with $1.5 billion from Bitcoin trading alone.

- The platform’s revenue-per-employee metric also outperformed tech giants, surpassing Tether’s $93 million and OnlyFans’s $37.6 million.

Institutional interest is also growing. In a significant move, 21Shares launched the first regulated Hyperliquid exchange-traded product (ETP) on the SIX Swiss Exchange, providing easier access to the protocol’s ecosystem.

Risk Factors and Platform Updates

Despite its rapid rise, Hyperliquid has faced some challenges. In recent months, the platform experienced market manipulation incidents, including the XPL token futures pump and a similar event involving Jelly memecoin.

In response, Hyperliquid implemented new protections:

- Introduced a 10x price cap relative to the 8-hour exponential moving average.

- Integrated external market data to improve price accuracy and reduce manipulation.

Analysts have also warned that upcoming token unlocks later this year could pressure the token’s price. Currently, only one-third of total tokens are in circulation, despite an estimated valuation of $50 billion.

CoinLaw’s Takeaway

In my experience, it’s rare to see a DeFi protocol explode with the kind of momentum Hyperliquid has shown. The $106 million revenue, $2 trillion volume, and dominant 70% market share are not just vanity stats. They show real traction. What really stands out to me is their ability to combine scalability with strong tokenomics. HYPE’s meteoric rise was no accident. Between whale accumulation, the buyback fund, and a fully on-chain system, this project is building a fortress. That said, the token unlocks and recent market manipulation issues are valid concerns. Whether Hyperliquid can maintain this pace and evolve responsibly will define its long-term success.