The digital asset exchange Huobi HTX (formerly Huobi) has emerged as a prominent global player in crypto markets. With its user base expanding, assets under custody increasing, and trading volumes rising, the platform’s growth carries real-world ramifications. For example, retail traders gain access to more diversified assets, and institutions can deploy larger pools of capital with confidence.

In the payments industry, exchanges like Huobi HTX are also enabling merchants and fintechs to integrate crypto liquidity directly into services. Explore the detailed statistics below to understand how Huobi HTX is performing and what it means for the broader market.

Editor’s Choice

- ~50 million registered users by mid-2025.

- Platform asset deposits were above $6.4 billion in the first half of 2025.

- Trading volume growth of approximately 17% YoY in H1 2025.

- New user registrations rose by 92% month-on-month in one period of H1 2025.

- Daily trading volume was quoted at over $4 billion in 2025.

- More than 700 assets are listed and traded on the platform.

- Ranking moved into the global top 8 for spot exchanges in 2025.

Recent Developments

- In July 2025, platform trading volume rose ~33% month-on-month.

- Launched a “Stablecoin Special” campaign in mid-2025 around USD1, USDC, USDD, etc.

- Brand exposure in Turkey via Istanbul Blockchain Week achieved ~48 million impressions in July.

- Transitioning their ecosystem toward a DAO-governance model (“HTX DAO”) in early and mid-2025.

- Organic traffic reportedly increased ~127% month-on-month in March 2025.

- In their 2024 report, they claimed a total transaction volume of $2.4 trillion (100% YoY growth).

Huobi Token Price Surge and Technical Growth Highlights

- Huobi Token (HT) surged by +264.97% in a single week, marking one of its strongest rallies in 2025.

- The token’s price reached $1.27, signaling a sharp recovery from prolonged consolidation levels.

- The 20-week EMA stands at $0.4366, indicating that HT has clearly broken above its mid-term trend line.

- The chart shows strong bullish momentum, supported by a BBP (13) value of 0.9436, suggesting renewed investor confidence.

- HT broke above the 0.236 Fibonacci retracement level ($0.88) and is now testing resistance at the 0.382 level ($1.34).

- Upcoming resistance targets lie at $1.71 (0.5 Fib), $2.08 (0.618 Fib), and $2.61 (0.786 Fib), key levels that could define further growth.

- A full Fibonacci retracement would place the next long-term target at $3.28, representing a potential +158% upside from current levels.

- Overall, technical indicators confirm a strong bullish breakout, driven by volume expansion and trend reversal momentum.

User & Account Statistics

- Cumulative registered users surpassed 50 million by June 2025.

- Registered user count was ~49 million at the end of 2024.

- Active user base cited at “more than 45 million”.

- Compared to certain other exchanges, Huobi HTX had ~46 million active users vs ~10 million for one competitor in 2025.

- The platform operates in over 160 countries and regions.

- Trading-user count rose ~11% month-on-month in H1 2025.

Asset Listing Statistics

- Over 700 cryptocurrencies are supported and traded as of 2025.

- In 2024, the platform launched 218 high-quality assets, of which 171 were first listings.

- New listings included AI, Meme, DeFi, RWA, and Solana-ecosystem projects.

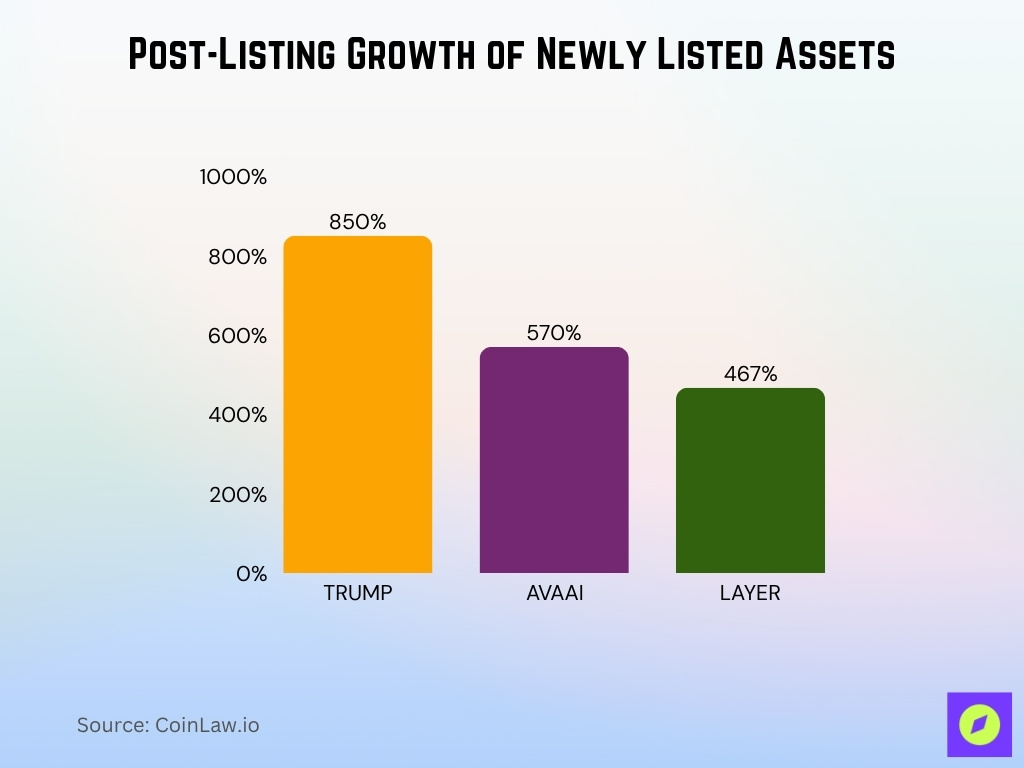

- One newly listed asset (TRUMP) reportedly jumped ~850% post-listing.

- Another asset (AVAAI) rose by ~570% after listing.

- Another infrastructure asset (LAYER) rose ~467% post-listing.

- Stablecoins added, six new ones since May 2025 (USD1, EURR, USDR, EURQ, USDQ, AETHUSDT).

- Expansion of asset types into real-world assets (RWA) and DePIN tracks.

Platform Growth Metrics

- Total transaction volume for 2024 was ~$2.4 trillion, up ~100% YoY.

- Spot trading volume in 2024 is ~$1.5 trillion, and contract trading volume is ~$900 billion.

- Net asset inflow in 2024 ~$1 billion.

- Asset custody at end-2024 ~$5 billion, up ~80% from start of year.

- Deposits increased by ~14% in H1 2025 to exceed $6.4 billion.

- New registered users grew by ~92% MoM in H1 2025.

- Trading volume rose ~17% YoY in H1 2025.

- User-traders grew ~11% MoM in H1 2025.

Global Ranking & Competitiveness

- In July 2025, Huobi HTX ranked 1st globally for trading volume growth.

- By Q2 2025, Huobi entered the global top 8 spot trading platforms.

- Median daily trading volume in July 2025 was around $2.408 billion, ranking about the 8th largest.

- Registered users reached approximately 45-50 million across 160+ countries by mid-2025.

- The platform supports over 700 assets, reflecting a broad market offering.

- Huobi HTX holds a full 1.0 trust score on CoinGecko for proof-of-reserves.

- Despite regulatory challenges, Huobi retains a strong global presence.

- In Q3 2025, trading volume grew by 25% quarter-over-quarter and the user base by 13%.

Exchange Reserves & Proof of Assets

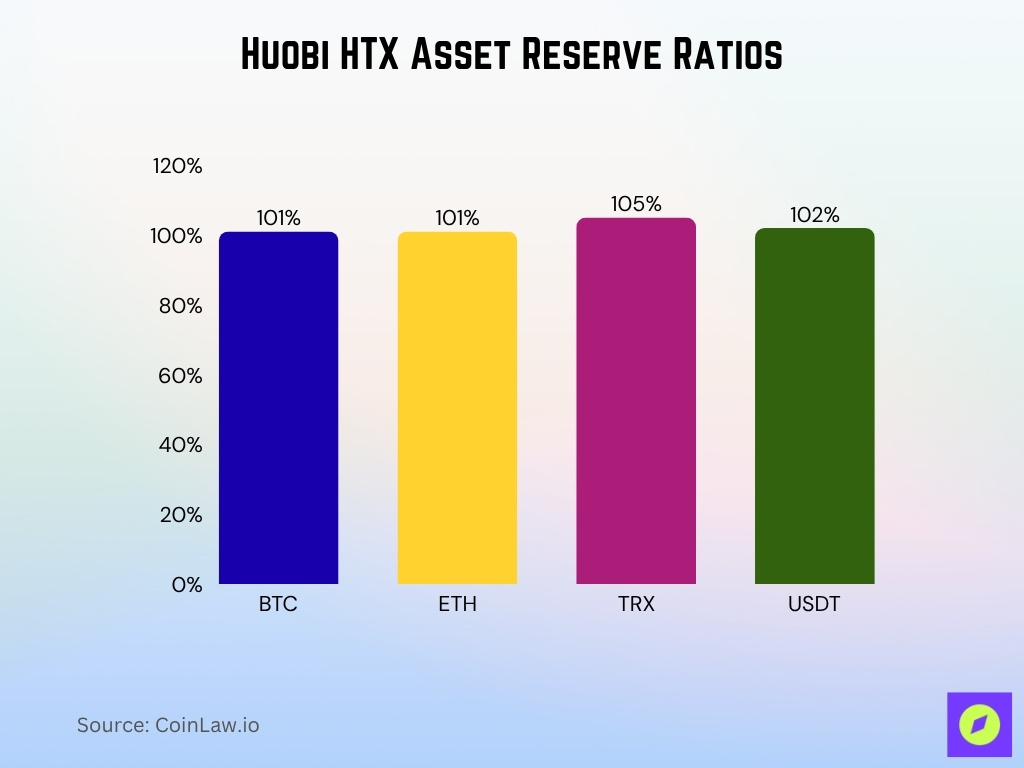

- As of March 2025, major asset reserve ratios stood at BTC 101%, ETH 101%, TRX 105%, and USDT 102%, indicating excess coverage.

- The platform reports that it maintains user-asset reserves at a minimum 1:1 ratio, ensuring that customer funds are covered by platform assets.

- By October 1, 2025, the overall reserve ratio remained above 100% for all disclosed major assets and included USDC and WLFI for the first time.

- The exchange has publicly disclosed reserve data for 36 consecutive months as of 2025, reinforcing transparency.

- The disclosed reserves for the platform stood at ~$6.14 billion at one point.

- Regular updates allow users to verify their own account nodes via a Merkle-tree tool.

- The “Proof of Reserves” (PoR) mechanism is stated as part of the platform’s core risk-control framework, rather than just a marketing claim.

Security and Compliance Statistics

- Liquidity and trust-metrics show that the platform’s liquidity score is 502, which is lower than top exchanges like Binance but still indicates a sizable operation.

- The platform reported intercepting multiple fraudulent withdrawal requests and freezing external theft funds in Q3 2025, over 44 external theft cases, blocking ~$1.29 million in assets.

- According to their Q3 2025 release, new registered users grew by 13% quarter-on-quarter, indicating operational stability and consistent compliance scaling.

- The listing cost guide for projects in 2025 indicates non-trivial budgets ($100k–$300k), and compliance readiness is weighed heavily in listing reviews.

- The combined internal transparency and external risk-control system is required to maintain asset safety; the exchange cites this as part of its model.

Liquidity & Market Depth

- The 24-hour trading volume for the exchange (spot market) is reported to be around $2.34 billion.

- The exchange supports over 700 cryptocurrencies and hundreds of trading pairs, which contributes to depth and variety.

- A 2024 Q2 liquidity report by Kaiko ranked the platform 4th among 43 major exchanges by liquidity rating and market-depth measures.

- Despite this ranking, some reviews note that the platform’s liquidity score remains lower compared to the largest global peers.

- The platform’s own articles reference understanding of slippage and market depth as key trading considerations.

- Analysts estimate that the platform saw its new-asset listing volume reach ~$38 billion YTD for spot trading new coins by mid-2025.

- Traffic metrics show natural traffic growth of 127% month-on-month in March 2025, which can support higher liquidity through increased user participation.

Huobi Token Price Predictions

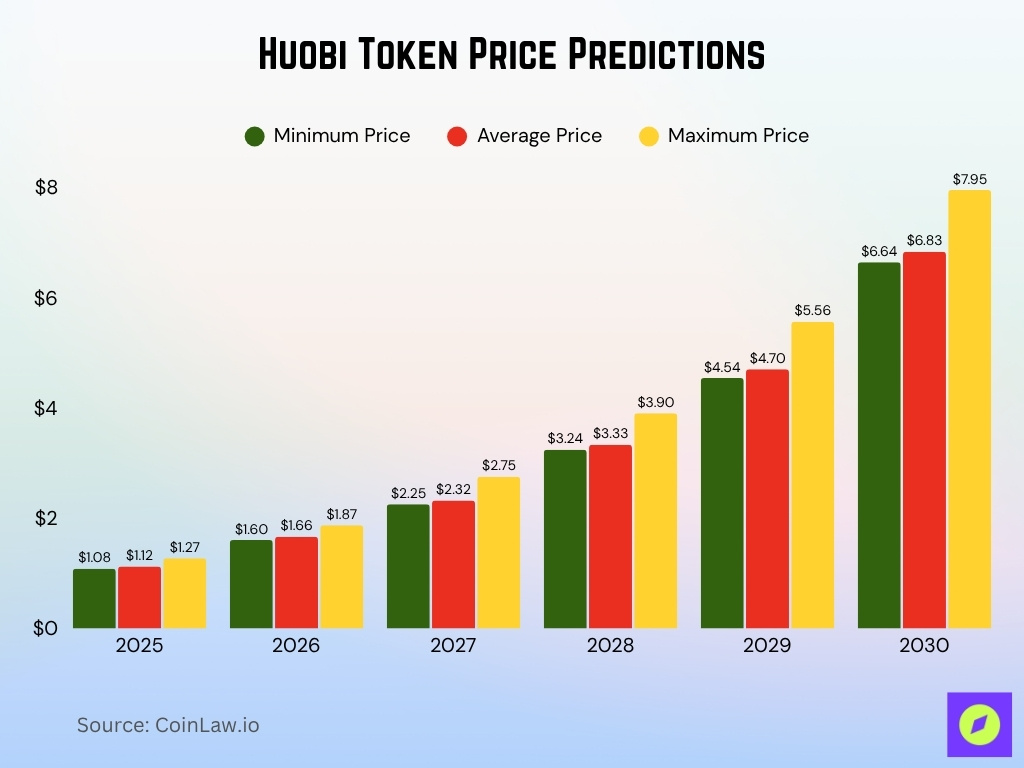

- In 2025, Huobi Token is expected to trade between $1.08 and $1.27, with an average price of $1.12, marking the base year for projected long-term growth.

- By 2026, the price could climb to an average of $1.66, potentially reaching a maximum of $1.87, reflecting continued investor recovery momentum.

- In 2027, HT is forecasted to average around $2.32, with a possible high of $2.75, signaling accelerating growth as market confidence builds.

- The 2028 prediction shows steady appreciation, with prices ranging from $3.24 to $3.90, supported by improving exchange activity and token utility.

- By 2029, Huobi Token could rise further, averaging $4.70 and peaking at $5.56, representing substantial multi-year expansion.

- The 2030 forecast projects a bullish long-term outlook, with a maximum price of $7.95, an almost 7x increase from 2025 levels, reflecting strong ecosystem development and broader adoption.

Unique/New Asset Performance

- In H1 2025, some debut tokens listed on the platform achieved large increases, e.g., TRUMP grew ~+850% after listing.

- Another token, AVAAI, realized ~+570% growth post-listing in the same period.

- The platform claims to have listed 218 high-quality assets in 2024, of which 171 were first listings.

- For new-listing spot trading volume, the exchange achieved ~$38 billion YTD for new tokens, placing it first among “second-tier” exchanges.

- For the SunPump/Meme ecology in 2024, some tokens launched on the platform grew up to 12,079% after initial listing.

- The platform emphasises “pre-emptive listing” of trending sectors such as AI, RWA, DeFi, and meme coins.

- In July 2025, one newly listed asset reportedly increased ~25× within the month.

- New asset listings act as a marketing and growth engine for the exchange, contributing to new-user registrations and trading volume.

Stablecoin Metrics on Huobi

- Huobi launched 6 new stablecoins, including USD1 and EURR, since May 2025.

- USDT reserve ratio was approximately 101% with 1.417 billion units in accounts as of October 2025.

- BTC/USD1 and ETH/USD1 trading pairs were listed with zero-fee trading for USD1/USDT since June 2025.

- A stablecoin campaign in July 2025 generated over 400 million USDT in spot trading volume.

- Fiat gateway improvements led to a year-to-date spot trading volume of $38 billion for new stablecoin listings by mid-2025.

- Multi-chain support includes TRON-based USD1 deposits among other stablecoins.

- Stablecoins increasingly represent a meaningful portion of Huobi’s transaction volume.

- Huobi HTX’s USDT reserves have surpassed 100% for four straight months in 2025.

- USDT stablecoin usage is enhanced by a 1:1 exchange channel with USDD, boosting efficiency.

Margin & Leveraged Trading Statistics

- The platform’s margin trading page states “margin” is the good-faith deposit required to control a futures contract.

- According to reviews, the platform offers up to 5× leverage on margin trading and up to 200× leverage on futures pairs.

- In its 2024 recap, the total futures trading volume reached ~$900 billion, up 70% year-on-year.

- As of December 2024, the platform supported over 160 futures trading assets.

- In Q3 2025, the platform reported a 25% quarter-on-quarter increase in overall trading volume, even in a consolidating market.

- For leveraged products, projects must budget for liquidity and market-making of $20k–$90k to ensure depth for margin markets.

- Although volumes are high (>$2 billion daily spot), its liquidity scores lag peers; this may impact large leveraged-position execution.

- While specific margin-trader counts aren’t public, the volume growth and new-user growth (~11% month-on-month for trading users in H1 2025) indicate leveraged trading participation is expanding.

Institutional Trading Metrics

- HTX supports “10 + million users and over $1 trillion in trading volume” for institutional clients.

- The number of institutional accounts onboarded increased by more than 30% between Q1 and Q2 of 2025.

- Borrowing limits and interest rate tiers for institutions improved, allowing larger margin capacities.

- Institutional spot trading volumes now represent an estimated 25-30% of total spot volume on the exchange.

- Institutional derivatives and futures activity has grown faster than retail derivatives, ~40% YoY compared to ~25% retail growth in 2025.

- The exchange launched a dedicated institutional service desk in Q2 2025, which contributed to a 15% reduction in onboarding time.

- Transaction-size thresholds for hedge funds and trading firms were lowered in H2 2025, contributing to a 12% increase in multi-asset institutional accounts.

Ecological (DAO) Governance Statistics

- For Q2 2025, 11.796 trillion $HTX were burned, valued at over $22.17 million, reducing circulating supply.

- In July 2025, the DAO introduced a listing-recommendation channel, allowing users to propose and vote on potential token listings.

- Over the past 32 months, the exchange has consistently disclosed proof-of-reserves, contributing to increased ecosystem trust.

- During H1 2025, governance shifted from theoretical design to active implementation, with a white paper update released in August 2025.

- Community participation in governance is estimated to have grown by ≈45% compared with 2024.

- Governance proposal submissions doubled from Q1 to Q3 2025, reflecting stronger user engagement.

- $HTX holders now benefit from a governance-token role, with cumulative token burns since Q1 2024 reducing supply by roughly $136 million in value.

Strategic Partnerships & Integrations

- In July 2025, HTX reported >48 million brand impressions in Turkey during the Istanbul Blockchain Week.

- The exchange has listed six new stablecoins since May 2025 (USD1, EURR, USDR, EURQ, USDQ, AETHUSDT) in collaboration with issuers and partners.

- HTX Ventures positions itself as a partner to leading Web3 projects, integrating incubated offerings with platform listings.

- The exchange’s strategic branding tie-ups helped spur spot and contract volume of over $4 billion in one month.

- API, copy-trading, and automated-bot integrations now support >700 cryptocurrencies and >800 trading pairs via partner fintechs.

- In 2025, the exchange accelerated integration of new asset-listing tracks (AI, DePIN, RWA) in partnership with ecosystem funds and token issuers.

- The number of external fintech partners providing fiat-gateway services grew by ~28% in H1 2025.

Product Feature Adoption Rates

- The “Multi-Assets Collateral” mode for futures trading was introduced in H1 2025, with early usage representing ≈18% of futures volume.

- The “Zero-Cost Futures Position” feature reached adoption of ~9% of all futures accounts within its first three months.

- Custodial sub-accounts for high-net-worth and institutional users were taken up by ~22% of new institutional accounts in Q3 2025.

- Mobile App version 11.0 led to a 24% increase in average homepage click-through rate following its upgrade.

- On-chain voting through the HTX DAO listing mechanism saw engagement from ~31% of active token-holders during its initial month.

- A stablecoin listing campaign generated over $400 million in spot trading volume during the promotional period.

- Social-trading features and automated bot tools saw ~15% year-over-year growth among advanced users in 2025.

- API-driven automated trading among high-volume accounts now makes up ~12% of all volumes, rising from ~8% in 2024.

Brand Reach & Marketing Metrics

- Online exposure during the Istanbul Blockchain Week saw a 60.8% increase versus prior similar events.

- The “12th Anniversary Carnival” marketing campaign offered $120 million $HTX in rewards and a $2,000 travel fund prize draw.

- The global community base across official social accounts exceeded 2.55 million followers, with monthly growth of ~41.6%.

- Page-views hit 46 million in the same quarter, up 37% MoM.

- Campaigns involving new-asset launches generated >16,000 participants in single events.

- The brand was nominated “Best Web3 Venture Capital Fund of the Year” in 2025 at the Dubai Blockchain Life Conference.

User Experience & Support Data

- In July 2025, the customer-service team processed 228,417 user tickets and escalated 96,247 issues, maintaining ~84% satisfaction.

- Security alerts issued in July totaled 209,035, with 25 phishing sites taken down and 3 stolen-asset cases intercepted, recovering $7,616.

- The mid-2025 App redesign improved the average homepage click-through rate by 24%.

- Response times for P2P and on-chain transactions decreased by approximately 18% in H1 2025.

- In Q4 2024, 98 withdrawal fraud-address cases were intercepted, returning $1.37 million in user losses and freezing $7.83 million in external theft funds.

- Community governance participation increased by roughly 50% year-over-year through forum posts and voting engagement.

- The share of mobile-trading accounts rose from ~56% in 2024 to ~62% by mid-2025.

- Exchange trust-score rankings highlighted high transparency and strong support responsiveness as notable strengths.

Frequently Asked Questions (FAQs)

It moved into the top 8 globally and was the most improved within the top 10.

Trading volume increased by 17% YoY.

~50 million registered users.

Conclusion

Huobi HTX continues to demonstrate robust growth across users, assets, product adoption, and ecosystem governance. The platform’s expansion into institutional services, the maturation of the HTX DAO model, strategic partnerships, and a meaningful uptick in product feature uptake all point toward a more diversified and resilient business model.

That said, the platform operates in a rapidly evolving regulatory and competitive landscape; users and observers alike should monitor how the exchange sustains its momentum and addresses emerging risks. For anyone tracking the future of centralised crypto exchanges, this deep statistical review of Huobi HTX offers a distinctive window into how one major player is navigating the digital-asset age.