Robinhood Markets, Inc. has seen its workforce shift significantly over the past few years. As the company ramps up new products in crypto, options, and financial services, understanding how many people work at Robinhood today helps assess its scale, strategy, and operational focus. In one scenario, its engineering-heavy hiring reflects efforts to improve platform stability; in another, customer support staffing responds to growing user bases and regulatory demands. Read on to explore detailed numbers, trends, and insights into where and how Robinhood is building its team.

How Many People Work At Robinhood?

- ≈ 2,300 employees at Robinhood as of December 31, 2024.

- Growth of 4.55% from 2023 to 2024 in total employee count.

- Headcount ~ 2,507 by August 2025, per Unify data.

- New hires ~ 182 in the recent period, per Unify (representing ~7.2% change).

- Engineering is the largest department with 827 people (~ one‑third of the total workforce).

- Robinhood’s DEI rating is 3.7/5 stars on Glassdoor, based on ~540 anonymous ratings.

- Revenue per employee in 2024 was ~$1.28 million.

Recent Developments

- Unify’s August 27, 2025, report shows Robinhood’s headcount at 2,507, up from previous measurements.

- The company has reported more new hires than departures, indicating net positive growth.

- Robinhood’s offerings expanded in 2025 into wealth management, tokenized assets, and other services, requiring additional staffing in compliance, tech, and operations.

- In its Q1 2025 results, Robinhood highlighted growth in subscriber products and new revenue streams. While that report doesn’t always break out headcount by department, expanding product lines typically correlate with hiring in engineering, finance, and support.

- There have been organizational shifts. Robinhood’s media arm, Sherwood, laid off some personnel to “streamline team structure.”

- The customer count and assets under custody have increased in recent years, putting pressure on infrastructure and compliance teams. Scaling operations is a likely response.

- DEI initiatives and ratings have been under more scrutiny recently, possibly affecting hiring priorities in diversity, inclusion, and employee support functions.

Robinhood’s Current Team (Key People)

- Vlad Tenev – CEO & President, is the co‑founder of Robinhood. He leads strategic vision, growth initiatives, product expansions, and regulatory compliance.

- Jason Warnick – Chief Financial Officer (CFO), in charge of financial planning, reporting, capital allocation, and helping steer the company toward profitability.

- Jeff Pinner – Chief Technology Officer (CTO), responsible for engineering, system reliability, technology architecture, and product infrastructure.

- Daniel Gallagher – Chief Legal, Compliance & Corporate Affairs Officer, handling legal risk, regulatory affairs, policy matters, and corporate governance.

- Chris Koegel – Vice President of Corporate Finance & Investor Relations, overseeing investor communications, capital structure, and financial transparency.

- Baiju Bhatt – Co‑Founder & Board Director, involved in shaping product design and long‑term direction, though no longer in the day‑to‑day executive role.

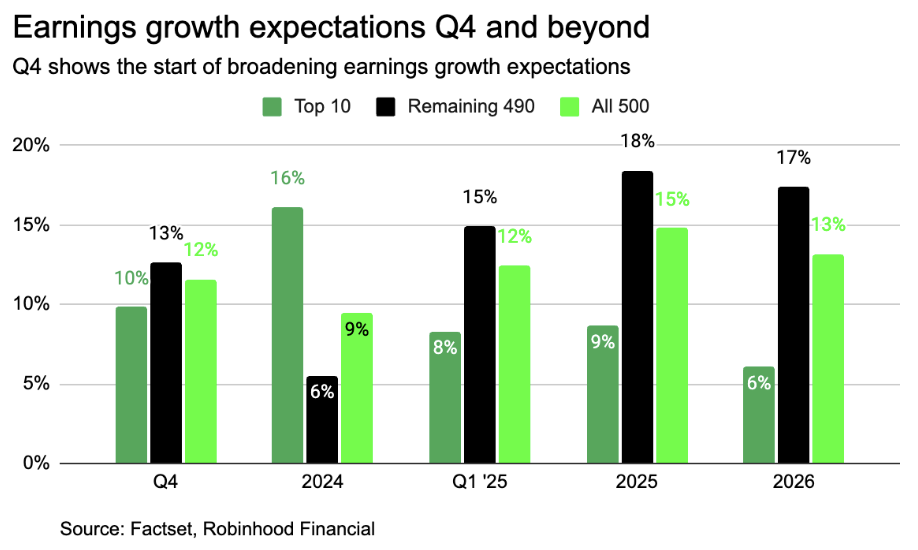

Robinhood Earnings Growth Expectations

- In Q4, Robinhood’s Top 10 stocks show 10% growth, while the remaining 490 deliver 13%, leading to an overall 12% for the S&P 500.

- For 2024, the Top 10 surge ahead with 16% growth, compared to just 6% for the remaining 490, pulling the total to 9%.

- By Q1 2025, momentum shifts as the remaining 490 jump to 15%, the Top 10 soften to 8%, and the overall S&P 500 holds at 12%.

- In 2025, the remaining 490 reach their peak with 18% growth, the Top 10 sit at 9%, and the All 500 average 15%.

- For 2026, forecasts show the Remaining 490 at 17%, the Top 10 at 6%, and the overall market at 13%.

Total Number of Employees

- At the end of 2020, about 2,100 employees.

- End of 2021, ~ 3,800 employees, a jump from 2020.

- End of 2022, back to ~ 2,300 employees, a large decline from 2021.

- End of 2023, ~ 2,200 employees, a slight drop from 2022.

- End of 2024, ~ 2,300 employees, up about 100 from 2023 (~4.55% growth).

- 2025 (mid / latest as of Unify’s report), ~ 2,507 employees.

- Growth from 2024 → 2025 (latest) is ~ 207 employees (≈ 9% growth, depending on exact counting).

- The 2022 drop from 2021 (~3,800 → ~2,300) marks the largest single‑year decline in recent history.

Employee Count Growth Over Time

- In 2021, Robinhood had ≈ 3,800 employees.

- By the end of 2022, that dropped to about 2,300 employees, a decline of nearly 39.5% year‑over‑year.

- In 2023, the headcount was roughly 2,200, a slight dip from 2022.

- For 2024, the count rose to ≈ 2,300, about 4.55% growth from 2023.

- As of August 2025, Robinhood employs ~ 2,500 people globally.

- The net gain from 2024 to mid‑2025 is approximately 200‑250 employees.

- The biggest contraction occurred from 2021 to 2022, during which Robinhood shed ~ 1,500 employees.

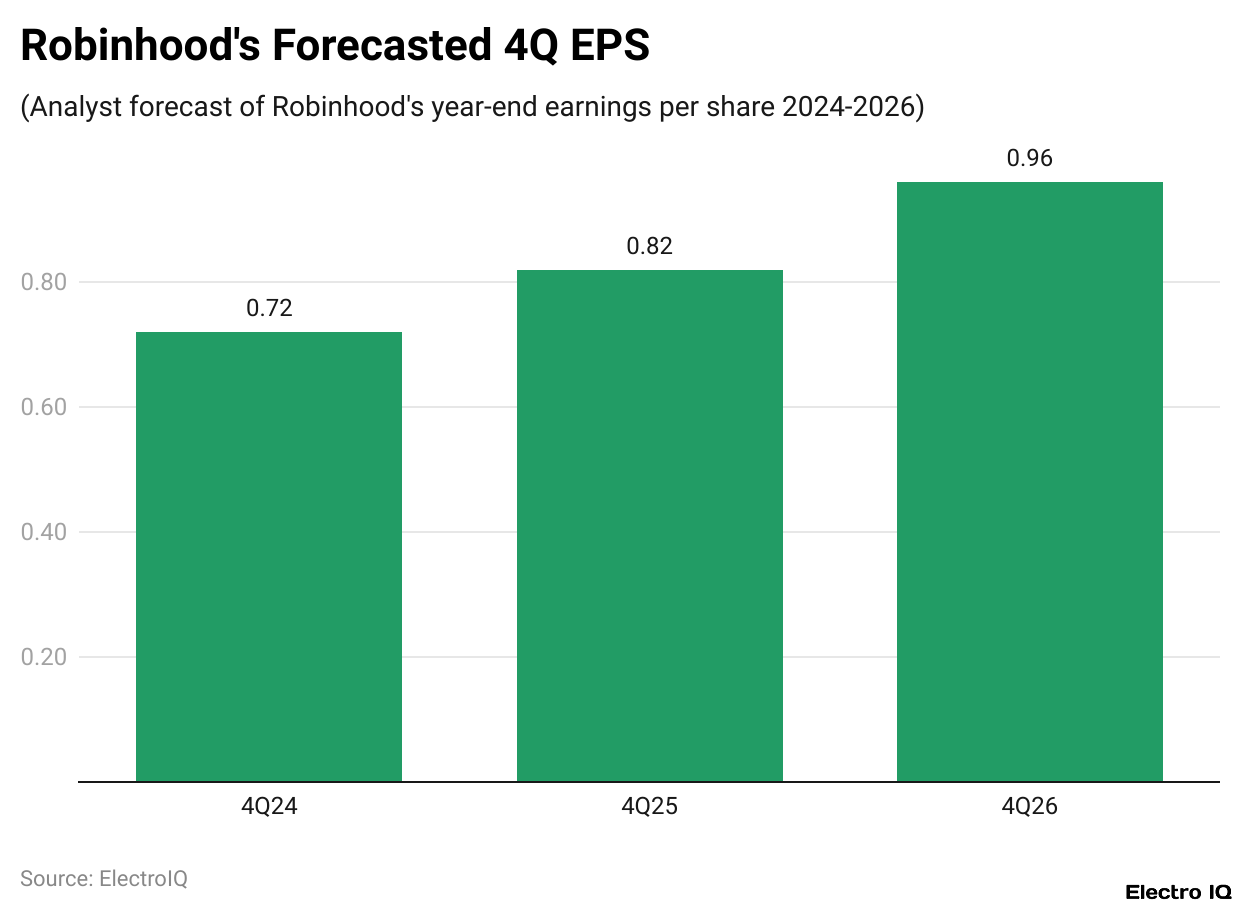

Robinhood’s Forecasted 4Q EPS

- In 4Q24, Robinhood’s earnings per share are projected at $0.72.

- By 4Q25, EPS is expected to rise to $0.82, reflecting steady growth.

- In 4Q26, forecasts show EPS reaching $0.96, marking a strong upward trend.

New Hires and Departures

- Recent reports show more hires than departures at Robinhood, signaling net positive growth as of August 2025.

- In April 2022, Robinhood announced cutting 9% of its full‑time workforce (~300 people) as part of cost rationalization.

- In August 2022, they further reduced staff by 23%, especially in operations, marketing, and program management.

- Layoffs in certain departments (engineering, recruiting, data science) also occurred in 2023, including ~ 150 employees impacted.

- The Sherwood (media) division had staff reduction in early 2025 to “streamline team structure,” though exact numbers weren’t disclosed.

- Departures of senior leadership, e.g., Baiju Bhatt stepping down as CCO in 2024, contribute to turnover.

- Hiring has been strongest in engineering, finance, and product functions.

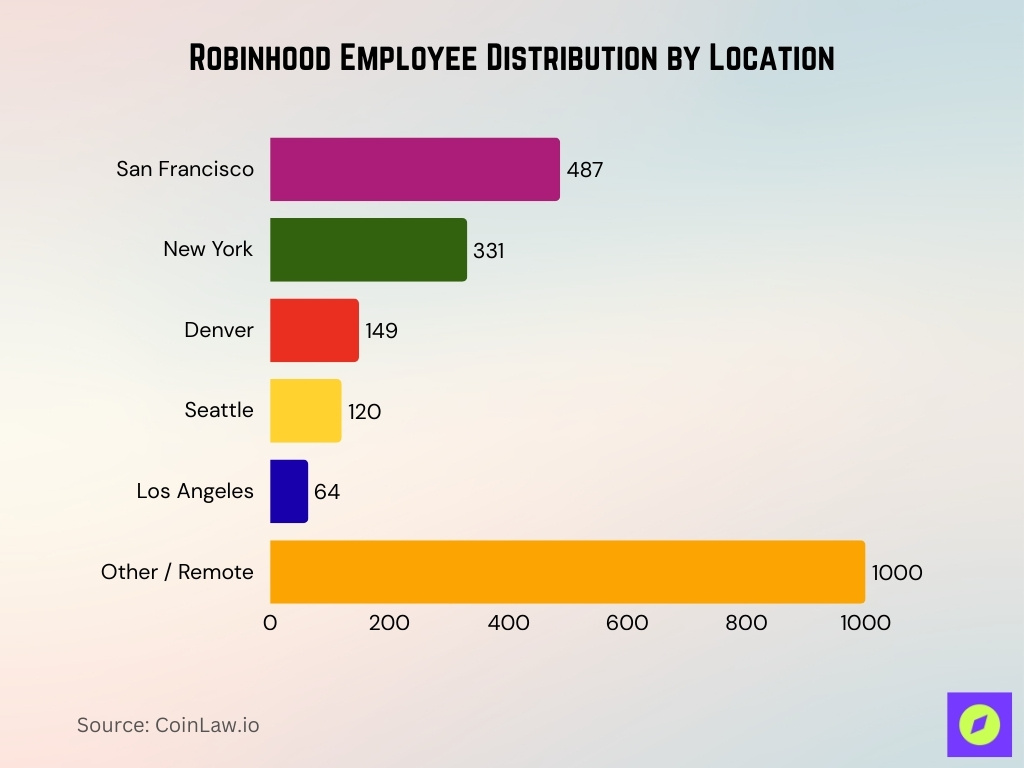

Employee Locations and Offices

- San Francisco hosts ~ 487 employees, the largest single location.

- New York has about 331 employees.

- Denver, ~ 149 employees.

- Seattle, ~ 120 employees.

- Los Angeles, ~ 64 employees.

- Remote or satellite offices / “Other” account for over 1,000 employees.

- The geographic spread supports Robinhood’s hybrid work model.

Revenue and Profit Per Employee

- In fiscal year 2024, revenue per employee at Robinhood was $1.28 million.

- That’s up from $847,730 per employee in 2023.

- In 2022, revenue per employee was ≈ $590,430.

- Net income (profit) per employee in 2024 was $613,480.

- Revenue growth, Robinhood’s annual revenue rose to $2.95 billion in 2024 (vs. ~$1.86B in 2023), which underlies the higher revenue/employee metrics.

- Quarterly revenue for Q2 2025 was $989 million, up ~45% year‑over‑year.

- Trailing twelve‑month (TTM) revenue as of mid‑2025 is ~$ 3.57 billion, reflecting continued business expansion.

Workforce Diversity and Inclusion

- As of August 2025, Unify does not publicly report detailed breakdowns by race/gender/age for Robinhood’s workforce in its headcount report.

- Robinhood’s Glassdoor DEI (Diversity, Equity & Inclusion) rating is ~ 3.7/5, based on employee feedback in areas like management of inclusiveness, though sample sizes and recency vary. Note, this is qualitative / sentiment data, not precise percentages.

- Comparisons within fintech generally show that companies of similar size have ~ 30‑40% female employees, and under‑20% representation for underrepresented people in STEM roles, but it’s unclear exactly where Robinhood stands relative to this.

- In investor letters or public disclosures, Robinhood has noted the importance of building “diverse teams,” especially in customer experience & compliance, but has not yet disclosed a full annual diversity census in its 2024‑2025 reports.

- Some of Robinhood’s public hiring advertisements emphasize inclusion and equal opportunity, suggesting that diversity & inclusion remains part of the talent‑acquisition strategy.

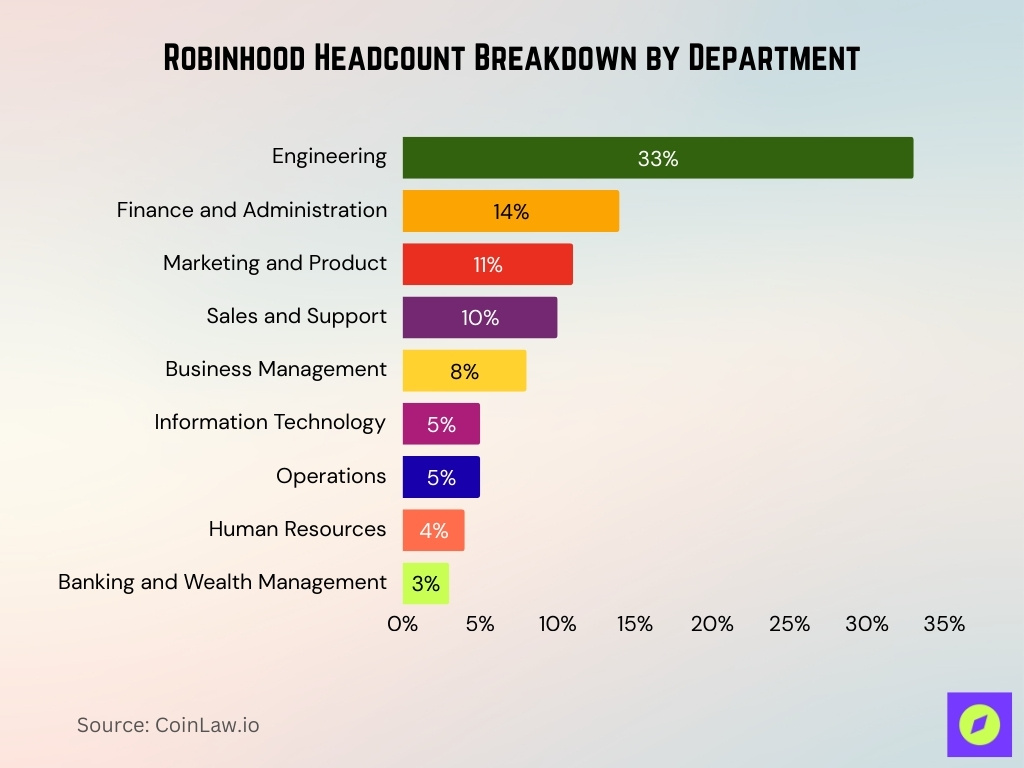

Robinhood Headcount Breakdown by Department

- Engineering leads with 33% of Robinhood’s total workforce, showing its heavy focus on product and platform development.

- Finance and Administration accounts for 14%, highlighting the importance of compliance, reporting, and financial management.

- Marketing and Product make up 11%, reflecting investment in user growth and product innovation.

- Sales and Support represent 10%, ensuring strong customer assistance and onboarding.

- Business Management holds 8%, focused on leadership and strategic operations.

- Information Technology and Operations each account for 5%, supporting technical infrastructure and internal processes.

- Human Resources stands at 4%, underscoring hiring and employee development functions.

- Banking and Wealth Management is 3%, indicating a smaller but specialized presence in financial advisory services.

Remote vs. Onsite Employees

- Unify’s August 2025 headcount report classifies about 1,091 employees under “Other/remote/various offices,” out of ~2,507 total employees (~43.5%). This suggests a large proportion of the workforce is in non‑core locations or hybrid/remote settings.

- Major hubs (San Francisco, New York, Denver, Seattle) together account for ~ 1,081 employees in core sites.

- Robinhood has not publicly disclosed a formal breakdown of fully remote vs fully onsite vs hybrid in their latest 10‑K or in investor reports (at least not in the sources found).

- Based on job postings and media covering Robinhood, many roles (especially in engineering & product) offer hybrid or remote flexibility.

- Some customer support, operations, and compliance functions are more likely to require onsite presence, especially where regulatory or security infrastructure mandates it.

- Geographic distribution (with numerous satellite, remote, or “other” locations) points to decentralized work arrangements in several departments.

Key Workforce Milestones

- In 2021, Robinhood peaked at ~ 3,800 employees, before layoffs & restructuring.

- 2022, sharp drop in workforce to ~ 2,300 employees, reflecting cost cuts / strategic refocus.

- 2023, slight further decline to ~ 2,200, then modest rebound.

- In 2024, a few percent growth, bringing headcount up to ~ 2,300. Revenue per employee also rose significantly.

- Mid‑2025, headcount reaches ≈ 2,500 (2,507 per Unify), marking a meaningful recovery from earlier contractions.

- In 2024, revenue per employee jumps ~ 51.35% vs. 2023.

- Profit (net income) per employee has shown volatility; per Bullfincher, profit per employee decreased significantly in fiscal year 2024 vs 2023.

- Also, there has been structural reallocation across departments; some departments saw reductions (marketing, program management, etc.) in earlier years, whereas engineering & finance have seen more stable or rising staffing.

Comparison with Other Fintech Companies

- Employee size, compared to peers like Square/Block, SoFi, Robinhood, is smaller than some vertically‑integrated fintechs but comparable to many digital brokers.

- Revenue per employee, Robinhood’s $1.28 million in revenue per employee (2024) is relatively high among brokerage/fintech companies; many in the sector have revenue per employee in the few-hundred-thousand to low‑million range.

- Profitability, profit per employee metrics are more mixed across fintechs; some have negative profit per employee or very small positive margins. Robinhood’s decrease in net income per employee in 2024 suggests pressure relative to peers who may have steadier margins.

- Remote work adoption, many fintechs of similar size are adopting hybrid or remote work, Robinhood’s remote/“other” location proportion (~43‑44%) seems in line with or somewhat higher than peers, which tend to cluster staff in major hubs.

- Workforce reduction trends, like Robinhood, several fintechs underwent layoffs in 2022‑2023, companies that scaled rapidly saw over‑hiring during growth phases, and then adjusted in market pullback.

- Diversity reporting, some peers (e.g,. larger fintechs like Stripe, PayPal) publish more detailed public diversity statistics, Robinhood’s public data is sparser.

Frequently Asked Questions (FAQs)

Robinhood had 2,507 employees, about 7.2% more than a year earlier.

At the end of 2024, Robinhood employed approximately 2,300 people.

In FY 2024, revenue per employee was about $1.28 million.

The net income per employee in 2024 was approximately $613,480.

Conclusion

Robinhood’s workforce today shows a company that has passed through contraction and is now in a recovery and recalibration phase. Revenue per employee has increased significantly, but net profit per person has shown strain. Remote or hybrid work plays a large part in its staffing, though precise splits in remote vs onsite remain under‑reported. Diversity and inclusion efforts are part of its public narrative, but clear numeric metrics are limited in recent disclosures.

Understanding these dynamics helps to see not just how many people work at Robinhood, but how the firm is investing in its workforce, where it’s leaning into strengths, and what areas (profitability, diversity, work models) may require more transparency or focus.