The question “how many people own Bitcoin?” sits at the intersection of finance, technology, and global adoption. On one hand, it reveals how far Bitcoin has penetrated mainstream use; on the other, it shows how much room remains for growth. For example, in corporate treasuries, companies are converting cash reserves into Bitcoin, and in emerging economies, individuals are using it to hedge inflation or manage remittances. This article outlines the latest ownership data, distribution patterns, and key trends, and invites you to explore the full spectrum of what the numbers really mean.

Editor’s Choice

- About 106 million people owned Bitcoin in 2025.

- In the US, about 28% of American adults owned some form of cryptocurrency (not just Bitcoin) in 2025.

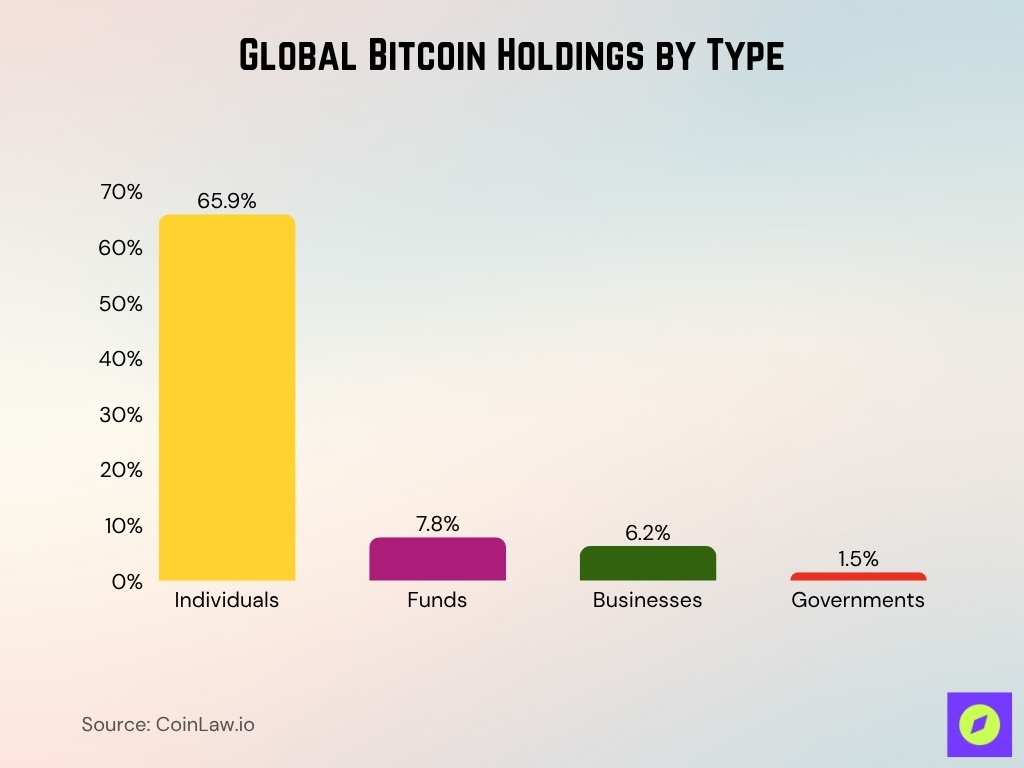

- Among Bitcoin’s circulating supply (≈ 21 million coins), individuals hold roughly 65.9%, institutions about 7.8%, businesses ~6.2%, and governments ~1.5%.

- In 2025, about 0.18% of all crypto owners actually hold at least one full Bitcoin, fewer than 2 in every 1,000 crypto participants.

- Over 48.7 million Bitcoin addresses hold more than $1, showing the broadest tier of ownership across small holders.

Recent Developments

- The 2025 surge in spot Bitcoin ETFs in the U.S. and inflows from institutional investors have raised visibility of Bitcoin ownership.

- Corporations and funds have expanded Bitcoin holdings, prompting new disclosures of treasury-level adoption.

- Growing regulatory clarity in several jurisdictions has lowered barriers for institutional and individual ownership, influencing distribution trends.

- Wallet provider metrics show a strong uptick in downloads and active addresses in 2024 and 2025, signalling user-base growth.

- Adoption surveys show crypto-ownership pickup in developed markets (UK, US, France) in 2025, for instance, UK crypto ownership rose from 18% to 24%.

- Blockchain research shows continued concentration of wealth, very large addresses hold a disproportionate share of Bitcoin, suggesting that growth in ownership doesn’t necessarily mean broad decentralisation.

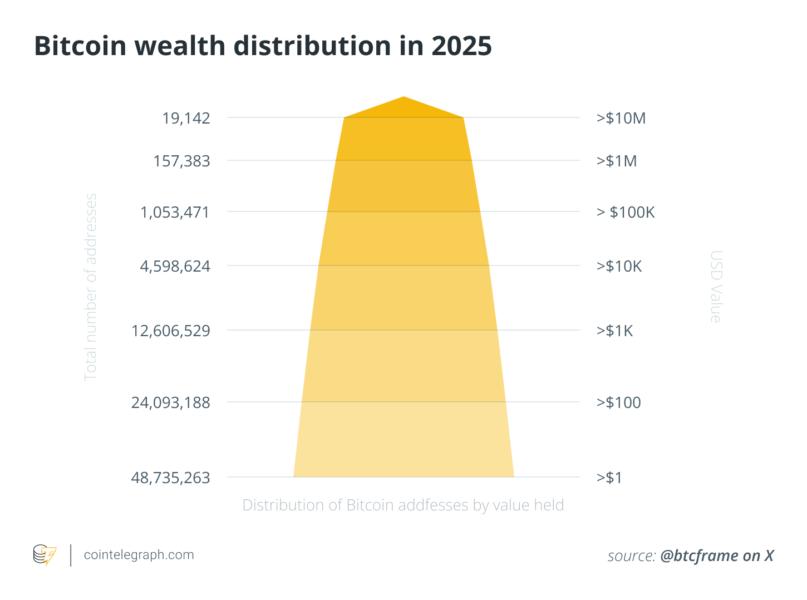

Bitcoin Wealth Distribution

- Around 24.1 million addresses have balances above $100, representing the expanding base of low-to-mid-value investors.

- Roughly 12.6 million addresses hold more than $1,000, indicating significant participation from retail-level investors.

- About 4.6 million addresses contain over $10,000 in Bitcoin, a growing group of mid-tier holders.

- More than 1.05 million addresses exceed $100,000, marking upper-level investors and early adopters.

- Approximately 157,000 addresses hold over $1 million, highlighting the high-net-worth segment of Bitcoin owners.

- Only 19,142 addresses possess more than $10 million worth of Bitcoin, representing the wealthiest holders or institutional entities.

How Many People Own Bitcoin?

- Global estimates suggest that about 106 million people owned Bitcoin in 2025.

- In the U.S., around 28% of adults, or about 65 million people, held some form of cryptocurrency in 2025.

- Ownership remains far lower in many developing regions; for example, Africa’s adoption rate is estimated at around 1.6%.

- The figure “4% the world’s population owns Bitcoin” is cited for 2025.

- The strong contrast between “owns some crypto” and “owns Bitcoin specifically” indicates that many hold smaller or alternate tokens.

- Because of multiple wallets per user and institutional addresses, the actual number of individual persons owning Bitcoin may differ from wallet counts.

Bitcoin Ownership Statistics by Year

- In 2023, global crypto ownership was estimated at ~420 million people, and in 2024, that rose to ~562 million, a ~33% increase year-over-year.

- In 2025, estimates put Bitcoin ownership specifically at ~106 million people.

- The percentage of the global population owning Bitcoin rose marginally from previous years, but remains in the low single-digits (≈ 4%).

- In 2024, crypto ownership in the U.S. remained steady (~21%) according to the Gemini report.

- The share of Bitcoin held by individuals (≈ 65.9%) in 2025 is slightly shifted compared to prior years as institutional ownership grows.

- Growth in wallet adoption accelerated in 2024, with 19.3 million wallet downloads in May 2024, representing a ~64.8% YoY increase.

Global Distribution of Bitcoin Owners

- According to the distribution of Bitcoin holdings by type, individuals hold ~65.9% of BTC supply, funds ~7.8%, businesses ~6.2%, and governments ~1.5%.

- Asia-Pacific leads with ~350 million active wallet users in 2025, about 43% of the global share of crypto wallets.

- Europe has ~140 million wallet users in 2025, a ~12% year-on-year increase.

- Africa’s wallet users reached ~75 million in 2025, reflecting rapid growth, though still lower overall adoption.

- Latin America stands at ~92 million wallet users in 2025, growth driven by inflation hedging behaviour.

- North America has ~134 million wallet users in 2025 (~16% of the global total).

- Globally, wallet ownership represents about 7.4% of all Internet users in 2025.

- The concentration of large Bitcoin addresses remains high; a small number of addresses hold a large share of BTC.

Who Owns the Most Bitcoin?

- Private companies hold about 312,000 BTC or ~1.5% of the total Bitcoin supply in private corporate treasuries.

- One firm, Block.one, reportedly owns ~164,000 BTC (~0.7% of total supply) as of the latest data.

- ETF-linked holdings, Spot Bitcoin ETFs, and related funds own ~1,358,000 BTC (roughly ~6% of supply) across various vehicles.

- Governments hold a non-trivial share, around 463,000 BTC (≈2.3% of total supply) is currently held by state authorities globally.

- The richest individual address ranges show extreme concentration; the top 100 richest addresses hold a very large share of the Bitcoin supply.

- The number of wallets holding at least $1 million worth of Bitcoin has surged in 2025, signalling institutional or large holder growth.

- Corporate and institutional ownership continues to rise, which may influence the distribution dynamics of Bitcoin.

- While many people own some Bitcoin, the number of very large holders remains small, reinforcing the skewed distribution.

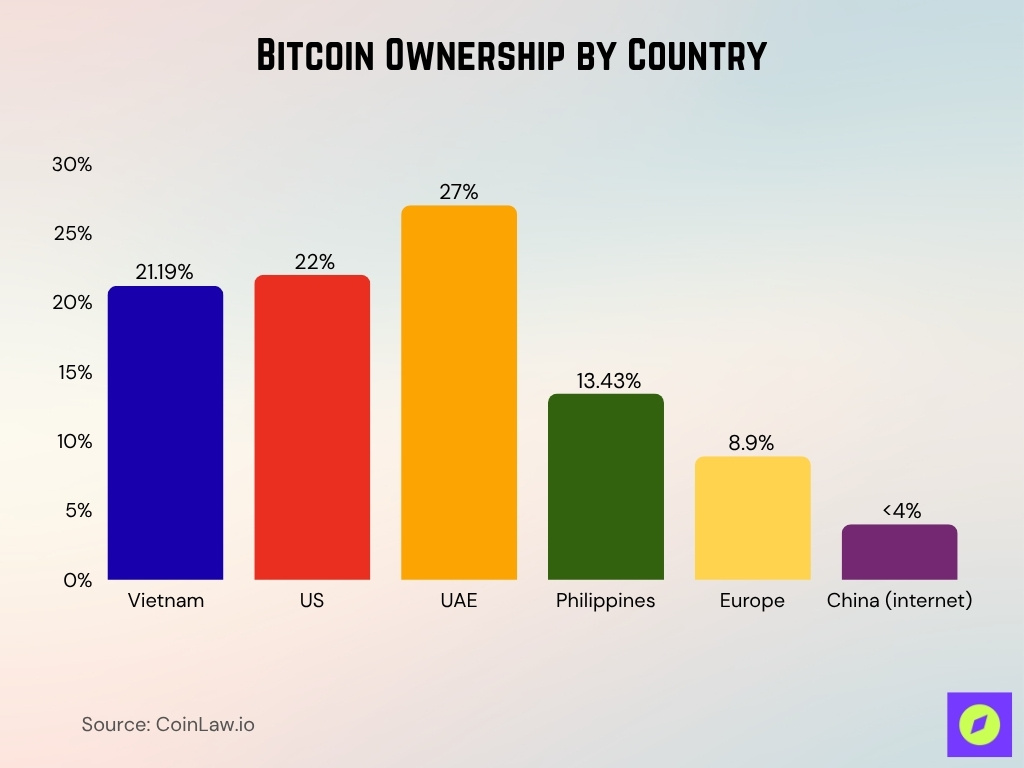

Bitcoin Ownership by Country

- In 2025, surveys suggest Vietnam may have one of the highest Bitcoin adoption rates globally (~21.19%), though results are based on self-reported data and may not account for wallet overlap.

- In the US, about 22% of adults own Bitcoin, while a higher share own some type of cryptocurrency.

- The United Arab Emirates ranks very high for crypto adoption, with just over 27% of residents owning crypto as of recent data.

- Smaller emerging markets show high participation, e.g., the Philippines is estimated to have ~13.43% population Bitcoin-ownership in 2025.

- In Europe, the average crypto ownership rate in 2025 is estimated at 8.9%, with many countries below the global average.

- China, despite large volumes of activity, still shows relatively modest publicly-reported ownership rates (under 4% of internet users) in some surveys.

- In Latin America, there is a strong interest; inflation-hedging behaviours in countries such as Brazil and Argentina push adoption higher than global averages.

- Many estimates rely on surveys plus wallet/address-data proxies, so country comparisons should be treated with caution.

Institutional and Corporate Bitcoin Ownership

- As of October 2025, U.S. spot Bitcoin ETFs collectively manage $169.48 billion in assets, accounting for 6.79% of Bitcoin’s total market capitalisation.

- Institutional Bitcoin ownership reached $414 billion by August 2025, largely driven by ETF adoption and corporate treasury strategies from firms like BlackRock and MicroStrategy.

- The total Bitcoin held within U.S. ETFs surpassed 1.34 million BTC (~6.4% of total supply), with BlackRock’s iShares Bitcoin Trust alone holding over 801,000 BTC.

- A 38% rise in corporate treasuries in Q3 2025 brought the number of public companies holding Bitcoin to 172, cumulatively owning more than 1 million BTC (~4.9% of all Bitcoin).

- According to Bitwise’s Q3 data, corporate Bitcoin reserves surged 40% quarter-over-quarter, now worth about $117 billion collectively among public entities.

- River’s research estimates funds and ETFs hold 7.8% of Bitcoin’s supply (around 1.63 million BTC), while businesses hold 6.2% as of August 2025.

- MicroStrategy remains the largest corporate holder with roughly 640,000 BTC, reaffirming Bitcoin’s role as a principal treasury asset.

- Institutional investors in the U.S. held approximately $21.2 billion in Bitcoin ETFs at the end of Q1 2025, with hedge funds and advisors representing a growing segment despite a 23% quarterly decline in reported AUM.

- Wallets containing at least $1 million worth of Bitcoin have expanded sharply since early 2024, now controlling over 76% of overall BTC wealth, indicating consolidation toward wealthier or institutional holders.

Demographics of Bitcoin Owners

- Gender gap: About 67% of cryptocurrency owners are men and 33% are women, according to recent U.S. data.

- Globally, one study estimated that men account for ~61% of crypto owners, women ~39% (2024 baseline).

- Median age of crypto owners in a U.S. survey was ~45 years old, indicating less dominance of just very young holders.

- In regions such as Asia-Pacific, younger age cohorts dominate adoption, but data are less granular.

- Education and income correlate with ownership; respondents with higher education or incomes show relatively higher ownership likelihood.

- The “early adopter” profile remains prominent; tech-savvy individuals, comfortable with risk, are overrepresented among Bitcoin owners.

- Although Bitcoin has broadened in use, demographic disparities remain substantial across gender, age, and socioeconomic lines.

Confidence in Crypto from the Strategic Bitcoin Reserve

- In the United States, 23% of non-owners said the Strategic Bitcoin Reserve increased their confidence in crypto’s value.

- In the United Kingdom, 21% of respondents felt more confident due to the Reserve’s existence.

- In France, only 15% of non-owners reported increased confidence, the lowest among surveyed nations.

- In Singapore, 19% of participants expressed improved trust in crypto’s stability.

- In Italy, 16% of respondents said the Reserve boosted their confidence.

- In Australia, 17% of non-owners became more optimistic about crypto value following the Reserve initiative.

Number of Bitcoin Wallets

- The Asia-Pacific region leads with ~350 million wallet users (~43% of global active wallets) in 2025.

- Europe has ~140 million active wallet users in 2025, marking a ~12% year-on-year rise.

- Latin America tallies ~92 million wallet users in 2025, with adoption driven in part by inflation-hedging behaviour.

- Africa registers ~75 million wallet users in 2025, reflecting rapid growth despite lesser overall penetration.

- In North America, active wallet users reach ~134 million in 2025 (~16% of the global total).

- Download growth, In May 2024, the number of wallets downloaded by 21 major providers was ~19.3 million, a ~64.8% increase year-on-year.

Daily and Monthly Active Bitcoin Users

- The Bitcoin network averaged 394,382 daily transactions in 2025, with the last 30 days reaching 439,534, an 11.45% increase versus the yearly mean.

- As of October 2025, Bitcoin processed 504,508 transactions in 24 hours, equivalent to over 21,000 per hour globally.

- Mean daily active Bitcoin addresses this year stood at 945,752, with a recent 30-day average slightly lower at 928,141 (−1.86%).

- Around 700,000–1,000,000 Bitcoin addresses are active daily, translating to roughly 300,000–500,000 unique users sending or receiving Bitcoin per day.

- Monthly active on-chain Bitcoin addresses are estimated at 30 million, reflecting the number of wallets regularly transacting.

- Monthly active crypto addresses overall are around 181 million, but only 40–70 million are considered active crypto users, up ~10 million from 2024.

- Network usage indicates around 270,000–500,000 transactions per day in mid-2025, depending on market volatility periods.

- Over 172 million total Bitcoin addresses have ever been active, yet only 25 million are regarded as economically active users on the network.

- Through 2025, daily transaction volume averaged $28.46 billion, suggesting consistent network liquidity despite wallet concentration trends.

- The total global pool of crypto users hit 716 million by 2025, representing a 16% annual increase, with Bitcoin responsible for the largest share of active network users.

Lost and Dormant Bitcoin Statistics

- As of 2025, between 2.3 million and 4 million BTC (11–18% of the maximum supply) are estimated to be permanently lost.

- As of August 2025, about 19.88 million BTC have been mined (≈94.8% of the 21 million cap).

- Large-dormancy wallets (coins untouched for several years) continue to accumulate, signalling a rising “sleeping supply”.

- Between January and March 2025, ~62,800 BTC aged over 7 years were spent, up from ~28,000 in Q1 2024.

- Dormant large-holder addresses (wallets untouched since 2010) continue to attract attention due to their potential market impact if moved.

- A significant portion of mined Bitcoin may effectively never circulate again, altering effective supply metrics.

Cryptocurrency Ownership vs Bitcoin Ownership

- The percentage of the world’s population that directly owns Bitcoin is much lower, approximately 4% in 2025.

- In the U.S., ~28% of American adults owned some form of cryptocurrency in 2025.

- Many users hold alternate cryptocurrencies, not just Bitcoin.

- Bitcoin remains the dominant cryptocurrency by value and name recognition, but many users diversify into other tokens.

- “Crypto ownership” must clarify whether it is Bitcoin-only or all cryptocurrencies.

Factors Influencing Bitcoin Adoption

- A growing number of Millennials and Gen Z (up to 65%) express a preference for crypto over traditional equities, though preferences vary across regions and survey methods.

- 14% of non-owners plan to buy crypto, and 67% of owners aim to increase holdings in 2025.

- India, the U.S., Pakistan, the Philippines, and Brazil led crypto adoption, with U.S. activity up ~50% year-on-year.

- Crypto payment use rose by ~45% in 2025, and 50% of SMEs now accept Bitcoin or stablecoins.

- 60% of users are aged 25–34, and ~80% live in urban areas, showing tech-driven adoption trends.

- 9 in 10 Fortune 500 executives call for clearer U.S. crypto rules, while 6 in 10 companies explore blockchain.

- 46% of Americans believe the Trump administration will boost mainstream crypto adoption.

- Asia-Pacific holds 37.6% of the global crypto market, while Africa’s adoption grew 19.4% year-on-year.

- Despite 72% of investors holding degrees, 40% still doubt crypto’s security and usability.

Methods for Estimating Bitcoin Owners

- 56.0 million Bitcoin addresses held non-zero balances as of August 2025, marking a new all-time high.

- 172 million addresses have ever held Bitcoin, but only 25 million are economically active wallets.

- About 983,000 wallets hold ≥1 BTC, though only ~800,000 represent true individual 1-BTC owners.

- An estimated 1.6–2.1 million BTC are lost or inaccessible, or roughly 8–10% of the total supply.

- On-chain models identify 30–35 million effective entities after clustering and overlap removal.

- 28% of U.S. adults (65 million) own cryptocurrency, with Bitcoin dominating their portfolios.

- Each Bitcoin holder averages 2.5 wallets, refining user count estimates.

- Combined data suggests 90–110 million unique Bitcoin owners worldwide in 2025.

Regulatory Environment and Its Impact on Ownership

- Over 64 jurisdictions advanced digital asset laws in 2025, marking a 43% year-on-year rise in global regulatory clarity.

- The U.S. introduced four executive orders, including a Strategic Bitcoin Reserve (March 2025), fueling a 35% Bitcoin price rise since the inauguration.

- The GENIUS Act (July 2025) created the first U.S. federal stablecoin framework mandating 100% reserves and monthly audits.

- The SEC framework (September 2025) cut ETF approval times from 270 to 75 days, a 72% efficiency gain, boosting institutional inflows.

- U.S. crypto ETF assets hit $156 billion by August 2025, with $29.4 billion in inflows during the first eight months.

- The FSB review (October 2025) found 58% of G20 members fully implemented crypto regulations, up from 22% in 2023.

- The CLARITY Act (2025) defined digital asset oversight between the SEC and CFTC, ending jurisdictional disputes.

- Regions like Singapore, Hong Kong, and the EU saw 2.3× higher institutional adoption than less-regulated markets.

- 76 licensed crypto ETPs trade in the U.S., showing a 12× growth since 2021 due to eased ETF laws.

- The G20 risk report (October 2025) warns that inconsistent frameworks pose significant global stability risks.

Future Outlook for Bitcoin Ownership

- Bitcoin’s market cap could surpass $15 trillion by 2030, with prices between $829,000–$999,000 per BTC.

- ARK Invest forecasts $710K (base), $300K (bear), and $1.48M (bull) per BTC by 2030, driven by institutional inflows.

- Coinbase CEO predicts Bitcoin could reach $1 million by 2030, aided by U.S. regulation and a Strategic Bitcoin Reserve.

- Institutional adoption controls about 8% of supply, expected to exceed 20% by 2030 with more ETFs and corporate holdings.

- Retail ownership may drop from 85% (2024) to 60% (2030) as institutions acquire more BTC via regulated channels.

- Post-2028 halving, long-term holders could own 74% of the supply kept in inactive wallets for over a year.

- Cathie Wood projects Bitcoin hitting $1.5 million by 2030 as institutional legitimacy and global integration grow.

- VanEck expects BTC to stabilise around $300,000 by 2030, assuming regulatory alignment and corporate adoption.

- Adoption models estimate 100M Bitcoin users by 2027 and 250M by 2030, fueled by DeFi and mobile wallets.

Frequently Asked Questions (FAQs)

Analysts estimate roughly 800,000 – 950,000 unique individuals hold at least one full Bitcoin.

About 28% of American adults, or approximately 65 million people, owned cryptocurrencies in 2025.

Estimates suggest that about 106 million people globally owned Bitcoin in 2025.

About ≈1.3%–4% of the world’s population holds Bitcoin in 2025.

Conclusion

In summary, the data show that while the scale of ownership of Bitcoin has grown significantly, it still remains a niche asset in global terms. With roughly 106 million people estimated to own Bitcoin and only around 4% of the world’s population participating directly, the potential for growth remains substantial.

Patterns in lost and dormant coins, the difference between Bitcoin and broader cryptocurrency ownership, and the interplay of regulations and structural factors all point to a complex but promising future. As institutional flows rise and more individuals gain access, the next decade may reshape how Bitcoin ownership is distributed, used, and perceived.