The hedge fund industry has long been shrouded in a mix of fascination and mystery. Known for their ability to generate high returns and their knack for navigating turbulent markets, hedge funds have become a cornerstone of the financial world. The hedge fund sector is undergoing transformations driven by market dynamics, regulatory changes, and technological advancements. This article explores the latest statistics and trends shaping the industry, providing a comprehensive analysis for professionals and enthusiasts alike.

Editor’s Choice

- Hedge fund investments in ESG strategies saw net outflows of $1.37 billion in July 2025, while environmental funds attracted $805 million.

- The number of active hedge funds grew by an estimated 3 to 4% year over year.

- Quantitative funds continued expanding their share of total hedge fund assets in 2025.

- Hedge funds using AI-driven strategies reported strong returns compared to traditional models.

- North America accounted for approximately 70% of global hedge fund assets under management.

- Top 10 hedge funds still control a disproportionately large share of industry assets.

Market Leaders

- Renaissance Technologies saw its 13F portfolio grow from $66.1 billion to $75.2 billion in Q2 2025, a 13.8% increase over the quarter.

- Citadel holds approximately $67 billion in AUM as of mid‑2025.

- Man Group reached $193 billion in assets in 2025 after Q2 net inflows hit $14 billion.

- Two Sigma and similar systematic / AI‑driven firms continue to grow, though specific 2025 AUM increases are not clearly published.

- Point72 Asset Management has $220.9 billion in AUM as of late July 2025.

- BlackRock’s hedge fund platform manages $76 billion in hedge assets, and its overall alternative investments are projected to push its total AUM toward $12.2 trillion in 2025.

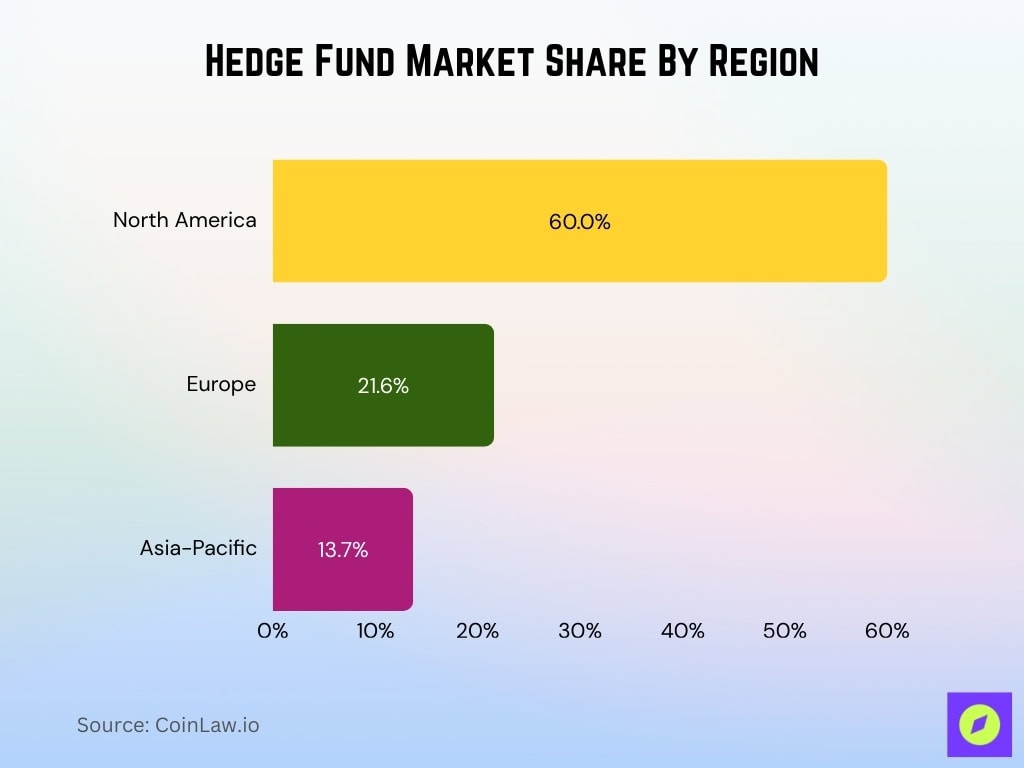

Market Share

- North America holds nearly 60% of global hedge fund AUM by mid‑2025.

- Europe contributed about 21.6% of total hedge fund assets in 2025.

- Asia‑Pacific represents around 13.7% of the hedge fund market in 2025.

- The top 20 hedge funds manage nearly 40% of total AUM as of 2025.

- Institutional investors account for approximately 65% of all hedge fund capital in 2025.

- Retail investor share remains modest at about 7% but shows slight growth in 2025.

- Multi‑strategy funds make up over 35% of hedge fund AUM in 2025

Industry Segmentation

- Small‑sized hedge funds (managing <$250 million) remain numerous and likely make up about 60‑65% of all funds in 2025 while controlling only about 10‑12% of AUM.

- Mid‑sized funds (managing $250 million‑$1 billion) continue fastest growth in AUM at roughly 12‑15% year‑over‑year in 2024‑2025.

- Large funds (managing >$1 billion) dominate and hold more than 80% of total industry AUM in 2025.

- US‑based hedge funds represent nearly 60% of global AUM in 2025, with Europe following around 20‑25%.

- Technology‑focused sectors account for about 25‑30% of hedge fund portfolio allocations in 2025.

- ESG‑focused funds’ AUM are estimated at $300+ billion in 2025, driven by institutional demand.

- Hedge funds in the healthcare and biotech sectors saw AUM growth of about 10‑15% in 2024–2025, powered by innovation and investment in medical technologies.

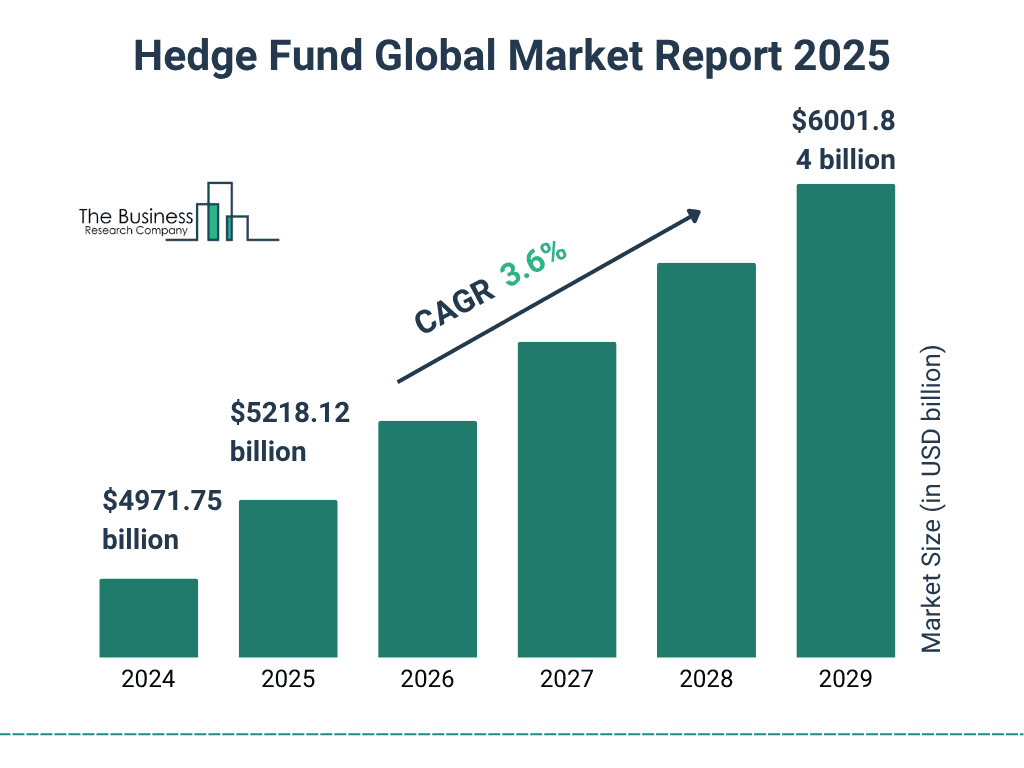

Hedge Fund Global Market Statistics

- The global hedge fund market is projected to reach $5,218.12 billion in 2025.

- The market is forecasted to grow at a CAGR of 3.6% from 2024 to 2029.

- By 2029, the hedge fund market size is expected to surpass $6,001.84 billion.

- Overall, the industry is adding more than $1 trillion in value within five years.

Market Trends

- On average, hedge funds delivered a 4.83% return in the first half of 2025, driven by tactical and quant‑equity strategies.

- Pressure on fees continues with many funds moving away from the traditional “2 and 20” rate to performance‑aligned and hurdle fee models, and management fees dropping toward 1.1%.

- AI adoption is high, with roughly 86% of hedge fund managers now using generative AI tools in investment or risk workflows.

- Private banks and wealth managers increased hedge fund assets by over 10% in H1 2025 as institutional demand surged.

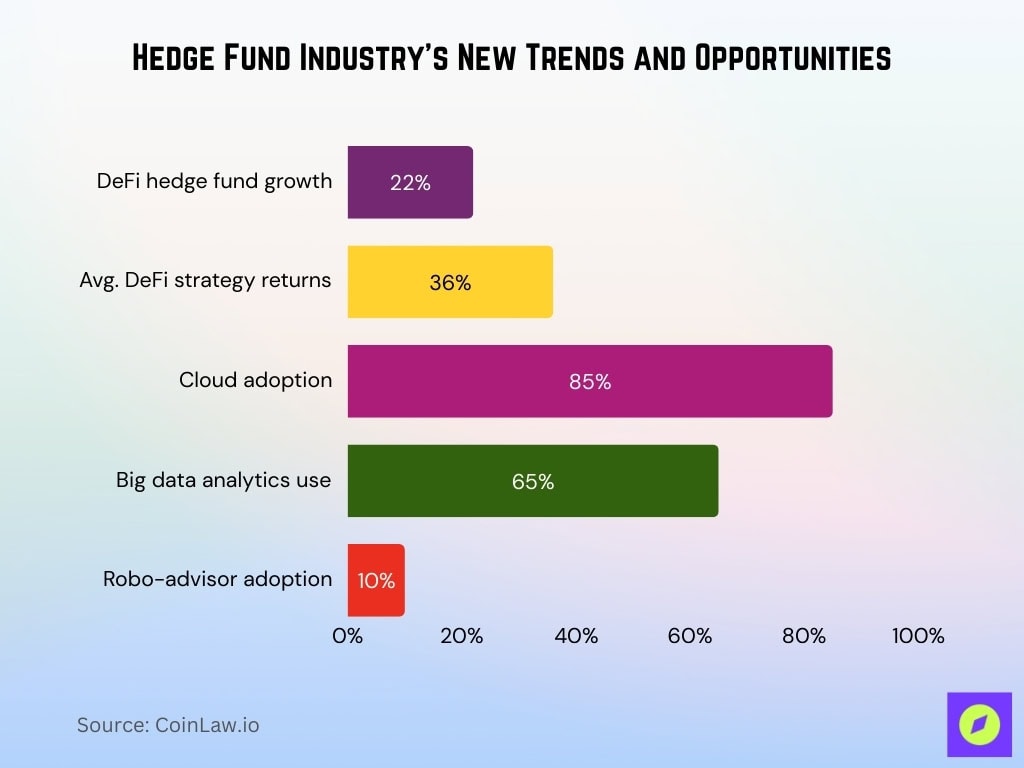

Identify New Trends and Opportunities

- DeFi‑focused crypto hedge funds grew about 22% in 2025, with average returns near 36% for DeFi strategies.

- Cloud computing adoption among hedge funds has reached about 85% in 2025, facilitating more scalable data storage and analytics.

- Big data analytics is employed by around 65% of hedge funds to improve investment decisions in 2025.

- The use of robo‑advisors in smaller hedge funds remains niche at approximately 10% employing automated client interfaces.

- Clean energy and climate‑tech investment interest remains strong with clean energy the top sector at 23% of climate funding, and recently raising around $9.4 billion in clean energy deals in 2024.

- The shift to AI‑augmented decision‑making is reducing costs and boosting efficiency in many funds, with cost savings of roughly 10‑12% industry‑wide expected by the end of 2025.

- Institutional interest in carbon credit markets is rising, though projections toward $50 billion by 2030 remain futures estimates.

- SPAC‑related hedge fund activity continues, but specific new investment totals like $60 billion are not confirmed in recent 2025 sources.

- NFT‑based hedge fund portfolios remain niche, and estimates like $2 billion market size are unverified in recent 2025 data.

- Asia‑Pacific hedge fund market growth is projected at around 10% annually, especially in India and Vietnam, driven by regulatory and economic reforms.

Hedge Fund Market News

- SEC postponed new hedge fund disclosure rules until October 1, 2026, due to regulatory delays.

- Activist investors secured a record 92% of board seats through settlements in U.S. companies during H1 2025.

- Settlements between activists and companies increased by 32% with 86 board seats won in H1 2025.

- SEC withdrew its proposed ESG disclosure rule in June 2025 after industry pushback.

- SEC formally ended defense of its climate disclosure rules in 2025, signaling a regulatory shift.

Core Hedge Fund Strategies Targeted by Investors

- 21% of fund searches focused on Long/Short Equity, making it the top strategy.

- 14% targeted Macro strategies, reflecting investor interest in global trends.

- 14% of searches went to Multi-Strategy funds, showing demand for diversified approaches.

- 12% targeted Managed Futures/CTA, highlighting growth in systematic trading.

- 10% of investors searched for fixed-income strategies, seeking stable returns.

- 9% focused on Event Driven funds, tied to corporate actions and restructurings.

- 9% searched for Long/Short Credit, signaling rising interest in credit opportunities.

- 7% of searches went to Equity Market Neutral, appealing for low-correlation exposure.

- 3% focused on Special Situations, indicating niche but targeted interest.

Recent Developments

- Global hedge fund AUM reached $4.74 trillion in the first half of 2025 with $37.3 billion in net inflows.

- The industry ended 2024 at $4.51 trillion, reflecting a growth of nearly 10% from the previous year.

- Funds managing over $5 billion attracted most of the new capital, taking in close to $30 billion in H1 2025.

- The average hedge fund return in H1 2025 was approximately 4.5%, led by quant equity and multi-strategy funds.

- Larger hedge funds dominated capital flows in 2025 as volatility pushed investors toward proven performers.

- Total industry capital rose by over $400 billion year over year heading into 2025.

- Institutional demand remained strong, favoring well-established hedge funds with consistent results.

Frequently Asked Questions (FAQs)

$4.74 trillion.

An increase of approximately $212.7 billion from Q1 to Q2 2025.

About 4.83 %.

Projected to reach approximately $11.05 trillion by 2030 with a CAGR of about 10.8 %.

Conclusion

The hedge fund industry continues to thrive as a dynamic pillar of the financial ecosystem. Despite challenges like regulatory pressures and market volatility, hedge funds remain a beacon of adaptability. Opportunities in DeFi, clean energy, and private markets are set to redefine the industry landscape, ensuring its relevance for years to come.