In recent years, ownership of cryptocurrencies and digital assets has surged, intensifying the need for more secure self-custody tools. As institutions and individuals alike shift toward non-custodial storage, hardware wallets are becoming central to the evolving infrastructure of digital asset security. In finance, hedge funds are deploying hardware appliances to isolate private keys. In retail, individual crypto users increasingly depend on cold wallets for long-term holdings. Let’s explore the data behind this momentum.

Editor’s Choice

- The hardware wallet market will grow at a CAGR of ~29.95% from 2025 to 2030.

- Another forecast projects a CAGR of 23.9% through 2031.

- Analysts project the total market value in 2025 to reach $0.56 billion.

- Alternatively, forecasts estimate $522.5 million for 2025.

- In 2024, the global market stood at $469.39 million and is set to rise to $582.98 million in 2025.

- In 2025, the USB-connectivity segment will command ~44.67% of revenue share.

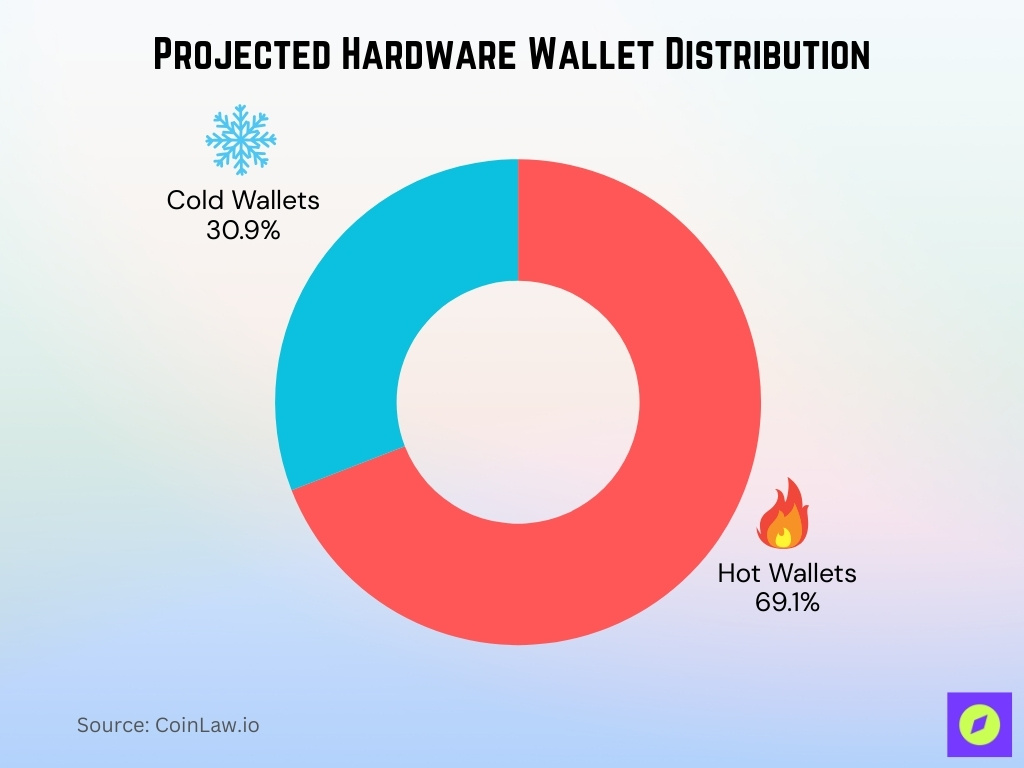

- In 2025, the hot wallet segment will hold ~69.1% of the market.

Recent Developments

- Cold wallet ownership among retail users rose by 34% year on year in 2025.

- Institutional adoption of secure wallet solutions, particularly for cold storage, saw YoY growth of up to 50%.

- Hot wallets still dominate primary storage; ~78% of crypto users rely on them in 2025.

- A surge in high-profile exchange hacks and bankruptcies has driven demand for noncustodial solutions.

- Block, Inc. launched Bitkey, a multisignature hardware wallet, in over 95 countries beginning in 2024.

- Tangem unveiled a self-custodial Visa card using its wallet chip, expanding hardware wallet UX into payments.

- Hardware wallet manufacturers are localizing secure element production to mitigate supply chain risks.

- Venture funding continues flowing to crypto security firms, enabling novel hardware designs and certification investment.

By Wallet Type (Hot vs Cold Wallets)

- In 2025, hot wallets are projected to capture 69.1% of the hardware wallet segment.

- Conversely, cold wallets are expected to account for ~30.9% of that segment.

- Among the broader wallet universe (not just hardware), ~78% of users use hot wallets in 2025.

- Cold wallets hold a 22% share in the total wallet market in 2025.

- The cold wallet or hardware wallet market is forecast to grow at a CAGR of ~30.76% through 2033.

- In 2024, hot wallets held ~56% revenue share in wallet markets overall; hardware was smaller but growing.

- The distinction matters because “hardware wallet” often equates to cold storage, differentiating from software hot wallets.

- As a subset, hardware wallet cold solutions benefit when users shift from custodial hot wallets to self-custody.

Connection Type (USB, NFC, Bluetooth)

- In 2025, USB connectivity is expected to hold ~44.67% of the hardware wallet market share.

- USB wallet share for 2024 stood at 47.52%.

- NFC and Bluetooth wallet segments are projected to grow strongly, with NFC foreseen at a 30.54% CAGR through 2030.

- Some reports assert USB dominance; about 60% of hardware wallet units use USB.

- NFC and Bluetooth combined may account for around 30% of the connectivity mix in the near term.

- The rising demand for portability and convenience is pushing NFC and Bluetooth adoption upward.

- Some smartcard wallets use NFC as a core interface, influencing segment growth.

- Certification costs and security burden are higher for wireless connections, which slows their initial uptake.

By End User (Individual vs Commercial)

- In 2024, individuals held ~72.31% of hardware wallet revenue share.

- Institutional and commercial deployments are forecast to grow at a CAGR of ~31.05% through 2030.

- While individuals currently dominate in wallet count, some forecasts predict that commercial deployments could generate up to 68.88% of total hardware wallet revenue in 2025, driven by larger order volumes and security demands.

- The discrepancy suggests increasing institutional demand offsetting individual dominance.

- Retail users currently make up ~82% of all crypto wallet holders globally.

- Institutional wallet usage rose 51% year-on-year in 2025.

- Retail crypto users manage an average of 2 to 3 wallets, including combinations of hot, cold, and custodial wallets, for diversified asset security.

- Commercial buyers place larger orders, driving revenue concentration even if fewer in number.

Hardware Wallet Market Outlook

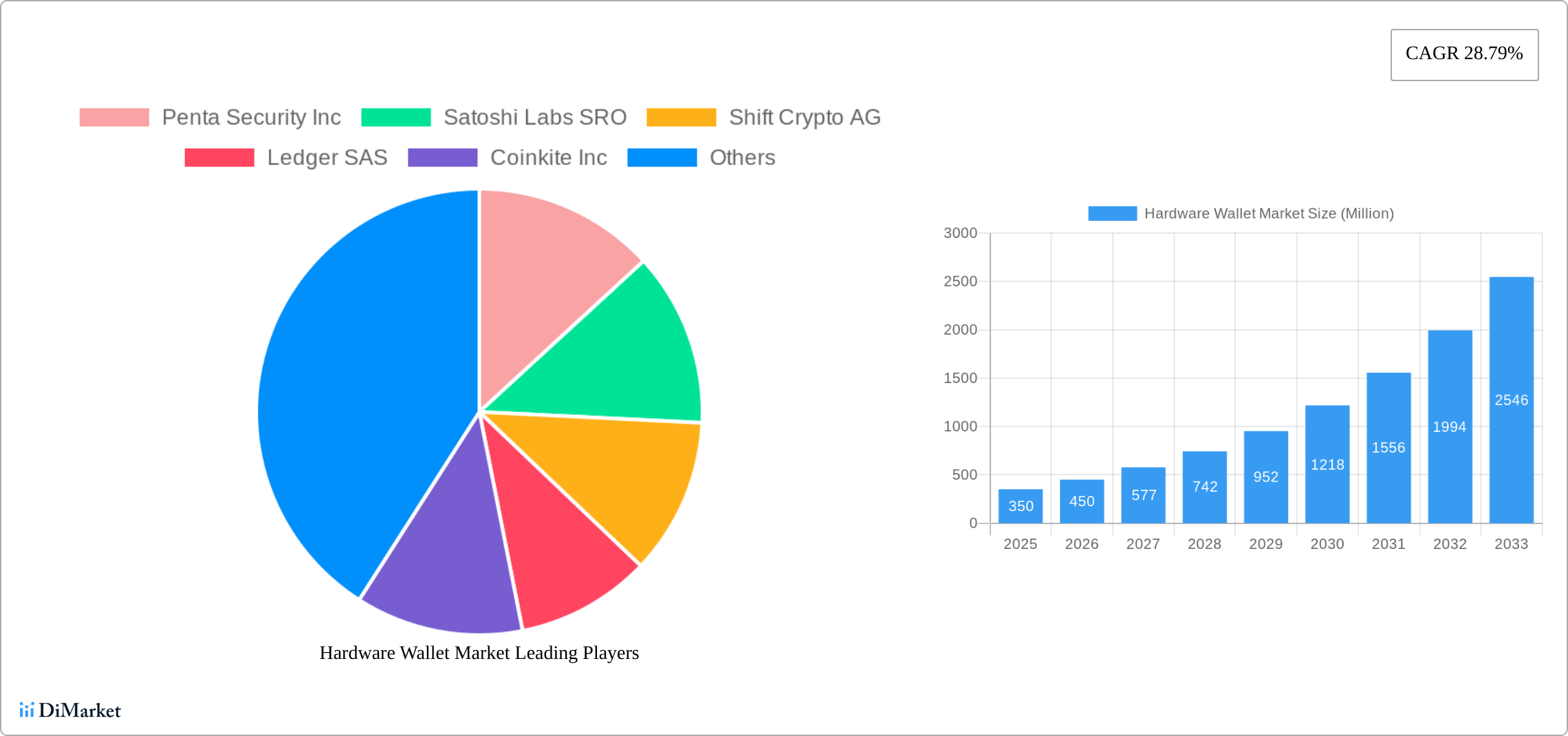

- The hardware wallet market size is expected to reach $350 million in 2025 and grow steadily to $2.55 billion by 2033.

- This expansion reflects a strong CAGR of 28.79% across the forecast period.

- Key market players include Penta Security Inc., Satoshi Labs SRO, Shift Crypto AG, Ledger SAS, and Coinkite Inc., alongside a large “Others” category dominating the share.

- The market more than doubles between 2029 ($952 million) and 2032 ($1.99 billion), showing accelerating adoption.

- By 2030, the market will surpass $1.2 billion, reinforcing the rising demand for secure digital asset storage.

Leading Hardware Wallet Brands and Market Share

- Major players include Ledger, Trezor, KeepKey, SafePal, CoolWallet, and Ellipal as dominant vendors in 2025.

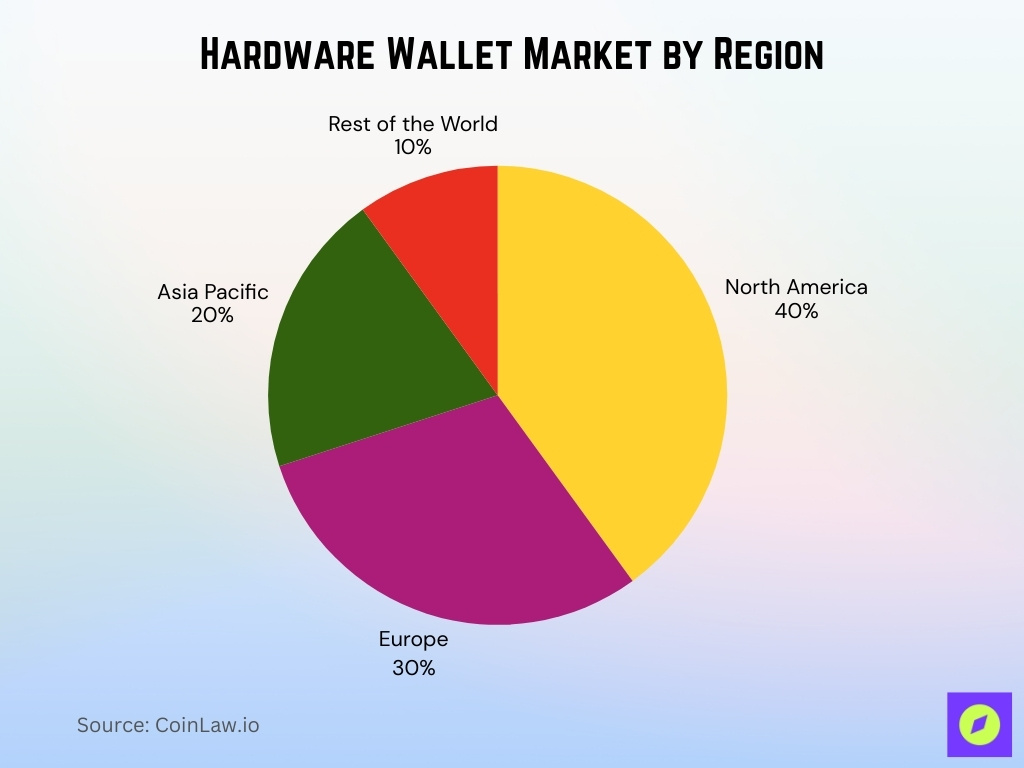

- In 2024, North America accounted for ~39.63% of hardware wallet revenue, with many leading brands headquartered or strongly distributed there.

- Asia Pacific is projected to post a 30.32% CAGR to 2030, as local and regional brands gain traction.

- In 2025, the Commercial or enterprise end-user segment is estimated to hold 68.88% share, which skews revenue concentration toward enterprise deployments.

- Ledger and Trezor routinely top “best hardware wallets” lists for both retail and advanced users.

- Block’s Bitkey launched in 2023 and began shipping hardware units in 2024.

- Tangem is notable for combining usability and security in card-style wallets.

- Newer entrants like SafePal, Ellipal, and CoolWallet push features such as wireless connectivity and phone-first UX to gain share.

Adoption and Usage Rates

- In 2024, the global hardware wallet market size was estimated at $469.39 million, with projections to rise to $582.98 million in 2025.

- The hardware wallet market is projected to $0.56 billion in 2025, growing to $2.06 billion by 2030.

- Estimates put the 2024 base at ~$474.7 million, with expansion toward ~$2,435 million by 2033.

- The hot wallet segment held ~63.41% share in 2024.

- USB connection type devices had ~47.52% share in 2024.

- North America leads regional adoption in 2025 at around 39.4% share.

- Enterprise hardware wallet adoption is projected to grow faster than consumer usage, with a forecasted 31.05% CAGR.

- Online sales channels accounted for ~54.73% of hardware wallet value in 2024; offline channels are forecast to register a 30.68% CAGR to 2030.

- Asia Pacific is the fastest-growing region, driven by smartphone penetration and crypto activity.

Hardware Wallet Market by Region

- North America dominates with 40% of the global hardware wallet market.

- Europe captures 30%, supported by strong regulations and crypto adoption.

- Asia Pacific accounts for 20%, fueled by growing demand in emerging tech hubs.

- The Rest of the World holds the remaining 10%, representing smaller but expanding markets.

Institutional vs Retail Adoption

- In 2024, individuals (retail) held ~72.31% of hardware wallet revenue share.

- Institutional deployments are forecast to expand at ~31.05% CAGR through 2030.

- In 2025, institutions are bringing maturity while retail injects momentum into the crypto market.

- Institutional usage of cold storage rose ~51% year-over-year in 2025.

- Retail investors continue to dominate wallet count, globally, ~82% of crypto holders are individuals.

- Average retail users hold ~2.7 wallets in 2025.

- Commercial buyers place larger-volume orders, so while fewer in count, they drive disproportionate revenue.

- Institutional adoption often ties with governance, key management, and risk protocols, pushing vendors to offer certification and APIs.

Restraints and Market Challenges

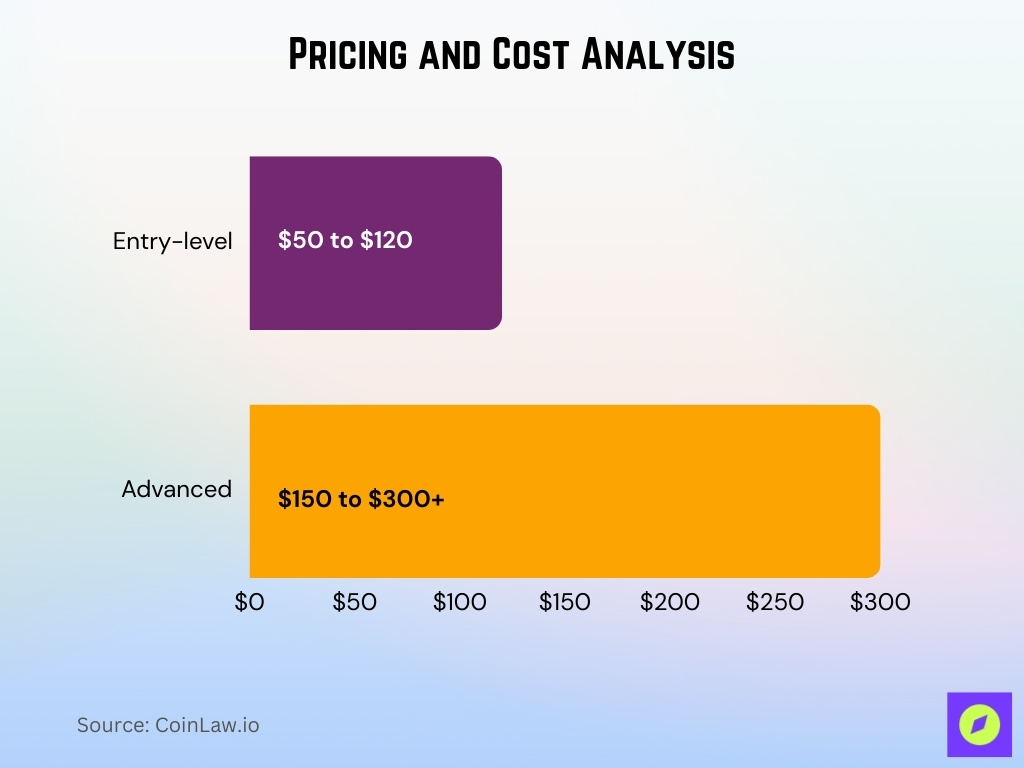

- Price sensitivity remains a barrier; advanced wallets can cost $150–$300+, limiting adoption in cost-conscious markets.

- Regulatory fragmentation across jurisdictions increases compliance complexity.

- User experience friction with seed phrases, firmware updates, and cross-chain management deters adoption.

- Wireless connectivity introduces higher security risk vectors and certification burdens.

- Supply chain constraints for secure chips and certification delays hamper scaling.

- Attacks like clipboard or UI manipulation still pose threats to wallet workflows.

- Emerging threats from quantum computing may pressure cryptographic standards in the future.

- Market consolidation and capital intensity favor incumbents, making it harder for newer entrants to scale.

Pricing and Cost Analysis

- Entry-level hardware wallets in 2025 tend to cost in the $50 to $120 range.

- Advanced units may run $150 to $300+, depending on features.

- Some manufacturers adopt subscription or firmware maintenance contract models.

- Cost drivers include secure element procurement, certifications, R&D, and warranty support.

- Regionally, tariffs and import duties can raise local retail prices by 10%–25%.

- Vendors often offer volume-based pricing for enterprise orders, with discounts that can range from 15% to 40%.

- Lifecycle cost includes firmware updates, customer support, and replacement warranties.

- Whether customers pay through one-time hardware fees vs bundled service fees shifts business models.

Competitive Landscape

- Ledger and Trezor remain legacy leaders, but challengers like SafePal, Ellipal, CoolWallet, Tangem, and Arculus are making headway.

- Block’s Bitkey, a multisignature wallet combining hardware and mobile, entered the scene with $150 price.

- Tangem’s card or wearable designs stand out in physical form and usability.

- OneKey is pushing open-source hardware and software integration with wallet UX.

- Some niche players target highly specialized use, such as ultra-secure vaults and cold storage appliances for enterprises.

- Competitive advantage increasingly hinges on security credibility, certification, customer support, and integrations.

- Partnerships with exchanges, DeFi platforms, and custody firms give hardware wallet brands distribution leverage.

Future Market Outlook and Forecasts

- Hardware wallet revenue projected at $0.56 billion in 2025, rising to $2.06 billion by 2030 (CAGR ~29.95%).

- Growth forecast from $582.98 million in 2025 to $3,300.86 million by 2033 (CAGR ~24.2%).

- Estimated $474.7 million in 2024, reaching $2,435.1 million by 2033 with CAGR ~18.93%.

- Forecasts a 23.9% CAGR from 2025 to 2031.

- Estimates $348.4 million for 2025, rising to $1,527.6 million by 2032 (CAGR ~23.5%).

- Market seen at $360 million in 2024, expecting $2,732 million by 2031 (CAGR ~31.96%).

- Valuation estimated at $680 million in 2025, with expansion to ~$4,767 million by 2035 (CAGR ~21%).

- The variation in forecasts reflects differing definitions and risk assumptions.

- Overall, the long-term trajectory suggests robust growth, with institutional demand, regulatory pressure, and security consciousness driving adoption.

Frequently Asked Questions (FAQs)

~$0.56 billion (per Mordor Intelligence).

~29.95% CAGR.

~47.52% share.

~72.31% of revenue.

Conclusion

The hardware wallet market today sits on the cusp of transformation. As the crypto ecosystem matures, demand is shifting toward devices that are not just secure vaults, but full-feature security terminals, with usability, recovery, compliance, and privacy baked in. While early forecasts diverge in scale, they uniformly point toward double-digit annual growth in the coming years. Incumbents may lead for now, but challengers with innovative form factors or compliance tools could reshape positions. In short, hardware wallets will remain core to self-custody strategy, and the next decade will define which brands, architectures, and security models prevail.