Imagine you’re at a bustling coffee shop, and the line is long. Instead of fumbling for cash or a card, you tap your phone, and voilà, payment is done. This seamless experience is powered by Google Pay, a digital wallet revolutionizing how we transact globally. In 2025, Google Pay continues to redefine convenience, with millions of users and billions of dollars in transactions worldwide. This article dives into the fascinating statistics behind its widespread adoption and impact.

Editor’s Choice: Key Usage Statistics

- Over 2.1 billion transactions were processed by Google Pay in 2025, showing a 30% increase from the previous year.

- Google Pay is now accepted by 87% of merchants in the United States, reflecting its expanding footprint.

- The app reached 5.2 billion global downloads in 2025, reinforcing its dominance in the mobile wallet space.

- In 2025, Google Pay captured 18% of the global digital payments market.

- 49% of US users now prefer Google Pay for contactless payments, widening the gap with traditional card usage.

- The platform supports transactions in 60+ currencies, highlighting its international adaptability.

- Over 6.4 million merchants worldwide integrated Google Pay in 2025, rising sharply from previous years.

Global User Base

- Google Pay reached 820 million active users globally in 2025, reflecting a 17% year-over-year growth.

- India accounts for 62% of the total user base, maintaining its position as Google Pay’s largest market.

- 85% of Google Pay users fall within the 18–45 age group, showing its appeal to tech-savvy millennials and Gen Z.

- The United States now has 165 million users, cementing its role in mature market adoption.

- The app is active in over 45 countries, with accelerated growth across Southeast Asia and Eastern Europe.

- In 2025, Google Pay added 30 million new users, with the majority from emerging economies.

- A 34% spike in new users occurred during the holiday season, fueled by cashback incentives and digital campaigns.

Market Share and Adoption Rates

- Google Pay holds 21.5% of the global mobile wallet market in 2025, still ranking second behind Apple Pay.

- Urban adoption hit 75%, with three out of four smartphone users having Google Pay installed in major cities.

- 1 in 2 Android users now use Google Pay for daily payments, up significantly from previous years.

- 88% of online retailers in India support Google Pay at checkout, reinforcing its e-commerce dominance.

- US adoption among small businesses jumped 19% in 2025, thanks to faster onboarding and no-code tools.

- 47% of users use Google Pay for peer-to-peer transfers, extending its role beyond retail.

- Adoption in Europe rose by 24%, with Germany, France, and Italy seeing strong gains from regional banking integrations.

Key Insights from Google Pay Usage and Demographics

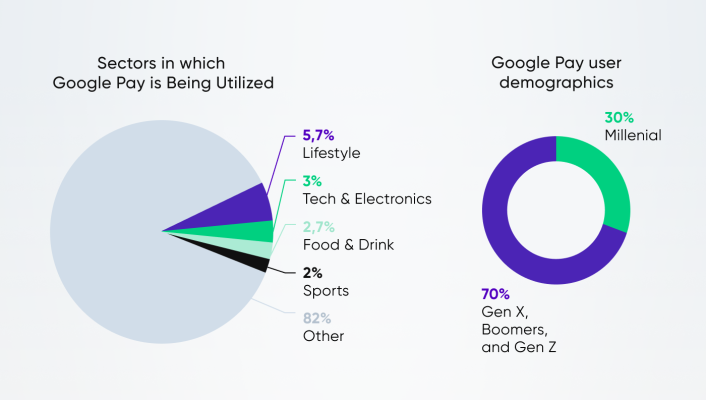

- Google Pay is used across diverse sectors, with Lifestyle (5.7%), Tech & Electronics (3%), Food & Drink (2.7%), and Sports (2%) showing notable adoption.

- A dominant 82% of transactions fall under “Other” categories, suggesting broad and varied use cases beyond listed sectors.

- In terms of user demographics, 30% of Google Pay users are Millennials, highlighting strong engagement from younger adults.

- The remaining 70% of users belong to Gen X, Boomers, and Gen Z, showcasing Google Pay’s cross-generational appeal.

Transaction Volume and Value

- Google Pay processed over $1.32 trillion globally in 2025, reflecting a 26% increase from the previous year.

- $490 billion in transactions were handled in the United States alone, underscoring its growing domestic footprint.

- Peer-to-peer payments exceeded $370 billion, showing continued strength in personal money transfers.

- The average global transaction value is $76, with higher spends in markets like the US, UK, and Singapore.

- 52% of transactions are under $100, reinforcing Google Pay’s role in daily micro-purchases.

- In-app purchase volume grew 33% year-over-year, supported by mobile-first consumer behavior.

- 35 million high-value transactions over $10,000 were logged in 2025, boosted by premium merchant partnerships.

- Mobile commerce transactions through Google Pay accounted for 35% of total digital wallet payments worldwide.

Regional Usage Insights

- India remains the top market for Google Pay with $610 billion in transaction value, marking a 22% annual increase.

- Southeast Asia adoption rose by 46%, led by strong uptake in Indonesia, Thailand, and Vietnam.

- North America accounts for 43% of total transaction volume, maintaining its lead in developed economies.

- Adoption in Europe jumped 21%, driven by strategic partnerships in the UK, Germany, and France.

- Google Pay usage in Latin America grew 39%, with Brazil and Mexico driving mobile wallet expansion.

- Africa and the Middle East saw an 18% increase in transaction volume, supported by rising fintech adoption.

- Australia recorded 24% growth in transaction value, with high usage in transit, retail, and hospitality.

- Merchant integrations in Japan grew 28%, reflecting deeper traction in a historically cash-centric market.

Integration with Merchants and Platforms

- Over 5 million merchants globally now support Google Pay, representing a 30% growth since 2022.

- Major retail giants like Walmart, Target, and Best Buy offer Google Pay as a checkout option, enhancing consumer convenience.

- Google Pay has integrated with 90% of top e-commerce platforms, including Shopify, WooCommerce, and Magento.

- Small businesses accounted for 20% of new integrations, boosted by simplified API tools from Google.

- Google Pay expanded its loyalty card and coupon integration, now supporting over 500 major brands worldwide.

- Transit systems in 50 cities worldwide, including New York, London, and Tokyo, now accept Google Pay for contactless travel payments.

- Restaurants and cafes witnessed a 35% rise in Google Pay transactions, driven by partnerships with food delivery platforms like DoorDash and Uber Eats.

- Google Pay’s integration with virtual reality platforms like Oculus and gaming services like Google Stadia has opened new avenues for digital transactions.

Technological Innovations and Features

- Google Pay now supports 65+ currencies through its multi-currency wallets, expanding global usability.

- Biometric authentication adoption reached 72% in 2025, strengthening security and user trust.

- NFC payments are now supported on 94% of Android devices, ensuring broad compatibility across brands.

- The split payment feature saw 38% user uptake within the first three months of 2025, growing in group use cases.

- AI-powered fraud detection prevented $1.4 billion in fraudulent activity, marking a significant leap in risk reduction.

- Crypto wallet linking usage rose 41%, enabling smooth crypto-to-fiat transactions within the app.

- Advanced analytics tools boosted merchant personalization, with 62% reporting better customer retention and ROI.

- Offline payment mode expanded to 12 countries, supporting secure, no-internet transactions in low-connectivity areas.

Regional Breakdown of Google Pay’s Customer Base

- The United States dominates Google Pay’s user base, accounting for a massive 61.9% of all customers.

- The United Kingdom holds 9.41%, making it the second-largest region for Google Pay users.

- Canada comes next with 7.12% of the total customer share.

- Users categorized under “Others” contribute 6.21%, representing a mix of smaller markets.

- Australia represents 5.54% of Google Pay’s global customer base.

- In Europe, Germany (2.75%), Spain (1.78%), and Italy (1.68%) show moderate adoption.

- Asian regions like Hong Kong (1.48%), Japan (1.02%), and the Netherlands (1.12%) hold smaller shares.

The data highlights Google Pay’s strong concentration in North America, especially the U.S., while also showing a growing international presence.

Google Pay User Demographics

- 45% of Google Pay users are millennials (ages 25–40), making them the largest demographic group on the platform.

- Gen Z adoption surged by 30%, particularly for peer-to-peer payments and subscription services.

- 70% of users identify as frequent digital shoppers, utilizing Google Pay for e-commerce transactions.

- Male users account for 55% of the user base, while female users represent 45%, showcasing a nearly balanced gender distribution.

- Users earning over $75,000 annually represent 40% of the user base in the United States, reflecting its popularity among higher-income groups.

- Urban residents dominate usage, with 80% of transactions originating from metropolitan areas globally.

- In emerging markets, rural adoption rates have increased by 18%, thanks to improved smartphone penetration and simplified interfaces.

- 25% of Google Pay users globally also use the app for managing loyalty cards and digital rewards.

Google Pay vs. Apple Pay vs. Samsung Pay Compared

- Google Pay boasts an 18.3% market share, trailing behind Apple Pay at 24%, but ahead of Samsung Pay’s 12%.

- In terms of global user base, Google Pay leads with 700 million active users, surpassing Samsung Pay’s 500 million, but falling short of Apple Pay’s 1 billion.

- Google Pay supports over 50 currencies, more than Apple Pay (40) and Samsung Pay (25), highlighting its global adaptability.

- While 70% of merchants globally accept Google Pay, Apple Pay leads with 85% acceptance, and Samsung Pay trails at 65%.

- Google Pay is the only platform offering seamless peer-to-peer transactions in 40+ countries, giving it a competitive edge.

- Apple Pay dominates iOS users with 95% penetration, while Google Pay captures 65% of Android users, the largest smartphone user group worldwide.

- Samsung Pay stands out with its MST technology, allowing it to work on traditional card readers, an area where Google Pay and Apple Pay are less versatile.

- Google Pay’s multi-platform integration, including web browsers and in-app payments, is broader compared to its competitors.

- Among US users, Google Pay’s market share grew by 15%, narrowing the gap with Apple Pay, which saw only a 5% growth.

Google Pay Global Reach and Usage Stats

- Google Pay operates in 42 countries, highlighting its expansive international footprint.

- The platform has 150 million users worldwide, showing widespread global adoption.

- 800,000 websites are integrated with Google Pay, enabling seamless online payments.

- Google Pay accounts for 20% of all mobile transactions globally, marking its strong influence in the digital payments space.

Recent Developments

- Google Pay expanded airline partnerships, now supporting boarding pass storage with 18 major carriers globally.

- Cross-border remittance now covers 35+ countries, with instant transfers growing by 28% year-over-year.

- ‘Pay later’ transactions rose by 26%, boosting average order value across travel, electronics, and healthcare sectors.

- Zero-fee model adoption by small businesses surged 37%, fueling strong merchant growth in emerging markets.

- Healthcare payments via Google Pay grew 44%, driven by expanded provider network integrations.

- Green payment rewards usage increased 31%, with eco-friendly merchants offering cashback up to 5%.

- Enhanced merchant analytics tools adoption rose 42%, improving targeted campaigns and customer insights.

- Wearable device usage jumped 58%, as smartwatches became a preferred mode for contactless payments.

- Customer support chatbot cut resolution times by 46%, significantly improving user experience for routine issues.

- Meta integration drove a 34% rise in in-app purchases on Facebook and Instagram via Google Pay.

Conclusion

As Google Pay expands, its innovations and user-friendly features ensure its position as a leading player in the digital payment ecosystem. From cross-border transactions to eco-friendly incentives, the platform addresses modern consumer needs while maintaining a robust technological infrastructure. Its ongoing competition with Apple Pay and Samsung Pay spurs advancements that benefit users worldwide. With more features, broader accessibility, and sustained growth, Google Pay is set to redefine the way we transact in 2025 and beyond.