The global cryptocurrency market continues to evolve rapidly, and the exchange Gate.io is actively shaping that trajectory. Gate.io’s performance offers a window into both institutional and retail crypto trends. For example, an asset manager benchmarking crypto platform security can use Gate.io’s reserves data as a comparative metric; likewise, a token-project team may choose Gate.io for listing because of its high trading-pair count and global reach. Read on to explore a full breakdown of the latest statistics, market share, user growth, and trading volumes for Gate.io.

Editor’s Choice

- In June 2025, Gate.io achieved a total reserve value of $10.453 billion, with a reserve ratio of 123.09%.

- The platform’s derivatives trading volume surged by 69.9% month-on-month in May 2025, reaching $264 billion.

- Gate.io’s spot trading volume for April 2025 was over $110 billion (+14% MoM growth).

- The exchange supports more than 3,500 cryptocurrencies and trading pairs, positioning itself among the largest in variety.

- As of mid-2025, Gate.io’s derivatives market share reached 4.13%, crossing several established competitors.

- Gate.io ranked among the top 3 global crypto exchanges by trading volume in selected metrics as of August 2025.

Recent Developments

- In May 2025, the platform announced that it now ranks second globally in 24-hour spot trading volume.

- Gate.io has rebranded its domain to Gate.com and refreshed its logo in 2025 to reinforce its “next-generation exchange” identity.

- The company is pushing an “All in Web3” strategy, integrating its centralized exchange features with Web3 infrastructure in 2025.

- In Q1 2025, the platform listed over 200 new tokens on its spot trading platform, enhancing its listing agility.

- Gate.io introduced refined futures and derivatives infrastructure, which is now cited as the “core engine” driving platform growth.

- The platform’s proof-of-reserves publication was enhanced with zero-knowledge proofs and Merkle-tree technology in 2025.

- Gate.io expanded its fiat-gateway support to include 36 fiat currencies via VISA/Mastercard as part of its institutional services upgrade.

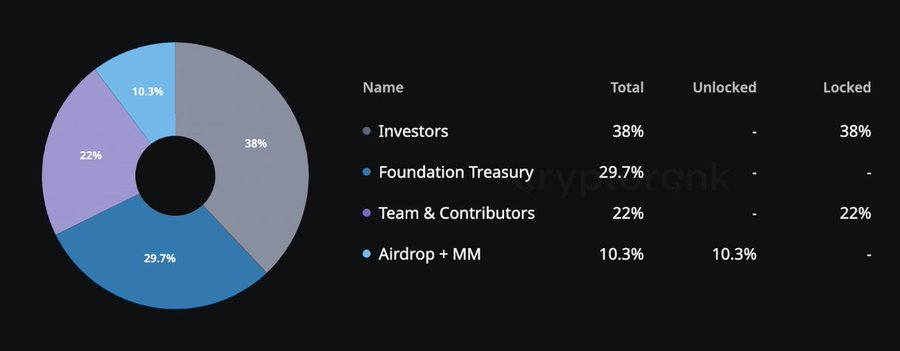

Token Allocation Overview

- Investors hold the largest share at 38%, all of which remains locked, reflecting a long-term investment commitment.

- The Foundation Treasury accounts for 29.7%, serving as the primary reserve for ecosystem development and operations.

- Team & Contributors collectively control 22%, entirely locked, showing deferred rewards aligned with project milestones.

- Airdrop + Market Making (MM) represents 10.3%, fully unlocked, aimed at boosting liquidity and early community participation.

User Growth and Demographics

- Gate.io surpassed 30 million global users by July 2025.

- Approximately 65% of new Gate.io users in 2025 came from outside Asia.

- In 2024, Gate.io expanded to serve users in more than 150 countries.

- The proportion of users under age 30 grew to nearly 44% in early 2025.

- Gate.io’s Q2 2025 internal data showed a 27% rise in futures trading activity among retail users aged 18–34.

- Over 60% of Gate.io’s new accounts in Q1 2025 were activated through the “Refer to Earn” program.

- Gate.io experienced a 22% year-over-year user growth rate from July 2024 to July 2025.

- Institutional clients represented 16% of Gate.io’s total trading volume in H1 2025.

- Female users accounted for about 19% of new registrations in Q2 2025.

- More than 85% of active users accessed Gate.io on mobile devices throughout 2025.

Market Share and Global Ranking

- Gate.io’s reserve ratio was 128.57% as of October 2025, among the highest globally.

- In Q1 2025, Gate.io recorded trading volume of around $361.3 billion for centralized products.

- July 2025 derivatives market share at Gate.io peaked at 11%, with $740 billion monthly volume.

- Gate.io ranked #2 globally in 24-hour spot trading volume multiple times in 2025.

- In May 2025, derivatives market share stood at 4.13%, outpacing many legacy competitors.

- Compared to the largest exchange, Gate.io’s spot volume market share reached 9% versus a 38% leader in April 2025.

- Reserve reporting exceeded 100% benchmark, with BTC reserve ratio at 138.7% in mid-2025.

- Top-10 centralized exchange rankings cited Gate.io’s quarterly volumes over $120 billion in Q3 2025.

- Gate.io is consistently included on “Top 10 Crypto Exchanges” lists for product diversity and transparency in 2025.

- Despite industry-wide volume drops, Gate.io’s derivatives volume surged 44% to $374 billion in July 2025.

Spot Trading Performance

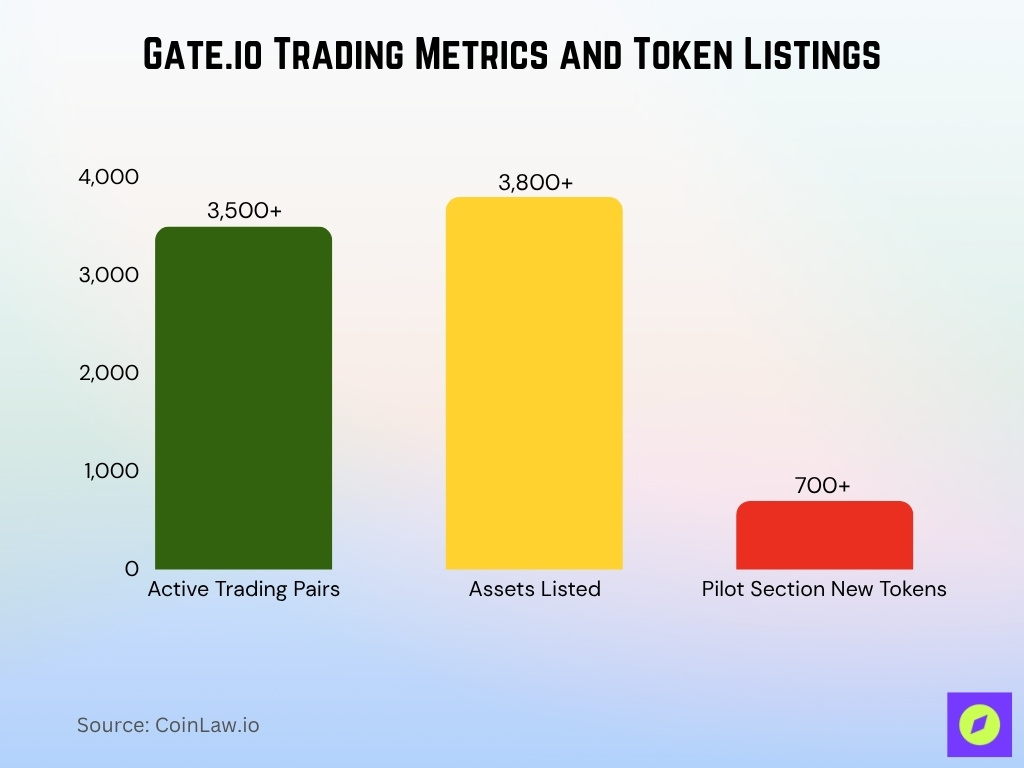

- Gate.io supports over 3,500 spot trading pairs, making it one of the largest in listing breadth.

- The exchange lists 3,800+ digital assets and has launched more than 700 new tokens via its Pilot Section as of early 2025.

- In April 2025, Gate.io achieved a spot trading volume of more than $110 billion, representing roughly +14% MoM versus March.

- Gate.io’s 24-hour combined spot and derivatives volume was about $13.185 billion, of which the vast majority (~99.6%) was spot trading.

- Retail trader activity contributes heavily to spot volume, and new “refer to earn” campaigns and high-yield listings were emphasised in Q1-Q2.

- The spot market remains a significant driver of Gate.io’s overall trading ecosystem, though growth is stronger in derivatives.

- The most active trading pair on the exchange is Bitcoin/USDT, registering a 24-hour volume of approximately $493 million.

Trading Volume Statistics

- In May 2025, Gate.io’s total derivatives volume reached $264 billion, marking a 69.9% month-on-month increase.

- Gate.io’s spot trading volume in April 2025 topped $110 billion, up roughly 14% from March.

- Gate.io’s 24-hour spot and derivatives combined volume recently measured at $13.185 billion.

- Market-share data show that trading volumes for top centralized exchanges shrank by ~27.7% in Q2 2025, while Gate.io bucked the trend in selected segments.

- Listings and new tokens contributed to trading volume growth, with over 200 new tokens listed in Q1 2025 on Gate.io.

- Gate.io’s trading volume growth is driven heavily by futures/perpetuals rather than only spot trading.

- Spot trading remains substantial. Gate now ranks second globally in 24-hour spot volume as of May 2025.

- The platform’s increased trading depth and liquidity are highlighted by reports pointing to strong retail activity across numerous new tokens and pairs.

Futures and Perpetuals Trading Data

- In May 2025, Gate.io recorded a derivatives trading volume of $264 billion, a +69.9% MoM increase.

- That surge lifted its derivatives market share to 4.13% globally, surpassing multiple established competitors.

- Gate.io achieved among the highest growth rates in global derivatives rankings during that period, scoring an “82.6” on one benchmark.

- Support for perpetual contracts is robust; the exchange lists hundreds of perpetual-pair markets.

- Gate.io’s listing of structured products tied to futures exposure (e.g., leveraged tokens) expanded in Q2 2025.

- Increased institutional participation in futures was noted, though specifics are limited, Gate.io emphasizes “institutional services” growth.

- The strong futures performance suggests Gate.io is increasingly competing with legacy derivatives-focused exchanges rather than only spot-centric ones.

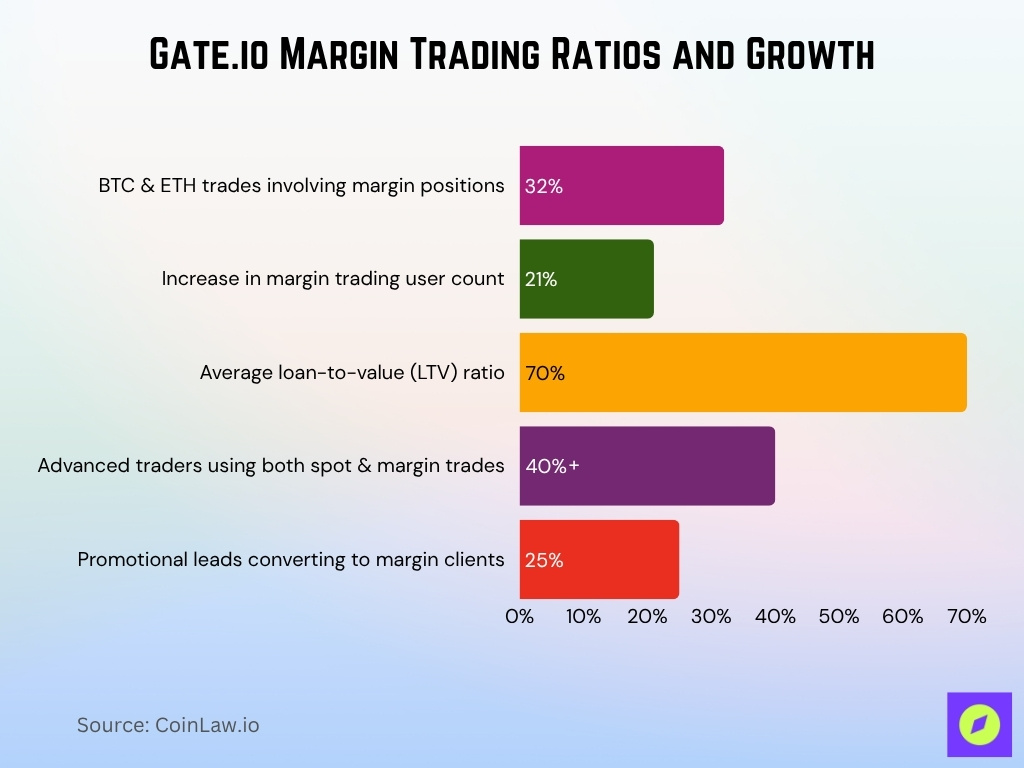

Margin Trading Statistics

- Over 32% of BTC and ETH trades on Gate.io included margin positions in H1 2025.

- Margin trading user count increased by 21% during Q1-Q2 2025.

- The average loan-to-value ratio for margin users hovered at 70% across major pairs.

- More than 40% of advanced traders executed both spot and margin trades in Q2 2025.

- Roughly 25% of promotional campaign leads converted to margin trading clients in Q2 2025.

- Gate.io margin trading volume exceeded $1.8 billion in Q2 2025.

- Q1 2025 saw margin-eligible assets grow to more than 370 tokens after new listings.

- Gate.io’s margin platform reported an average user leverage setting of 4.8x in 2025.

- Gate.io maintains average bid-ask spreads under 0.04% on margin-tradable pairs.

- Platform margin trading-related risk management flagged fewer than 0.7% accounts for high-risk activity in 2025.

Supported Cryptocurrencies and Trading Pairs

- Gate.io offers 3,800+ digital assets and 3,500+ trading pairs as of mid-2025.

- In 2024, Gate.io listed 873 new tokens, with 437 making debut listings on the platform.

- The trading infrastructure supports spot, futures, and margin across these pairs, offering one of the largest breadths among global exchanges.

- Gate.io launched a “Pilot Section” to onboard emerging tokens, and by early 2025, it had over 700 project tokens via pilot listings.

- The most-active trading pair remains BTC/USDT, but many smaller altcoin pairs show high turnover due to listing promotions and liquidity depth.

- Regional fiat support expansion has allowed more localised pairs (fiat ↔ crypto) in emerging markets.

- Listing speed and “first-mover” token availability on Gate.io are cited by project teams as a differentiator.

GateToken (GT) Metrics

- The native token GateToken (GT) is used on GateChain and in Gate.io’s ecosystem. 1,542,910.75 GT (~$33.84 million) were burned in Q1 2025.

- That burn follows the deflationary model; the supply has reduced by approximately 59.54% since issuance.

- The current circulating supply is ~117.3 million GT, and the 24-hour trading volume is around $608.8 million.

- GT rose by “nearly 70%” in early 2025.

- The token is used for gas fees on GateChain, for staking, and as part of listing-reward and incentive programs inside the Gate ecosystem.

- Token burn transparency is emphasised, Gate.io publishes quarterly burns and claims a>128% reserve ratio for the exchange.

- GT’s utility is expected to expand via Gate Layer’s higher-throughput chain, further increasing demand.

- While the GT price remains volatile (recently ~$14.79), the structural tokenomics and burn schedule are key strategic metrics to monitor.

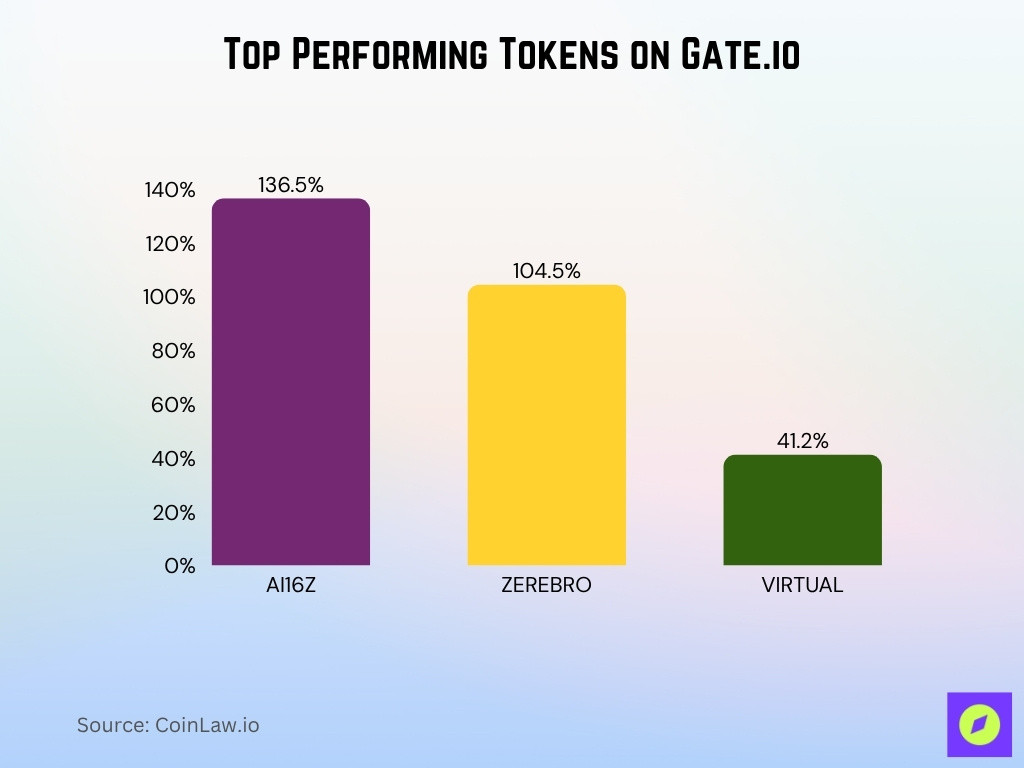

Top Performing Tokens on Gate.io

- AI16Z led the market with an impressive 136.5% gain over the past 7 days, showing strong investor momentum.

- ZEREBRO followed with a 104.5% rise, maintaining steady upward movement in trading activity.

- VIRTUAL recorded a 41.2% increase, reflecting moderate but consistent growth among trending tokens.

Staking and Earn Products

- Gate Earn AUM surpassed $2.1 billion in May 2025.

- Users could stake or earn yields on nearly 1,000 digital assets as of May 2025.

- Dual Investment supported more than 62 tokens for structured-yield products in Q2 2025.

- Average annual percentage yield (APY) for flexible staking products was 7.9% in Q2 2025.

- Fixed-term staking lock-up volumes increased by 31% year-over-year in Q2 2025.

- GT token-burn campaigns drove a 19% increase in Launchpool participation in Q2 2025.

- Institutional Earn offerings accounted for 13% of total AUM in Q2 2025.

- More than 280,000 users newly enrolled in Earn products between March and June 2025.

- Non-trading revenue from Earn and staking rose 22% quarter-over-quarter in Q1 2025.

- Earn products linked to DeFi strategies reached integration with 14 protocols by June 2025.

Lending and Crypto Loan Data

- The broader crypto-collateralized lending market rose by 27.44% in Q2 2025 to reach $53.09 billion.

- On Gate.io’s platform, typical loan interest rates for major assets were as low as 0.88% p.a. for BTC, 1.76% for ETH, and 2.63% for USDT.

- Standard crypto loan interest tends to start around 9% p.a., with discounts up to 70% for higher VIP levels on Gate.io.

- Gate.io supports lending across “56 mainstream cryptocurrencies” and “500+ loanable assets” in its loan product.

- The exchange’s “Lend & Earn” campaign reached notable milestones, for example, reporting new heights in customer assets of around $500 million.

- Gate.io uses collateralised crypto-loans, and its reporting emphasises advanced audit tools such as zk-proof and Merkle tree to underpin transparency for asset-backed lending.

Platform Fees and Costs

- Gate.io spot fees are 0.2% and futures fees are 0.02% maker/0.05% taker (VIP 0, 2025).

- Standard crypto-loan interest rates start in the ~9% p.a. range for non-VIP users, exclusive of collateral conditions.

- Crypto deposits are typically free, but withdrawal fees vary significantly by asset and network.

- Gate.io’s fee structure reduces maker/taker costs substantially at high VIP levels (e.g., 0% maker / 0.02% taker at VIP 15-16).

- Listing a new token on Gate.io in 2025 is estimated to cost between $200,000 and $250,000, plus additional budgets for liquidity/marketing.

Regulatory Licenses and Compliance

- Gate.io’s reserves reached $10.865 billion with a 128.57% reserve ratio as of May 8, 2025.

- Earlier in Q1 2025, the reserves figure was ~$10.328 billion with the same 128.58% reserve ratio.

- Gate.io entities hold regulatory licenses or approvals across multiple jurisdictions, including Malta, Lithuania, Italy, the Bahamas, and Gibraltar.

- The KYC/AML process has been streamlined. Gate.io lists a six-step verification process that, for many users, can be completed in under 10 minutes.

- The exchange uses a zero-knowledge proof design for its reserves audit, enabling users to verify asset backing without revealing personal data.

Security Incidents and Proof of Reserves

- As of September 2025, the platform shows a Trust Score of 10/10, with reserves of about $12.02 billion and a reserve ratio of 123.98%.

- Gate.io’s proof-of-reserves audits indicate all major assets (BTC, ETH, USDT, GT, DOGE, XRP) have reserve ratios exceeding 100% (e.g., BTC 137.69%, ETH 121.36%).

- The exchange operates a bug-bounty program, third-party audits, a cold-storage majority asset model, and publishes security updates.

- Historical incident, Gate.io disclosed a past breach (2018) for ~$234 million; however, later audit claims assert no user funds were lost.

- The audit code base is open source on GitHub, showing Merkle-proof mechanisms for user account verification.

- Reserve excess funds (over 100%) to provide a buffer against operational risk. Gate.io’s excess reserve figure of ~$2.415 billion in May 2025 underscores this.

Listing and Launchpad Statistics

- Gate.io’s listing fee in 2025 is estimated at $200K–$250K, placing it mid-range among major exchanges.

- Gate Startup was ranked #7 crypto launch with a 56% token launch success rate.

- A recent listing of XLAB contributed to the futures-trading growth of 31% and the monthly volume growth of 69.9% for Q1.

- The broad token support (3,800+ cryptocurrencies) and wide trading pair count support listing activity.

DeFi and Web3 Ecosystem Metrics

- Gate.io listed over 3,850 digital assets by Q3 2025.

- More than 420,000 users activated Web3 wallets or DeFi vault accounts in 2025.

- Gate.io ecosystem offered access to 90+ DeFi protocols via integrated dApp browser as of Q3 2025.

- Monthly Web3 wallet transaction volume exceeded $320 million in 2025.

- Zero-knowledge proof audits covered reserves for 99% of listed tokens in September 2025.

- Launchpad enabled access to 27 new Web3 protocol launches in Q3 2025.

- Staking and dual-investment offerings averaged annual yields of 8.4% in 2025.

- User participation in DeFi vault strategies increased by 38% quarter-over-quarter in Q3 2025.

- Merkle tree-based reserve snapshots will be published in 100% of quarterly transparency reports in 2025.

- Gate.io supported 17 blockchains for multi-chain DeFi and Web3 product integrations in 2025.

Frequently Asked Questions (FAQs)

Gate.io reported total reserves of $10.865 billion with a reserve ratio of 128.57%.

The derivatives trading volume reached $264 billion with a 69.9% MoM increase.

Gate.io supports 3,800+ digital assets and over 3,500 trading pairs.

Gate.io’s 2024 trading volume reached $3.8 trillion, a 120% year-on-year increase.

Conclusion

Gate.io is operating at a mature level across multiple fronts, lending and loan products are gaining traction, fees are competitive and tiered to reward engagement, regulatory licensing and proofs-of-reserves show a strong transparency posture, security systems are reinforced, listing and launchpad activity remain robust, and the ecosystem is expanding into Web3 territory. For U.S.-based users, regulatory access remains restricted, so careful attention to local compliance is essential.

Globally, however, Gate.io’s metrics indicate a platform that blends high asset diversity, growing trading volumes, and increasing institutional-style infrastructure. If you’re evaluating crypto exchanges with advanced features, substantial asset counts, and a wide-ranging product stack, these statistics should help you assess Gate.io’s standing and risk-reward profile. Explore the earlier sections for deeper data on user growth, market share, trading volumes, and more.