In the world of Forex trading, where the global currency market sees trillions of dollars exchange hands daily, understanding the numbers behind the trade can be just as critical as the trade itself. Forex trading has evolved from a specialized investment opportunity for big banks and financial institutions to a market accessible to retail traders worldwide.

This market continues to expand with unprecedented technological advancements, increased regulatory attention, and diverse market participants from all corners of the globe. Here, we delve into the statistics that define the current state of Forex, offering insights to help traders, investors, and financial enthusiasts navigate this dynamic landscape.

Editor’s Choice: Key Global Trends in Forex Trading

- Daily trading volume averaged around $7.51 trillion per day in early 2025, reflecting continued high market liquidity.

- Retail FX/CFD trading surged to over $30 trillion per month in Q2 2025, showing extraordinary retail participation growth.

- The US dollar remained dominant, involved in about 88.5% of trades, followed by the Euro at ~31% and the Japanese yen at ~13.5% of daily volumes.

- Algorithmic trading now drives approximately 92% of Forex transactions, thanks to the widespread adoption of automation.

- Crypto-Forex integration gained traction in 2025 as many jurisdictions started folding cryptocurrencies into existing FX frameworks.

- Asia-Pacific’s share of global Forex volume remained strong at around 32%, with the region continuing to assert its influence into 2025.

Forex Market Share by Instrument Type

- Forex swaps account for 47.9% of the total foreign exchange market, reflecting their widespread use in currency hedging and short-term liquidity needs.

- The combined share of spot forex, outright forwards, and other instruments is 52.1%, highlighting the continued dominance of traditional trading segments.

- This near-even split between forex swaps and spot/forward-based instruments shows a diversified structure in FX market operations.

- The data emphasizes how derivative-based instruments play a crucial role in global currency trading strategies.

Market Size and Growth Statistics

- Retail Forex brokers’ revenue remains at approximately $17.5 billion, based on the latest available data.

- Currency exchange services in the United States continued to generate around $55 billion in annual revenue.

- Mobile Forex trading accounted for roughly 65% of retail trades, showing sustained mobile dominance in 2025.

- Europe-based Forex brokers maintain approximately 20% of the global market share, led by firms in Cyprus, the UK, and Germany.

- Emerging markets in Africa and Southeast Asia remain key growth zones, with participation steadily increasing through 2025.

Revenue and Profitability of Major Forex Brokers

- The top five Forex brokers generated a combined over $12 billion in revenue in 2025, with US-based firms still leading the sector.

- European brokers delivered strong profitability in 2025 with average net margins near 47 %, buoyed by institutional demand and favorable regulatory conditions.

- CMC Markets recorded £340.1 million in revenue and £62.2 million in net profit for fiscal 2025, delivering a 33 % jump in pre‑tax profit.

- IG Group boosted revenue to over $1 billion in 2025, supported by a robust mix of retail and institutional trading.

- eToro posted revenue of about $931 million in 2024 and reached an assets‑under‑management of $16.9 billion by early 2025.

- XM Group reported $550 million in revenue in 2025, with profit margins sustained at around 35 % due to expansion across Asia‑Pacific and Latin America.

- Forex.com achieved a $650 million profit in 2025, reflecting elevated client activity and transaction volumes across its platforms.

Trading Volume and Currency Pair Statistics

- EUR/USD remains the most traded currency pair with about 25% of total Forex turnover in 2025, averaging $1.01 trillion daily.

- USD/JPY and GBP/USD continue to follow closely, maintaining their positions among the top traded pairs.

- Emerging market currencies like CNY and MXN continue to grow in trading volume, reflecting increasing global interest.

- Crypto-Forex pairs such as BTC/USD and ETH/USD account for about 5% of overall trading volume, showing stable demand.

- Cross-currency pairs excluding USD represent approximately 15% of the market volume, influenced by strong regional activity.

- High-frequency trading dominates developed markets, contributing to around 60% of currency transactions.

- The average institutional trade size rose to approximately $1.2 million per transaction in 2025 due to increased market volatility.

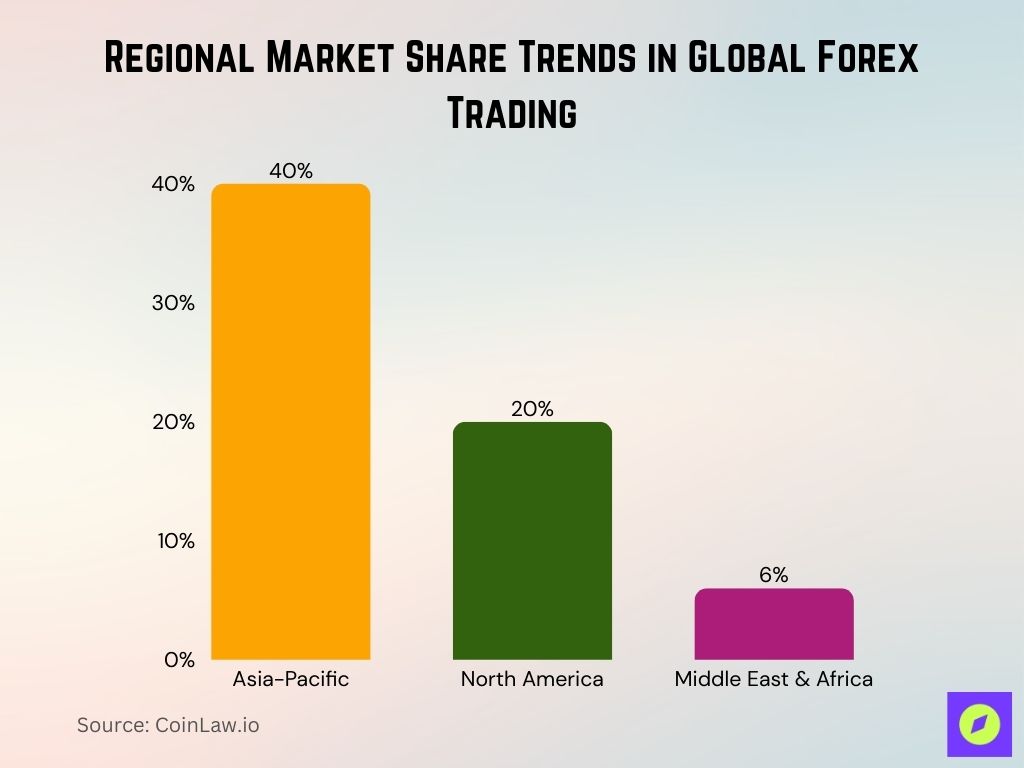

Regional Breakdown and Market Share

- The United Kingdom remains the largest Forex hub, capturing approximately 43 % of global trading volume in 2025, thanks to its deep liquidity and institutional infrastructure.

- Asia‑Pacific leads with about 40 % of the Forex market share, driven by major hubs like Tokyo, Singapore, and Hong Kong.

- North America accounts for roughly 20 % of global Forex turnover, supported by strong U.S. market activity and regulatory stability.The

- Middle East & Africa together contribute around 6 % of total Forex trading volume, with growing activity from key financial centers like the UAE and South Africa.

- Latin America is seeing rapid growth with an estimated 30 % year‑on‑year increase in Forex participation, largely driven by volatility in Brazil and Mexico.

- Singapore continues to outpace Hong Kong as a leading Asian Forex center, with a market share gain of about 10 %, reflecting its strategic financial significance.

- Africa, led by South Africa, remains a small but expanding player in Forex, with increased interest from both retail and institutional investors across the region.

Broader Variety of Market Participants

- Central banks remain major players in Forex, using interventions and monetary policies to influence currency movements.

- Hedge funds contributed significantly in 2025, with FX trading volume up by over 20% compared to the previous year.

- Institutional investors, including pension funds and insurance companies, now control about 60% of outstanding FX contracts.

- Corporations engaged in international trade continue to drive Forex activity as they hedge against currency risk.

- Retail traders expanded further in 2025, fueled by increased mobile access and user-friendly trading platforms.

- Proprietary trading firms continue to contribute to market liquidity through high-frequency trading strategies.

- Family offices and high-net-worth individuals are increasing their presence in Forex for diversification and asset growth.

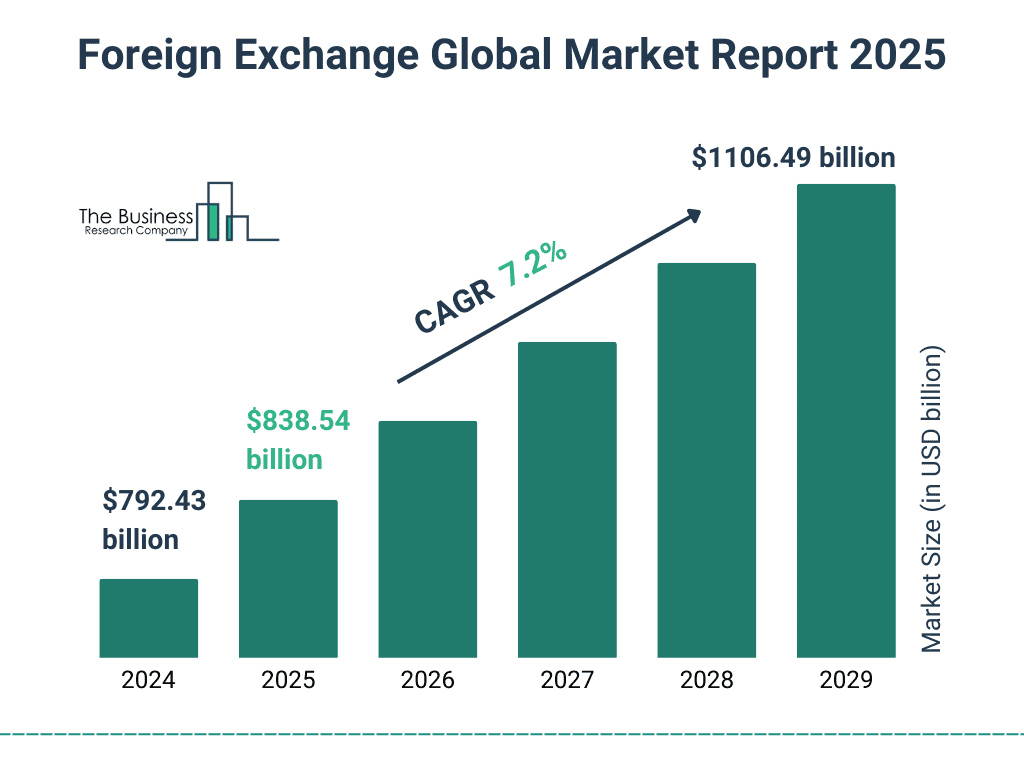

Foreign Exchange Market Size Outlook

- The global forex market is projected to grow from $792.43 billion in 2024 to $1106.49 billion by 2029.

- In 2025, the market is expected to reach $838.54 billion, marking steady year-over-year expansion.

- The forecast reflects a compound annual growth rate (CAGR) of 7.2%, highlighting strong momentum in the FX sector.

- This consistent growth suggests increasing demand for currency exchange, hedging tools, and global financial integration.

- The rise from $792.43B to $1106.49B over five years signals expanding participation from retail and institutional traders alike.

Impact of Technology and Algorithmic Trading

- Algorithmic trading now accounts for over 90% of Forex trading volume in 2025 as automated systems dominate both retail and institutional activity.

- AI tools power about 15% of Forex trades, enhancing precision through fast data analysis and execution.

- Machine learning directly influences over 50% of institutional trading decisions, reshaping how strategies are devised.

- A growing share of brokers, around one‑third, use blockchain to improve transaction transparency and security in 2025.

- Usage of automated trading bots among retail traders continues to climb, with substantial year‑on‑year increases, especially on platforms like MetaTrader.

- Trading latency standards in Forex have improved significantly, with 100–300 ms now typical, though high‑frequency traders still aim for sub‑100 ms speeds.

- Mobile platforms remain vital, with real‑time access and rapid execution driving continued dominance of mobile in the retail trading landscape.

Global Currency Usage in Forex Trading

- The US dollar dominates the global forex market with a 58.8% share, reinforcing its role as the primary reserve and trading currency.

- The Euro holds 20.6%, making it the second most traded currency in global foreign exchange markets.

- The Japanese Yen accounts for 5.5%, reflecting its significance in Asia-Pacific currency pairs.

- The British Pound contributes 4.7%, maintaining its position as a major global currency.

- The Chinese Yuan makes up 2.8%, showing the gradual internationalization of China’s currency.

- Other currencies collectively represent 7.6%, highlighting the diversity but limited global reach of less common currencies.

Regulatory and Compliance Developments

- Compliance costs for Forex brokers increased by about 25% in 2025 amid tighter regulations and digital oversight mandates.

- EU regulators introduced new rules under DORA and MiCA that significantly reshaped leverage and crypto‑asset compliance standards.

- Anti‑money laundering efforts intensified, with around 85% of brokers expanding their AML controls and monitoring capabilities in 2025.

- Cryptocurrency‑Forex offerings faced stricter rules globally as several regions imposed tighter KYC and marketing restrictions.

- The US CFTC and SEC issued record fines in 2025 for Forex fraud and misleading practices, reflecting a zero‑tolerance enforcement stance.

- Regional regulators such as CySEC now require brokers to publish transparency data, including average spreads and slippage information.

- Australia’s ASIC expanded leverage limits to 30:1 for retail Forex in 2025, aligning with global risk mitigation efforts.

Forex Turnover by Market Participant

- Reporting dealers account for 46% of total foreign exchange turnover, underscoring their central role in global currency liquidity.

- Non-reporting banks contribute 22%, making them the second-largest group in FX market activity.

- Institutional investors make up 11%, reflecting growing participation from pension funds, insurance firms, and asset managers.

- Hedge funds and proprietary trading firms (PTF) represent 7%, signaling active speculative and algorithmic strategies.

- Retail forex traders contribute 6%, showing continued interest from individual market participants.

- The official sector, including central banks and supranational institutions, accounts for just 1% of turnover.

Recent Developments

- MetaTrader 5 has taken the lead in platform usage with a 54.2 % market share of combined MT4/MT5 trading volume in 2025, surpassing MetaTrader 4’s share.

- Traders increasingly adopt next-gen tools like AI-driven risk management and sentiment indicators to improve decision‑making.

- DeFi-powered Forex-like trading via decentralized exchanges is gaining traction, introducing blockchain-enabled alternatives to traditional Forex platforms.

- ESG is becoming a factor in FX operations, with about 15% of firms now incorporating ESG reporting into their reporting frameworks.

- Broker–FinTech partnerships surged by around 30%, driving innovation and modern trading feature rollouts in 2025.

- Usage of advanced risk-management tools increased by 25%, reinforcing a growing focus on protection against volatile moves.

- AI-powered market analytics are now offered by roughly 50% of broker platforms, making real-time insights more accessible to retail traders.

Conclusion

The Forex industry is defined by accelerated growth, technological advances, and evolving regulations that shape trading activities for both institutional and retail participants. As the largest and most liquid financial market globally, Forex offers unparalleled opportunities, yet demands precision, knowledge, and adaptability from its traders. New market participants, coupled with advancements in algorithmic trading and AI, continue to transform the landscape, making Forex more accessible yet more complex than ever. Regulatory changes and technological innovations ensure a balanced ecosystem, promising a future where Forex remains a vital, thriving part of the global financial system.