Financial sanctions have become a core instrument of global policy, affecting everything from multinational banks to commodity trade. In one scenario, a U.S.-based financial institution faces multi-jurisdictional screening burdens when dealing with cross-border payments that touch sanctioned persons. In another, a supply-chain manager in Europe must re-route shipments due to new export-control sanctions imposed on a foreign entity. This article guides you through the current landscape with clear statistics and insight into how sanctions are evolving.

Editor’s Choice

- Globally, there were 79,830 sanctioned individuals and entities as of March 2025.

- Annual “sanctions inflation” (the year-on-year increase in sanctioned persons) is 17.1%, down from 18.9% a year earlier.

- The Global Sanctions Index (GSI) has reached a value of 446, representing a 446% increase since its base in Jan 2017.

- The share of sanctions based on United Nations consensus has fallen to approximately 1.2% of all sanctions.

- The trend of “hyper-divergence” in sanctions regimes is rising, coordination is weaker, and independent national sanctions are increasing.

- The number of explicit sanctions programmes tracked by LSEG is over 300 worldwide.

- Sanctions remain a major cost center for regulated financial services. Surveys show 43% of compliance leaders cite limited sanctions-screening capability as the biggest risk in 2025.

Recent Developments

- Growth in sanctions issuance moderated but remained elevated in H1 2025, per LexisNexis Risk Solutions.

- The U.S. plans to increase sanctions and export controls pressure on China throughout 2025.

- Sanctions against entities facilitating the Ukraine war, especially Russia-linked groups, remain a key focus.

- The UK designated about 269 ships under its Russia sanctions regime, with 159 ships designated in 2025 alone.

- Enforcement in the UK has shifted toward proactive investigations, with 240 active cases under review as of April 2025.

- Around 364 individuals, entities, and ships have been sanctioned by the UK targeting the Russia-Ukraine conflict since 2025.

- Third-country risks rise as non-core sanctioning jurisdiction firms face increased sanctions exposure.

- Regulatory fines globally in H1 2025 surged to $1.23 billion, a 417% increase vs. H1 2024, reflecting intensified sanctions enforcement.

- UK sanctions enforcement actions by OFSI increased, with 57 enforcement actions and £500,000 in penalties issued in 2025.

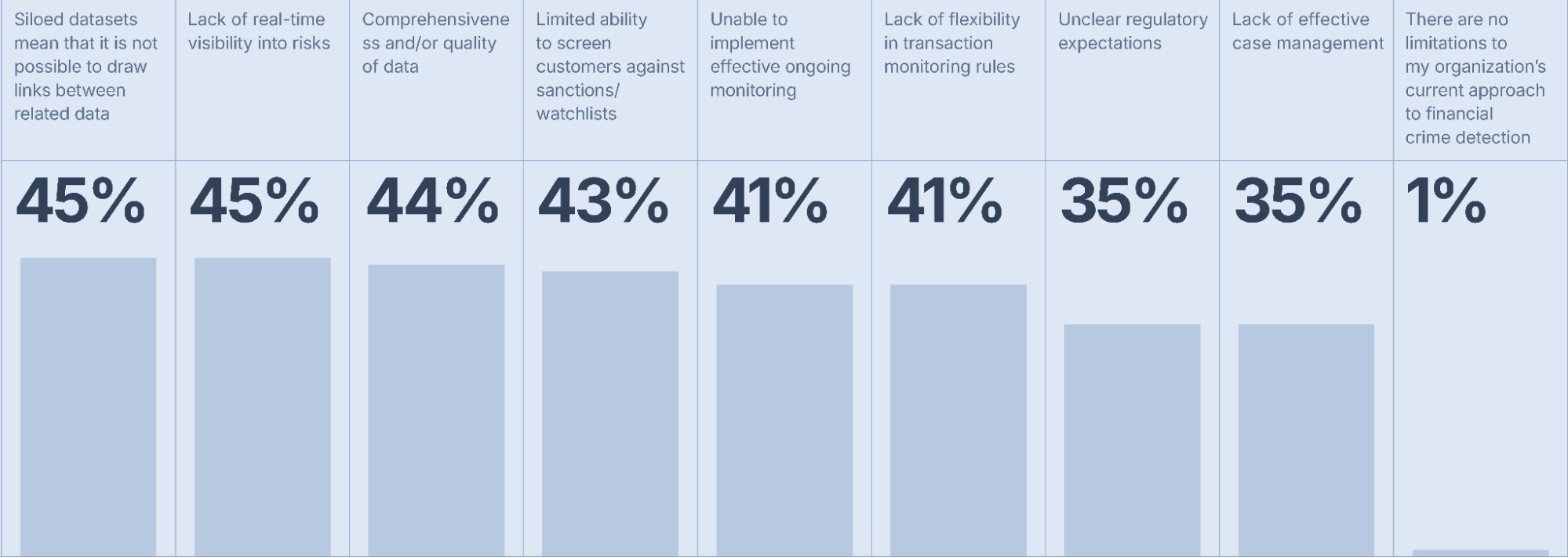

Main Limitations in Financial Crime Detection

- 45% cited siloed datasets as a key limitation, blocking the ability to connect related financial crime data.

- 45% reported a lack of real-time risk visibility, limiting timely response to suspicious activity.

- 44% pointed to poor data completeness or quality, making detection and investigation difficult.

- 43% struggled with screening against sanctions or watchlists, reducing effectiveness in catching high-risk individuals.

- 41% were unable to implement effective ongoing monitoring, hampering long-term detection strategies.

- 41% faced a lack of flexibility in monitoring rules, creating blind spots in evolving threat environments.

- 35% highlighted unclear regulatory expectations, leading to inconsistent compliance.

- 35% noted ineffective case management, which delays resolution and investigation.

- Only 1% said they had no limitations in their financial crime detection systems.

Global Overview of Financial Sanctions

- The Global Sanctions Index (GSI) base-index of January 2017 = 100 now stands at 446 as of March 2025.

- Since 2017, the number of sanctioned persons (legal and natural) has grown by approximately 346% (466% of base).

- The annual rate of increase (“inflation”) now is 17.1%, down slightly from early-year measurements.

- The UN-based sanctions share is historically low, around 1.2% of total sanctions as of March 2025.

- Autonomous national sanction regimes (e.g., U.S., EU, UK) now dominate the landscape rather than multilateral frameworks.

- Divergence between sanctioning jurisdictions is rising (“hyper-divergence”), increasing third-party risk.

Total Number of Sanctioned Persons Worldwide

- As of March 2025, there are 79,830 sanctioned persons globally (deduplicated across lists).

- In March 2024, the figure was over 70,000, indicating growth of around 10,000+ year-on-year.

- In April 2023, the number was 60,000+, per earlier GSI editions.

- The year-on-year net additions in 2024/2025 are estimated in the mid-to-low thousands (≈10,000+).

- The deduplicated count excludes multiple designations of the same person across lists.

- The increase in sanctioned persons driving the GSI reflects both new designations and expansion of scope (legal persons, entities).

- The data pool tracks sanctions across natural persons (individuals) and legal persons (entities) in all known lists.

- The growth rate is slowing; for example, inflation was ~25% in 2023, compared with ~17% in 2025.

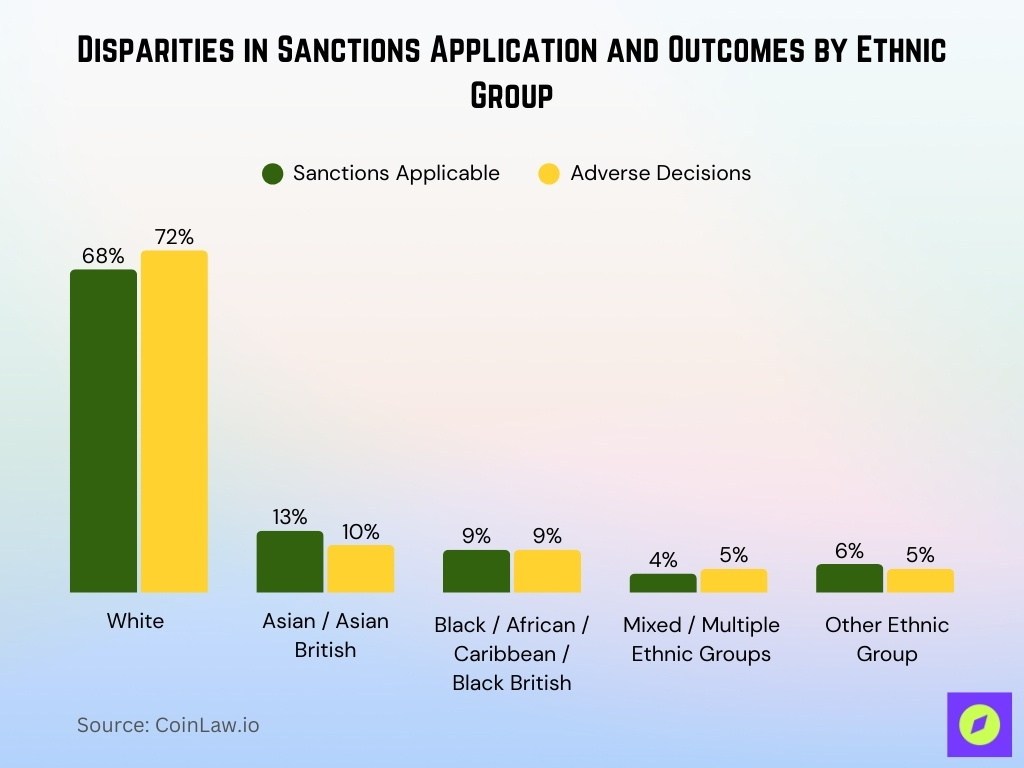

Ethnic Disparities in Sanctions Application and Outcomes

- White individuals accounted for 68% of cases where sanctions could be applied, and received 72% of all adverse decisions.

- Asian / Asian British individuals were eligible in 13% of sanctionable cases, but had a lower 10% share of adverse outcomes.

- Black / African / Caribbean / Black British individuals represented 9% in both sanction applicability and adverse decisions.

- Mixed / Multiple Ethnic Groups made up 4% of sanction eligibility, but received 5% of adverse decisions.

- Other Ethnic Groups appeared in 6% of sanctionable cases and had 5% of adverse outcomes.

Annual Trends in Financial Sanctions Issuance

- In early editions, annual sanctions inflation reached ~25% in 2023.

- For the period ending March 2025, the inflation rate stands at 17.1%, down from 18.9% a year earlier.

- In March 2024, the inflation rate was ~16%.

- The index value increased from ~370 in March 2024 to 446 in March 2025.

- The annual net growth in sanctioned persons has slowed, but the absolute level remains high, indicating sustained high-volume activity.

- National sanctioning bodies like the U.S. Office of Foreign Assets Control (OFAC) continue at an aggressive pace of designations, even as inflation moderates.

- Enforcement and delistings are also gaining attention, though net additions remain positive.

- The trend suggests a maturing sanctions landscape, from rapid growth to a phase of sustained high-volume issuance with slower acceleration.

Most Sanctioned Countries

- Russia has faced 23,960 unique sanctions actions since 2022’s invasion, with 2,700 sanctioned entities as of October 2025.

- China had the fastest growth in sanctions designations in 2024, up 96%, from 102 to 200.

- Iran remains among the top sanctioned states, with more than 5,000 sanctions historically.

- Countries such as North Korea, Syria and Belarus each report more than 1,000 active sanctions.

- According to the list of sanctioned countries by major regimes in 2025, the U.S., EU and UN list collectively more than 10 states subject to broad sanctions programmes.

- Data from the Center for a New American Security indicate that the U.S. alone had 742 designations on Russia in the past decade.

- In summary, while Russia remains the dominant target, China’s rapid increase and Iran’s sustained sanctions make them core focus areas in 2025.

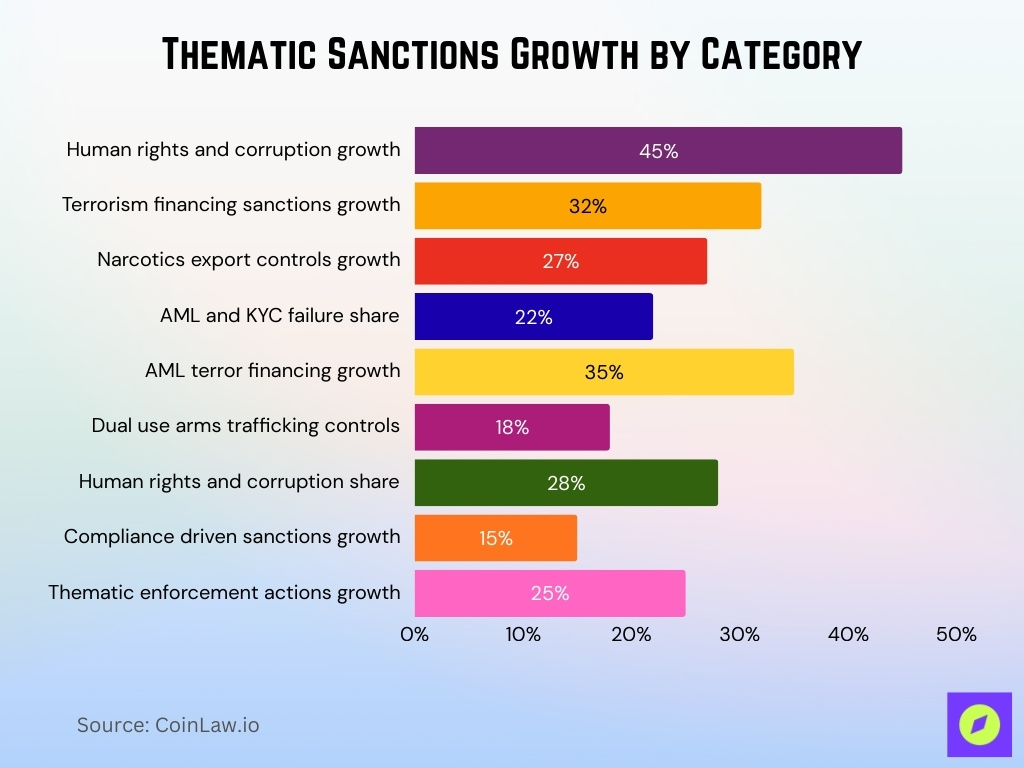

Thematic Sanctions: Terrorism, Narcotics, Human Rights

- Sanctions for human-rights abuses and corruption increased by 45% over the last five years.

- Sanctions targeting terrorism financing expanded by 32% in 2025.

- Export controls on narcotics-related financial flows rose by 27% in 2025.

- Firms failing AML/KYC controls accounted for 22% of new sanctions under thematic programs in 2025.

- Targeted financial sanctions under AML frameworks for terror-financing rose by 35% in 2025.

- Dual-use goods export controls linked to arms trafficking sanctions grew by 18% in scope.

- Sanctions tied to human rights and corruption cases now comprise 28% of all thematic sanctions.

- Regulatory and compliance-driven sanctions grew faster than purely geopolitical sanctions by 15% in 2025.

- In 2025, sanctions enforcement actions specific to thematic programs rose by 25%.

Changes in Sanctions Policies by Major Jurisdictions (US, EU, UN, UK)

- The UK lowered the Oil Price Cap on Russian crude oil from $60 to $47.60 per barrel, effective September 2, 2025.

- The EU adopted its 19th sanctions package against Russia in October 2025, expanding asset freezes and export bans.

- US sanctions designations rose to over 17,000 entities and individuals by mid-2025, a 25% increase since 2023.

- US enforcement actions dropped by 16% to 396 breaches in the year ending 2024, while closed cases more than tripled to 242.

- OFAC tracks over 60 active sanctions programs across various sectors and regions as of 2025.

Sanctions Targeting Crypto Assets

- As of early 2025, OFAC had frozen or seized approximately $1.8 billion in crypto-assets under its sanctions programmes.

- The number of designated crypto wallets tracked by OFAC rose 32% year-on-year, reaching 1,245 wallets by Q1 2025.

- Inflows to illicit crypto addresses dropped from $21.9 billion in 2023 to $14.8 billion in 2024, a decline of about 33%.

- It is almost certain that UK crypto-asset firms have under-reported sanctions breaches since August 2022.

- In February 2025, crypto-asset theft linked to DPRK-affiliated actors amounted to about $1.5 billion.

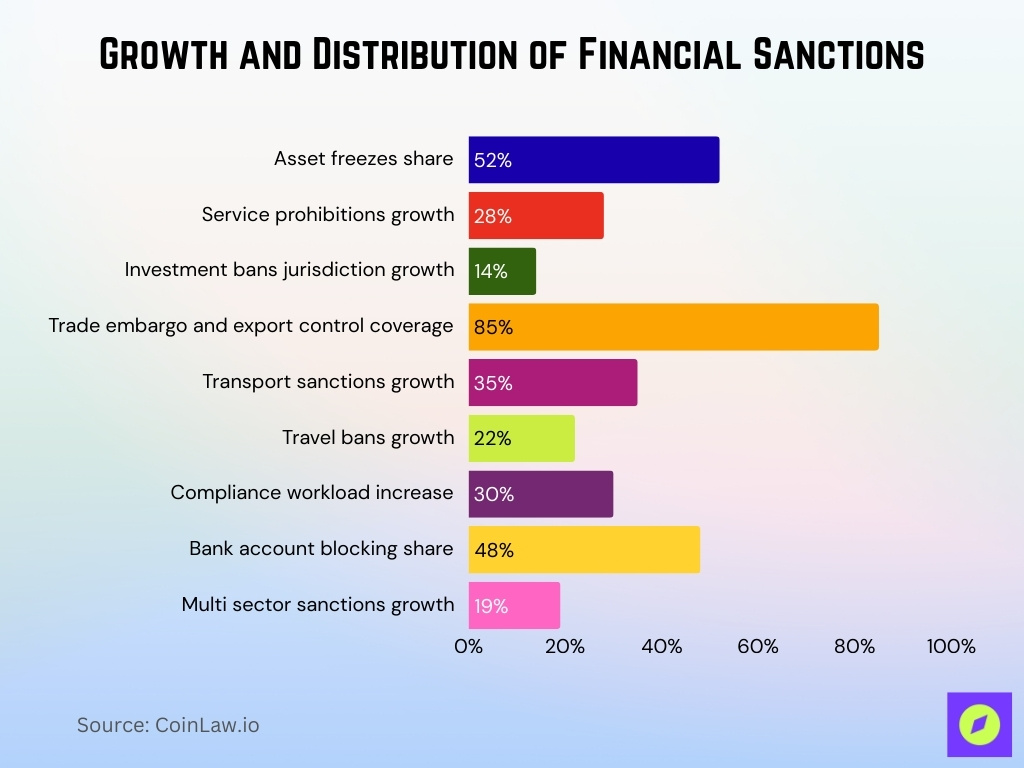

Key Types of Financial Sanctions Imposed

- Asset freezes accounted for 52% of all financial sanctions imposed in 2025.

- Service prohibition cases increased by 28% in 2025.

- Investment bans expanded to include 14% more jurisdictions in 2025.

- Trade embargoes and export controls covered 85% of sanctioned goods and persons globally.

- Transport sanctions increased by 35%, targeting shipping and aircraft linked to sanctioned entities.

- Travel bans affecting designated individuals rose by 22% in 2025.

- Firms reported a 30% increase in compliance workload due to complex sanction types.

- Blocking bank accounts comprised 48% of restrictive measures in financial sanctions.

- Economic sectors affected by multi-type sanctions increased by 19% in 2025.

Country-Specific Financial Sanctions (Russia, China, Iran, etc.)

- For Russia, the EU’s 2025 sanctions package added 75 entities, bringing the total listing to over 2,400 individuals and firms.

- Russia’s maritime “shadow fleet” is increasingly targeted, with 189 vessels added to the EU sanctions list in 2025 alone.

- China, In the first half of 2025, China imported 1.5 million barrels per day (bpd) of Russian oil, an 80% increase compared to the same period in 2021.

- Iran, The U.S. sanctions programmes list shows Iran-related sanctions as “active” as of Nov 2025, reflecting ongoing escalations.

- UK’s enforcement data, 396 recorded cases of financial sanctions breaches in the UK for the year ending 2024, a 16% decrease from the previous year.

- The UK and EU jointly designed a roadmap to phase out Russian energy imports by the end of 2027, showing sanctions targeting energy revenue.

Trends in Entity-Based Export Controls

- BIS introduced the “50% Rule” in September 2025, covering entities owned ≥50% by listed parties.

- The number of Chinese entities blocklisted for export controls may increase from 1,300 to over 20,000.

- Global companies face a 30% increase in export violation risks due to broader entity definitions.

- Enforcement monitors re-exports, foreign subsidiaries, and extended end-use networks more proactively.

- The enhanced export-control regime blocks upstream flows of goods and technology to sanctioned entities.

- Compliance screening integration across financial, trade, and logistics sectors rose by 25% in 2025.

- Chinese export control laws now include a similar 50% ownership rule restricting licensing approvals.

Impact of Financial Sanctions on Global Trade

- World merchandise trade volume is expected to decline by 0.2% in 2025, down from a +2.9% expansion in 2024.

- Commercial services trade volume growth is forecast at 4.0% in 2025, down from 6.8% in 2024.

- Sanctions-driven trade disruption is contributing to the downgrade; recent tariffs and policy shifts have cut growth by nearly 3 percentage points.

- Businesses identify sanctions as a growing political risk in trade finance, affecting letters of credit, payment systems and bank guarantees.

Multi-Jurisdictional Sanctions Conflicts

- Over 99% of vessels sanctioned by the EU, UK, and US were flagged before official designation in 2025.

- Unilateral sanctions dominate with low coordination among sanctioning bodies globally.

- Firms face overlapping and conflicting obligations across jurisdictions more than 70% of the time.

- Secondary sanctions expose non-US firms to US penalties even if local laws allow certain activities.

- Multi-jurisdictional enforcement actions increased by 28% in 2025 compared to 2024.

- Legal uncertainty affects 65% of firms operating under multiple sanctions regimes.

- Jurisdictional arbitrage risk is a key concern for 85% of multinational companies in sanctions compliance.

- Compliance teams report 34% higher costs managing multi-jurisdictional sanctions conflicts.

- Simultaneous investigations by multiple regulators rose by 22% year-over-year.

- Managing conflicting sanctions regimes is a top compliance priority for 78% of global firms in 2025.

Regional Distribution of Financial Sanctions

- Only 1.2% of global sanctions originate under the United Nations.

- North America and Europe account for over 75% of global sanctioning activity.

- Asia-Pacific and “third-country” jurisdictions saw an increase of 28% in compliance burdens.

- North America’s contribution to global merchandise trade growth is projected to subtract 1.7 percentage points in 2025.

- Latin America, Africa, and Southeast Asia face rising spill-over risks from secondary sanctions.

- The UK is actively monitoring crypto-asset firms, with over 60 firms under scrutiny in 2025.

- Middle East and Central Asia are key nodes for sanctions evasion, involving $9 billion in shadow finance flows.

- Regional compliance strategies must consider geographic and sectoral heterogeneity, affecting 68% of global firms.

- Regulatory fragmentation means EU sanctions rules apply directly to 27 countries, whereas the Asia-Pacific has 17 autonomous sanctions programs.

Future Outlook for Global Financial Sanctions

- Sanctions inflation may end in 2025, with annual growth slowing to 5-7% globally.

- Enforcement focus will shift toward delisting, monitoring, and hybrid compliance regimes by 2026.

- Entity-based export controls and digital asset sanctions are expected to grow by 35% in the next five years.

- Secondary and tertiary sanctions risk causes a 25% rise in compliance complexity for non-US firms.

- Mid-sized firms’ sanctions compliance costs are projected to increase by 20-30% by 2027.

- ESG-linked sanctions related to human rights and supply chain diligence rose by 40% in 2025.

- Blockchain analytics and AI screening reduce sanctions monitoring lag times by up to 50%.

- AI-powered sanctions systems reduce false positives in screening by 30-40% while improving detection accuracy.

- Companies are shifting to dynamic sanctions-risk intelligence, with 60% adopting scenario planning tools.

- Regulatory uncertainties and divergence drive a 15% increase in sanctions-related operational risks.

Frequently Asked Questions (FAQs)

Approximately 1.25 % of all sanctions are based on UN consensus regimes.

Around 189 vessels were added in 2025 alone.

Estimates suggest the number could rise from roughly 1,300 to more than 20,000 Chinese entities.

Conclusion

Financial sanctions remain a powerful tool of global policy, but the landscape is shifting. While growth in numbers may slow, complexity, scope and enforcement are expanding. From crypto-asset freezing to entity-based export controls and trade-finance disruptions, the ripple effects span industries, geographies and business functions. Firms that treat sanctions as purely a checklist risk being exposed. Instead, they must build forward-looking risk frameworks that integrate compliance, strategy and supply-chain resilience.