The decentralized derivatives exchange dYdX Foundation’s protocol, known as dYdX Trading and its native token DYDX, is carving out a meaningful niche in the crypto derivatives ecosystem. From institutional partnerships to deep liquidity for perpetual futures, its progress shows up in real-world applications such as hedge funds accessing on-chain leveraged markets and retail traders using self-custody perpetual positions. In the following sections we’ll unpack key data points, platform evolution, and performance metrics for readers seeking a clear, data-driven view of dYdX.

Editor’s Choice

- Cumulative trading volume on dYdX passed $1.4 trillion+ as of 2025.

- In H1 2025 alone the protocol processed $316 billion in volume on its chain.

- Daily average trading volume on the dYdX v4 chain recently reached around $200 million+.

- The DYDX token buy-back program has burned over 24 million tokens (~$15.7 million) as of mid-2025.

- Open interest (OI) on perpetual markets climbed to ~$175–200 million in recent quarters.

- Token distribution: ~78% of the 1 billion supply unlocked as of mid-2025.

- The derivatives DEX market is forecast to hit $3.48 trillion in volume in 2025, underscoring broader sector growth.

Recent Developments

- The dYdX ecosystem released a semi-annual H1 2025 report showing cumulative volume of over $1.4 trillion and H1 volume of ~$316 billion.

- Launch of the DYDX token buy-back program: as of March 1 2025, ~85% of DYDX tokens were unlocked and emissions slated to drop by 50% starting June 2025.

- The protocol announced a roadmap update including Telegram trading, social login, and token staking for fee reduction, aiming for roll-outs in late 2025.

- The transition from Ethereum-based token to native chain architecture matured, with the bridge shutdown finalised and >94% migration of ethDYDX to DYDX by June 2025.

- Listing expansion: The platform added hundreds of markets (e.g., the “MegaVault” update listed 171 markets in July 2025) and added infrastructure upgrades.

- Institutional on-ramp via ETP products such as 21Shares DYDX ETP (September 2025) enabling regulated exposure to the token.

- Liquidity and protocol monetization matured, with recent quarterly data showing open interest and perpetual volumes climbing, even as rewards taper.

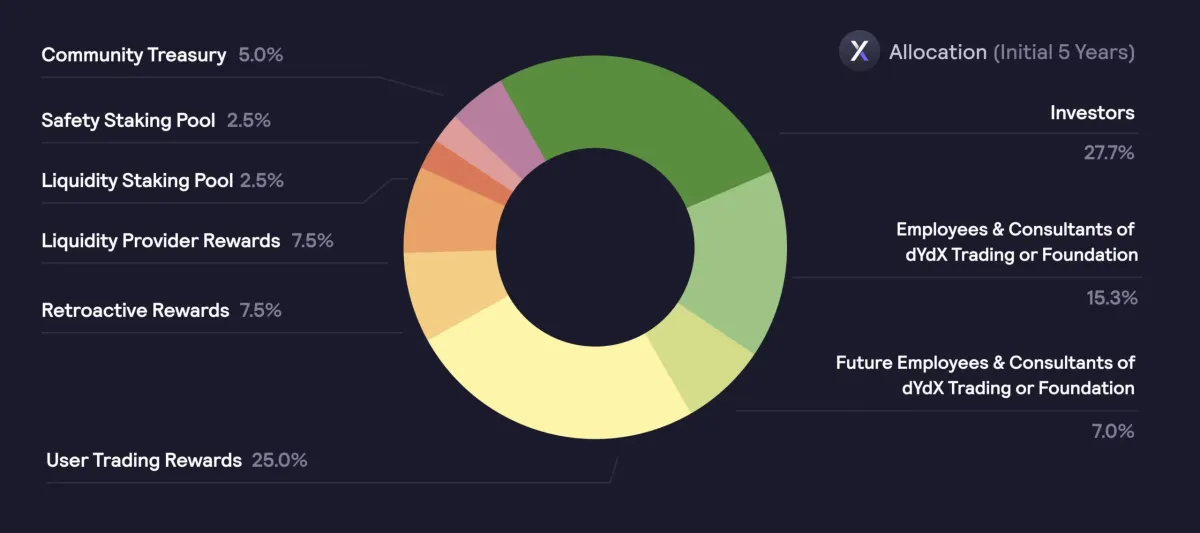

dYdX Token Allocation Overview

- Investors receive the largest share with 27.7% of total dYdX tokens.

- User Trading Rewards account for 25%, incentivizing active traders on the platform.

- Employees & Consultants of dYdX Trading or Foundation are allocated 15.3%, supporting team and advisor compensation.

- Future Employees & Consultants will receive 7%, ensuring long-term talent retention.

- Retroactive Rewards make up 7.5%, recognizing early platform contributors.

- Liquidity Provider Rewards also receive 7.5%, encouraging liquidity in dYdX markets.

- Community Treasury holds 5%, funding governance and ecosystem growth initiatives.

- Safety Staking Pool is assigned 2.5%, reserved for protocol risk mitigation.

- Liquidity Staking Pool gets 2.5%, aimed at supporting staking-based incentives.

Overview of dYdX Exchange

- The dYdX protocol operates as a decentralized exchange (DEX) focused on derivatives, especially perpetual futures.

- It runs on its own chain (the dYdX Chain, v4) built using Cosmos SDK architecture for scalability and performance.

- The platform offers advanced market infrastructure with high-performance APIs, deep liquidity, and order types familiar to centralized exchange traders but in a self-custody context.

- It has supported 200+ markets, open interest in the ballpark of $200 million, and lifetime volume around $1.5 trillion.

- As of recent data, 24-hour derivatives volume on the chain is approximately $150–180 million and open interest ~$175 million.

- The design philosophy emphasizes “trade anything,” meaning permissionless market listings, real world assets (RWAs) roadmap in 2026, and cross-chain integration.

- While U.S. retail may face restrictions, the global user base spans professional traders and institutions.

dYdX History and Evolution

- The original dYdX protocol launched as a derivatives platform, later migrating to its native chain (dYdX Chain) on October 26, 2023.

- By mid-2024 the ecosystem hit major milestones with volume in 2024 alone reaching ~$270 billion and cumulative volume since 2021 exceeding ~$1.46 trillion.

- The protocol added features including permissionless market listings, MegaVault liquidity pools, affiliate programs, staking, and governance tools.

- Token migration from Ethereum-based ethDYDX to native DYDX included a new staking module and a buy-back mechanism in 2025.

- Infrastructure upgrades in 2025 included API performance improvements (~98% latency reduction) and better UX for professional traders.

- The 2025 roadmap emphasized spot trading, cross-chain integrations, and real-world asset perpetuals scheduled for 2026.

- The evolution toward a full-featured derivatives and spot exchange on its own chain signals ecosystem maturity.

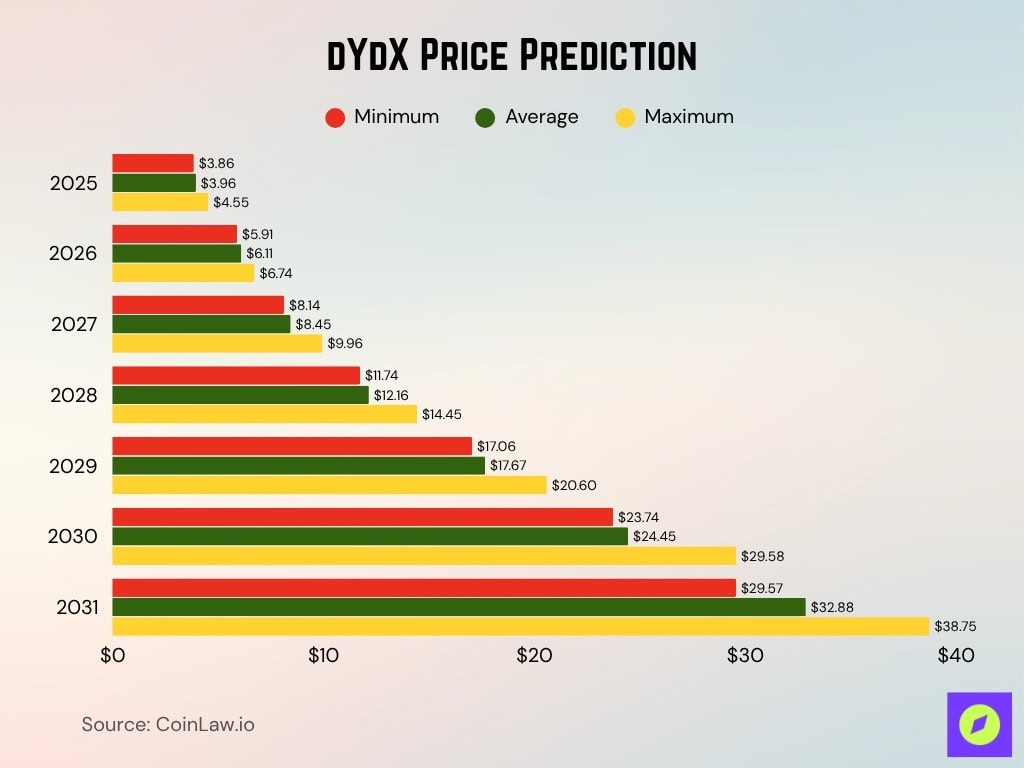

dYdX Price Prediction

- 2025: dYdX is projected to trade between $3.86 and $4.55, averaging around $3.96 as the protocol stabilizes post-v4 migration.

- 2026: The price could climb to an average of $6.11, with a potential high of $6.74, reflecting growing perpetual trading adoption.

- 2027: Forecasts show dYdX averaging $8.45, possibly reaching $9.96, driven by on-chain liquidity expansion.

- 2028: dYdX may rise to $12.16 on average, with a top range near $14.45, supported by increased governance and staking utility.

- 2029: The token could surge past $20, averaging $17.67, as decentralized derivatives markets mature.

- 2030: dYdX is expected to average $24.45, with optimistic scenarios projecting a high of $29.58.

- 2031: Long-term projections point to an average of $32.88, with a possible maximum of $38.75, signaling sustained ecosystem growth.

Key Metrics and Performance

- Lifetime volume reached approximately $1.5 trillion.

- In 2024, the platform achieved ~$270 billion in trading volume, marking year-over-year growth.

- Daily trading volume averaged around $200 million +.

- Open interest in Q2 2025 climbed to ~$200 million, with BTC and ETH markets accounting for ~80% share.

- Circulating supply stands at ~782 million DYDX (of a max 1 billion).

- Market cap is approximately $268 million as of mid-2025.

- Annualized fees are around $19.64 million, with 24-hour fees averaging $55,000.

- Over 24.06 million DYDX (~$15.7 million) burned to reduce circulating supply.

- ~78% of tokens unlocked as of late 2025, with emissions scheduled to complete by June 2026.

- The broader DEX derivatives market grew ~132% YoY in 2024 and is projected to hit $3.48 trillion in 2025.

Daily and Monthly Trading Volume

- Trading volume on the dYdX Foundation chain averaged around $200 million per day in 2025.

- The H1 2025 report noted $316 billion in trading volume since chain launch, bringing cumulative volume past $1.4 trillion+.

- 24-hour derivatives volume is approximately $250.3 million.

- DYDX token trading volume fluctuates between $14 million to $25 million in recent 24-hour periods.

- Monthly volume is roughly $6 billion, based on daily averages.

- “Surge Season” recorded over $4.7 billion in trading volume across 226 live markets.

- The DEX derivatives market could reach $3.48 trillion in 2025.

- Volume momentum remains positive, linked to ecosystem updates and roadmap announcements.

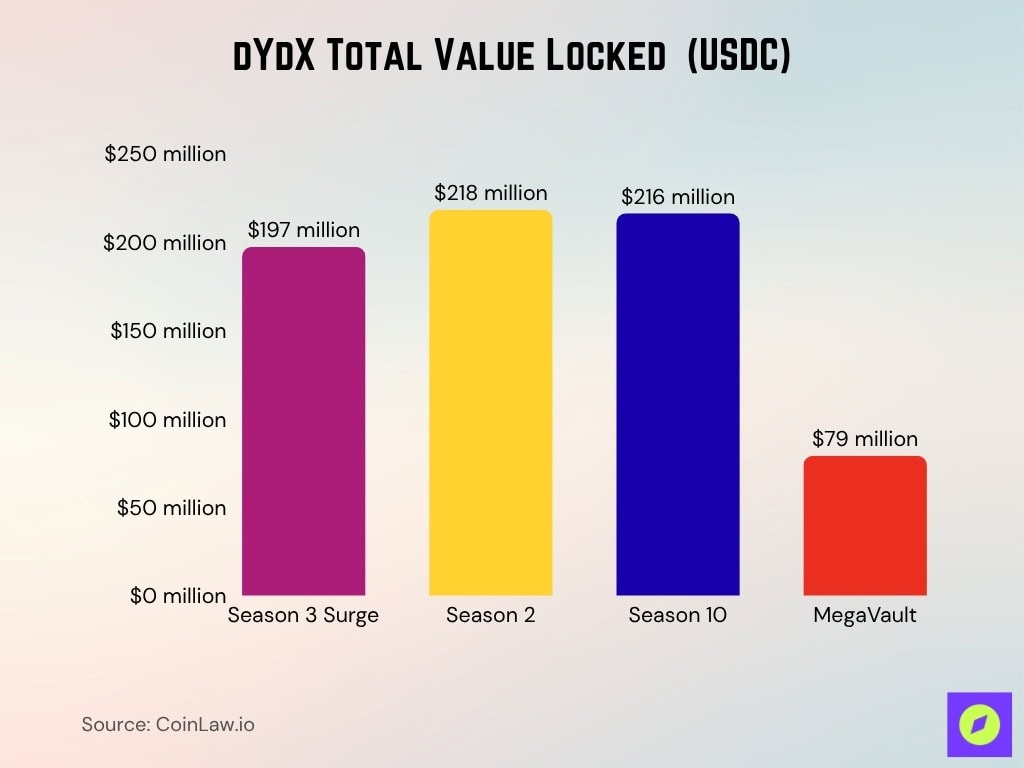

Total Value Locked (TVL)

- Season 3 Surge reported $197 million USDC in TVL.

- Season 2 showed $218 million USDC, up 4%.

- Season 10 recorded $216 million USDC, slightly lower than prior seasons.

- MegaVault exceeded $79 million USDC.

- Higher TVL enhances liquidity and derivatives depth.

- TVL reflects staked and liquidity-providing assets across the ecosystem.

- Verifiable TVL methodologies are becoming an industry standard.

Open Interest Statistics

- Open interest (OI) has climbed to around $175 million.

- Q2 2025 OI reached approximately $163 million, with BTC and ETH accounting for ~80%.

- Another dataset shows OI at $171.6 million.

- During Season 4 Surge, OI declined from $207 million to $163 million (-21%).

- Season 3 Surge showed OI > $207 million, up 8% from the start.

- OI growth in earlier seasons indicates solid participation, though market sensitivity persists.

- BTC and ETH dominance in OI remains strong.

- OI demonstrates active derivatives trading but smaller scale relative to centralized platforms.

dYdX Tokenomics

- DYDX token serves governance, staking, and incentive functions.

- As of January 2025, ~53,000 holders and ~17,700 stakers lock 241.2 million tokens at ~14.93% APR.

- The buy-back program has burned 24.06 million DYDX tokens (~$15.7 million) by mid-2025.

- Token rewards include staking, trading incentives, and governance participation.

- Maximum supply is 1 billion DYDX.

- Emissions tapered mid-2025, reducing inflation.

- Governance empowers proposals for upgrades and listings.

- Token holder and staking growth signals healthy user engagement.

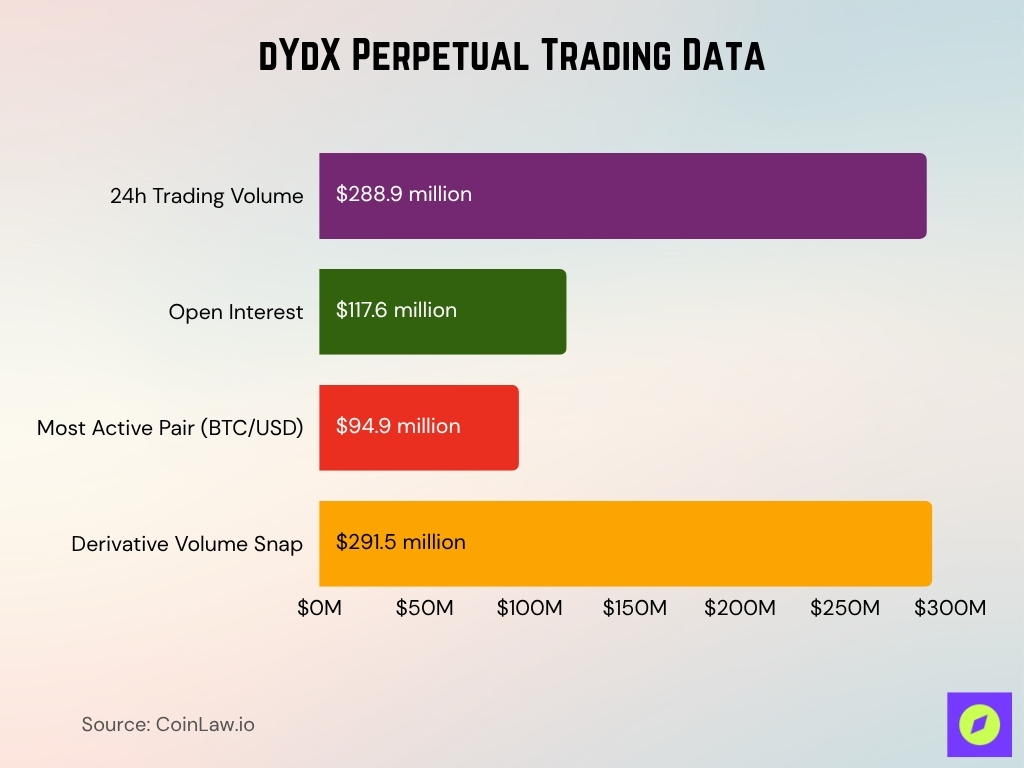

Perpetual Trading Data

- 24-hour trading volume reached $288.9 million, with open interest of ~$117.6 million.

- The most active pair, BTC/USD, had over $94.9 million in volume.

- Derivative volume snapshots show up to $291.5 million.

- Leverage availability keeps perpetual markets active.

- dYdX’s perpetual metrics are growing but still smaller than centralized competitors.

DYDX Token Distribution

- Circulating supply is 782–790 million DYDX, with remaining tokens locked.

- ~30% of tokens (~241.2 million) are staked.

- Buy-back burn of 24 million+ tokens reduces supply.

- The trading rewards program distributed over $63 million in 2024.

- Emission schedules evolve as tokens unlock, influencing governance participation.

- ~53,000 holders suggest a broad token base.

- Combined with burns and staking, distribution aligns with ecosystem performance.

Market Cap and Valuation

- DYDX market cap is around $268 million.

- Modest valuation compared to competitors offers growth potential.

- The DEX derivatives market’s expansion to $3.48 trillion could lift valuations.

- Lifetime volume (~$1.5 trillion) supports long-term value.

- Fee revenue (~$3–5 million quarterly) provides a revenue-based valuation anchor.

- Buy-back and burn programs reflect capital discipline.

- Unlocks and supply control remain key valuation levers.

- Token distribution and staking levels influence perceived value alignment.

Leading Trading Pairs

- dYdX Chain lists 235 trading pairs as of October 2025.

- BTC/USD accounts for $94 million of 24-hour volume.

- Core pairs dominate overall activity.

- Smaller pairs face wider spreads and lower liquidity.

- Broad listings reflect platform ambition.

- Pair expansion forms a central part of the 2025 roadmap.

- Liquidity concentration may shift as new assets onboard.

Staking Statistics

- Total staked tokens: 295.39 million DYDX as of July 2025.

- Network APR stands around 3.57%.

- Top validators include Polychain dYdX (29.5 m), Ex Machina (29.3 m), Kiln (11.8 m).

- Rewards are paid in USDC to avoid inflation.

- Validator delegations rose by +1.3 m DYDX in a single month.

- Higher staking enhances decentralization and network security.

- Strong staking participation shows early-stage resilience.

Liquidity Metrics

- The MegaVault liquidity engine strengthens order routing and depth.

- Buy-back programs totaling 2.87 million DYDX (~$1.88 million) improve liquidity stability.

- Validator performance metrics remain high.

- With 235 markets, liquidity corridors are expanding.

- Volume-to-liquidity ratios (~$288 m in 24 h) suggest healthy utilization.

- API latency improved by 98% in H1 2025, boosting liquidity performance.

- Ongoing improvements target tighter spreads and lower slippage.

User Growth and Adoption Statistics

- Token holders grew from 37,000 to 68,600 (+84%) in 12 months.

- Cumulative trading volume reached $1.4 trillion+.

- A $20 million trading competition attracted new users.

- Institutional flows gained traction through ETPs and integrations.

- Global DeFi users reached 14.2 million wallets by mid-2025.

- Growth in staking and governance participation reflects broader engagement.

- U.S. user restrictions persist, focusing growth on international markets.

Governance and Voting Statistics

- Governance vote on Sept 3 2025 saw 56.71% turnout and 86.20% approval.

- Proposal 297 aims to reduce validators to 42 by October 2025.

- Grants program held 9.1 million DYDX and $3.3 million USDC as of September 2025.

- SubDAO spending in H1 2025 totaled $2.3 million in grants and $1.4 million in buybacks.

- Governance allows voting on upgrades, emissions, and validator changes.

- Active community participation signals a robust governance process.

- Participation levels remain healthy but could increase for greater decentralization.

Frequently Asked Questions (FAQs)

The average daily trading volume on the dYdX v4 chain recently stood at around $200 million.

dYdX has processed over $1.4 trillion in cumulative trading volume as of its H1 2025 report.

Open interest recently reached approximately $175 million on the dYdX chain.

The number of DYDX token holders surpassed 70,700 as of July 2025.

Conclusion

Across key metrics, including trading volume, open interest, staking participation, liquidity provision, user adoption, and governance engagement, the dYdX ecosystem presents a narrative of maturing momentum. The protocol has processed over $1.4 trillion in lifetime volume, accrued hundreds of millions in staked tokens, and delivered tangible upgrades to infrastructure and participation models. Yet, relative to the largest derivatives venues, there remains significant room for growth.

For U.S.-based and global traders alike, dYdX offers a compelling decentralized alternative, especially for perpetuals and self-custody use cases. As you dive deeper into the full article, you’ll gain further insight into the token-level dynamics, market comparisons, and forward-looking opportunities that define this ecosystem.