Cryptocurrency payments are gaining ground, but they still account for just a sliver of global financial activity. Only 2.6% of U.S. consumers use crypto for payments, despite an 82.1% projected growth in adoption over the next two years. At the same time, stablecoin circulation has surged to approximately $255 billion. This signals growing interest from both consumers and businesses. Explore the full article to understand how crypto stacks up against fiat in scale, speed, cost, and security.

Editor’s Choice

- U.S. crypto payment adoption is forecasted to grow 82.1% by 2026, though from a low base.

- By mid‑2025, the global stablecoin market will stand at $255 billion.

- Crypto adoption reached 12.4% of the internet-connected adult population globally in 2025.

- Global crypto ownership rose to 562 million people in 2024, up 34% year-over-year.

- PayPal now allows U.S. merchants to accept payments in over 100 cryptocurrencies.

- Over $2.17 billion has been stolen from crypto services so far in 2025, already exceeding full-year losses of 2024.

- India’s UPI system processed 19.47 billion transactions in July 2025, worth ₹25.08 trillion (~$293 billion).

Recent Developments

- The U.S. House passed the GENIUS Act, creating a regulatory framework for stablecoins, potentially enabling broader consumer payments.

- PayPal launched “Pay with Crypto” in the U.S., supporting 100+ coins and auto-converting proceeds into its stablecoin, PYUSD, offering 0.99% fees initially.

- Major banks and FinTechs like Bank of America, Stripe, and PayPal are entering the stablecoin space amid growing regulatory acceptance.

- Chainalysis reports $2.17 billion stolen from crypto platforms in 2025, with the DPRK hack of ByBit being the largest ever.

- Stablecoin transactions grew by 21.7% year-over-year in Q1–Q2 2025. This growth was primarily driven by adoption in remittance-heavy markets like Latin America and Africa, and inflation-affected economies such as Argentina and Nigeria.

- Demand for stablecoins is rising in remittance corridors. Bitso manages over 10% of U.S.–Mexico remittances using stablecoins.

- Crypto ownership interest remains strong; 14% of non-owners plan to enter the space in 2025, and 48% are open to it.

Global Adoption Rates: Cryptocurrency vs. Fiat Payments

- Latin America leads regional crypto ownership with 15.2% average, followed by Europe at 8.9%.

- The Philippines and Iran report strong adoption, with 13.4% and 13.5% of their populations using crypto, respectively.

- Global crypto users hit 562 million by 2024, marking an increase from 420 million in 2023.

- In the U.S., 17% of adults have used or invested in crypto.

- In 2025, 12.4% of internet-connected adults globally use crypto.

- In 2024, more than 20% of large enterprises were using digital currencies for payments or collateral.

- Meanwhile, fiat remains dominant globally, with UPI in India alone processing $293 billion in one month.

Market Size: Cryptocurrency and Fiat Payment Systems

- The crypto payment gateways market is estimated at $1.685 million in 2025, with a projected CAGR of 13.6% to reach $6.03 million by 2035.

- The crypto payment apps market was $556.9 million in 2024 and is expected to grow at a 17.8% CAGR through 2033.

- Stablecoin markets stand at $255 billion as of mid‑2025.

- Global payments revenue across all systems reached $2.4 trillion in 2023 and may hit $3.1 trillion by 2028.

- PayPal now taps into a $3–4 trillion crypto market via its new merchant platform.

- CBDC transaction volumes are poised for explosive growth, projected to increase by 260,000% by 2030.

- India’s UPI processed nearly $293 billion worth of payments in a single month (July 2025).

Growth Rates of Usage Over Time

- Crypto payments in the U.S. are expected to grow 82.1% by 2026, yet remain niche at 2.6% of the population.

- Stablecoin usage expanded 21.7% in 2025.

- Global crypto ownership rose 34% in 2024, from 420 million to 562 million users.

- Bitso’s stablecoin payment volume grew 50% year-over-year to reach $12 billion in 2024.

- Orbital reports 148% growth in stablecoin payments, totaling $6 billion across 3 million transactions.

- Mobile wallet installs linked to crypto platforms rose 13.8% to 982 million globally.

- PayPal’s merchant uptake of crypto payments is increasing, with over 100 cryptocurrencies now supported.

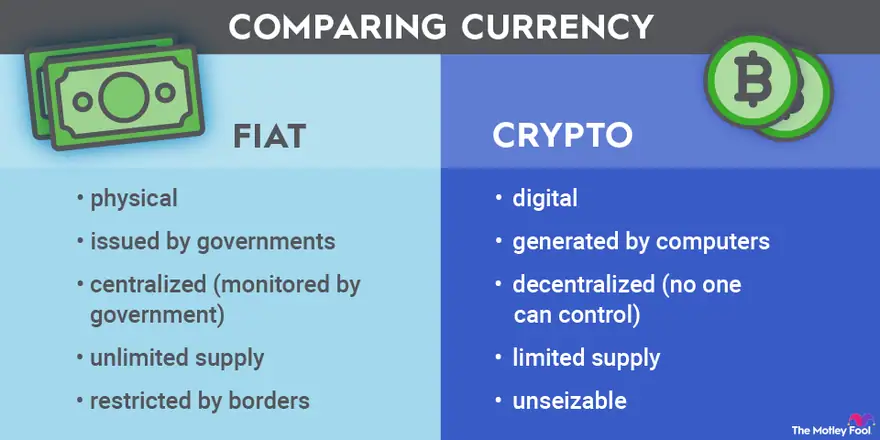

Fiat vs Crypto: Key Differences in Currency Characteristics

- Fiat currency is physical, while crypto is digital.

- Fiat is issued by governments, whereas crypto is generated by computers.

- Fiat is centralized (monitored and controlled by governments); crypto is decentralized (no single entity controls it).

- Fiat has an unlimited supply; crypto has a limited supply.

- Fiat is restricted by borders; crypto is unseizable and borderless.

Transaction Volume Comparison

- Bitso reported $12 billion in crypto payment volume in 2024.

- Orbital facilitated $6 billion in stablecoin payments all-time.

- UPI processed ₹25.08 trillion (~$293 billion) in just one month, July 2025.

- Global on-chain stablecoin transfer volume surpassed $27.6 trillion in 2024, exceeding the combined volumes of Visa ($14T) and Mastercard ($9T), although this includes internal transactions and lacks adjusted net flows.

- Global payments revenue stood at $2.4 trillion in 2023.

- CBDC volume projected to rise exponentially, 260,000% by 2030.

- PayPal’s crypto integration taps into a $3–4 trillion market.

- Bitso’s volume grew 50% year-over-year.

Transaction Value Comparison

- In 2024, global stablecoin transfers amounted to $752 billion in a single month, up from $409 billion the year prior.

- Fireblocks reports that stablecoins accounted for nearly half of transaction volume on their platform in 2024.

- PayPal’s “Pay with Crypto” taps into a $3–4 trillion crypto payments market, now accessible to U.S. merchants.

- The broader cross‑border payments market hit $194.6 trillion in 2024, expected to reach $320 trillion by 2032.

- Wholesale cross‑border payments are estimated at $1 quadrillion in 2024.

- Supported by tokenized cash insights, McKinsey expects token-based systems to dramatically shift global settlements in 2025.

- Deloitte forecasts that by 2030, one in four large-value international transfers will settle via tokenized platforms, saving businesses over $50 billion.

Crypto vs Fiat: Settlement Behavior Trends

- In 2024, fiat settlements accounted for 73.0%, while crypto settlements made up only 27.0%.

- In H1 2025, crypto settlements jumped to 40.9%, while fiat dropped to 59.1%.

- This reflects a 13.9 percentage point increase in crypto usage for settlements within a year.

- The data highlights that merchants are increasingly favoring crypto, especially in the first half of 2025.

Cross‑border Payments and Remittances

- Traditional remittances globally cost 6–7% per transaction in 2024.

- Crypto routes, including stablecoins and mobile money, reduce this to around 5%.

- Between Feb 2024 and Feb 2025, $6.3 trillion in stablecoin payments were settled, equivalent to 15% of global retail cross‑border payments.

- Traditional corridors slowed by multiple intermediaries see settlement times slashed from days to seconds with stablecoins.

- McKinsey highlights that tokenized cash tools will fundamentally alter payment settlement rails in 2025.

- Institutions report speed as the top benefit (48%) of stablecoins in cross‑border use, followed by cost savings.

- Regions with FX volatility or inflation see stablecoin remittances rise as a dollar alternative.

Payment Penetration by Country and Region

- In developed markets, credit and debit cards still lead. In Europe, bank transfers account for 49% of e‑commerce payments, while PayPal covers 72% of U.S. online shoppers.

- In Southeast Asia, ASEAN nations’ real‑time payment networks now support cross‑border QR payments, with no USD conversion needed.

- Brazil’s Pix reaches 75% adult adoption and handles 40% of online transaction volume.

- Latin America’s digital payments revenue is projected to triple to $300 billion by 2027, with e‑commerce hitting $260 billion by 2028.

- In the Philippines, GCash boasts 81 million active users by 2023, becoming a dominant digital payment method.

- Real‑time payment frameworks in Japan (Zengin) and Korea (HOFIN), supported by PayPay (55 million users) and KakaoPay (38 million users), facilitate 62% of cross-border purchases via mobile apps.

- Alternative methods, local wallets, transfers, now rival cards across Latin America, signaling fragmented but vibrant digital adoption.

Top Barriers to Digital Currency Adoption

- 43% of respondents cited security of payment platforms as a key concern.

- Another 43% pointed to the disconnected nature of the industry as a barrier.

- 37% identified the changing regulatory landscape as a major obstacle.

- 36% were concerned about the instability of the digital currency market.

Adoption in Retail and E‑commerce

- A 2025 merchant survey shows 46% accept cryptocurrency payments, 82% favor it due to fewer intermediaries.

- Roughly 2,300 U.S. businesses accept Bitcoin, not counting ATMs.

- Among Americans, 16% made at least one purchase with crypto, 34% express interest across spending categories.

- Checkout.com’s 2022 data shows 77% of merchants supporting crypto or stablecoins saw cross‑border sales increase.

- Gucci and other luxury brands accept crypto via processors like Flexa and BitPay, though consumer use remains limited.

- MoonPay launched a Mastercard stablecoin-enabled debit card for point‑of‑sale conversion in 2025.

- Fiserv promotes crypto acceptance to retailers, citing efficiency, though skepticism persists over actual usage.

Merchant Acceptance Rates

- 46% of merchants have integrated crypto payments, and process simplification was a key motivator for 82%.

- PayPal’s “Pay with Crypto” promises up to 90% lower fees (0.99% transactional fee) compared to international credit cards.

- Stripe now supports USDC payments for Shopify merchants, expanding stablecoin acceptance.

- Checkout.com found that 77% of crypto-accepting merchants saw cross-border sales growth.

- MoonPay’s stablecoin debit card and BitLicense demonstrate regulatory‑compliant merchant integration.

User Demographics and Ownership Statistics

- In the U.S., 28% of adults own cryptocurrencies, jumping to 51% among Gen Z.

- 16% of Americans made at least one crypto purchase, and 34% express interest across multiple spending categories.

- Global rates show strong crypto use even in emerging markets, and household ownership surges in nations with currency instability.

- Stablecoin wallets with regular activity reached 46 million last month, up from 27 million year-over-year.

- In institutional surveys, 48% of payments professionals highlight speed as the top benefit of stablecoins.

Transaction Speed and Settlement Time

- Stablecoins settle payments in seconds, operating 24/7, vastly faster than traditional systems like ACH and SWIFT.

- European instant payments now require transfer and verification to complete within 10 seconds under EU regulation, effective January 2025.

- The Lightning Network processes Bitcoin payments in milliseconds to under a minute, compared to on-chain averages of 10 minutes.

- RTGS (Real-Time Gross Settlement) systems deliver immediate, final settlement, though actual timing may extend when banks process transactions.

- Across Fireblocks’ network, 48% of respondents say speed is the top benefit of stablecoins in real-world use.

- Legacy remittance paths, like correspondent banking, take days, while stablecoins cut these to mere seconds.

- Visa Direct, converted to an instant payments system in the U.S. in 2025, handled about 10 billion transactions in 2024, showcasing the broader push toward real-time rails.

Transaction Fees: Crypto vs. Fiat

- Credit card interchange fees in the U.S. average around 1.79%, composed of various splits between banks and networks.

- Remittance fees average 6.4% globally on a $200 transfer; cryptocurrency options often charge only a few cents.

- PayPal’s “Pay with Crypto” service charges just 0.99%, up to 90% cheaper than traditional cross-border card fees.

- Crypto transfers may cost negligible network fees, depending on chain congestion and gas pricing.

- By enabling retailer-issued stablecoins, companies like Walmart or Amazon could save 2–3% per transaction on processing fees.

- Fireblocks report, stablecoins represent nearly half of transaction volume on their platform, highlighting cost-efficiency appeal.

- Visa and Mastercard collect close to $95 billion annually in swipe fees; stablecoin alternatives could pressure this revenue stream.

Security and Fraud Statistics

- Illicit crypto activity accounted for only 0.14% of blockchain volume in the prior year.

- Stablecoins enable traceability and freezing of addresses, aiding law enforcement, $225 million was recently seized in fraud investigations thanks to blockchain visibility.

- Tether, a major stablecoin issuer, resolved past reserve concerns with a $41 million regulatory fine in 2021.

- While stablecoins are growing in mainstream finance, concerns remain around reserve transparency and FX infrastructure gaps.

- The U.S. GENIUS Act mandates 1:1 reserve backing, introducing more oversight and consumer protections.

- On Fireblocks’ platform, 86% of providers cite infrastructure readiness as a key adoption driver.

- North American firms, 88% view stablecoin regulation as an enabling, not a barrier, contribution to safer crypto payments.

Chargebacks and Refund Rates

- Bitcoin transactions are irreversible, which means chargebacks are rare or impossible, unlike with credit cards.

- Merchants accepting crypto enjoy reduced chargeback fraud risk due to direct peer-to-peer settlement.

- Traditional credit card systems in the U.S. see typical chargeback rates between 0.5% to 1% of transactions.

- Stablecoins may integrate refund logic via smart contracts, but widespread implementation remains under development.

- No comprehensive datasets yet exist for worldwide crypto refund rates; most exchanges rely on user-initiated refunds or dispute mechanisms.

Regulatory Compliance and Legal Status

- The U.S. GENIUS Act now allows retailers to issue stablecoins and requires 1:1-backed reserves.

- In the EU, MiCA provides a framework applying to stablecoin issuers and intermediaries.

- North America leads institutionally, with 88% of firms seeing stablecoin regulation as a green light.

- Globally, policymakers balance innovation vs. stability; some markets remain cautious, while others embrace testing platforms.

- Stablecoin infrastructure providers report 86% readiness to implement compliant systems.

- Fireblocks data shows 9 in 10 cite regulations and standards as key to broader adoption.

- Despite regulatory efforts, challenges persist, especially regarding yield-bearing stablecoins, FX exposure, and reserve clarity.

Volatility and Price Stability

- Stablecoins are pegged to fiat (primarily USD), with ~99% designed to maintain stable value.

- While crypto markets remain inherently volatile, stablecoins serve as a relatively calm store of value and medium of exchange.

- Institutional projections, stablecoin market cap could exceed $1 trillion in five years, or stay around $500 billion by 2028.

- Compared to volatile cryptos like Bitcoin or Ethereum, stablecoins offer price stability.

- Price stability benefits cross-border users who lack robust local payment systems and are sensitive to FX volatility.

- However, stablecoins are not immune to market stress if their backing assets face liquidity issues or interest rate shocks.

Environmental Impact: Energy Consumption

- Bitcoin transactions cost about 707.6 kWh of electricity each.

- Ethereum (pre-merge) consumed around 62.56 kWh per transaction; newer models (e.g., proof-of-stake) are far more efficient.

- XRP stands out as extremely efficient, using only 0.0079 kWh per transaction on average.

- Ethereum’s shift to PoS in 2022 reduced energy consumption by 99.98%, with settlement times of about 12 seconds.

- Stablecoins built on efficient chains benefit from reduced energy costs.

- Traditional fiat rails like Visa and SWIFT use centralized infrastructure with relative energy efficiency per transaction; quantification varies significantly by system.

Conclusion

Cryptocurrency payments, particularly via stablecoins, offer compelling advantages in speed, cost, transparency, and traceability compared to traditional fiat systems. Transaction settlement now happens in seconds, fees fall well below credit card or remittance averages, and advanced security features position them as more traceable and fraud-resistant. Regulatory moves like the U.S. GENIUS Act and the EU’s MiCA bring legitimacy and structure. That said, challenges remain, from chargeback workflows to infrastructure maturity, environmental footprints, and volatile global markets.

In sum, while crypto is not yet mainstream, it is rapidly evolving from niche to credible. As adoption scales and oversight strengthens, stablecoins and related payment systems could reshape finance, especially for cross-border commerce, underbanked populations, and 24/7 global economies.