Hot wallets, software‑based crypto wallets that remain connected to the internet, play a central role in how people access, use, and trade digital assets. Today, their importance has grown in tandem with surges in DeFi activity, NFT transactions, and demand for fast, mobile‑friendly payments. For example, retail users rely on hot wallets daily for trading or paying with cryptocurrencies, while institutions increasingly use them to interact with smart contracts and DeFi platforms. This article digs into the latest statistics on hot wallets, usage, growth, security risks, market share, and what drives adoption. Read on to understand how hot wallets shape the crypto landscape in the U.S. and globally.

Editor’s Choice

- Hot wallets make up the majority of active crypto wallets globally, accounting for an estimated 72% to 78% of usage depending on region and platform.

- The crypto wallet market is projected to grow from $14.39 billion in 2024 to over $19 billion in 2025, representing a ~32% YoY growth driven by rising mobile usage and DeFi adoption.”

- Hot wallets accounted for about 55–57% of global wallet revenue, largely due to their dominance in mobile and DeFi applications.

- The U.S. crypto wallet market generated about $2,966 million in revenue in 2024, with hot wallets being the largest and fastest-growing segment.

- The hardware wallet market size is projected at $0.56 billion in 2025, growing at a CAGR of 29.95% toward 2030.

- Over 58% of crypto wallet users now demand mobile wallet access, and biometric authentication usage rose by ~46%.

- Hot wallet revenue is forecasted to grow from $1.5 billion in 2024 to $5.2 billion by 2033, reflecting a projected CAGR of around 15%.

Recent Developments

- Hardware wallets and cold storage solutions are gaining popularity in response to increasing high‑value thefts from hot wallets.

- Cross‑chain compatibility is becoming a standard feature in new hot wallets; more wallets launched now include DeFi integration and support for multiple chains.

- More users demand wallet features like multi‑signature support, ~36% of enterprises require shared custody solutions.

- Regulatory pressure in regions like the EU, through MiCA, and the U.S., with various compliance rules, is pushing wallet providers toward higher security and transparency.

- Hardware wallet card formats are growing. As of Q2 2025, cold wallet cards hold ~19% of assets stored via hardware solutions.

- Retail staking wallets globally rose to ~68 million in 2025, up ~22% from the previous year.

- Software wallet downloads topped 520 million globally in 2025.

- Desktop wallet usage among hot wallets is declining; desktops make up only 9% of hot wallet usage in 2025.

Hot Wallet vs. Cold Wallet: Key Differences

- Hot wallets connect to the internet and offer fast access, high convenience. Cold wallets store keys offline for enhanced security but less convenience.

- Hot wallet risks, exposure to phishing, hacking, seed phrase leaks, cold wallet risks, physical damage, loss, and device failure.

- Many users adopt hybrid strategies, small amounts or frequently traded assets in hot wallets, and large, long‑term holdings in cold wallets.

- Cold wallets increasingly offer features like air‑gapped transactions, NFC cards, or USB devices to improve ease‑of‑use.

- Hot wallets are preferred where transaction speed matters, trading, DeFi, NFTs, and payments. Cold wallets are preferred for long‑term storage, institutional custody.

- The cost per device for hardware cold wallets remains higher, including secure element chip, certifications, and hot wallets; cost is usually a software subscription or free with trade‑offs.

- Recovery risk, hot wallets depend heavily on third‑party security, custodial or software updates, cold wallets depend on physical backup or safe storage of devices or seed phrases.

- Growth trade‑off, hot wallets are expanding faster in user base and feature set, cold wallets are slowly gaining as security concerns mount.

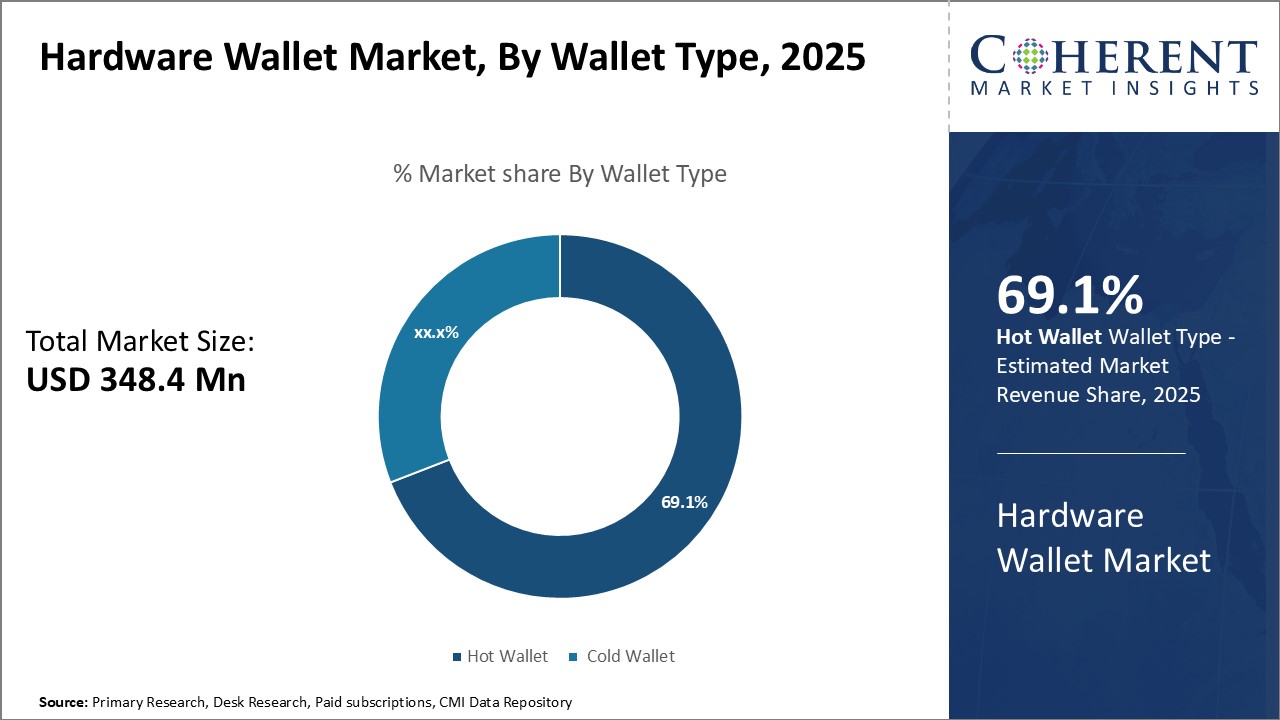

Hardware Wallet Market, By Wallet Type

- The total hardware wallet market is projected at $348.4 million in 2025.

- Hot wallets will dominate with a 69.1% market share, making them the leading choice for users.

- Cold wallets are estimated to account for the remaining 30.9% share of the market.

- Hot wallets represent nearly 7 out of every 10 dollars spent on hardware wallets in 2025.

Global Hot Wallet Usage Statistics

- Hot wallets represent ~78% of all crypto wallets in 2025.

- Cold wallets make up the remaining ~22%.

- Desktop hot wallet usage has dropped to 9% of hot wallet usage globally in 2025.

- Custodial wallets are used by about 41% of users, non‑custodial wallets by 59%.

- Retail users hold ~82% of all wallets, and institutional wallet adoption rose by 51% year‑over‑year.

- The average retail user holds about 2.7 wallets in 2025.

- Institutional wallets, over 31 million wallets tied to organizations in 2025.

- Among institutional wallets, about 43% are custodial.

Hot Wallet Market Share and Growth Trends

- The global crypto wallet market size was $13.77 billion in 2024 and is projected to reach $18.00 billion in 2025.

- The long‑term forecast expects growth to $153.88 billion by 2033, with a CAGR of ~30.76% from 2025 to 2033.

- Hot wallets dominated the wallet type segment in 2024 with a revenue share of about 56%.

- U.S. revenue from crypto wallets was about $2,966 million in 2024, with hot wallets being the most lucrative and fastest‑growing segment.

- The hardware wallet market, as a proxy for cold storage, is small compared to the total wallet market but growing fast, $0.56 billion in 2025, expected to reach $2.06 billion by 2030.

- Hot wallet market revenue is forecast to increase from $1.5 billion in 2024 to $5.2 billion by 2033.

- In the hardware wallet market, cold wallets are set to expand at ~30.76% CAGR from 2025 to 2033.

- In 2025, USB‑connected hardware wallets are expected to hold a large share (~44.67%) among hardware wallet formats.

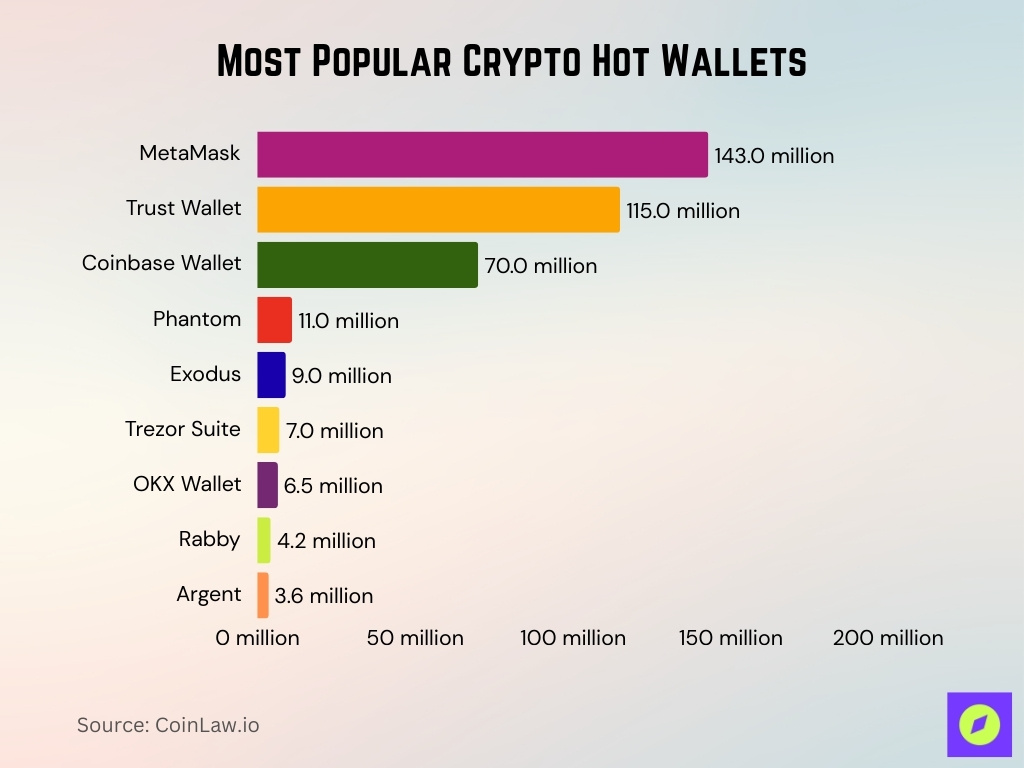

Most Popular Crypto Hot Wallets by Users

- MetaMask remains the most widely used hot wallet globally in 2025, with roughly 143 million users.

- Trust Wallet has about 115 million downloads or active users, placing it firmly in second place.

- Coinbase Wallet has over 70 million users worldwide, appreciated especially by those seeking regulated and custodial features.

- Phantom Wallet, focused on the Solana ecosystem, grew to 11 million users in 2025.

- Exodus reports 9 million monthly active users, favored for multi‑asset support and UI experience.

- Trezor Suite, tied to cold or hybrid functionality, supports around 7 million users, up ~21% year‑over‑year.

- OKX Wallet usage surged to 6.5 million users, boosted by OKX’s Web3 ecosystem integration.

- Emerging wallets like Rabby Wallet reached ~4.2 million installs or users in 2025, especially among DeFi‑oriented users.

- Argent Wallet, with Layer 2 compatibility and focused on non‑custodial or self‑custody features, expanded to 3.6 million users globally.

Custodial vs. Non‑Custodial Hot Wallets

- In 2025, around 41% of hot wallet users use custodial wallets, third‑party holds the private key, and 59% use non‑custodial or self‑custody wallets.

- The non‑custodial wallets market was valued at about $1.5 billion in 2023. It is forecasted to grow to $3.5 billion by 2031, at a CAGR of ~8%.

- Users of custodial wallets often trade more frequently, while non‑custodial users tend to hold more assets long‑term or engage in DeFi or NFT activity.

- Among institutional wallets, ~43% are custodial.

- Self‑custody awareness rose to approximately 71% among crypto users in 2025.

- Custodial wallets are preferred by newer users who prioritize ease of recovery, customer support, or regulatory assurances.

- Non‑custodial wallets are preferred by DeFi or NFT users, power users, and those with higher risk tolerance.

- Hybrid models, holding some funds custodially, others self‑custodially, are increasingly common.

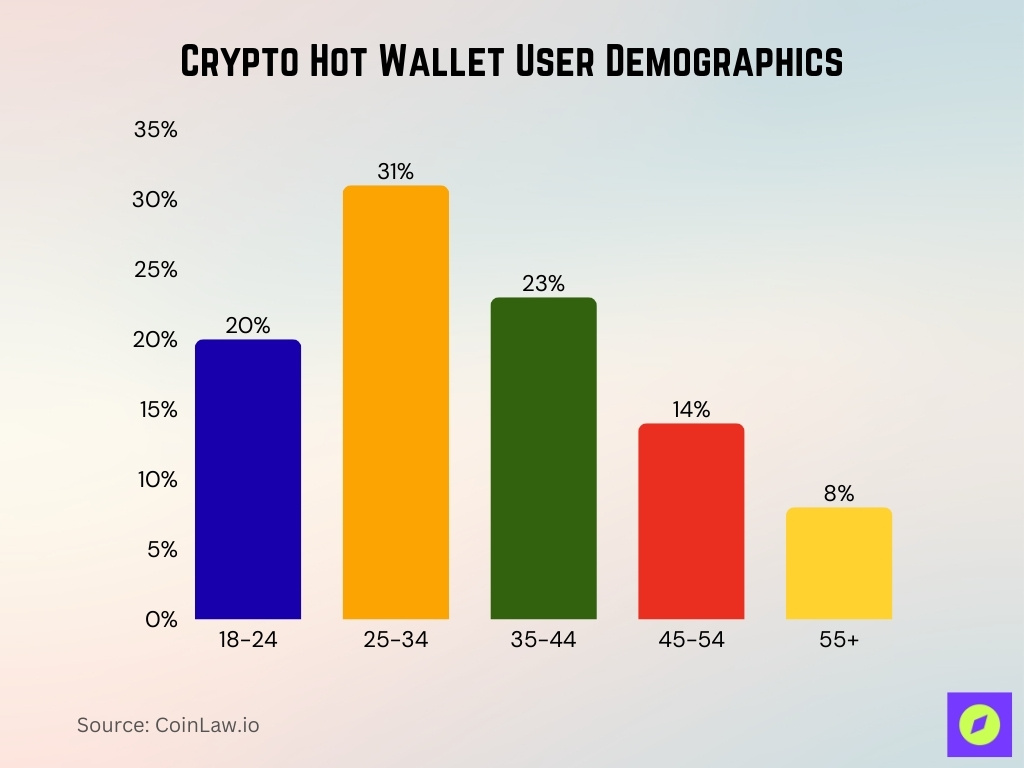

Hot Wallet User Demographics and Preferences

- The 25‑34 age group makes up about 31% of crypto wallet users globally in 2025, still the largest single age segment.

- Ages 35‑44 account for ~23%, 18‑24 for ~20%, with drop‑offs in older groups, 45‑54 ~14%, 55+ ~8%.

- Gen Z represents ~28% of crypto participants, showing sharp growth particularly in NFT or dApp usage.

- Millennials remain the dominant cohort, about 40% of total users.

- Gender split among crypto wallet users is uneven, with about 67% male, 33% female globally.

- In the U.S., the median crypto user age has moved up toward 37 years old, reflecting more mature adoption.

- 78%+ of users access crypto services via mobile apps, making mobile the preferred platform over desktop.

- The average wallet balance globally is ~$3,560 in 2025, up about 11% YoY.

Mobile vs. Desktop Hot Wallet Adoption

- Mobile wallets are used by over 78% of hot wallet users in 2025.

- Desktop wallet usage has declined, representing only ~9% of hot wallet usage globally in 2025.

- Browser extension wallets make up ~12% of usage, especially among NFT traders and DeFi users.

- Android accounts for about 61% of mobile wallet installs or usage, and iOS has ~36%.

- Wallets that sync across devices have seen ~42% YoY growth.

- Mobile wallets with biometric authentication are very common; ~84% include biometric as an option.

- Features like push notifications, real‑time alerts, and QR code payments have seen strong uptake in mobile wallets, contributing to higher retention.

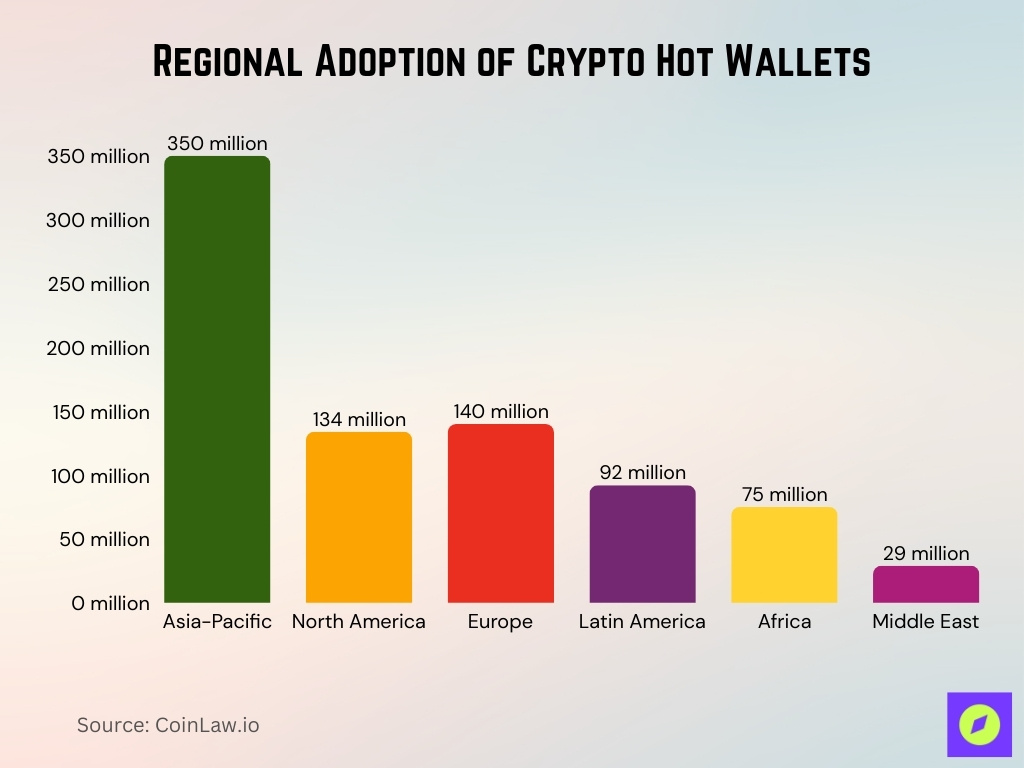

Regional Adoption of Hot Wallets

- The Asia‑Pacific region leads with ~350 million active wallet users in 2025, representing about 43% of global users.

- North America has ~134 million wallet users, ~16% of the global total.

- Europe counts ~140 million wallets, growing ~12% YoY.

- Latin America reached ~92 million users, often driven by inflation and as a hedge against currency volatility.

- Africa has ~75 million users in 2025, and growth has doubled in two years.

- The Middle East recorded ~29 million active wallets.

- Regional penetration among internet users, the U.S. leads with ~27%, followed by South Korea (~24%), Singapore (~22%), and Brazil (~20%).

Hot Wallet Adoption in DeFi and NFTs

- Globally, 198 million wallets are active in DeFi in 2025, ~24% of total crypto wallets.

- NFT-linked wallets surpassed 290 million globally in 2025, marking a 30%+ YoY increase.

- Among Gen Z, NFT wallet ownership surged by ~42% in 2025.

- Most NFT interactions, ~61%, arise from gaming sectors.

- Metaverse wallet adoption reached about 79 million users in 2025.

- Staking‑enabled wallets in DeFi climbed to ~92 million users.

- The average DeFi wallet supports about 5.4 tokens and interacts with ~2.3 chains in 2025.

Hot Wallet Transaction Volume and Frequency

- Bitcoin network reports about 362,913 transactions per day as of mid‑September 2025, down ~33% from a year ago.

- OKX Wallet users average 3.2 transactions per day per active user in 2025, up from ~2.0 or day in 2024.

- Among OKX active users, “power users” initiate over 25 swaps weekly.

- Swap activity in the wallet at OKX rose 41% year‑over‑year.

- Cross‑chain bridging feature usage at OKX increased by 57% between Q3 2024 and Q2 2025.

- DeFi users in the OKX wallet rose 32% YoY in 2025.

- Transaction success rate within the OKX wallet exceeds 99.8%.

- Phantom Wallet’s perpetual futures trading volume has passed $1 billion in cumulative volume.

Security Risks and Hot Wallet Incident Statistics

- In the first half of 2025, over $1.93 billion was stolen in crypto‑related crimes.

- By mid‑2025, funds stolen from crypto services surpassed $2.17 billion, outpacing total losses in 2024.

- Wallet compromises accounted for $1.7 billion of those losses, over 34 distinct incidents.

- Phishing campaigns led to ~$410 million stolen from victims via 132 separate attacks.

- Phemex lost over $85 million in a hot‑wallet attack in early 2025.

- Hot wallet breaches cause ~82% of all centralized exchange-related losses over the past five years.

- API vulnerabilities contributed to 17% of CEX hacks in 2025.

- Unauthorized account access played a role in 29% of CEX breaches.

Security Features in Crypto Hot Wallets

- Wallets with multi‑factor authentication show ~62% lower incidence of compromise compared to those without.

- Biometric authentication is present in 84% of mobile wallets globally in 2025.

- Phantom Wallet offers optional hardware‑wallet integrations plus independent audits and bug bounty programs.

- Address poisoning attacks have targeted ~17 million victims, causing over $83.8 million in direct loss.

- WalletProbe detected 13 attack vectors and 21 concrete attack strategies among 39 browser‑based wallet extensions.

- Over 27% of wallet‑related incidents stem from software vulnerabilities or third‑party integration gaps.

Regulatory Impact on Hot Wallet Usage

- Regulatory clarity in the U.S. is increasing oversight of intermediaries and custodial wallet providers.

- The EU’s MiCA regulation pressures providers to disclose transaction frequency, reserves for stablecoins, and other risk metrics.

- FATF reports that only 40 of 138 jurisdictions are largely compliant with its virtual asset rules as of April 2025.

- Regulatory gaps affect ~41% of wallet developers.

- In the U.S., surveyed users put security as their top concern; 35% cite it as the most important factor.

Frequently Asked Questions (FAQs)

A compound annual growth rate (CAGR) of 26.3% from 2025 to 2033.

Hot wallets held 56.0% of the global crypto wallet market revenue in 2024.

Valued at approximately $2.93 billion in 2025, projected to increase to $7.09 billion by 2029. (CAGR around 24.7%).

$12.59 billion in 2024, projected to reach $100.77 billion by 2033.

Conclusion

Hot wallets continue to dominate crypto usage by frequency, accessibility, and growth. Transaction volumes are rising on many platforms, and user security remains a major concern. Major losses from hacks, phishing, and vulnerabilities show that convenience comes with risk. Meanwhile, improvements in UI or UX, regulatory clarity, and advanced security features are helping to raise the safety bar. Users and providers who stay informed and adopt best practices, like multi‑factor and biometric authentication, clear transaction feedback, and hybrid custody strategies, can enjoy the benefits of hot wallets while reducing exposure. Explore earlier sections of this article to see which wallets lead in adoption, how markets are evolving, and where opportunity and risk intersect.