Cryptocurrency has increasingly become a frontline in the fight against money laundering. In the U.S., regulators are now relying on blockchain analytics to detect hidden financial flows in real time. Industries such as fintech and law enforcement are deploying AI-powered tools to flag suspicious activity at scale. Let’s explore key data that shapes the 2025 crypto-AML landscape.

Editor’s Choice

- $40.9 billion flowed into illicit crypto addresses in 2024, down from prior highs.

- $51 billion moved into illicit wallets in 2024, with $40 billion laundered and $2 billion stolen.

- $4.2 billion tied to crypto money laundering in 2024, a 23% rise versus 2023.

- 69% of crypto exchanges fail to meet FATF’s Travel Rule.

- 88% of financial institutions reported plans to deploy AI/ML-powered tools for anti–money laundering by 2025, compared with 62% in 2023.

- 17% more crypto value stolen by mid-2025 compared to 2022, with potential to surpass $4 billion by year-end.

- In H1 2025, blockchain attacks numbered 121 incidents, causing $2.373 billion in losses, a 66% rise in cost despite fewer hacks.

Recent Developments

- Mid-2025 thefts from crypto services hit $2.17 billion, exceeding full-year 2024 totals.

- If trends persist, stolen crypto could eclipse $4 billion by the end of 2025.

- Security incidents in blockchain dropped in count but spiked in damages in H1 2025.

- U.S. DOJ indicted 12 individuals in a RICO crypto laundering case involving over $263 million, part of $1.5 billion stolen in Q1 2025.

- The DOJ sought seizure of $225.3 million in crypto from pig-butchering scams, and 2024 crypto fraud losses totaled $5.8 billion.

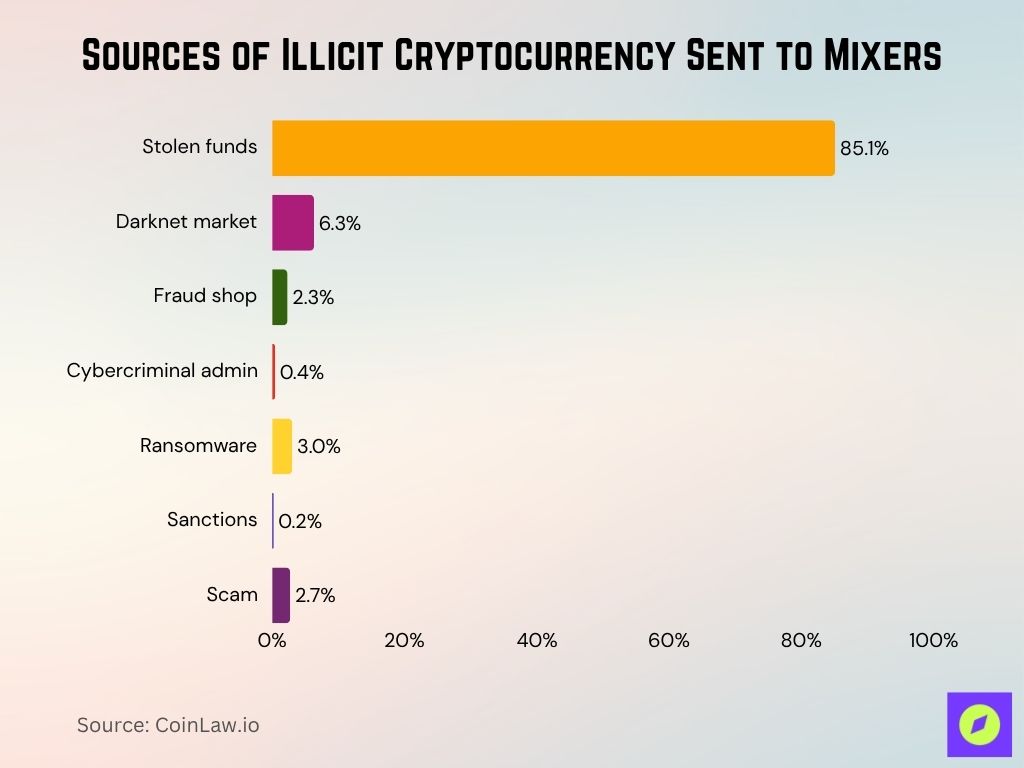

Sources of Illicit Cryptocurrency Sent to Mixers

- Stolen funds dominate, making up 85.1% of all illicit cryptocurrency sent to mixers.

- Darknet market transactions contribute 6.3%, showing their continued role in illegal crypto flows.

- Ransomware payments account for 3.0% of the total mixed illicit funds.

- Scams represent 2.7%, reflecting fraudulent schemes laundering through mixers.

- Fraud shops are responsible for 2.3% of mixer-bound illicit crypto.

- Cybercriminal admin activities account for 0.4%, indicating lower but notable use.

- Sanctions-related transactions make up 0.2%, highlighting restricted entities’ attempts to obscure funds.

Overview of Cryptocurrency and AML

- Illicit crypto inflows reached about $40.9 billion in 2024.

- $51 billion entered illicit wallets in 2024, $40 billion laundered, $2 billion stolen.

- Crypto-linked money laundering volume increased by 23% in 2024 compared to 2023.

- 69% of exchanges remain noncompliant with the FATF Travel Rule.

- Blockchain offers enhanced traceability and tamper resistance; 15% of AML/KYC procedures are expected to use blockchain in 2025.

- Global financial crime, including crypto-based, may cost the world economy up to $2 trillion annually.

- AI/ML adoption in AML rose to almost 90% of institutions by 2025.

Global Volume of Crypto Money Laundering

- In 2024, $40 billion was laundered via crypto.

- $4.2 billion linked directly to crypto laundering, up 23% from 2023.

- Illicit inflows to crypto wallets are estimated at $40.9 billion in 2024.

- U.S. scam losses from crypto in 2024, $9.3 billion, representing 56% of all scam losses.

- An estimated $1 trillion was lost to scams globally in 2024, and crypto played a major role.

- Only 0.1% of illicit crypto funds are ever recovered.

- Globally, an estimated 2–5% of GDP is laundered annually, up to $2 trillion, with crypto contributing to the rise.

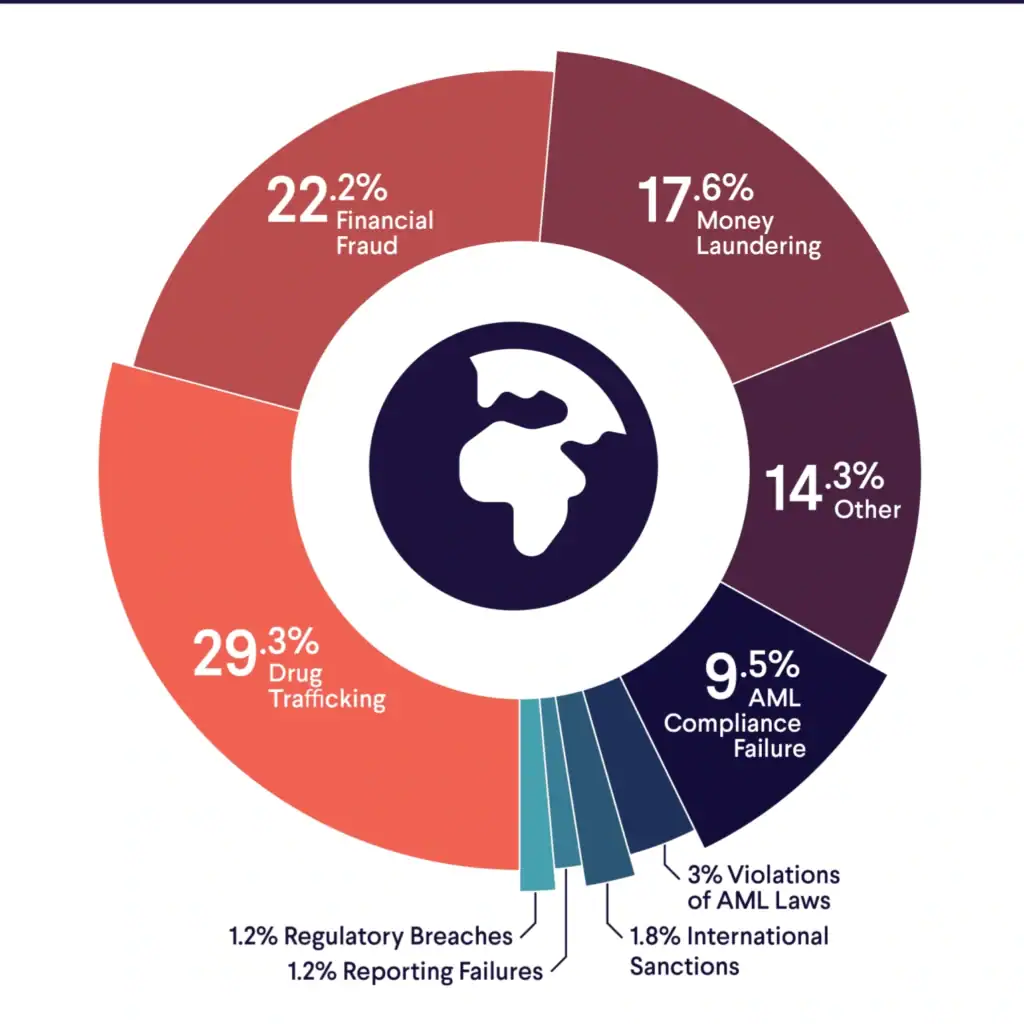

Global Breakdown of Illicit Activities

- Drug trafficking leads with 29.3% of reported illicit activities.

- Financial fraud makes up 22.2%, highlighting a major global financial crime issue.

- Money laundering accounts for 17.6% of all cases.

- Other crimes represent 14.3% of the total.

- AML compliance failures contribute 9.5%, showing gaps in anti-money laundering systems.

- Violations of AML laws make up 3% of the total.

- International sanctions breaches stand at 1.8%.

- Regulatory breaches and reporting failures each account for 1.2%.

Year-on-Year Trends in Illicit Crypto Activity

- Crypto laundering volume rose 23% from 2023 to 2024.

- Mid-2025 thefts exceed the entire 2024 total, already $2.17 billion stolen.

- If the current pace holds, stolen funds may hit $4 billion by the end of 2025.

- Scam losses via crypto in the U.S. in 2024, $9.3 billion, over half of all scam losses.

- Global scam losses hit $1 trillion in 2024, and crypto was a key channel.

- Blockchain AML/KYC adoption expands from 62% in 2023 to ~90% in 2025.

- Blockchain-based AML/KYC is expected to reach 15% usage by 2025.

Common Money Laundering Methods in Cryptocurrency

- Use of mixers and tumblers remains widespread for obfuscation.

- Pass-through wallets, peel chains, and VPNs are employed in laundering schemes.

- Crypto scams like “pig butchering” funnel funds via stablecoins, DOJ sought $225 million seizure.

- Mixers like ChipMixer previously laundered over $3 billion before being shut down.

- Tether is frequently used in laundering and sanctions-evasion operations.

- Xinbi Guarantee processed an estimated $8.4 billion in illicit trades via Telegram-linked escrow services since 2022, while Haowang Guarantee’s operations exceeded $27 billion before being dismantled by Chinese authorities in late 2024.

- Haowang Guarantee operated over $27 billion in illicit transaction volume before takedown.

Use of Crypto Exchanges and Mixers in Money Laundering

- In 2025, crypto exchanges faced over $1 billion in AML-related fines, signaling growing scrutiny.

- OKX was penalized with a record $500 million guilty plea for AML failures.

- KuCoin agreed to pay nearly $300 million in fines and forfeiture for violations, including money laundering.

- BitMEX was fined $100 million for AML/KYC program failures.

- Blockchain companies report 69% now use AI-driven AML systems, up from 52% in 2024.

- Mixers handled billions before takedown; one known platform laundered over $3 billion.

- Stablecoins, especially tethered ones, remain prevalent in laundering schemes.

Top Cryptocurrency Exchanges Used for Money Laundering

- Binance handled 27.5% of the illicit cryptocurrency cash-outs, making it the most frequently used exchange for laundering activities.

- Huobi accounted for 24.7% of the total, indicating its significant role in suspicious fund flows.

- All other exchanges combined processed 47.8% of laundering transactions, showing that illicit activity is spread across a wide range of platforms.

Cross-Chain Bridges and Obfuscation Techniques

- Criminals increasingly use cross-chain bridges to move funds between networks, complicating traceability.

- FATF found that stablecoins are frequently exploited to bypass traditional rail controls.

- AI and real-time screening tools are now flagging cross-border crypto flows tied to obfuscation.

- Mixers remain common; one study shows that AI tracing patterns across bridges enhances detection.

- Privacy tokens continue to facilitate anonymity across chains.

- Traceability drops significantly when funds cross into unregulated or non-compliant jurisdictions.

- Regulatory focus on bridge risks has intensified, especially involving stablecoins.

Global Anti-Money Laundering (AML) Market Growth

- The AML market was valued at $2.92 billion in 2024.

- It is projected to grow to $3.39 billion in 2025.

- The market is expected to expand at a CAGR of 15.2%.

- By 2029, the AML market is forecasted to reach $5.98 billion.

- Continuous growth reflects rising regulatory pressures and the adoption of AML solutions worldwide.

Technology and Machine Learning Use in Crypto AML

- RegTech market expected to exceed $22 billion by mid-2025, growing at a 23.5% CAGR.

- Blockchain forensics, AI-based monitoring, and automated KYC tools now drive AML advances across crypto platforms.

- FinCEN’s reporting rise shows the effectiveness of real-time compliance systems.

- Asia-Pacific leads AI and NLP deployment in multilingual compliance and monitoring.

- CARF and associated AI-enhanced data reporting are setting new global transparency standards.

- Japan’s tech-infused margin between compliant vs. illicit transaction rates highlights the impact of monitoring upgrades.

- Innovations like graph analytics and deep learning models help trace laundering pathways with greater speed and precision.

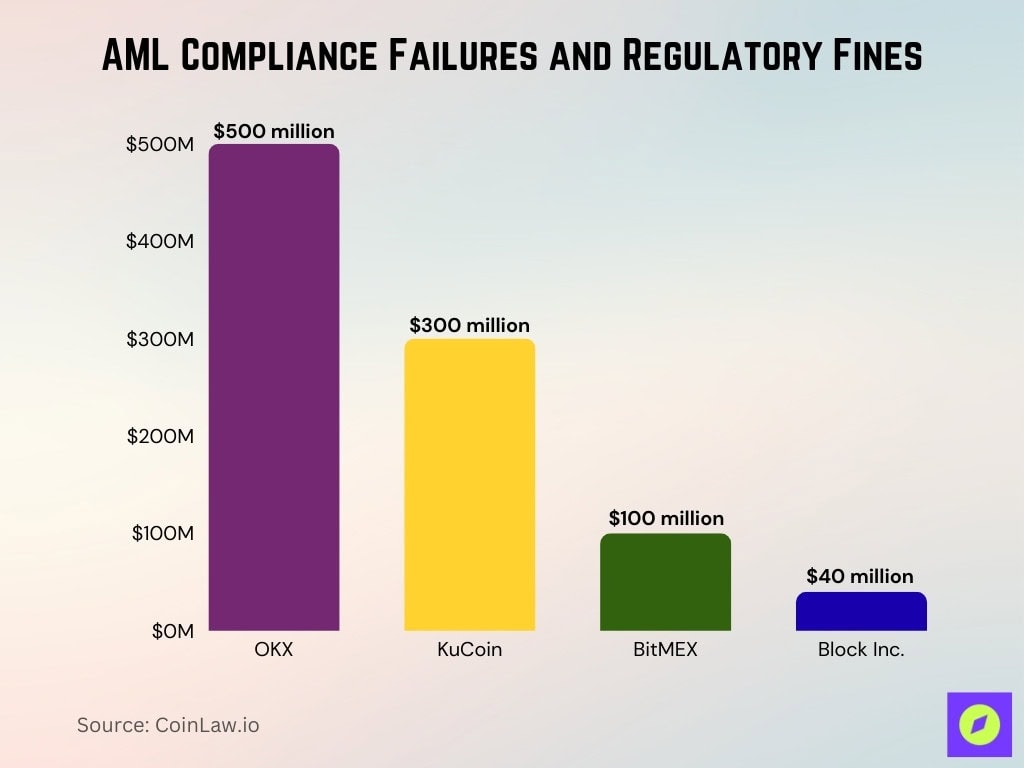

AML Compliance Failures and Regulatory Fines

- OKX agreed to over $500 million in penalties for AML violations.

- KuCoin paid nearly $300 million for failures in AML/KYC controls.

- BitMEX faced a $100 million fine and probation for poor AML/KYC measures.

- Block Inc. paid $40 million to NYDFS for AML shortcomings.

- Total crypto exchange AML fines in 2025 exceeded $1 billion.

- The average fine issued to non-compliant crypto businesses rose to $3.8 million globally in the first half of 2025, representing a 21% increase from 2024 levels.

- Approximately 31% of crypto exchanges penalized in 2024 faced further action, such as license revocation.

Impact of AML Regulations on Crypto Markets

- Only 40 of 138 jurisdictions were largely FATF-compliant by April 2025, highlighting regulatory gaps.

- Hong Kong’s new stablecoin law requires KYC for every token holder, raising compliance and privacy concerns.

- Stricter global rules increase transparency mandates for crypto firms.

- U.K.’s FCA roadmap introduces market infrastructure and management requirements for crypto by 2026.

- Regulatory scrutiny has pushed firms toward AML investments like KYC and automation systems.

- Emerging frameworks now enable 4x faster investigative outcomes via public–private AML collaboration.

- Compliance costs globally for banks and institutions exceed $60 billion annually.

Financial Impact of Major Crypto Money Laundering Incidents

- Bitfinex Hack resulted in losses exceeding $4.5 billion, making it one of the largest crypto laundering cases in history.

- Token theft accounted for $3.0 billion in illicitly moved digital assets.

- The Thodex Scam led to $2.0 billion in fraudulent transactions.

- Tornado Cash, a crypto mixer service, was linked to $1.0 billion in laundered funds.

- Bitcoin Fog was tied to $0.4 billion in illicit transactions.

KYC and Customer Due Diligence Statistics

- AI-powered KYC tools reduced identity verification time by 42% in 2025.

- Biometric KYC improved pass rates by 35%, especially in high-risk regions.

- Block Inc. was fined $40M partly for inadequate CDD and transaction monitoring failures.

- Compliance budgets remain uncertain; 41.3% of professionals doubt if current budgets suffice for 2025 goals.

- End-to-end KYC platforms now centralize onboarding, risk scoring, and documentation to improve compliance agility.

- Improved data integrity and risk management are key focuses in 2025’s AML/KYC evolution.

- Blockchain-based KYC now covers around 15% of AML processes, improving traceability.

Transaction Monitoring and Reporting Statistics

- 90% of illicit AML transactions evade detection, underscoring monitoring gaps.

- AI-driven monitoring, using deep learning, improved detection accuracy by 37%.

- Faster AML case resolution achieved through public–private intelligence sharing networks.

- Traditional rule-based systems are being supplemented with AI to catch nuanced laundering flows.

- About 15% of monitoring systems have transitioned to blockchain-backed infrastructures.

- Emerging tools like graph-based ML models are identifying laundering networks with higher efficiency and lower cost.

- Compliance officers face growing personal liability for AML failures and increasing vigilance.

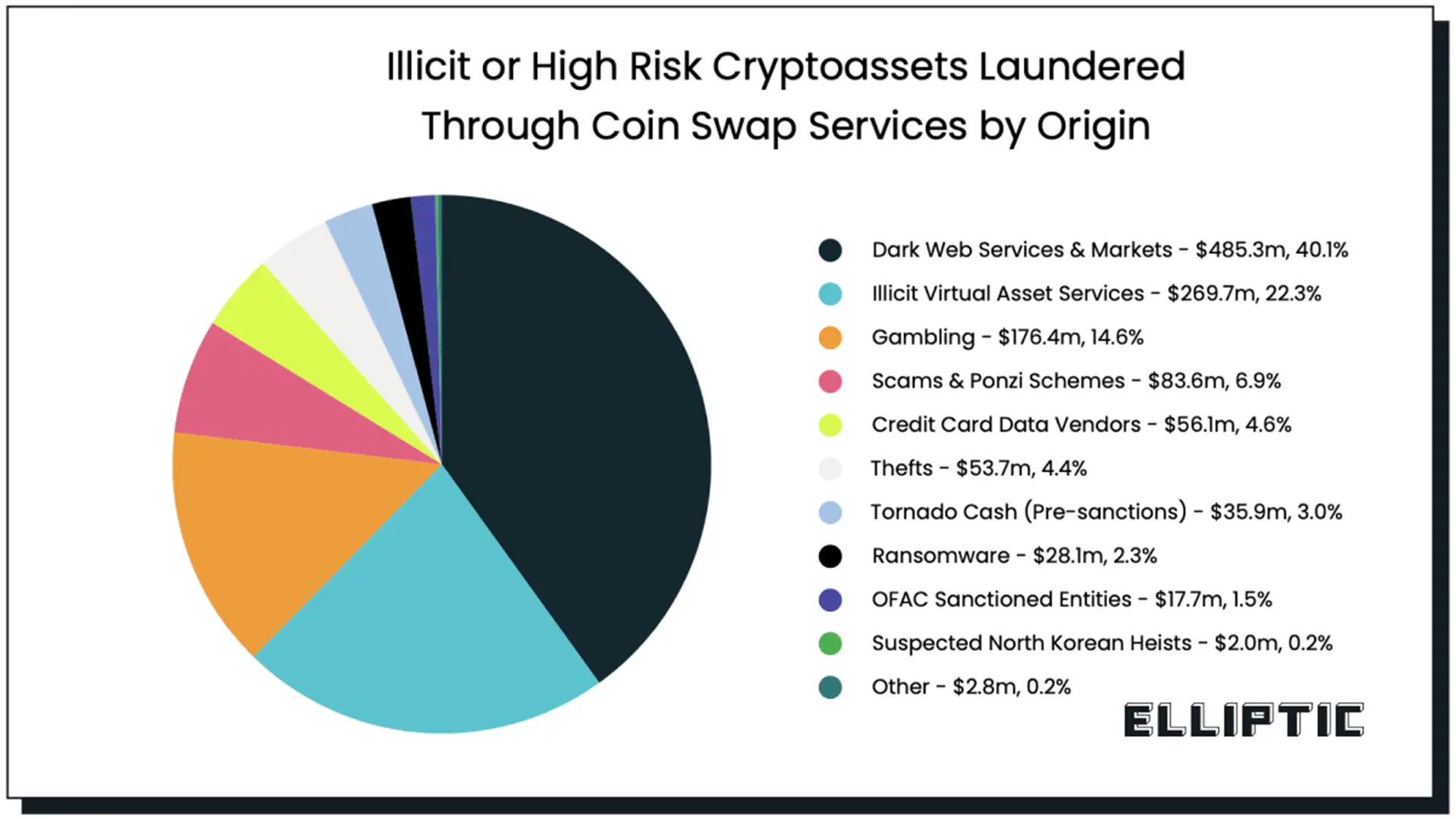

Illicit or High-Risk Cryptoassets Laundered via Coin Swap Services

- Dark Web Services & Markets dominate with $485.3M (40.1%) of laundered assets.

- Illicit Virtual Asset Services account for $269.7M (22.3%).

- Gambling platforms were used to launder $176.4M (14.6%).

- Scams & Ponzi Schemes contributed $83.6M (6.9%).

- Credit Card Data Vendors made up $56.1M (4.6%).

- Thefts resulted in $53.7M (4.4%) being laundered.

- Tornado Cash (Pre-sanctions) was linked to $35.9M (3.0%).

- Ransomware attacks accounted for $28.1M (2.3%).

- OFAC Sanctioned Entities laundered $17.7M (1.5%).

- Suspected North Korean Heists represented $2.0M (0.2%).

- Other sources contributed $2.8M (0.2%).

Regional and Country-Specific AML Statistics

- Only 40 of 138 jurisdictions assessed were “largely compliant” with FATF crypto standards as of April 2025.

- Iran’s crypto outflows surged 70%, reaching $4.2 billion in 2024, as users sought to evade sanctions.

- FinCEN reported a 34% increase in suspicious activity reports from crypto businesses following the new 2024 KYC guideline enforcement.

- Australia’s mandatory crypto reporting froze $500 million in assets due to forensic alerts.

- Japan’s Payment Services Act reforms led to a 70% compliance rate among exchanges by Q1 2025, reducing illicit transactions by 22%.

- Asia-Pacific, especially India, China, and Singapore, is accelerating the adoption of AML tech, including AI and NLP tools for multilingual monitoring.

- Approximately 48% of multinational crypto firms now run regional compliance teams to handle country-specific rules in 2025.

Notable Enforcement Actions and Prosecutions

- North Korea-linked hackers were responsible for the largest crypto theft to date, $1.5 billion from ByBit in early 2025.

- North Korean assets accounted for 61% of the $2.2 billion stolen in 2024.

- $51 billion flowed into illicit crypto wallets in 2024, evidencing rising AML enforcement urgency.

- In Q1 2025, the DOJ sought seizure of $225 million USDT tied to pig-butchering operations.

- FATF’s mid-2025 report emphasized weak oversight and the need for more expansive global enforcement.

- Around $1.7 billion in crypto was stolen from compromised wallets in H1 2025 alone.

- The trend of law enforcement targeting crypto laundering infrastructure, including mixers and sanctioned wallets, is growing globally.

Top Challenges in Financial Crime Compliance

- Integrating solutions is the biggest challenge, cited by 63% of organizations.

- Accessing insights via dashboards is a difficulty for 62% of respondents.

- Risk modeling and scoring pose challenges for 61% of compliance teams.

- Completing a regulatory audit is challenging for 55% of organizations.

- Case management is a key issue for 54% of respondents.

Growth of Crypto-Related Suspicious Activity Reports

- SARs from crypto firms jumped 34% after stricter KYC measures in 2024.

- This rise reflects better detection as well as increased regulatory pressure across regions.

- Australia’s freezing of $500 million in suspicious crypto assets signals the tangible impact of alerts.

- Watchdog oversight, public–private partnerships, and mandated reporting are key components driving SAR growth.

- Japan’s compliance success, with 70% of exchanges following the updated law, demonstrates the scale of monitoring improvements.

- OECD’s upcoming Crypto-Asset Reporting Framework will further expand reporting obligations globally.

- As CARF rolls out, global SAR counts are expected to climb significantly as exchanges share more jurisdictional data.

Key Challenges in Crypto AML Enforcement

- Only 40 of 138 jurisdictions are largely FATF compliant, leaving many enforcement blind spots.

- Stablecoins were linked to 63% of identified illicit laundering transactions globally in 2024, while Bitcoin continued to dominate ransomware and darknet market payments.

- Pig butchering scams grew 40% year-on-year, aided by GenAI and elaborate deception techniques.

- 90% of illicit transactions still evade detection, underlining gaps in current monitoring systems.

- Rapid cross-border movement via mixers and bridge protocols challenges AML traceability.

- Alignment delays with frameworks like CARF and inconsistent national policies hamper compliance efficacy.

- Resource constraints, costs of implementation, training, and technology continue to stifle enforcement progress.

Future Outlook for Cryptocurrency AML

- RegTech’s explosive growth signals continued focus on AML efficiency and automation.

- OECD’s CARF and FATF’s global recommendations are expanding the adoption of standardized reporting.

- AI and blockchain-based KYC, combined with public–private data sharing, may reduce illicit activity by enabling 4× faster investigations.

- Stablecoin oversight is poised to tighten through regulation, particularly where they dominate illicit flows.

- Crypto firms are expected to adopt proactive compliance via regional teams and real-time monitoring systems.

- Coordination across jurisdictions will be crucial to closing regulatory gaps and fostering AML resilience.

Conclusion

The fight against crypto-enabled money laundering continues to intensify in 2025. While $51 billion in illicit funds flowed into crypto, enforcement actions and AML tech show progress. Yet challenges like stablecoin misuse, global compliance gaps, and evolving scam strategies highlight that the landscape remains complex. Continued innovation, AI, real-time SARs, RegTech, and unified global standards like CARF offer a path toward stronger AML defenses. The road ahead requires vigilance, collaboration, and adaptability to stay ahead of sophisticated financial crimes.