Venture capital funding in the crypto sector is hitting a pivotal moment as the landscape shifts from hype-driven deals to more strategic, infrastructure-led investments. Firms are doubling down on protocols, regulatory clarity is improving, and institutional players are showing renewed interest. For instance, global financial institutions are increasingly allocating to crypto venture vehicles, and major blockchain infrastructure firms are raising multi-hundred-million-dollar rounds. Read on to explore the key statistics shaping this trend.

Editor’s Choice

- In the first half of 2025, crypto companies raised more than $16 billion in venture funding year-to-date.

- The global VC investment into crypto and blockchain startups for Q2 2025 was $1.97 billion across 378 deals.

- Funding for blockchain/crypto startups in 2024 reached $13.6 billion, up from $10.1 billion in 2023.

- In Q1 2025, blockchain and crypto startups raised $4.8 billion, already matching roughly 60% of all 2024 VC capital in the space.

- The share of sub-$5 million VC rounds fell to 48.6% in Q2 2025 from 55.4% in 2024, indicating larger deal sizes.

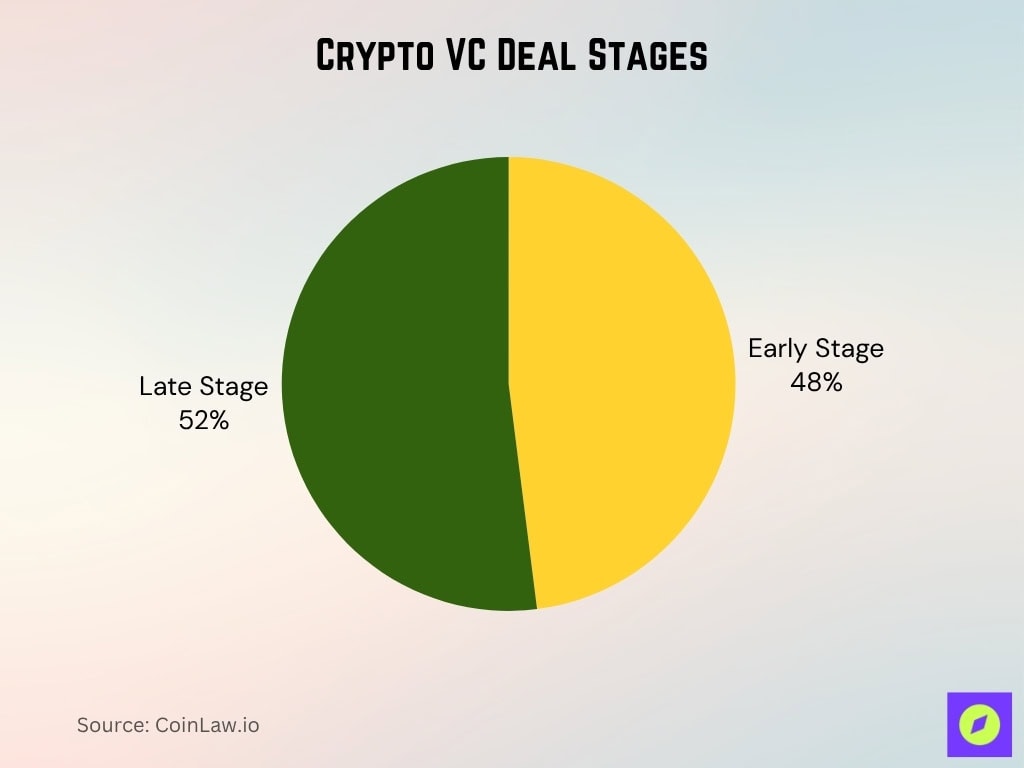

- Later-stage deals captured roughly 52% of capital invested in Q2 2025 in the crypto startup sector.

- Prediction: Crypto VC funding is forecast to hit about $18 billion in 2025.

Recent Developments

- The 2025 cycle is stronger than past ones, powered by regulatory clarity in the U.S. and abroad.

- The number of crypto-related mergers & acquisitions in H1 2025 reached 185 deals, with projections to surpass 248 deals in full-year 2024.

- Infrastructure and mining categories led Q2 2025 investments, including a ~$300 million cloud-mining deal and $200 million+ in privacy/security and infrastructure.

- A massive $2 billion deal in Q1 2025 between MGX and a major crypto exchange skewed quarterly comparisons; without it, Q2 drop would have been ~29% rather than 59%.

- The correlation between bitcoin price and VC funding in crypto startups has weakened over the past year.

- Investors are increasingly favouring later-stage deals, even as earlier-stage funding remains constrained.

- Analysts note that even with a recovery from 2023 to 2024, funding is still well below the 2021 peak (~$32 billion).

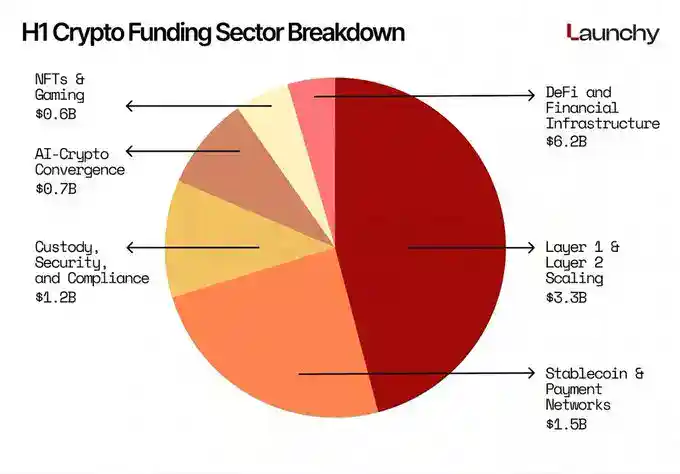

Crypto Funding Sector Breakdown

- DeFi and financial infrastructure led the market with $6.2 billion in funding, reflecting the strongest institutional demand in early 2025.

- Layer 1 and Layer 2 scaling projects secured $3.3 billion, showing continued investor confidence in base layer performance upgrades.

- Stablecoin and payment networks attracted $1.5 billion, highlighting the push for more reliable global settlement systems.

- Custody, security, and compliance solutions raised $1.2 billion, underscoring rising regulatory pressure and the need for safer on-chain operations.

- AI crypto convergence startups pulled in $0.7 billion, signaling growing interest in AI-driven blockchain automation.

- NFTs and gaming drew $0.6 billion, maintaining a niche yet steady investment despite market shifts.

Overview of Crypto Venture Capital Funding

- Venture capital funding for blockchain startups reached about $13.6 billion in 2024.

- In 2023, the comparable figure was ~$10.1 billion.

- For Q2 2025, the figure was $1.97 billion across 378 deals.

- Q1 2025 alone raised $4.8 billion for blockchain and crypto startups.

- Larger deal sizes are becoming more common; the share of rounds under $5 million dropped to 48.6% in Q2 2025.

- The share of capital going to later-stage deals reached 52% in Q2 2025.

- Forecasts expect funding to rise to ~$18 billion in 2025.

Global Trends in Crypto VC Funding

- The U.S. accounts for over 60% of global crypto VC funding as of 2025.

- Global crypto VC funding is projected to reach around $18 billion in 2025.

- Over 100 crypto M&A deals have been announced worldwide so far in 2025.

- Cross-border VC interest is growing, focusing on mature Layer-1 modular blockchain ecosystems.

- Despite a rebound in crypto asset prices, global VC activity in crypto startups declined by 25% year-over-year in Q2 2025.

- Major global funds led mega-rounds exceeding $500 million in 2025, highlighting institutionalization.

- Smaller-ticket seed rounds dropped by approximately 35% globally in Q2 2025 compared to 2024.

- Infrastructure and security segments attracted over 40% of total crypto VC investments in 2025, beyond token-native projects.

- Crypto venture funding in September 2025 surged to $5.1 billion despite fewer deals, indicating larger round sizes.

- Crypto M&A deal value exceeded $10 billion in Q3 2025, a more than 30-fold increase from the previous year.

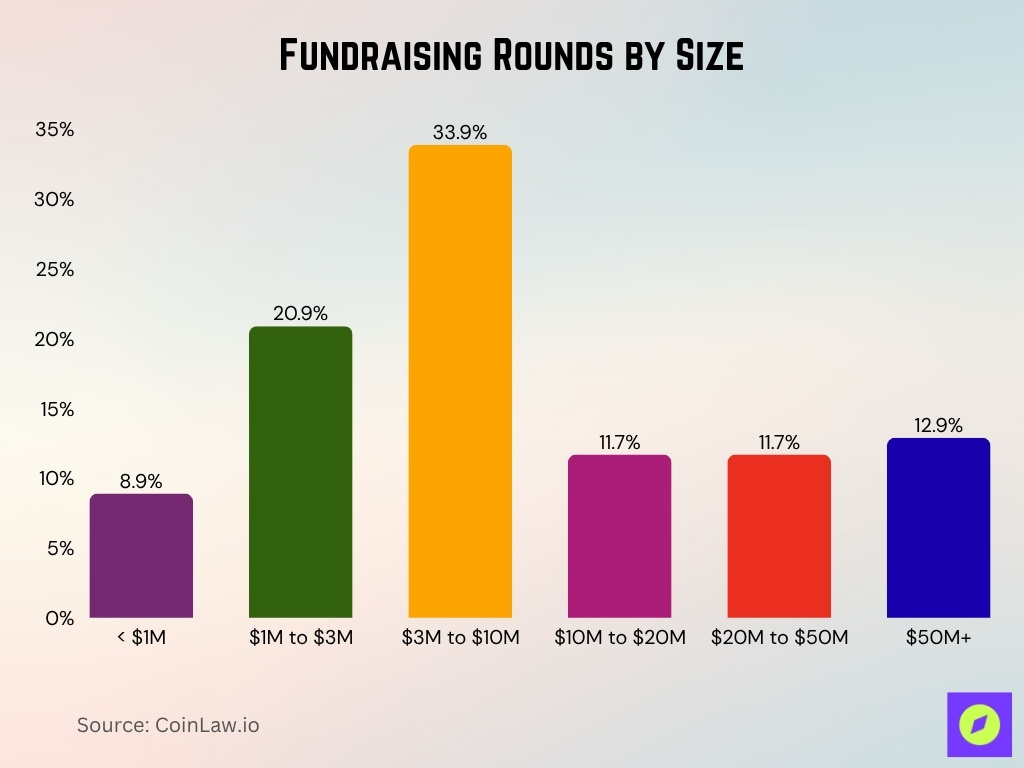

Fundraising Rounds by Size

- Total funding reached $10.02 billion, highlighting strong capital flow into crypto startups during the quarter.

- Rounds are sized at $3 million to $10 million, dominated by activity, accounting for 33.9% of all deals.

- Funding rounds between $1 million and $3 million made up 20.9%, showing steady early-stage appetite.

- Deals below $1 million represented 8.9%, reflecting a smaller share of micro rounds.

- Mid-sized rounds in the $10 million to $20 million and $20 million to $50 million brackets each captured 11.7% of total activity.

- Large-scale rounds of $50 million or more comprised 12.9%, signaling continued investor confidence in late-stage, high-growth projects.

Yearly and Quarterly Crypto VC Investment Volumes

- 2023, ~$10.1 billion in venture capital funding for blockchain startups.

- 2024, ~$13.6 billion, a ~35% increase year-over-year from 2023.

- Crypto startups raised $4.8 billion in Q1 2025 and $2 billion in Q2, bringing H1 funding to approximately $6.8 billion.

- Share of rounds under $5 million in Q2 2025 was 48.6% of all rounds, down from 55.4% in 2024.

- Later-stage deals captured approximately 52% of total capital in Q2 2025.

- Forecast for full-year 2025: ~$18 billion in crypto VC funding.

- The large MGX-Binance deal (~$2 billion) in Q1 skewed comparisons; without it, the Q2 drop would have been approximately 29% instead of 59%.

Regional Analysis of Crypto VC Funding

- Global crypto adoption continues rising while regional funding flows remain uneven.

- In Q2 2025, the U.S. regained leadership in crypto startup investment volumes after a temporary shift.

- Asia remained muted in Q3 2025, with only ~$16.8 billion in overall VC investment across 2,310 deals (though not crypto-specific).

- Europe in Q1 2025 held steady at ~$12.6 billion in broader VC funding (not crypto-only), representing ~11% of global venture deal value.

- Crypto infrastructure projects in Latin America and the Middle East are gaining traction, though precise numbers are limited.

- Emerging markets show higher crypto-asset adoption yet attract smaller VC rounds relative to the U.S./Europe.

- A list of 1,098 crypto startups globally raised ~$18.7 billion, with an average funding of ~$270.8 million per company.

Early-Stage vs. Late-Stage Crypto VC Investments

- In Q2 2025, early-stage (pre-seed/seed/Series A) deals accounted for 48% of capital invested in crypto VC, while late-stage deals comprised 52%.

- The number of deals in Q2 was 378 across crypto and blockchain startups.

- Compared to a prior quarter, the share of late-stage investment exceeding early-stage marks a distinct shift.

- The fundraising pace for early-stage appears more resilient than for mega-growth rounds.

- Traditional seed rounds are morphing; seed rounds now carry characteristics of what used to be Series A in size and scope.

- For the broader VC market, sub-$5 million rounds fell to 50.3% of all deals in 2025 from 57.0% in 2024.

- The trend suggests investors are raising the bar for early-stage companies, demanding clearer metrics and business models.

- Late-stage rounds involve larger checks and fewer companies, signalling selectivity and maturity in the crypto VC space.

Top Crypto Venture Capital Firms

- The top 10 crypto VC funds for 2025 include Polychain Capital and Coinbase Ventures.

- Around 21 new crypto venture funds deployed approximately $1.76 billion in Q2 2025 alone.

- Coinbase Ventures led Q2 2025 with 25 deals, surpassing other major investors.

- Polychain Capital led a $9.5 million funding round for Blueprint Finance in mid-2025.

- Seed-stage deals made up nearly 19.4% of the 1,673 tracked crypto funding rounds in 2025.

- Many top crypto VC firms focus on infrastructure, DeFi, tokenization, and Web3 middleware.

- Institutional investors emphasize ecosystem building over single-project bets.

- Professionalization increased, with crypto VCs rivaling traditional tech VCs in due diligence.

- Polychain Capital projects reported ROI multiples like 760x for Solana and 130x for Uniswap.

Fundraising Rounds Breakdown (Seed, Series A/B/C+)

- In Q2 2025, fundraising for crypto/blockchain start-ups reached levels “not seen since the bull market”.

- Of the capital invested in Q2 2025, 52% went into later-stage rounds (Series B/C+/growth).

- Earlier-stage rounds (seed to Series A) comprised ~48% of the capital in Q2 2025.

- Seed-to-Series C round sizes grew by ~5-22% and valuations by 3-60%.

- The average seed check size in the Web3/crypto context remains small compared to growth rounds, but the data are patchy.

- The shift toward fewer but larger rounds suggests maturation in fundraising structure.

- In Q2, there were 378 deals, with some undisclosed rounds breaking traditional stage definitions.

- The stage breakdown implies that investors are picking fewer early bets and favouring stronger traction or infrastructure plays.

Most Active VC Investors in Crypto

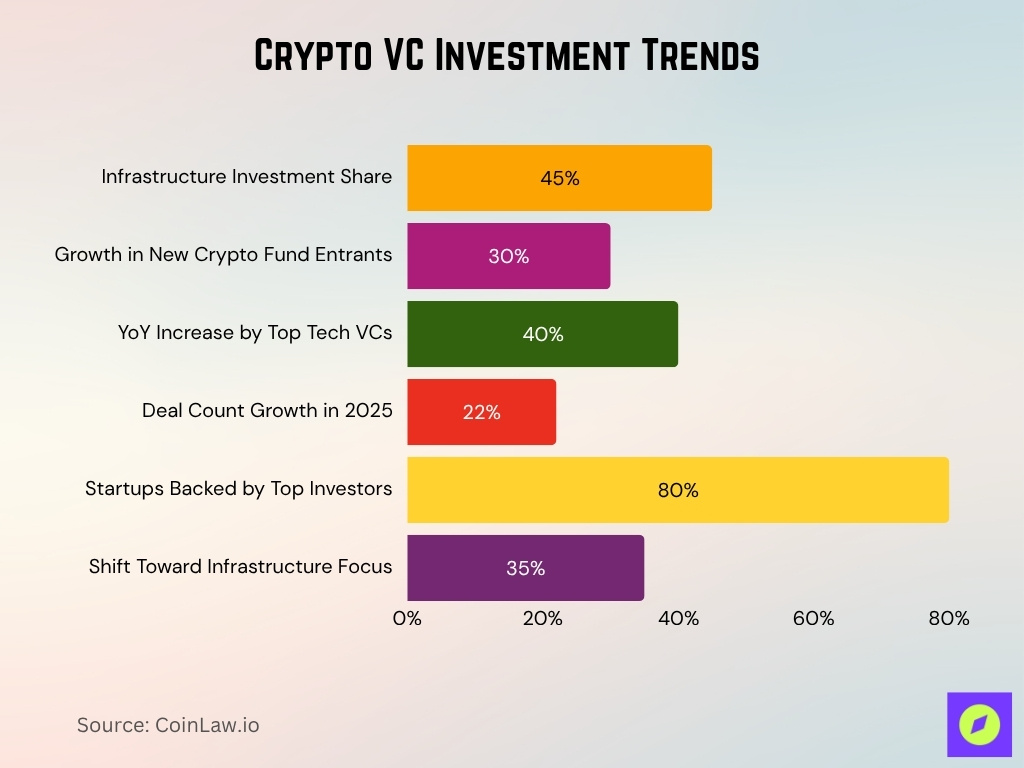

- 21 new crypto-specific VC funds raised approximately $1.76 billion in Q2 2025 alone.

- Infrastructure sectors like mining, layer-1, and wallets received over 45% of recent VC investments.

- Fresh capital entrants rose by nearly 30% in crypto fund launches during 2025.

- Leading tech-VC firms, including a16z and Sequoia Capital, increased crypto investments by 40% year-over-year.

- Crypto VC activity grew by 22% in deal counts through the first three quarters of 2025.

- Top investors serve as key gatekeepers providing access to capital and ecosystems for over 80% of funded crypto startups.

- Institutional VC focus shifted to scalable blockchain infrastructure rather than consumer crypto apps by over 35% in 2025.

Leading Blockchain Projects Funded by VCs

- 1,098 blockchain companies raised approximately $18.7 billion, averaging about $270.8 million each.

- Largest funding rounds targeted wallets, layer-1 protocols, and infrastructure providers.

- The mining sector led Q2 2025 with nearly $300 million invested in a cloud-mining company.

- Deals over $200 million focused on privacy, security, and infrastructure projects.

- Over 60% of leading VCs now prioritize product-market fit and real-world adoption before large investments.

- Blockchain funding shifted from “token mania” to infrastructure build-out in 2025.

- Funded projects with tangible business models attract over 70% of total crypto VC investments.

- Privacy and security blockchain projects accounted for more than 15% of Q2 2025 funding volume.

- Infrastructure-focused deals represent a 40% increase year-over-year in crypto VC investments.

Notable Exits and IPOs in Crypto VC

- In 2025, listings of VC-backed companies reached an estimated $86 billion at IPO price, compared with $56.5 billion in 2024.

- Circle floated in June 2025 at $31 per share and soon scaled to a market cap of ~$44.98 billion.

- Exit activity by merged & acquired crypto companies in 2025 has already surpassed multiples of 2024 levels.

- The number of U.S. VC-backed companies going public at $1 billion+ value hit 13 by mid-August 2025, up from eight in full-year 2024.

- Exits for crypto venture-backed infrastructure companies are now riding on traditional public markets rather than token unlocks.

- The revival of IPOs in crypto signals that the exit window is reopening, which may draw more VC capital into the sector.

- Exit values remain below peak-bull-run levels (2021-22), so while improving, the market remains in “catch-up” mode.

Recent Shifts in Investment Strategies

- VC investment in infrastructure, staking, wallets, and custody rose by 35% in 2025.

- In Q1 2025, one large deal comprised over 40% of total capital invested in crypto startups.

- Seed and early-stage rounds declined by 12% in frequency and size compared to 2024.

- VC capital moving toward real-world asset tokenization and DeFi infrastructure grew by 28% year-over-year.

- The interplay between crypto and AI funding rose, with cross-sector investments increasing 22% in 2025.

- Investors prioritize product-market fit and user adoption over token speculation in 2025.

- Late-stage funding rounds accounted for 55% of crypto VC deal value in Q1 2025.

- Regulatory clarity influenced 65% of investment decisions among top VCs in 2025.

- The share of sub-$5 million rounds fell from 55.4% in 2024 to 48.6% in 2025, marking a decade low.

Noteworthy Declines or Surges in Funding

- 2025 crypto VC funding is projected between $18 billion and $20 billion as confidence returns.

- In Q2 2025, the capital invested in crypto startups fell to ~$1.97 billion, marking a sharp quarterly drop.

- The share of rounds under $5 million declined, evidencing fewer smaller bets and more concentrated investments.

- Deal counts remain elevated (446 deals in Q1 2025 for $4.8 billion raised) but skewed by large outliers.

- Other categories, such as consumer crypto apps and speculative tokens, are experiencing relative declines in investor attention.

- This unevenness means some sub-sectors are thriving while others contract or stagnate.

Impact of Regulatory Changes on Crypto VC

- The GENIUS Act, signed in July 2025, mandates 100% reserve backing for stablecoins with highly liquid assets.

- MiCAR became fully operational in December 2024, enhancing institutional crypto capital flows in the EU.

- 59% of institutional investors plan to allocate over 5% of AUM to crypto or digital assets in 2025.

- Clear regulations correlate with a 30% increase in VC investment activity in crypto sectors.

- Jurisdictions lacking clarity experience up to 25% lower capital inflows and more exit hurdles.

- Regulatory risks are now factored into 80% of crypto VC term sheets and valuations.

- Regulatory changes are expected to drive long-term maturity in the crypto VC market despite short-term deal slowdowns.

- The GENIUS Act introduces robust auditability and registration, increasing market confidence by 37%.

- MiCAR requires detailed whitepapers and consumer protections, affecting over 70% of EU crypto service providers.

- Institutional investor confidence rose by 28% following regulatory clarity from GENIUS and MiCAR.

Institutional Participation in Crypto VC

- 43% of private equity firms now actively invest in blockchain or digital assets, up from 18% in 2021.

- Over 59% of asset managers plan to allocate more than 5% of AUM to digital assets in 2025.

- Institutional capital primarily targets larger rounds, infrastructure, and later-stage companies.

- Average VC check sizes increased by 30% due to institutional participation in 2025.

- About 40% of major institutional funds have established dedicated crypto-venture desks.

- Institutional presence boosted governance standards, with 70% of funded crypto startups adopting enhanced compliance measures.

- Crypto VC funding witnessed a 22% year-over-year increase, driven by institutional inflows.

- Digital asset AUM among institutions reached $235 billion by mid-2025, up from $90 billion in 2022.

Risk Factors and Market Challenges

- The FSB reported 98 jurisdictions with significant regulatory gaps in crypto as of 2025.

- Only 40 of 138 jurisdictions were largely compliant with crypto regulations by April 2025.

- Crypto asset volatility remains high, with monthly price swings exceeding 20% common in 2025.

- Liquidity risks arise, with token lock-ups and regulatory delays affecting exit possibilities in over 30% of projects.

- Macro headwinds cut risk appetite by 15% among crypto VCs due to rising interest rates and tech sector downturns.

- Execution risk affects 45% of blockchain infrastructure projects due to technological and competitive challenges.

- Operational risks include smart-contract exploits in 12% of funded startups reported in 2025.

- Custody security concerns influenced 35% of VC deal evaluations in crypto projects this year.

- VCs increasingly require clear business models and regulatory awareness in 85% of funding deals.

- Regulatory uncertainty adds an average 20% premium on due diligence costs for crypto investments.

Future Outlook and Emerging Opportunities

- Funding predictions for crypto VC in 2025 range between $18 billion and $25 billion.

- Tokenization of real-world assets (RWA) attracted over $2.5 billion in VC funding in 2025.

- DeFi infrastructure funding grew by 30% year-over-year through Q3 2025.

- Crypto-AI hybrid ventures increased funding by 22% in 2025 compared to 2024.

- Institutional demand fueled a 35% rise in deals related to custody and regulated token infrastructure.

- Capital concentration in the U.S. and Europe reached 75% of total crypto VC investments in 2025.

- Latin America, Africa, and Southeast Asia saw a 28% growth in crypto VC investment activity.

- IPO windows reopened in 2025, with crypto exit valuations increasing by 40% compared to 2024.

- Regulatory clarity could reduce risk premia by up to 25%, unlocking billions in capital.

Frequently Asked Questions (FAQs)

$21.7 million.

48.6%.

Between $18 billion and $25 billion.

52%.

Conclusion

The cycle for crypto venture capital is marked by a significant shift, from speculative token-round frenzy to infrastructure-led, institutional-backed growth. With larger rounds, improved exit paths, and clearer regulations, the landscape is evolving. At the same time, risk factors remain elevated and investor expectations are more stringent. For entrepreneurs and allocators, the focus is now on real business models, scalable infrastructure, and measurable returns. The full article above provides a detailed, data-driven view of the trends shaping the space.