Back in 2009, when Bitcoin made its quiet debut, the concept of decentralized currency was niche, if not outright radical. Fast forward, and what was once a cryptographic experiment has become a global phenomenon reshaping finance, identity, and trust. But who exactly are the people behind the wallets? This article explores the evolving demographics of crypto users, from age and gender to geography and occupation, giving you a clear picture of who’s leading the charge into the decentralized future.

Key Takeaways

- 1Global crypto users surpassed 580 million in 2025, marking a 34% increase from the previous year.

- 2First-time crypto adopters grew by 19% year-over-year, driven by mobile-first exchanges and stablecoin usage.

- 3The US remains the largest single-country market, with over 58 million active users.

- 4The largest age group in crypto is now 25–34, comprising 31% of users worldwide.

- 5Male users still dominate, but now make up 61% of all crypto owners.

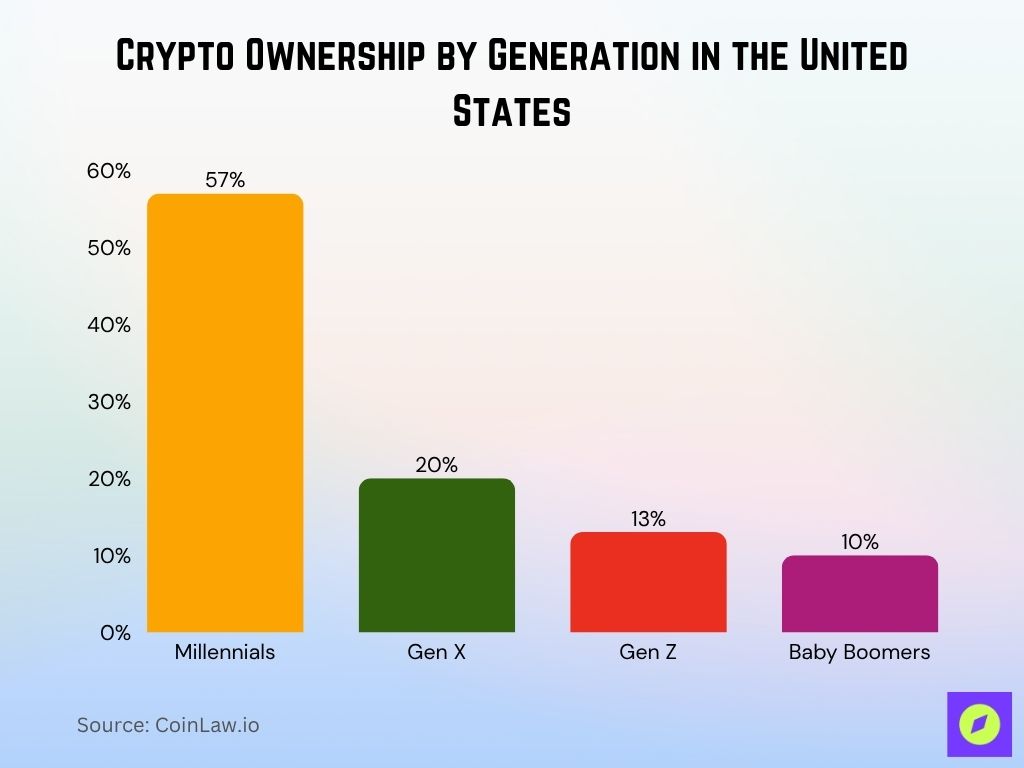

Crypto Ownership by Generation in the United States

- Millennials make up the largest share of crypto owners in the US, accounting for 57% of all users.

- Gen X represents the second-largest group, holding 20% of the crypto ownership share.

- Gen Z, despite being younger and digitally native, accounts for only 13% of crypto owners.

- Baby Boomers have the smallest presence in the crypto space, contributing just 10% to the total ownership.

Global Distribution of Crypto Users

- Asia continues to lead with 43% of all global crypto users in 2025, mainly driven by India, Vietnam, and the Philippines.

- North America follows with 17%, with the US alone holding 10% of the global share.

- Europe accounts for 15%, with notable user growth in Germany, France, and Spain.

- Africa, an emerging crypto hub, now represents 10%, with Nigeria and Kenya at the forefront.

- Latin America shows a steady climb, making up 9% of global users, driven by economic instability and remittance flows.

- The Middle East now accounts for 4% of global users, with growing adoption in the UAE and Saudi Arabia.

- Oceania remains the smallest segment, at 2%, although crypto literacy rates are high in Australia and New Zealand.

- Cross-border remittance users grew to 56 million, with Asia and Africa being key corridors.

- Over 78% of users in 2025 access crypto services via mobile apps.

- The global average wallet balance in 2025 is $3,560, an increase of 11% year-over-year.

Age-Based Demographics of Crypto Users

- The 25–34 age group makes up 31% of crypto users in 2025, remaining the dominant segment.

- The 35–44 bracket follows at 23%, often showing larger wallet balances and long-term holding strategies.

- 18–24-year-olds represent 20%, showing increased engagement through gamified finance platforms.

- The 45–54 demographic holds 14%, mostly in developed markets with stable incomes.

- Users 55 and older make up 8%, a slight uptick attributed to institutional outreach and retirement diversification.

- The average age of a global crypto user in 2025 is 34.8 years.

- In the US, the median crypto user age is now 37, while in Southeast Asia, it’s closer to 29.

- Gen Z (born 1997–2012) now accounts for 28% of global crypto participants.

- Millennials (born 1981–1996) still dominate, with 40% of total users.

- Among Gen X and Boomers, adoption is slow but steady; 15% of Gen X now hold at least one crypto asset.

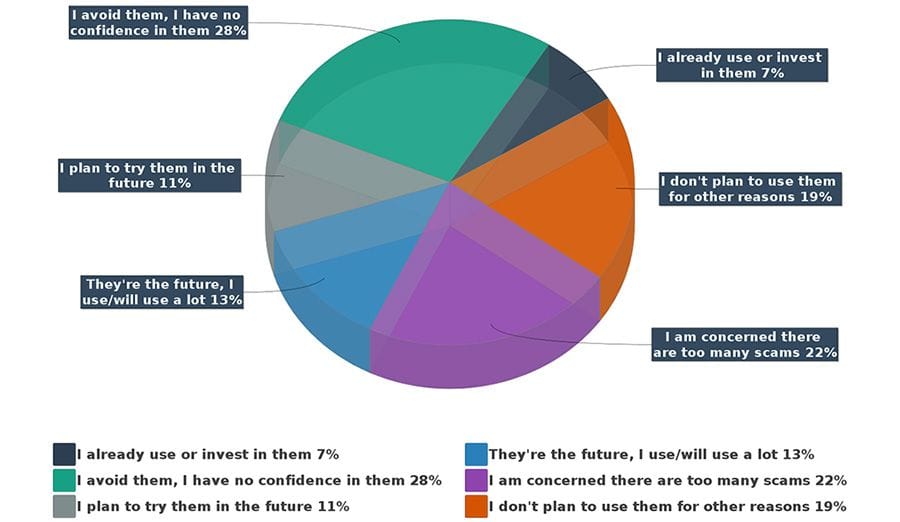

Public Sentiment Toward Cryptocurrency Usage

- 28% of respondents avoid cryptocurrencies, citing no confidence in them.

- 22% are concerned about scams, making them hesitant to engage with crypto.

- 19% stated they don’t plan to use crypto for other personal reasons.

- 13% believe crypto is the future and plan to use it heavily.

- 11% say they plan to try crypto in the future.

- Only 7% currently use or invest in cryptocurrencies.

Gender Breakdown of Cryptocurrency Ownership

- Male users account for 61% of all crypto owners in 2025, continuing a slow but consistent decline from earlier years.

- Non-binary and other gender identities represent 3% of the user base.

- In the US, women now comprise 44% of new wallet registrations.

- Women are more likely to invest in stablecoins and DeFi yield platforms rather than speculative tokens.

- 73% of male users report active trading behavior, compared to 48% of women, who prefer long-term strategies.

- Among Gen Z women, crypto ownership has risen to 35%, a sharp rise from 22% just two years prior.

- Educational outreach programs targeting women led to 18% growth in female crypto club participation at US universities.

- In Nigeria and South Africa, women represent over 45% of peer-to-peer exchange volume.

- The gender wealth gap in crypto shrank by 6% in 2025, driven by inclusive financial literacy tools.

Income Levels Among Crypto Investors

- The largest investor group in 2025 earns between $50,000–$100,000, representing 29% of all users.

- Users with over $100,000 in annual income make up 22%, but contribute nearly 40% of total crypto holdings.

- Low-income users (earning under $25,000) comprise 19%, largely driven by remittance and inflation-hedging needs.

- In the US, crypto usage among households earning under $40,000 rose by 12% year-over-year.

- 32% of crypto holders identify as “gig economy workers,” a segment with high adoption due to digital wallets and borderless payments.

- Among self-employed professionals, crypto investment rose by 14%, mostly for tax-optimized holdings.

- Wealthier users favor Ethereum staking, real-world asset tokens, and private blockchain allocations.

- Stablecoins are the preferred choice for 58% of users in lower-income brackets.

- Over 11% of households with a net worth of over $1 million now allocate at least 5% to digital assets.

- Institutional interest pushed high-net-worth individual (HNWI) participation to 3.1 million globally in 2025.

Market Share of Top Cryptocurrencies

- Bitcoin dominates the market with a massive 51.4% share of the total cryptocurrency market cap.

- Ethereum holds the second-largest position, accounting for 20.4% of the market.

- Tether, a leading stablecoin, represents 7.1% of the total market cap.

- XRP, known for fast cross-border payments, contributes 3.5% to the overall share.

- All other cryptocurrencies combined make up 17.7%, showing a fragmented remainder beyond the top coins.

Education Level of Crypto Users

- Crypto users with at least a bachelor’s degree make up 52% of the global user base in 2025.

- Postgraduates (master’s or PhDs) account for 17%, with the highest concentration in North America and Europe.

- Users with only a high school diploma represent 21%, particularly strong in emerging economies.

- 10% of global users reported no formal education beyond secondary school, though they access crypto via mobile-first platforms.

- In the US, college-educated individuals represent 62% of crypto investors.

- Among Gen Z users, 41% are currently enrolled in higher education and use crypto for micro-investments and learning.

- Crypto literacy programs increased enrollment by 26% globally, especially in Latin America and Southeast Asia.

- Online certification platforms offering blockchain courses saw a 47% surge in enrollments in 2025.

- Community college students now represent 12% of new crypto adopters in the US.

- In Africa, users with vocational training or non-traditional education make up 19% of the total crypto base.

Occupation and Industry Representation

- The largest segment of crypto users in 2025 is employed in technology, comprising 24% of all users.

- Freelancers and gig workers follow closely at 21%, using crypto for real-time payments and contracts.

- Professionals in finance and banking account for 11%, driven by interest in DeFi and tokenized assets.

- Students represent 9% of users globally, with the highest growth among university-level learners.

- Workers in the retail and hospitality sectors make up 7%, often using stablecoins for peer-to-peer transactions.

- Creative industries (e.g., art, music, design) represent 6%, especially active in NFT and DAO communities.

- Healthcare professionals make up 4% of crypto users, with rising interest in medical data tokenization.

- Government and public sector employees represent 3%, primarily in pilot programs or CBDC initiatives.

- Among entrepreneurs, 17% report accepting crypto as a form of business payment.

- Manufacturing and logistics workers account for 5%, with usage driven by remittance and cross-border settlements.

Top Countries Leading in Cryptocurrency Adoption

- India leads globally with 93.5 million crypto owners, the highest in the world.

- China ranks second with 59.1 million users, despite strict regulations.

- USA follows closely with 52.9 million crypto owners.

- Brazil has 26 million users, the highest in Latin America.

- Vietnam reports 20.9 million crypto users, showing strong Southeast Asian interest.

- Pakistan has a growing user base of 15.9 million.

- Philippines comes in with 15.8 million, indicating solid grassroots adoption.

- Nigeria leads Africa with 13.3 million crypto users.

- Indonesia has 12.2 million owners actively participating in the crypto market.

- Russia rounds out the list with 8.7 million crypto holders.

Adoption Rates by Region

- North America has an adoption rate of 17% among the adult population in 2025.

- Asia-Pacific leads globally, with an adoption rate of 23%, driven by India and Southeast Asia.

- Latin America’s adoption rate is 15%, showing consistent year-over-year growth.

- Europe reports 12%, with Germany, Spain, and Switzerland at the top.

- Africa’s crypto adoption rate hit 14%, with the highest mobile wallet integration globally.

- The Middle East reports 10% adoption, with strong regulatory pilots in the UAE and Qatar.

- In the US, state-level adoption varies, with California leading at 22%, followed by New York at 19%.

- Among urban populations worldwide, crypto adoption is 25%, compared to 11% in rural areas.

- Countries with low fiat stability have an average crypto adoption rate of 18%, nearly double that of high-stability nations.

- Regions with high internet penetration correlate with 24% higher adoption rates than those with limited access.

Racial and Ethnic Demographics of Crypto Users

- In the United States, Hispanic/Latino users represent 25% of the crypto user base in 2025.

- Black or African American users make up 23%.

- White/Caucasian users represent 39%, as diversity continues to grow.

- Asian American users now account for 11%, with high representation in staking and DeFi protocols.

- Among users identifying as multiracial or mixed ethnicity, adoption rose to 6%.

- In South Africa, Black African users represent over 80% of the national crypto user base.

- In Brazil, Afro-Brazilian users make up 31% of the crypto community.

- In India, urban users from lower-caste backgrounds now make up 14% of the total user pool.

- Across the Middle East, Arab ethnicity dominates with 89%, but the region also sees rising interest among South Asian expats.

- In Indonesia, crypto ownership among the indigenous population reached 17%, often tied to mobile lending and micro-crypto apps.

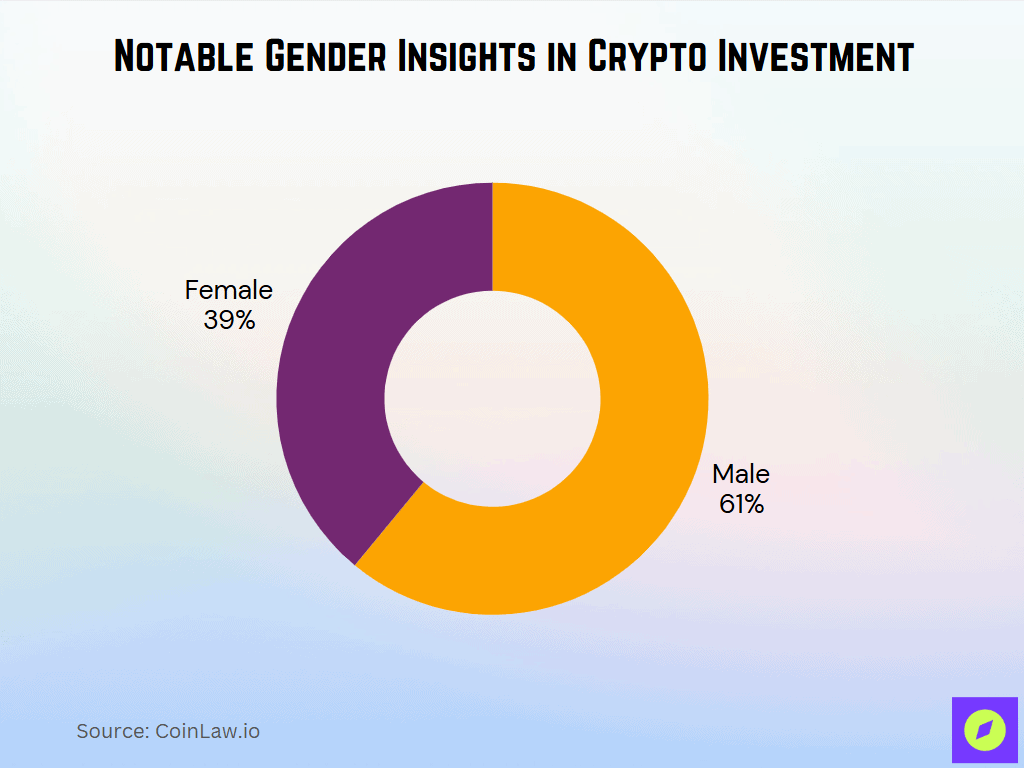

Notable Gender Insights in Crypto Investment

- 61% of cryptocurrency investors are male, indicating male dominance in crypto adoption.

- 39% of investors are female, showing a growing presence of women in the digital asset space.

While the gap remains, the gender disparity in crypto investment is gradually narrowing as awareness and accessibility improve.

Motivations for Crypto Investment by Demographic Group

- Millennials cite wealth building as their top motivation, with 46% identifying long-term gains as the primary reason for investing in 2025.

- Gen Z users are most driven by innovation and tech curiosity, with 42% stating they joined for education and experimentation.

- Among users in emerging markets, inflation protection was cited by 51% as a core reason for investing.

- Low-income users often view crypto as a remittance tool, with 37% saying it’s their primary use case.

- Retirees and Boomers cited portfolio diversification as the top reason for adoption, especially in the US and UK.

- 30% of first-time users said they were influenced by family or peer recommendations.

- Ethnic minorities in the US cite distrust in traditional financial systems as a motivator for 28% of respondents.

- Users aged 18–24 are highly influenced by social media and influencers, with 35% citing platforms like TikTok or YouTube.

- Globally, 20% of users indicated access to DeFi lending and earning tools was their main driver for crypto usage in 2025.

Preferred Cryptocurrencies by Demographic Segment

- Bitcoin remains the most widely held cryptocurrency, owned by 71% of all global users in 2025.

- Ethereum follows at 53%, particularly popular among users aged 25–44 and those involved in DeFi or staking.

- Stablecoins (like USDT and USDC) are most popular among low-income users, with 44% ownership in that group.

- Solana sees the strongest adoption among developers and creatives, with 28% holding SOL for app interaction.

- Cardano is preferred by users aged 45+, with 17% citing long-term belief in its scientific model.

- Among Gen Z, DOGE and meme tokens remain influential, held by 33% of this cohort.

- Layer 2 tokens (e.g., Polygon, Arbitrum) are increasingly held by those in tech professions, making up 21% of their portfolios.

- Users in Africa show high usage of BUSD and local stablecoins, particularly for P2P trading.

- In Asia, TON (The Open Network) and BNB have risen in adoption due to integrations with messaging apps and local exchanges.

- Among institutional users, tokenized assets and yield-bearing coins (e.g., Lido Staked ETH) are now held by 34% of portfolios.

Cryptocurrency Purchase Intentions Among Non-Owners

- In 2023, 49% of non-owners said they will never purchase cryptocurrency, while 46% would consider buying in the future, and only 5% intended to purchase within 12 months.

- By 2024, rejection dropped to 44%, while 15% said they definitely plan to buy within the year.

- In 2025, the percentage of those who will never purchase fell further to 38%, with 48% now open to buying and 14% definitely planning to do so.

Trends in First-Time Crypto Adoption

- New crypto users grew by 19% globally in 2025, reflecting a maturing market.

- The average age of a first-time user is now 30.2 years, up from 28.6 last year.

- Mobile-first platforms account for 72% of initial user sign-ups, especially in Southeast Asia and Sub-Saharan Africa.

- In the US, 17% of new users in 2025 came from underbanked or unbanked households.

- Gaming platforms and NFT ecosystems were entry points for 14% of new users, especially Gen Z.

- The most common first asset purchased is Bitcoin (41%), followed by Ethereum (29%) and USDT (18%).

- User referrals and community rewards were cited as the onboarding source for 22% of newcomers.

- Among new users, women make up 41%.

- In Latin America, government distrust was cited by 39% of first-time users as their reason for entering crypto.

- Globally, one in five first-time users said financial hardship in the past year led them to explore crypto for income or protection.

Recent Developments

- Global crypto adoption in 2025 is estimated to hit 7.2% of the world population.

- Over 1.5 million merchants now accept crypto payments directly, with Shopify and Stripe integrating stablecoin solutions.

- US stablecoin regulation moved forward with federal clarity in Q1 2025, prompting institutional adoption growth by 26%.

- In Brazil and India, central banks launched sandbox pilots integrating digital asset compliance protocols with fintech apps.

- The average transaction cost on Layer 2 networks dropped to $0.02, fueling mass retail adoption.

- Major tech platforms like Telegram and WhatsApp launched native crypto payment features for select tokens.

- Decentralized identity (DID) usage surged by 41% as users seek cross-chain verification and privacy solutions.

- Cross-border P2P payment apps processed over $89 billion in 2025 via crypto rails.

- Environmental concerns decreased as over 62% of crypto mining is now powered by renewable energy.

- Crypto ETFs have attracted $67 billion in total AUM globally, led by North America and Europe.

Conclusion

Crypto adoption is no longer a fringe movement. Today, it’s an integrated part of how people invest, send money, protect their assets, and even express their identities. Whether it’s a student in Lagos using Bitcoin to save in USD-equivalent value or a Boomer in Florida allocating ETH in their retirement fund, crypto has become a tool of financial agency. The data paints a nuanced portrait: young but maturing, male-led but diversifying, risk-prone yet increasingly secure. As the ecosystem evolves, one constant remains: the people powering it are as diverse as the networks they connect to.