HODLing, the practice of holding cryptocurrency long term despite volatility, remains central to many investors’ strategies. Its relevance is especially clear in two contexts: retail portfolio resilience, where individual investors resist selling during downturns, and institutional treasury strategy, where major firms allocate crypto as reserve assets. Below, you’ll find the key metrics and trends shaping HODLing today, before diving deeper into each topic.

Editor’s Choice

- Over 560 million people globally hold crypto assets.

- The global crypto ownership rate is about 6.8% of the adult population.

- North America’s crypto ownership reached ~16% in 2025.

- Bitcoin dominance remains high at ≈ 59.3% of the total crypto market.

- In 2025, inflows into crypto ETFs hit a record $5.95 billion in one week.

- Institutional adoption of digital assets is projected to hit 87% in 2025 (among listed institutions).

- The United Arab Emirates achieved a 25.3% crypto ownership rate, leading globally.

Recent Developments

- Record ETF inflows: Global crypto ETFs saw $5.95 billion in net inflows in a single week in early October 2025.

- Institutional adoption rising: 87% of surveyed institutional investors plan or already hold digital assets.

- Market capitalization highs: Bitcoin set new all‑time highs near $112,000 in May 2025.

- ETF expansion in the U.S.: Spot Bitcoin ETFs now total over $94 billion in assets under management.

- Dormant wallet activity: Bitcoin wallets inactive for years revived, moving $2 billion in value.

- Crypto fund assets under management approached $160 billion by mid-2025.

- During a sharp correction in October 2025, liquidations exceeded $15 billion within 24 hours, among the highest in recent history.

- Government stockpile proposals: The U.S. announced plans for a strategic crypto reserve with ~198,000 BTC.

- Adoption index updates: Chainalysis placed India and the U.S. among the top adopters in the 2025 Global Adoption Index.

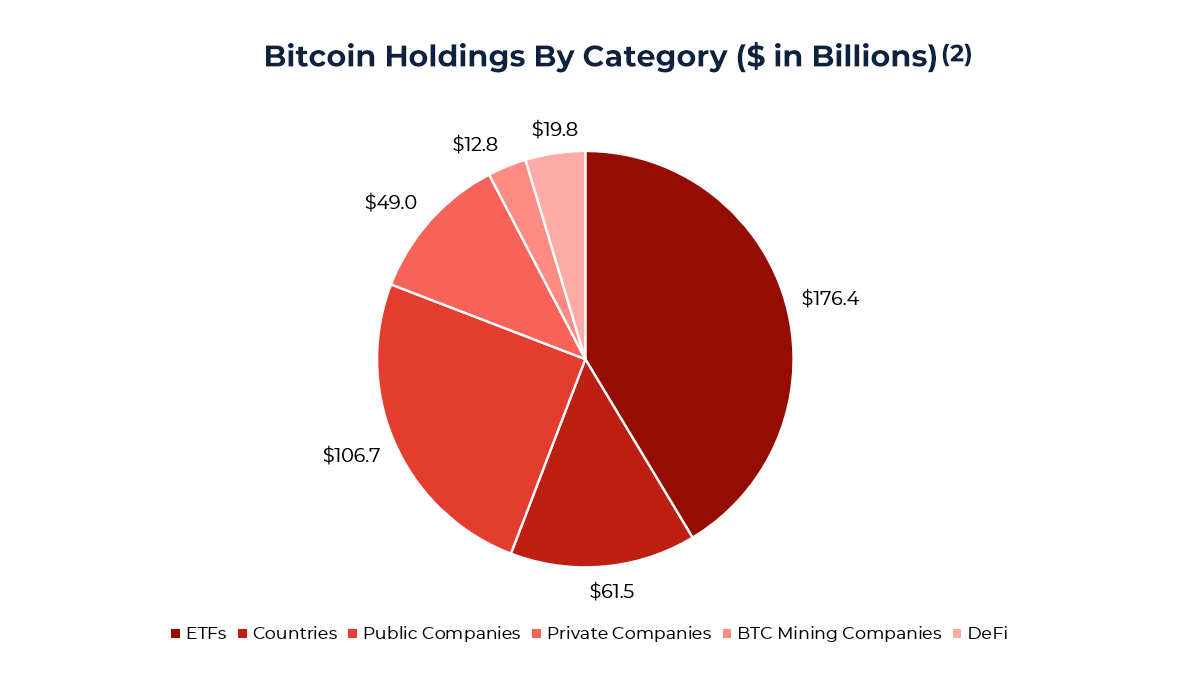

Bitcoin Holdings by Category

- ETFs hold the largest share of Bitcoin, totaling $176.4 billion, reflecting strong institutional interest through regulated investment vehicles.

- Countries collectively own around $106.7 billion in Bitcoin, led by governments using BTC for reserves and strategic diversification.

- Public companies such as MicroStrategy and Tesla account for $61.5 billion, showcasing corporate treasury adoption of crypto assets.

- Private companies hold approximately $49.0 billion, representing early-stage and venture-backed firms that maintain Bitcoin as part of their balance sheets.

- BTC mining companies retain about $19.8 billion, much of which comes from mined and unliquidated BTC reserves.

- DeFi protocols collectively store $12.8 billion, signaling the growing use of Bitcoin as collateral and liquidity within decentralized ecosystems.

What is Crypto HODLing?

- Surveys suggest a majority of retail holders tend to HODL during market volatility, with some studies indicating 55–60% resist panic selling.

- The term began as a typo for “hold” in a famous 2013 Bitcoin forum post by GameKyuubi, declaring “I AM HODLING”.

- HODLing evolved into a mindset: 54% of crypto investors hold through both market highs and lows.

- Bitcoin’s SoV Index hit $1.03 trillion in 2024, underscoring the trend of treating crypto as digital gold and a store of value.

- HODLing assumes long-term growth, with long-term holders (3–5+ years) achieving 2,500%+ returns since 2013 versus losses for most short-term traders.

- For retail users, HODLing helps avoid timing mistakes and saves on trading fees; over 72% of failed trades are by short-term traders.

- 244 public companies now hold Bitcoin, highlighting institutional use of HODLing to diversify and hold non-correlated assets.

- About 37% of HODLers also stake or earn yield on their coins while holding, blending passive income with long-term strategies.

- HODLing plays best in markets with strong fundamentals. 79% of long-term holders cite decentralization and network security as top reasons for holding.

Key Facts and Origins of HODL

- The word “HODL” began as a typo in a December 2013 Bitcoin forum post titled “I AM HODLING,” authored by GameKyuubi.

- HODL quickly became a meme and investment mantra for crypto enthusiasts, spreading widely across forums and social media.

- The phrase “Hold On for Dear Life” was later embraced as a backronym, cementing HODL’s place in crypto culture.

- Early HODLers weathered multiple bear markets; Bitcoin’s average holding period is now 4.4 years, showing resilience and patience.

- Countries with long-term capital gains tax structures see higher HODLing rates, with U.S. long-term holders benefiting from lower tax bands.

- Historical performance: long-term Bitcoin holding (“HODLing”) outperformed trading in 2025, delivering 52.8% annual returns versus inconsistent short-term results.

- The HODL approach mirrors classic “buy and hold” investing, as championed by Benjamin Graham, but adapted for crypto’s volatility.

- Most HODLers cite belief in technology and network growth, outweighing short-term price fluctuations and media sentiment.

- Staking and DeFi yield protocols enable “active HODLing”, earning while holding, which now attracts more long-term participants each year.

- In 2025, institutional crypto treasury adoption surged as 172 public firms now hold Bitcoin reserves, up 38% in Q3 alone; HODLing is now a corporate investment strategy.

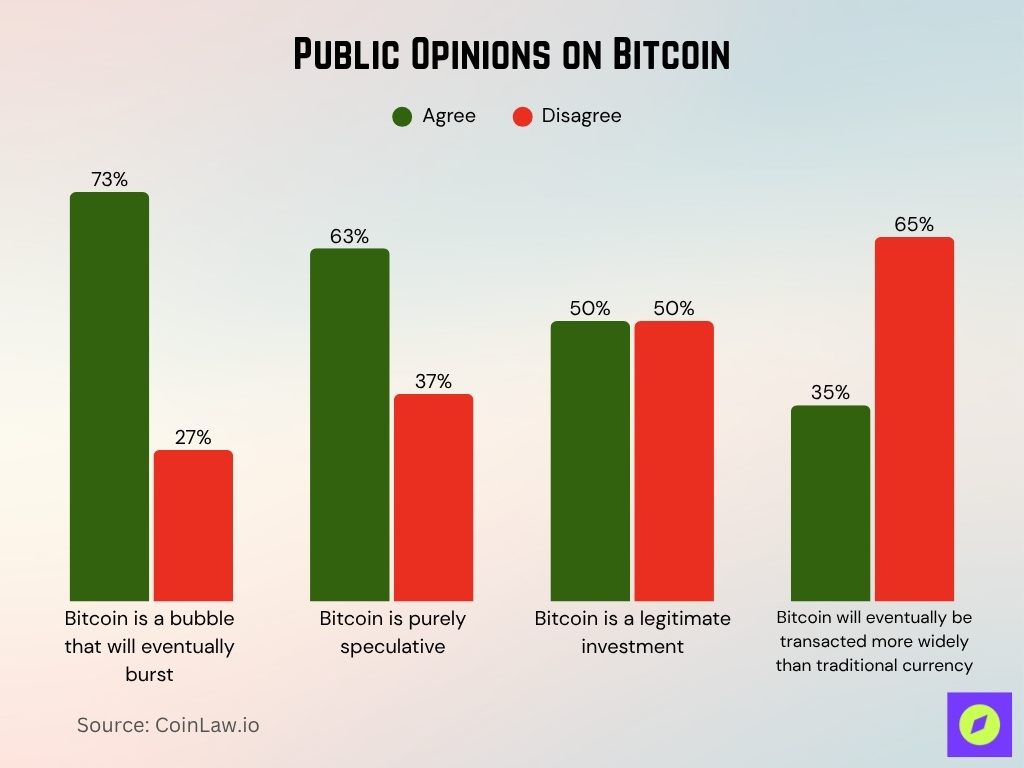

Public Opinions on Bitcoin

- 73% of respondents believe Bitcoin is a bubble that will eventually burst, showing lingering skepticism about its long-term stability.

- 63% agree that Bitcoin is purely speculative, reflecting the perception that much of its value comes from market hype rather than intrinsic fundamentals.

- Opinions are evenly divided on legitimacy, with 50% viewing Bitcoin as a legitimate investment and 50% disagreeing, indicating a split between traditional and crypto-native investors.

- Only 35% believe Bitcoin will eventually be transacted more widely than traditional currency, while 65% disagree, suggesting limited confidence in its adoption as a mainstream payment method.

Global Crypto Ownership & Adoption Rates

- Global crypto ownership hovers around 6.8% of people (>560 million individuals).

- In North America, ownership climbed to ~16% in 2025.

- Latin America posted a 15.2% national adoption average in 2025.

- Europe’s average adult ownership reached 8.9% in 2025.

- In the Middle East, about 11.3% of adults now hold crypto.

- The UAE leads globally with 25.3% of its population owning crypto.

- Asia‑Pacific accounts for ~37.6% of the global crypto market share in 2025.

- Africa recorded a 19.4% year-on-year adoption increase in 2025.

- India and the U.S. top the 2025 Chainalysis Global Adoption Index.

- In the U.S., estimates suggest ~22% of Americans own Bitcoin (or crypto).

HODLing Trends and Market Overview

- Bitcoin dominance rose to ~59.3% of the total crypto market in 2025.

- Ethereum remains the second-largest crypto by market cap, often held long-term.

- Altcoin interest increased, but HODLing behavior is more conservative than speculative.

- Retail ownership hit record highs in Q1 2025, with wallet downloads surpassing 12 million.

- Over 560 million people now hold cryptocurrency globally.

- Stablecoin holdings increased, with many users holding USDT, USDC, and DAI for long-term stability.

- Corporate treasuries now include crypto in 11% of Fortune 500 companies.

- Bitcoin ETFs fueled a sharp increase in HODL behavior among traditional investors.

- Regulatory discussions (e.g., strategic crypto reserves) fueled long-term confidence.

- Bear market exits decreased as long-term conviction appears stronger than in prior years.

Demographics of Crypto HODLers

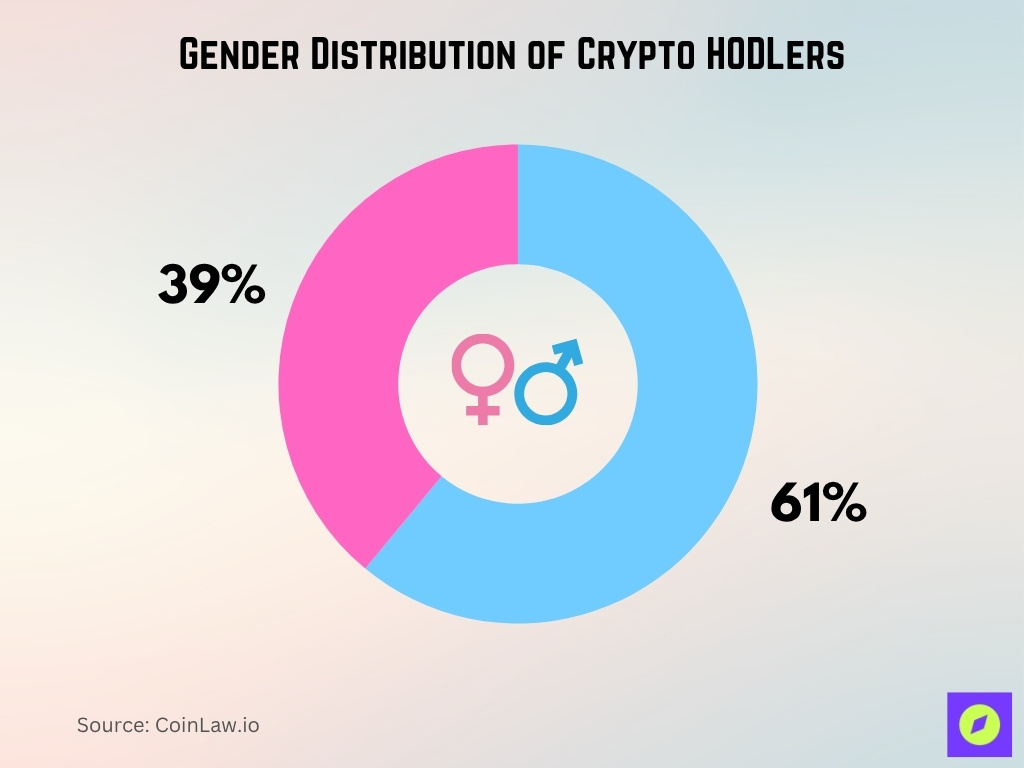

- The gender breakdown among HODLers is 61% male and 39% female, with the gap slowly narrowing.

- 74% of global crypto users are between the ages of 25–44, marking Millennials and Gen Z as dominant HODLers.

- Gen Z and Millennials now account for nearly 68% of first-time crypto HODLers worldwide.

- Baby Boomers make up just 8–15% of holders, but ETF adoption among Boomers has increased by 20% since 2023.

- 36% of HODLers earn over $100,000 annually, and longer holding durations correlate strongly with higher-income brackets.

- Crypto HODLing is the fastest-growing among tech workers (14%), finance professionals (7%), and freelance workers (9%).

- Urban and suburban crypto owners display 24% higher wallet activity than rural users on average.

- 71% of crypto HODLers have a Bachelor’s degree or higher, favoring long-term holding strategies.

- In high-inflation regions like Nigeria, 50%+ of adults hold crypto long-term as a hedge.

- Non‑custodial wallet users have 41% longer holding periods than those relying on exchange-based platforms.

Long-Term Holding Patterns

- 2025 data shows 72% of Bitcoin in circulation has not moved in over 6 months.

- Dormant wallets reactivated for the first time in over 10 years, some moving large sums.

- ETH staking surged post-Merge, increasing locked ETH supply in long-term contracts.

- Wallets holding crypto for 3+ years account for 38% of the Bitcoin supply.

- Glassnode data indicates that Bitcoin HODL waves continue to thicken, representing holder maturity.

- Altcoin long-term holders are rising, particularly for Solana, Chainlink, and Polygon.

- Retail HODLers increasingly use hardware wallets, indicating a long-view approach.

- Exchange outflows spiked, as users withdraw to cold storage to hold long-term.

- Institutions added Bitcoin to balance sheets as a 5+ year position.

- Surveys show 56% of crypto owners intend to hold for 3 or more years.

HODLing by Cryptocurrency (Bitcoin, Ethereum, Altcoins)

- Over 68% of Bitcoin’s supply is held in wallets that have been inactive for more than a year, reflecting strong long-term HODLing.

- Ethereum staking surpassed 35 million ETH in 2025, covering about 30% of the total supply and boosting multi-year holder behavior.

- Altcoins like Solana, Avalanche, and Cardano now represent 43–44% of the total crypto market cap, with notable growth in long-term holders due to ecosystem expansion.

- Chainlink, Polkadot, and Cosmos have seen HODLing durations rise by 19–28% as DeFi adoption surged in 2025.

- Wrapped Bitcoin (WBTC) supply in DeFi grew to 274,000 WBTC, and over 63% of it remains unspent for extended periods.

- Litecoin and Monero communities average 14–17 months of wallet inactivity, reflecting resilient HODL behavior despite low mainstream attention.

- Shiba Inu and Dogecoin retain resilient user bases, with about 8% of holders keeping tokens for more than a year.

- XRP’s long-term holders remain steady, accounting for 9–11% of wallets despite persistent legal issues in 2025.

- BNB HODLing durations grew 34% among validators and ecosystem users, following protocol upgrades and expansion.

- Liquid staking protocols like Rocket Pool increased the average ETH lock-up period to 2.4 years, up from 1.2 years before upgrade incentives.

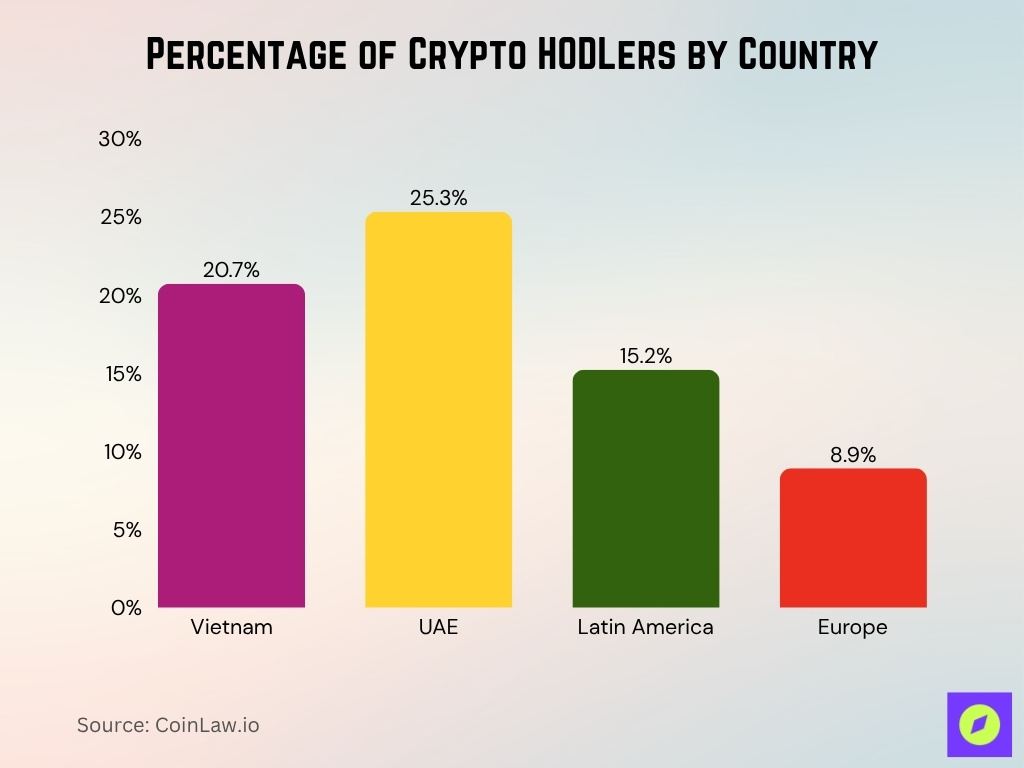

Percentage of HODLers by Country

- In Vietnam, ~20.7% of the population owns or uses crypto, a high rate that likely corresponds to active HODLing behavior in the region.

- The UAE leads on a per‑country basis with 25.3% ownership, a population engaged enough to support HODLing.

- Latin America shows ~15.2% crypto adoption on average, which implies sizable numbers of HODLers across multiple countries.

- Europe’s adult crypto ownership is about 8.9%. In mature markets, many of those holders likely practice HODLing.

- India ranks #1 in the 2025 Chainalysis Global Crypto Adoption Index, reflecting strong grassroots holding behavior.

- The United States also ranks in the top group of adopters in 2025, indicating a significant share of long-term holders.

- In Africa, the adoption growth of 19.4% year-on-year signals rising long-term holding behavior among new entrants.

- Among crypto owners globally, 61% are men, 39% are women, a demographic split that is carried into HODLing populations.

- About 74% of crypto owners are aged 25–44, a prime age group for HODLing.

Total Value Held in Crypto by HODLers

- Total value held by long-term Bitcoin holders surpassed $1.4 trillion in 2025.

- Ethereum’s staked value crossed $97 billion, with most stakers retaining ETH for long periods.

- Stablecoins such as USDC and DAI hold $130 billion+ in total market cap, many used as long-term reserves.

- Solana HODLers hold over $36 billion in value across wallets inactive for 6+ months.

- Institutional HODL wallets show a median value of $8.6 million per address.

- Binance’s SAFU fund, considered a form of institutional HODL, stores > $1 billion in crypto.

- Cold storage holdings increased to over 65% of exchange-owned assets.

- Custodians report growing demand for 5+ year vault terms among corporate clients.

- Personal wallets with balances over 1 BTC grew by 12% in 2025, indicating more HODLers accumulating.

Institutional vs. Retail HODLers

- Institutions now control 24% of total Bitcoin held, up from 17% in 2023.

- Retail holders still account for 60%+ of wallets, but hold smaller average balances.

- Corporate treasuries grew in 2025, led by public companies like MicroStrategy and Tesla.

- Pension funds and university endowments began allocating up to 2% of portfolios to crypto.

- High-net-worth individuals increasingly use family offices to HODL long term.

- Retail adoption often reflects dollar-cost averaging strategies in BTC and ETH.

- ETF inflows show increasing passive HODL behavior via traditional investment vehicles.

- Custodians offer different tiers for institutional vs. retail HODLing strategies.

- Family offices report that over 80% of their crypto exposure is held for over 18 months.

- Wealth management firms integrate crypto into long-term estate planning services.

Duration of HODL by Investor Type

- Public companies worldwide now hold ~859,000 BTC, a 120% increase year over year, reflecting multi‑year holding strategies.

- Institutional investors (e.g., via Bitcoin ETFs) held 22.9% of U.S. Bitcoin ETF AUM in Q1 2025; many of those are likely not short-term trades.

- Hedge funds cut short-term holdings by nearly one-third in Q1 2025, suggesting a shift toward longer-term positions.

- Advisor accounts increased BTC holdings in BTC terms during the same quarter, indicating they accumulate and hold longer.

- Among retail owners, 14% of non-owners plan to enter crypto in 2025, while 48% are open to entering, implying many new holders may adopt HODLing early.

- In past reports, more than 55% of U.S. crypto holders held assets valued under $100,000, often in long-term positions rather than trading.

- Long-dormant Bitcoin wallets (inactive for over 14 years) moved ~$2 billion in value during 2025, showing some extreme-duration holders remain active.

- Only ~0.18% of crypto owners hold one full Bitcoin or more, indicating even long-term holders are often fractional-position holders.

- Institutional adoption surveys show 35% of institutions allocate 1–5% of their portfolios to digital assets, suggesting moderate but sustained exposure over time.

HODLing vs. Active Trading Outcomes

- Historically, long-term holders (3–5 + years) tend to outperform short-term traders across major crypto cycles.

- During extreme volatility (e.g., October 2025), leveraged positions saw over $15 billion in liquidations in 24 hours. Short-term traders suffered significantly more.

- Bitcoin’s price reached near $109,000 in early 2025, but pullbacks penalized frequent traders.

- Crypto ETFs globally saw $5.95 billion in net inflows in one week, investors choosing exposure rather than timing trades.

- During Q1 2025, institutional holders reduced tactical exposure but held core positions, a hybrid of HODLing over trading.

- Volatility spikes tend to punish active traders more, while HODLers can ride out short-term fluctuations.

- In bear market periods, HODLers who remain invested often regain losses, whereas active traders may miss rebounds.

Factors Influencing HODLing Behavior

- About 73% of crypto holders plan to hold or add to their investments throughout 2025, preferring a long-term view.

- Institutional interest is high: 86% of surveyed firms have exposure or plan allocations to digital assets for portfolio diversification.

- Lower long-term capital gains tax rates, typically 0%, 15%, or 20%, make HODLing more attractive compared to frequent trading in the U.S..

- 43% of people first acquired crypto due to recommendations from friends or family, and 38% because of interest in blockchain technology.

- Staking access is a motivator, with 63% of holders citing passive yield as a reason to maintain positions for over a year.

- FOMO drives behavior: 31% of holders say positive price movement is the top reason for staying long-term in crypto markets.

- Frequent trading fees and slippage influence smaller investors, resulting in a 25% higher median holding duration among low-balance accounts.

- Emotional stability matters, as only 20% of holders admit that media hype or influencer endorsements affect their decisions to hold.

- Regulatory uncertainty leads 52% of institutions to prefer “set and forget” HODLing until clear rules emerge.

- Liquidity constraints prompt 41% of large holders to avoid frequent selling and instead commit to multi-year positions.

Staking and Earning While HODLing

- Over 50% of the ETH supply is now staked in proof-of-stake, with participation driven by accessible staking pools.

- “Liquid staking” platforms command 31.1% of the Ethereum staking market, offering yield and tradable derivatives for flexibility.

- Staking yields range from 3%–15% APY, depending on the chain. Liquid staking often pays up to 12.5% average APY in 2025.

- Around 38% of retail stakers use pools and DPoS models, drawn by user-friendly features and lower fees.

- Compound reward rates mean staking returns are 25–37% higher for assets held more than 12 months versus intermittent staking.

- Major upgrades like Ethereum’s Pectra and Solana’s MEV incentives raised annualized staking rewards by 15–22% for long-term HODLers.

- Typical stakers split their holdings: over 57% of users keep some tokens staked and the rest liquid for flexibility.

- DeFi yield protocols like Aave, Uniswap, and Curve have a combined TVL of over $22 billion from HODLers seeking yield.

- Direct in-wallet staking options now generate 41% higher participation among passive HODLers versus standalone platforms.

- The global staking market is projected to expand by 35% in 2025, largely driven by user demand for compounding rewards.

Tools and Platforms for Long-Term HODLers

- Over 60% of long-term holders in 2025 use custodial wallets with passive-staking to earn yield on idle assets.

- Hardware wallet adoption reached 7 million+ units sold globally, with Ledger and Trezor accounting for over 80% of the market share.

- About 34% of high-net-worth crypto investors use self-custody multisig setups to manage assets above $500,000.

- Yield aggregator platforms now monitor over $6.2 billion in staked assets for long-term holders worldwide.

- DeFi protocols Aave, Compound, and Curve collectively support $22 billion in locked value from long-term participants.

- Liquid staking services (Lido, Rocket Pool) represent more than 35% of all Ethereum staked as of 2025.

- Approximately 17% of HODLers use tokenization platforms to borrow or collateralize holdings without selling.

- Advanced dashboard tools have increased retention for long-term validators by 24% in the past year.

- Institutional-grade custody solutions (BitGo, Fireblocks) safeguard over $120 billion in long-term crypto reserves.

- More than 41% of passive crypto holders say staking dashboards directly influence holding duration decisions.

Regulatory Impact on HODLing

- The U.K. will allow crypto ETNs in ISAs from 2025, potentially increasing the share of crypto ISAs to over £1 billion in assets within a year.

- U.S. institutional inflows are projected to unlock up to $2 trillion in long-term crypto holdings if full regulatory clarity is achieved.

- The U.S. Strategic Bitcoin Reserve proposal would place about 198,000 BTC (worth over $10 billion) under direct federal control for long-term storage.

- U.S. capital gains holding periods impact behavior: more than 42% of investors would hold assets over 12 months if favorable long-term rates are protected.

- Regulatory crackdowns in 2021 led to a 19% decline in active trading but a 12% rise in median holding duration among U.S. retail users.

- In countries defining crypto as “property,” average HODLing periods are 30% longer than in regions with “securities” frameworks.

- New staking tax rules in the EU led to 25% of stakers shifting to longer validator lock-ups exceeding 12 months.

- Stringent KYC and wallet reporting rules can cause a 17% reduction in the number of large on-chain holdings above $1 million.

- FATF travel rule enforcement led to 8% of holders consolidating assets in local custodial platforms for long-term safekeeping.

- Decentralization compliance audits drove an 18% increase in validator node self-hosting among long-term ETH holders since 2023.

Frequently Asked Questions (FAQs)

About 12.4 % of the global population holds cryptocurrency as of 2025.

Roughly 860 to 861 million people are estimated to use or own crypto in 2025.

Approximately 73 % of institutional investors report holding one or more altcoins beyond Bitcoin and Ethereum.

Publicly listed firms collectively hold around 1.02 million BTC, which is about 4.8% of the total Bitcoin supply.

Conclusion

HODLing will remain a resilient and evolving strategy across retail and institutional landscapes. The shift toward passive accumulation, staking-enabled returns, and supportive regulation underscores HODLing’s central role in the crypto ecosystem. As markets mature, the contrast between long-term holders and short‑term traders grows starker. Whether you’re a retail investor or institutional allocator, these statistics and trends offer a snapshot of HODLing’s strength. Explore the full article for deeper insights into HODLing patterns, outcome comparisons, and regional breakdowns.