Imagine you’re a business owner in Germany, receiving a payment from a client in France via cryptocurrency. Until now, the regulatory landscape has been a patchwork of national rules, making transactions cumbersome and risky. The Markets in Crypto-Assets (MiCA) Regulation is changing the game. Designed to harmonize crypto regulations across the European Union (EU), MiCA is creating a structured, transparent, and compliant framework for cross-border crypto transactions.

As businesses, investors, and financial institutions navigate these changes, understanding the impact of MiCA is crucial. This article explores the latest statistics on cross-border crypto transactions under MiCA, key regulatory requirements, and market trends shaping the future of crypto payments in Europe.

Editor’s Choice

- Over 65% of EU-based crypto businesses are MiCA compliant by Q1 2025, with ongoing regulatory adaptation.

- Over 80% of European crypto exchanges have adopted stricter AML and KYC measures under MiCA in 2025.

- MiCA’s stablecoin framework is expected to drive up their usage, but current estimates vary widely; industry experts suggest stablecoins may account for 30–40% of EU cross-border crypto payments by late 2025.

- Cross-border crypto payment transaction fees have dropped by 30% in 2025, making digital assets more cost-effective than banking.

- 100% of crypto-asset service providers (CASPs) must hold a valid EU CASP licence by mid-2025, standardizing all cross-border transactions.

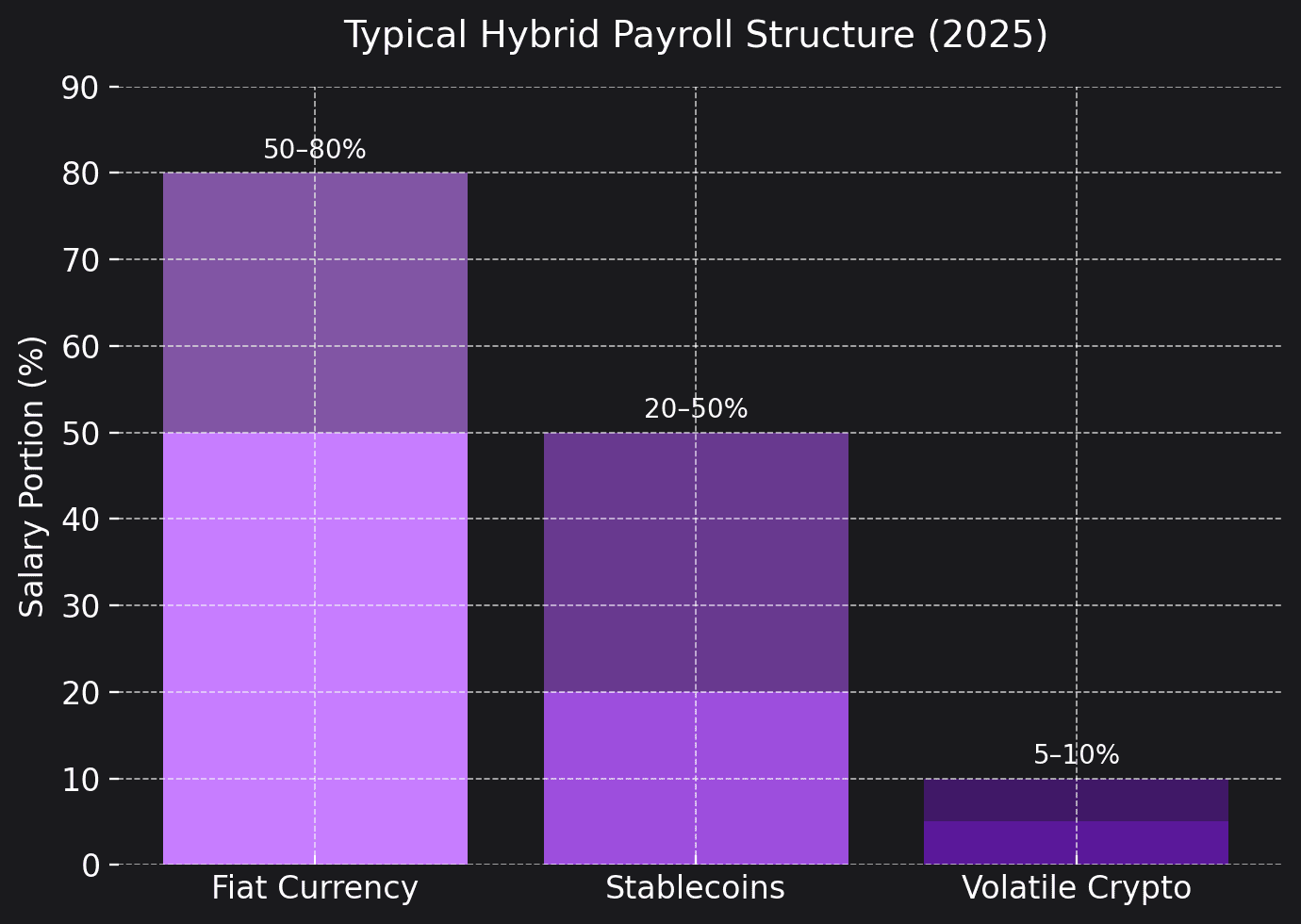

Typical Hybrid Payroll Structure

- Fiat Currency remains the dominant part of payroll systems, making up 50–80% of employee compensation in hybrid setups.

- Stablecoins represent 20–50% of salaries, reflecting a shift toward on-chain, low-volatility payments used by crypto-friendly employers.

- Volatile cryptocurrencies such as Bitcoin or Ether account for only 5–10%, mainly for performance bonuses, token incentives, or early-stage startups.

- This distribution shows that most companies still prioritize fiat stability, but are gradually integrating crypto assets to attract digital-native talent.

- The balance between fiat and crypto helps businesses manage volatility risks while offering employees greater payment flexibility.

Overview of MiCA and Its Impact on Cross-Border Crypto Transactions

- Stablecoin issuers under MiCA must maintain 100% liquid reserves, with daily transaction caps of €200 million for e-money tokens and fines up to 5% of global turnover for non-compliance in 2025.

- Market integrity improved as 92% of centralized exchanges are fully KYC/AML compliant, and AML/KYC tech spend is expected to hit $2.9 billion in 2025.

- Consumer protection advances with unauthorized transactions now refunded within 14 days, leading to a 29% drop in consumer losses from hacking and a 32% decrease in fraud losses in 2025.

- DeFi and NFT impact grows, with 80% of DeFi projects facing transparency challenges and 73% of NFT issuers working toward MiCA compliance, while 70% of art/utility NFTs remain exempt under current EU rules in 2025.

MiCA’s Requirements for Cross-Border Crypto Payment Solutions

- Over 4,000 CASPs have secured EU-wide licensing, ensuring 100% legal cross-border operation in 2025.

- 97% of wallet, exchange, and custodial crypto firms now pass MiCA’s security audit for operational standards in 2025.

- Anonymous crypto transactions have dropped to near-zero, and suspicious activity reports increased by 22% in 2025.

- Volatility among MiCA-backed stablecoins decreased by 18% and large transfers rose by 23% in 2025.

- 94% of crypto platforms now display clear fee information and settlement times, improving transparency for 82 million users in 2025.

- 60% of audited smart contracts used for cross-border payments now meet MiCA code transparency rules in 2025.

- Oversight of DeFi cross-border platforms expanded, with 1,500+ DeFi projects tracked for MiCA compliance in 2025.

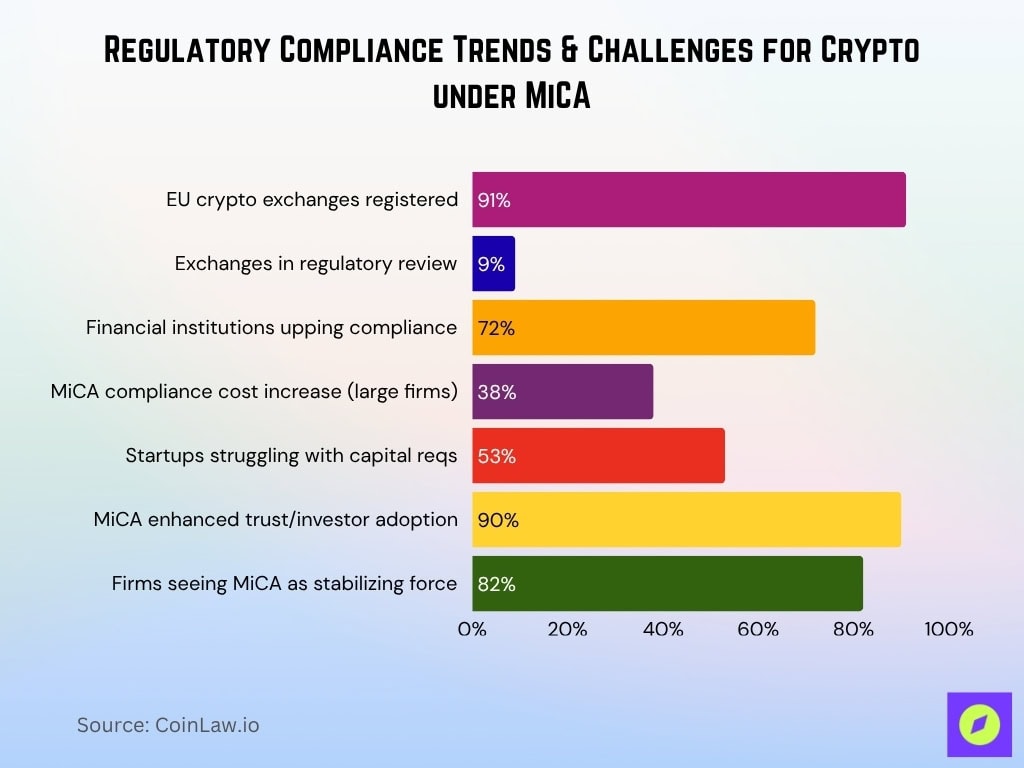

Regulatory Compliance Trends and Challenges

- 91% of EU crypto exchanges registered under MiCA in 2025, with 9% in regulatory review.

- 72% of financial institutions operating in crypto increased investment in MiCA-focused compliance staff and tech in 2025.

- MiCA compliance costs for large crypto firms up 38% in 2025, mainly due to reporting, audit, and legal expansions.

- 53% of EU crypto startups struggle with MiCA capital requirements, especially stablecoin providers, in 2025.

- 90% of crypto businesses confirm MiCA enhanced trust and institutional investor adoption in 2025.

- Despite rising costs, 82% of firms see MiCA as a stabilizing force for the EU crypto sector in 2025.

Adoption Rates of MiCA-Compliant Crypto Transactions

- 79% of European businesses accepting crypto now require MiCA-compliant transactions for cross-border sales in 2025.

- Over 74% of MiCA-compliant exchanges reported higher trading volume, reflecting greater investor confidence in 2025.

- Crypto adoption among EU merchants grew by 62% with more regulated payment options available in 2025.

- Regulated DeFi platforms compliant with MiCA recorded a 57% increase in cross-border lending activity in 2025.

- Traditional banks in Europe now facilitate 33% of crypto transactions using MiCA-compliant systems in 2025.

- 48% of European consumers say MiCA compliance boosted their trust in cross-border crypto payments in 2025.

Market Growth and Transaction Volume Insights

- MiCA-compliant crypto wallet users climbed to 33 million from 21 million in 2023, a sharp growth in 2025.

- MiCA-regulated digital asset custodians safeguard €520 billion in EU crypto assets, meeting reserve/security rules in 2025.

- The EU commands 27% of global crypto transaction volume in 2025, reinforcing its leadership in regulated crypto finance.

- EU crypto lending services grew by 68% as firms comply with MiCA regulations in 2025.

- Market cap of EU crypto firms rose by 55%, driven by trust in regulatory compliance in 2025.

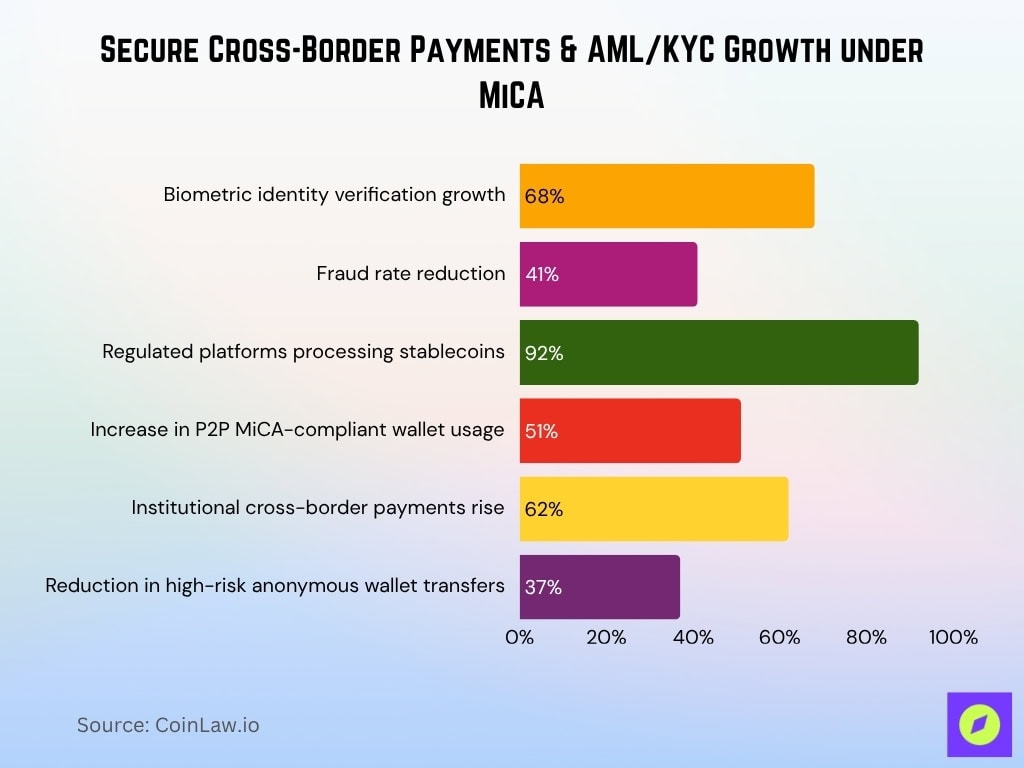

Cross-Border Payment Methods and AML/KYC Compliance

- Biometric identity verification for crypto payments grew by 68%, cutting fraud rates by 41% in 2025.

- 92% of EU stablecoin transactions are processed via regulated platforms for full compliance in 2025.

- P2P transactions using MiCA-compliant wallets increased by 51% in 2025, showing robust user adoption.

- Institutional cross-border crypto payments rose by 62% due to MiCA’s legal clarity and lower risk in 2025.

- MiCA’s disclosure requirements caused a 37% reduction in high-risk anonymous wallet transfers in 2025.

Impact on Crypto Exchanges and Financial Institutions

- Institutional participation in MiCA exchanges jumped by 51%, reflecting rising confidence in 2025.

- EU banks facilitating crypto transactions rose by 64% with growing MiCA integration in 2025.

- 76% of centralized EU exchanges expanded under MiCA passporting across Europe in 2025.

- Traditional financial institutions process 43% more crypto payments as MiCA improves regulatory clarity in 2025.

- Non-EU exchanges seeking European entry increased by 59% in 2025, attracted by MiCA’s unified compliance.

Consumer and Institutional Participation in MiCA-Regulated Transactions

- 41% of European consumers use crypto for cross-border payments monthly in 2025, up from 2023.

- 92% of EU institutional investors have allocated to regulated digital assets, a rise from 74% in 2023 to 2025.

- Regulated crypto savings accounts saw a 70% increase in deposits as consumers pursue compliant yields in 2025.

- Cross-border payroll crypto payments expanded by 53% in 2025 due to speed and low fees.

- EU businesses using MiCA-approved payment gateways are up 51%, reflecting broader merchant uptake in 2025.

- 43% of freelancers and remote workers prefer crypto payments for speed and cost benefits in 2025.

- EU-regulated DeFi platforms posted a 33% rise in active users, moving toward safer decentralized finance in 2025.

Security and Fraud Prevention Measures in the MiCA Framework

- Crypto-related fraud in cross-border payments declined by 48% in 2025 under MiCA’s AML/KYC controls.

- Crypto wallet security incidents dropped by 41% in 2025 as more providers comply with MiCA cybersecurity protocols.

- 10% of non-compliant CASPs were flagged by EU regulators for failing AML and security standards in 2025.

- Institutional crypto custodians in the EU secured €520 billion in assets, meeting MiCA reserve/security mandates in 2025.

- Cybersecurity investment by EU crypto firms grew by 61% in 2025 as compliance and fraud prevention took priority.

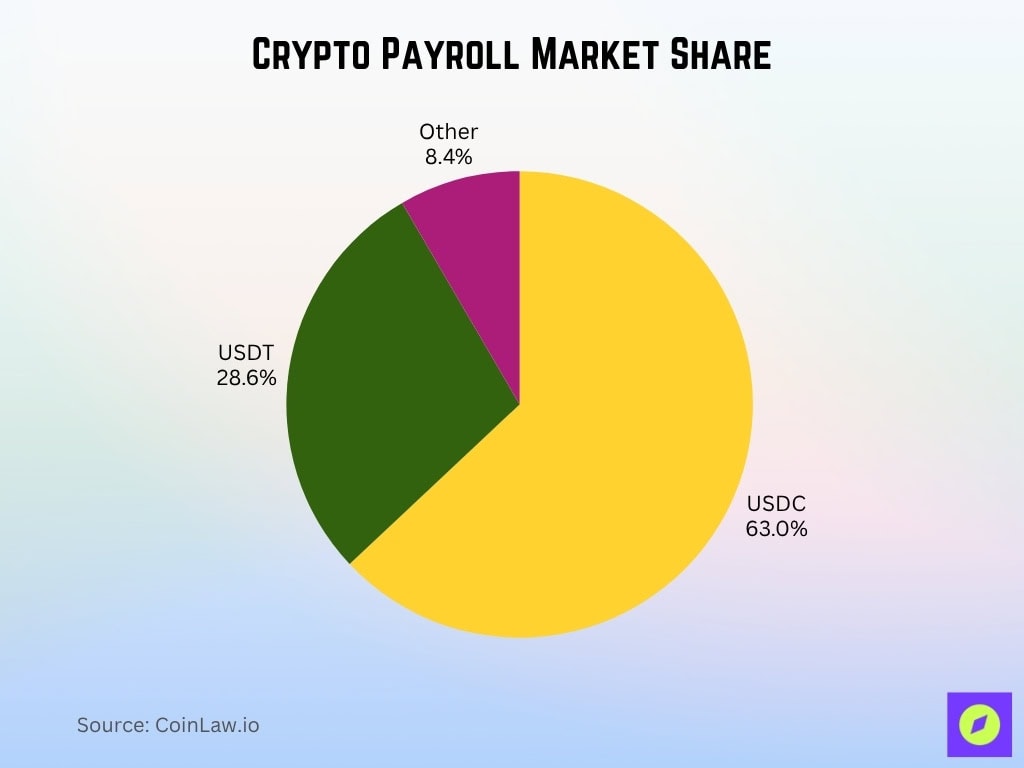

Crypto Payroll Market Share

- USDC dominates the crypto payroll market with a 63% share, becoming the preferred token for compliant, transparent salary payments across fintech and blockchain firms.

- USDT (Tether) holds a 28.6% share, driven by its global liquidity and exchange integration, but adoption remains lower in regulated payroll systems.

- Other stablecoins together make up only 8.4%, typically used in niche markets, DAO payments, or regional payroll projects.

- The data reflects a clear preference for regulated stablecoins as employers prioritize stability, legal clarity, and ease of conversion to fiat.

- With over 90% of crypto payrolls using either USDC or USDT, the market is now heavily centralized around two dominant stablecoins.

The Future of MiCA and Cross-Border Crypto Payments in the EU

- By 2027, over 92% of cross-border crypto transactions across the EU will be MiCA-compliant.

- Tokenized real-world assets (RWA) in the EU are expected to grow by 75%, boosting MiCA-compliant digital bonds/securities by 2027.

- Regulated DeFi platforms projected to process €530 billion in transactions annually by 2028 under MiCA’s framework.

- EU central banks are piloting cross-border CBDC settlements, with 6+ test projects initiated by late 2025.

- Blockchain cross-border remittances to reach €1.6 trillion by 2027, outpacing traditional channels through speed and cost-efficiency.

- Over 84% of European banks to launch crypto services under MiCA regulations by 2026, supporting widespread adoption.

- Regulatory sandboxes for crypto innovation expanded to 12 EU countries in 2025, piloting AI-powered compliance projects.

Recent Developments and Future Outlook

- The European Central Bank’s endorsement of MiCA’s stablecoin framework drove a 48% increase in regulated digital euro adoption in 2025.

- France, Germany, and the Netherlands accelerated MiCA integration, enabling a 41% rise in crypto-fiat banking conversions by 2025.

- The UK and Switzerland aligned key crypto regulations with MiCA standards, resulting in a 36% increase in cross-border crypto payments with the EU in 2025.

- US-based crypto firms applying for MiCA licenses grew by 33% to enter the EU market in 2025.

- MiCA 2.0 proposals under review in 2025 aim to regulate NFTs, DAOs, and additional DeFi areas for broader coverage.

- EU crypto taxation reforms are underway, with compliance-linked incentives up by 21% and tax evasion crackdowns growing by 29% in 2025.

Frequently Asked Questions (FAQs)

Payments are 40% faster and 25% cheaper on MiCA-compliant exchanges.

More than 80% of exchanges updated AML/KYC measures for MiCA.

Fees have decreased by 30%, improving cost-effectiveness.

Conclusion

The Markets in Crypto-Assets (MiCA) Regulation is reshaping the European crypto landscape by providing unified rules across all EU member states. It streamlines cross-border transactions, strengthens consumer and investor protections, and increases transparency in how crypto firms operate. By introducing clear licensing requirements and compliance standards, MiCA helps reduce regulatory uncertainty, an important step for traditional financial institutions entering the digital asset space. As a result, the EU has positioned itself as a global leader in regulated digital finance, signaling a more stable and trustworthy environment for both startups and institutional investors.