The credit‑repair industry has become a pivotal support system for U.S. consumers seeking to restore creditworthiness and access more favourable borrowing terms. For example, real estate brokers and mortgage lenders refer clients to credit‑repair services when a low credit score is the major barrier to home loan approval. In another scenario, small businesses leverage credit‑repair firms to improve personal credit before launching business credit applications or securing vendor lines. In the following sections, you’ll find a detailed statistical overview of the industry, from business counts to client demographics, and you’re invited to explore the full article for deeper insights.

Editor’s Choice

- In the U.S., there were approximately 43,810 credit‑repair businesses operating as of recent estimates.

- About 70% of US consumers maintain a credit score of 670 or above heading into 2025, reflecting recent FICO and Experian data.

- The typical client age for credit‑repair services falls in the 25‑44 years range.

- Total U.S. consumer debt reached $17.86 trillion in June 2025, up 2.0% year‑over‑year.

- A sizeable part of demand for credit‑repair services is driven by rising consumer credit card interest rates, which climbed above 22% in some data sets.

Recent Developments

- Regulatory complaints about credit repair companies reached approximately 2,600 in 2022, with 82% determined to be actionable.

- Over 700,000 complaints were made to CFPB regarding credit reporting errors between 2020 and 2021, indicating growing scrutiny.

- Subscription-based credit repair models are expanding, contributing to a 13.6% CAGR growth in the market through 2032.

- Consumers facing credit card interest rates averaging above 20% and rising living costs have driven higher demand for credit repair.

- Around 40% of credit repair clients are aged 35-44, with younger adults aged 25-34 representing 25% and growing as a client segment.

- Credit repair demand correlates with consumers with credit scores below 660, typical of millennials with thinner credit histories.

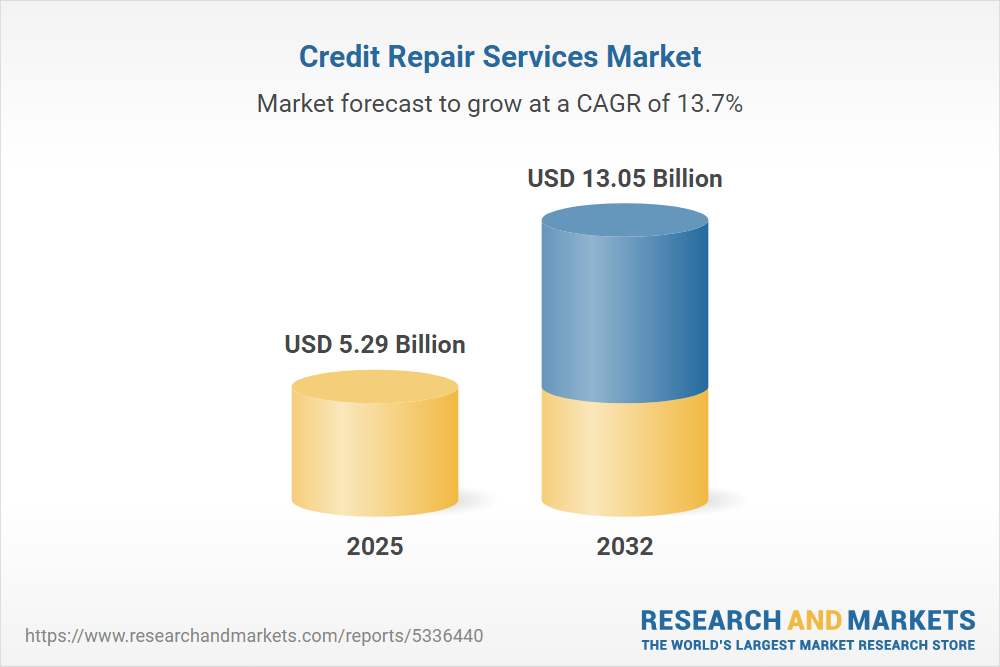

Credit Repair Services Market Growth Highlights

- The global credit repair market is valued at $5.29 billion in 2025.

- The industry is projected to reach $13.05 billion by 2032, showing strong expansion.

- The market is growing at a 13.7% CAGR through 2032.

- The increase from $5.29 billion to $13.05 billion reflects more than 2x growth over the period.

- Rising demand for consumer credit restoration is fueling market acceleration.

- Financial wellness, dispute resolution, and identity protection tools continue to push market adoption upward.

Number of Credit Repair Businesses

- The U.S. credit repair sector includes approximately 43,810 businesses as of 2025.

- The industry has experienced a 4.8% annual decline in the number of businesses since 2020.

- New entrants averaged 1,200 annually between 2022 and 2024, fluctuating due to regulatory costs.

- About 65% of credit repair businesses offer online or hybrid digital services.

- California, Florida, and Texas account for over 45% of all credit repair firms nationwide.

- Small to medium enterprises represent around 88% of credit repair companies.

- Monthly subscription models have grown to comprise 28% of service offerings in 2025.

- Pay-after-results business models now make up 12% of the market.

- Consolidation led to a 7% decrease in the number of firms from 2023 to 2025.

- Compliance and licensing costs increased by an average of 15% since 2023, raising entry barriers.

Demographics of Credit Repair Clients

- 40% of credit repair clients are aged 35-44 years.

- Approximately 25% of clients are aged 25-34 years.

- Most clients have credit scores in the “fair” to “poor” range, typically 620-669 or lower.

- Around 60% of credit repair clients earn below the national median household income, often under $50,000-$60,000.

- Renters constitute about 55% of credit repair service clients, higher than homeowners.

- Nearly 50% of clients are first-time users of credit repair services.

- Black and Hispanic consumers experience a 20-30% higher rate of credit-reporting disputes than other ethnic groups.

- Urban and metropolitan areas account for over 70% of credit repair clients.

- Millennials and Gen Z clients with limited credit history constitute an increasing share, now about 35% of the market.

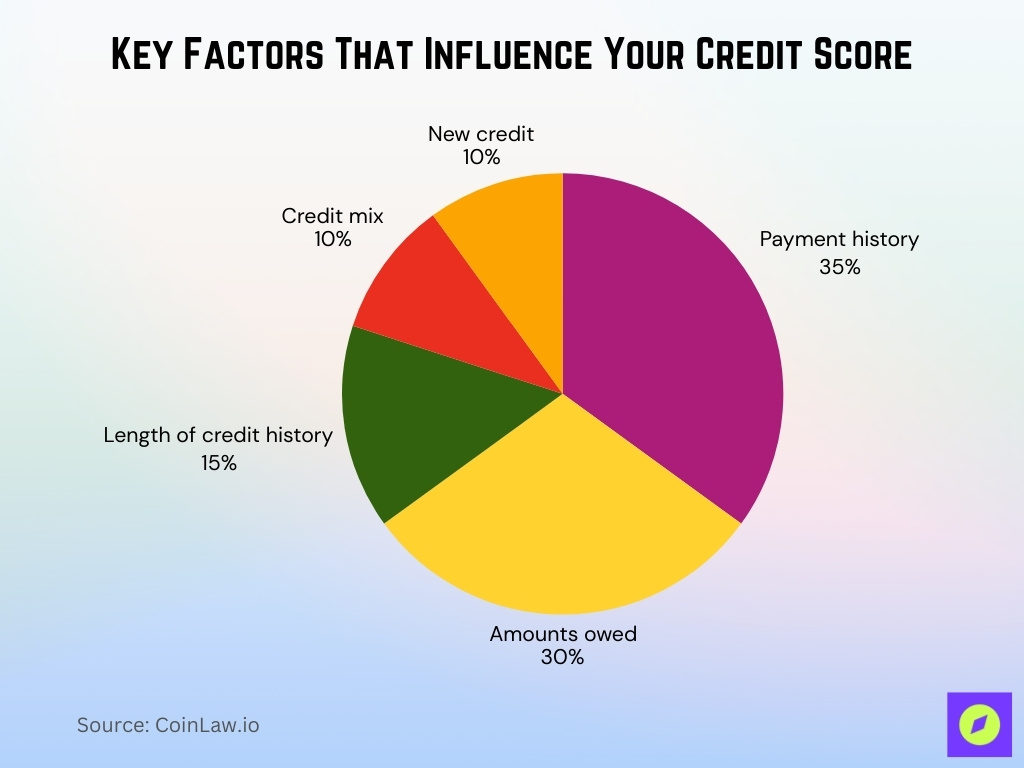

Key Factors That Influence Your Credit Score

- Payment history contributes the most to credit scoring models at 35%, making timely payments the strongest driver of a high score.

- Amounts owed account for 30%, meaning high credit utilization can significantly lower your score.

- Length of credit history represents 15%, rewarding consumers who maintain long-standing, well-managed accounts.

- Credit mix makes up 10%, with scoring models favoring a balanced combination of loans and revolving credit.

- New credit also carries 10%, as too many recent hard inquiries or new accounts can temporarily reduce your score.

Cost of Credit Repair Services

- Most U.S. credit repair companies charge monthly subscription fees ranging from $50 to $150.

- Initial setup fees generally range between $70 and $200.

- Typical monthly fees in the market average between $50 and $100 per month.

- Clients often pay a total of several hundred to over $1,000 for services over multiple months.

- Subscription models now represent over 60% of credit repair service offerings.

- Pay-after-results models account for approximately 12% of credit repair businesses.

- Some firms offer flat-rate six-month plans costing around $599 as an alternative to monthly fees.

Average Credit Score Improvement

- The average US FICO score reached 715 in early 2025.

- From 2018 to 2023, the average U.S. FICO score increased by 14 points.

- Clients disputing report errors often see faster score improvements, typically within 3-6 months.

- Dramatic score increases over 100 points are rare unless major credit issues are resolved.

- Consistent good credit behavior over 3-6 months usually yields moderate improvements in the absence of major derogatory items.

- Most credit repair clients experience score improvements in the range of 10 to 50 points.

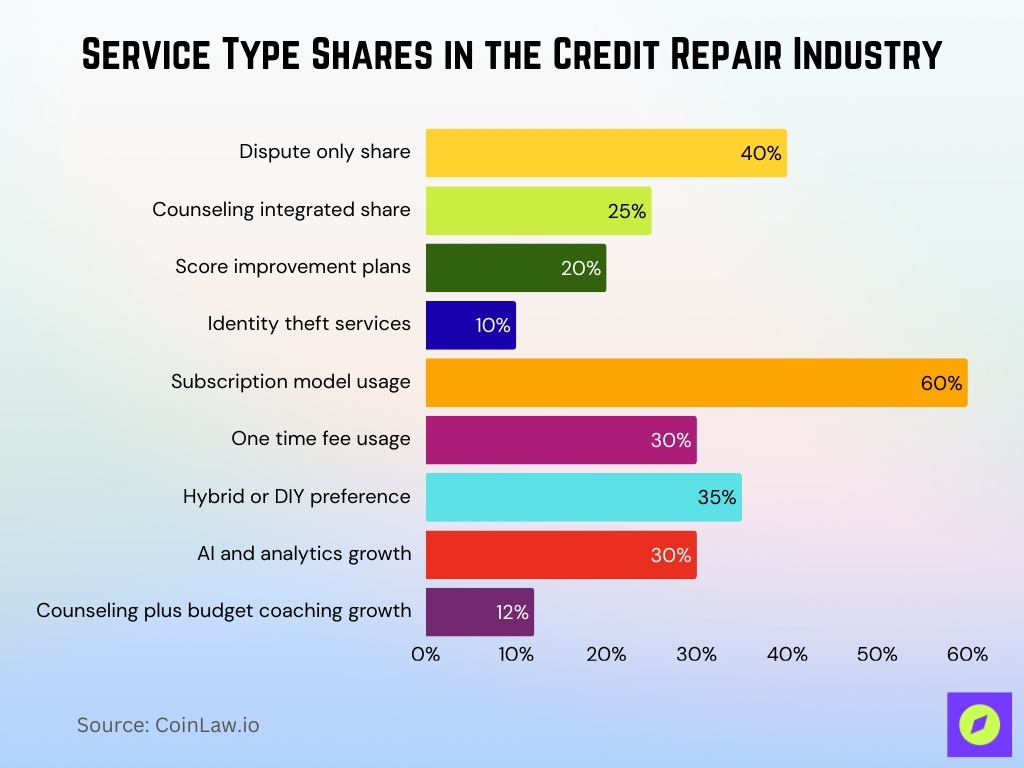

Credit Repair Service Types

- Dispute-only services account for approximately 40% of the market share in credit repair services.

- Credit counseling integrated services make up about 25% of credit repair offerings.

- Credit score improvement plans, including monitoring and educational tools, represent around 20% of service types.

- Identity-theft protection services have grown to represent roughly 10% of credit repair services.

- Subscription-based models are used by over 60% of credit repair firms, reflecting an industry shift.

- One-time fee models still comprise about 30% of credit repair payment structures.

- Hybrid or do-it-yourself plus expert-assist models now capture about 35% of consumer preferences.

- AI and analytics integration into services has increased by 30% annually through 2025.

- Credit counseling combined with budget coaching sees a 12% growth rate annually.

Credit Repair Process Overview

- Credit repair firms begin the process by reviewing credit reports from the three major bureaus.

- They identify inaccurate or unverifiable items for dispute, which make up about 15–20% of reported errors.

- They submit dispute letters to bureaus and creditors, triggering legally mandated investigations that must finish within 30 days.

- They conduct follow-up monitoring to confirm that disputed items are corrected or removed within the 30-day window.

- They advise clients to improve credit behavior, especially maintaining on-time payments, which account for 35% of the FICO score.

- Over 50% of providers offer ongoing monitoring and alert services.

- The full credit repair process typically spans 3 to 6 months, depending on report complexity and dispute volume.

- Ethical firms avoid disputing accurate negative items, which stay on credit reports for up to 7 years unless outdated or incorrect.

- Providers use automation and AI tools to streamline dispute identification and submissions, improving efficiency by 30% year over year.

Customer Satisfaction and Outcomes

- About 67% of credit repair clients rate their overall experience as “Good” or “Excellent.”

- Approximately 6.6% of users report having a “Bad” experience with credit repair firms.

- Around 12% of clients perceive credit repair practices as “Shady” or “Borderline illegal.”

- 25.8% of clients feel they were kept as customers longer than necessary by repair firms.

- 55.2% of respondents say billing was as agreed without surprise fees.

- The Consumer Financial Protection Bureau received roughly 2,600 complaints against credit repair companies in 2022.

- Industry revenue grew by about 2.8% CAGR from 2018 to 2025 despite modest score improvements.

Technological Advances in Credit Repair

- AI and automation boost dispute-processing efficiency by over 30% annually through 2025.

- Subscription-based platforms with self-service tools make up more than 60% of new credit repair offerings.

- Around 15% of credit repair firms adopt blockchain-enabled identity-verification modules.

- Digital dispute volumes rise 20% year-over-year because automation drives mass-generated claims.

- About 55% of credit repair clients use mobile apps and dashboards for real-time credit updates.

- Digital platforms cut entry costs by roughly 40%, allowing smaller providers to scale faster.

- About 70% of credit repair providers implement encryption and multi-factor authentication compliance.

- Machine learning supports client segmentation in about 25% of firms to deliver personalized services.

- Roughly 30% of service providers offer integrations with credit monitoring and loan-eligibility tools.

- Clients expect dispute-resolution turnaround times under 45 days, enabled by new tech innovations.

Regional Market Distribution

- North America’s credit repair market stood at $2.726 billion in 2024, reflecting its position as the largest regional segment.

- The U.S. contributed $2.150 billion, emphasizing its dominance within the regional total.

- Asia Pacific reached $1.567 billion in 2024, showing meaningful participation in global demand.

- North America is expected to expand at a 0.7% CAGR through 2031, indicating slow but steady growth.

- Emerging markets are growing above 5% CAGR, driven by rising consumer awareness of credit health.

- U.S. states with bigger populations and higher poor-credit rates generate over 50% of the national demand.

- Urban and suburban regions account for around 80% of U.S. credit repair usage, showing strong concentration in populated areas.

- Cross-border credit repair activity continues to rise, now making up about 10% of total market volume.

- Latin America and the Caribbean represent roughly 8% of the global credit repair market, adding to broader international growth.

Regulatory and Compliance Impact

- The Credit Repair Organizations Act (CROA) prohibits upfront fees before credit repair work is done.

- Compliance costs have caused 12% of smaller firms to exit the market since 2023.

- CFPB rulings in 2025 increased enforcement actions by 28% against misleading marketing and upfront fee violations.

- Automated dispute volumes have risen by over 20%, triggering regulator concerns about data integrity.

- CROA and state laws mandate record-keeping, pushing 35% of firms to upgrade tech infrastructure.

- Pay-for-performance models face stricter scrutiny compared to subscription-based pricing models.

- Consumer awareness of regulatory protections has increased by 25%, driving demand for ethical practices.

Subscription and Pricing Models

- Over 60% of credit repair firms now use subscription-based pricing models.

- One-time fee models account for about 25% of credit repair services in 2025.

- Pay-for-performance models represent roughly 15% of pricing structures.

- Bundled services with credit monitoring and identity theft protection increase average monthly fees by 30-40%.

- Subscription pricing supports scalable digital delivery and spreads customer acquisition costs by over 25%.

- Clients expect 100% pricing transparency on monthly fees, cancellation policies, and service inclusions.

- Lower-cost subscription plans target younger adults with thinner credit profiles, growing this segment by 18% annually.

- Annual subscription plans are gaining traction, making up about 20% of subscription model usage.

Impact of Credit Repair on Borrowing Power

- 44% of consumers who accessed their credit reports found at least one error, indicating repair potential.

- Average FICO scores rose by 14 points from 2018 to 2023, aiding borrowing power.

- A 20-30 point credit score increase can shift borrowers from subprime to near-prime lending tiers.

- Improved credit scores can reduce mortgage interest rates by approximately 0.6 percentage points, lowering monthly payments by over $160 on a $400,000 loan.

- Borrowers addressing payment behavior alongside repair see stronger loan approval chances.

- Firms integrating alternative data (rent, utilities) help increase borrowing power for about 30% of clients.

Frequently Asked Questions (FAQs)

About 70%.

44%.

20–30 points.

$50 to $150 per month.

Conclusion

The U.S. credit-repair industry today operates at a mature yet evolving juncture. In particular, with domestic revenues and global growth, the sector is guided by three major vectors: regional demand dynamics, technological innovation, and regulatory structure. Amid these shifts, changing pricing models and advancing tools mean the most effective providers will combine transparency, compliance, and a measurable-outcome focus. For this reason, consumers and advisors alike must understand the interplay between service type, pricing, technology, and borrowing-power impact. As a result, as you evaluate or engage with credit-repair services, the forthcoming data and trends will help you make informed decisions.