Imagine a world where credit cards are not just a convenient tool for purchasing, but a financial lifeline shaping the behavior and preferences of millions. Credit cards have revolutionized spending habits, offering not just a mode of payment but a way to manage finances with flexibility. In the United States, nearly every consumer relies on this piece of plastic, and the numbers surrounding its usage, debt, and trends are both staggering and insightful. As we delve into the latest credit card statistics, we uncover key trends shaping the future of credit in a constantly evolving financial landscape.

Editor’s Choice

- 216 million American adults held at least one credit card, with about 81% of adults having card access.

- Total U.S. credit card debt surpassed $1.21 trillion, rising about 6.1% year over year.

- There were roughly 631 million active credit card accounts, increasing from 617 million the year before.

- About 94% of consumers reported being satisfied with their credit cards and valued their convenience.

- Around 82% of cardholders had at least one rewards card, and 90% valued their rewards program.

- The average APR across all credit card accounts was 20.97%, while accounts assessed interest averaged 22.30%.

- The average APR for all accounts in the prior quarter was 21.39%, indicating persistently elevated borrowing costs.

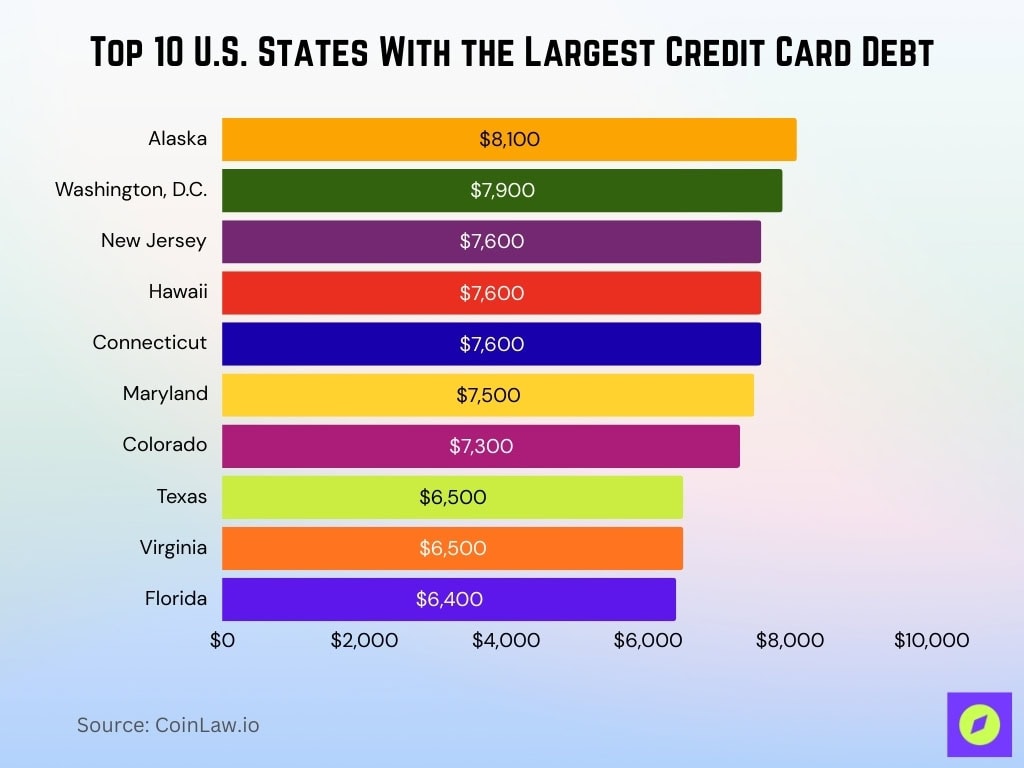

Top 10 U.S. States With the Largest Credit Card Debt

- Alaska leads with an average credit card balance of about $8,100 per consumer, the highest in the nation.

- Washington, D.C. cardholders carry roughly $7,900 in average balances, among the highest statewide figures.

- New Jersey residents hold average balances near $7,600, placing the state in the top tier for card debt.

- Hawaii cardholders owe around $7,600 on average, reflecting high living costs and heavy credit use.

- Connecticut consumers carry about $7,600 in average card debt, exceeding the national balance norm.

- Maryland residents have average credit card balances close to $7,500, also well above the U.S. average.

- Colorado cardholders report average balances of roughly $7,300, ranking among the top indebted states.

- Florida averages about $6,400 in credit card balances per consumer, significantly higher than in low-debt states.

- Texas residents carry around $6,500 in average card debt, placing the state in the national top ten.

- Virginia cardholders owe approximately $6,500 on average, similar to Texas and above the national mean.

Usage and Consumer Preferences

- 79% of U.S. households use credit cards, which account for about 35% of all consumer payments by number.

- Among households using both cards and BNPL, the share of spending on credit cards fell from 70% to 58%, a drop of about $279 per household.

- Roughly 52% of U.S. consumers pay their credit card balance in full each month, leaving nearly half with revolving debt.

- About 83% of consumers have signed up for at least one credit card primarily because of rewards, especially cash back.

- Cash back is the favorite feature for around 50–54% of rewards cardholders, while only about 9–12% prioritize travel points or miles.

- U.S. mobile wallet adoption has reached 43% of households, with 27% using BNPL alongside cards.

- Apple Pay is accepted at about 94% of U.S. retailers, while Google Pay is supported by roughly 87% of merchants.

- Google Wallet has around 48.6 million U.S. users and is projected to reach 57 million by 2028.

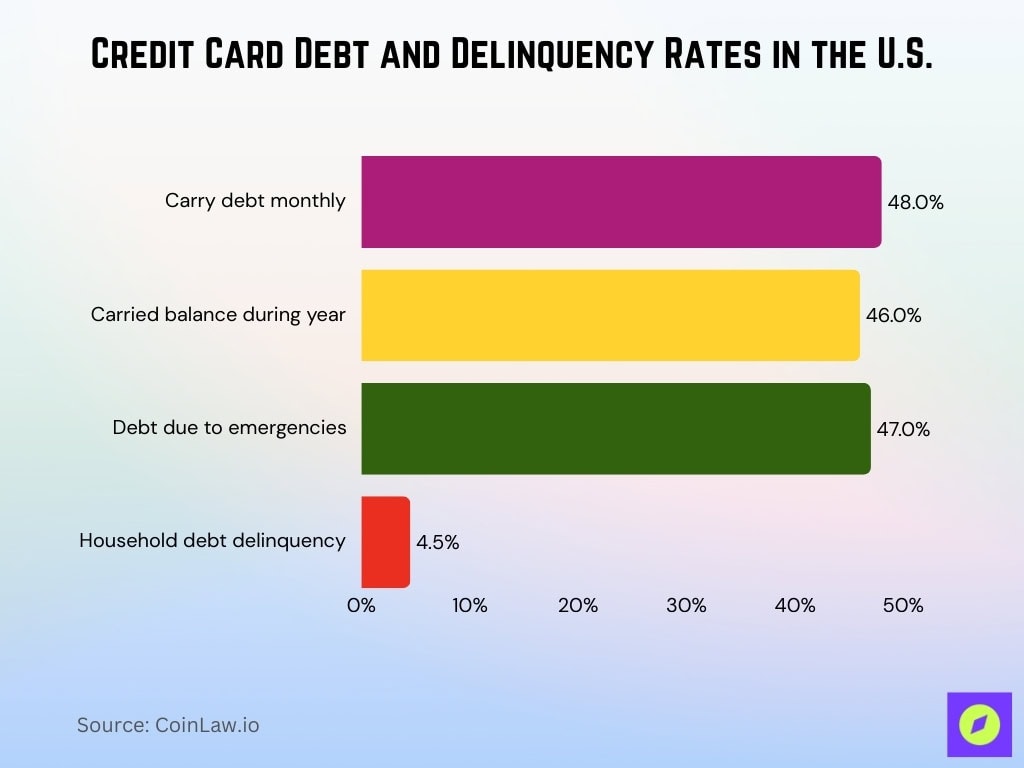

Credit Card Debt Statistics

- Total U.S. credit card balances reached a record $1.233 trillion in Q3, up from $1.21 trillion the prior quarter.

- Revolving debt tied to credit cards now accounts for about $1.21 trillion of total household liabilities.

- Nearly 48% of American credit cardholders carry debt from month to month, up from 44% a year earlier.

- About 46% of adult credit cardholders carried a balance for at least one month during the year, according to Federal Reserve data.

- Roughly 47% of borrowers cite unexpected or emergency expenses as the main reason for their card debt.

- Aggregate delinquency across all household debt reached 4.5%, with card delinquencies remaining elevated versus pre‑pandemic norms.

Credit Card vs. Cash Statistics

- Credit cards account for about 35% of all U.S. consumer payments by number, while cash represents roughly 14% of payments.

- Credit cards are used for about 40% of in‑store transactions and 73.3% of all U.S. retail sales by dollar value.

- Cash is now used in only 11% of U.S. in‑store transactions, with 81% of shoppers preferring cards over cash.

- Americans spent about $5.42 trillion on credit cards out of $7.40 trillion in total retail spending in the latest year.

- U.S. consumers spent roughly $683 billion in cash for retail purchases, far below card‑based spending levels.

- The average U.S. credit card transaction is about $96.56, several times larger than typical small‑value cash payments.

- Consumers are about 2x as likely to use credit cards rather than cash for any given transaction.

- For in‑person payments, 35% of consumers prefer credit cards, compared with 19% who prefer cash, and the rest favor debit.

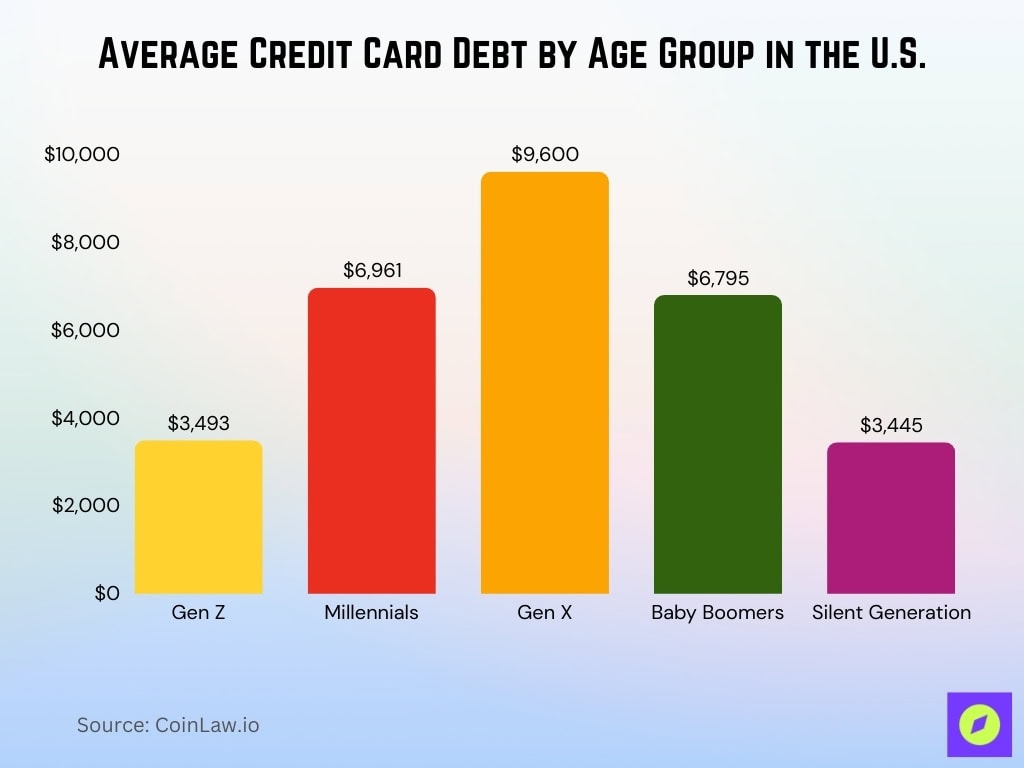

Debt by Age

- Gen Z cardholders now carry an average balance of about $3,493, slightly above the $3,445 held by the Silent Generation.

- Millennials have average credit card balances of roughly $6,961, surpassing the $6,795 owed by Baby Boomers.

- Gen X continues to lead in credit card debt, with average balances reaching about $9,600 per person.

- Baby Boomers carry average balances of $6,795, lower than Gen X and millennials but still well above younger and older cohorts.

- The Silent Generation holds average balances of around $3,445, remaining the group with the lowest dollar credit card debt.

- Overall average U.S. credit card balances rose to about $6,735, up from $6,699 a year earlier.

- Millennials’ average balances increased by roughly $2,600 over the past three years, reflecting rising reliance on revolving credit.

- About 25% of Americans say they would use a credit card and pay over time to cover a $1,000 emergency expense.

Credit Card Debt by Income

- Households earning under $50,000 are the most likely to carry card debt, with about 54–56% revolving month to month.

- About 50% of households earning $50,000–$79,999 report carrying a credit card balance from month to month.

- Roughly 39% of households with incomes between $80,000–$99,999 carry ongoing credit card debt.

- Only about 34–41% of households earning $100,000+ carry card debt from month to month, the lowest share by income group.

- Overall, 46% of American credit cardholders carry a balance as of mid‑year, down from 48% the prior November.

- Among all cardholders with unpaid balances, the national average credit card debt is about $7,321, up 5.8% year over year.

- The more households earn, the less likely they are to rely on revolving credit card debt, even when they have higher spending power.

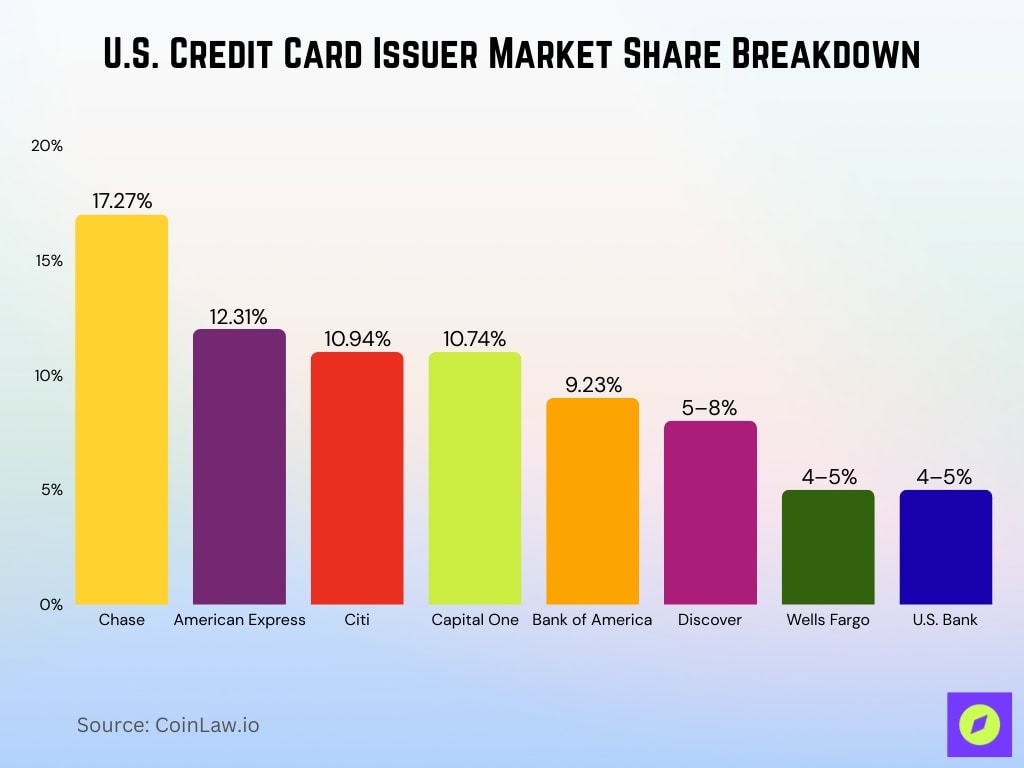

U.S. Credit Card Issuer Market Share Breakdown

- Chase remains the largest U.S. credit card issuer with a market share of about 17.27% of purchase volume.

- American Express holds a market share of 12.31%, ranking second among major issuers.

- Citi controls roughly 10.94% of issuer market share, narrowly ahead of Capital One.

- Capital One holds about 10.74% market share, solidifying its position among the top four issuers.

- Bank of America accounts for approximately 9.23% of the U.S. credit card issuer market.

- Discover captures around 5–8% share of purchase volume, depending on whether only Visa/Mastercard or all networks are considered.

- Wells Fargo and U.S. Bank each have issuer shares in the mid‑single digits, around 4–5% of purchase volume.

Technological Innovations in Credit Cards

- About 82% of U.S. cardholders who have been issued a contactless card have used it at POS, with contactless accounting for over 75% of Mastercard network transactions.

- A majority, 53% of U.S. consumers now prefer contactless for in‑store payments, rising to 65% among Gen Z shoppers.

- Apple Pay has roughly 65.6 million active U.S. users versus about 35 million for Google Pay, giving Apple around 49% of the mobile wallet user base.

- In‑store, Apple Pay captures about 54% of mobile wallet taps, supported by roughly 85–90% retailer acceptance.

- Contactless Tap to Phone merchant adoption grew 200% year over year, with nearly 30% of participating sellers being new small businesses.

- Globally, contactless payment value is projected to double to $10 trillion by 2030, up from around $5 trillion in 2025.

- A global survey reports 71% of consumers now prefer contactless payments over traditional methods, up from 62% in 2022.

- AI‑driven fraud detection platforms were valued at about $4.16 billion in 2025 and are projected to reach $13.29 billion by 2032.

Recent Developments

- The average APR across all credit card accounts is about 20.97%, while accounts assessed interest average 22.30%, both near historic highs.

- For accounts assessed interest as of August, the average credit card APR stood at about 22.83%, reflecting elevated rate margins.

- Nearly 48% of American credit cardholders currently carry debt from month to month, up from 44% a year earlier.

- Among cardholders with unpaid balances, average credit card debt has climbed to roughly $7,321, an increase of 5.8% year over year.

- Overall household debt delinquency reached about 4.5%, with new 30‑day credit card delinquencies rising to 8.8% and serious delinquencies to 12.4%.

- Credit card balances in the U.S. hit roughly $1.233 trillion in Q3, up from about $1.21 trillion earlier in the year.

- Consumers’ use of installment or BNPL‑style plans linked to cards now affects roughly 28–30% of credit card accounts.

- Credit card‑related complaints to federal agencies have risen by around 14–38% over recent years, with fraud and billing disputes leading the issues.

Frequently Asked Questions (FAQs)

81% of U.S. adults own a credit card.

Over 800 million credit cards are in circulation.

53% of Americans carry credit card debt.

32% of those with credit card debt owe $10,000 or more.

Conclusion

As we step into a future where credit cards are more than just a payment method, it’s clear that innovations like contactless payments, AI-driven security, and crypto-linked cards are shaping the financial landscape. The statistics reveal a world increasingly reliant on credit, where consumer preferences, debt trends, and technological advances are reshaping how we use and think about credit cards. As these trends evolve, one thing remains certain: credit cards will continue to play a critical role in the way we spend, borrow, and manage our finances.