In a bustling New York café, a customer grabs her coffee and taps her phone on a sleek payment terminal. A second later, the beep signals that her payment is complete. This seamless, almost magical interaction is the hallmark of contactless payments. Over the last decade, the way we pay for goods and services has transformed. The global adoption of contactless technology surged during the pandemic, and its momentum shows no sign of slowing down. Today, contactless payments are not just a convenience; they are redefining commerce and consumer expectations.

Editor’s Choice

- 86% of global consumers now use contactless payment methods in 2025.

- In the United States, 68% of card transactions are contactless-enabled, marking a 10% increase over the past year.

- 83% of small businesses that adopted contactless technology in 2025 reported higher customer satisfaction.

- Mobile wallet usage is expected to reach 5.6 billion users globally by the end of 2025, representing a 7% YoY growth.

- The adoption of NFC technology has risen by 37.6% in North America in 2025, driven by consumer demand for faster transactions.

- Tap-to-pay transactions are now 60% faster than chip-based payments in 2025, reducing checkout time and enhancing customer experience.

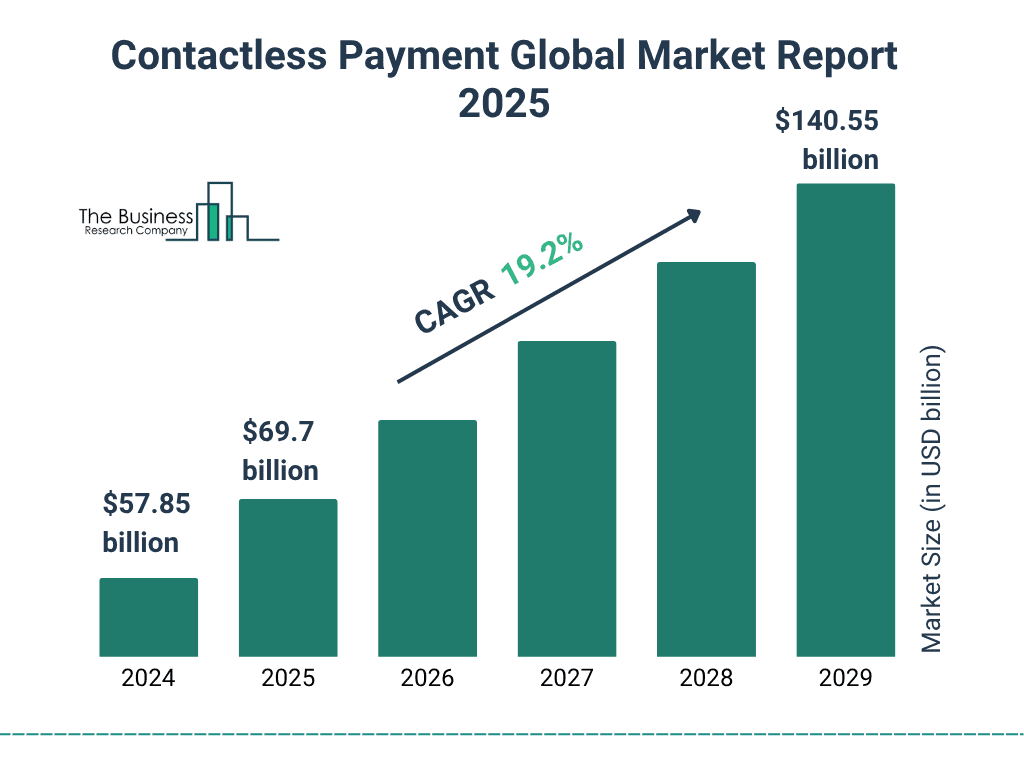

Global Contactless Payment Market Growth

- The global contactless payment market is projected to hit $69.7 billion, driven by consumer preference for speed, convenience, and hygiene in payments.

- This represents a strong compound annual growth rate (CAGR) of 19.2%, highlighting the sustained momentum in digital and tap-to-pay transactions.

- In 2025, the market

- The surge in NFC-enabled devices and merchant adoption across retail, transit, and hospitality sectors continues to expand market reach.

- By 2029, contactless payments are set to more than double their 2025 size, signaling one of the fastest-growing segments in the digital payments ecosystem.

- Growth is strongly supported by financial inclusion initiatives, mobile wallet expansion, and post-pandemic behavioral shifts toward cashless transactions.

Post-Pandemic Growth in Contactless Payments

- 410% global increase in contactless transactions from 2020 to 2025.

- 72% of consumers switched to contactless payments for hygiene and convenience in 2025.

- In 2025, digital wallet transactions accounted for 38% of all in-store sales, up from 29% in 2023.

- Healthcare and essential service sectors saw contactless usage increase by 82% in 2025 as safety remained a top priority.

- Banks issued over 610 million contactless-enabled cards globally in 2025, responding to surging demand.

- The U.S. saw a 65% increase in the adoption of contactless payment in grocery stores between 2023 and 2025.

- 81% of consumers report feeling safer using contactless payment options in 2025 due to hygiene and speed.

Most Popular In-Store Payment Methods

- Digital wallets and mobile payments (e.g., Apple Pay, Google Pay) now account for 45–50% of all in-store transactions globally, making them the dominant payment method for point-of-sale purchases.

- Credit and debit cards (including contactless cards) remain a major option, representing 25–30% of in-store payments worldwide.

- Cash usage has declined significantly, now estimated at just 2–5% of all in-store payments in developed markets.

- Buy Now, Pay Later (BNPL) services have achieved less than 2% share for in-store transactions, with higher uptake in online shopping environments.

- Emerging payment technologies such as wearables, QR codes, crypto, and bank transfers collectively account for under 1% of global in-store payments, reflecting their still-limited mainstream adoption.

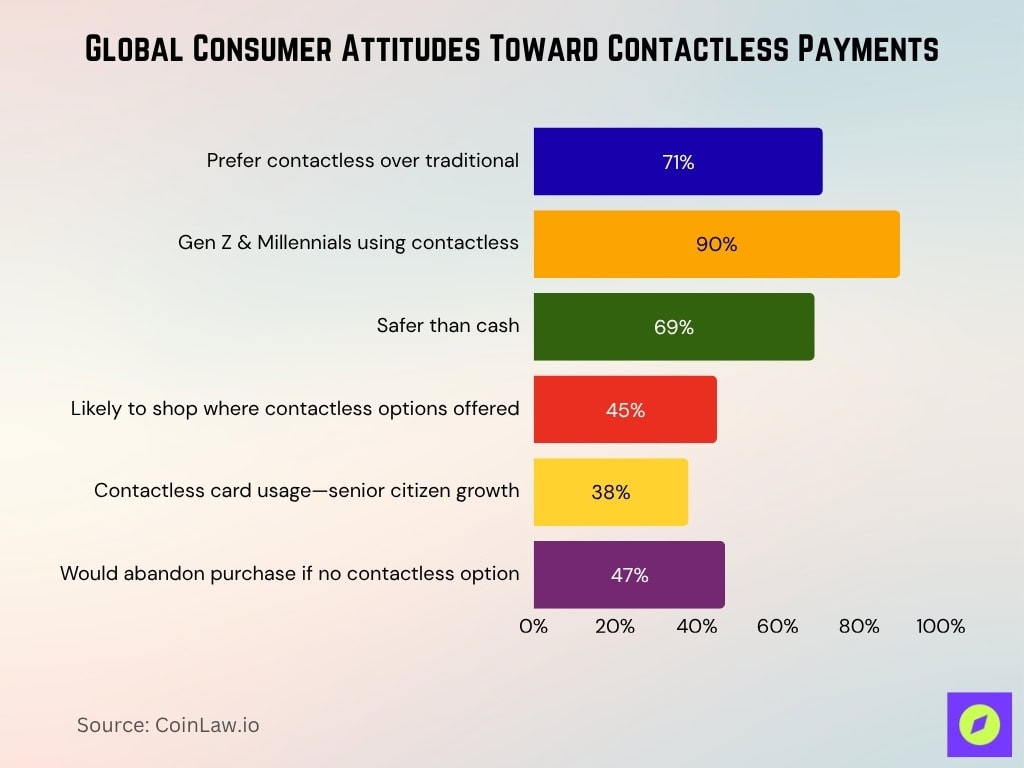

Consumer Perspective on Contactless Payments

- 71% of consumers globally stated they prefer contactless payments over traditional methods in 2025.

- 90% of Gen Z and Millennials in the U.S. have used a contactless payment method at least once in the past month.

- 69% of consumers believe contactless transactions are safer than using cash, citing reduced exposure to germs and theft risks.

- 45% of customers are more likely to shop at retailers that offer contactless payment options.

- U.S. households with annual incomes exceeding $100,000 are 2.3 times more likely to use mobile wallets as their primary payment method.

- Among senior citizens, contactless card usage has grown by 38% in the past two years, driven by simplified onboarding and education campaigns.

- 47% of global consumers indicated they would abandon a purchase if a contactless payment option was unavailable.

Regional Insights and Market Segmentation

- Asia-Pacific leads globally, with contactless payments accounting for 56% of all transactions in 2025, driven by widespread mobile wallet adoption.

- In the U.S., 67% of consumers use contactless payments regularly in 2025, with metropolitan areas leading adoption.

- Europe has achieved near-universal adoption, with 97% of POS terminals supporting contactless technology in 2025.

- Africa’s contactless payment market is expanding at a CAGR of 19% in 2025, driven by mobile payment platforms like M-Pesa.

- Latin America saw a 33% increase in contactless payments in 2025, spurred by fintech companies targeting underbanked populations.

- In Canada, 81% of in-person card transactions are contactless in 2025, reflecting a strong preference for tap-to-pay technology.

- The Middle East has experienced 27% YoY growth in mobile wallet adoption in 2025, with the UAE and Saudi Arabia leading the charge.

The Evolution of POS Payments Technology

- 72% of retailers in the U.S. upgraded their POS systems between 2020 and 2025 to enable contactless payments.

- Smart POS terminals supporting mobile wallets and QR code scanning now account for 44% of global POS shipments in 2025.

- 57% of small businesses in the U.S. accept mobile wallet payments in 2025, up from 42% in 2020.

- POS systems integrated with biometric authentication are gaining traction, with 19% of retailers deploying them in 2025.

- Contactless-enabled vending machines have increased by 38% globally in 2025, allowing consumers to purchase without physical interaction.

- AI-powered POS systems are being adopted to analyze customer spending behavior, increasing sales by up to 20% in pilot programs in 2025.

Technological Innovations and NFC Payment Adoption

- Over 97% of new smartphones released in 2025 come equipped with NFC technology, ensuring widespread compatibility with contactless payments.

- Biometric authentication, such as facial recognition and fingerprint scanning, is now integrated into 72% of mobile wallets globally in 2025.

- Wearable payment devices account for 12% of contactless transactions worldwide in 2025, driven by smartwatches and rings.

- Tokenization technology has reduced fraud rates by 34% for NFC payments in 2025, boosting consumer trust.

- Blockchain-based contactless payment solutions are emerging in 2025, offering zero chargeback risk for merchants.

- Smart refrigerators and IoT devices now enable direct tap-to-order payments, contributing to an estimated 12% incremental growth in wearable payment usage by 2025.

Recent Developments

- Amazon rolled out palm payment technology to over 700 U.S. stores in 2025, allowing customers to pay by scanning their palms.

- The Federal Reserve launched a digital payment pilot program in 2025, targeting underserved areas and advancing CBDC testing with 12 financial institutions.

- PayPal introduced a small business toolkit in 2025 featuring QR code and NFC payment integration for seamless transactions.

- Contactless payment adoption in U.S. public transit systems expanded to more than 700 projects and 80% of cities in 2025, reducing reliance on cash and paper tickets.

- In 2025, Samsung accelerated the adoption of ultra-wideband (UWB) technology for enhanced security and seamless mobile payments.

- Central bank digital currencies (CBDCs) like India’s Digital Rupee and China’s e-CNY reached $982 billion in transactions by 2025, integrating with contactless infrastructures.

Frequently Asked Questions (FAQs)

Contactless payments account for 60% of all in-store transactions in the US in 2025.

Mobile wallets are projected to reach 5.6 billion users worldwide in 2025, driving the surge in contactless transactions.

Digital wallets account for 30% of global point-of-sale payments in 2025.

Europe is expected to have 300 million contactless payment users in 2025.

Conclusion

Contactless payments are no longer just a convenience; they have become a fundamental part of the modern payment ecosystem. With technological advancements like biometric authentication, wearable devices, and blockchain solutions, the future of contactless payments is poised for even greater innovation. The contactless revolution will likely redefine how we transact, with global transactions expected to be contactless. This is not just a trend; it is the future of payments.