Coinbase Wallet, Coinbase’s self‑custody Web3 wallet, has gained attention today both from users seeking control over their crypto assets and from regulators monitoring security and reporting. In sectors like DeFi and NFTs, the Wallet’s growth reflects shifting preferences toward decentralization, while in finance and risk management, its metrics inform compliance and market behavior. Below are key statistics and emerging patterns shaping the Coinbase Wallet ecosystem.

Editor’s Choice

- Total monthly Coinbase platform users: 120 million across 2025.

- Monthly transacting users (users who make at least one transaction per month): 8.7 million in Q2 2025.

- Verified user count (Coinbase, all platforms): 108 million as of end‑2024.

- Coinbase Wallet’s monthly active users: 3.2 million in 2025.

- Assets under management (AUM) / under custody: $404 billion by the end of 2024.

- Quarterly trading volume (latest figure): $237 billion.

- Coinbase’s holding of Bitcoin: over 12% of all Bitcoin globally.

Recent Developments

- In May 2025, Coinbase disclosed a cyberattack affecting under 1% of its monthly transacting users (MTUs), estimated remediation cost between $180‑400 million.

- Coinbase became a member of the S&P 500 in May 2025, boosting visibility and legitimacy among institutional investors.

- Acquisition of Deribit in May 2025 for approx $2.9 billion (cash + stock), expanding into derivatives trading.

- SEC investigation ongoing regarding whether Coinbase overstated “verified users,” a metric it no longer reports.

- Growth in institutional staking services, stablecoin services, and DeFi access as wallets and custody broadened.

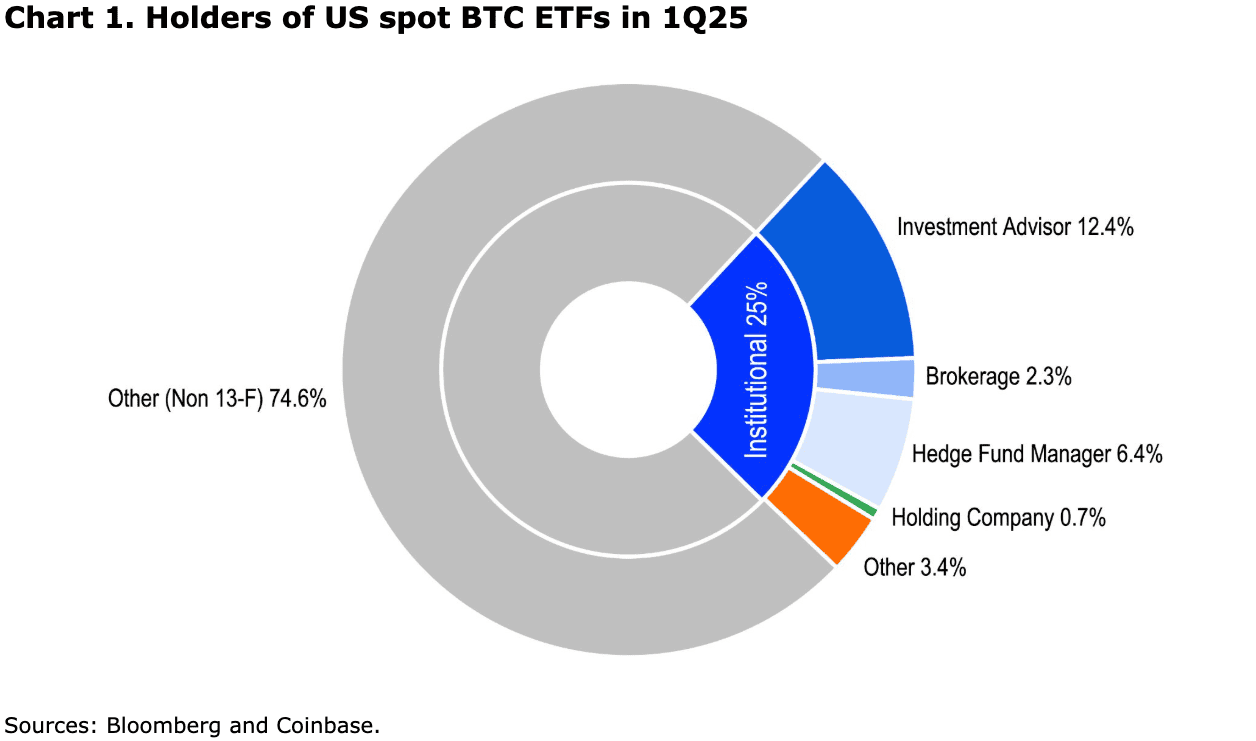

Holders of US Spot BTC ETFs

- Other (Non 13-F) investors account for 74.6%, making up the largest share of spot Bitcoin ETF holders.

- Institutional investors represent 25% of total holders, highlighting strong professional participation.

- Within institutions, Investment Advisors hold 12.4%, showing their growing role in BTC ETF adoption.

- Hedge Fund Managers control 6.4%, reflecting interest from active trading and arbitrage strategies.

- Brokerages account for 2.3%, contributing through client portfolio exposure.

- Holding Companies represent 0.7%, signaling minor corporate balance sheet allocations.

- Other institutional holders make up 3.4%, rounding out the remaining portion of the professional segment.

Monthly Active Users

- Coinbase Wallet monthly active users: approx 3.2 million in 2025.

- By contrast, the broader Coinbase user base (all platforms) had 120 million monthly users in 2025.

- The fraction of Wallet MAUs vs total users is thus around 2.7% (3.2M wallet users / 120M total).

- Monthly transacting users across Coinbase: 8.7 million in Q2 2025. Wallet‑MAUs are smaller, implying many users use the main exchange rather than the Wallet.

- Growth rate of Coinbase’s user base (all platforms) from 2024 to 2025: ~20%.

- Verified users in 2024: 108 million. In previous years (2021‑2022), they reported ~43 million → 108 million, showing strong multi‑year growth.

User Growth Over Time

- Verified users jumped from 43 million in Q1 2021 to 108 million by end‑2022.

- From 2024 to 2025, total monthly users increased from 96 million (in 2024) to 120 million in 2025.

- Net income grew drastically: for the 12 months ending June 30, 2025, net income was $2.86 billion, up about 93% YoY.

- In 2024, platform assets managed (or under custody) rose to $404 billion, recovering from lows in late 2023.

- Trading volume: latest quarter ≈ $237 billion. That reflects broader market usage and interest.

- Exchange supports over 270 cryptocurrencies as of mid‑2025.

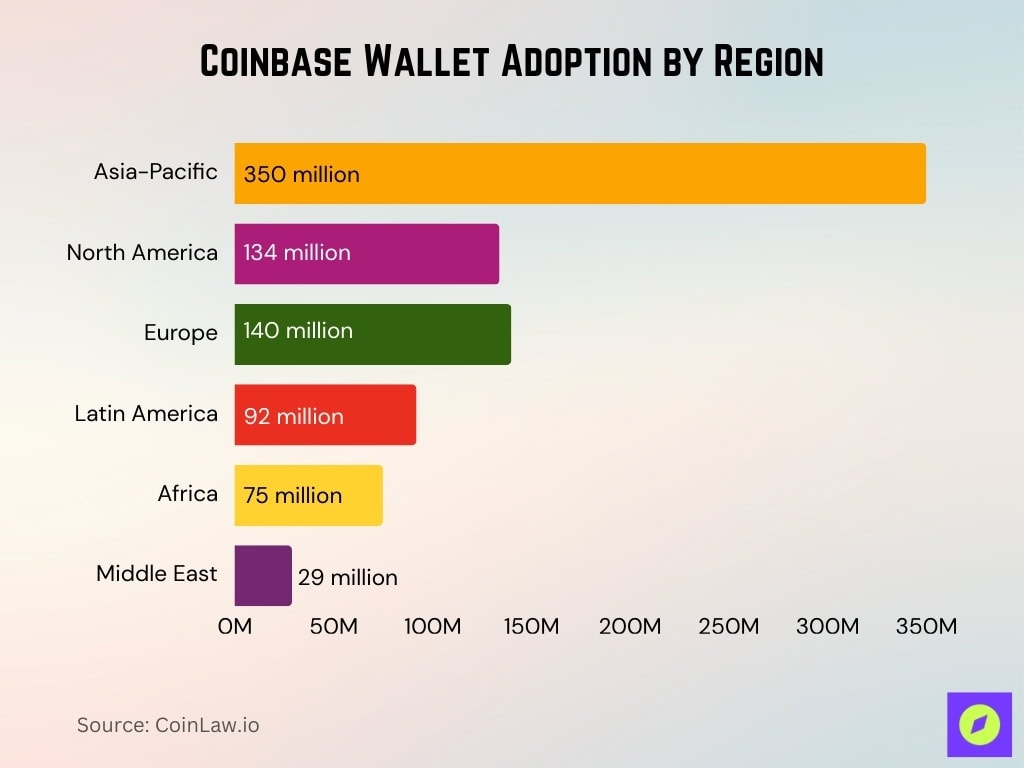

Adoption by Region

- Asia‑Pacific (APAC) leads global wallet adoption: 350 million active crypto wallet users in 2025, ~43% of the global total.

- North America holds about 134 million wallet users in 2025.

- Europe has 140 million wallet users, led by Germany, France, and the UK.

- Latin America is growing fast: 92 million users, driven by remittances and inflation concerns.

- Africa’s wallet count more than doubled in two years, now 75 million in 2025.

- Middle East: 29 million active wallets in 2025.

- YoY growth is strongest in regions like Africa (≈ +38%) and Latin America.

- Regulatory clarity is a key factor: regions with clearer crypto or wallet regulation (e.g., EU, UK, some APAC nations) see more stable growth.

DeFi and NFT Usage

- Globally in 2025, 198 million wallets are active in DeFi (≈ 24% of all wallets).

- 48% of all wallets have interacted with at least one dApp.

- NFT‑linked wallets total ~294 million in 2025, up ~33% year over year.

- Gaming NFT assets dominate NFT wallet interactions: ~61% of those NFT wallet ops are from gaming sectors.

- Metaverse wallet adoption reached about 79 million users.

- Staking‑enabled wallets in DeFi rose to ≈ 92 million in 2025.

- Average DeFi wallet supports 5.4 tokens and interacts with 2.3 chains on average.

- Among Gen Z users, NFT wallet ownership surged 42% in 2025.

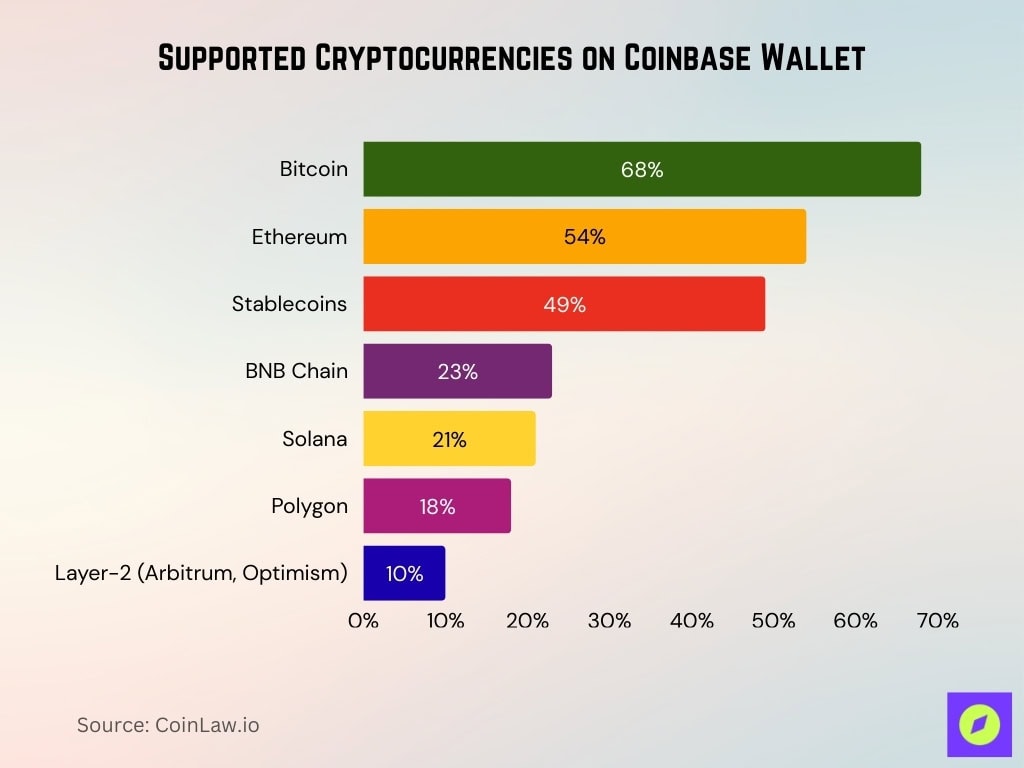

Supported Cryptocurrencies on Coinbase Wallet

- Coinbase supports over 270 cryptocurrencies across its platform.

- In 2025, Bitcoin remained the most commonly held asset, appearing in about 68% of surveyed active wallets.

- Ethereum is stored in ~54% of wallets.

- Stablecoins (USDC, USDT) are stored in ~49% of wallets, up ~18% YoY.

- Other chains growing in wallet penetration: BNB Chain (~23%), Polygon (~18%), Solana (~21%), etc.

- Layer‑2 tokens (e.g., Arbitrum, Optimism) now feature in ~10% of all wallets combined.

Security and Compliance Statistics

- In a 2025 survey of global crypto wallet users, 35% cite security as their top concern.

- Phishing and wallet‑related thefts exceeded $1.1 billion globally in 2025.

- Wallets with multi‑factor authentication (MFA) show a ~62% lower incidence of compromise.

- Biometric authentication is now used in 84% of mobile wallets.

- Roughly 22% of crypto users report using hardware wallets for long-term asset storage.

- Regulatory compliance is rising: 67% of active wallets are KYC-linked in regulated jurisdictions.

- About 24 countries introduced new wallet compliance frameworks in 2025.

- In the U.S., new IRS crypto reporting rules caused ~15% of users to move to more compliant platforms.

Demographic Insights

- Most wallet users globally are aged 18–34, with a concentration in the 25–35 age bracket.

- Gender split: ~70% male, ~29–30% female in many surveys (with some small variance).

- Users with higher education (college degree or more) make up a large share (~67%) of wallet holders.

- Income: A substantial portion are in middle to upper income brackets; many early‑adopters with income over $50,000–100,000 annually.

- Emerging markets contribute a growing share: many users in Latin America, Africa, and APAC are younger and mobile‑first.

- Retention tends to be higher in mobile wallet users vs browser extension or desktop users.

- Gen Z wallets show strong interest in NFTs and gaming, driving growth in those segments.

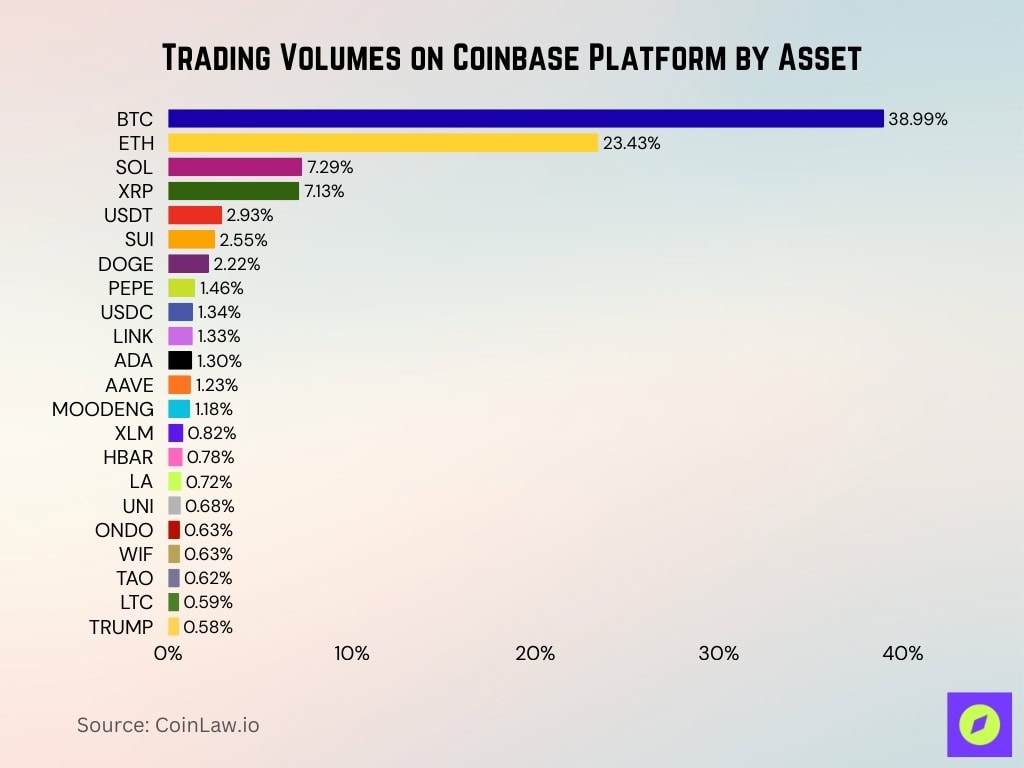

Trading Volumes on the Coinbase Platform by Asset

- Bitcoin (BTC) leads Coinbase trading with a dominant 38.99% share of total volume.

- Ethereum (ETH) ranks second, capturing 23.43%, reflecting strong DeFi and smart contract usage.

- Solana (SOL) holds 7.29%, slightly edging out XRP in platform activity.

- XRP commands 7.13%, driven by cross-border utility and retail demand.

- Tether (USDT) represents 2.93%, the top-traded stablecoin on Coinbase.

- SUI accounts for 2.55%, gaining traction in new L1 ecosystems.

- Dogecoin (DOGE) sees 2.22% of trading volume, fueled by memecoin appeal.

- PEPE holds 1.46%, another memecoin with notable engagement.

- USD Coin (USDC) trades at 1.34%, showcasing continued use despite lower volatility.

- Chainlink (LINK) captures 1.33%, reflecting its role in Web3 infrastructure.

- Cardano (ADA) makes up 1.30%, maintaining relevance among L1s.

- Aave (AAVE) sees 1.23%, driven by DeFi lending protocols.

- MOODENG contributes 1.18% to trading volume.

- Stellar (XLM) holds 0.82%, associated with cross-border and remittance use.

- Hedera (HBAR) is at 0.78%, supported by enterprise integrations.

- LATOKEN (LA) holds 0.72%.

- Uniswap (UNI) sees 0.68% as a leading DEX token.

- Ondo (ONDO) and WIF each contribute 0.63%.

- TAO closely follows at 0.62%.

- Litecoin (LTC) trades at 0.59%, maintaining legacy coin presence.

- TRUMP token rounds out the list with 0.58% of trading volume.

Integration With Coinbase Exchange

- Coinbase Wallet acts independently of Coinbase Exchange, but many users link them for easier transfers, staking, and trading of assets they hold in the wallet.

- As of 2025, Coinbase Exchange continues to dominate trading volume, while Coinbase Wallet usage (self‑custody, DeFi/NFT interactions) is growing but remains smaller in user count (~3.2 million monthly active users) compared to exchange‑based transactors.

- Supported cryptocurrencies across the platform (exchange + wallet) exceed 270 assets.

- Coinbase’s staking services extend into wallet holdings; wallets with staking‑enabled DeFi protocols are part of this integration.

- Regulatory and security compliance across both wallet and exchange was promoted jointly, especially after the 2025 breach remediation and increased scrutiny.

App Downloads and Engagement

- The Coinbase mobile apps received ~15,000 downloads per day in 2025, a slight drop compared to their 30‑day moving average of ~16,167 daily.

- As of mid‑2025, Coinbase reports 3.2 million monthly active users of its Wallet product, reflecting users who engage with the self‑custody / Web3 wallet.

- In Q2 2025, monthly transacting users (MTUs) on Coinbase overall stood at 8.7 million, showing how many are performing at least one transaction/month.

- Total monthly visits (not necessarily unique users) to Coinbase’s platforms climbed to 120 million in 2025, up ~20% from ~96 million in 2024.

- User engagement (measured via transactions, trading volume, or DeFi/NFT activity) shows that many users sign up but do not transact every month; the verified vs transacting user gap remains significant.

- In Q1 2025, assets under custody / on platform rose to ~$328 billion, showing a rising value of holdings, which likely increases engagement through staking, transfers, etc.

- Coinbase One, its subscription membership tier, has accumulated ~1 million subscribers in 2025, suggesting a portion of users are investing in deeper engagement or premium features.

Revenue Impact

- Trailing twelve‑month revenue for Coinbase as of mid‑2025 is $6.71 billion, marking a strong growth trajectory.

- Trading volume (quarterly) reached approximately $237 billion, contributing heavily to transaction fee‑based revenues.

- The user base is growing (to ~120 million monthly users) has driven revenue up ~49% year over year in certain segments.

- Subscription & Services revenues (which include blockchain rewards, custodial fees, etc.) are rising, though exact values are less publicly broken out. The presence of ~1 million Coinbase One subscribers boosts recurring revenue.

- Assets under custody (AUM) increased from ~$193 billion in 2024 to ~$328 billion by Q1 2025 in some reports, increasing potential revenue from staking, custody, and associated fees.

- Coinbase custodies over 12% of all circulating Bitcoin, plus around 11% of staked Ether, which gives it leverage in staking revenue and institutional trust.

Supported Countries

- Coinbase operates in over 100 countries worldwide.

- However, access is restricted in certain countries under U.S. sanctions, for example, Russia, Iran, and North Korea.

- Some service features vary by jurisdiction: staking, derivatives, perpetual futures, or specific trading options may be legal/operable in some countries and restricted in others.

- Coinbase NFT service is not available in Singapore, and not in any country restricted by the Office of Foreign Assets Control (OFAC).

- USDC (stablecoin) fiat‑on/off ramp availability through Coinbase is offered in many regions: Africa, Asia, Europe, North America, Oceania, and South America. Some countries listed include the Philippines.

Coinbase Wallet vs. Competitor Wallets

- MetaMask is the market leader among hot wallets: 22.66 million users in 2025. Coinbase Wallet trails behind with ~11.00 million users.

- Trust Wallet holds ~10.40 million users. Blockchain.com Wallet ~10 million. These help contextualize Coinbase Wallet’s position.

- In “hot wallet” rankings by features (security, coin support, ease of use), NerdWallet lists Coinbase Wallet with a 4.3/5 rating vs Trust Wallet (4.4) and MetaMask (4.0) in September 2025.

- Feature differences: MetaMask is well‑known for its browser extension. Coinbase Wallet offers a mobile app, a browser extension, and integration with Coinbase’s exchange ecosystem. Performance and UI vary among them.

Notable Coinbase Wallet Developments and Updates

- The Coinbase Wallet supports major chains and tokens, including Ethereum‑based tokens, Bitcoin, Solana, Dogecoin, and Litecoin, among others.

- Added support for improved features like “smart wallet” utilities: automated transaction management and fee optimization.

- Growing emphasis on NFT integration, with Coinbase NFT and Wallet working together, although some geographical restrictions apply.

- Security or compliance updates: continuing adjustments to KYC/AML rules depending on jurisdiction. Restrictions in service for sanctioned regions.

Frequently Asked Questions (FAQs)

8.7 million

$6.71 billion.

$404 billion.

Over 12% of circulating Bitcoin

Conclusion

Coinbase Wallet today is showing meaningful growth and maturing in many dimensions. It is clearly reinforcing its position in the crypto wallet landscape. Yet it still trails some competitors in pure user counts (e.g., MetaMask) and must navigate regulatory restrictions in various jurisdictions. For users, this means increased options and features. For institutional stakeholders, it means scaling risk, compliance, and trust. As the crypto ecosystem continues evolving, Coinbase Wallet’s trajectory suggests a shift toward deeper engagement, broader adoption, and more integration with DeFi, NFT, and web3 applications.