Cloud mining has reshaped the way individuals and institutions participate in cryptocurrency mining by offering scalable, hardware-free solutions. As proof-of-work mining becomes more competitive and energy-intensive, cloud mining presents a viable alternative, particularly for those seeking passive income or diversification in digital asset exposure.

From data centers in Texas to AI-powered platforms in Europe, the evolution of cloud mining is not only accelerating adoption but also fueling debates around regulation, sustainability, and profitability. Dive into this comprehensive statistical overview to understand where cloud mining stands today, and where it’s headed next.

Editor’s Choice

- The global cryptocurrency mining market reached $14.81 billion in 2025, growing at a 2.8% CAGR from 2024.

- BitFuFu completed a SPAC merger in 2024 to list on NASDAQ, reporting estimated revenue of $271 million from mining and hosting services, per its investor filings.

- Industry surveys suggest that up to 28% of small-scale or hobbyist miners participate through cloud platforms, primarily due to the lower cost of entry.

- The U.S. leads Bitcoin mining with 34% of global hash rate, with 40% powered by renewable energy.

- Bitcoin mining consumed approximately 105 TWh in early 2025, equivalent to Sweden’s national usage.

- Some platforms advertise high daily returns (e.g., 10.5%), but such figures are often promotional and not independently verified. Experts caution that sustainable ROI in cloud mining is typically much lower.

- Over 52% of Bitcoin mining electricity in 2025 came from clean sources like hydro, wind, and nuclear.

Recent Developments

- In 2024, BitFuFu became the first cloud mining company listed on NASDAQ, raising $74 million via a SPAC.

- Cloud mining revenue saw notable year-over-year growth in 2024, with some providers reporting gains of 50% or more due to increased demand and institutional interest.

- MiningFortune’s AI-powered platform launched in Q1 2025 with an uptime of 99.98% and automated switching.

- The so-called GENIUS Act has been proposed in U.S. policy circles to increase ESG standards in mining, but has not yet been enacted into law.

- Claims of high daily payouts from platforms like CryptoSolo remain unverified and should be interpreted as promotional. Independent audits or third-party verification are lacking.

- Extreme summer heat in 2025 led to grid disruptions in Texas, triggering increased reliance on cloud mining.

- Ethereum’s continued shift to proof-of-stake has increased demand for BTC-based mining contracts.

- Promos offering 100%-800% APR on XRP-based cloud contracts drew regulatory scrutiny in early 2025.

- Platforms such as WinnerMining have advertised up to $5,000/day in earnings, but these figures are promotional and often lack supporting financial disclosures or audited data.

- Mobile access to cloud mining services has grown significantly, with platforms like ECOS and StormGain reporting user growth exceeding 40% YoY among mobile users.

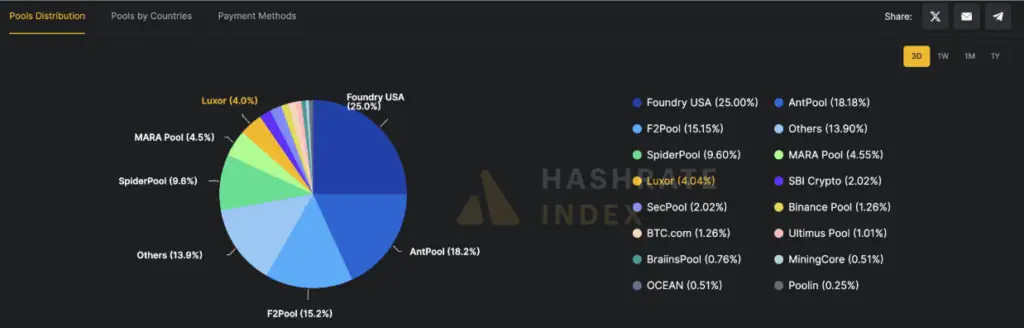

Global Bitcoin Mining Pool Distribution

- Foundry USA leads with a 25% share, dominating the global hashrate among all mining pools.

- AntPool follows with an impressive 18.2% of total mining activity.

- F2Pool holds a solid 15.2% market share, making it the third-largest player.

- Others collectively represent 13.9%, indicating a fragmented tail of smaller pools.

- SpiderPool captures 9.6% of the hashrate, ranking in the top five globally.

- MARA Pool contributes 4.6%, highlighting its growing presence in institutional mining.

- Luxor accounts for 4.0%, expanding its footprint across North America.

- SecPool and SBI Crypto each hold 2.0%, showing stable participation.

- BTC.com and Binance Pool both command 1.3%, despite earlier dominance in previous years.

- Smaller pools like Ultimus Pool (1.0%), BrainsPool (0.8%), OCEAN (0.5%), MiningCore (0.5%), and Poolin (0.25%) round out the bottom tier of contributors.

What is Cloud Mining?

- Cloud mining allows users to mine cryptocurrencies without owning hardware by leasing hash power.

- Typically offered via web or mobile platforms, users purchase contracts based on hash rate and duration.

- Contracts usually include maintenance, electricity, and hardware depreciation fees.

- Users receive daily or weekly payouts, usually in BTC, ETH, or other supported coins.

- Cloud mining supports decentralization by enabling small-scale participation across the globe.

- Providers operate industrial mining farms in low-cost regions like Iceland, Canada, and Kazakhstan.

- The model shifts mining risks from the individual to the service provider.

- Cloud mining is often confused with crypto staking, but they are entirely different in mechanism and purpose.

- Early platforms include Genesis Mining and Hashflare; modern leaders include BitFuFu and NiceHash.

- The legal status of cloud mining varies by jurisdiction, influencing platform availability and structure.

How Cloud Mining Works

- Users sign up on a platform, select a mining contract (duration, hash rate), and pay upfront or via subscription.

- The provider allocates a share of computing power from its mining farm to the user.

- Mining rewards generated by this allocated hash power are shared with the user after deducting platform fees.

- Rewards are based on network difficulty, block rewards, mining pool performance, and coin value.

- Payouts are typically automated and delivered to a linked wallet in BTC, ETH, or selected coins.

- Platforms manage hardware maintenance, cooling, power, and uptime reliability.

- Smart contracts or dashboards provide transparency into mining performance and earnings.

- Some services allow auto-switching between coins based on profitability metrics.

- Newer platforms incorporate AI to optimize contract yields and power distribution in real time.

- Security and ROI depend on uptime, power cost, regulation, and fee structures.

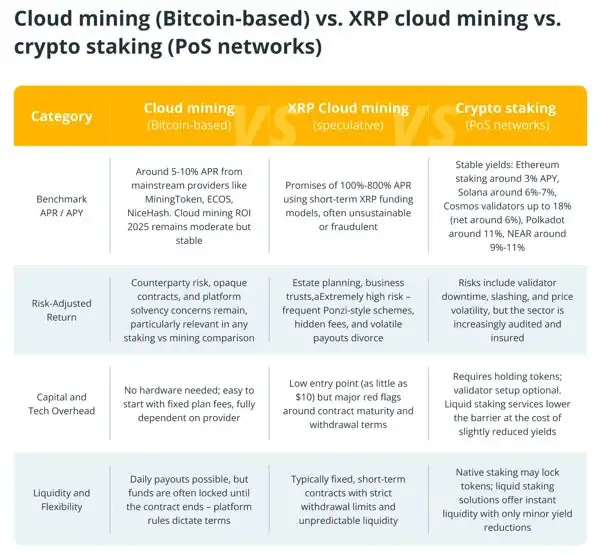

Cloud Mining vs XRP Cloud Mining vs Crypto Staking

- Cloud mining (Bitcoin-based) offers 5–10% APR, with stable returns from providers like MiningToken, ECOS, and NiceHash.

- XRP cloud mining advertises 100%–800% APR, but is often linked to unsustainable or fraudulent funding models.

- Crypto staking (PoS networks) delivers stable yields: Ethereum ~3%, Solana ~6–7%, Cosmos up to 18%, Polkadot ~11%, and NEAR ~9–11%.

- Cloud mining risks include counterparty exposure, opaque contracts, and platform solvency concerns.

- XRP cloud mining is considered extremely high risk due to Ponzi-style structures, hidden fees, and volatile payouts.

- Crypto staking risks involve validator downtime, slashing, and token volatility, but the sector is increasingly insured.

- Cloud mining requires no hardware, is easy to start, and typically uses fixed plan fees.

- XRP cloud mining offers low entry barriers (as little as $10), but has contractual red flags and limited withdrawal options.

- Crypto staking demands holding tokens and may require validator software, though liquid staking eases access.

- Liquidity is moderate for cloud mining: daily payouts are common but often locked by platform terms.

- XRP cloud mining tends to be short-term and illiquid, often tied to fixed durations.

- Crypto staking flexibility varies: native staking locks tokens, but liquid staking enables early exits through derivative tokens or redemption tools.

Types of Cloud Mining

- Hosted Mining: User leases physical space in a data center but owns the hardware.

- Leased Hash Power: Most common; users buy hash power from the provider’s mining pool.

- Virtual Hosted Mining: User rents a virtual server to install mining software.

- AI-Optimized Contracts: Platforms like ETNCrypto automatically shift mining targets to maximize profit.

- Fixed-Term Contracts: Pre-set duration (30, 60, 365 days) and hash power.

- Open-Ended Contracts: Valid until unprofitable or cancelled.

- Prepaid Contracts: Full payment upfront, including fees.

- Postpaid/Profit-Sharing: Deduct fees from earnings, often more flexible for users.

- Green Contracts: Emphasize renewable energy usage.

- Mobile-First Mining: StormGain, ECOS, and others now support mining on Android/iOS devices.

Global Cloud Mining Market Size and Growth

- The global cryptocurrency mining market reached $14.81 billion in 2025, up from $14.4 billion in 2024.

- While estimates vary, cloud mining platforms are projected to surpass $110 million in annual revenue in 2025, though total market valuations (including hardware, hosting, and services) could be significantly higher.

- Projected CAGR for cloud mining platforms is 5%, reaching $147.75 million by 2031.

- BitFuFu leads the market with $271 million in 2024 revenue, mostly from cloud mining and hosting services.

- Genesis Mining and NiceHash hold a combined 22% market share in the cloud mining segment.

- Institutional participation has increased, with $260 million in crypto inflows in August 2025 alone.

- U.S.-based platforms contribute 34% of the hash rate share, benefitting from regulatory clarity.

- Cloud mining’s growth is influenced by mining bans in countries like China and shifting operations abroad.

- Mobile cloud mining adoption has grown 41% YoY among users under 35.

- Emerging markets in Africa and Latin America are adopting cloud mining as a passive income solution.

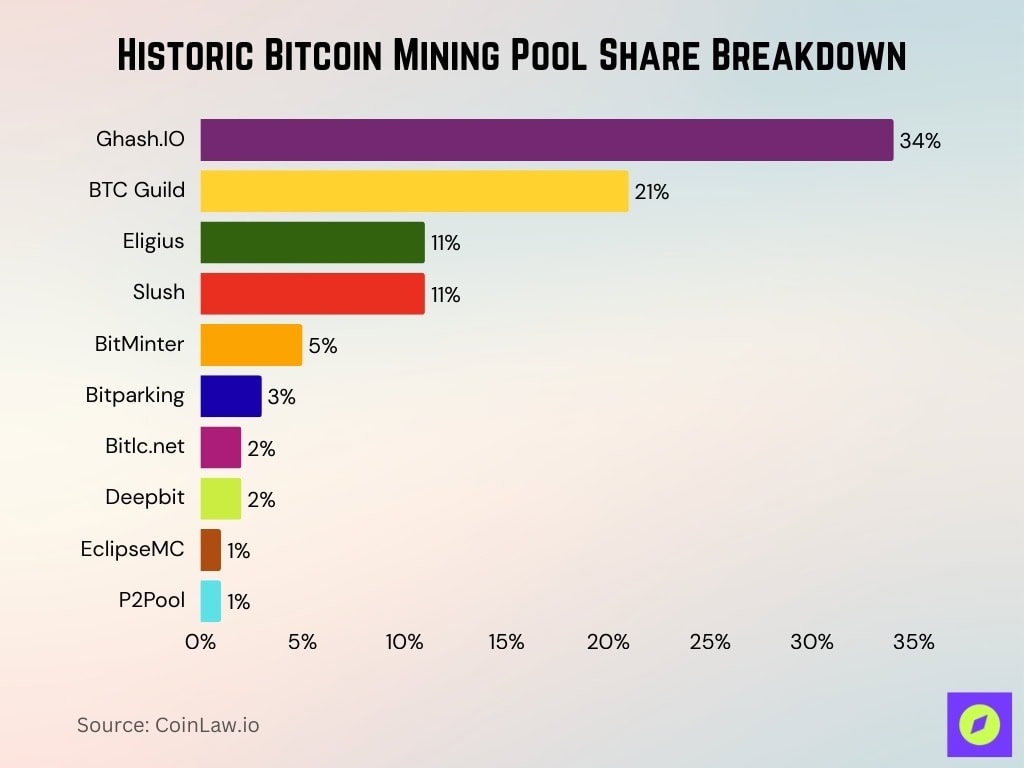

Historic Bitcoin Mining Pool Share Breakdown

- Ghash.IO dominated the network with a massive 34% share, raising early concerns about potential 51% attack risks.

- BTC Guild held a strong 21% of total mining power, making it the second-largest pool at the time.

- Eligius and Slush Pool were tied with 11% each, contributing to Bitcoin’s decentralized mining base.

- BitMinter contributed 5%, followed by Bitparking at 3%, and Bitlc.net and Deepbit at 2% each.

- Smaller pools like EclipseMC and P2Pool each accounted for 1%.

Key Market Drivers for Cloud Mining

- Rising institutional interest has driven over 52% growth in cloud mining revenues.

- The broader cryptocurrency mining market hit $14.81 billion in 2025.

- Hash rate centralization continues; industrial-scale farms control 45% of mining power globally.

- Cloud models now serve 28% of small-scale miners worldwide.

- U.S. cryptocurrency mining represents over 34% of global hash rate, with 40% of its power from renewables.

- Advancements in cooling are adopted by 36% of firms, improving efficiency.

- ESG investments push 59% of mining operations toward green energy or hybrid systems.

- Federal policy in the U.S. led to $260 million in net inflows into Bitcoin in August 2025.

- The need for flexibility and infrastructure resilience came into focus after the August 2025 flash crash.

Leading Cloud Mining Platforms

- BitFuFu remains the largest, posting $271 million in revenue in 2024.

- Genesis Mining, NiceHash, and similar providers expanded cloud mining services by 19% in 2025.

- MiningFortune has gained attention for transparent ROI, flexible contracts, and structural resilience.

- Regulated platform ZA Miner delivers clear, fee-free contracts and robust profitability.

- WinnerMining advertises daily profits up to $5,000 mining XRP and BTC.

- Platforms are experimenting with AI to optimize mining contracts and coin switching, though results vary and remain largely unaudited.

- CryptoSolo maintained 99.9% uptime and delivered $10,560 daily payouts in a 2025 test deployment.

Major Trends in Cloud Mining

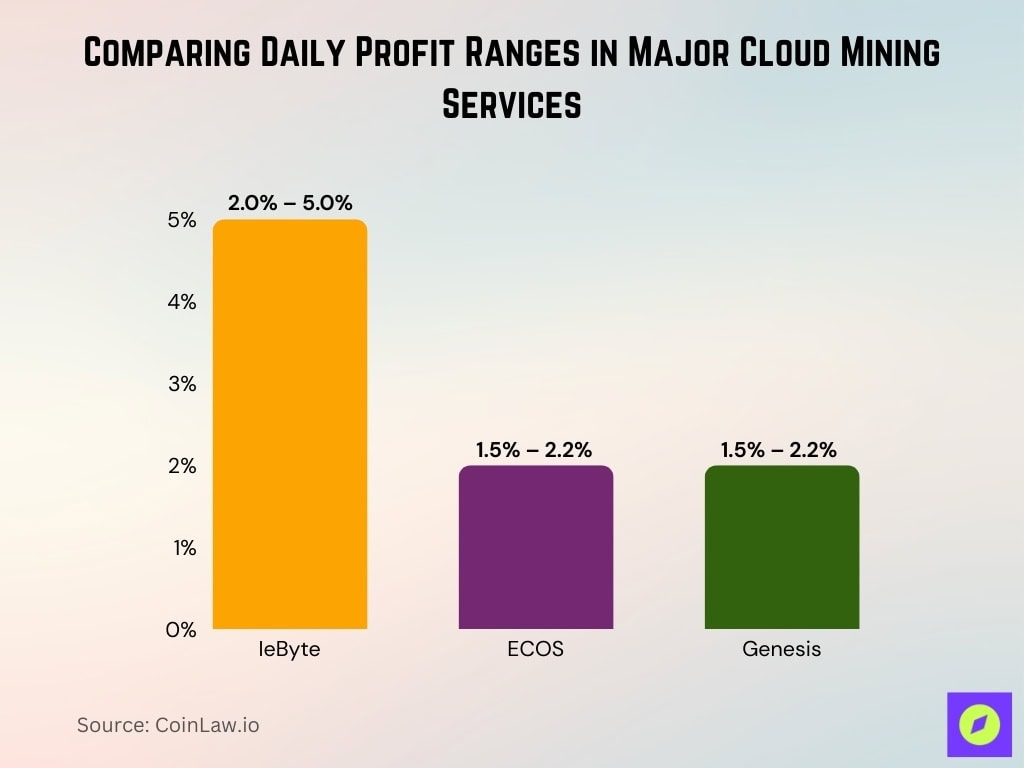

- High daily-return contracts are increasingly available, with IeByte posting 2%–5% daily profit, and ECOS and Genesis delivering 1.5%–2.2%.

- AI-driven auto-optimization platforms like ETNCrypto are rapidly reshaping how mining targets are selected.

- Regulated and ESG-aligned services are emerging, backed by initiatives like the U.S. GENIUS Act.

- Mobile-first onboarding lowers barriers; ETNCrypto, StormGain, and ECOS offer easy, app-based contract access and management.

- Convergence with DeFi, staking, and exchanges continues, offering users blended exposure to passive income strategies.

- Sustainability and transparency matter more; green mining contracts and audit-ready platforms gain user trust.

- Hashrate financialization, mining-as-a-service, and hedging tools help operators manage volatility in crypto and energy markets.

Regional Analysis of Cloud Mining

- The U.S. controls about 34% of global mining capacity.

- Within the U.S., 40% of mining capacity uses renewable energy, with Texas at 17%.

- China’s mining ban shifted operations toward clean-energy regions like Iceland and Paraguay.

- North America leads in renewable-powered mining, with 74% of renewable-based hash power.

- Cloud mining usage includes 28% of small-scale miners globally.

- Countries like Canada and Nordic nations benefit from increased cloud mining demand.

- Regions with energy policy incentives are seeing cloud mining growth outpace others.

Cloud Mining Revenue and Profitability Statistics

- BitFuFu posted $271 million in cloud mining revenue in 2024.

- CryptoSolo’s 30-day live test in 2025 yielded $0,560 per day.

- WinnerMining reports daily income up to $5,000.

- Platforms report average ROI rates between 5%-10% APR.

- MiningFortune touts transparency and stability.

- Cloud mining revenues contributed to the $4.81 billion crypto mining market.

- Institutional investment directed $260 million into Bitcoin in August 2025.

Energy Consumption and Environmental Impact

- Bitcoin mining consumed about 105 TWh of electricity in early 2025.

- Clean energy usage in mining rose to 62% globally.

- In North America, 74% of renewable-fed mining comes from hydropower and solar.

- Estimates of CO₂ emissions per Bitcoin transaction vary widely; some analyses place the figure around 700 kg, depending on energy sources and mining efficiency.

- Over 52% of Bitcoin’s electricity came from clean sources.

- Proof-of-work infrastructure continues to produce significant electronic waste.

- Data centers contributed 105 million metric tons of CO₂, up 300% since 2018.

- Some estimates suggest Bitcoin mining accounts for 0.5%–1% of global electricity use and under 0.5% of global CO₂ emissions, though precise numbers vary by methodology.

- Data center and AI energy needs are doubling from 2022 to 2026.

Cost Structure and Pricing Models in Cloud Mining

- The cloud mining market stood at $105 million in 2024, expected to reach $110.25 million in 2025.

- Contract-based models remain dominant.

- Subscription models are gaining traction for enterprise users.

- Profit-sharing platforms take a platform fee and redistribute net returns.

- AI-optimized models shift hash power based on real-time profitability.

- Regulated platforms like ZA Miner remove maintenance fees.

- Promotional offers entice new users, though they carry a higher risk.

- Platforms include overhead costs like cooling, electricity, and maintenance.

- ROI varies widely; average users may see 5%-10% APR.

Type of Cryptocurrency

- Most platforms focus on Bitcoin (BTC) and Ethereum (ETH), given their dominance in proof-of-work mining.

- Some services include Litecoin (LTC) and Dogecoin (DOGE), typically bundled in multi-coin contracts via ASIC-compatible systems.

- ETNCrypto’s contract performance shows daily ROI up to 10.5% for Antminer S21 Pro targeting higher-yield coins. Smaller rigs post 1.5%–6.4% returns, depending on the contract tier and coin mined.

- XRP-based mining offers remain highly speculative, with platforms advertising 100%–800% APR, though often unrealistic.

- Monero (XMR) isn’t common in cloud mining due to its RandomX proof-of-work, which favors CPU/GPU over ASIC; few services support it.

- Platforms like ViaBTC provide multi-cryptocurrency contracts in mining pools, allowing miners to switch between BTC, LTC, and others.

- AI-powered models automatically shift between coins based on profitability, increasing exposure to altcoins beyond BTC and ETH.

- Overall, BTC and ETH remain the most consistently offered and reliable options across mainstream cloud mining platforms.

Adoption by User Segment (Individuals vs. Enterprises)

- Individual users increased cloud mining subscriptions by 21% in 2025, with key services like Genesis Mining and BitDeer leading the trend.

- U.S. hobbyist miners grew by 14% year-over-year, drawn to low-overhead, cloud-based or mobile-first mining options.

- On the enterprise side, adoption is rising as organizations see cloud mining as a passive investment channel or infrastructure support for broader blockchain applications.

- Financial institutions are also exploring cloud mining for diversification and exposure to crypto-assets alongside DeFi and ETF holdings.

- Platforms like IeByte heavily market to both segments, highlighting beginner-friendly onboarding and institutional-grade performance.

- Mobile-first platforms, such as ECOS and ETNCrypto, appeal to individual users with easy access to contracts and immediate payouts.

- Regulatory clarity, including the U.S. GENIUS Act tied to ESG compliance, bolsters institutional trust in cloud mining platforms.

- Overall, while individuals continue to be the primary drivers of user growth, enterprise and institutional demand are growing as mining matures.

Pool Market Share

- ViaBTC ranks among the top three Bitcoin mining pools globally by hashrate, now extending into cloud services.

- BitFuFu runs its own private-label mining pool launched in late 2024, offering zero commission cloud-mining services.

- Platforms like NiceHash offer a global hashpower marketplace, functioning across both individual and pooled models.

- Legacy services like Genesis Mining and ECOS still hold significant shares but face increasing competition from agile AI-optimized platforms.

- Hybrid players like IeByte are gaining traction, emphasizing both superior returns and ease of entry.

- Market dynamics favor platforms offering transparency, regulatory assurance, and performance data. This has helped newer entrants grab share from legacy pools.

- Overall, the market remains fragmented, dominated by a mix of established pools, AI-first platforms, and regulatory-compliant providers.

Risks and Challenges in Cloud Mining

- Market volatility makes returns unpredictable; some promotional offers promise 100%–800% APR, but the risk is high.

- Environmental and health concerns are rising. U.S. communities near mining facilities report noise pollution, insomnia, and anxiety due to constant fan noise up to 100 dB.

- Energy grid strain risks operations in areas prone to curtailment, especially in high-use states like Texas.

- Increasing legal and regulatory pressure, notably around energy use, AML and CTF norms, and securities laws.

- Hardware obsolescence drives significant electronic waste, as mining rigs often live only 4–5 years, with limited recycling infrastructure.

- Institutional investor pressure has led miners to stockpile BTC to buffer against rising costs, but this also adds financial complexity.

- Competition from AI data centers threatens access to grid power and infrastructure, potentially limiting future expansion.

Regulation and Compliance in Cloud Mining

- The U.S. SEC clarified in March 2025 that proof-of-work mining doesn’t constitute securities, giving relief to operators.

- The FATF continues enforcing AML and CTF standards on mining firms, particularly large-scale and cross-border operations.

- The U.S. introduced the GENIUS Act in mid-2025, mandating stablecoin reserves and ESG alignment for institutional cloud mining services.

- Platforms in regulated zones, like ECOS in Armenia’s Free Economic Zone, benefit from tax incentives and legal clarity.

- Transparency is now a trust driver; regulated entities like IeByte and ZA Miner promote clean contracts and verifiable returns.

- Cross-border scrutiny is increasing, particularly around environmental permits and energy consumption declarations.

- Regulatory compliance is becoming a competitive advantage for platforms seeking institutional clients and long-term viability.

Security in Cloud Mining Platforms

- Platforms regulated or licensed, such as ECOS and IeByte, prioritize transparency and secure contract structures, building user trust.

- Markets with peer-to-peer hash-sharing, like NiceHash, expose users to platform-level risk and require vigilant issuer credibility checks.

- Some platforms, like BitFuFu, minimize platform commission by using their own mining pools, reducing fee friction.

- ROI and uptime metrics, for example, CryptoSolo’s 99.9% uptime, serve as informal security signals, showing platform reliability.

- AI-driven automation in platforms, such as ETNCrypto, reduces user intervention risk, yet adds opacity; users must rely on provider integrity.

- Robust customer support, wallet withdrawal policies, and insurance mechanisms are now factors in assessing platform safety.

- Institutional pressure encourages the adoption of smart contracts and independent audits to verify platform operations and returns.

Green and Sustainable Initiatives in Cloud Mining

- Over 52% of Bitcoin mining electricity now comes from clean energy sources, including hydro, wind, solar, and nuclear, driving greener cloud mining demand.

- Platforms like Zaminer leverage solar and wind in over 100 global sites to offer sustainable cloud mining contracts.

- Pairing renewable energy with mining helps deploy green infrastructure. Studies show solar-powered mining systems can cut ROI timelines from approximately 8.1 years to approximately 3.5 years, while preventing annual CO₂ emissions of 50,000 tons.

- Platforms now market their carbon-cutting potential by redirecting surplus renewable energy into mining workloads.

- The GENIUS Act requires ESG disclosure from cloud mining platforms, pushing more sustainable practices.

- Recycling of ASIC hardware is improving; up to 87% of hardware is now recycled or repurposed in some cases.

- Sustainable branding now differentiates premium platforms and attracts eco-conscious investors.

Future Outlook of Cloud Mining

- Industry projections for the total cloud mining market vary widely; some include hardware, hosting, and software, while others report platform-specific revenue closer to $110 million.

- AI-driven systems will dominate, optimizing coin selection and maximizing yield while lowering user effort.

- Regulatory clarity, such as the GENIUS Act and ESG disclosure rules, will cement institutional adoption and elevate industry standards.

- Sustainable practices, renewable energy pairing, and recycling will evolve from selling points to market norms.

- Platforms may merge cloud mining with DeFi, staking, and NFT ecosystems to create hybrid income portfolios.

- Grid competition with AI data centers will require mining services to innovate, for example, by using stranded gas or remote renewable energy zones.

- Greater transparency through audits and performance dashboards will be key to platform credibility and long-term growth.

Conclusion

Cloud mining today has become a dynamic blend of accessibility, automation, and strategic innovation. Individual users and institutions alike now access passive crypto income through AI-optimized platforms, transparent contracts, and green models. Key challenges remain: profit volatility, regulation, energy strain, and hardware waste, but the strongest platforms are addressing these through sustainability, compliance, and superior tech.